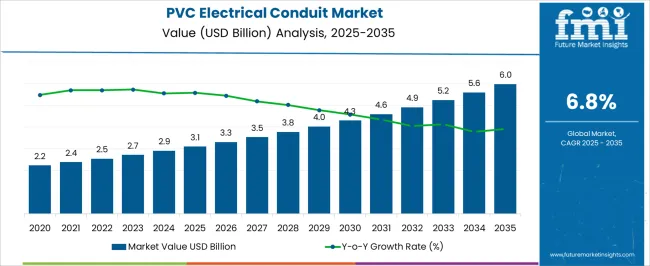

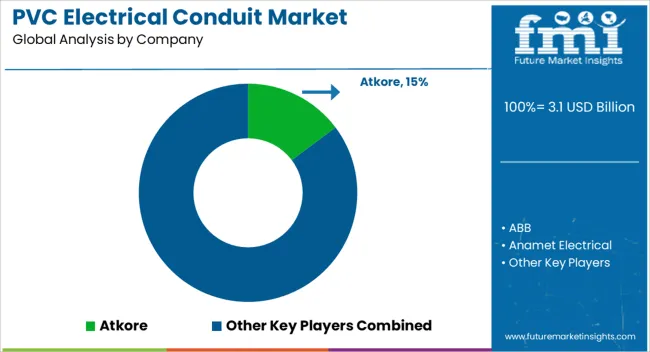

The PVC electrical conduit market is estimated to be valued at USD 3.1 billion in 2025. It is projected to reach USD 6.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period. The PVC electrical conduit market is projected to create an absolute gain of USD 2.9 billion and a growth multiplier of 1.94x over the decade. This strong growth is supported by a CAGR of 6.8%, driven by increasing demand for electrical infrastructure, commercial and residential construction, and the need for energy-efficient wiring solutions.

During the first five years (2025–2030), the market will expand from USD 3.1 billion to USD 4.3 billion, adding USD 1.2 billion, which accounts for 41.4% of the total incremental growth, with a 5-year multiplier of 1.39x. The second phase (2030–2035) contributes USD 1.7 billion, representing 58.6% of incremental growth, driven by infrastructure upgrades, energy efficiency mandates, and growing urbanization. Annual increments increase from USD 0.3 billion in early years to USD 0.5 billion by 2035, signaling stronger growth driven by regulatory requirements for energy-efficient electrical systems and wider adoption in emerging economies. Manufacturers focusing on cost-effective, durable, and sustainable PVC conduit solutions will capture the largest share of this USD 2.9 billion opportunity.

| Metric | Value |

|---|---|

| PVC Electrical Conduit Market Estimated Value in (2025 E) | USD 3.1 billion |

| PVC Electrical Conduit Market Forecast Value in (2035 F) | USD 6.0 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

A strong shift toward non-metallic conduit systems has been observed, supported by regulatory directives promoting safer, corrosion-resistant, and easier-to-install alternatives. Recent developments in infrastructure modernization, particularly in residential and utility sectors, have driven demand for PVC conduits, owing to their lightweight structure and low installation cost.

The future outlook remains optimistic as urbanization intensifies and smart housing initiatives gain momentum globally. Technological improvements in material formulation and manufacturing techniques are expected further to enhance product durability and performance under diverse environmental conditions.

The market is also benefiting from policy-backed rural electrification programs and the proliferation of energy-efficient building standards. These elements collectively point toward sustained market expansion, with manufacturers focusing on scalable production, distribution efficiency, and compliance with evolving electrical safety norms to meet rising demand across both developed and emerging markets.

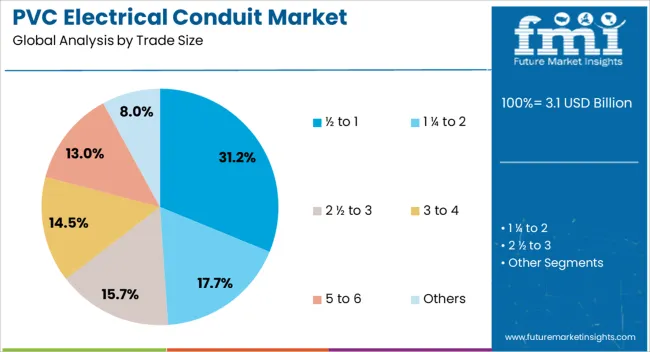

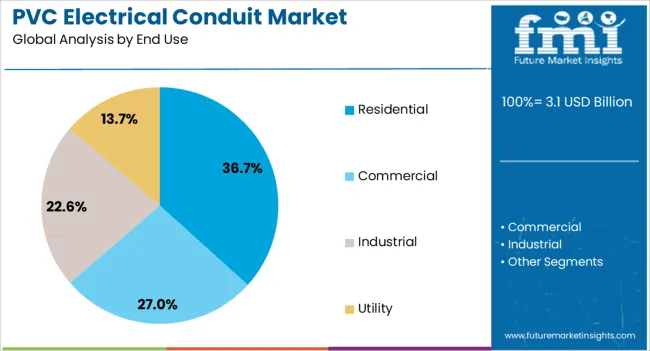

The PVC electrical conduit market is segmented by trade size, end use, and geographic regions. By trade size, the PVC electrical conduit market is divided into ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others. In terms of end use, the PVC electrical conduit market is classified into Residential, Commercial, Industrial, and Utility. Regionally, the PVC electrical conduit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ½ to 1 trade size subsegment is projected to account for 31.2% of the PVC Electrical Conduit market revenue share in 2025, marking it as the leading trade size. This preference is being driven by widespread residential and light commercial applications where flexible routing and compact installations are required. The subsegment's growth has been supported by increased residential construction activity, where smaller diameter conduits are typically used for branch circuits, lighting, and low-voltage wiring.

Its dominance is also linked to ease of handling, lower material cost, and compatibility with standard wiring practices. As per industry publications and electrical contractor feedback, the ½ to 1 size category provides the optimal balance between flexibility and structural integrity, making it the default choice in most low-load applications.

Its extensive availability across retail and wholesale distribution channels, along with its compliance with residential electrical codes, has further strengthened its market hold. These factors combined have ensured its continued leadership in conduit selection across major building projects.

The residential end use segment is anticipated to represent 36.7% of the PVC Electrical Conduit market revenue share in 2025, positioning it as the dominant end use category. Growth in this segment has been primarily fueled by sustained demand for new housing developments, particularly in rapidly urbanizing regions. Government-backed affordable housing programs and an increasing focus on safe home electrical systems have significantly contributed to the adoption of PVC conduits in residential wiring applications.

Industry updates have emphasized that residential builders prefer PVC conduits due to their lower cost, corrosion resistance, and ease of cutting and joining at the site. The segment's expansion is further aided by energy efficiency regulations and the integration of smart home technologies, which often require complex yet adaptable wiring systems. Manufacturers are responding with pre-cut and flexible conduit solutions tailored to housing needs.

Opportunities in expanding infrastructure and trends toward eco-friendly materials are shaping the market, while challenges related to raw material costs and regulatory compliance persist. By 2025, overcoming these barriers with efficient solutions and stable supply chains will be crucial for continued market growth.

The PVC electrical conduit market is growing due to the increasing demand for durable, cost-effective wiring solutions in the construction and electrical industries. PVC conduits offer excellent protection against corrosion, impact, and fire hazards, making them ideal for use in residential, commercial, and industrial wiring applications. By 2025, the need for safe and affordable wiring materials will continue to drive growth, particularly as building and construction projects expand globally.

Opportunities in the PVC electrical conduit market are increasing with the expansion of construction and electrical infrastructure. As new residential and commercial projects require efficient electrical wiring systems, demand for high-quality, reliable PVC conduits is expected to rise. The growing demand for low-maintenance electrical infrastructure in both developing and developed regions is driving market growth. By 2025, these opportunities will be key to boosting market expansion in the construction and infrastructure sectors.

Emerging trends in the PVC electrical conduit market include a shift towards eco-friendly and recyclable materials. With increasing awareness of environmental concerns, manufacturers are developing PVC conduits with reduced environmental impact, including recyclable versions that align with regulatory requirements and consumer preferences. By 2025, the demand for more sustainable conduit options will likely grow, as companies seek ways to meet green building standards and reduce their carbon footprint.

Despite growth, challenges such as fluctuations in raw material prices and regulatory compliance remain in the PVC electrical conduit market. The cost of raw materials for PVC production can vary significantly, affecting manufacturing costs and product pricing. Additionally, stringent regulations governing the quality and safety of electrical products can increase the complexity of compliance. By 2025, addressing these challenges through stable sourcing strategies and streamlined regulatory processes will be essential for continued market growth.

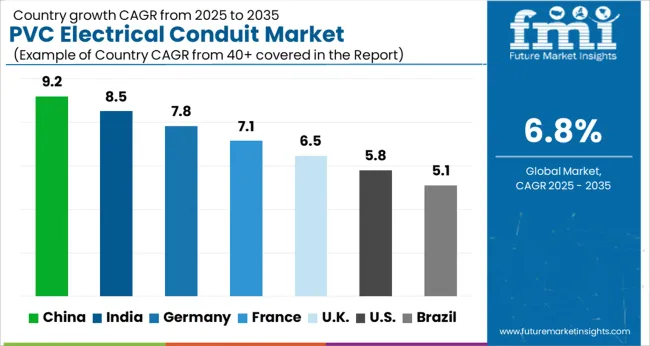

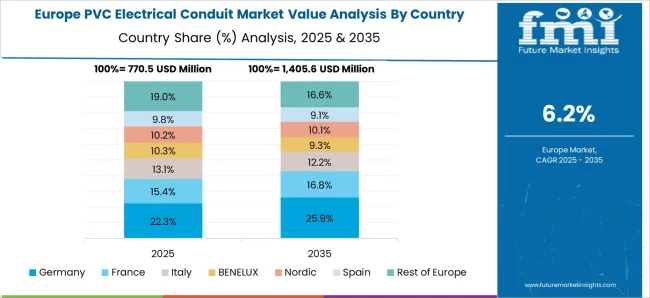

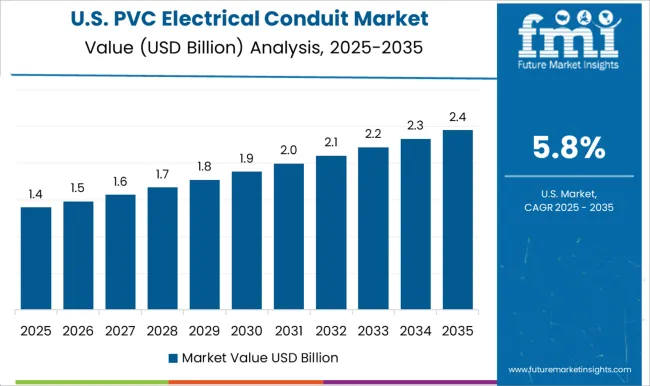

The global PVC electrical conduit market is projected to grow at a 6.8% CAGR from 2025 to 2035. China leads with a growth rate of 9.2%, followed by India at 8.5%, and France at 7.1%. The United Kingdom records a growth rate of 6.5%, while the United States shows the slowest growth at 5.8%. These varying growth rates are driven by factors such as the increasing demand for infrastructure development, the need for cost-effective electrical solutions, and the growing focus on safety and sustainability in electrical installations. Emerging markets like China and India are experiencing higher growth due to rapid urbanization, industrialization, and increasing electricity consumption, while more mature markets like the USA and the UK see steady growth driven by regulatory standards, technological advancements, and investments in infrastructure projects. This report includes insights on 40+ countries; the top markets are shown here for reference.

The PVC electrical conduit market in China is growing rapidly, with a projected CAGR of 9.2%. China’s expanding construction and industrial sectors, coupled with a rising focus on infrastructure development, are driving the demand for PVC electrical conduits. The country’s government initiatives to improve electricity access, enhance safety standards, and modernize electrical infrastructure are contributing significantly to market growth. Additionally, China’s increasing investments in residential, commercial, and industrial projects, along with the rising use of energy-efficient and cost-effective electrical materials, further fuel the demand for PVC electrical conduits.

The PVC electrical conduit market in India is projected to grow at a CAGR of 8.5%. India’s increasing focus on infrastructure development, urbanization, and industrial expansion is driving the demand for PVC electrical conduits. The growing adoption of energy-efficient electrical systems, along with government initiatives to enhance the power distribution network and improve electricity access in rural areas, is accelerating the market growth. Additionally, India’s rising construction and real estate sectors, combined with the increasing demand for safety and cost-effective electrical installations, are further contributing to the market’s expansion.

The PVC electrical conduit market in France is projected to grow at a CAGR of 7.1%. France’s increasing investments in infrastructure, residential and commercial construction, and renovation projects are driving the demand for PVC electrical conduits. The country’s strong regulatory environment for electrical installations, coupled with a rising focus on energy efficiency and sustainability, is further accelerating the adoption of PVC conduits. Additionally, France’s focus on improving electrical grid systems and integrating renewable energy sources into its infrastructure contributes to the steady growth of the market.

The PVC electrical conduit market in the United Kingdom is projected to grow at a CAGR of 6.5%. The UK’s focus on infrastructure development, including residential, commercial, and industrial construction projects, is contributing to steady demand for PVC electrical conduits. The country’s emphasis on building energy-efficient and sustainable buildings, along with regulatory compliance for electrical installations, drives the adoption of PVC conduits. Additionally, the UK’s increasing investments in renewable energy and grid modernization further accelerate the need for electrical conduit solutions.

The PVC electrical conduit market in the United States is expected to grow at a CAGR of 5.8%. The USA market is driven by the growing demand for electrical installations in residential, commercial, and industrial sectors, along with the rising need for safe, cost-effective, and efficient electrical solutions. The country’s regulatory standards for electrical safety and the growing focus on sustainable building practices are contributing to steady market growth. Additionally, the USA focus on modernizing electrical grids and improving energy efficiency further accelerates the demand for PVC electrical conduits.

The PVC electrical conduit landscape has been led by producers and cable-management brands that supply rigid PVC and flexible nonmetallic systems for residential, commercial, industrial, and utility builds. Atkore offers a full range of rigid PVC conduit and fittings for above- and below-ground use. ABB provides PVC conduit and fittings through the Carlon line. Astral Limited supplies uPVC electrical conduit and fittings in India. Bahra Electric manufactures PVC and uPVC conduits and accessories for regional projects. CANTEX is a major United States producer of PVC electrical conduit, fittings, and boxes. Anamet Electrical and Electri-Flex deliver flexible PVC-based solutions for liquid-tight and high-flex routing needs. Champion Fiberglass should be classified under fiberglass conduit rather than PVC.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| Trade Size | ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others |

| End Use | Residential, Commercial, Industrial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Atkore, ABB, ANAMET Electrical, Astral Limited, Bahra Electric, CANTEX, Electri-Flex |

| Additional Attributes | Dollar sales by conduit type and application, demand dynamics across residential, commercial, and industrial sectors, regional trends in PVC electrical conduit adoption, innovation in flexible, durable, and fire-resistant materials, impact of regulatory standards on safety and compliance, and emerging use cases in smart grid infrastructure and energy-efficient building systems. |

The global PVC electrical conduit market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the PVC electrical conduit market is projected to reach USD 6.0 billion by 2035.

The PVC electrical conduit market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in PVC electrical conduit market are ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6 and others.

In terms of end use, residential segment to command 36.7% share in the PVC electrical conduit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

PVC-M High Impact Resistant Water Supply Pipe Market Size and Share Forecast Outlook 2025 to 2035

PVC UV Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

PVC Cling Film Market Size and Share Forecast Outlook 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

PVC Footwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

PVC Packing Straps Market Report – Key Trends & Forecast 2025 to 2035

Market Share Insights of PVC-Free Cap Liner Manufacturers

Leading Providers & Market Share in PVC Tapes Industry

PVC Cling Wrap Market Trends & Growth Forecast 2024-2034

PVC Blister Packs Market

PVC Container Market

PVC-Free Packaging Market

PVC-free Cap Liners Market

Non PVC Plasticizers Market Growth & Outlook 2022 to 2032

Rewritable PVC Cards Market

Polyvinyl Chloride (PVC) Packaging Film Market Forecast and Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA