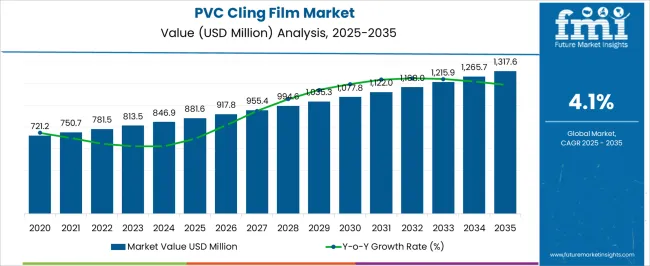

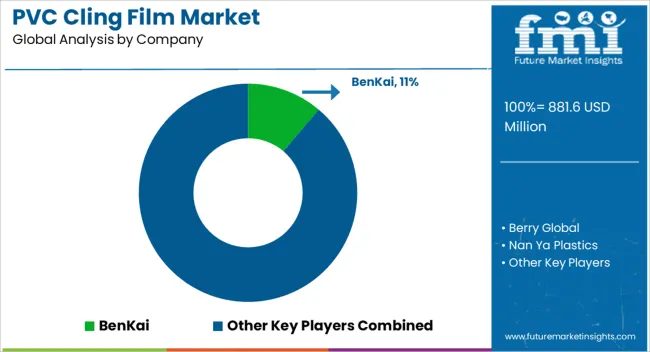

The PVC Cling Film Market is estimated to be valued at USD 881.6 million in 2025 and is projected to reach USD 1317.6 million by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

Rising demand from household and commercial kitchens, supermarkets, and food service providers also supports this growth phase. From 2030 to 2035, the period is characterized by increased adoption of convenient, cost-effective, and durable packaging solutions across both developed and emerging economies. Expansion of ready-to-eat meals, online food delivery, and perishable goods logistics enhances the role of cling films in maintaining product integrity. This phase highlights ongoing demand from retail and food service channels, supported by innovations in eco-friendly PVC films and recyclable packaging formats. Overall, the PVC cling film market is set for sustained growth, driven by evolving consumer food habits, retail sector expansion, and the need for cost-efficient packaging solutions that balance performance with safety.

| Metric | Value |

|---|---|

| PVC Cling Film Market Estimated Value in (2025 E) | USD 881.6 million |

| PVC Cling Film Market Forecast Value in (2035 F) | USD 1317.6 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

The PVC cling film market is gaining notable traction as industries and consumers prioritize packaging materials that combine flexibility, clarity, and strong cling properties. The ability of PVC cling films to preserve freshness, prevent contamination, and extend product shelf life has positioned them as a preferred choice in both household and commercial food applications.

Regulatory emphasis on food safety and hygiene, coupled with growing retail and e-commerce activities in perishable goods, is reinforcing the use of high-quality cling films. Advances in manufacturing processes have enabled better tensile strength, improved barrier properties, and enhanced temperature resistance, making these films suitable for diverse wrapping and sealing needs.

Sustainable production practices and recyclability initiatives are also influencing market dynamics, as manufacturers invest in eco-friendly formulations to align with environmental compliance Looking ahead, the integration of automated packaging systems and expansion of organized retail channels are expected to drive broader adoption of PVC cling films in emerging and developed markets alike.

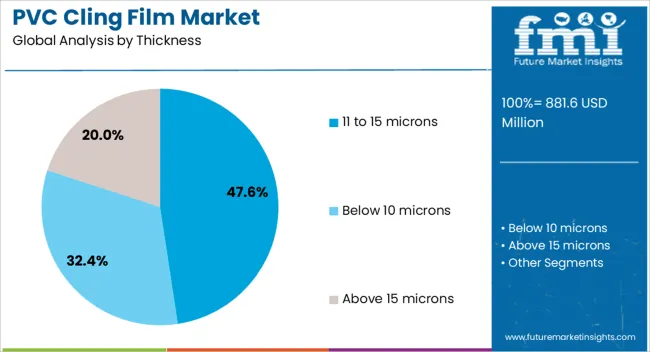

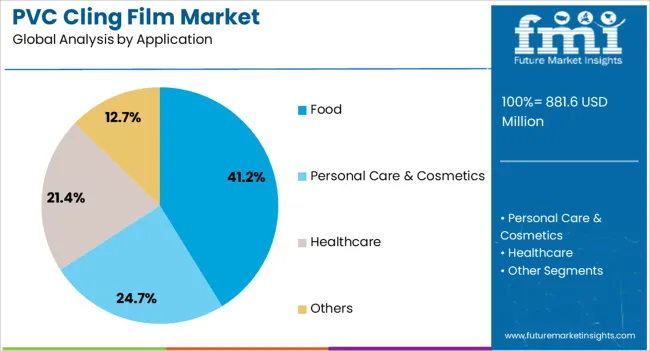

The PVC cling film market is segmented by thickness, application, and geographic regions. By thickness, PVC cling film market is divided into 11 to 15 microns, Below 10 microns, and Above 15 microns. In terms of application, PVC cling film market is classified into Food, Personal Care & Cosmetics, Healthcare, and Others. Regionally, the PVC cling film industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 11 to 15 microns thickness category is projected to hold 47.6% of the PVC cling film market revenue share in 2025, marking it as the leading thickness segment. This dominance is being driven by its optimal balance between durability and flexibility, which makes it suitable for both manual and machine wrapping processes.

The segment’s popularity has been reinforced by its ability to provide excellent sealing performance while maintaining high transparency, which is crucial for product visibility in retail displays. Its superior stretchability and resistance to tearing have supported adoption in high-volume packaging operations across food and non-food sectors.

The thickness range also offers efficient material usage, contributing to cost savings for commercial users without compromising on protective properties Additionally, its compatibility with a wide range of food contact standards has ensured consistent demand in the global market, solidifying its position as the preferred specification for large-scale packaging applications.

The food application segment is expected to account for 41.2% of the PVC cling film market’s revenue share in 2025, reflecting its central role in the industry. Growth in this segment is being supported by the increasing need to maintain food freshness, prevent moisture loss, and protect against external contaminants during storage and transportation.

The ability of PVC cling films to conform tightly to various food shapes and surfaces without the need for adhesives has made them indispensable in households, restaurants, and retail food packaging. Rising consumption of fresh produce, meat, seafood, and bakery items has further expanded the demand for cling films in this segment.

Compliance with food-grade safety regulations and the ability to withstand refrigeration and moderate heat conditions have reinforced their utility The expanding network of supermarkets, convenience stores, and online grocery delivery platforms is also contributing to sustained growth, as packaged fresh food becomes more prevalent in consumer purchasing habits.

The PVC cling film market is expanding due to food preservation needs, foodservice growth, regulatory-driven innovation, and competitive distribution strategies. Its versatility ensures continued adoption across retail, household, and institutional channels.

The PVC cling film market has grown significantly as food preservation and hygiene become major priorities across retail and household settings. Its ability to provide tight sealing, flexibility, and visibility makes it a preferred choice for wrapping fresh produce, meat, dairy, and bakery items. Supermarkets and convenience stores continue to rely on PVC cling film to extend shelf life and improve display appeal. Households also contribute consistently due to the convenience of portion wrapping and meal preparation. Growth in food delivery services has further expanded usage in disposable packaging. The segment continues to benefit from affordability, stretchability, and compatibility with a wide range of substrates used in everyday food storage.

Foodservice establishments, including restaurants, catering firms, and quick-service outlets, are major contributors to PVC cling film demand. Its versatility in wrapping prepared meals and securing storage containers supports efficiency in commercial kitchens. The ability to maintain freshness while preventing odor transfer has made it indispensable in high-volume food preparation environments. Bulk packaging formats are widely purchased by foodservice operators, contributing to steady demand. Growth in takeaway and ready-to-eat segments has also spurred greater adoption, particularly in emerging economies where food delivery is becoming a central part of urban lifestyles. These trends ensure consistent volume expansion in the foodservice sector.

Regulatory requirements in packaging have influenced the PVC cling film market, leading producers to invest in safer formulations with low levels of plasticizers. Markets such as Europe and North America enforce stringent compliance regarding food-contact materials, encouraging manufacturers to adopt advanced additives and enhance quality testing. Reformulated films are designed to ensure safety while maintaining flexibility and transparency. This has increased consumer confidence, particularly in retail food applications. Producers are also focusing on extending compatibility with microwave and freezer storage, providing additional utility. The regulatory push, while challenging, has been leveraged as an opportunity to create higher-value variants of cling films.

Competition in the PVC cling film market is shaped by both multinational producers and regional players catering to domestic demand. Global leaders focus on improving distribution networks, expanding product portfolios, and establishing partnerships with major retailers and foodservice providers. Regional firms often compete on cost while emphasizing locally relevant packaging solutions. E-commerce has emerged as a channel for household cling films, boosting accessibility. Companies are also diversifying into multipack formats and value-added rolls, which appeal to consumers seeking convenience. The overall strategy across the sector revolves around balancing cost-effectiveness with performance, while ensuring continuous availability across retail and institutional supply chains.

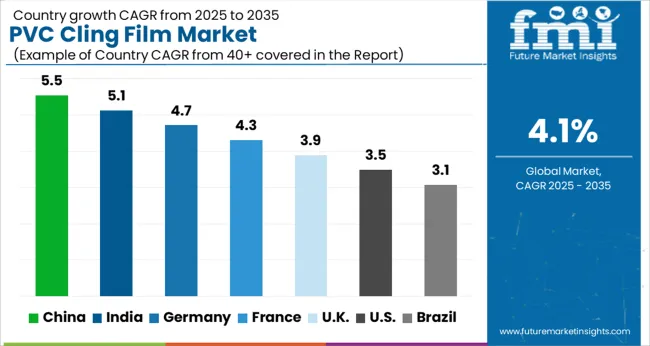

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

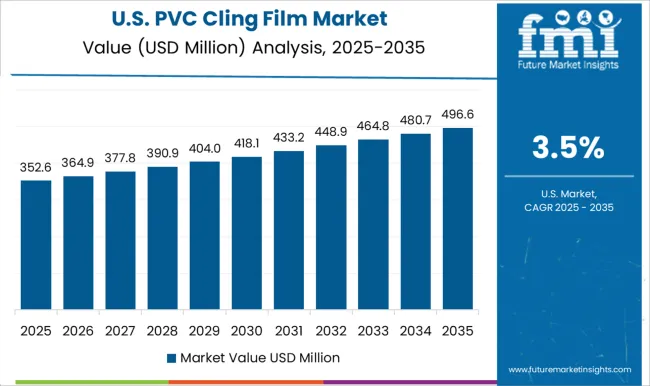

| USA | 3.5% |

| Brazil | 3.1% |

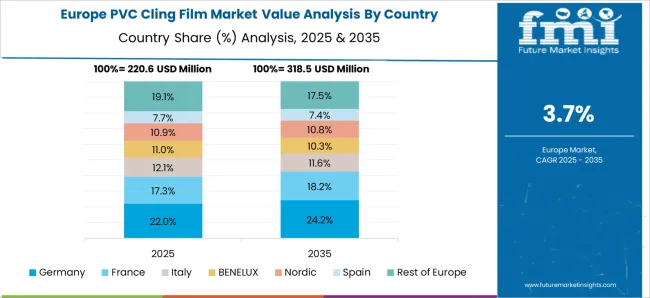

The PVC cling film market is projected to expand globally at a CAGR of 4.1% between 2025 and 2035, supported by demand in food preservation, expanding retail channels, and increased foodservice applications. China leads with a CAGR of 5.5%, driven by large-scale retail packaging, supermarket adoption, and higher household consumption of cling films. India follows at 5.1%, benefiting from rapid growth in organized retail, rising middle-class consumption, and expansion in packaged food distribution. France posts 4.3%, reflecting higher demand in bakery, dairy, and perishable food sectors with continued emphasis on safe food-contact materials. The United Kingdom records 3.9%, aided by steady household usage and foodservice expansion despite regulatory pressures. The United States achieves 3.5%, reflecting a mature market where supermarket chains and institutional catering remain the key contributors to cling film demand. The analysis spans more than 40 countries, with these six serving as strategic benchmarks for packaging innovation, retail partnerships, and compliance-driven growth in the global PVC cling film industry.

China is projected to achieve a 5.5% CAGR during 2025–2035, well above the global 4.1% baseline. During 2020–2024, the CAGR was closer to 4.4%, as household adoption and supermarket demand steadily increased but remained impacted by fluctuating raw material prices. The next period will gain momentum from expanding organized retail, higher use in foodservice, and stronger household penetration in urban areas. Packaging converters are focusing on cost-effective rolls for both supermarkets and local wet markets. Regulatory compliance is also driving innovation toward safer plasticizer formulations, enhancing consumer confidence. China is positioned to remain the anchor market in Asia, balancing scale, affordability, and product diversification.

India is expected to post a 5.1% CAGR in 2025–2035, above the global average. Between 2020–2024, CAGR was about 4.3%, reflecting steady growth from food packaging and household applications, although infrastructure gaps limited full-scale adoption. The next period is projected to rise on the back of expanding modern trade, e-commerce-driven grocery sales, and greater penetration of packaged food segments. Small and mid-size converters are increasingly serving local markets with low-cost, high-volume rolls, while premium producers are catering to organized retail. Rising middle-class consumption and food delivery services are expected to sustain double-digit demand for household-use cling films, securing India’s role as a fast-expanding growth hub.

France is projected to grow at a 4.3% CAGR during 2025–2035, slightly above the global pace. For 2020–2024, CAGR stood near 3.6%, as demand was steady in bakeries and supermarkets but restricted by regulatory discussions on plastics. The improved outlook comes from bakery and dairy sectors expanding cling film adoption for retail displays, supported by safe food-contact materials. Premium converters are also focusing on odor-resistant and low-migration products, catering to export-oriented segments. Supermarket chains are demanding multipack rolls, improving consumer convenience. With strong emphasis on quality and compliance, France’s cling film market remains a model for value-added adoption in Western Europe.

The United Kingdom is expected to record a 3.9% CAGR during 2025–2035, below the global 4.1%. In 2020–2024, CAGR is estimated at 3.1%, when moderate supermarket demand and limited new foodservice contracts kept growth restrained. The improved forecast reflects increased packaged food consumption, food delivery expansion, and supermarket private-label initiatives that require reliable cling films. Bulk foodservice rolls are becoming more common as caterers expand into institutional contracts. Reformulated, compliance-driven films are also lifting adoption across supermarkets concerned with consumer health. The rise from 3.1% to 3.9% signals gradual strengthening supported by retail and catering growth.

The United States is expected to grow at a 3.5% CAGR during 2025–2035, trailing the global benchmark. During 2020–2024, CAGR was about 2.8%, reflecting a mature market with limited new applications outside foodservice. The shift upward is attributed to supermarket chains prioritizing fresh food packaging, institutional catering expansions, and household adoption of value multipacks. Retailers have begun emphasizing cost-effective and safe cling films, responding to shifting consumer preferences. While growth is slower compared to Asia, innovation in food-grade safety, bulk roll offerings, and branding strategies are expected to maintain steady volumes. The USA remains a stable yet mature market, with incremental gains over the forecast horizon.

Berry Global remains a leader with an extensive product portfolio, offering PVC and PE-based cling films tailored for supermarkets, foodservice operators, and industrial catering. Nan Ya Plastics focuses on mass-scale production of PVC cling films with consistent quality for both domestic and export markets. Pactiv Evergreen delivers strong presence in North America, providing cling films designed for food packaging and foodservice applications. Zhengzhou Eming Aluminium Industry integrates PVC cling films into its packaging line, serving wholesale distributors.

CL Industries India offers domestically produced cling films with a focus on retail multipacks and foodservice applications. Jiashan Hengyu Plastic and Shenzhen Jingfeng Industrial cater to export markets with customized cling film rolls for supermarkets and restaurants. Qingdao Kingchuan Packaging specializes in high-clarity PVC films designed for retail-ready food applications. IPG (Intertape Polymer Group) extends its packaging expertise to include cling films for food storage and retail distribution. Changzhou Plastics Researching and Manufacturing emphasizes R&D-led solutions for high-quality cling films. Boston Polymers and Magnum Packaging maintain regional significance through customized cling film offerings. Maskati Bros serves the Middle East with packaged film rolls for supermarkets and institutional kitchens.

Galaxy Converting, Divya Plastic Industries, and NRR Industries support the market with reliable domestic cling film solutions focused on affordability. Pragya Flexifilm Industries supplies PVC cling films for both retail and export, with specialization in multi-size rolls. US Packaging and Wrapping strengthens North American presence by offering premium cling films directly to retailers and foodservice chains.

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Thickness | 11 to 15 microns, Below 10 microns, and Above 15 microns |

| Application | Food, Personal Care & Cosmetics, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BenKai, Berry Global, Nan Ya Plastics, Pactiv Evergreen, Zhengzhou Eming Aluminium Industry, CL Industries India, Jiashan Hengyu Plastic, Shenzhen Jingfeng Industrial, Qingdao Kingchuan Packaging, IPG, Changzhou Plastics Researching and Manufacturing, Boston Polymers, Magnum Packaging, Maskati Bros, Galaxy Converting, Divya Plastic Industries, NRR Industries, Pragya Flexifilm Industries, and US Packaging and Wrapping |

| Additional Attributes | Dollar sales, share, CAGR, demand split across retail and foodservice, regional consumption trends, raw material pricing shifts, packaging regulations, competitor capacity, private-label growth, export opportunities, e-commerce channels. |

The global PVC cling film market is estimated to be valued at USD 881.6 million in 2025.

The market size for the PVC cling film market is projected to reach USD 1,317.6 million by 2035.

The PVC cling film market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in PVC cling film market are 11 to 15 microns, below 10 microns and above 15 microns.

In terms of application, food segment to command 41.2% share in the PVC cling film market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PVC UV Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

PVC Footwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

PVC Packing Straps Market Report – Key Trends & Forecast 2025 to 2035

Market Share Insights of PVC-Free Cap Liner Manufacturers

Leading Providers & Market Share in PVC Tapes Industry

PVC Blister Packs Market

PVC Container Market

PVC-Free Packaging Market

PVC-free Cap Liners Market

PVC Cling Wrap Market Trends & Growth Forecast 2024-2034

Non PVC Plasticizers Market Growth & Outlook 2022 to 2032

Rewritable PVC Cards Market

Residential PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

PVC Packaging Film Market from 2024 to 2034

Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Cling Film Industry

Cycling Power Meter Market Growth - Trends & Forecast 2025 to 2035

Recycling Trucks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA