The shipping tapes industry is continuously developing because to increased demand from e-commerce, logistics, and industrial packaging industries. Innovation and sustainability with increased high-performance adhesives offer a way to improve durability and security while keeping ecologically conscious.

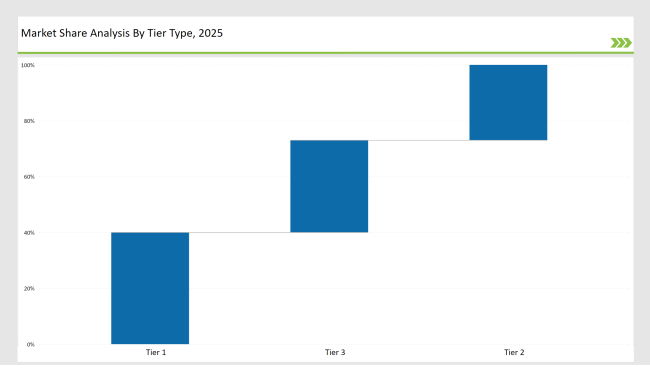

Tier 1: 3M, Intertape Polymer Group, and Tesa SE dominate the market, accounting for 40%. With such companies providing cutting-edge adhesive technology, extensive distribution networks, and a slew of environmental programs, competition becomes somewhat more fierce.

Tier 2: Shurtape Technologies, Avery Dennison, and Berry Global control 27% of the market, focusing on customized, cost-effective, and high-strength shipping tapes for a wide range of applications.

Tier 3: Regional and specialty producers account for 33% of the market, producing specialized tapes for ecologically friendly, tamper-evident, and heavy-duty packaging solutions.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (3M, Intertape Polymer Group, Tesa SE) | 18% |

| Rest of Top 5 (Shurtape Technologies, Avery Dennison) | 13% |

| Next 5 of Top 10 (Berry Global, Uline, Henkel, Nitto Denko, Scapa Group) | 9% |

Growing e-commerce sales and increasing demand for secure, durable, and sustainable packaging solutions drive the shipping tapes industry's expansion across various sectors.

Manufacturers are enhancing adhesive technology and eco-friendly solutions to meet evolving market needs.

Industry leaders are innovating with sustainable materials, tamper-proof security features, and automation to improve efficiency and reduce environmental impact.

Year-on-Year Leaders

Technology suppliers should prioritize sustainability, automation, and customization in shipping tape production. Investing in AI-driven adhesive optimization, biodegradable materials, and smart tracking technology will drive efficiency and align with industry trends.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | 3M, Intertape Polymer Group, Tesa SE |

| Tier 2 | Shurtape Technologies, Avery Dennison, Berry Global |

| Tier 3 | Uline, Henkel, Nitto Denko, Scapa Group |

Companies in the shipping tapes industry are investing in sustainability, automation, and smart packaging solutions. Initiatives include AI-driven adhesive technology, tamper-proof security features, and eco-friendly packaging tapes.

| Manufacturer | Latest Developments |

|---|---|

| 3M | Launched high-performance eco-friendly tapes (March 2024). |

| Intertape Polymer Group | Expanded biodegradable tape production (August 2023). |

| Tesa SE | Developed tamper-evident tapes with enhanced security (May 2024). |

| Shurtape Technologies | Introduced high-bond reinforced tapes (November 2023). |

| Avery Dennison | Integrated RFID technology into shipping tapes (February 2024). |

The shipping tapes industry is evolving with a focus on sustainability, security, and smart adhesive solutions. Vendors aim to improve durability, reduce plastic waste, and enhance shipping efficiency.

The shipping tapes industry is shifting towards automation, AI-driven adhesive technology, and sustainable materials. Companies will continue investing in eco-friendly solutions, smart tracking, and high-strength tape innovations to enhance packaging security and efficiency.

Increased e-commerce, logistics demand, and sustainability trends.

3M, Intertape Polymer Group, Tesa SE, Shurtape Technologies, and Avery Dennison.

Biodegradable tapes, tamper-evident technology, and RFID tracking.

Asia-Pacific, North America, and Europe.

Companies are developing recyclable, biodegradable, and water-activated tape solutions.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shipping Label Market Size and Share Forecast Outlook 2025 to 2035

Shipping Supply Market Size and Share Forecast Outlook 2025 to 2035

Shipping Mailers Market Size and Share Forecast Outlook 2025 to 2035

Shipping Container Market Size, Share & Forecast 2025 to 2035

Competitive Breakdown of Shipping Mailers Manufacturers

Shipping Tapes Market Size and Share Forecast Outlook 2025 to 2035

Cargo Shipping Market Size and Share Forecast Outlook 2025 to 2035

Insulated Shipping Boxes Market Innovations & Growth 2025-2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Insulated Styrofoam Shipping Boxes Market Growth & Forecast 2025 to 2035

Industry Share Analysis for Insulated Styrofoam Shipping Boxes Companies

Tapes Market Insights – Growth & Demand 2025 to 2035

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

ESD Tapes and Labels Market from 2025 to 2035

USA Tapes Market Analysis – Growth & Forecast 2024-2034

Leading Providers & Market Share in PVC Tapes Industry

Seam Tapes Market Insights – Growth & Demand Forecast 2025-2035

Foil Tapes Market

Nano Tapes Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA