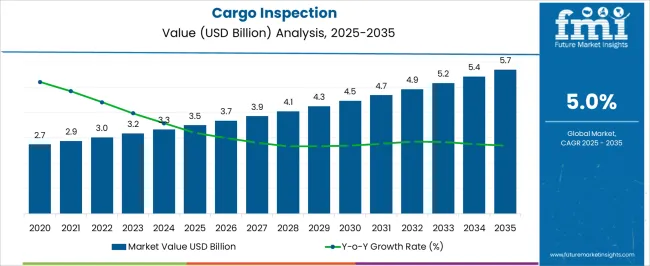

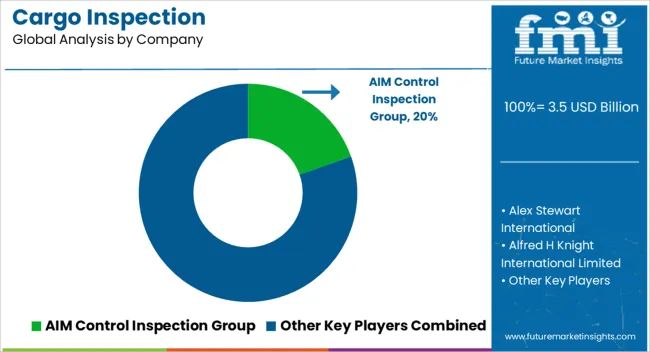

The Cargo Inspection Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 5.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Cargo Inspection Market Estimated Value in (2025 E) | USD 3.5 billion |

| Cargo Inspection Market Forecast Value in (2035 F) | USD 5.7 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The cargo inspection market is advancing steadily due to increasing cross-border trade volumes, heightened global security protocols, and stricter compliance requirements in logistics and customs operations. Governments and regulatory bodies are emphasizing safe and efficient cargo handling to detect contraband, verify manifest accuracy, and ensure product quality.

Investments in smart infrastructure and automated inspection technologies are gaining momentum to reduce bottlenecks and enhance throughput in busy port and transit zones. Additionally, supply chain digitization, along with demand for real-time data, is driving the adoption of integrated inspection platforms.

The future outlook remains robust as stakeholders prioritize traceability, operational transparency, and regulatory alignment across the cargo movement ecosystem.

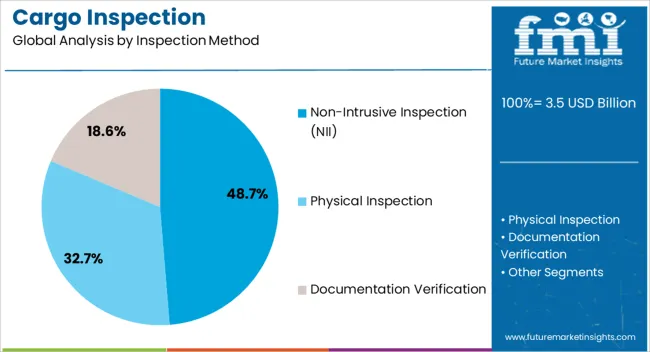

The market is segmented by Inspection Method, Technology, Offering, Application, and End-User and region. By Inspection Method, the market is divided into Non-Intrusive Inspection (NII), Physical Inspection, and Documentation Verification.

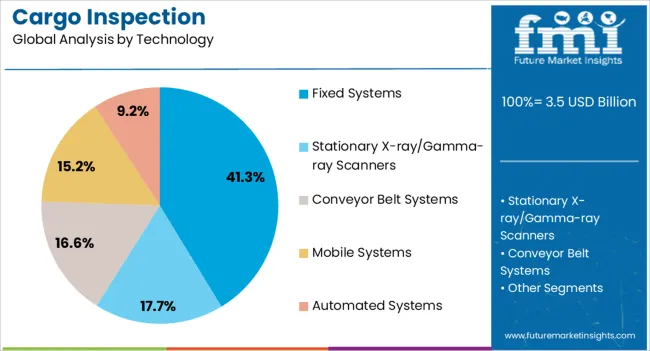

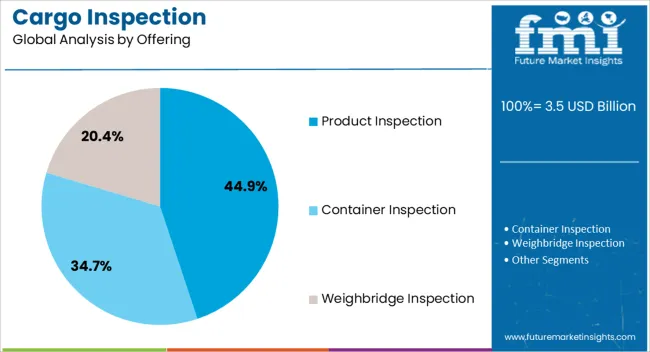

In terms of Technology, the market is classified into Fixed Systems, Stationary X-ray/Gamma-ray Scanners, Conveyor Belt Systems, Mobile Systems, and Automated Systems. Based on Offering, the market is segmented into Product Inspection, Container Inspection, and Weighbridge Inspection.

By Application, the market is divided into Customs and Border Security, Logistics and Supply Chain, and Transportation Hubs. By End-User, the market is segmented into Mining, Oil & Gas, Chemicals, Agriculture, Manufacturing, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The non intrusive inspection method is projected to represent 48.70% of total market revenue by 2025, emerging as the leading segment. This dominance is being driven by its ability to inspect cargo without physical unpacking, significantly reducing clearance times and minimizing handling risks.

Advanced imaging and scanning technologies are enabling rapid detection of anomalies, contraband, and structural inconsistencies in containers. The adoption of this method is further strengthened by its alignment with international customs protocols and its ability to improve cargo flow while maintaining security.

As trade volumes surge and customs efficiency becomes a critical metric, non intrusive inspection continues to lead in enhancing throughput without compromising safety.

The fixed systems segment is expected to account for 41.30% of the total market revenue by 2025 within the technology category, positioning it as the dominant format. Fixed systems are increasingly deployed at seaports, border checkpoints, and logistics hubs due to their high scanning accuracy and ability to manage large inspection volumes.

These systems support continuous operation with minimal downtime, which is essential in high traffic environments. Their integration with automated cargo handling and surveillance platforms is further amplifying their value.

Fixed solutions also enable seamless data capture and storage for regulatory compliance and audit purposes. This makes fixed systems a reliable choice for stakeholders seeking robust and scalable inspection infrastructure.

The product inspection segment is projected to hold 44.90% of total market revenue by 2025 under the offering category, making it the leading area. This growth is being supported by increased quality control requirements and the need to detect damage, tampering, or non compliance at the individual product level within cargo shipments.

Industries such as food and beverage, pharmaceuticals, and electronics rely heavily on product level inspection to maintain brand integrity and regulatory adherence. The integration of AI driven image analysis and defect recognition technologies has further expanded the capabilities of product inspection solutions.

As quality assurance becomes central to cross border logistics, this segment continues to lead due to its critical role in verifying shipment integrity and reducing downstream risk.

Cargo inspection is experiencing stable demand growth, supported by rising global shipment volumes, trade regulation compliance, and automation of port operations. Market value exceeded USD 2.9 billion in 2023, with year-on-year growth at 4.2%. Non-intrusive systems, including X-ray and 3D imaging technologies, now account for nearly 40% of inspection workflows. Asia-Pacific holds the largest share, followed by North America and Europe. Containerized shipping, pharmaceutical cargo, and temperature-sensitive goods are accelerating inspection modernization across logistics terminals, border crossings, and bonded warehouses. Bulk carriers, tankers, and rail freight networks are increasing adoption of smart cargo tracking and pre-clearance tools.

Growth in global trade and transshipment activity is increasing the throughput of cargo inspection facilities, especially at high-traffic ports and dry terminals. Over 8,700 new inspection units were installed worldwide between mid-2023 and mid-2025, driven by demands for faster customs clearance, contraband detection, and verification of declared cargo types. Automated scanners, RFID-linked manifests, and container profiling software are replacing manual verification processes. Industrial users in sectors such as chemicals, metals, and food logistics are adopting in-line inspection tools that combine radiation, temperature, and weight monitoring. Government agencies are integrating remote-access modules and AI-based threat scoring systems into national inspection frameworks, enabling risk-based screening that increases throughput by up to 34% in operational test zones.

Despite rising demand, full-scale deployment of advanced cargo inspection solutions faces structural bottlenecks. System-level investment remains high, with average setup costs for mobile scanning units and containerized inspection booths ranging from USD 490,000 to 890,000. Many mid-size terminals in Africa, Latin America, and Southeast Asia lack adequate power infrastructure, slowing down-field deployment. Inter-agency standards are inconsistent, causing cross-border inspection redundancies and customs clearance delays. Operator training remains a weak link—only 42% of scanning personnel in lower-tier ports meet the full technical certification requirements for complex imaging systems. Integration failures between logistics software and scanning platforms have delayed system commissioning by 6–10 weeks in several regional cargo corridors.

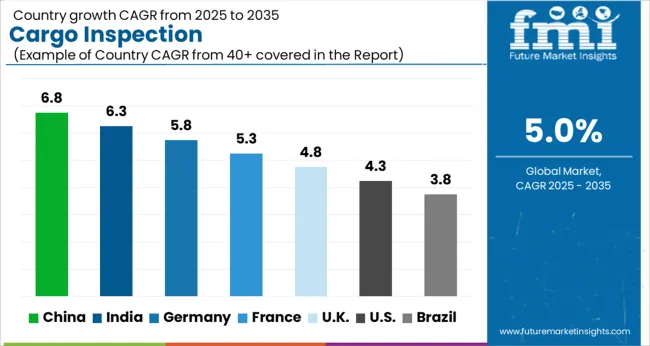

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

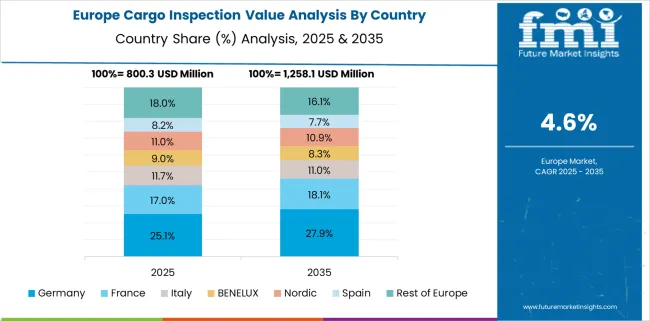

The global cargo inspection market is projected to grow at a CAGR of 5.5% from 2025 to 2035. China (BRICS) leads with a growth rate of 6.8%, surpassing the global average by 1.3 percentage points, supported by expanding trade volumes and stricter compliance enforcement in export hubs. In the OECD region, Germany records 5.8% (+0.3 pp), driven by high-value industrial exports and robust quality assurance systems. France follows at 5.3% (–0.2 pp), maintaining a stable growth pace aligned with EU trade and customs protocols. In contrast, the United States (OECD) posts a CAGR of 4.3%, falling 1.2 pp below the global average, likely reflecting market maturity and slower infrastructure upgrades. Brazil (BRICS) trails further at 3.8% (–1.7 pp), impacted by uneven enforcement practices and infrastructure constraints. The report features insights from 40+ countries, with the top five shown below.

China reports a 6.8% growth rate in the cargo inspection market, above the global average of 5.5%. Expansion is linked to the installation of automated systems across large-volume terminals. Manual verification processes are being phased out in favor of digital infrastructure. Port authorities have adopted container profiling software aligned with state-level trade controls. Market focus remains on AI integration for anomaly detection and real-time classification. Domestic developers are entering international contracts tied to container handling automation. Standardization policies continue to shape technical requirements for inspection system manufacturers operating in bonded zones.

Germany records a 5.8% growth rate in the cargo inspection market, slightly higher than the global average of 5.5%. Equipment upgrades are taking place in freight hubs located near chemical production zones and cross-border rail routes. Regulatory alignment with EU customs enforcement has increased demand for precision scanning equipment. Companies are configuring inspection tools to detect chemical compounds and restricted military-grade items. Digital interfaces are being adapted for multilingual processing across customs checkpoints. Growth is expected to continue through expanded infrastructure at inland waterways and regional rail yards.

France reports a 5.3% growth rate in cargo inspection, slightly under the global rate of 5.5%. Customs agencies are adopting modular systems in inland hubs with high container turnover. Deployment includes vehicle-mounted scanners and mobile stations for river-linked freight terminals. Software vendors are offering pre-clearance tools aligned with EU classification schedules. Public-private projects have focused on improving inspection traceability across import-export points. Authorities are modifying data handling structures to support large-scale image analysis from multiple scanning platforms.

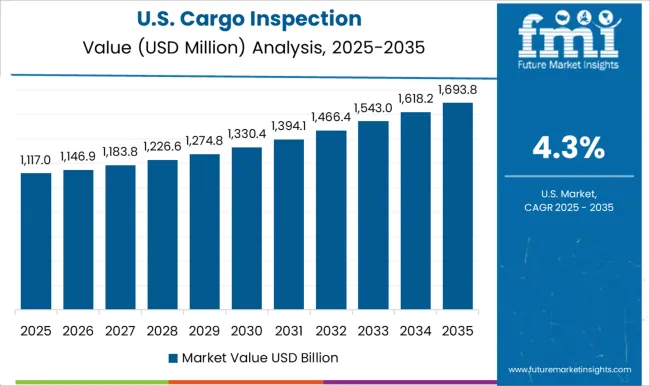

United States reports a 4.3% growth rate in cargo inspection, below the global average of 5.5%. Investments are directed toward updating land-border systems and high-volume export terminals. Detection units are being recalibrated to account for dual-use components and controlled shipments. Federal contracts include trials of automated tracking tags linked to digital manifests. Port authorities are coordinating with national intelligence bodies to identify structural gaps in container screening. Equipment procurement plans extend to large land crossings not yet covered by real-time digital inspection infrastructure.

Brazil posts a 3.8% growth rate in cargo inspection, under the global benchmark of 5.5%. Public infrastructure limitations continue to restrict scanning coverage across commercial ports. Inspection procedures are concentrated in grain and meat export zones. Trial deployments of mobile X-ray equipment have begun in high-traffic customs locations. Software pilots for routing algorithms are ongoing at federal checkpoints. Replacement of aging scanners remains slow across key port districts due to budget constraints. Regional trade agreements have led to requests for transparent container profiling.

AIM Control Inspection Group holds a 19.6% share of the cargo inspection market, supported by a broad service portfolio covering pre-shipment, loading, and discharge inspections. SGS Group, Bureau Veritas, and Intertek Group plc offer multi-sector coverage with global operational reach and compliance-driven inspection protocols. DEKRA SE, DNV GL AS, and TUV SUD focus on technical inspections across maritime, energy, and industrial shipments. AmSpec Group and Camin Cargo Control specialize in petroleum and chemical cargo assessment, while Cotecna and Alfred H Knight manage trade-related verification and testing. Barriers to market entry include international regulatory complexity, the need for accreditation under global trade standards, and maintaining inspection consistency across diverse cargo categories and shipping conditions.

On January 14, 2025, Wabtec announced that it will acquire Evident's Inspection Technologies division.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 Billion |

| Inspection Method | Non-Intrusive Inspection (NII), Physical Inspection, and Documentation Verification |

| Technology | Fixed Systems, Stationary X-ray/Gamma-ray Scanners, Conveyor Belt Systems, Mobile Systems, and Automated Systems |

| Offering | Product Inspection, Container Inspection, and Weighbridge Inspection |

| Application | Customs and Border Security, Logistics and Supply Chain, and Transportation Hubs |

| End-User | Mining, Oil & Gas, Chemicals, Agriculture, Manufacturing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AIM Control Inspection Group, Alex Stewart International, Alfred H Knight International Limited, AmSpec Group, Brookes Bell LLP, Bureau Veritas, Camin Cargo Control Inc., Core Laboratories, Cotecna Inspection SA, CWM Survey & Inspection BV, DEKRA SE, DNV GL AS, Eurofins Scientific SE, Intertek Group plc, Lloyd's Register, Qtech Control Limited, Sandler & Travis Trade Advisory Services, Saybolt, SGS Group, and TUV SUD |

| Additional Attributes | Dollar sales by inspection type and cargo category, growing demand in oil & gas and agriculture exports, stable activity in metal commodities and containerized trade, digital imaging systems and AI-based analytics drive accuracy and regulatory compliance in cross-border inspections |

The global cargo inspection market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the cargo inspection market is projected to reach USD 5.7 billion by 2035.

The cargo inspection market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in cargo inspection market are non-intrusive inspection (nii), physical inspection and documentation verification.

In terms of technology, fixed systems segment to command 41.3% share in the cargo inspection market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cargo Vans Market Size and Share Forecast Outlook 2025 to 2035

Cargo Shipping Market Size and Share Forecast Outlook 2025 to 2035

Cargo Bike Tire Market Growth – Trends & Forecast 2025-2035

Cargo Bike Market Growth - Trends & Forecast 2024 to 2034

Air Cargo Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cargo Containers Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cargo Handling Equipment Market

Aircraft Cargo Winches Market

Trailer & Cargo Container Tracking Market Size and Share Forecast Outlook 2025 to 2035

Electric 3-wheeler Cargo Bikes Market Size and Share Forecast Outlook 2025 to 2035

Inspection Drone in Oil and Gas Market Size and Share Forecast Outlook 2025 to 2035

Inspection Management Software Market Size and Share Forecast Outlook 2025 to 2035

Inspection Robots Market Size and Share Forecast Outlook 2025 to 2035

Inspection and Inventory Labels Market Size and Share Forecast Outlook 2025 to 2035

Inspection Lighting Fixture Market Size and Share Forecast Outlook 2025 to 2035

Inspection & Weighing Machine Industry Analysis in ASEAN and Gulf Countries Analysis - Size, Share, and Forecast 2025 to 2035

Examining Market Share Trends in Inspection and Inventory Labels

Inspection Machines Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA