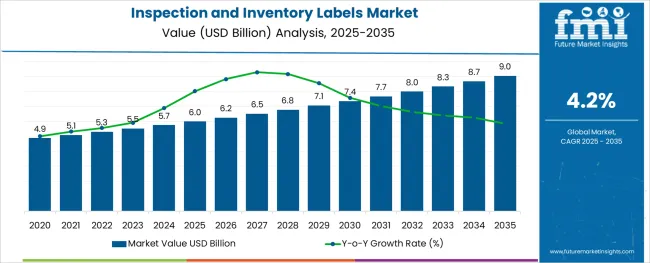

The Inspection and Inventory Labels Market is estimated to be valued at USD 6.0 billion in 2025 and is projected to reach USD 9.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

The inspection and inventory labels market is undergoing significant growth as industries prioritize accuracy, traceability, and regulatory compliance in supply chain operations. Advancements in label durability, print clarity, and adhesive technology are supporting performance in demanding environments such as cold storage, logistics hubs, and food packaging lines. With the growing integration of warehouse automation and real-time inventory systems, demand for scannable and intelligent labeling solutions has intensified.

Labels embedded with tamper-evident features and QR or barcode functionality are being deployed across food safety, industrial inspection, and retail logistics workflows. In parallel, manufacturers are focusing on environmentally conscious materials and inks that align with sustainability standards and extended producer responsibility guidelines.

As the global distribution of goods becomes more complex, standardized labeling systems are becoming essential for ensuring chain-of-custody verification, improving audit readiness, and minimizing inventory shrinkage. The market is expected to benefit further from digital transformation initiatives and traceability mandates across regulated industries.

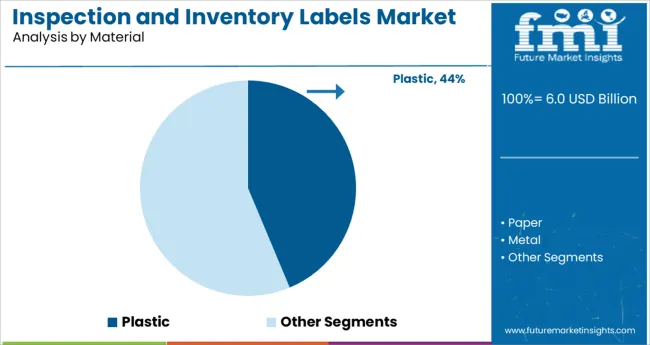

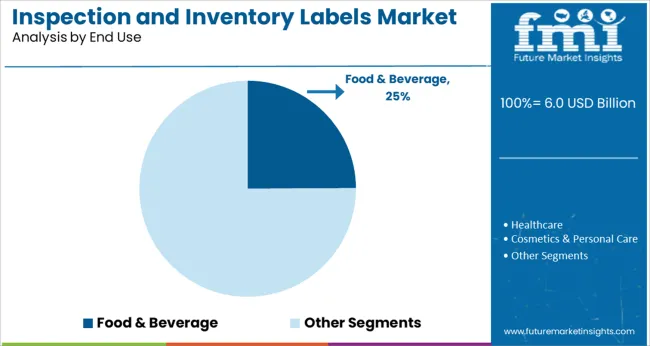

The market is segmented by Material, Product Type, and End Use and region. By Material, the market is divided into Plastic, Paper, and Metal. In terms of Product Type, the market is classified into Barcode Label, RFID Label, Holographic Label, and EAS Label. Based on End Use, the market is segmented into Food & Beverage, Healthcare, Cosmetics & Personal Care, Automotive, Electrical & Electronics, and Other Consumer Goods. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Plastic-based labels are anticipated to hold 43.7% of total market revenue by 2025, making them the dominant material category in the inspection and inventory labels market. This leadership is driven by plastic’s superior durability, moisture resistance, and adaptability to both high and low temperature environments.

Plastic substrates are favored in sectors requiring robust adhesion on non-porous surfaces, including food packaging, industrial equipment, and refrigerated inventory. In addition, plastic labels support a variety of printing methods such as thermal transfer and flexographic printing, which enhance resistance to smudging, chemicals, and UV exposure.

These advantages make plastic ideal for long-term label performance and readability in dynamic supply chain conditions. With regulatory pressure increasing on food and pharmaceutical traceability, plastic labels are being integrated with tracking identifiers like serialized barcodes and authentication markers, further cementing their relevance in high-performance inventory and inspection workflows.

The barcode label segment is expected to account for 39.8% of total market revenue by 2025, positioning it as the leading product type. This dominance is supported by widespread adoption of barcoding systems for real-time data capture, asset tracking, and inventory reconciliation across warehousing, distribution, and manufacturing facilities.

Barcode labels offer operational efficiency by enabling automated scanning, which reduces human error and accelerates throughput. Additionally, global standards and compatibility with ERP and WMS platforms have made barcode labeling a foundational component of digital logistics infrastructure.

The versatility of barcode formats, including linear and 2D codes, allows seamless use across packaging sizes and supply chain stages. Technological improvements in print resolution and label material quality have ensured consistent performance under variable conditions, reinforcing barcode labels as an essential element in modern inspection and inventory control practices.

The food and beverage industry is projected to capture 24.9% of market revenue in 2025, establishing it as the most prominent end use segment. This position is being reinforced by stringent food safety regulations and the need for batch-level traceability throughout the production and distribution process.

Labels are essential for displaying expiration dates, lot codes, storage instructions, and allergen information—elements critical to consumer safety and compliance with regional labeling mandates. In addition to functional requirements, labels in this sector must perform reliably under cold chain logistics, condensation, and frequent handling, making material and adhesive selection especially critical.

Barcode and QR code integration is enhancing traceability, supporting recall readiness, and enabling interactive consumer engagement. As brands invest in transparent and compliant packaging, inspection and inventory labels are being seen as a critical tool for both regulatory fulfillment and supply chain optimization within the food and beverage ecosystem.

Inspection and inventory labels help in eliminating errors that often occur during manual inventory tracking. Inspection and inventory labels improve the productivity and efficiency of employees as they can easily locate products and shelves to prepare shipments.

These factors are expected to drive the growth of the global inspection and inventory labels market during the forecast period. The common types of Inspection and inventory labels are rack labels, retro-reflective labels. Inspection and inventory labels are used to streamline the workflow by making products easier to identify. It helps in identifying desired products for proper inventory management.

Also, inspection and inventory labels are colour-coded for proper identification of products. These factors are expected to drive the sales of inspection and inventory labels globally during the next decade. Besides, inspection and inventory labels are designed to withstand harsh oil, solvents and other chemicals during shipping and logistics.

Overall, the market is expected to witness high growth prospects during the next decade as demand for inspection and inventory labels keeps on increasing.

The Asian region is expected to dominate the inspection and inventory labels market during the forecast period. It is attributed to the growth in the logistics and warehousing sector, especially in India and China.

Here, there is a lack of automation in the inspection and inventory management in logistics and warehousing. This factor is expected to create immense opportunities for the growth of the inspection and inventory labels market during the forecast period, increasing the demand for inspection and inventory labels.

The USA is expected to be one of the leading markets for the inspection and inventory labels market. This is due to the high adoption of automation in the region. Similar trends are followed by European countries such as the UK, Germany and Italy, among others.

The inspection and inventory labels market is expected to witness high growth prospects during the next decade. This pushes the overall demand for inspection and inventory labels.

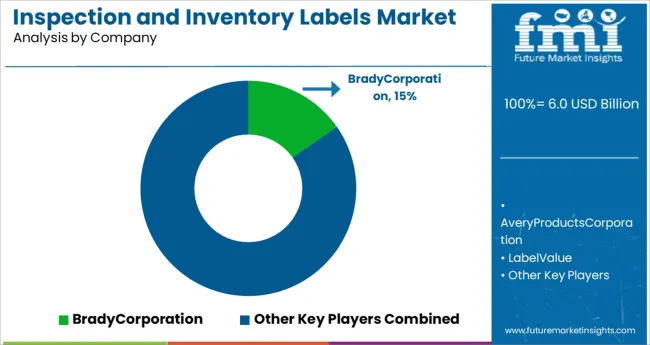

The key players in the Inspection and inventory labels market are focusing on enhancing the compact design that fits with all the products and goods and non-sticky qualities. This is driving the sales of Inspection and inventory labels.

Key players in the inspection and inventory labels market include Labelmaster, FSI Label, TOSHIBA Global Commerce Solutions Inc, Coast Label Company, Label Specialities Inc and The Label Printers LP.

Recent Market Development:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.2% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments covered | Width, Product Type, End Use, Region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Labelmaster; FSI Label; TOSHIBA Global Commerce Solutions Inc; Coast Label Company; Label Specialities Inc; The Label Printers LP |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global inspection and inventory labels market is estimated to be valued at USD 6.0 billion in 2025.

It is projected to reach USD 9.0 billion by 2035.

The market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types are plastic, paper and metal.

barcode label segment is expected to dominate with a 39.8% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examining Market Share Trends in Inspection and Inventory Labels

Labels Market Forecast and Outlook 2025 to 2035

Inventory Tag Market Size and Share Forecast Outlook 2025 to 2035

Inspection Drone in Oil and Gas Market Size and Share Forecast Outlook 2025 to 2035

Inspection Management Software Market Size and Share Forecast Outlook 2025 to 2035

Inspection Robots Market Size and Share Forecast Outlook 2025 to 2035

Labels, Tapes And Films Market Size and Share Forecast Outlook 2025 to 2035

Inspection Lighting Fixture Market Size and Share Forecast Outlook 2025 to 2035

Inventory Management Software Market Analysis - Size, Share, and Forecast 2025 to 2035

Inspection & Weighing Machine Industry Analysis in ASEAN and Gulf Countries Analysis - Size, Share, and Forecast 2025 to 2035

Competitive Overview of Labels Companies

Inspection Machines Market Growth – Trends & Forecast 2025 to 2035

PCB Inspection Microscope Market Size and Share Forecast Outlook 2025 to 2035

Bar Inspection System Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among USA Labels Providers

Tire Inspection System Market - Outlook 2025 to 2035

Foam Labels Market Trends and Growth 2035

Pipe Inspection Robot Market Growth – Trends & Forecast 2025 to 2035

Market Share Breakdown of Foil Labels Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA