The logistics packaging market is experiencing robust growth driven by expanding global trade, increasing e-commerce penetration, and heightened demand for durable and sustainable packaging solutions. The current market scenario reflects strong adoption of efficient packaging materials designed to optimize space utilization and reduce transportation costs. Industrial automation and digital logistics integration are supporting consistent market advancement.

Growing emphasis on supply chain optimization and environmental compliance is prompting manufacturers to innovate with lightweight, recyclable, and high-strength materials. The future outlook remains positive as companies continue to invest in advanced packaging technologies that enhance product protection and operational efficiency. Growth rationale is being reinforced by rising demand across sectors such as food and beverages, pharmaceuticals, and consumer goods.

These industries require secure, cost-effective, and traceable packaging systems Ongoing innovation, improved material performance, and sustainability-driven initiatives are expected to ensure steady expansion of the logistics packaging market across global manufacturing and distribution networks.

| Metric | Value |

|---|---|

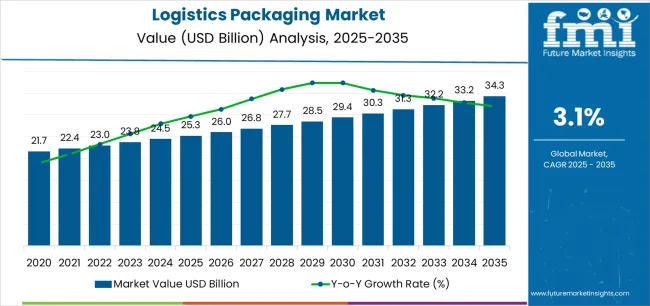

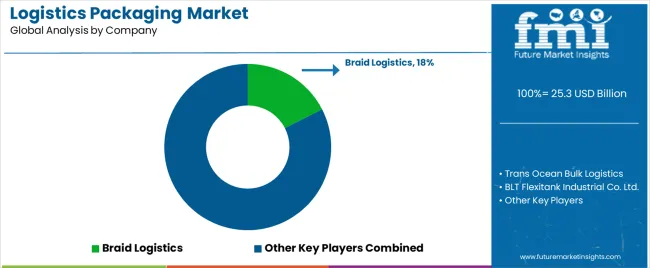

| Logistics Packaging Market Estimated Value in (2025 E) | USD 25.3 billion |

| Logistics Packaging Market Forecast Value in (2035 F) | USD 34.3 billion |

| Forecast CAGR (2025 to 2035) | 3.1% |

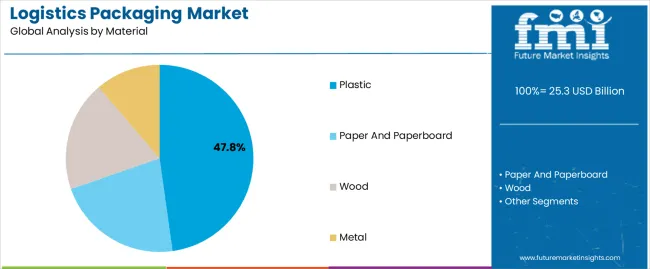

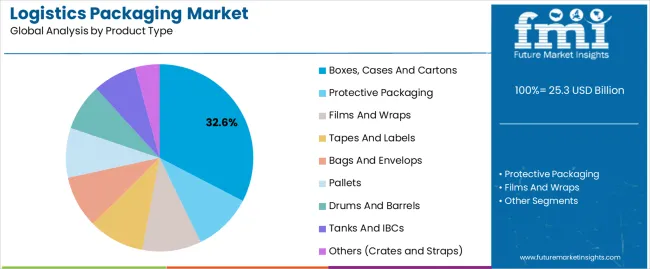

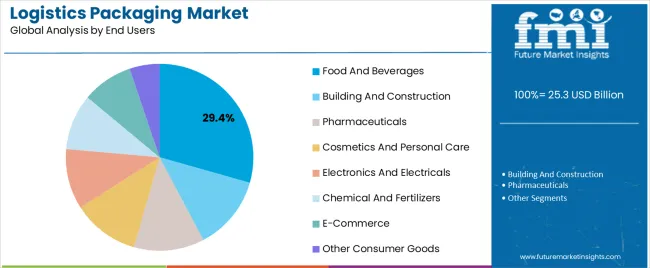

The market is segmented by Material, Product Type, and End Users and region. By Material, the market is divided into Plastic, Paper And Paperboard, Wood, and Metal. In terms of Product Type, the market is classified into Boxes, Cases And Cartons, Protective Packaging, Films And Wraps, Tapes And Labels, Bags And Envelops, Pallets, Drums And Barrels, Tanks And IBCs, and Others (Crates and Straps). Based on End Users, the market is segmented into Food And Beverages, Building And Construction, Pharmaceuticals, Cosmetics And Personal Care, Electronics And Electricals, Chemical And Fertilizers, E-Commerce, and Other Consumer Goods. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic segment, holding 47.8% of the material category, has emerged as the leading choice due to its versatility, strength-to-weight ratio, and cost-effectiveness in large-scale logistics operations. Its dominance is being supported by improved polymer formulations that enhance durability and resistance to impact, moisture, and temperature variations.

Plastic’s adaptability to various packaging formats such as containers, wraps, and pallets has reinforced its demand across multiple end-user industries. Despite growing regulatory scrutiny over environmental concerns, advancements in recyclable and biodegradable plastic materials are sustaining market momentum.

Continuous innovation in lightweight design and cost-efficient production techniques is further improving performance and reducing waste generation The segment’s growth trajectory remains strong as logistics providers and manufacturers increasingly adopt plastic-based solutions to balance durability, sustainability, and affordability in high-volume packaging applications.

The boxes, cases, and cartons segment, accounting for 32.6% of the product type category, has been leading the market owing to its universal applicability in storage, handling, and transportation processes. Its dominance is attributed to superior protection against mechanical damage and ease of stacking, labeling, and customization.

Demand is being supported by the expanding e-commerce industry and the need for standardized packaging formats that ensure secure shipment and efficient warehouse management. Manufacturers are focusing on innovation in structural design and material optimization to improve strength while minimizing weight.

Adoption of smart packaging technologies, including RFID tagging and tamper-evident features, is enhancing tracking and security throughout the logistics chain As global trade volumes continue to rise, the segment is expected to retain its leadership position through its reliability, adaptability, and compatibility with automated packaging and distribution systems.

The food and beverages segment, representing 29.4% of the end-user category, has maintained dominance due to stringent requirements for hygiene, product preservation, and temperature control in transport and storage. Growth has been driven by increasing consumption of processed and packaged food, as well as expanding global cold chain infrastructure.

Packaging solutions designed for this sector emphasize contamination prevention, durability, and compliance with food safety standards. The segment benefits from continuous innovation in barrier materials and insulated packaging that maintain freshness and extend shelf life.

Rising demand for sustainable and recyclable packaging is influencing product design and material selection, with major brands adopting eco-friendly alternatives The continued expansion of the global food service and retail sectors is expected to reinforce the segment’s leading position, ensuring steady demand for high-quality logistics packaging across supply chains.

Logistics packaging plays an indispensable role in the supply chain management cycle as it facilitates transit and brings down transportation costs. Robust logistics packaging ensures their effective distribution, provides protection to fragile items, and develops attractive packages to attract customers.

Manufacturers of logistics packaging can integrate their packaging with smart technology to give neck-to-neck competition to their peers. Radio Frequency Identification (RFID) tags and smart sensors are some smart technologies that customers are finding useful as they give complete information about the products.

In addition to these developments, the revenue growth of logistics packaging market players is drive by growing demand for intelligent box recommendation systems that helps save human’s time and energy as it does what its name suggests.

| Leading Material | Plastic |

|---|---|

| Value Share (2025) | 48.3% |

Plastic logistics packaging materials compose 48.3% of the logistics packaging market. This is because plastic is massively used to package consumer goods, foods, and beverages, healthcare products, etc.

Players choose to use plastic material as a resistant and high-quality packaging material and it is suitable for the transportation of an extensive variety of goods. Plastic packaging material is also insensitive to temperature fluctuations and offers excellent insulation.

| Leading Product Type | Protective Packaging |

|---|---|

| Value Share (2025) | 45.20% |

In the logistics packaging industry, the market share of protective packaging is expected to be 43.1% by 2025 end. Value generation from the sales of protective packaging is going to outpace that of other segments. Most commonly purchased protective packaging includes bubble sheets and air bags, edge protectors, layer pads, etc.

The demand for protective packaging is increasing as it protects and buffers the product potential harm or friction during shipping from the warehouse or manufacturer to the consumer. Usually, it is used to pack fragile products, however, it can also be used to package non-fragile items.

| Countries | Forecast CAGR (2025 to 2035) |

|---|---|

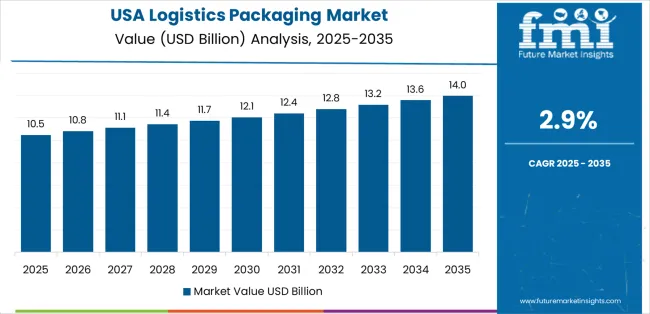

| The United States | 2.10% |

| Canada | 3.50% |

| The United Kingdom | 3.80% |

| China | 5.70% |

| India | 6.40% |

The business activities related to logistics packaging in the United States have the potential to grow at a 2.1% CAGR. Significant advancements in the field of shipping logistics packaging are providing significant stimulus to the market.

The United States has the means to enjoy advanced technology on a prior basis owing to available resources in the country, substantial government funding, skilled human resources, and modern infrastructure that supports research activities.

In August 2025, for instance, researchers from the Case Western Reserve University came up with a revolutionary “smart packaging” system that has the potential to transform food logistics.

The technology is said to elevate food transportation efficiency by monitoring the state of perishable foods during transport. This distinct approach holds the potential to reshape supply chains, curtail costs, and ascertain improved-quality food to be eventually consumed.

The use of logistics packaging is increasing in Canada at an estimated 3.5% CAGR. Key players in the market are seeking ways to expand their customer base, which would lead to higher revenues for them.

In January 2025, for instance, Nulogy, an active solutions provider for supply chain collaborations, officially announced that TCO LLC has entered the Nulogy community. This community includes manufacturers, suppliers, logistics providers, and fast-moving consumer goods (FMCG) brands that operate and work on Nulogy.

TCO LLC, which is a Kentucky-based contract packager, logistics provider, and manufacturer, spotted an opportunity to strategically ramp up its contract packaging operation to ensure business growth. With this intent, the company chose Nulogy’s Shop Floor Solution to boost the digital foundation of its co-pack operation.

Players of logistics packaging can expect a growth of 5.7% CAGR in China over the next 10 years. This growth graph suggests lucrative opportunities as opposed to prospects in matured markets like the United States and Europe.

China has been promoting standardization, minimization, and recycling of express packaging for quite some time now. These steps are aimed at the green development of its logistics packaging sector.

Recently, an intelligent box recommendation system has been introduced which automatically creates a packaging plan for product arrangement, box size, and protection measures. Using this system considerably improves box space utilization.

The logistics packaging industry is in its prime currently. The industry is driven by the growing enthusiasm for online shopping sprees, booming economic activities, and increasing discretionary incomes of people.

The initiative of this burgeoning industry to evolve into green logistics services is incredible, considering the piling of packaging wastes created by the boom of eCommerce.

The market scope for logistics packaging in the United Kingdom has been forecasted to register a 3.8% CAGR in the following decade. Demand in the United Kingdom is expected to be higher than in countries of the European Union.

Key players are employing age-old tried and tested acquisitions and mergers to strengthen their position in the market. For instance, in February 2025, Logson Group, a packaging firm, obtained Challenge Packaging, to scale up its offering in England’s southeast region.

Challenge Packaging is a packaging supply chain solutions provider and corrugated cardboard packaging manufacturer. Logson Group, on the other hand, is an independent group of packaging firms The group has been prominently acquisitive in recent years, which explains the purchase of Challenge Packaging.

This transaction offers continuity for Challenge Packaging to exist as a part of Logson Group, which is an ambitious and exciting growth platform in the sector.

The growth of the logistics packaging market in India remains unparalleled in other Asian countries. FMI analysts have estimated that the logistics packaging sector in India has the potential to expand at a CAGR of 6.4% over the next 10 years.

Soon the logistics firms in India would be required to strictly abide by certain packaging standards within their large warehouses. In a news update in December 2025, it was reported that government of India is actively creating packaging standards to enforce optimum space utilization in warehouses.

This concept aligns with the government’s goal to slash logistics costs, which are presently at 14-15% of GDP, to levels equivalent to advanced economies, which is around 7-8%. Affordab

With the multifold growth in the logistics sector, the demand for logistics packaging is accelerating at an accelerated pace. Significant opportunities in this sector is attracting several logistics packaging startups to expand their business.

FMI has picked the top five entrants from the sea of startups, including SURE Pak, Stockare, Logiun, SECUR LPT, and AeroClay, who hold a lot of promise. These companies are reimagining the shipping logistics packaging solutions to bring efficiencies in the market.

A few key trends set in motion by these startups include

Key players in the logistics packaging industry are increasing their production facilities to meet the growing demands for logistics packaging. Players are setting up their facilities in high-growth locations, where labor prices are less and/or resources are available in abundance, to reduce their costs.

Industry participants are seeking ways to contribute to a greener world by introducing recyclable products, thus doing their bit to protect the environment. Market contenders are further expanding their network of partners to reach an ever-growing population of clients who require professional packaging solutions.

Players are expanding their product range to include all types of boxes, box pallets, packaging containers, etc. To ensure customer satisfaction so that they repeat these services, players are taking extra measures to ensure high levels of quality.

Market participants are also offering customized solutions to meet storage and transportation needs. Additionally, companies are investing in research and development activities to search for new and distinct designs, production technologies, and raw materials, so that they can develop improved products and lower their impact on the environment.

Latest Developments Taking Place in the Logistics Packaging Market

The global logistics packaging market is estimated to be valued at USD 25.3 billion in 2025.

The market size for the logistics packaging market is projected to reach USD 34.3 billion by 2035.

The logistics packaging market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in logistics packaging market are plastic, paper and paperboard, wood and metal.

In terms of product type, boxes, cases and cartons segment to command 32.6% share in the logistics packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Players & Market Share in the Logistics Packaging Industry

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Logistics Robots Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA