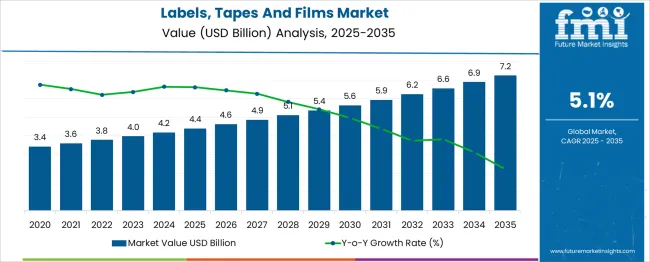

The labels, tapes and films market is estimated to be valued at USD 4.4 billion in 2025. It is projected to reach USD 7.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period. The market expansion represents a growth multiplier of 1.64x, supported by a CAGR of 5.1%, indicating moderate but steady growth across packaging, industrial, and logistics applications.

Phase-wise analysis shows that the first five-year period (2025-2030) is projected to contribute approximately USD 1.1 billion, accounting for 39% of the total incremental value, as demand for pressure-sensitive labels, security films, and barcode solutions grows with e-commerce and FMCG penetration. The second phase (2030-2035) is estimated to generate around USD 1.7 billion, representing 61% of total absolute gains, driven by smart labeling adoption, RFID integration, and enhanced performance films catering to sustainability-focused packaging formats.

The larger share of incremental opportunity in the latter half signals stronger investment in advanced label technologies, including tamper-evident solutions and heat-resistant tapes for industrial applications. Manufacturers focusing on multi-layer structures, eco-compliant adhesives, and regional capacity expansion will be positioned to capture this USD 2.8 billion growth window, especially in high-demand sectors such as healthcare labeling and food traceability.

| Metric | Value |

|---|---|

| Labels, Tapes And Films Market Estimated Value in (2025 E) | USD 4.4 billion |

| Labels, Tapes And Films Market Forecast Value in (2035 F) | USD 7.2 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The labels, tapes, and films market holds a strong presence within multiple packaging and adhesive-related sectors. In the packaging materials market, it accounts for approximately 12–14%, driven by growing demand for flexible and durable packaging solutions. Within the adhesive products market, its share is about 10–12%, as tapes are widely used in industrial, commercial, and household applications. In the industrial and specialty films market, the contribution stands at nearly 15–18%, reflecting the use of films in protective layers, lamination, and barrier applications.

For the printing and labeling solutions market, its share is significant at 25–28%, since labeling is integral to branding and regulatory compliance across industries. In the consumer goods and retail packaging market, the share is around 8–10%, as labels and films are essential components for product presentation and safety.

Market growth is supported by increasing e-commerce activity, demand for tamper-evident packaging, and adoption of sustainable film solutions. Technological advancements such as digital printing, eco-friendly adhesives, and smart labeling for traceability are further enhancing the appeal of these products. As industries focus on brand differentiation, sustainability, and efficiency in packaging, the labels, tapes, and films segment is expected to strengthen its position across these parent markets in the coming years.

The labels, tapes, and films market is undergoing a notable transformation as sustainability imperatives, advancements in adhesive technologies, and evolving end-user expectations converge to reshape demand patterns. Growing emphasis on lightweight, durable, and recyclable materials has accelerated the shift toward engineered films and pressure-sensitive labels.

Operational benefits such as reduced material waste, improved production efficiency, and enhanced aesthetics are driving adoption across industries. Future growth is expected to be reinforced by technological innovations in smart labels and eco-friendly films alongside increasing investments in automation and digital printing.

The market’s trajectory is being shaped by regulatory compliance pressures, heightened brand differentiation efforts, and rising consumer awareness about sustainable packaging, which collectively create fertile ground for further expansion and innovation.

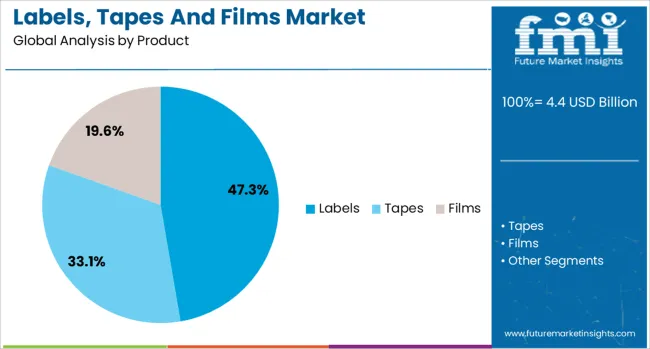

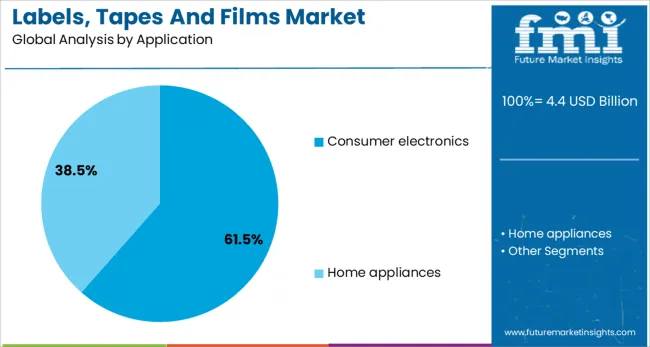

The labels, tapes and films market is segmented by product, application, and geographic regions. By product, the labels, tapes and films market is divided into Labels, Tapes, and Films. In terms of application of the labels, tapes and films market is classified into Consumer electronics and Home appliances. Regionally, the labels, tapes and films industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product the labels segment is expected to hold 47.30% of the total market revenue in 2025 establishing itself as the dominant product category. This leadership has been attributed to the increasing need for product identification traceability and regulatory compliance, which has intensified demand for durable and high-performance labels.

Enhanced capabilities of labels to support branding initiatives and communicate critical information have further reinforced their prominence. Advances in materials and adhesives enabling superior durability and compatibility with diverse surfaces have made labels indispensable across multiple applications.

The ability to seamlessly integrate security features and smart technologies such as RFID has also strengthened their relevance making them the preferred choice for manufacturers and retailers seeking efficiency compliance and customer engagement.

Segmented by application, the consumer electronics segment is projected to account for 61.5% of the market revenue in 2025, maintaining its position as the leading application area. This dominance has been fueled by the intricate labeling and protective film requirements inherent to electronic devices, which demand precision, durability, and aesthetic appeal.

Labels, tapes, and films have been increasingly deployed in electronic components and devices to provide insulation protection, branding, and compliance marking. The proliferation of portable and miniaturized electronics has intensified the need for specialized solutions that can withstand heat, moisture, and mechanical stress while maintaining performance integrity.

The growing complexity of supply chains in consumer electronics has amplified the use of functional and intelligent labels to ensure product authenticity, traceability, and regulatory conformity, thereby consolidating the segment’s leadership.

The labels, tapes and films market has been advanced by rising packaging and logistics demand, regulatory traceability norms, and digital printing adoption in 2024–2025. Opportunities lie in smart label adoption, multi‑functional tapes, and regional expansion. Trends such as increased use of pressure‑sensitive materials, adhesive innovation, and printable film enhancements are being observed. Restraints include raw material price volatility, adhesive regulatory compliance costs, and supply chain bottlenecks affecting execution timelines. The opinionated view is that firms investing in flexible substrates and adhesive development are better positioned despite margin pressures.

Growth in the labels, tapes, and films market has been driven by booming e-commerce, logistics expansion, and mandatory labeling compliance in food, pharma, and consumer goods segments during 2024 and 2025. Demand for high‑performance adhesive tapes and durable films surged in packaging applications, particularly for brand protection and product tracing. The electronics sector continued absorbing flexible films and tapes for insulation and device assembly. Compliance labeling regulations enforced in regions like North America and Asia-Pacific further increased the deployment of specialty labels. It is believed that these forces collectively sustained expansion at approximately USD 45–46 billion in 2025

Opportunities were presented in 2024–2025 by demand for smart labels embedded with QR, RFID and traceability features, and the rise of multi-functional adhesive tapes tailored to industrial and logistics uses. Fate was considered bright for firms offering printable label films supporting secure coding and anti-counterfeit functionality. Expansion opportunities were seen in segments requiring freezer-resistant, heat‑lag adhesive types for specialized sectors. Entry into emerging regions such as Asia-Pacific offered further upside via localized adhesive solutions adapted to high-growth consumer markets and packaging transitions.

A trend is emerging in the growing adoption of pressure‑sensitive tapes and labels coupled with digital printing and flexographic production for personalized, short-run runs. Demand for polypropylene-backed tapes rose to nearly 35 % share in 2025 due to strength and versatility in packaging and electronics uses. Water‑based adhesive systems that reduce volatile organic compounds were introduced in 2024–2025, meeting tightening regulations. Digital print-enabled label films enabled faster turnaround and customization. These developments were considered defining industry trends shaping supplier competitiveness.

One restraint faced in 2024 and 2025 is volatility in feedstocks like polypropylene, PVC and adhesive resin that raised production costs and compressed margins. Regulatory pressure related to solvent-based adhesive systems and VOC emissions forced shifts to water-based adhesives, raising compliance and conversion expenditure. Supply chain disruptions, especially in Asia, created execution delays across label and film delivery. Firms lacking vertical sourcing or localized production were deemed most exposed. These constraints were seen as material in limiting the pace of expansion despite strong end-user demand.

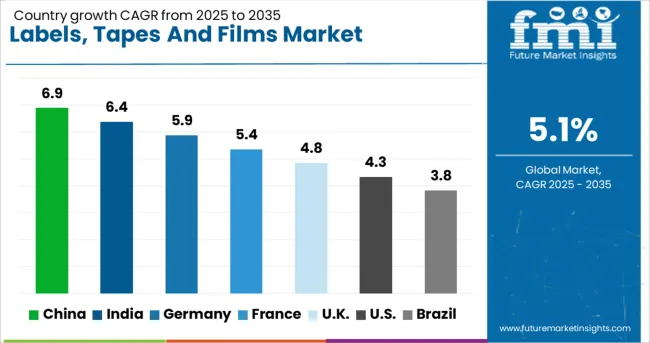

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| Uk | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

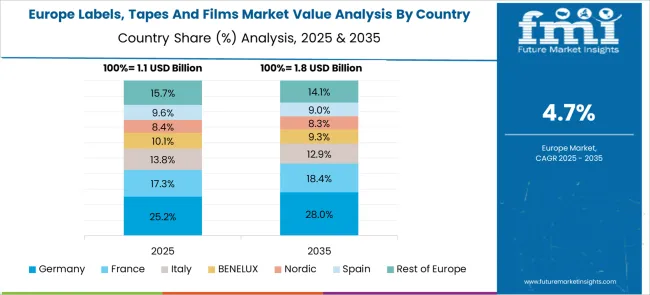

The global labels, tapes, and films market is projected to grow at a CAGR of 5.1% from 2025 to 2035. China leads with 6.9%, followed by India at 6.4% and Germany at 5.9%. France posts 5.4%, while the United Kingdom records 4.8%. Growth is fueled by demand from packaging, logistics, and industrial sectors, supported by advancements in adhesive technology and digital printing. China and India dominate due to rising e-commerce and FMCG expansion, while Germany emphasizes high-performance specialty films. France and the UK focus on eco-friendly substrates and smart label technologies for retail and manufacturing applications.

The labels, tapes, and films market in China is projected to grow at 6.9%, driven by high demand in packaging, automotive, and consumer goods sectors. Pressure-sensitive adhesive labels dominate FMCG and logistics segments. Manufacturers integrate digital printing for variable data labeling. Growth in cross-border e-commerce accelerates adoption of tamper-evident tapes and smart labels.

The labels, tapes, and films market in India is forecast to grow at 6.4%, supported by rapid growth in food packaging, retail, and healthcare industries. Self-adhesive tapes dominate industrial and consumer packaging applications. Manufacturers introduce eco-friendly films to comply with sustainability norms. Increasing adoption of RFID-enabled labels strengthens traceability in logistics and supply chain management.

The labels, tapes, and films market in Germany is expected to grow at 5.9%, driven by demand for high-performance films in automotive and electronics sectors. Heat-resistant tapes dominate specialized industrial applications. Manufacturers develop printable films for digital packaging solutions. Compliance with EU circular economy policies accelerates innovations in recyclable substrates.

The labels, tapes, and films market in France is projected to grow at 5.4%, driven by premium branding needs in wine, cosmetics, and gourmet packaging. Pressure-sensitive labels dominate high-end product labeling applications. Manufacturers emphasize luxury finishes and anti-counterfeit features. Integration of smart technologies, such as QR codes, supports traceability and consumer engagement.

The labels, tapes, and films market in the UK is forecast to grow at 4.8%, supported by the adoption of sustainable packaging solutions and increased demand for logistics labeling. Water-based adhesive tapes dominate eco-friendly product lines. Manufacturers explore biodegradable and compostable films for regulatory compliance. Growth in omnichannel retail and home delivery drives demand for high-strength labeling solutions.

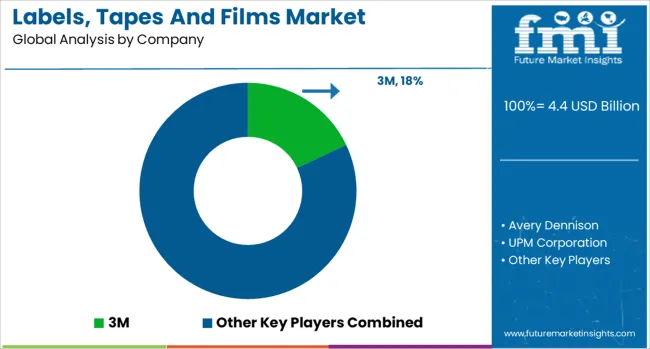

The labels, tapes, and films market is moderately consolidated, with 3M recognized as a leading player due to its broad portfolio of adhesive solutions, industrial tapes, and specialty films tailored for automotive, electronics, and packaging applications. The company’s focus on innovation and global distribution has strengthened its leadership position in this segment. Key players include Avery Dennison, UPM Corporation, Scapa Group, tesa SE, FLEXcon Company, Inc., American Biltrite, and CCL Industries.

These companies offer a wide range of pressure-sensitive labels, industrial tapes, and performance films designed for applications such as product branding, surface protection, and component bonding. Their strategies emphasize high-performance adhesives, customizable formats, and sustainability-focused products. Market growth is being driven by expanding e-commerce and packaging industries, rising demand for lightweight bonding solutions in automotive and electronics, and the growing preference for high-durability labeling in logistics and consumer goods.

Manufacturers are investing in advanced adhesives for extreme environments, recyclable and bio-based films, and smart labeling technologies with RFID integration. Asia-Pacific remains the fastest-growing region due to industrialization and manufacturing expansion, while North America and Europe maintain steady demand for specialty tapes and films in industrial and healthcare sectors.

Innovations such as UV and digital printing compatibility, alongside sustainable coatings, enhance durability, print clarity, and eco-friendly performance, making these films essential for modern labeling requirements and regulatory compliance across diverse high-demand sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.4 Billion |

| Product | Labels, Tapes, and Films |

| Application | Consumer electronics and Home appliances |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Avery Dennison, UPM Corporation, Scapa Group, tesa SE, FLEXcon Company, Inc., American Biltrite, and CCL Industries |

| Additional Attributes | Dollar sales by product type (labels, adhesive tapes, industrial films) and application (electronics, food, logistics, healthcare), regional demand trends, competitive landscape, buyer preference for sustainable and printable formats, integration with packaging systems, innovations in smart labels, recyclable substrates, and high-barrier performance films. |

The global labels, tapes and films market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the labels, tapes and films market is projected to reach USD 7.2 billion by 2035.

The labels, tapes and films market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in labels, tapes and films market are labels, tapes and films.

In terms of application, consumer electronics segment to command 61.5% share in the labels, tapes and films market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tapes Market Insights – Growth & Demand 2025 to 2035

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in PVC Tapes Industry

USA Tapes Market Analysis – Growth & Forecast 2024-2034

ESD Tapes and Labels Market from 2025 to 2035

Seam Tapes Market Insights – Growth & Demand Forecast 2025-2035

Foil Tapes Market

Nano Tapes Market

Pouch Tapes Market Size and Share Forecast Outlook 2025 to 2035

Washi Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Tapes Market Insights – Growth & Demand 2025–2035

Market Share Breakdown of Paper Tapes Providers

Carbon Tapes Market Size and Share Forecast Outlook 2025 to 2035

Rubber Tapes Market Trends - Growth & Forecast 2025 to 2035

Mastic Tapes Market from 2025 to 2035

Spacer Tapes Market Insights & Growth Outlook through 2034

Filmic Tapes Market

Tissue Tapes Market

Suture Tapes Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA