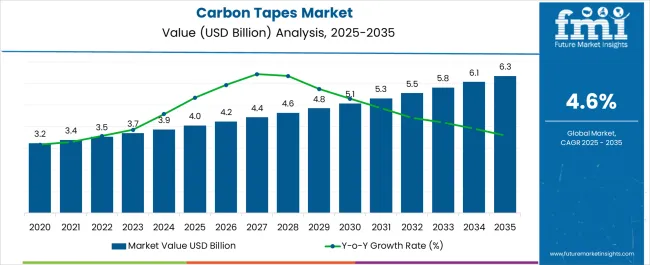

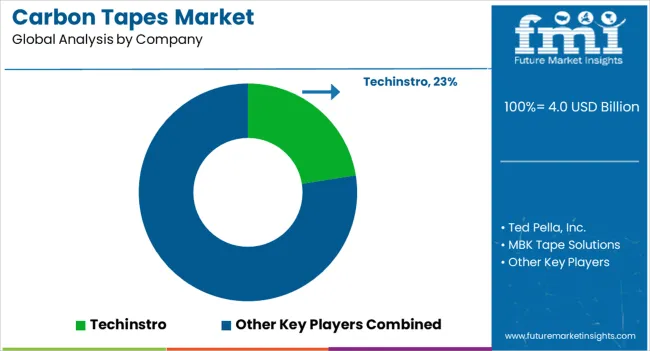

The Carbon Tapes Market is estimated to be valued at USD 4.0 billion in 2025 and is projected to reach USD 6.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

| Metric | Value |

|---|---|

| Carbon Tapes Market Estimated Value in (2025 E) | USD 4.0 billion |

| Carbon Tapes Market Forecast Value in (2035 F) | USD 6.3 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The carbon tapes market is expanding steadily, driven by rising demand for lightweight and high strength composite materials across advanced manufacturing industries. Increasing use of carbon fiber reinforced components in aerospace, defense, automotive, and sporting goods is fueling market adoption.

Continuous advancements in resin formulations and prepreg technologies are improving thermal stability, durability, and structural integrity, enabling greater performance efficiency in demanding applications. Sustainability initiatives and a growing emphasis on fuel efficiency are also accelerating the replacement of traditional materials with carbon tapes.

Furthermore, investments in automated tape laying and high precision manufacturing processes are supporting scalable production capabilities. With defense modernization programs and aerospace innovation accelerating globally, the market outlook remains positive as carbon tapes become integral to high performance engineering solutions.

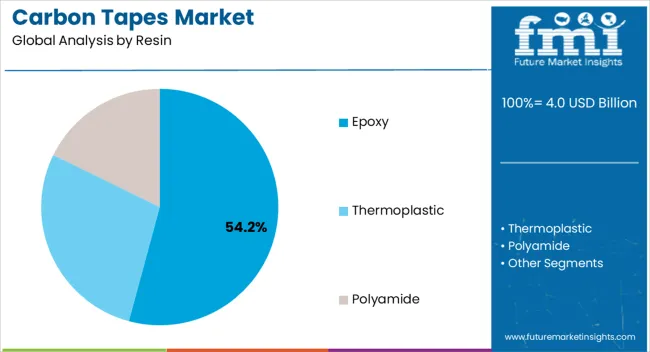

The epoxy resin segment is projected to hold 54.20% of total revenue by 2025 within the resin category, positioning it as the leading material. Its dominance is supported by superior adhesion, chemical resistance, and structural stability that make it highly suitable for aerospace and defense applications.

Epoxy based carbon tapes offer consistent mechanical strength and compatibility with prepreg technologies, ensuring high performance in critical load bearing components. The ability to withstand extreme environmental conditions further reinforces its adoption.

As industries increasingly demand durable and lightweight composites, epoxy resin continues to anchor the growth of the resin segment.

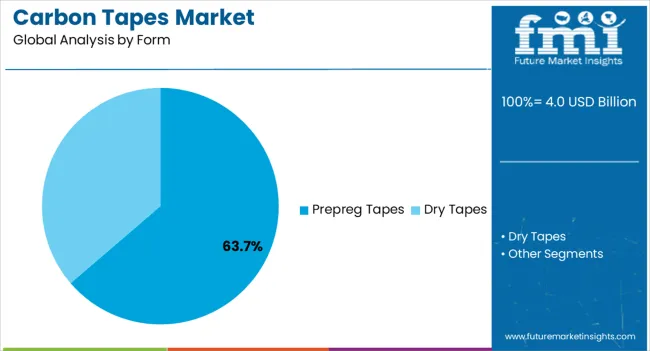

The prepreg tapes segment is expected to account for 63.70% of market revenue by 2025 within the form category, making it the most dominant format. This growth is attributed to its ability to deliver uniform resin distribution, improved process efficiency, and reduced manufacturing defects.

Prepreg tapes support advanced automation in tape laying and fiber placement, enabling the production of complex geometries with precision. Their suitability for high performance sectors such as aerospace and automotive has accelerated adoption, as they provide superior mechanical properties and reduce production cycle times.

The consistent quality and reduced variability offered by prepreg tapes reinforce their leadership within the form category.

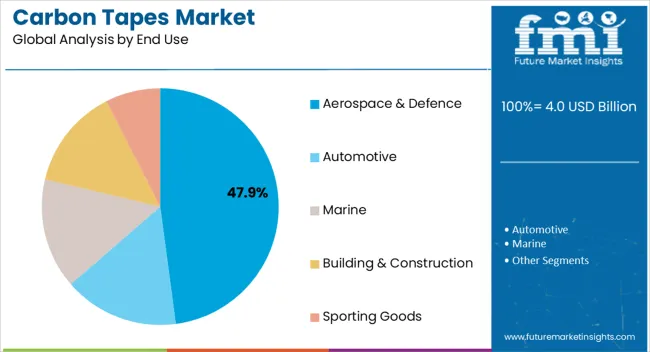

The aerospace and defence segment is projected to contribute 47.90% of total revenue by 2025 within the end use category, positioning it as the largest market. Growth is being driven by the sector’s demand for lightweight, high strength materials to improve fuel efficiency, extend operational range, and meet stringent performance standards.

Carbon tapes are extensively used in primary and secondary structural components including fuselage, wings, and defense equipment. Rising investments in fleet modernization, next generation aircraft, and defense innovations are boosting the requirement for advanced composite solutions.

The critical need for materials that balance safety, strength, and weight reduction continues to ensure aerospace and defence dominate the end use category in the carbon tapes market.

Sales of carbon tapes are slated to increase at a 4.6% CAGR over the forecast period, in comparison to the CAGR of 3.4% registered during 2020 to 2024. The global carbon tapes industry reached USD 4 billion in 2025 from USD 3.2 billion in 2020.

The carbon tape made from carbon fiber offers high strength and durability. It offers high-temperature tolerance and low thermal expansion property, making it a preferred choice among end use industries for reinforcement.

Carbon tape is the perfect solution for firmly connecting two components and ensuring optimal electrical conductivity between them. Therefore, it is also called carbon conductive tape. Carbon tapes are available in different resins such as epoxy carbon tapes, thermoplastic carbon tapes, and polyamide carbon tapes.

Increasing demand for these carbon tapes are attributed to several end-user industries, including aerospace & defense, automotive, building & construction, and others. In addition, new technologies such as automated tape laying and automatic fiber insertion have made it possible to produce composite parts with cost-effective, quick, and accurate composite layups.

The carbon tapes help the end use industries to manufacture multifunctional parts in less time and cost. Thus, the demand for carbon tapes is anticipated to grow at a faster pace during the forecast period.

End use industries use most common materials to replace the rebar in carbon tape-based concrete structures. Using carbon tape prevents damage or concrete as iron tends to accumulate rust on the surface.

Using these tapes during construction reduces time and cost required to install the structure. Carbon plastic reinforcements based on carbon tapes are used in home construction, bridge construction, processing plant design, and utility construction. Metal structures are the most common concrete structures, but carbon tape is used to repair and reinforce stone and woodwork.

Carbon tape is used in sports equipment, from ice hockey sticks to jogging shoes, golf clubs, and tennis rackets. Also, it is used in horse riding, motorcycles, and mountaineer crash helmets. All sports containing a high risk of head injuries use carbon tapes. Increasing participation in a variety of sports results in high demand for various sporting equipment which bolster the demand for carbon tapes in the sporting industry.

| Country | Market Share (2025) |

|---|---|

| United States | 24% |

| Germany | 5.3% |

| Japan | 3.9% |

| Australia | 2.9% |

Manufacturers in Japan are Preferring Carbon Fiber Tapes

Sales in the Japan carbon tapes sector are anticipated to increase at a CAGR of 5.4% during 2025 to 2035. As per the statistics published by the Japan Automobile Manufacturer Association (JAMA), Japan is the third manufacturer in the automobile industry which has a total export of around 3.9 million units in the year 2024.

Also, the key players operating in the automotive industry have their presence in Japan due to technological advancements. The number of vehicles exported witnessed a meteoric rise in 2024, which has also resulted in increased use of carbon tapes across the automobile sector.

high Demand for High Fiber Woven Carbon Tapes in India Boost Sales

Total demand for carbon tapes in India is likely to create an incremental opportunity of USD 3.9 billion during the forecast period, with a CAGR of 7.2%. According to the All India Association of Industries (AIAI), India has increased its military and defense expenditure by announcing a defense budget of around USD 67.4 billion for the years 2024 to 2024.

India has allotted more than 10% compared to the previous years. The government is spending a high amount on the military defense system for the future. India has also shown a positive graph in the aerospace industry after the impact of a pandemic.

| Segment | Resin |

|---|---|

| Top-segment | Epoxy |

| Market Share (2025) | 48% |

| Segment | End Use |

|---|---|

| Top-segment | Aerospace and defense |

| Market Share (2025) | 41.3% |

Demand for Epoxy Carbon Tapes is likely to Continue Gaining Traction

By resin, the epoxy segment is projected to expand 1.6x the current value during the forecast period. Epoxy resin exhibits low shrinkage when cured and adheres well to all types of fibers. In addition to this, epoxy resin is highly corrosion resistant and is less susceptible to water and heat than other polymer matrices.

Sales in the Aerospace and Defense Sector to Remain High

The aerospace & defense segment accounted for around 41% of the total market share in 2025. Carbon tapes are one of the most common materials used in manufacturing composite aerospace parts. Demand for carbon tapes in aircraft structural manufacturing such as wing spars, wing skins, and access panels is expected to drive the market

The key players operating in the carbon tapes business are focusing on introducing advanced products to cater to the growing demand. Also, key players are trying to expand their resources through mergers & acquisitions. For instance:

The global carbon tapes market is estimated to be valued at USD 4.0 billion in 2025.

The market size for the carbon tapes market is projected to reach USD 6.3 billion by 2035.

The carbon tapes market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in carbon tapes market are epoxy, thermoplastic and polyamide.

In terms of form, prepreg tapes segment to command 63.7% share in the carbon tapes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Free Waste Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Carbon Labeled Packaged Meal Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Bike Wheelset Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Lasers Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Packaging Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Construction Repair Market Size and Share Forecast Outlook 2025 to 2035

Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Dioxide Synthesis Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Neutral Skincare Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Reinforced Plastic Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Wraps Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Boat Hulls Market Size and Share Forecast Outlook 2025 to 2035

Carbon Textile Reinforced Concrete Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA