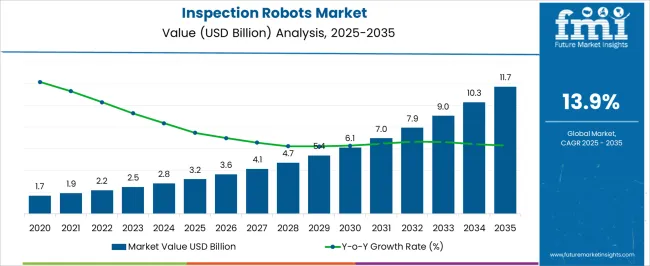

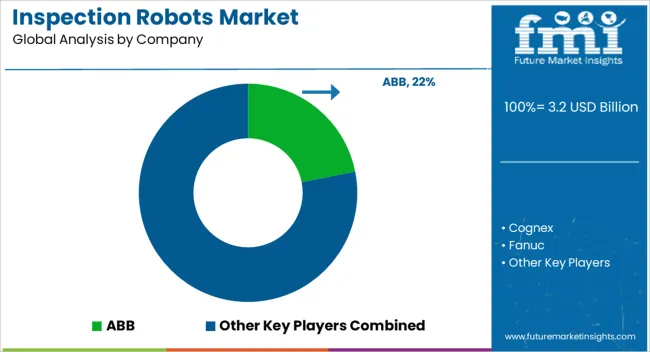

The inspection robots market is valued at USD 3.2 billion in 2025 and is projected to reach USD 11.7 billion by 2035, growing at a CAGR of 13.9%. The market follows a clear acceleration-deceleration pattern over the forecast period. From 2021 to 2025, the market gradually grows from USD 1.7 billion to USD 3.2 billion, with annual increments moving through USD 1.9 billion, 2.2 billion, 2.5 billion, and 2.8 billion. This early phase shows moderate acceleration as industries like manufacturing, oil and gas, and infrastructure adopt inspection robots for tasks such as pipeline monitoring, facility inspections, and asset management. The initial growth is steady, driven by increasing efficiency and safety benefits.

Between 2026 and 2030, the market sees significant acceleration, expanding from USD 3.2 billion to USD 7.0 billion, with values rising through USD 3.6 billion, 4.1 billion, 4.7 billion, and 5.4 billion. This phase is marked by rapid adoption, driven by improvements in robot autonomy, AI integration, and real-time data processing, enabling inspection robots to operate across complex environments with minimal human intervention. From 2031 to 2035, the market experiences a slight deceleration, although it continues to rise from USD 7.9 billion to USD 11.7 billion. Intermediate values include USD 9.0 billion, 10.3 billion, and 11.7 billion. This final phase exhibits sustained growth, albeit at a slightly slower rate, as widespread industry adoption stabilizes the growth pattern. Innovation continues to drive efficiency and expand into new application areas.

| Metric | Value |

|---|---|

| Inspection Robots Market Estimated Value in (2025 E) | USD 3.2 billion |

| Inspection Robots Market Forecast Value in (2035 F) | USD 11.7 billion |

| Forecast CAGR (2025 to 2035) | 13.9% |

The robotics market is the largest contributor, accounting for approximately 30-35% of the market. Robotics technology enables inspection robots to perform autonomous inspections in hazardous or difficult-to-reach areas, such as in power plants, pipelines, and factories. The industrial automation market contributes around 20-25%, as inspection robots are increasingly used for quality control, equipment monitoring, and maintenance tasks in manufacturing environments.

The oil and gas market holds about 15-18%, with inspection robots being deployed to inspect pipelines, offshore rigs, and refineries, reducing the need for human intervention in hazardous conditions. The aerospace and defense market adds approximately 10-12%, as inspection robots are used for inspecting aircrafts, military equipment, and infrastructure in hard-to-reach or dangerous areas, ensuring safety and compliance. The building and construction market contributes around 8-10%, as inspection robots are utilized for structural inspections, particularly in high-rise buildings, bridges, and tunnels, where human access is limited or risky.

The energy and utilities market holds about 5-8%, with inspection robots used to monitor power lines, wind turbines, and solar panels, ensuring the continuous operation of energy infrastructure.

The inspection robots market is undergoing steady expansion, driven by the need for enhanced operational safety, efficiency, and precision across industrial sectors. The current landscape reflects strong adoption in manufacturing, oil and gas, power generation, and infrastructure monitoring, where automation mitigates human risk and reduces downtime. Technological advancements in sensors, imaging systems, and AI-based analytics have further amplified the capabilities of inspection robots, enabling accurate defect detection and predictive maintenance.

Rising labor costs and stringent safety regulations are prompting industries to shift toward robotic inspection as a cost-effective alternative. The market outlook remains favorable, with integration into Industry 4.0 frameworks and expanding use in harsh and hazardous environments reinforcing growth prospects.

While mobile and autonomous systems are gaining momentum, demand for both stationary and non-autonomous units persists, supported by specific operational requirements. Over the forecast period, continued investment in robotics innovation and sector-specific customization is expected to solidify the market’s position as an indispensable component of industrial quality assurance.

The inspection robots market is segmented by type, technology, application, end use, and geographic regions. By type, inspection robots market is divided into Non-autonomous, Semi-autonomous, and Fully autonomous. In terms of technology, inspection robots market is classified into Stationary and Mobile. Based on application, inspection robots market is segmented into Visual inspection, Ultrasonic inspection, Laser scanning inspection, Thermal inspection, and Quality inspection. By end use, inspection robots market is segmented into Automotive, Construction, Food & beverages, Manufacturing, Oil & gas, Power, and Others. Regionally, the inspection robots industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

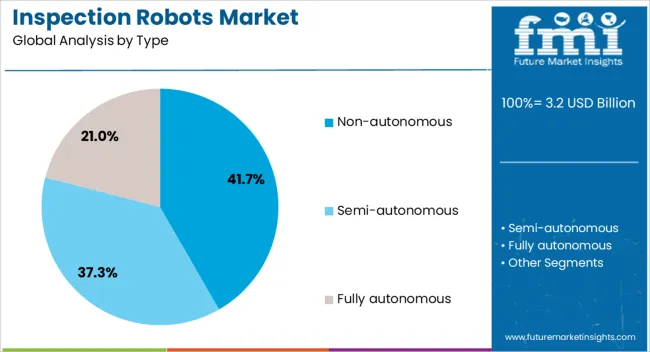

The non-autonomous segment accounts for approximately 41.7% of the inspection robots market, reflecting its continued relevance in applications requiring controlled and operator-guided functionality. This segment’s adoption is supported by cost advantages over fully autonomous systems, making it suitable for small to mid-scale operations. Non-autonomous inspection robots are valued for their precision and reliability in environments where direct human oversight ensures compliance with inspection standards.

They are often deployed in scenarios with repetitive tasks or defined inspection routes, where automation benefits can be achieved without full autonomy. Additionally, the segment benefits from lower maintenance complexity and reduced software integration requirements compared to advanced autonomous systems.

Industries with budget constraints or where operator expertise is integral to the inspection process continue to drive this segment’s demand. With ongoing improvements in user interfaces and semi-automated assistance features, the non-autonomous category is anticipated to maintain a strong share in the near to mid-term.

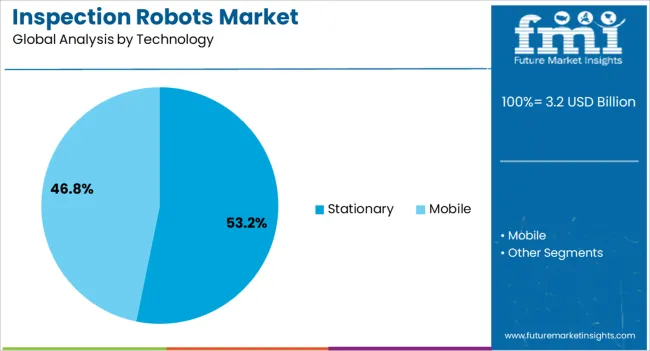

The stationary segment leads the inspection robots market’s technology category with a share of approximately 53.2%. Its dominance is largely attributed to the high precision and stability offered in fixed-position inspection setups, particularly in quality control lines and repetitive manufacturing environments. Stationary inspection robots excel in environments where consistent positioning is critical for measurement accuracy, such as assembly line monitoring and component testing.

Their integration with conveyor systems and fixed sensors enhances throughput while ensuring minimal error margins. This segment is also preferred in applications requiring high-resolution imaging, 3D scanning, and non-destructive testing, as stationary platforms provide an optimal setup for such operations.

Reduced mobility requirements translate into simpler designs, lower operational costs, and extended system lifespan. The combination of operational reliability, scalability in high-volume production, and integration compatibility with existing infrastructure has reinforced the stationary segment’s leading position, which is expected to remain robust throughout the forecast horizon.

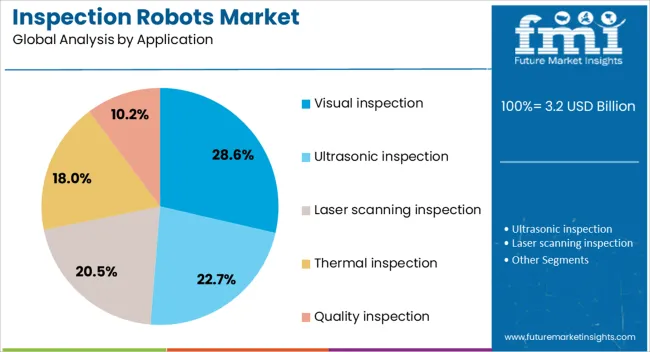

The visual inspection segment holds approximately 28.6% of the inspection robots market by application, benefiting from its essential role in defect detection, quality verification, and compliance assurance. This segment’s growth is supported by the rising adoption of high-definition cameras, thermal imaging, and AI-driven vision systems, which enhance detection accuracy and processing speed. Visual inspection robots are deployed across industries such as electronics, automotive, and aerospace, where precision in identifying surface anomalies, dimensional deviations, or assembly defects is critical.

The approach reduces human error and accelerates inspection cycles, thereby improving productivity. Moreover, visual inspection systems are adaptable to both stationary and mobile platforms, increasing their applicability across varied operational environments.

Cost efficiencies are realized through reduced rework, improved quality consistency, and early detection of faults. As advancements in computer vision and machine learning continue, the visual inspection segment is expected to retain its importance as a core application area within the inspection robots market.

The inspection robots market is experiencing growth as industries across sectors, including manufacturing, aerospace, automotive, and energy, increasingly rely on robotic systems for routine inspections and maintenance tasks. Demand is driven by the need for increased efficiency, accuracy, and safety in monitoring infrastructure, machinery, and equipment, particularly in hard-to-reach or hazardous environments. Challenges include the high cost of initial investment, complexity in robot design for specific inspection needs, and regulatory hurdles around safety standards. Opportunities exist in the development of autonomous inspection robots equipped with advanced sensors, AI-powered analytics, and the integration of drones for aerial inspections. Trends highlight the growing adoption of robots in predictive maintenance, real-time monitoring, and data collection.

The demand for inspection robots is being driven by the growing need for automation in routine inspections and maintenance tasks. Industries such as manufacturing, oil and gas, automotive, and aerospace are increasingly adopting robots to perform inspections of machinery, pipelines, and infrastructure, reducing the need for human intervention in hazardous or difficult-to-access locations. Automation of these tasks improves the speed, accuracy, and consistency of inspections while reducing operational downtime and minimizing safety risks. The use of robots for predictive maintenance is also gaining traction, as they enable early detection of wear and tear, thus preventing costly breakdowns. As industries continue to embrace automation, the role of inspection robots in maintaining operational efficiency is expected to expand.

The inspection robots market faces several challenges, including high initial costs for development, deployment, and maintenance. The cost of advanced robotics technology, such as AI-powered systems, sensors, and cameras, can be prohibitive for small and medium-sized enterprises. Additionally, the complexity of robot designs tailored to specific inspection tasks, such as inspections in confined or hazardous environments, adds to both development and operational costs. Regulatory compliance, particularly in industries like oil and gas, aerospace, and healthcare, requires robots to meet stringent safety and operational standards, further increasing costs and development time. Technical challenges, such as ensuring high levels of accuracy, autonomy, and battery life in harsh or remote environments, also present obstacles to widespread adoption.

Robots equipped with AI can perform real-time analysis and decision-making, enabling more efficient inspections and reducing the need for human intervention. AI-driven robots are also capable of detecting anomalies, predicting maintenance needs, and improving the overall accuracy of inspections. Additionally, drones equipped with high-resolution cameras and sensors are gaining popularity for aerial inspections of large infrastructure, such as power lines, wind turbines, and bridges. These autonomous systems can access difficult-to-reach areas, improving both safety and operational efficiency. As industries increasingly adopt predictive maintenance practices, the market for autonomous inspection robots is expected to see significant growth in the coming years.

Real-time data collection and analysis are becoming a key feature in modern inspection robots, enabling companies to monitor the condition of equipment and infrastructure continuously. This trend is particularly significant in industries such as energy, manufacturing, and oil and gas, where early detection of issues can prevent costly downtime and ensure continuous operation. Additionally, predictive maintenance algorithms powered by AI and machine learning are helping businesses optimize maintenance schedules and reduce unplanned outages. As the demand for smarter, data-driven inspection solutions continues to grow, robots that can integrate seamlessly with existing maintenance systems and provide actionable insights are likely to be in high demand.

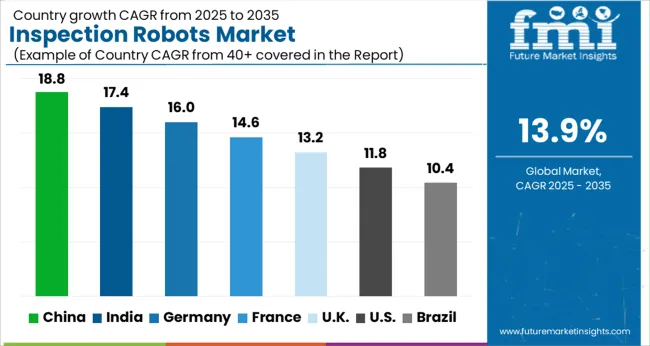

| Country | CAGR |

|---|---|

| China | 18.8% |

| India | 17.4% |

| Germany | 16.0% |

| France | 14.6% |

| UK | 13.2% |

| USA | 11.8% |

| Brazil | 10.4% |

The global inspection robots market is expected to grow at a CAGR of 13.9% from 2025 to 2035, with China leading the market at 18.8%, followed by India at 17.4% and France at 14.6%. The market is driven by growing industrial automation across sectors such as manufacturing, construction, energy, and aerospace. Increasing investments in robotics technology and the need for efficient and safe inspection processes are key factors contributing to this growth. As industries expand globally and adopt more advanced robotics for maintenance and monitoring, the demand for inspection robots will continue to rise in these key regions. The analysis includes over 40+ countries, with the leading markets detailed below.

The inspection robots market in China is expected to grow at a CAGR of 18.8% from 2025 to 2035, driven by the rapid expansion of industrial automation and the need for more efficient and safer inspection processes. With the country’s industrial sector booming, particularly in manufacturing, infrastructure, and energy, there is a rising demand for robots that can carry out inspections in hazardous and hard-to-reach areas. In sectors such as oil & gas, power generation, and construction, where inspections are critical for safety and maintenance, the adoption of inspection robots is becoming increasingly important. China’s significant investments in technological advancements and smart manufacturing solutions are expected to further accelerate the market growth. The government’s focus on improving industrial efficiency and safety standards will also drive the adoption of robots for inspection tasks.

The inspection robots market in India is projected to grow at a CAGR of 17.4% from 2025 to 2035, fueled by the country’s growing industrial base and the increasing focus on automation across various sectors. The rising need for efficient and accurate inspection in industries such as manufacturing, construction, and energy is driving the demand for robots that can perform tasks like equipment inspections, monitoring, and quality assurance. As India continues to invest in infrastructure development and smart factories, the need for advanced inspection technologies, including robotics, is expanding rapidly. The growing interest in enhancing worker safety and operational efficiency is also driving this market. India’s expanding industrial and energy sectors will play a key role in increasing the demand for inspection robots.

The inspection robots market in France is expected to grow at a CAGR of 14.6% from 2025 to 2035, as the country increasingly adopts advanced technologies for industrial inspection and maintenance. The French manufacturing, automotive, and energy sectors are seeing rapid automation and digitalization, creating a demand for robots that can efficiently conduct inspections in complex and high-risk environments. Inspection robots are becoming crucial in sectors such as aerospace, automotive, and utilities, where precision and safety are paramount. The government’s emphasis on advancing automation in the workplace and supporting technological innovation is expected to drive further growth. Furthermore, France’s position as a leader in research and development of robotics will foster the growth of inspection robots in the industrial sector.

The UK inspection robots market is forecast to grow at a CAGR of 13.2% from 2025 to 2035, driven by the increasing adoption of industrial robots in manufacturing, energy, and infrastructure sectors. The UK has been at the forefront of integrating robotics into industries such as oil & gas, transportation, and construction, where inspections are essential for maintaining safety and compliance. The use of robots for visual inspections, maintenance checks, and equipment monitoring is becoming widespread across the country’s industrial plants and facilities. The country’s strong focus on improving operational efficiency, reducing downtime, and ensuring safety will further drive the demand for inspection robots in the coming years.

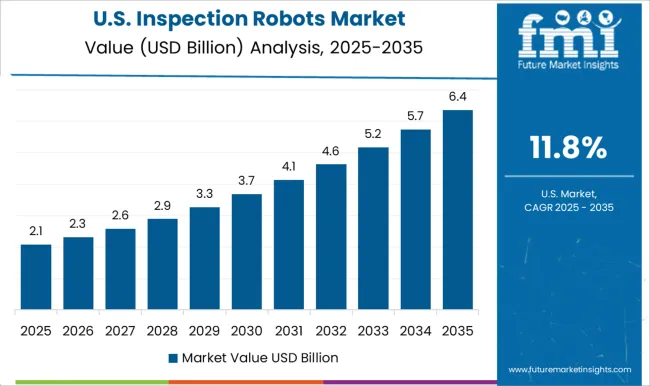

The USA inspection robots market is expected to grow at a CAGR of 11.8% from 2025 to 2035. The demand for robots in industrial inspection is driven by the country’s advanced manufacturing sector, which requires constant monitoring and inspection to maintain high standards of quality and safety. Robots play an essential role in performing inspections in high-risk areas such as nuclear plants, power generation facilities, and hazardous material handling. The USA is seeing increased investment in automation and AI technologies, which enhances the capabilities of inspection robots. The demand for drones and autonomous robots for visual inspections, as well as for monitoring infrastructure and assets, is also on the rise. The USA government’s support for technological innovation and the adoption of robotics in various sectors will continue to fuel market growth.

In the inspection robots market, competition revolves around the ability to provide automation, precision, and flexibility for industrial inspection tasks. ABB is a key player, offering robots with advanced vision systems for quality control and defect detection in industries like automotive, electronics, and manufacturing. The company integrates AI and machine learning algorithms into its inspection robots, allowing for real-time data analysis and predictive maintenance. Cognex competes by specializing in machine vision technology, providing vision-guided robotic systems designed for high-precision inspection in industrial settings. Their solutions are widely used in automated visual inspection, barcode reading, and part tracking applications.

Fanuc is recognized for its versatile robotic systems that include inspection functions, focusing on high-speed, high-accuracy visual inspections in production lines, particularly in electronics and automotive sectors. The company's robots are equipped with advanced sensors and cameras for precise measurements and defect detection. Kuka offers inspection robots with flexibility and reliability, often used in complex environments requiring high-precision measurements for parts inspection, surface analysis, and quality control. Universal Robots, known for its collaborative robots (cobots), focuses on easy deployment and integration into existing production lines.

Its robots are equipped with vision and force sensors, making them ideal for small-scale inspection tasks and automating repetitive inspection processes in smaller operations. Strategies across these companies emphasize flexibility, ease of integration, and scalability. ABB and Cognex focus on high-performance, vision-integrated inspection systems, while Fanuc and Kuka differentiate with robust, adaptable robotic arms for heavy-duty applications. Universal Robots targets small businesses and industries with flexible, easy-to-deploy robots that reduce the cost of automation. Product brochures highlight features such as high-definition cameras, AI-powered vision systems, real-time analytics, and integration with ERP and quality management systems for seamless workflow automation and efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 Billion |

| Type | Non-autonomous, Semi-autonomous, and Fully autonomous |

| Technology | Stationary and Mobile |

| Application | Visual inspection, Ultrasonic inspection, Laser scanning inspection, Thermal inspection, and Quality inspection |

| End Use | Automotive, Construction, Food & beverages, Manufacturing, Oil & gas, Power, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Cognex, Fanuc, Kuka, and Universal Robots |

| Additional Attributes | Dollar sales by robot type (articulated, collaborative, mobile), application (quality control, defect detection, surface inspection), and industry (automotive, electronics, aerospace, manufacturing). Demand dynamics are driven by increasing automation in manufacturing, the need for precision in quality control, and reduced operational costs. Regional growth is strong in North America, Europe, and Asia-Pacific, supported by advancements in industrial automation, smart manufacturing, and quality assurance technologies. |

The global inspection robots market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the inspection robots market is projected to reach USD 11.7 billion by 2035.

The inspection robots market is expected to grow at a 13.9% CAGR between 2025 and 2035.

The key product types in inspection robots market are non-autonomous, semi-autonomous and fully autonomous.

In terms of technology, stationary segment to command 53.2% share in the inspection robots market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inspection Drone in Oil and Gas Market Size and Share Forecast Outlook 2025 to 2035

Inspection Management Software Market Size and Share Forecast Outlook 2025 to 2035

Inspection and Inventory Labels Market Size and Share Forecast Outlook 2025 to 2035

Inspection Lighting Fixture Market Size and Share Forecast Outlook 2025 to 2035

Inspection & Weighing Machine Industry Analysis in ASEAN and Gulf Countries Analysis - Size, Share, and Forecast 2025 to 2035

Examining Market Share Trends in Inspection and Inventory Labels

Inspection Machines Market Growth – Trends & Forecast 2025 to 2035

PCB Inspection Microscope Market Size and Share Forecast Outlook 2025 to 2035

Bar Inspection System Market Size and Share Forecast Outlook 2025 to 2035

Tire Inspection System Market - Outlook 2025 to 2035

Pipe Inspection Robot Market Growth – Trends & Forecast 2025 to 2035

Field Inspection Tester Market Size and Share Forecast Outlook 2025 to 2035

Drone Inspection and Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cargo Inspection Market Size and Share Forecast Outlook 2025 to 2035

Wafer Inspection Market Size and Share Forecast Outlook 2025 to 2035

Fabric Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

Flight Inspection Market Size and Share Forecast Outlook 2025 to 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

Photomask Inspection Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA