The Flight Inspection Market is estimated to be valued at USD 6.1 billion in 2025 and is projected to reach USD 9.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period. A comparative assessment of early versus late growth curves reveals a front-loaded stability phase transitioning into a moderately steeper trajectory in the latter years. During the early stage (2025–2030), the market progresses from USD 5.8 billion to 7.3 billion, adding USD 1.5 billion, which accounts for roughly 40% of the total incremental opportunity, driven primarily by routine calibration programs, airport expansions in emerging economies, and ICAO compliance mandates.

The annual increment averages USD 240 million in this period, signaling controlled expansion with minimal volatility. In contrast, the late stage (2030–2035) contributes USD 2.2 billion, nearly 60% of overall gains, with annual additions accelerating beyond USD 350 million by 2033–2035 as automation-based flight validation, GNSS augmentation, and drone-integrated inspection systems achieve broader deployment. This curve steepening reflects a shift from traditional ground-based checks toward high-frequency, technology-intensive processes across busy air corridors and next-gen airports. Companies aligning portfolios with real-time data analytics, remote monitoring, and UAV-enabled inspection platforms during this late-phase acceleration are poised to capture disproportionate value as regulatory frameworks tighten globally.

| Metric | Value |

|---|---|

| Flight Inspection Market Estimated Value in (2025 E) | USD 6.1 billion |

| Flight Inspection Market Forecast Value in (2035 F) | USD 9.5 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The flight inspection market holds a specialised and technical role within the aviation infrastructure ecosystem. Within the aviation safety and navigation services market, it contributes around 8–10%, ensuring the compliance and calibration of instrument landing systems (ILS), VOR, DME, and other navigational aids critical to safe air traffic operations. Within the narrower flight inspection and calibration equipment market, it dominates 40–45% of total value, because service flights and airborne calibration tools form the core component of the segment. In the broader aerospace testing and inspection market, it represents 5–6%, sharing importance with structural integrity checks, non-destructive testing, and component certification.

As drones and unmanned systems grow in inspection roles, UAS inspection and survey market share is shifting; still, traditional flight inspection by crewed aircraft retains 3–4%, mainly for certified calibration missions where drone platforms are not yet approved. within the airport operations and infrastructure support services market, flight inspection services contribute 6–7%, as airports rely on regular airborne checks to maintain instrument accuracy and regulatory compliance. Collectively, while not among the biggest revenue pools in aviation, flight inspection fills a critical function for air navigation reliability, regulatory safety, and instrument precision, especially in complex or high-traffic airspace networks.

Governments and aviation authorities are increasing investments in inspection systems to ensure the accuracy and reliability of air navigation aids, which is critical for maintaining airspace safety. As airspace modernization initiatives gain momentum across regions, demand for integrated and automated flight inspection systems is accelerating. Furthermore, the growth of regional and private airports, especially in emerging economies, is intensifying the need for routine and precise inspection operations.

Ongoing upgrades in Instrument Landing Systems (ILS), VOR, DME, and GBAS systems have made periodic calibration essential, reinforcing the criticality of flight inspection services and technology deployment.

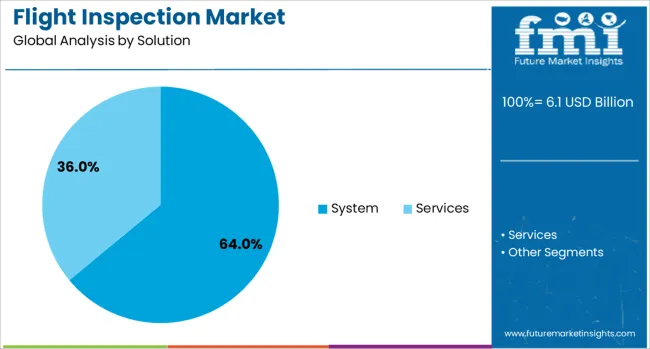

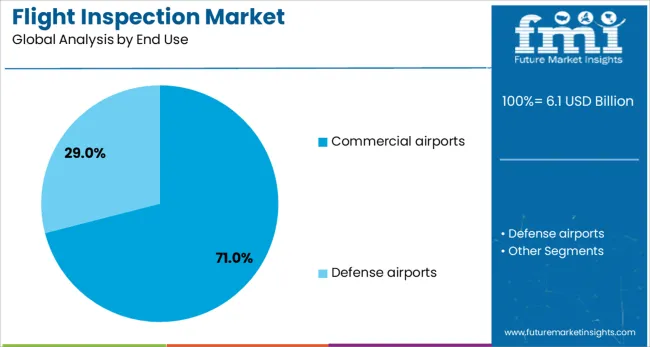

The flight inspection market is segmented by solution, end use, and geographic regions. The flight inspection market is divided into Systems and Services. The end use of the flight inspection market is classified into Commercial airports and Defense airports. Regionally, the flight inspection industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

System-based solutions are projected to account for 64.00% of total revenue in the flight inspection market in 2025, making them the dominant segment. The segment’s growth has been supported by increasing demand for autonomous and precision-driven inspection equipment capable of providing real-time data and seamless integration with aircraft platforms.

As flight calibration becomes more complex, there is a clear shift from standalone services toward embedded system architectures that enhance inspection efficiency and reduce human error. System solutions are also being prioritized due to their scalability, diagnostic accuracy, and ability to support multi-mission platforms, making them ideal for commercial, defense, and regulatory applications.

Advanced onboard systems with modular software updates are further driving the preference for this segment.

Commercial airports are expected to hold a dominant 71.00% share in the flight inspection market by 2025. This leadership is being driven by the continuous expansion and modernization of airport infrastructure to meet increasing passenger and cargo traffic.

As part of safety assurance protocols, regulatory bodies mandate regular inspection of navigational aids, ILS, and runway alignment systems—functions predominantly required at commercial hubs. These airports typically maintain more frequent calibration cycles due to high traffic density, making them consistent users of flight inspection services and technologies.

The emphasis on uninterrupted operations and compliance with international aviation safety norms has reinforced demand from this segment. Additionally, the incorporation of next-generation air traffic control systems is expected further to strengthen the role of flight inspection at commercial airports.

Flight inspection involves validating the performance and accuracy of navigational aids, communication systems, and instrument landing systems to ensure aviation safety and compliance. These services and systems are essential for airport infrastructure, air traffic management, and calibration of flight procedures. Growth has been supported by rising air traffic, expansion of airport infrastructure, and regulatory mandates for periodic inspections. Manufacturers and service providers are focusing on advanced flight inspection aircraft, automation in calibration systems, and integration of digital reporting tools to improve precision, reduce downtime, and meet global aviation standards.

Adoption of flight inspection systems has been driven by the increasing frequency of air travel, which requires enhanced safety and operational efficiency. Regulatory authorities mandate routine inspection of navigation aids, including Instrument Landing Systems (ILS), VOR, and RNAV systems, reinforcing demand. Expansion of commercial airports and the development of regional connectivity projects have accelerated the need for modern flight inspection solutions. Growth in private and business aviation has also contributed to periodic calibration requirements. Rising demand for precision-based navigation procedures such as Performance-Based Navigation (PBN) is further creating consistent inspection needs across both developed and emerging markets.

Market growth has been constrained by significant capital investment needed for specialized aircraft, calibration systems, and software platforms. Operational costs remain high due to the complexity of flight inspection procedures and frequent system upgrades required to comply with evolving aviation standards. Shortage of trained flight inspection crews and technical specialists adds to operational challenges, particularly in developing regions. Long lead times for certification and approval from aviation authorities delay project timelines. Budgetary limitations in smaller airports and regional airstrips further restrict adoption, as these facilities often prioritize basic infrastructure over advanced inspection systems.

Significant opportunities lie in automating calibration systems and integrating data analytics platforms to streamline inspection processes and minimize human error. Expansion of regional airport networks under government connectivity programs is creating new demand for flight inspection services. Modernization of air traffic management infrastructure, including the deployment of GNSS-based navigation aids, presents strong growth potential for next-generation inspection systems. Increasing adoption of UAV-based flight inspection solutions offers cost-effective alternatives for smaller airfields. Strategic collaborations between aviation authorities and service providers for long-term contracts provide recurring revenue streams. Emerging markets in Asia-Pacific and Latin America are particularly attractive for new installations and service agreements.

Recent trends highlight the deployment of purpose-built inspection aircraft equipped with advanced avionics and sensor suites for faster calibration cycles. Development of UAV-enabled systems for short-range inspections is gaining traction to reduce costs and improve turnaround times. Integration of digital twin technology is being explored to simulate inspection procedures and optimize maintenance planning. Cloud-based platforms for real-time data sharing between inspection teams and regulatory bodies are being adopted to improve reporting efficiency. Manufacturers are investing in modular inspection kits compatible with multiple aircraft types, offering flexibility for diverse operational requirements across global aviation networks.

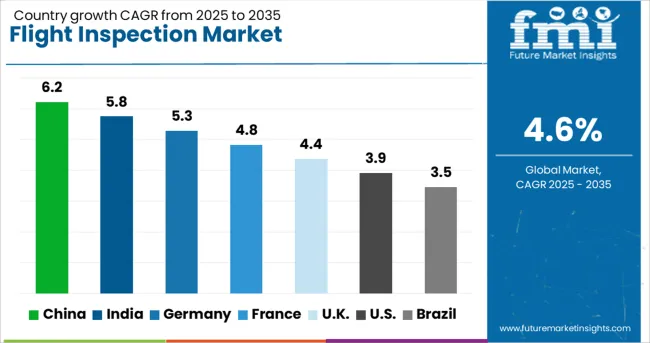

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

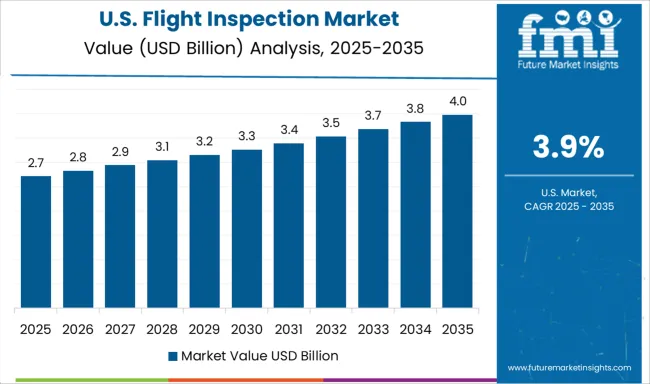

| USA | 3.9% |

| Brazil | 3.5% |

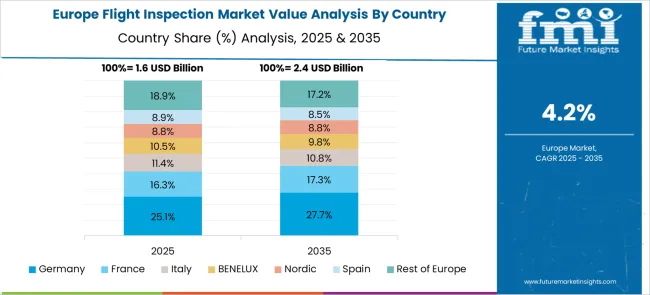

The flight inspection market is projected to grow globally at a CAGR of 4.6% from 2025 to 2035. Among the top five markets, China leads at 6.2%, followed by India at 5.8%, while Germany posts 5.3%, the United Kingdom records 4.4%, and the United States stands at 3.9%. These growth rates represent a premium of +35% for China and +26% for India over the global average, whereas Germany remains ahead by +15%, while the UK and the US lag behind at –4% and –15%, respectively. Divergence reflects stronger aviation infrastructure expansion and regulatory upgrades in BRICS markets such as China and India, while OECD nations show steady demand for system modernization and compliance upgrades. The analysis spans over 40 countries, with the leading markets detailed below.

China is expected to grow at a CAGR of 6.2% through 2035, supported by rapid expansion of aviation infrastructure and stringent compliance requirements under national air safety programs. Increasing investments in regional airports and new runways drive demand for advanced flight inspection systems for calibration of Instrument Landing Systems (ILS), VHF Omnidirectional Range (VOR), and Performance-Based Navigation (PBN). Domestic manufacturers are strengthening production of airborne inspection platforms, while partnerships with global suppliers enhance system integration and digital accuracy. Adoption of real-time data transmission and AI-based fault detection capabilities is accelerating modernization in airport networks.

India is forecasted to achieve a CAGR of 5.8% through 2035, driven by increasing investments in aviation infrastructure, particularly under airport modernization programs and the expansion of regional connectivity. Flight inspection systems are widely deployed for routine checks on navigational aids such as ILS, VOR, and Doppler systems across new and existing runways. Domestic demand is supported by fleet expansion in both commercial and defense aviation segments. Indian suppliers are focusing on cost-optimized solutions, while international firms introduce advanced calibration tools and software integration capabilities for high-precision navigation validation. The integration of digital inspection tools with centralized monitoring platforms is enhancing operational safety standards nationwide.

Germany is expected to post a CAGR of 5.3% through 2035, supported by its well-developed aviation network and high adoption of advanced air navigation calibration technologies. Growing air traffic and strict EASA (European Union Aviation Safety Agency) compliance standards drive continuous upgrades of flight inspection systems. German manufacturers prioritize integration of GNSS-based approaches and AI-assisted diagnostics for precise validation of ground-based and satellite navigation systems. Deployment of autonomous and semi-autonomous calibration aircraft is gaining attention to reduce operational downtime and enhance accuracy. Partnerships with airport authorities and OEMs further strengthen technological advancements in the domestic market.

The United Kingdom is projected to grow at a CAGR of 4.4% through 2035, driven by modernization of regional airports, upgrades in air navigation systems, and the adoption of PBN procedures. Rising traffic at international hubs and low-cost carrier expansions require efficient calibration of ILS, VOR, and satellite-based systems. British suppliers are investing in software-driven platforms that enable remote diagnostics and predictive maintenance of inspection systems. Growth in unmanned aerial platforms for flight inspection is anticipated to optimize operational timelines, reducing dependency on manned aircraft. The integration of real-time data analytics ensures compliance with evolving aviation safety standards across the UK.

The United States is forecasted to achieve a CAGR of 3.9% through 2035, driven by the FAA’s ongoing modernization initiatives under the NextGen air traffic management program. Replacement of legacy navigation systems and implementation of GBAS (Ground-Based Augmentation System) technology are primary factors fueling flight inspection demand. USA suppliers are focusing on integrated digital platforms offering real-time performance monitoring and AI-enabled fault detection for faster calibration cycles. Increased adoption of twin-use inspection systems across commercial and defense applications further strengthens the market. However, market maturity and extended life cycles of existing infrastructure slightly constrain incremental growth compared to emerging markets.

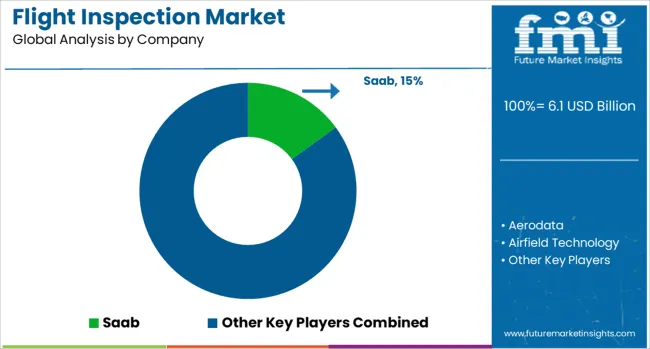

The flight inspection market is dominated by aerospace OEMs, avionics specialists, and service providers delivering solutions for calibrating and validating ground-based navigation aids and airport systems. Saab leads with comprehensive flight inspection systems and turnkey service solutions integrated with advanced avionics for global civil and military operations. Aerodata specializes in customized airborne flight inspection systems and mission management software tailored to regional aviation authorities. Bombardier and Textron Aviation provide aircraft platforms commonly modified for flight inspection missions, offering stability and performance suited for calibration tasks. Cobham and ST Engineering deliver specialized communication and mission equipment, enabling high-accuracy inspection for Instrument Landing Systems (ILS), VOR, and GNSS-based procedures.

Norwegian Special Mission focuses on equipping turboprop and light jet platforms with advanced inspection suites, while Flight Calibration Services, Flight Precision, and Airfield Technology serve as key global operators performing periodic calibration for airports and air navigation service providers. ENAV, Italy’s air navigation authority, and Safran contribute through advanced flight validation technologies and system integration expertise. Radiola and Mistras Group add niche capabilities in navigational system integrity checks and signal quality assurance. Competitive differentiation depends on system accuracy, compliance with ICAO and FAA standards, integration of GNSS and ADS-B capabilities, and the ability to deliver cost-efficient inspection services globally. Strategic priorities involve digitalization through real-time data transfer, autonomous inspection technologies, and multi-sensor platforms for faster mission turnaround. Future competitiveness will rely on expanding services for Performance-Based Navigation (PBN) and drone-enabled inspection systems for smaller airfields.

The flight inspection market focuses on broadening capabilities through automation and advanced digital platforms. Manufacturers are prioritizing the design of modern inspection systems that utilize GNSS technology and real-time analytics for improved precision and efficiency. Collaborative agreements with airports and air navigation service providers are strengthening long-term engagements. Emphasis is being placed on workforce training and the adoption of simulation tools to ensure adherence to ICAO requirements. Expansion into high-growth regions through localized operations and continuous upgrades to inspection fleets is essential. Integration of data-driven functionalities is also driving competitiveness across commercial and defense aviation segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.1 Billion |

| Solution | System and Services |

| End Use | Commercial airports and Defense airports |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Saab, Aerodata, Airfield Technology, Bombardier, Cobham, ENAV, Flight Calibration Services, Flight Precision, Mistras Group, Norwegian Special Mission, Radiola, Safran, ST Engineering, and Textron Aviation |

| Additional Attributes | Dollar sales by solution type (airborne flight inspection systems, ground validation equipment, service contracts) and application (commercial airports, military airbases, heliports). Demand dynamics are driven by increasing air traffic, stricter ICAO/FAA calibration requirements, and rapid expansion of satellite-based navigation systems. Regional trends show North America and Europe leading due to regulatory frameworks, while Asia-Pacific experiences the fastest growth with airport infrastructure development. Innovation focuses on lightweight, modular flight inspection suites, GNSS augmentation for precision validation, and integration of cloud-based analytics for real-time reporting. |

The global flight inspection market is estimated to be valued at USD 6.1 billion in 2025.

The market size for the flight inspection market is projected to reach USD 9.5 billion by 2035.

The flight inspection market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in flight inspection market are system, _precision approach path indicator (papi), _instrument landing system (ils), _very high frequency (vhf) omni-directional range (vor), _distance measuring equipment (dme), _others, services, _commissioning, _pre-flight inspection, _periodic and _special.

In terms of end use, commercial airports segment to command 71.0% share in the flight inspection market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flight Information Display System Market Size and Share Forecast Outlook 2025 to 2035

Flight Line Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Flight Data Monitoring and Analysis Market Size and Share Forecast Outlook 2025 to 2035

Flight Data Recording (FDR) Market Size and Share Forecast Outlook 2025 to 2035

Flight Tracking System Market Insights - Trends & Forecast 2025 to 2035

Flight Simulator Market Report – Trends & Forecast 2020-2030

In-flight Retail and Advertising Market Size and Share Forecast Outlook 2025 to 2035

In-flight Internet Market Size and Share Forecast Outlook 2025 to 2035

In-flight Entertainment & Connectivity Market

Time Of Flight Cameras Market Size and Share Forecast Outlook 2025 to 2035

Time of Flight (ToF) Sensor Market Insights - Growth & Forecast 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Flight Recorder Market Size and Share Forecast Outlook 2025 to 2035

Electronic Flight Bag Market Size and Share Forecast Outlook 2025 to 2035

Inspection Drone in Oil and Gas Market Size and Share Forecast Outlook 2025 to 2035

Inspection Management Software Market Size and Share Forecast Outlook 2025 to 2035

Inspection Robots Market Size and Share Forecast Outlook 2025 to 2035

Inspection and Inventory Labels Market Size and Share Forecast Outlook 2025 to 2035

Inspection Lighting Fixture Market Size and Share Forecast Outlook 2025 to 2035

Inspection & Weighing Machine Industry Analysis in ASEAN and Gulf Countries Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA