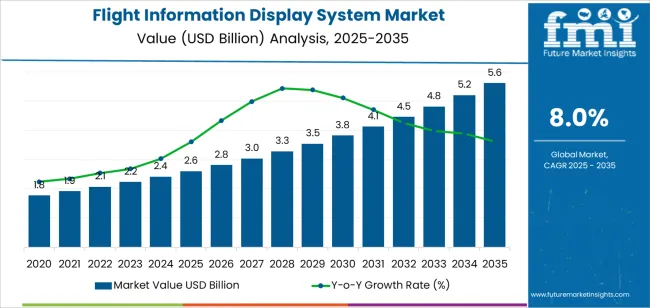

The flight information display system market is projected to reach USD 5.6 billion by 2035, up from USD 2.6 billion in 2025, at a CAGR of 8.0%, as airports adopt digital display platforms to manage rising air traffic and the growing need for real-time operational communication. Demand strengthens as aviation networks depend on accurate scheduling data, synchronized gate management and dynamic passenger information across terminals. Real time systems maintain the leading role due to their ability to deliver continuous updates that improve coordination between airport operators, airlines and ground service teams.

The shift toward cloud-based architectures supports centralized control, faster data refresh cycles and higher system scalability for expanding airport infrastructures. Energy-efficient LED units, multilingual interfaces and touchscreen-enabled formats continue to be integrated into both new and renovated terminal environments. Asia Pacific contributes the strongest uptake due to large airport construction programs across China, India and Southeast Asia, while North America and Europe sustain deployment through modernization of legacy systems and investment in smart terminal frameworks. Growth is shaped by the adoption of AI-based analytics that enhance delay prediction, gate planning and content automation for passenger communication.

Asia Pacific is expected to lead global demand due to rapid airport expansion projects across China, India, and Southeast Asia. North America and Europe follow closely, supported by continuous modernization of existing airport systems and adherence to smart terminal design standards. By 2035, the integration of AI-based data analytics, multilingual communication platforms, and predictive flight management systems will further refine the performance and adaptability of flight information display technologies.

Between 2025 and 2030, the Flight Information Display System Market is projected to grow from USD 2.6 billion to USD 3.8 billion, reflecting a growth volatility index (GVI) of 1.22, indicating a strong acceleration phase. This period will be driven by the rapid modernization of airport infrastructure, increasing air passenger traffic, and the global push toward digital transformation in aviation operations. The integration of AI, cloud computing, and real-time data synchronization is revolutionizing flight information management, enhancing operational efficiency and passenger experience. Airports worldwide are investing in high-definition, energy-efficient display systems and adaptive content management platforms to ensure seamless and dynamic communication across terminals.

From 2030 to 2035, the market is forecast to expand from USD 3.8 billion to USD 5.6 billion, resulting in a GVI of 0.78, signaling a mild deceleration as adoption reaches maturity. During this phase, the market will stabilize as most international airports transition to fully digital ecosystems, while regional and domestic airports continue modernization initiatives. Growth will be sustained by ongoing system upgrades, integration with biometric and smart gate technologies, and demand for unified display management across global hubs. Strategic collaborations between system integrators, software developers, and aviation authorities will drive innovations focused on sustainability, cybersecurity, and enhanced passenger engagement.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.6 billion |

| Market Forecast Value (2035) | USD 5.6 billion |

| Forecast CAGR (2025–2035) | 8.0% |

The flight information display system (FIDS) market is growing as airports modernize infrastructure to improve passenger communication, operational efficiency, and data integration. FIDS solutions provide real-time updates on arrivals, departures, gate assignments, and baggage status through digital screens and networked software platforms. The increasing volume of air traffic and passenger throughput drives demand for scalable, automated display systems that interface seamlessly with airport operational databases and airline scheduling software. Manufacturers focus on delivering high-resolution, energy-efficient displays supported by cloud-based management tools to ensure reliability and fast data synchronization across terminals.

Growth is reinforced by the ongoing expansion of airport terminals and the adoption of smart airport technologies integrating Internet of Things (IoT) connectivity and centralized control architectures. Advanced FIDS platforms now include multilingual display capabilities, mobile device integration, and customizable layouts for passenger flow optimization. Asia-Pacific and Middle Eastern regions lead installation projects due to rapid airport construction and aviation network expansion. While high installation and maintenance costs present challenges for smaller airports, modular systems and software-as-a-service models are increasing accessibility. Continued emphasis on digital transformation, operational transparency, and passenger experience enhancement ensures sustained global demand for flight information display systems in modern aviation management.

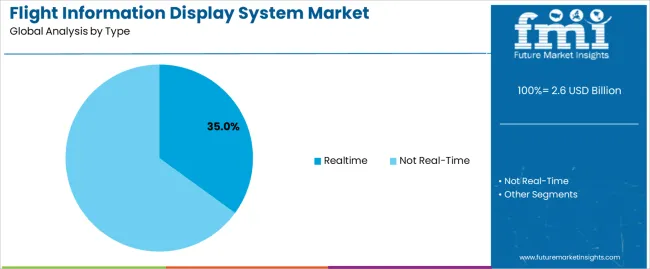

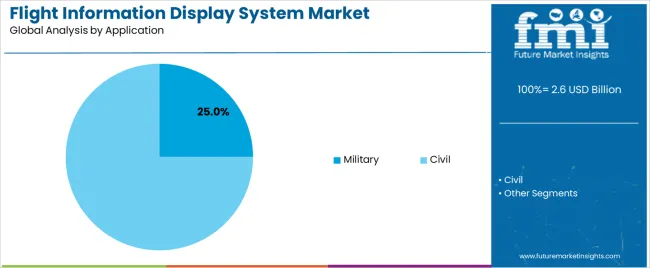

The flight information display system (FIDS) market is segmented by type, application, and region. By type, the market is divided into real-time and not real-time systems. Based on application, it is categorized into military and civil. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions capture system functionality, operational environment, and regional adoption trends across aviation infrastructure, defense command systems, and civil airport networks.

The real-time segment accounts for approximately 35.0% of the global flight information display system market in 2025, representing the leading type category. Its dominance is attributed to the critical need for live flight data management and dissemination across both airport and defense operations. Real-time systems enable continuous monitoring and immediate updates on flight schedules, gate assignments, aircraft movements, and operational alerts, supporting efficient traffic coordination and passenger information delivery.

In the civil aviation sector, airports implement real-time FIDS for operational transparency and passenger flow management, while military command centers employ similar systems for mission coordination and airspace control. The segment’s growth is supported by the integration of advanced data communication networks, cloud connectivity, and automated update protocols that reduce latency and human error. Manufacturers are developing systems compatible with next-generation air traffic management platforms, featuring higher data resolution and flexible display configurations. Regional adoption is particularly strong in North America and Europe, where airport modernization programs prioritize digital information display integration. The real-time segment maintains leadership through its central role in enhancing situational awareness and operational responsiveness across global aviation systems.

The military segment represents about 25.0% of the total flight information display system market in 2025, making it the leading application category. Its dominance is supported by the essential role of FIDS technology in defense aviation operations, where real-time flight tracking, mission scheduling, and logistics coordination are mission-critical. Military-grade display systems are designed to handle encrypted data, secure transmission protocols, and redundant communication structures for reliable information sharing across command units and airbases.

Demand within this segment is reinforced by increasing defense investments in digital control and monitoring infrastructure. Flight display systems in military environments are often integrated with radar, telemetry, and sensor networks to support tactical decision-making. Manufacturers focus on developing ruggedized, high-contrast displays with extended operational life for deployment in command centers and field operations. Growth is most evident in North America, East Asia, and Europe, where modernization of air defense systems remains a strategic priority. The military segment continues to dominate market demand due to its reliance on real-time situational awareness and secure data management, ensuring operational efficiency and safety across military aviation networks worldwide.

The flight information display system (FIDS) market is expanding as airports modernize infrastructure to improve passenger flow and operational efficiency. These systems deliver real-time updates on flight schedules, gate changes, and baggage information, serving as critical communication tools between airport management and passengers. Growth is supported by increasing air traffic, rising passenger expectations, and the integration of digital technologies across airport operations. However, the market faces challenges such as high installation and maintenance costs, compatibility issues with legacy systems, and the need for continuous software updates. Manufacturers are introducing cloud-based and AI-driven solutions to enhance data accuracy and flexibility.

Global airport expansion and renovation projects are driving demand for efficient FIDS installations. As passenger volumes increase, airports seek scalable and automated systems capable of displaying dynamic information across terminals. Integration of these systems with airport operational databases and flight management systems enables seamless communication and improved situational awareness for staff and travelers. The trend toward digital signage, modular display units, and centralized control platforms further accelerates adoption in both new and existing airports.

The high capital investment required for large-scale system deployment remains a key restraint, especially for regional or smaller airports. Maintenance of display hardware, frequent software updates, and energy consumption add to long-term operating costs. Integration challenges also arise due to varied legacy systems, differing data formats, and limited interoperability among platforms. In some cases, limited technical expertise and infrastructure gaps delay implementation timelines, particularly in developing regions. These factors collectively limit uniform market growth despite rising demand for modern passenger information systems.

The FIDS market is witnessing a transition toward smart, data-driven solutions that enhance passenger experience and streamline airport operations. Cloud connectivity allows remote updates and centralized control, while AI-based predictive tools improve gate management and delay forecasting. Interactive and multilingual displays are becoming standard in global airports, offering greater accessibility for international travelers. The integration of IoT sensors and real-time data analytics is transforming traditional display systems into intelligent communication networks, marking a significant step toward fully connected airport ecosystems.

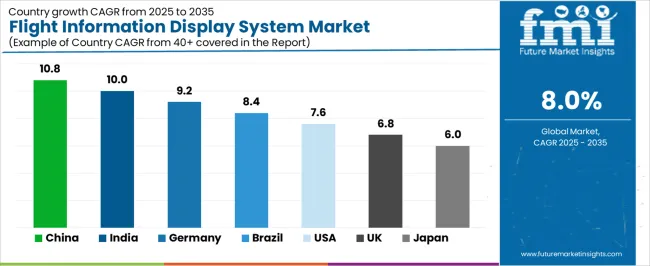

| Country | CAGR (%) |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| Brazil | 8.4% |

| USA | 7.6% |

| UK | 6.8% |

| Japan | 6.0% |

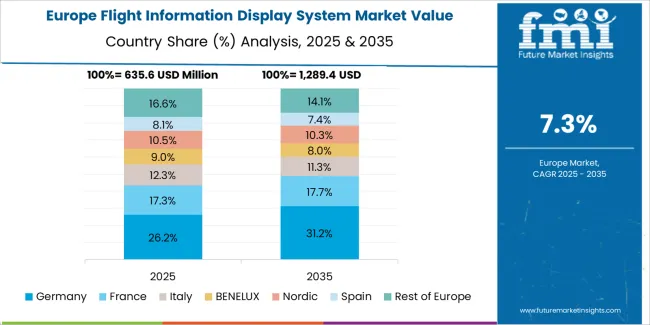

The Flight Information Display System (FIDS) Market is witnessing significant global growth, with China leading at a 10.8% CAGR through 2035, propelled by airport expansion projects, rapid aviation infrastructure upgrades, and digitalization in passenger communication systems. India follows at 10.0%, driven by rising air traffic, new airport construction under government initiatives, and increased adoption of smart display technologies. Germany records 9.2%, supported by innovation in display systems, seamless integration with airport management platforms, and strong focus on automation. Brazil grows at 8.4%, benefitting from aviation modernization and investment in passenger experience technologies. The USA, with a 7.6% CAGR, remains a technologically advanced market emphasizing real-time data analytics, while the UK (6.8%) and Japan (6.0%) continue adopting sustainable, energy-efficient, and AI-enabled display systems for enhanced operational efficiency.

China is experiencing rapid growth in the flight information display system market, projected to expand at a CAGR of 10.8% through 2035. Large-scale airport modernization projects and expanding domestic air travel networks are driving deployment of advanced display technologies. Local manufacturers are investing in digital signage, LED panels, and integrated data management systems to support efficient flight information delivery. Government programs promoting aviation digitalization are reinforcing adoption across both international and regional airports, ensuring steady market expansion.

India is witnessing significant expansion in the flight information display system market, increasing at a CAGR of 10.0% through 2035. Rising passenger traffic and upgrades across metro and regional airports are fueling equipment installations. Local system integrators are adopting cloud-based and networked display systems to improve real-time information management. The government’s regional connectivity programs continue to promote smart airport technology adoption, while private airport operators focus on passenger service improvement.

Across Germany, the flight information display system market is advancing at a CAGR of 9.2%, driven by engineering innovation, digital control systems, and precision software integration. Manufacturers focus on modular display units and integrated data synchronization technologies to enhance efficiency. The country’s strong aviation infrastructure modernization program promotes installation of advanced FIDS systems in both major and regional airports. Integration of predictive maintenance and automation technologies continues to support reliability and long-term operational efficiency.

Brazil is showing steady progress in the flight information display system market, projected to grow at a CAGR of 8.4% through 2035. Expansion of domestic air routes and increasing passenger traffic are driving the installation of modern FIDS platforms. Local and international vendors are collaborating to implement cloud-managed systems offering real-time scheduling and gate information. Airport renovation programs focusing on digitalization continue to create opportunities for technology suppliers.

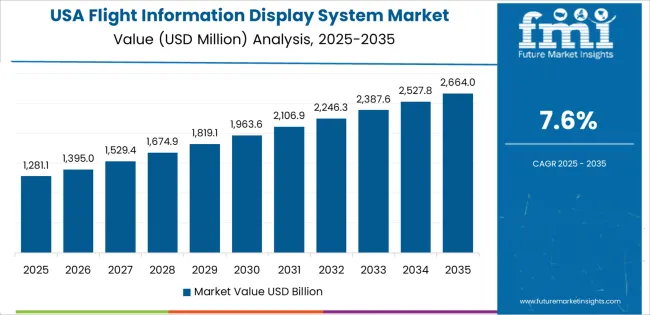

In the United States, the flight information display system market is growing at a CAGR of 7.6% through 2035. Strong demand for digital passenger communication systems across major airports is driving investment in integrated FIDS solutions. Manufacturers are incorporating AI-driven data analytics and automated content delivery platforms to improve reliability. Growth in airport renovation projects under federal infrastructure initiatives supports steady market activity. System upgrades are also aligning with sustainability goals through energy-efficient display technologies.

Across the United Kingdom, the flight information display system market is expanding at a CAGR of 6.8% through 2035. Ongoing digital transformation in aviation and emphasis on passenger experience optimization are encouraging adoption of advanced display technologies. Airports are integrating centralized management platforms to synchronize data across multiple terminals. Growth in self-service and automation systems is further supporting FIDS installations across new and upgraded facilities nationwide.

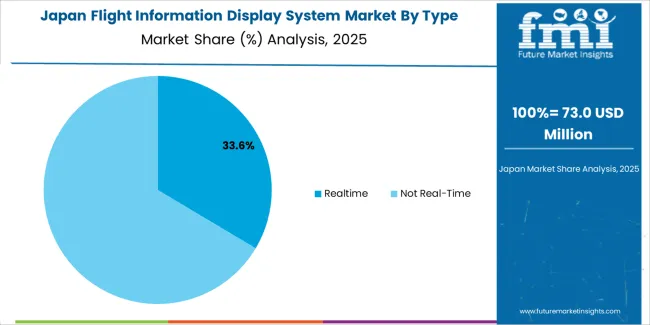

Japan is showing stable development in the flight information display system market, forecast to rise at a CAGR of 6.0% through 2035. Domestic manufacturers focus on compact, energy-efficient systems compatible with both large airports and regional terminals. Integration of IoT-based control and predictive maintenance capabilities enhances performance reliability. Growing air traffic and terminal upgrades are contributing to steady product adoption. Continued innovation in modular screen technology ensures long-term product consistency and reduced maintenance cycles.

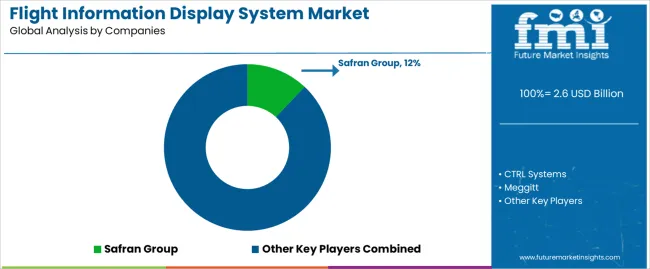

The global flight information display system (FIDS) market is moderately consolidated, led by aerospace technology companies and avionics specialists integrating advanced data visualization into modern cockpit and ground control systems. Safran Group holds a leading position through high-reliability avionics displays designed for commercial and defense aircraft platforms. CTRL Systems and Meggitt contribute through flight instrumentation solutions that emphasize real-time performance data and environmental monitoring accuracy. Honeywell Aerospace and Teledyne Controls maintain strong positions, leveraging digital cockpit integration and data management architectures that support enhanced situational awareness. Airbus SE and General Electric Company strengthen competitiveness through integrated flight management and display technologies used in next-generation airframes.

The Boeing Company and SITA focus on flight information management at both onboard and ground-based operational levels, emphasizing connectivity, automation, and global interoperability. Curtiss-Wright and FLYHT Aerospace Solutions enhance system reliability through modular avionics and real-time data transmission solutions. Rolls-Royce supports this market indirectly via integrated engine data display systems for predictive maintenance and operational efficiency. Competition in this market is shaped by software adaptability, visual clarity, and compliance with international aviation safety regulations. Strategic differentiation depends on digital integration, lightweight display design, and compatibility with AI-driven flight analytics. Long-term market growth will be supported by increasing aircraft modernization programs, demand for improved situational display systems, and continuous advancements in avionics visualization technology.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type (Classification) | Realtime, Not Real-Time |

| Application | Military, Civil |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | Safran Group, CTRL Systems, Meggitt, Honeywell Aerospace, Teledyne Controls, Airbus SE, GE, Boeing, SITA, Curtiss-Wright, FLYHT, Rolls-Royce |

| Additional Attributes | Modular and cloud-based FIDS deployment models; integration with airport operational databases and AI analytics; focus on energy-efficient, high-resolution displays and multilingual passenger interfaces. |

The global flight information display system market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the flight information display system market is projected to reach USD 5.6 billion by 2035.

The flight information display system market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in flight information display system market are realtime and not real-time.

In terms of application, military segment to command 25.0% share in the flight information display system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flight Line Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Flight Data Monitoring and Analysis Market Size and Share Forecast Outlook 2025 to 2035

Flight Data Recording (FDR) Market Size and Share Forecast Outlook 2025 to 2035

Flight Inspection Market Size and Share Forecast Outlook 2025 to 2035

Flight Simulator Market Report – Trends & Forecast 2020-2030

Flight Tracking System Market Insights - Trends & Forecast 2025 to 2035

In-flight Retail and Advertising Market Size and Share Forecast Outlook 2025 to 2035

In-flight Internet Market Size and Share Forecast Outlook 2025 to 2035

In-flight Entertainment & Connectivity Market

Time Of Flight Cameras Market Size and Share Forecast Outlook 2025 to 2035

Time of Flight (ToF) Sensor Market Insights - Growth & Forecast 2025 to 2035

Aircraft Flight Recorder Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Electronic Flight Bag Market Size and Share Forecast Outlook 2025 to 2035

Information Security Consulting Market

Weather Information Technology Market Analysis - Growth & Forecast through 2034

Product Information Management Market Growth – Trends & Forecast 2024-2034

Student Information System Market

Airport Information Display System Market

Building Information Modeling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA