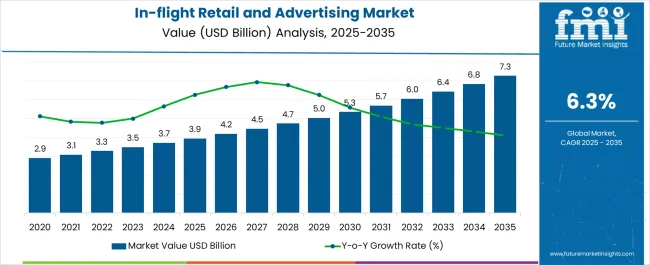

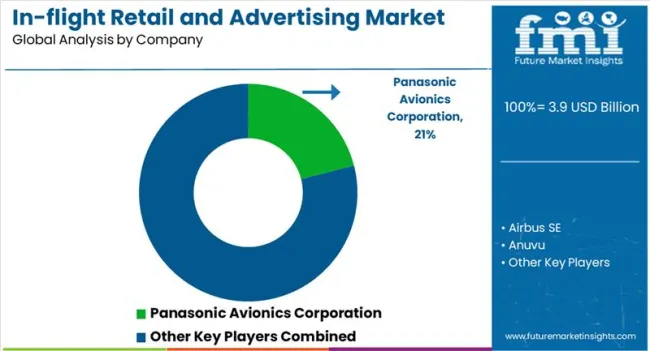

The global in-flight retail and advertising market is likely to expand from USD 3.9 billion in 2025 to USD 7.2 billion by 2035, reflecting a 6.3% CAGR and generating an absolute dollar opportunity of USD 3.3 billion. Growth is driven by increasing passenger traffic, higher adoption of digital advertising solutions, and rising demand for in-flight retail experiences that enhance ancillary revenue for airlines. Technological innovations, including mobile ordering, targeted advertising, and personalized promotions, support market expansion across global airlines and flight segments.

From 2025 to 2028, rolling CAGR remains close to the long-term average, supported by North America and Europe, where inflight retail is already established and airlines are integrating digital advertising solutions. Between 2029 and 2032, rolling CAGR increases slightly as Asia Pacific and Latin America experience rising air travel, modernization of airline fleets, and adoption of enhanced retail platforms, contributing a larger share of absolute growth. From 2033 to 2035, rolling CAGR moderates as mature markets stabilize, with incremental revenue increasingly derived from digital engagement, premium services, and customized inflight promotions. Overall, the USD 3.3 billion opportunity highlights consistent expansion, with rolling CAGR analysis revealing early stability, mid-period acceleration, and late-stage moderation in line with passenger growth, technological adoption, and regional market maturation.

| Attributes | Value |

|---|---|

| Market Value (2025) | USD 3.9 billion |

| Forecast Value (2035) | USD 7.2 billion |

| Forecast CAGR | 6.3% |

The inflight retail and advertising market is driven by five primary parent markets with specific shares. Airlines lead with 45%, offering onboard sales of duty-free products, snacks, and travel essentials while integrating advertising opportunities. Airports contribute 20%, providing lounges and boarding areas with retail and promotional displays. Hospitality and tourism represent 15%, collaborating with airlines for travel packages and inflight promotions. Travel and logistics services account for 10%, leveraging cross-selling and bundled offers. Media and advertising agencies hold 10%, designing campaigns and content for inflight audiences. These segments collectively define global demand and shape strategies in inflight retail and advertising.

Recent developments in the in-flight retail and advertising market focus on digitalization, personalization, and enhanced passenger experience. Airlines are adopting e-commerce platforms, digital catalogs, and mobile apps to facilitate in-flight purchases. Targeted advertising using passenger data, seatback screens, and onboard Wi-Fi is increasing engagement and revenue. Collaboration with luxury brands, regional products, and experiential services is expanding product offerings. Contactless payment systems, loyalty program integration, and real-time inventory management are improving convenience and operational efficiency.

Market expansion is being supported by the recovery and growth of global air travel, with increasing passenger volumes creating larger audiences for inflight retail and advertising activities. Airlines are focusing on ancillary revenue generation to improve profitability and offset operational costs. The captive audience nature of air travel provides unique opportunities for targeted advertising and premium retail experiences that cannot be replicated in other environments.

The advancement of inflight connectivity and entertainment technologies is enabling more sophisticated retail platforms and advertising delivery systems. Passengers are increasingly willing to spend on premium products and experiences during long-haul flights, particularly in business and first-class cabins. The growing emphasis on passenger experience differentiation is driving airlines to invest in enhanced retail offerings and personalized advertising capabilities.

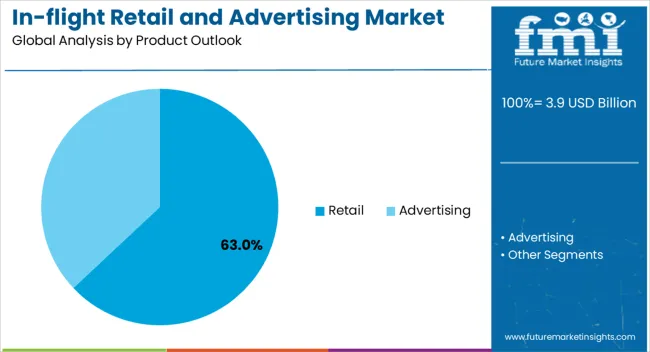

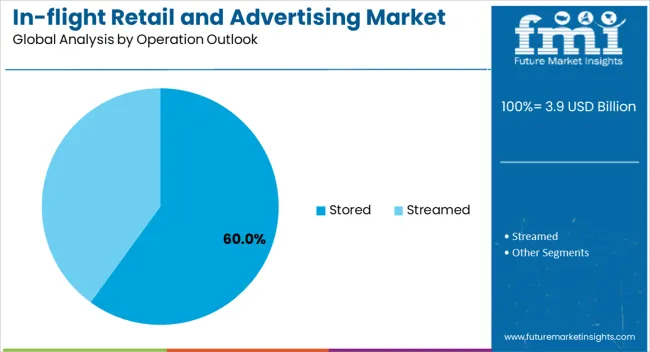

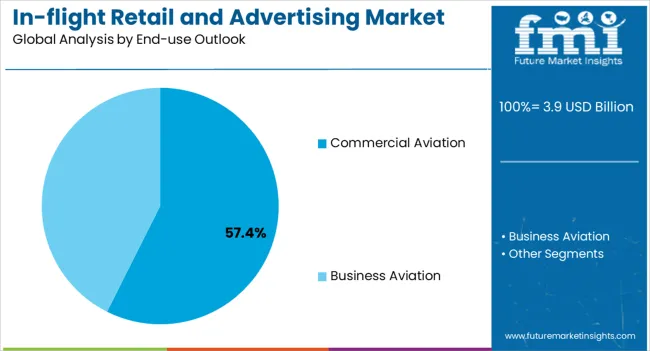

The market is segmented by product outlook, seat type, operation, end-use, and region. By product outlook, the market is divided into retail and advertising segments. The retail segment includes duty-free products, food and beverages, travel essentials, electronics and gadgets, and others. The advertising segment comprises display ads, digital ads, print ads, and others. Based on seat type, the market is categorized into business class, first class, premium economy class, and economy class. In terms of operation, the market is segmented into stored and streamed delivery methods. By end-use, the market is classified into commercial aviation and business aviation. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Retail activities are projected to account for 63% of the inflight retail and advertising market in 2025. This leading share is supported by the continued demand for duty-free shopping, premium food and beverage services, and travel essentials during flight. The retail segment benefits from the captive audience environment and passengers' willingness to purchase premium products and exclusive items not available elsewhere. Airlines are expanding their retail catalogues and partnering with luxury brands to enhance the shopping experience and increase average transaction values.

Business class passengers are expected to represent 48% of inflight retail and advertising spending in 2025. This dominant share reflects the higher disposable income and spending propensity of business class travellers who are more likely to purchase premium products and services during flight. Business class passengers typically have longer flight durations and greater exposure to retail offerings through enhanced service levels and personalized attention. The segment benefits from targeted marketing efforts and exclusive product offerings designed for affluent travellers.

Stored content and products are projected to contribute 60% of the market in 2025, representing traditional retail inventory and pre-loaded advertising content. This approach ensures the consistent availability of products and advertising content regardless of connectivity issues. Stored operations include physical retail inventory, downloaded entertainment content, and pre-programmed advertising materials. The segment benefits from reliability and the ability to offer consistent experiences across all flight routes and aircraft configurations.

Commercial aviation is estimated to hold 57% of the market share in 2025. This significant share reflects the large passenger volumes and frequent flight schedules of commercial airlines compared to business aviation. Commercial aviation benefits from economies of scale, established retail partnerships, and comprehensive advertising platforms that reach diverse passenger demographics. The segment includes both full-service carriers and low-cost airlines that are increasingly adopting retail and advertising strategies to generate ancillary revenue.

The in-flight retail and advertising market is advancing steadily due to recovering air travel demand and airlines' focus on ancillary revenue generation. The market faces challenges, including economic uncertainties affecting discretionary spending, varying connectivity infrastructure across aircraft fleets, and evolving passenger preferences for digital versus traditional retail experiences. Technological advancements and personalization capabilities continue to influence market development patterns.

The integration of advanced digital platforms and mobile payment systems is transforming traditional in-flight retail and advertising approaches. Airlines are implementing sophisticated e-commerce platforms that enable seamless transactions, personalized recommendations, and real-time inventory management. Digital advertising technologies are providing more targeted and interactive advertising experiences that engage passengers throughout their journey. These technological improvements are enhancing conversion rates and average transaction values while providing better analytics for optimization.

Modern in-flight retail and advertising systems are incorporating artificial intelligence and machine learning technologies to deliver personalized experiences based on passenger profiles, travel patterns, and preferences. Advanced analytics enable dynamic pricing, targeted product recommendations, and customized advertising content that resonates with individual passengers. These personalization capabilities are improving customer satisfaction and driving higher engagement rates while enabling airlines to optimize their retail and advertising strategies for maximum revenue generation.

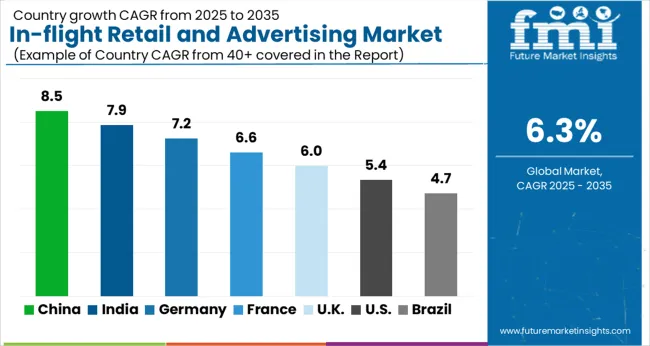

| Countries | CAGR |

|---|---|

| China | 8.5 |

| India | 7.9 |

| Germany | 7.2 |

| France | 6.6 |

| UK | 6.0 |

| USA | 5.4 |

| Brazil | 4.7 |

The in-flight retail and advertising market is estimated to grow at a global CAGR of 6.3%, driven by rising passenger traffic, airline service diversification, and the adoption of targeted advertising solutions. China leads at 8.5%, a 1.35× multiple of the global rate, supported by BRICS-driven airline network expansion, increasing domestic travel, and commercial partnerships. India follows at 7.9%, 1.25× the global benchmark, reflecting growing air passenger volumes and retail service adoption. Germany records 7.2%, 1.14× the global CAGR, shaped by OECD-led innovation, premium airline services, and advertising partnerships. France posts 6.6%, slightly above the global rate, supported by specialized in-flight retail programs. The United Kingdom stands at 6.0%, near the global average, driven by selective airline adoption and commercial campaigns. The United States records 5.4%, 0.85× the benchmark, with growth concentrated in premium carriers and advertising networks. Brazil grows at 4.7%, 0.75× the global rate, reflecting emerging regional airline development.

This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to expand at a CAGR of 8.5%, surpassing the global average due to rapid growth in domestic and international air travel. Airlines such as China Southern and Air China are investing in high-tech in-flight entertainment systems integrated with e-commerce platforms. Passenger engagement is enhanced through mobile app-based shopping and dynamic advertising content. Inflight advertising revenue is further boosted by partnerships with luxury brands and tech companies. China is also focusing on expanding ancillary revenue streams through targeted promotions during flights.

India is anticipated to grow at a CAGR of 7.9%, supported by rising domestic travel demand and increasing airline investments in digital retail and advertising solutions. Carriers like IndiGo and Air India are adopting in-flight entertainment apps integrated with targeted marketing campaigns. Growth is driven by the integration of AI-driven content personalization, enabling airlines to optimize advertising effectiveness and onboard product sales. Regional airports are enhancing passenger experience with interactive kiosks, inflight promotions, and e-commerce options.

Germany is growing at a CAGR of 7.2%, driven by the adoption of digital inflight entertainment systems and AI-enabled marketing solutions. Lufthansa and Eurowings are integrating mobile apps with onboard retail catalogs to increase passenger purchases. AI and data analytics are deployed for campaign personalization, dynamic pricing, and real-time promotional updates. Airlines are emphasizing luxury and premium product placements in inflight retail offerings. The growth focuses on improving passenger engagement, maximizing ancillary revenue, and enhancing the travel experience with interactive digital platforms. High-speed connectivity and cloud-based systems are expanding the reach of onboard advertising and e-commerce initiatives.

France is expected to grow at a CAGR of 6.6%, supported by innovation in inflight advertising and retail offerings across carriers like Air France and HOP!. Focus is on personalization of content, leveraging passenger data to enhance onboard sales and ad targeting. Digital kiosks and mobile app integration are expanding retail touchpoints. Attention is on optimizing revenue streams while improving customer experience. Investment in high-speed connectivity and AI-enabled marketing platforms allows airlines to deliver targeted promotions and monitor performance in real time. Ancillary revenue growth is expected to benefit from partnerships with fashion, technology, and luxury brands.

The UK is expanding at a CAGR of 6.0%, driven by adoption of digital inflight retail solutions and targeted advertising across carriers like British Airways and easyJet. AI-powered personalization tools are deployed to increase in-flight purchases and optimize ad placement. Airlines are upgrading onboard entertainment systems to include mobile app integration, digital kiosks, and interactive seatback displays. The market is highly influenced by increased international travel demand and premium passenger segments.

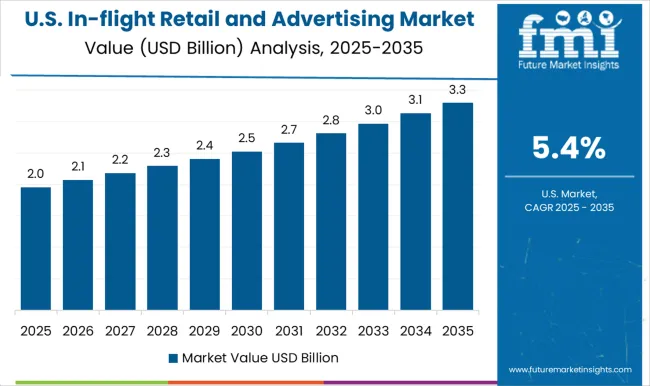

The US market is growing at a CAGR of 5.4%, supported by increasing adoption of digital advertising and inflight eCommerce among carriers such as Delta, United, and American Airlines. Investments in high-speed Wi-Fi, mobile app integration, and AI-powered targeted campaigns drive passenger engagement. Airlines are leveraging real-time analytics to optimize ad content and maximize onboard product sales. The strategies focus on enhancing the travel experience, increasing revenue per passenger, and reducing operational inefficiencies. AI and data-driven insights are applied to develop personalized marketing campaigns, track conversion rates, and identify passenger preferences.

Brazil is expected to grow at a CAGR of 4.7%, driven by the adoption of in-flight retail and advertising solutions among carriers like LATAM Airlines Brazil and Gol. Focus is on integrating digital kiosks, seatback screens, and mobile apps for passenger engagement and sales. Expansion is supported by AI-driven ad targeting and partnerships with consumer brands. The strategies prioritize on increasing ancillary revenue, enhancing customer experience, and supporting long-haul and domestic routes with data-driven advertising solutions. Growing international travel and tourism contribute to market growth.

Panasonic Avionics Corporation delivers advanced in-flight entertainment and connectivity systems supporting airline retail strategies, including duty-free partnerships and premium brand collaborations. Airbus SE integrates in-flight retail and connectivity solutions within its aircraft platforms, enabling seamless passenger experiences and exclusive product offerings. Anuvu provides digital platforms and content services that support in-flight e-commerce and tailored retail engagement. Astronics Corporation develops power and connectivity systems that enhance the integration of in-flight retail and digital services.

The in-flight retail and advertising market is characterized by collaboration between airlines, retail partners, technology providers, and advertising agencies. Airlines are investing in advanced retail platforms, digital advertising capabilities, personalized service delivery, and strategic partnerships to maximize ancillary revenue opportunities. Technology integration, brand partnerships, and passenger experience enhancement are central to developing competitive retail and advertising programs that generate steady revenue growth.

Gogo Inc. offers in-flight connectivity solutions that enable real-time e-commerce transactions and digital advertising delivery. Viasat Inc. provides high-capacity satellite connectivity supporting streaming, interactive retail applications, and passenger engagement platforms. IMM International specializes in in-flight advertising solutions designed for targeted campaigns based on passenger demographics and route networks. Intelsat SA delivers satellite communication services that support in-flight streaming, e-commerce platforms, and advertising integration. RTX Corporation develops aviation systems and technologies that integrate with onboard retail and connectivity platforms. Thales Group provides in-flight entertainment, digital advertising formats, and real-time analytics supporting retail effectiveness and revenue optimization.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.9 billion |

| Product Outlook | Retail (Duty-free Products, Food & Beverages, Travel Essentials, Electronics & Gadgets, Others), Advertising (Display Ads, Digital Ads, Print Ads, Others) |

| Seat Type Outlook | Business Class, First Class, Premium Economy Class, Economy Class |

| Operation Outlook | Stored, Streamed |

| End-use Outlook | Commercial Aviation, Business Aviation |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, France |

| Key Players | Panasonic Avionics Corporation, Airbus SE, Anuvu, Astronics Corporation, Gogo Inc, Viasat Inc, IMM International, Intelsat SA, RTX Corporation, Thales Group |

| Additional Attributes | Revenue analysis by product type, seat class, operation method, and end-use segments, regional demand patterns across major aviation markets, competitive positioning with airlines, retail partners, and technology providers, passenger preferences for traditional versus digital retail experiences, integration with advanced inflight entertainment systems and connectivity solutions, innovations in personalized retail recommendations and targeted advertising delivery, and adoption of mobile payment systems with seamless transaction processing and real-time inventory management capabilities. |

The global in-flight retail and advertising market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the in-flight retail and advertising market is projected to reach USD 7.3 billion by 2035.

The in-flight retail and advertising market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in the in-flight retail and advertising market include retail, duty-free products, food & beverages, travel essentials, electronics & gadgets, and others. Additionally, advertising encompasses display ads, digital ads, print ads, and other forms.

In terms of seat type outlook, the business class segment is expected to command 48.3% share in the in-flight retail and advertising market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retail Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Retail Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail E-Commerce Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail Automation Market Size and Share Forecast Outlook 2025 to 2035

Retail Clinics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Displays Market Size and Share Forecast Outlook 2025 to 2035

Retail Sales of Legume Snacks in the UK Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Layered Verrine‑Style Desserts in France Analysis - Size, Share & Forecast 2025 to 2035

US Convenience Confectionery Retail Sales Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Bergamot from Calabria in Italy Analysis - Size, Share & Forecast 2025 to 2035

Retail Colocation Market Size and Share Forecast Outlook 2025 to 2035

Retail Warehouse Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Retail Vending Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Retail Analytics Market Analysis by Solution, Function, Enterprise Size, Deployment Model, Field Crowdsourcing, and Region Through 2035

Examining Market Share Trends in the Retail Paper Bag Industry

Market Share Distribution Among Retail Glass Packaging Companies

Market Share Distribution Among Retail Vending Machine Suppliers

India Retail Mineral Turpentine Oil Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA