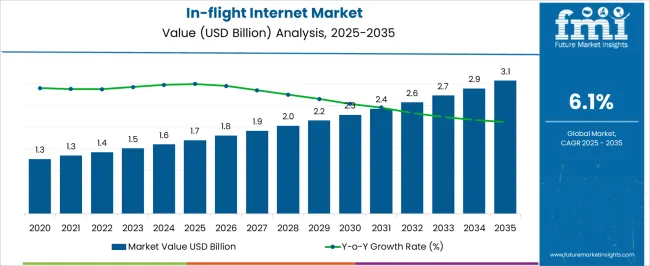

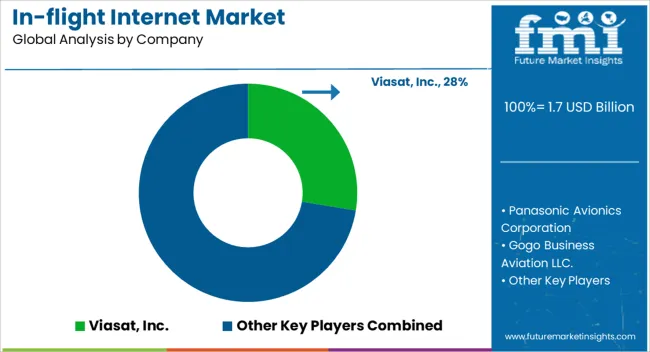

The In-flight internet market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period. Aviation authorities across regions, including the Federal Aviation Administration in the United States, the European Union Aviation Safety Agency in Europe, and comparable agencies in the Asia-Pacific region, impose stringent regulations governing onboard connectivity systems, including electromagnetic compatibility, safety certifications, and frequency licensing. These regulatory requirements directly affect market entry timelines, technology adoption, and network architecture decisions. International guidelines on satellite communications, interference mitigation, and cybersecurity further influence investment decisions and technology integration.

Regulatory compliance also drives innovation in hardware and software solutions, as manufacturers develop systems that meet efficiency and safety criteria while enabling high-speed connectivity for passengers. The cumulative effect of these regulations moderates market growth, ensuring that technological expansion is aligned with aviation safety and operational reliability. The annual increase from USD 1.7 billion in 2025 to USD 3.1 billion in 2035 illustrates a steady adoption trajectory constrained and guided by regulatory oversight. The regulatory landscape remains a critical determinant of market structure, influencing both investment patterns and regional deployment priorities.

| Metric | Value |

|---|---|

| In-flight Internet Market Estimated Value in (2025 E) | USD 1.7 billion |

| In-flight Internet Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The in-flight internet market represents a specialized segment within the global aviation and airline services industry, emphasizing connectivity, passenger experience, and operational efficiency. Within the broader airline services sector, it accounts for about 6.8%, driven by increasing passenger demand for continuous digital access during flights. In the aviation connectivity and onboard entertainment segment, its share is around 7.3%, reflecting adoption across commercial airlines, business jets, and regional carriers.

Across the satellite communication and airborne network equipment market, it holds approximately 5.5%, supporting real-time data transmission and streaming services. Within the airline digital services ecosystem, it represents 4.6%, highlighting the role of integrated Wi-Fi solutions in passenger engagement and ancillary revenue generation. In the aviation infrastructure and network management sector, it contributes about 3.9%, emphasizing integration with airline operational efficiency and flight monitoring systems. Recent developments in this market have focused on satellite technology advancements, bandwidth optimization, and service expansion.

High-throughput satellites and low-earth orbit (LEO) constellations are being deployed to enhance global coverage and reduce latency. Key players are collaborating with airlines, satellite operators, and avionics manufacturers to deliver seamless connectivity and upgraded onboard experiences. Adoption of hybrid Ku/Ka-band systems, 5G-enabled ground stations, and intelligent bandwidth allocation platforms is gaining momentum to optimize performance.

The subscription-based packages, real-time content streaming, and integration with passenger apps are being introduced to increase revenue streams. Cybersecurity and data protection solutions are also being prioritized to safeguard communications.

The in-flight internet market is witnessing substantial growth as airlines increasingly prioritize passenger connectivity as a key differentiator in customer experience. Expanding air travel across both developed and emerging markets, along with rising passenger expectations for seamless digital access, is accelerating the adoption of advanced in-flight connectivity systems. The integration of high-throughput satellites and next-generation ground infrastructure is enhancing the availability, speed, and reliability of onboard internet services.

Airlines are leveraging these technologies to offer tiered service models, onboard entertainment, and ancillary revenue opportunities through digital platforms. Regulatory support for connectivity expansion in multiple regions, coupled with strategic partnerships between airlines, satellite providers, and technology firms, is further strengthening market momentum.

Additionally, the growing use of internet-based aircraft operations and crew communication is contributing to demand As the aviation industry evolves toward more connected and digitized operations, the in-flight internet market is expected to expand significantly, supported by continuous innovation, scalable bandwidth solutions, and a strong focus on enhancing the passenger journey through always-on connectivity.

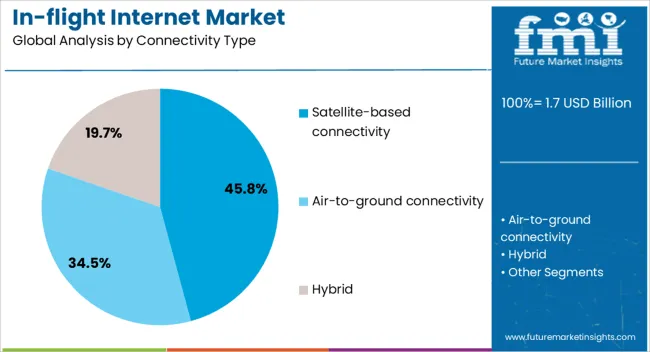

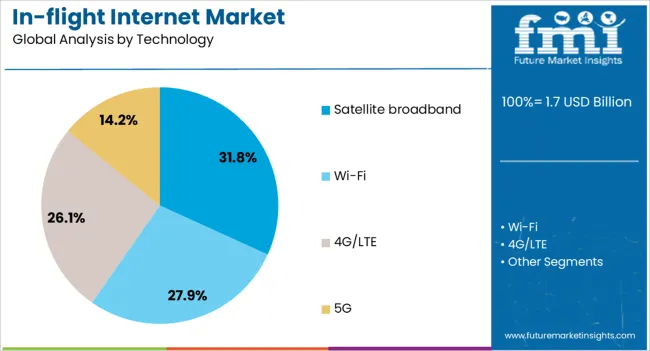

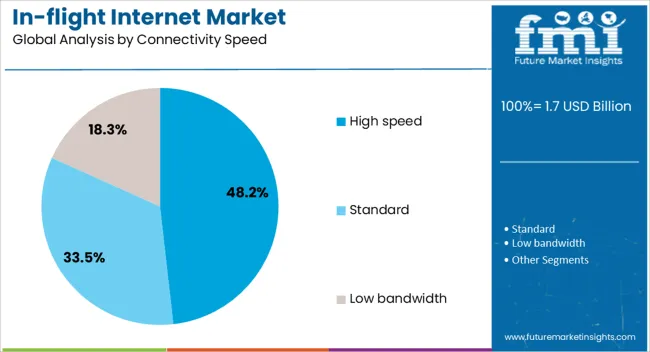

The in-flight internet market is segmented by connectivity type, technology, connectivity speed, installation type, service model, aircraft type, and geographic regions. By connectivity type, in-flight internet market is divided into Satellite-based connectivity, Air-to-ground connectivity, and Hybrid. In terms of technology, in-flight internet market is classified into Satellite broadband, Wi-Fi, 4G/LTE, and 5G.

Based on connectivity speed, the in-flight internet market is segmented into high-speed, Standard, and low-bandwidth. By installation type, in-flight internet market is segmented into Line-fit and Retrofit. By service model, in-flight internet market is segmented into Freemium, Free Wi-fi, and Paid Wi-fi. By aircraft type, in-flight internet market is segmented into Narrow-body aircraft and Wide-body aircraft. Regionally, the in-flight internet industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The satellite-based connectivity segment is projected to account for 45.8% of the in-flight internet market revenue share in 2025, establishing itself as the dominant connectivity type. This leadership is being driven by the ability of satellite systems to deliver consistent internet access across long-haul and transcontinental flight routes, where terrestrial networks are unavailable. The use of geostationary and low-earth orbit satellites allows for extensive coverage and stable bandwidth delivery, which is critical for maintaining uninterrupted internet service throughout flight durations.

Airlines are increasingly adopting satellite-based solutions due to their scalability, ability to support large user volumes, and growing compatibility with advanced onboard equipment. Continuous investment in satellite network capacity and ground station infrastructure is further enhancing service reliability and reducing latency.

The flexibility of satellite platforms in serving multiple aircraft fleets and adapting to varying bandwidth demands is reinforcing their adoption. As passenger demand for continuous and high-quality internet access grows, satellite-based connectivity is expected to remain the preferred choice for both commercial and regional airline operators worldwide.

The satellite broadband segment is anticipated to hold 31.8% of the in-flight internet market revenue share in 2025, making it the leading technology type. This segment’s growth is being propelled by advancements in satellite communication systems that enable high-capacity data transfer, allowing passengers to engage in bandwidth-intensive activities such as streaming, video conferencing, and real-time communication.

Satellite broadband technology supports seamless global coverage, particularly beneficial for intercontinental routes where ground-based connectivity infrastructure is not feasible. The rise in adoption of high-throughput satellites and the deployment of low-earth orbit constellations are significantly improving data speeds, reducing latency, and enabling more reliable service delivery.

Airlines are increasingly selecting satellite broadband as a cost-effective solution to meet rising customer expectations while optimizing operational efficiency through enhanced crew connectivity and aircraft health monitoring. The scalability and adaptability of this technology to serve varying flight densities and airline business models are contributing to its strong market share and continued growth trajectory across the aviation sector.

The high speed connectivity segment is expected to capture 48.2% of the in-flight internet market revenue share in 2025, positioning it as the leading connectivity speed category. This leadership is being reinforced by the growing demand for uninterrupted streaming, virtual meetings, and access to cloud-based services during flights, which require stable and high-bandwidth internet.

High speed in-flight connectivity is becoming a standard expectation among business and leisure travelers, prompting airlines to invest in upgraded communication hardware and software to support faster data throughput. The introduction of advanced antenna technologies, such as electronically steered phased arrays, and the integration of low-latency satellite networks are contributing to improved service speeds and coverage consistency.

The ability to deliver broadband-like speeds at cruising altitudes is allowing airlines to enhance the overall passenger experience while simultaneously unlocking new digital revenue streams. As competition intensifies and customer satisfaction becomes increasingly tied to digital offerings, high-speed connectivity is expected to maintain its lead as the most critical performance benchmark in in-flight internet services.

The market has emerged as a key enabler of connected aviation, offering passengers continuous access to digital services during flights. Airlines and private operators are investing in satellite-based and air-to-ground communication systems to provide high-speed connectivity for entertainment, work, and operational efficiency. Increasing passenger expectations, the rise of business travel, and demand for real-time communication are driving adoption. The integration of Wi-Fi with onboard applications, streaming platforms, and passenger services is enhancing overall flight experience. Market growth is influenced by technological advancements in broadband satellite networks, antenna design, and data compression.

Satellite communication (SATCOM) systems have become the backbone of in-flight internet services, enabling global coverage and reliable connectivity at cruising altitudes. Ka-band and Ku-band satellite networks are widely deployed to enhance bandwidth and reduce latency, providing passengers with seamless access to web services, video streaming, and cloud applications. Airlines are increasingly partnering with satellite providers to integrate multi-beam antennas, ensuring uninterrupted coverage even on long-haul international routes. Technological innovations in phased-array antennas and adaptive bandwidth management have improved signal reliability in challenging weather conditions. This widespread adoption of satellite systems is fueling demand for advanced onboard networking solutions while allowing airlines to differentiate service offerings and improve passenger satisfaction across various cabin classes.

The rapid increase in passenger expectations for uninterrupted connectivity has been a critical driver of the in-flight internet market. Travelers are seeking the ability to stream multimedia, access email, participate in video calls, and utilize onboard applications throughout flights. Business travelers, in particular, value continuous connectivity for productivity and communication during air travel. Airlines are responding by offering tiered connectivity plans, integrating Wi-Fi with entertainment systems, and providing seamless authentication and billing experiences. Data analytics are being leveraged to monitor usage patterns, optimize bandwidth allocation, and enhance service quality. The rising demand for reliable, high-speed in-flight internet services has prompted significant investments in network upgrades, equipment retrofitting, and fleet-wide standardization.

Technological innovations in antenna systems, network optimization, and onboard routers are transforming the in-flight internet market. Low-profile, electronically steerable antennas enable higher data throughput and consistent connectivity across flight paths. Advanced onboard routers with intelligent traffic management improve network efficiency while supporting multiple concurrent devices. Integration of 5G and next-generation satellite constellations enhances capacity, reduces latency, and enables real-time communication for both passengers and crew. Airlines are also investing in hybrid communication architectures combining air-to-ground and satellite links to ensure redundancy. These innovations not only improve passenger experience but also facilitate operational benefits, including real-time telemetry, predictive maintenance, and enhanced flight operations management.

Despite strong market growth, deployment of in-flight internet services is constrained by high capital and operational expenditures, regulatory approvals, and technical complexities. Satellite connectivity requires significant investment in aircraft-mounted antennas, onboard routers, and network licenses. Airspace regulations and spectrum allocation differ across regions, complicating service deployment on international routes. Maintenance and software updates of onboard connectivity systems necessitate trained personnel and ongoing monitoring, adding to operating costs. The bandwidth limitations and fluctuating satellite coverage can affect service quality. These financial and regulatory barriers require airlines and service providers to adopt innovative business models, strategic partnerships, and phased implementation plans to expand reliable in-flight internet services globally.

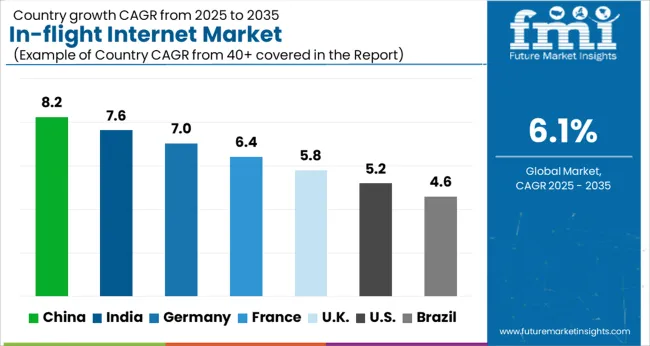

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The market is projected to grow at a CAGR of 6.1% from 2025 to 2035. Germany recorded 7.0% as advancements in connectivity infrastructure and airline partnerships fueled adoption. India reached 7.6%, driven by increased passenger demand and fleet modernization. China led with 8.2%, reflecting extensive investment in aviation connectivity and technology integration. The United Kingdom stood at 5.8% with gradual network enhancements, while the United States reached 5.2% supported by retrofitting initiatives and growing passenger expectations. These countries are pivotal in advancing production, scaling operations, and driving innovation in the market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 8.2%, driven by rapid expansion of domestic and international airlines and increasing passenger expectations for connectivity. Adoption is reinforced by investments in satellite based broadband, LTE and Wi-Fi systems on commercial aircraft. Airlines are upgrading fleets with advanced connectivity solutions to enhance passenger experience and attract premium travelers. Partnerships between aviation technology providers and telecom operators further strengthen network coverage across domestic and regional routes.

India is expected to grow at a CAGR of 7.6%, supported by expanding domestic airline operations and rising passenger demand for uninterrupted connectivity. Adoption is reinforced by installation of Ka-band and Ku-band satellite systems on narrowbody and regional aircraft. Government initiatives to improve aviation infrastructure and in-flight digital services further encourage market growth. Airlines are partnering with technology providers to offer tiered subscription plans and premium services for business and leisure travelers.

Germany is projected to grow at a CAGR of 7.0%, driven by business travel demand and increasing digital services on European carriers. Adoption is reinforced by high passenger expectations for seamless connectivity on long haul and short haul flights. Airlines focus on integrating high speed Wi-Fi and entertainment platforms for enhanced customer experience. Collaborations with satellite operators and avionics providers help expand coverage and optimize network reliability.

The United Kingdom is expected to grow at a CAGR of 5.8%, supported by both short haul European operations and long haul intercontinental flights. Adoption is reinforced by premium airlines offering subscription and pay per use Wi-Fi services. Increasing passenger expectations, airline digital transformation initiatives, and upgrades to narrowbody and widebody fleets support market growth. Operators focus on reliability, speed, and coverage consistency to enhance customer satisfaction.

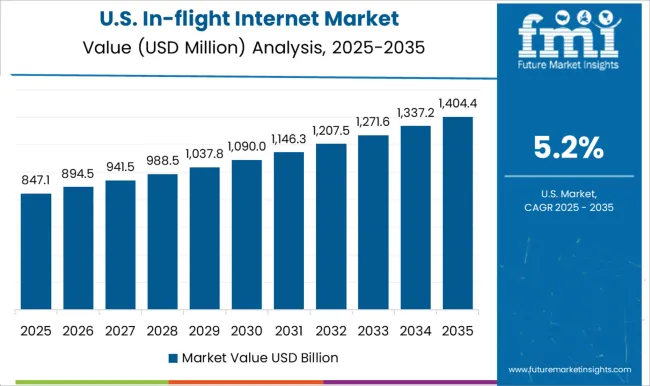

The United States is projected to grow at a CAGR of 5.2%, driven by adoption among major domestic and international carriers. Demand is reinforced by increasing business and leisure travel, passenger expectations for continuous connectivity, and integration of entertainment and communication platforms. Technological focus is on high throughput satellite (HTS) systems and inflight LTE/Wi-Fi hybrid solutions. Fleet upgrades and retrofits sustain steady market growth.

The market is characterized by the presence of a few global leaders and several regional or specialized providers, all competing to offer seamless connectivity, higher bandwidth, and low-latency solutions for commercial, business, and private aviation. Viasat, Inc. leads through satellite-based broadband, offering high-speed global coverage and innovative Ka-band and LEO satellite solutions. Panasonic Avionics Corporation focuses on integrated connectivity systems, combining in-flight entertainment with high-performance internet solutions, targeting airline partnerships and fleet-wide digital upgrades. Gogo Business Aviation LLC specializes in air-to-ground and satellite connectivity solutions for private and business aircraft, emphasizing real-time communications, streaming, and operational efficiency.

Deutsche Telekom AG leverages its global telecommunications infrastructure and satellite partnerships to provide enterprise-grade connectivity for airlines and aircraft OEMs, while Lufthansa Technik integrates advanced network management, cybersecurity, and tailored passenger experience solutions for its airline customers. Smaller and emerging providers differentiate by offering region-specific bandwidth solutions, IoT-enabled aircraft systems, and cost-effective deployment models for retrofit and new installations. Innovation trends such as satellite mega-constellations, 5G hybrid networks, AI-driven bandwidth management, and secure data handling continue to shape competitive strategies, driving partnerships, mergers, and technology licensing across the aviation connectivity ecosystem.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Connectivity Type | Satellite-based connectivity, Air-to-ground connectivity, and Hybrid |

| Technology | Satellite broadband, Wi-Fi, 4G/LTE, and 5G |

| Connectivity Speed | High speed, Standard, and Low bandwidth |

| Installation Type | Line-fit and Retrofit |

| Service Model | Freemium, Free Wi-fi, and Paid Wi-fi |

| Aircraft Type | Narrow-body aircraft and Wide-body aircraft |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Viasat, Inc., Panasonic Avionics Corporation, Gogo Business Aviation LLC., Deutsche Telekom AG, and Lufthansa Technik |

| Additional Attributes | Dollar sales by service type and aircraft category, demand dynamics across commercial airlines, business jets, and regional carriers, regional trends in connectivity adoption, innovation in satellite bandwidth, low-latency communication, and passenger experience, environmental impact of satellite and ground infrastructure, and emerging use cases in real-time entertainment, operational efficiency, and inflight business solutions. |

The global in-flight internet market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the in-flight internet market is projected to reach USD 3.1 billion by 2035.

The in-flight internet market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in in-flight internet market are satellite-based connectivity, _ka-band, _ku-band, _l-band, _others, air-to-ground connectivity and hybrid.

In terms of technology, satellite broadband segment to command 31.8% share in the in-flight internet market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Internet Protocol Television Market Size and Share Forecast Outlook 2025 to 2035

Internet Of Things In Farm Management Market Size and Share Forecast Outlook 2025 to 2035

Internet Security Market Size and Share Forecast Outlook 2025 to 2035

Internet Of Things IoT Monetization Market Size and Share Forecast Outlook 2025 to 2035

Internet Protocol Television (IPTV) CDN Market Size and Share Forecast Outlook 2025 to 2035

Internet of Robotics Things - Market Trends & Forecast 2025 to 2035

Internet of Everything (IoE) Market Analysis – Size, Share & Forecast 2025-2035

Internet of Things Vehicle-to-Vehicle Communication Market

IoT Security Product Market Report – Growth & Forecast 2017 to 2027

Telecom Internet Of Things (IoT) Market Size and Share Forecast Outlook 2025 to 2035

Dedicated Internet Access Market

Voice Over Internet Protocol (VoIP) Over WLAN (VoWLAN) Market Size and Share Forecast Outlook 2025 to 2035

Voice over Internet Protocol (VoIP) Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Enterprise Internet Reputation Management Market Share

Enterprise Internet Reputation Management Market Growth – Trends & Forecast 2025 to 2035

Automotive Internet of Things (IoT) Market

UK Enterprise Internet Reputation Management Market Growth – Demand, Trends & Forecast 2025-2035

USA Enterprise Internet Reputation Management Market Analysis – Size, Share & Innovations 2025-2035

Japan Enterprise Internet Reputation Management Market Report – Size, Growth & Forecast 2025-2035

Germany Enterprise Internet Reputation Management Market Outlook – Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA