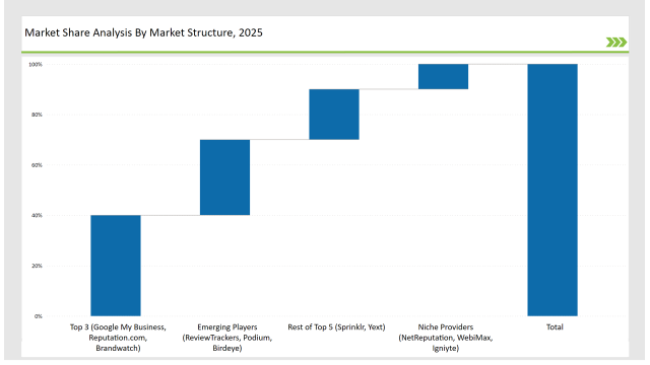

The Enterprise Internet Reputation Management (IRM) market is expanding rapidly as organizations prioritize online brand perception, consumer trust, and crisis management. Google My Business (GMB), Reputation.com, and Brandwatch lead the market, controlling 40%. They leverage AI-driven sentiment analysis and automated review management to enhance brand trust.

Sprinklr and Yext, holding 20%, focus on multi-platform reputation monitoring and AI-powered insights. Emerging players like ReviewTrackers, Podium, and Birdeye capture 30%, excelling in real-time sentiment tracking and customer engagement automation. Niche providers such as NetReputation, WebiMax, and Igniyte account for 10%, specializing in crisis management, reputation repair, and content suppression.

| Category | Industry Share (%) |

|---|---|

| Top 3 (Google My Business, Reputation.com, Brandwatch) | 40% |

| Rest of Top 5 (Sprinklr, Yext) | 20% |

| Emerging Players (ReviewTrackers, Podium, Birdeye) | 30% |

| Niche Providers (NetReputation, WebiMax, Igniyte) | 10% |

| Market Concentration | Assessment |

|---|---|

| High (> 60% by top 10 players) | Medium |

| Medium (40-60%) | High |

| Low (< 40%) | Low |

Reputation Monitoring leads the market with a 40% share as businesses face increasing brand vulnerabilities from social media and online reviews. Google My Business and Reputation.com dominate this segment with AI-powered review aggregation, automated sentiment analysis, and crisis alert systems.

Reputation Repair accounts for 30%, focusing on suppressing negative content, managing PR crises, and improving brand perception. NetReputation and WebiMax specialize in content suppression, online reputation repair, and crisis communication strategies.

Reputation Analysis holds 20%, with Brandwatch and Sprinklr leveraging big data analytics to monitor consumer sentiment and track reputation trends in real time.

Other reputation management solutions, including automated social media listening tools and industry-specific reputation solutions, contribute 10%.

Cloud-based solutions dominate with a 70% market share, as businesses seek scalability, automation, and real-time insights. Reputation.com, Brandwatch, and Sprinklr lead this category with AI-powered cloud solutions integrated with social media and review platforms.

On-premises solutions hold a 30% share, catering to enterprises with strict data security needs. Yext and NetReputation offer tailored solutions that help companies manage and protect their online reputation while maintaining data sovereignty.

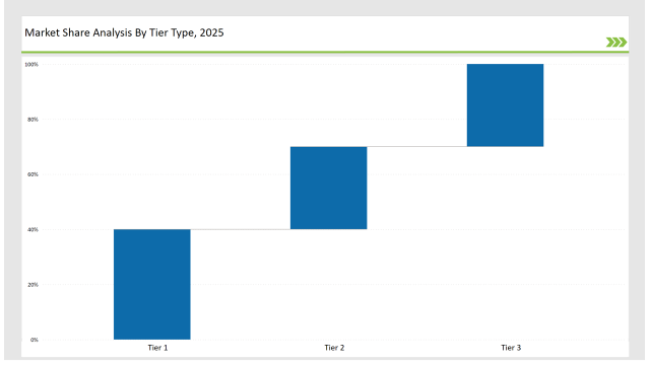

| Tier | Tier 1 |

|---|---|

| Vendors | Google My Business, Reputation.com, Brandwatch |

| Consolidated Market Share (%) | 40% |

| Tier | Tier 2 |

|---|---|

| Vendors | Sprinklr, Yext, ReviewTrackers |

| Consolidated Market Share (%) | 30% |

| Tier | Tier 3 |

|---|---|

| Vendors | Podium, Birdeye, NetReputation, WebiMax, Igniyte |

| Consolidated Market Share (%) | 30% |

| Vendor | Key Focus |

|---|---|

| Google My Business | Enhances AI-driven reputation monitoring tools and review management automation. |

| Reputation.com | Advances sentiment analysis and automated review response capabilities. |

| Brandwatch | Strengthens big data reputation analysis and predictive brand monitoring. |

| Sprinklr | Develops real-time AI-powered social listening and crisis management solutions. |

| Yext | Integrates reputation management with local SEO and search optimization. |

| NetReputation | Specializes in content suppression, crisis management, and online reputation repair. |

Vendors must refine AI models to predict reputation threats, automate review responses, and mitigate PR crises in real time. AI-driven brand monitoring and deep-learning-based sentiment analysis will enhance trust and consumer engagement. Automated reputation repair mechanisms, blockchain-backed authenticity tracking, and AI-powered content suppression will improve brand resilience.

Expansion into emerging markets will drive growth, necessitating region-specific compliance features and multilingual capabilities. Cloud-based reputation platforms will remain a key differentiator, ensuring businesses of all sizes can adopt cost-effective, comprehensive reputation management solutions. Stronger partnerships with CRM and ERP providers will help integrate real-time reputation monitoring within existing workflows, enhancing brand consistency and crisis response times.

Google My Business, Reputation.com, and Brandwatch hold 50% of the market.

Emerging players like ReviewTrackers, Podium, and Birdeye hold 20%.

Niche providers like NetReputation and WebiMax hold 10%.

The top 5 vendors control 70% of the market.

Market concentration is categorized as medium, with the top 10 players controlling 60-70% of the market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enterprise A2P SMS Market Size and Share Forecast Outlook 2025 to 2035

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Graph Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Mobility Market Size and Share Forecast Outlook 2025 to 2035

Enterprise LLM Market Size and Share Forecast Outlook 2025 to 2035

Enterprise VSAT Systems Market Size and Share Forecast Outlook 2025 to 2035

Enterprise AI Governance and Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enterprise Resource Planning (ERP) Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise IoT Market Size and Share Forecast Outlook 2025 to 2035

Enterprise WLAN Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Network Equipment Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Video Market Analysis - Size, Share, and Forecast 2025 to 2035

Enterprise-Grade DLT Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Information Archiving (EIA) Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Manufacturing Intelligence Market Analysis by Deployment Type, Offering, End-use Industry, and Region Through 2035

Enterprise Laboratory Informatics Market Analysis by Type of Solution, Component, Delivery, Industry, and Region Through 2035

Enterprise File Sharing And Synchronization Market

Enterprise Flash Storage Market

Enterprise File Sync And Share Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA