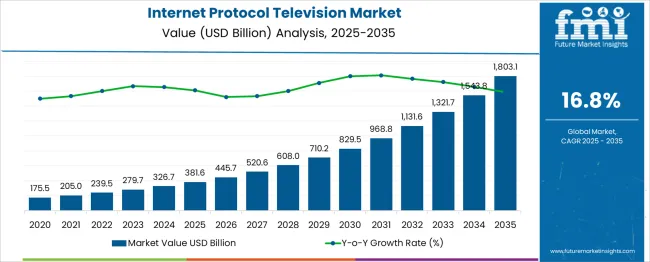

The global internet protocol television market is anticipated to grow from USD 381.5 billion in 2025 to approximately USD 1803.1 billion by 2035, recording an absolute increase of USD 1421.6 billion over the forecast period. This translates into a total growth of 372.6%, with the market forecast to expand at a CAGR of 16.8% between 2025 and 2035. The market size is expected to grow by nearly 4.73X during the same period, supported by the increasing adoption of streaming services and growing demand for personalized content delivery across multiple devices.

Between 2025 and 2030, the internet protocol television market is projected to expand from USD 381.6 billion to USD 844.2 billion, resulting in a value increase of USD 462.7 billion, which represents 32.5% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of high-speed internet infrastructure, increasing consumer preference for on-demand content, and growing adoption of smart devices capable of streaming IPTV content. Service providers are expanding their content libraries and enhancing streaming quality to address evolving consumer expectations.

From 2030 to 2035, the market is forecast to grow from USD 844.2 billion to USD 1,803.1 billion, adding another USD 958.92 billion, which constitutes 67.5% of the ten-year expansion. This period is expected to be characterized by advancement in video compression technologies, integration of artificial intelligence for content recommendation, and development of immersive viewing experiences through virtual and augmented reality. The growing adoption of 5G networks will enable higher quality streaming and support for emerging applications in gaming and interactive entertainment.

Between 2020 and 2025, the internet protocol television market experienced accelerated expansion, driven by pandemic-induced shifts in viewing habits and increasing cord-cutting trends among traditional television subscribers. The market developed as telecommunications companies and streaming service providers recognized the opportunity to deliver comprehensive entertainment packages through internet protocol networks. Content creators and distributors began investing heavily in original programming and exclusive content to differentiate their IPTV offerings.

| Metric | Value |

|---|---|

| Internet Protocol Television Market Value (2025) | USD 381.6 billion |

| Internet Protocol Television Market Forecast Value (2035) | USD 1,803.1 billion |

| Internet Protocol Television Market Forecast CAGR | 16.8% |

Market expansion is being supported by the widespread availability of high-speed broadband infrastructure and the corresponding consumer shift toward internet-based entertainment consumption. Modern households increasingly prefer flexible viewing options that allow content access across multiple devices and locations, driving demand for IPTV services that support seamless content delivery. The ability to customize viewing experiences and access extensive content libraries has made IPTV an attractive alternative to traditional broadcasting methods.

The growing sophistication of streaming technologies and increasing investment in original content production are driving demand for advanced IPTV platforms that can deliver high-quality viewing experiences. Content providers are leveraging data analytics and artificial intelligence to personalize content recommendations and improve user engagement. Competitive pricing models and flexible subscription options are making IPTV services accessible to broader consumer segments across different income levels.

The growing deployment of cloud-based content delivery networks is enabling efficient distribution of high-quality video content to global audiences with reduced latency and improved streaming reliability. Advanced compression algorithms and adaptive bitrate streaming technologies provide optimal viewing experiences across varying network conditions and device capabilities. These technological improvements are particularly valuable for live sports events, news broadcasting, and interactive entertainment content that require real-time delivery.

Modern IPTV platforms are incorporating cross-device synchronization capabilities that allow seamless content transitions between smartphones, tablets, smart TVs, and desktop computers. Integration with smart home systems and voice-activated controls enhances user convenience and accessibility. The expanding ecosystem of connected devices creates opportunities for innovative viewing experiences and interactive content formats that leverage multiple device capabilities simultaneously.

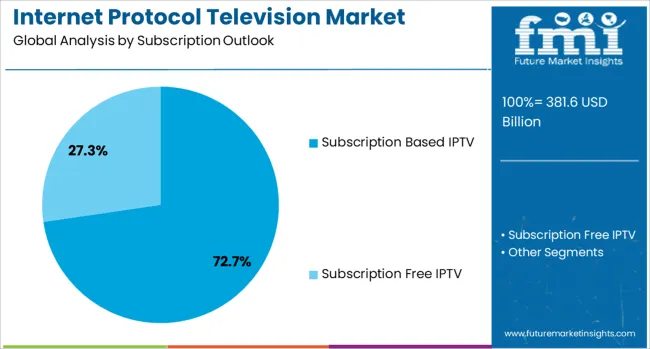

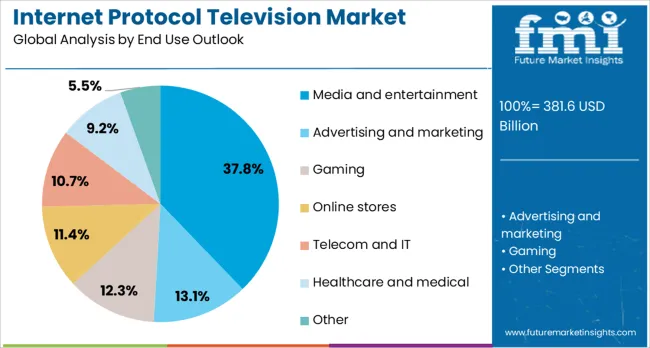

The market is segmented by subscription model, component type, device category, end use application, and region. By subscription model, the market is divided into subscription based IPTV and subscription free IPTV. Based on component type, the market is categorized into software and hardware solutions. In terms of device category, the market is segmented into smartphones and tablets, smart TVs, desktops and laptops, and others. By end use application, the market is classified into media and entertainment, advertising and marketing, gaming, online stores, telecom and IT, healthcare and medical, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Subscription Based IPTV is projected to account for 72.7% of the internet protocol television market in 2025. This leading share is supported by consumer preference for premium content access and ad-free viewing experiences that subscription models provide. Subscription based services offer comprehensive content libraries, exclusive programming, and personalized viewing recommendations that justify monthly or annual payment structures. The segment benefits from recurring revenue models that enable investment in content acquisition and platform development.

Software components are expected to represent 55.7% of IPTV technology investments in 2025. This dominant share reflects the critical importance of streaming software platforms, content management systems, and user interface applications in delivering comprehensive IPTV experiences. Modern IPTV services rely heavily on sophisticated software solutions for content encoding, delivery optimization, user authentication, and analytics reporting. The segment benefits from continuous software updates and feature enhancements that improve service quality and user satisfaction.

Smartphones and tablets are projected to contribute 35% of the market in 2025, representing the growing preference for mobile content consumption and on-the-go entertainment access. These portable devices offer convenience and flexibility that align with modern lifestyle patterns and viewing preferences. Mobile IPTV applications support offline viewing capabilities, social sharing features, and location-based content recommendations. The segment is supported by improving mobile network speeds and increasing smartphone penetration in emerging markets.

Media and entertainment applications are estimated to hold 37.8% of the market share in 2025. This dominance reflects the primary use case for IPTV services in delivering movies, television series, documentaries, and live entertainment programming to consumer audiences. Professional content producers and distributors utilize IPTV platforms to reach global audiences and monetize their content libraries through various revenue models. The segment provides diverse entertainment options that cater to different demographic groups and cultural preferences.

The internet protocol television market is advancing rapidly due to increasing consumer demand for on-demand content and growing availability of high-speed internet infrastructure. The market faces challenges, including content licensing complexities, network bandwidth limitations, and intense competition among streaming service providers. Technological advancement and strategic partnerships continue to influence platform capabilities and market development patterns.

The growing investment in original content creation is enabling IPTV platforms to differentiate their offerings and build subscriber loyalty through exclusive programming that cannot be accessed through traditional broadcasting channels. Premium content production includes scripted series, documentaries, live sports coverage, and interactive entertainment formats that leverage IPTV platform capabilities. These investments are particularly valuable for building brand recognition and justifying subscription pricing in competitive markets.

Modern IPTV platforms are incorporating artificial intelligence algorithms that analyze viewing patterns, preferences, and engagement metrics to provide personalized content recommendations and optimize user experiences. Machine learning systems enable dynamic content curation, automated quality adjustments, and predictive analytics that improve platform performance. Advanced AI capabilities also support content moderation, fraud detection, and customer service automation that enhance operational efficiency.

| Countries | CAGR (2025-2035) |

|---|---|

| China | 22.7% |

| India | 21% |

| Germany | 19.3% |

| France | 17.6% |

| UK | 16% |

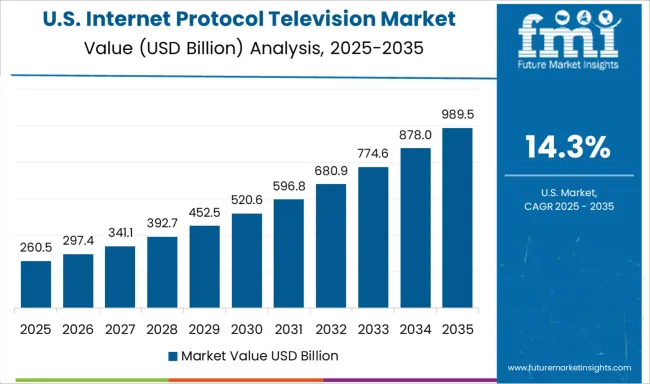

| USA | 14.3% |

| Brazil | 12.6% |

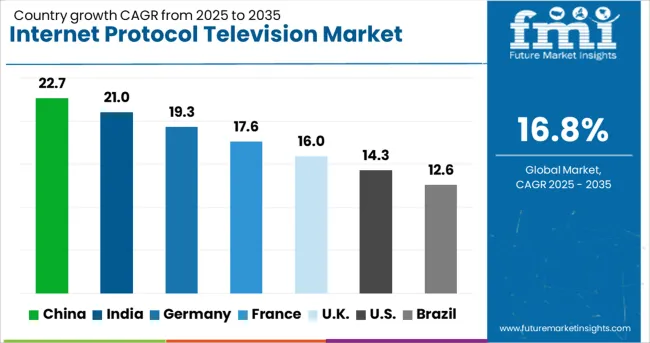

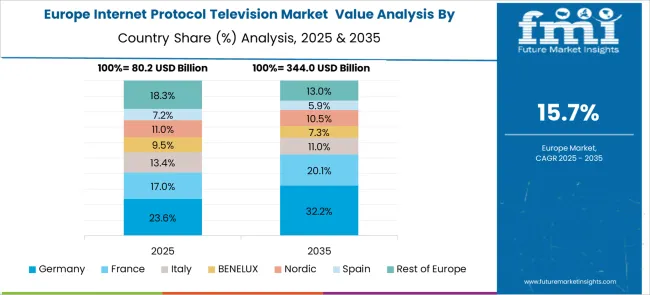

The internet protocol television market demonstrates exceptional growth patterns across key countries, with China leading at a 22.7% CAGR through 2035, driven by massive digital infrastructure investment, government support for streaming technologies, and rapid urbanization creating demand for advanced entertainment services. India follows at 21%, supported by expanding internet penetration, growing smartphone adoption, and increasing disposable income, enabling premium content subscriptions. Germany maintains strong growth at 19.3%, emphasizing high-quality content delivery and advanced streaming technologies. France grows at 17.6%, integrating IPTV with its existing telecommunications infrastructure. The UK advances at 16%, focusing on premium content aggregation and multi-platform integration. The USA shows steady growth at 14.3%, prioritizing content personalization and advanced analytics. Brazil records 12.6% growth, driven by improving internet infrastructure and expanding middle-class entertainment consumption.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from internet protocol television in China is projected to exhibit the highest growth rate with a CAGR of 22.7% through 2035, driven by massive government investment in 5G infrastructure, rapid urbanization creating demand for advanced entertainment services, and growing consumer preference for on-demand content consumption. The country's expanding digital economy and increasing disposable income among urban populations are creating significant opportunities for premium IPTV service providers. Major telecommunications companies and technology platforms are establishing comprehensive content delivery networks that support high-quality streaming across diverse device categories.

Government digital transformation initiatives are supporting development of advanced streaming infrastructure and content creation programs that enhance domestic IPTV platform capabilities throughout major metropolitan and emerging market regions.

Revenue from internet protocol television in India is expanding at a CAGR of 21%, supported by rapid smartphone adoption, improving internet infrastructure, and growing consumer demand for affordable entertainment content across diverse language preferences and cultural backgrounds. The country's expanding middle class and increasing digital literacy are driving subscription growth for both domestic and international IPTV platforms. Telecommunications companies are bundling IPTV services with mobile data plans to provide comprehensive entertainment packages that appeal to price-conscious consumers.

Technology companies and content creators are developing localized programming and regional language content that addresses diverse cultural preferences and market segments throughout India's expansive geographic regions.

Revenue from Internet Protocol Television in Germany is growing at a CAGR of 19.3%, driven by consumer preference for high-quality content delivery, advanced streaming technologies, and comprehensive entertainment packages that integrate live television with on-demand programming options. German consumers demonstrate willingness to pay premium subscription fees for ad-free content access and exclusive programming that meets their quality expectations. Telecommunications companies are investing in fiber optic infrastructure and advanced content delivery networks that support 4K streaming and interactive television applications.

Content providers are developing German-language programming and acquiring international content rights that appeal to sophisticated entertainment preferences and cultural expectations throughout German-speaking markets.

Revenue from Internet Protocol Television in France is expanding at a CAGR of 17.6%, supported by integration of IPTV services with existing telecommunications infrastructure, government support for digital content creation, and consumer preference for comprehensive entertainment packages that combine television, internet, and mobile services. French telecommunications providers are leveraging existing network infrastructure to deliver competitive IPTV offerings that compete effectively with traditional broadcasting services. Content creators are developing French-language programming and European content that appeals to domestic audience preferences.

Telecommunications industry consolidation is enabling integrated service delivery that combines IPTV with broadband internet and mobile communications in comprehensive consumer packages throughout French metropolitan and rural markets.

Revenue from Internet Protocol Television in the UK is projected to grow at a CAGR of 16%, driven by sophisticated content aggregation platforms that combine live television, on-demand programming, and streaming services in unified user interfaces. British consumers increasingly prefer integrated entertainment solutions that provide access to multiple content sources through single subscription packages. Telecommunications companies and content providers are developing partnerships that enable comprehensive content libraries and cross-platform compatibility.

Technology companies are implementing advanced content recommendation systems and personalization features that enhance user engagement and support subscription retention throughout competitive UK entertainment markets.

Demand for internet protocol television in the USA is expanding at a CAGR of 14.3%, driven by sophisticated content personalization technologies, comprehensive original programming investment, and advanced analytics capabilities that optimize user experiences and engagement metrics. American streaming platforms are leveraging artificial intelligence and machine learning technologies to provide personalized content recommendations and dynamic user interfaces that adapt to individual viewing preferences. Content creators are investing heavily in original programming production that differentiates IPTV platforms from traditional broadcasting services.

Technology companies are developing advanced streaming infrastructure and content delivery networks that support high-quality viewing experiences across diverse geographic regions and network conditions throughout American markets.

Demand for internet protocol television in Brazil is growing at a CAGR of 12.6%, supported by improving internet infrastructure, expanding middle class entertainment consumption, and increasing smartphone penetration that enables mobile content access throughout urban and rural regions. Brazilian telecommunications companies are investing in network infrastructure improvements that support reliable streaming services and high-quality content delivery. Content creators are developing Portuguese-language programming and localized entertainment content that appeals to Brazilian cultural preferences and market expectations.

Government infrastructure development programs are supporting broadband internet expansion and digital inclusion initiatives that enable IPTV service access across diverse socioeconomic segments throughout Brazilian geographic regions.

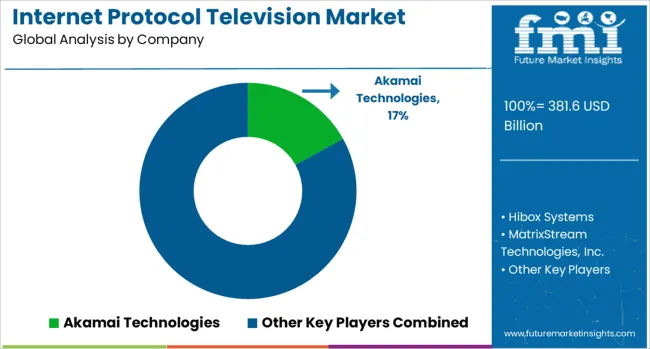

The internet protocol television market is defined by competition among technology platforms, telecommunications providers, and content streaming companies. Companies are investing in original content production, advanced streaming technologies, personalized user experiences, and global content distribution networks to deliver compelling, reliable, and cost-effective entertainment solutions. Strategic partnerships, technological innovation, and content acquisition are central to strengthening service portfolios and market presence.

Akamai Technologies offers global content delivery network solutions that optimize streaming performance and reliability for IPTV platforms worldwide. Hibox Systems provides comprehensive IPTV platform solutions with advanced content management and user interface capabilities. MatrixStream Technologies Inc. delivers professional streaming solutions with a focus on scalability and content security. Muvi offers white-label streaming platform solutions that enable content creators to launch branded IPTV services. MwareTV provides middleware solutions that integrate IPTV services with telecommunications infrastructure.

Setplex LLC offers comprehensive IPTV platform development and content management solutions for service providers. TeleData GmbH delivers telecommunications infrastructure solutions that support IPTV service deployment. Deutsche Telekom AG provides integrated IPTV services with telecommunications and internet packages throughout European markets. Telergy offers cloud-based IPTV solutions with a focus on scalability and global content delivery. Triple Play Interactive Network Pvt. Ltd. provides interactive television solutions that integrate entertainment with telecommunications services.

| Item | Value |

|---|---|

| Quantitative Units | USD 381.6 billion |

| Subscription Model | Subscription Based IPTV, Subscription Free IPTV |

| Component Type | Software, Hardware |

| Device Category | Smartphones & Tablets, Smart TVs, Desktops and Laptops, Others |

| End Use Application | Media and entertainment, Advertising and marketing, Gaming, Online stores, Telecom and IT, Healthcare and medical, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, France, Brazil |

| Key Companies Profiled | Akamai Technologies, Hibox Systems, MatrixStream Technologies Inc., Muvi, MwareTV, Setplex LLC, TeleData GmbH, Deutsche Telekom AG, Telergy, Triple Play Interactive Network Pvt. Ltd. |

| Additional Attributes | Dollar sales by subscription model, component type, device category, and end use application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established technology providers and emerging streaming platforms, consumer preferences for subscription versus free content models, integration with artificial intelligence and machine learning technologies for content personalization, innovations in streaming quality optimization and cross-device compatibility, and adoption of advanced analytics solutions with user behavior tracking and engagement optimization features. |

The global internet protocol television market is estimated to be valued at USD 381.6 billion in 2025.

The market size for the internet protocol television market is projected to reach USD 1,803.1 billion by 2035.

The internet protocol television market is expected to grow at a 16.8% CAGR between 2025 and 2035.

The key product types in internet protocol television market are subscription based iptv and subscription free iptv.

In terms of component outlook , software segment to command 55.7% share in the internet protocol television market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Internet Protocol Television (IPTV) CDN Market Size and Share Forecast Outlook 2025 to 2035

Internet Of Things In Farm Management Market Size and Share Forecast Outlook 2025 to 2035

Internet Security Market Size and Share Forecast Outlook 2025 to 2035

Internet Of Things IoT Monetization Market Size and Share Forecast Outlook 2025 to 2035

Internet of Robotics Things - Market Trends & Forecast 2025 to 2035

Internet of Everything (IoE) Market Analysis – Size, Share & Forecast 2025-2035

Internet of Things Vehicle-to-Vehicle Communication Market

IoT Security Product Market Report – Growth & Forecast 2017 to 2027

Telecom Internet Of Things (IoT) Market Size and Share Forecast Outlook 2025 to 2035

In-flight Internet Market Size and Share Forecast Outlook 2025 to 2035

Dedicated Internet Access Market

Competitive Overview of Enterprise Internet Reputation Management Market Share

Enterprise Internet Reputation Management Market Growth – Trends & Forecast 2025 to 2035

Automotive Internet of Things (IoT) Market

Voice Over Internet Protocol (VoIP) Over WLAN (VoWLAN) Market Size and Share Forecast Outlook 2025 to 2035

Voice over Internet Protocol (VoIP) Market Size and Share Forecast Outlook 2025 to 2035

UK Enterprise Internet Reputation Management Market Growth – Demand, Trends & Forecast 2025-2035

USA Enterprise Internet Reputation Management Market Analysis – Size, Share & Innovations 2025-2035

Japan Enterprise Internet Reputation Management Market Report – Size, Growth & Forecast 2025-2035

Germany Enterprise Internet Reputation Management Market Outlook – Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA