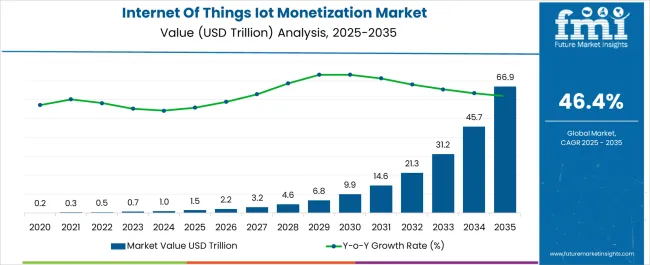

The internet of things IoT monetization market is estimated to be valued at USD 1.5 trillion in 2025 and is projected to reach USD 66.9 trillion by 2035, registering a compound annual growth rate (CAGR) of 46.4% over the forecast period.

The market maturity curve shows early adoption from 2020–2024, with annual growth from 0.2 to 1.0 USD trillion, driven by pilot deployments, subscription models, and early enterprise experimentation. By 2025, adoption enters the scaling phase as broader industry uptake accelerates. Between 2025–2030, the market grows from 1.5 to 9.9 USD trillion, fueled by expanded digital services, ecosystem partnerships, and recurring revenue models. From 2030–2035, growth moderates as consolidation occurs, with major platform providers and service integrators dominating revenue streams. The adoption lifecycle mirrors this progression. During 2020–2024, early adopters validate monetization models, establish pricing frameworks, and demonstrate ROI for connected devices.

From 2025–2030, scaling occurs as mainstream enterprises expand deployment, standardize revenue-sharing mechanisms, and integrate monetization across multiple IoT applications. By 2030–2035, consolidation dominates: late entrants follow proven monetization strategies, mergers and alliances shape market dynamics, and procurement focuses on cost efficiency and predictable revenue streams. The market transitions from experimental adoption, through rapid scale-up, to a mature phase with stable revenue, established service models, and dominant platform ecosystems.

| Metric | Value |

|---|---|

| Internet Of Things IoT Monetization Market Estimated Value in (2025 E) | USD 1.5 trillion |

| Internet Of Things IoT Monetization Market Forecast Value in (2035 F) | USD 66.9 trillion |

| Forecast CAGR (2025 to 2035) | 46.4% |

Seasonality in the IoT monetization market is influenced by enterprise budgeting cycles, technology rollouts, and product launch schedules. Data indicates that Q3 and Q4 often account for 40–45% of annual monetization revenue, coinciding with end-of-year deployments, subscription renewals, and contract closures. Conversely, Q1 typically records 10–15% lower revenue, as organizations adjust budgets and plan new deployments. Industry-specific launches, such as connected vehicles or smart manufacturing solutions, can create short-term spikes of 10–20% above baseline, requiring providers to scale billing, analytics, and service support. Providers align platform readiness and contractual execution with these seasonal peaks to ensure stable revenue streams.

Cyclicality reflects broader enterprise investment and technology adoption patterns. IoT deployments and monetization initiatives often follow 3–5 year product refresh or expansion cycles, generating periodic revenue surges that can increase annual market size by USD 5–10 trillion. Regulatory changes, platform upgrades, or shifts in enterprise strategy can further accelerate monetization temporarily, producing short-term spikes of 10–15% above projected growth. These cyclical trends overlay the underlying CAGR of 46.4%, producing alternating periods of rapid expansion and moderate stabilization. Recognizing these cycles allows providers to optimize pricing, subscription management, and platform scaling effectively.

The market is advancing rapidly, driven by the increasing integration of connected devices across industries and the rising need for sustainable revenue generation models. The shift from traditional hardware sales to service-oriented and subscription-based offerings has enabled companies to unlock continuous income streams while delivering enhanced customer value. Cloud computing, edge processing, and advanced analytics are playing a pivotal role in monetization strategies by enabling real-time data processing and scalable service deployment.

Businesses are leveraging IoT platforms to develop usage-based pricing models, enhance operational efficiency, and improve customer engagement. Regulatory encouragement for digital transformation, combined with the expansion of 5G networks, is further accelerating market adoption.

With industrial, commercial, and consumer sectors investing heavily in IoT infrastructure, the market outlook remains positive Future growth will be shaped by innovation in AI-driven analytics, interoperability standards, and integrated cybersecurity measures, ensuring IoT monetization strategies remain both scalable and secure in a rapidly evolving digital ecosystem.

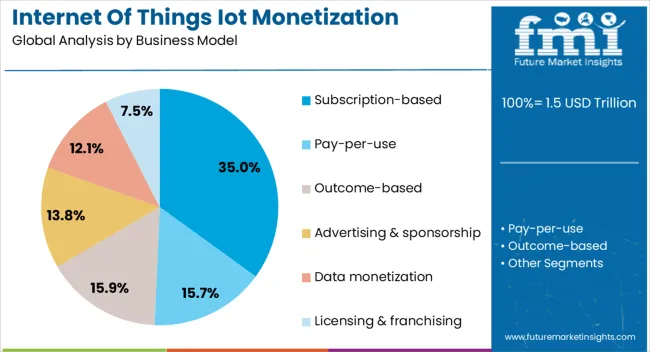

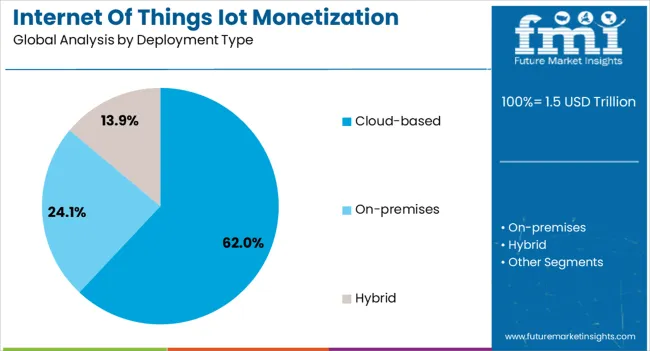

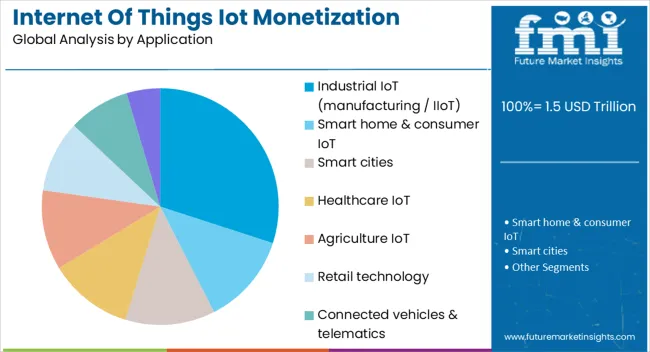

The internet of things IoT monetization market is segmented by business model, deployment type, application, and geographic regions. By business model, internet of things IoT monetization market is divided into subscription-based, pay-per-use, outcome-based, advertising & sponsorship, data monetization, and licensing & franchising. In terms of deployment type, internet of things IoT monetization market is classified into cloud-based, on-premises, and hybrid. Based on application, internet of things IoT monetization market is segmented into Industrial IoT (manufacturing / IIoT), smart home & consumer IoT, smart cities, healthcare IoT, agriculture IoT, retail technology, connected vehicles & telematics, and energy & utility management. Regionally, the internet of things IoT monetization industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The subscription-based segment is projected to hold 35% of the Internet of things monetization market revenue share in 2025, making it the leading business model. Growth in this segment has been driven by the recurring revenue potential it offers, allowing service providers to maintain steady income streams while enhancing customer retention. Businesses have increasingly adopted subscription models to deliver IoT-enabled services such as predictive maintenance, remote monitoring, and analytics platforms. This model enables companies to roll out continuous software updates, add premium features, and improve customer experiences without requiring new hardware installations. Cost predictability for customers and revenue stability for providers have further supported its appeal. The scalability of subscription-based services, combined with the ability to tailor offerings to different customer segments, has strengthened its market dominance As IoT ecosystems expand across sectors, the demand for flexible, service-oriented monetization models is expected to maintain the segment’s leadership position.

The cloud-based deployment type is anticipated to account for 62% of the market revenue share in 2025, positioning it as the dominant deployment approach. Its leadership has been attributed to the ability to manage large-scale IoT networks with centralized control, reduced infrastructure costs, and enhanced scalability. Cloud platforms have enabled real-time data processing, seamless integration with analytics tools, and remote device management, making them ideal for rapidly expanding IoT environments. Businesses benefit from reduced time-to-market for new services, lower capital expenditures, and flexible resource allocation through cloud adoption. The demand for global accessibility, coupled with the need to integrate AI and big data capabilities, has reinforced the shift toward cloud-based IoT solutions. Furthermore, cloud deployment supports continuous software updates and security patches, which are essential for sustaining customer trust As the IoT landscape grows increasingly complex, the cloud-based model is expected to remain the preferred choice for deployment.

The industrial IoT segment, specifically manufacturing and IIoT applications, is projected to hold 30% of the market revenue share in 2025, making it the leading application segment. Growth in this area has been supported by the need for operational efficiency, predictive maintenance, and real-time production monitoring in manufacturing facilities. IoT-enabled systems in industrial environments allow data-driven decision-making, reduced downtime, and optimized asset utilization. The integration of advanced analytics and AI-driven insights into production processes has helped manufacturers improve productivity and quality control. Monetization opportunities have emerged through the provision of value-added services, including equipment performance monitoring, energy optimization, and remote diagnostics. The scalability of IIoT solutions and their ability to integrate with existing infrastructure have enhanced adoption rates As industries continue to digitize and automate, the industrial IoT segment is expected to maintain its leadership by delivering measurable operational and financial benefits to enterprises worldwide.

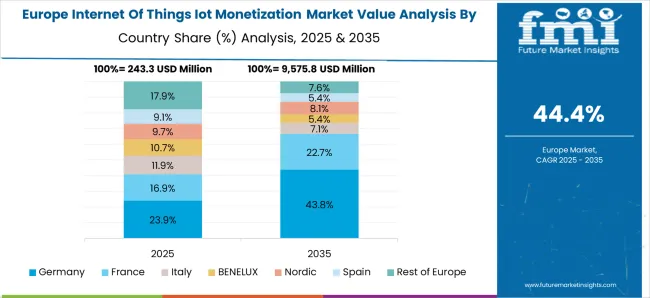

The IoT monetization market is expanding as enterprises seek revenue generation, cost optimization, and value extraction from IoT data. North America and Europe lead adoption due to mature digital infrastructure and enterprise IoT deployments, while Asia-Pacific is growing rapidly with industrial IoT and smart city projects. Key players like Cisco, Siemens, IBM, PTC, and HPE focus on platform-based solutions, analytics, and integration services. The market emphasizes data-driven business models, scalable platforms, and partnerships to turn IoT connectivity into measurable financial and operational outcomes.

Companies are leveraging IoT-generated data to optimize operations, reduce downtime, and create new revenue streams. Industrial sectors such as manufacturing, logistics, and utilities use IoT sensors to monitor equipment performance, predict maintenance, and enhance productivity. Providers like Siemens and PTC offer platforms that aggregate and analyze sensor data, enabling actionable insights and operational cost reduction. Enterprises are increasingly exploring subscription-based services, pay-per-use models, and value-added analytics. Until alternative technologies match IoT’s ability to generate real-time, actionable insights, monetization strategies centered on data-driven operations remain critical for enterprise competitiveness.

IoT monetization extends to smart home devices, wearables, and connected appliances, where companies derive revenue from subscription services, app ecosystems, and premium features. Cisco and IBM provide platforms that integrate device management, user analytics, and content delivery for monetizable services. Regions with high smartphone penetration, like North America and Europe, see faster adoption of IoT-enabled monetization models. Companies focus on user engagement, personalized offerings, and recurring revenue streams. Until alternative monetization strategies deliver comparable consumer value and data utilization, IoT platforms remain the primary channel for generating income from connected consumer devices.

IoT monetization requires robust platforms capable of integrating devices, managing data, and supporting analytics. Platform providers like HPE and IBM create scalable solutions with cloud connectivity, cybersecurity features, and developer ecosystems. Partnerships between IoT device manufacturers and platform providers enhance revenue opportunities through bundled services and cross-selling analytics tools. Regional differences exist: North America emphasizes enterprise-grade solutions, Europe focuses on regulated sectors, while Asia-Pacific is expanding rapidly in manufacturing and smart city applications. Until competing platforms match scalability, security, and interoperability, leading providers dominate monetization opportunities.

Major companies differentiate through platform capabilities, analytics sophistication, and service integration. Cisco emphasizes networking and IoT connectivity, PTC focuses on industrial digital twins, and IBM offers AI-driven analytics and cloud integration. Regional players compete on cost-effective solutions or niche vertical applications. Market strategies include platform-as-a-service offerings, consulting services, and recurring subscription models. Companies investing in interoperability, analytics, and value-added services secure long-term partnerships with enterprises. Until alternative monetization frameworks deliver comparable insights and operational benefits, IoT platforms and integrated solutions remain central to market growth.

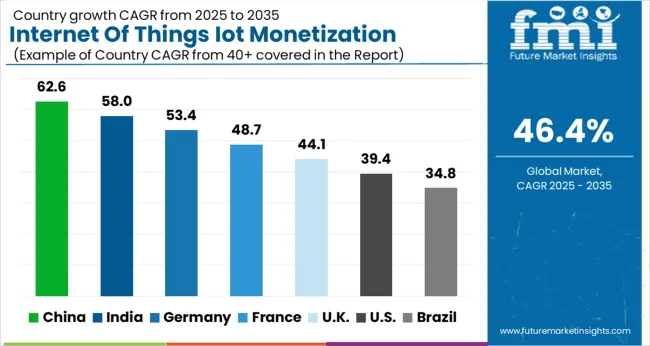

| Country | CAGR |

|---|---|

| China | 62.6% |

| India | 58.0% |

| Germany | 53.4% |

| France | 48.7% |

| UK | 44.1% |

| USA | 39.4% |

| Brazil | 34.8% |

The global internet of things (IoT) monetization market is projected to grow at a CAGR of 46.4% through 2035, supported by increasing demand across connected devices, enterprise applications, and data-driven services. Among BRICS nations, China has been recorded with 62.6% growth, driven by large-scale deployment and monetization of IoT networks and platforms, while India has been observed at 58.0%, supported by rising utilization in smart infrastructure and industrial IoT applications. In the OECD region, Germany has been measured at 53.4%, where production and adoption for connected enterprise and industrial applications have been steadily maintained. The United Kingdom has been noted at 44.1%, reflecting consistent deployment in smart services and data monetization, while the USA has been recorded at 39.4%, with production and utilization across enterprise, industrial, and consumer IoT sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The Internet of Things (IoT) monetization market in China is expanding at a CAGR of 62.6%, driven by rapid adoption across manufacturing, retail, smart cities, and industrial IoT applications. Businesses increasingly leverage IoT platforms to generate revenue streams through data analytics, predictive maintenance, and subscription-based services. The market benefits from government initiatives promoting digital transformation, smart infrastructure, and Industry 4.0 adoption. Advanced IoT monetization solutions offer real-time insights, operational efficiency, and improved customer engagement, driving higher demand in sectors such as logistics, healthcare, and energy. Investment in 5G connectivity, cloud computing, and AI-powered analytics further enhances IoT monetization opportunities. Enterprises are exploring new business models, including data-as-a-service, device-as-a-service, and pay-per-use solutions, contributing to sustained growth. China's focus on smart city projects, industrial digitization, and connected devices ensures a strong foundation for the IoT monetization market.

The IoT monetization market in India is growing at a CAGR of 58.0%, driven by rapid digital adoption and the expansion of connected devices across industries. Businesses are increasingly leveraging IoT platforms to extract value from sensor data, enable predictive analytics, and create subscription-based services. Smart city initiatives, industrial automation projects, and the expansion of IoT infrastructure boost market growth. Advancements in 5G connectivity, cloud computing, and AI integration improve IoT monetization efficiency and scalability. Key applications include logistics, energy management, healthcare monitoring, and retail analytics. Companies are adopting new business models such as device-as-a-service and data-as-a-service to unlock revenue potential. Government programs promoting smart cities, digitalization, and industrial IoT adoption provide additional market support. The combination of technological innovation, infrastructure growth, and digital transformation drives consistent adoption of IoT monetization solutions in India.

The IoT monetization market in Germany is growing at a CAGR of 53.4%, fueled by industrial digitization, smart manufacturing, and energy management applications. Companies are leveraging IoT platforms to derive revenue from sensor data, predictive maintenance, and subscription-based solutions. Germany’s strong focus on Industry 4.0, connected manufacturing, and digital transformation supports market expansion. Technological innovations in AI analytics, edge computing, and cloud-based IoT solutions enhance monetization capabilities and operational efficiency. Enterprises are adopting innovative business models such as pay-per-use and data-as-a-service to maximize ROI. Applications in logistics, healthcare, and energy sectors further drive adoption. Government incentives for smart infrastructure, industrial automation, and sustainable IoT solutions reinforce market growth. The combination of advanced technology adoption, regulatory support, and industrial modernization ensures robust development of the IoT monetization market in Germany.

The IoT monetization market in the United Kingdom is expanding at a CAGR of 44.1%, driven by increasing adoption of connected devices in industrial, retail, and smart city applications. Businesses are utilizing IoT platforms to monetize data, enhance predictive analytics, and offer subscription-based services. Government initiatives for smart infrastructure, energy efficiency, and urban digitization support the market. Technological advancements in cloud computing, AI, and edge analytics enhance the efficiency of IoT monetization solutions. Key applications include logistics, manufacturing, energy management, and healthcare monitoring. Enterprises are adopting new business models, including pay-per-use services and data-as-a-service, to maximize revenue potential. Increasing investments in IoT platforms, digital transformation, and smart infrastructure ensure a strong market foundation. Growing awareness of operational efficiency, customer engagement, and data-driven decision-making drives the expansion of the IoT monetization market in the United Kingdom.

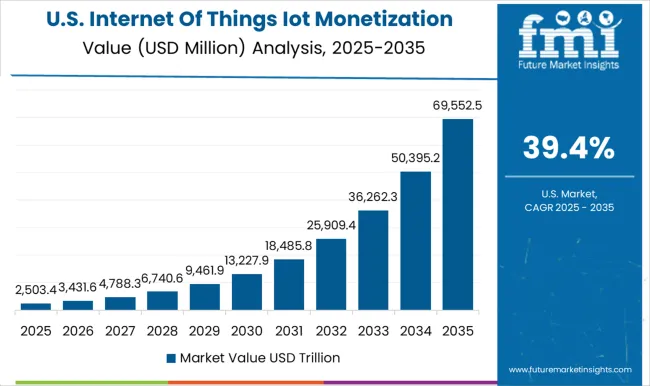

The IoT monetization market in the United States is growing at a CAGR of 39.4%, fueled by widespread adoption of connected devices, smart manufacturing, and industrial IoT applications. Companies are monetizing sensor data, predictive maintenance insights, and subscription services to unlock new revenue streams. Growth is supported by advancements in 5G, cloud computing, AI-powered analytics, and edge computing. Key applications include healthcare, logistics, energy management, and smart cities. Business models such as data-as-a-service, device-as-a-service, and pay-per-use solutions enable organizations to optimize monetization strategies. Government programs promoting digital infrastructure, industrial automation, and smart city initiatives further support market expansion. With rising digital transformation, industrial modernization, and consumer IoT adoption, the United States offers strong growth opportunities for IoT monetization platforms, ensuring continued market development in the coming years.

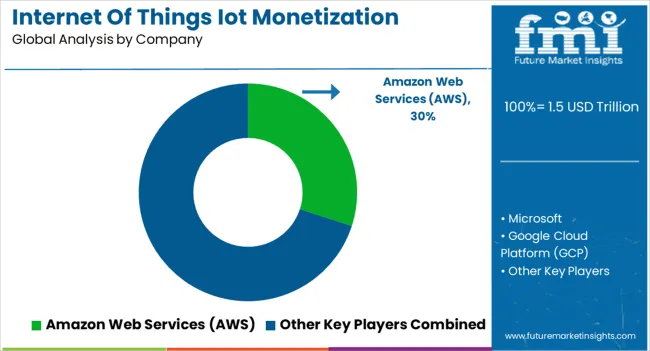

The Internet of Things (IoT) monetization market is witnessing rapid growth as enterprises seek to convert connected devices and data into tangible revenue streams. IoT monetization platforms enable organizations to manage, analyze, and monetize the massive volumes of data generated by IoT devices, facilitating subscription-based services, usage-based billing, and advanced analytics for operational efficiency. This market is driven by increasing IoT adoption across manufacturing, automotive, healthcare, and smart city applications, as well as the growing need for real-time insights and digital service offerings. Amazon Web Services (AWS) leads with its IoT platform solutions, offering scalable cloud infrastructure, analytics, and billing capabilities to enable device connectivity and data monetization. Microsoft provides Azure IoT services that support end-to-end device management, data integration, and flexible monetization models for enterprise and industrial applications.

Google Cloud Platform (GCP) focuses on AI-driven analytics, data insights, and IoT monetization solutions, empowering businesses to optimize operations and generate new revenue streams from connected devices. IBM offers robust IoT platforms with advanced analytics, blockchain integration, and IoT device management, enabling enterprises to create value from IoT ecosystems. Ericsson and Huawei are key players in telecom-driven IoT monetization, delivering network-enabled solutions for device connectivity, subscription management, and real-time service monetization. PTC supports IoT monetization through its ThingWorx platform, providing flexible deployment, device monitoring, and analytics to capture business value. Additional IoT platform and telecom vendors continue to expand their offerings, focusing on flexible pricing models, AI-enabled insights, and cross-industry solutions to accelerate IoT revenue generation globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 trillion |

| Business Model | Subscription-based, Pay-per-use, Outcome-based, Advertising & sponsorship, Data monetization, and Licensing & franchising |

| Deployment Type | Cloud-based, On-premises, and Hybrid |

| Application | Industrial IoT (manufacturing / IIoT), Smart home & consumer IoT, Smart cities, Healthcare IoT, Agriculture IoT, Retail technology, Connected vehicles & telematics, and Energy & utility management |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amazon Web Services (AWS), Microsoft, Google Cloud Platform (GCP), IBM, Ericsson, PTC, Huawei, and Other IoT platform / telco vendors |

| Additional Attributes | Dollar sales by type including subscription services, data analytics, and platform solutions, application across smart homes, industrial IoT, healthcare, and transportation, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing IoT adoption, demand for data-driven insights, and the need for revenue generation from connected devices. |

The global internet of things IoT monetization market is estimated to be valued at USD 1.5 trillion in 2025.

The market size for the internet of things IoT monetization market is projected to reach USD 66.9 trillion by 2035.

The internet of things IoT monetization market is expected to grow at a 46.4% CAGR between 2025 and 2035.

The key product types in internet of things IoT monetization market are subscription-based, pay-per-use, outcome-based, advertising & sponsorship, data monetization and licensing & franchising.

In terms of deployment type, cloud-based segment to command 62.0% share in the internet of things IoT monetization market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Internet Protocol Television Market Size and Share Forecast Outlook 2025 to 2035

Internet Security Market Size and Share Forecast Outlook 2025 to 2035

Internet Protocol Television (IPTV) CDN Market Size and Share Forecast Outlook 2025 to 2035

Internet of Everything (IoE) Market Analysis – Size, Share & Forecast 2025-2035

Internet Of Things In Farm Management Market Size and Share Forecast Outlook 2025 to 2035

Internet of Things Vehicle-to-Vehicle Communication Market

IoT Security Product Market Report – Growth & Forecast 2017 to 2027

Internet of Robotics Things - Market Trends & Forecast 2025 to 2035

Telecom Internet Of Things (IoT) Market Size and Share Forecast Outlook 2025 to 2035

In-flight Internet Market Size and Share Forecast Outlook 2025 to 2035

Dedicated Internet Access Market

Voice Over Internet Protocol (VoIP) Over WLAN (VoWLAN) Market Size and Share Forecast Outlook 2025 to 2035

Voice over Internet Protocol (VoIP) Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Enterprise Internet Reputation Management Market Share

Enterprise Internet Reputation Management Market Growth – Trends & Forecast 2025 to 2035

Automotive Internet of Things (IoT) Market

UK Enterprise Internet Reputation Management Market Growth – Demand, Trends & Forecast 2025-2035

USA Enterprise Internet Reputation Management Market Analysis – Size, Share & Innovations 2025-2035

Japan Enterprise Internet Reputation Management Market Report – Size, Growth & Forecast 2025-2035

Germany Enterprise Internet Reputation Management Market Outlook – Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA