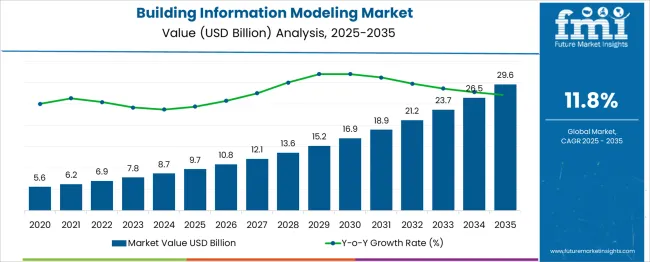

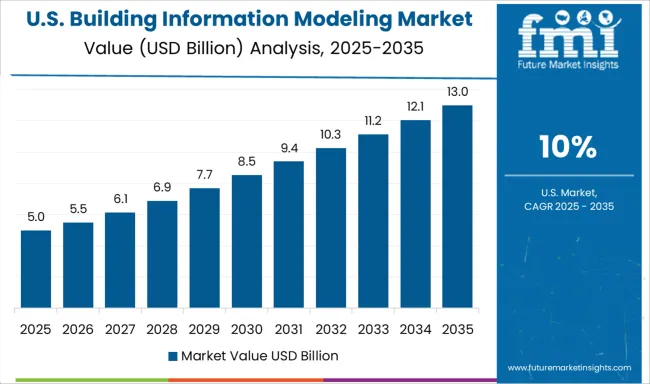

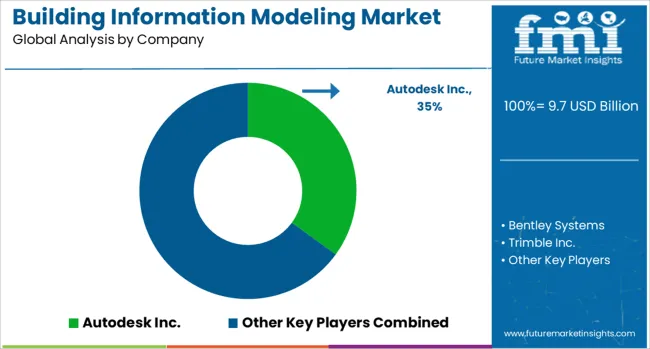

The global building information modeling market is anticipated to grow from USD 9.7 billion in 2025 to approximately USD 29.6 billion by 2035, recording an absolute increase of USD 19.9 billion over the forecast period. This translates into a total growth of 205.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 11.8% between 2025 and 2035. The overall market size is expected to grow by nearly 3.05X during the same period, supported by increasing adoption of digital construction technologies, growing emphasis on sustainable building practices, and rising demand for collaborative design and project management solutions across the construction industry.

Between 2025 and 2030, the market is projected to expand from USD 9.7 billion to USD 16.9 billion, resulting in a value increase of USD 7.2 billion, which represents 36.4% of the total forecast growth for the decade. This phase of growth will be shaped by increasing government mandates for BIM adoption in public infrastructure projects, growing awareness of cost savings through improved project coordination, and rising demand for cloud-based collaborative platforms. Software providers are focusing on artificial intelligence integration, automated clash detection, and enhanced visualization capabilities to meet evolving industry requirements.

From 2030 to 2035, the market is forecast to grow from USD 16.9 billion to USD 29.6 billion, adding another USD 12.7 billion, which constitutes 63.6% of the overall ten-year expansion. This period is expected to be characterized by widespread deployment of augmented reality and virtual reality integration, advanced predictive analytics for project management, and development of comprehensive digital twin capabilities for building lifecycle management. The growing emphasis on sustainable construction practices and carbon footprint reduction will drive demand for BIM solutions that support environmental analysis and green building certification processes.

Between 2020 and 2025, the Building Information Modeling market experienced steady acceleration driven by digital transformation initiatives across the construction industry and increasing recognition of BIM benefits for project efficiency and cost reduction. The market developed as construction companies recognized the critical importance of digital collaboration tools for managing complex projects and maintaining productivity during pandemic-related disruptions. Government infrastructure investment programs and regulatory requirements for BIM adoption in public projects established the foundation for sustained market growth.

| Parameter | Value |

|---|---|

| Market Value (2025) | USD 9.7 billion |

| Market Forecast Value (2035) | USD 29.6 billion |

| Market Forecast CAGR (2025 to 2035) | 11.8% |

Market expansion is being supported by the fundamental shift toward digital construction processes and the increasing complexity of modern building projects requiring sophisticated coordination and management tools. Construction industry inefficiencies and cost overruns are driving demand for BIM solutions that enable better project planning, clash detection, and resource optimization throughout project lifecycles. The growing emphasis on sustainable construction practices is compelling adoption of BIM tools that support environmental analysis, energy efficiency modeling, and green building certification requirements.

The rising adoption of prefabrication and modular construction techniques requires precise digital modeling and coordination capabilities that BIM platforms provide. Infrastructure modernization programs and smart city initiatives are creating substantial demand for comprehensive digital modeling solutions that support complex urban planning and development projects. The increasing importance of asset management and facility operations is driving adoption of BIM solutions that extend beyond construction to support building lifecycle management and maintenance optimization.

The market is segmented by component outlook, deployment outlook, project lifecycle outlook, application outlook, building type outlook, and region. By component outlook, the market is divided into software and services categories. Services include professional services and managed services. Based on deployment outlook, the market is categorized into on-premises and cloud deployments. In terms of project lifecycle outlook, the market is segmented into pre-construction, construction, and operation phases. By application outlook, the market is classified into designing, planning and modeling, and asset management. By building type outlook, the market is divided into commercial, industrial, residential, and government segments. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Software component is projected to account for 66% of the market in 2025. This leading share is supported by the fundamental importance of BIM software applications that provide core modeling, design, and analysis capabilities essential for digital construction processes. Software solutions offer comprehensive functionality including 3D modeling, clash detection, quantity takeoff, and project visualization that form the foundation of BIM implementation. The segment benefits from continuous innovation in software capabilities, cloud-based deployment options, and integration with emerging technologies including artificial intelligence and machine learning.

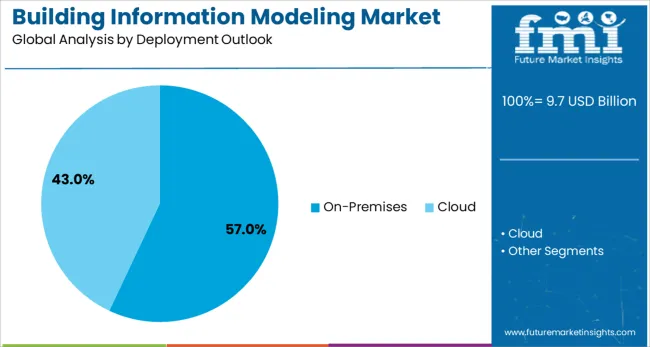

On-premises deployment is expected to represent 57% of building information modeling demand in 2025. This significant share reflects industry preference for direct control over sensitive project data and the need for high-performance computing capabilities required for complex modeling operations. On-premises solutions provide enhanced security, customization flexibility, and integration with existing enterprise systems that many construction and engineering firms require. The segment benefits from established IT infrastructure in large organizations and the ability to handle computationally intensive modeling tasks without relying on internet connectivity.

Pre-construction phase is projected to contribute 32% of the market in 2025, representing the critical early stages of project development where BIM implementation provides maximum value through design optimization and planning efficiency. Pre-construction BIM applications include conceptual design, detailed modeling, clash detection, and cost estimation that establish project foundations and prevent costly modifications during construction. The segment is supported by increasing recognition of BIM benefits for early-stage project coordination and the ability to identify and resolve potential issues before construction begins.

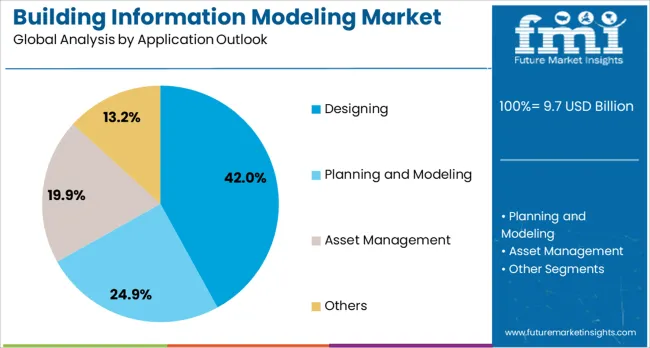

Designing application is estimated to hold 42% of the market share in 2025. This dominant share reflects the fundamental role of design activities in BIM implementation and the comprehensive modeling capabilities required for architectural, structural, and MEP system design coordination. Design applications provide essential functionality for creating detailed 3D models, generating construction documentation, and facilitating collaborative design processes across multidisciplinary project teams. The segment benefits from continuous advancement in design software capabilities and integration with analysis and simulation tools.

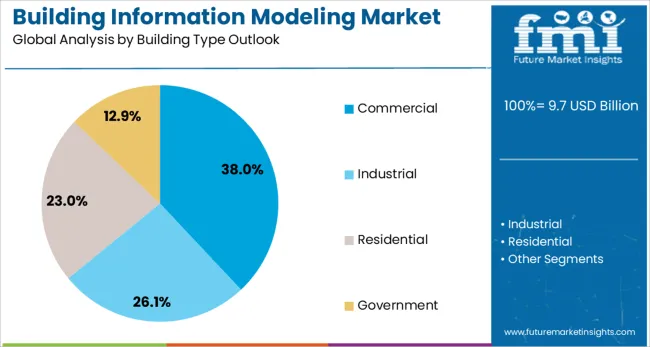

Commercial building type is projected to represent 38% of building information modeling demand in 2025. This substantial share reflects the complexity of commercial construction projects and the significant cost savings potential that BIM implementation provides for large-scale developments. Commercial projects typically involve multiple stakeholders, complex systems integration, and tight schedules that benefit substantially from BIM coordination and collaboration capabilities. The segment benefits from strong return on investment for BIM implementation and increasing owner requirements for digital project delivery.

The Building Information Modeling market is advancing rapidly due to increasing government mandates and growing recognition of productivity benefits. However, the market faces challenges including high implementation costs, workforce training requirements, and resistance to change within traditional construction organizations. Interoperability issues between different software platforms and data management complexities continue to influence adoption patterns and technology development priorities.

The growing deployment of artificial intelligence and machine learning capabilities in BIM platforms is enabling automated design optimization, predictive project analytics, and intelligent clash detection that reduces manual review requirements. AI-powered BIM solutions can analyze historical project data to predict potential issues, optimize resource allocation, and suggest design improvements based on performance criteria. These technologies enhance decision-making processes, improve project outcomes, and provide construction professionals with actionable insights for continuous improvement and risk mitigation.

BIM software providers are developing comprehensive cloud-based platforms that enable real-time collaboration among distributed project teams while providing scalable computing resources for complex modeling operations. Cloud platforms support simultaneous multi-user access, automatic version control, and seamless data sharing across project stakeholders regardless of geographic location. These solutions reduce IT infrastructure requirements, enable flexible licensing models, and support the growing trend toward remote work and global project collaboration in the construction industry.

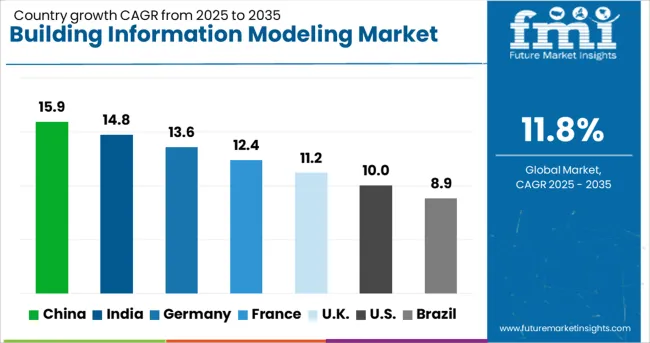

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 15.9% |

| India | 14.8% |

| Germany | 13.6% |

| France | 12.4% |

| UK | 11.2% |

| USA | 10% |

| Brazil | 8.9% |

The building information modeling market demonstrates strong growth across key countries, with China leading at 15.9% CAGR through 2035, driven by massive infrastructure development, smart city initiatives, and government digitization mandates for construction projects. India follows closely at 14.8%, supported by expanding urban development, infrastructure modernization programs, and increasing adoption of digital construction technologies. Germany records 13.6% growth, emphasizing precision engineering and advanced manufacturing integration with BIM systems. France advances at 12.4%, focusing on sustainable construction and heritage building renovation projects. The UK shows growth at 11.2%, driven by infrastructure investment and digital construction innovation. The USA maintains steady expansion at 10%, supported by established BIM adoption and continuous technology advancement.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from building information modeling in China is projected to exhibit the highest growth rate with a CAGR of 15.9% through 2035, driven by unprecedented infrastructure development programs, comprehensive smart city initiatives, and government mandates requiring BIM adoption for major construction projects. The country's commitment to urban modernization and sustainable development is creating massive demand for sophisticated digital modeling and project management solutions across residential, commercial, and infrastructure sectors. Chinese construction companies are rapidly adopting BIM technologies to improve project efficiency, reduce construction waste, and meet stringent quality and environmental standards. Government support for construction industry digitization and technology innovation is accelerating BIM platform development and deployment across diverse project types and geographic regions.

Revenue from building information modeling in India is expanding at a CAGR of 14.8%, supported by rapid urban development, comprehensive infrastructure modernization programs, and increasing adoption of digital construction technologies across government and private sector projects. The country's massive housing development requirements and smart city mission are driving substantial demand for BIM solutions that enable efficient project planning, coordination, and delivery. Growing awareness of BIM benefits among construction professionals and increasing availability of skilled technical resources are accelerating technology adoption across diverse project categories and market segments. Government initiatives promoting digital India and construction industry modernization are creating favorable conditions for BIM implementation and encouraging international technology partnerships. The expanding engineering and construction services sector and increasing foreign investment in infrastructure development are driving comprehensive BIM adoption that supports complex project management and quality control requirements.

Demand for building information modeling in Germany is projected to grow at a CAGR of 13.6%, supported by the country's emphasis on precision engineering excellence and comprehensive integration of BIM technologies with advanced manufacturing and industrial automation systems. German construction and engineering companies are implementing sophisticated BIM platforms that support complex project coordination, quality control, and sustainability analysis requirements. The emphasis on environmental sustainability and energy efficiency is driving adoption of BIM solutions that enable comprehensive environmental impact analysis and green building optimization. Advanced manufacturing capabilities and Industry 4.0 implementation are establishing German companies as leaders in integrated digital construction and prefabrication technologies. The focus on technical education and workforce development is ensuring comprehensive BIM expertise across engineering and construction organizations while supporting continuous innovation and best practice development.

Demand for building information modeling in France is expanding at a CAGR of 12.4%, driven by comprehensive sustainable construction initiatives, extensive heritage building renovation projects, and government commitments to carbon neutrality that require sophisticated environmental analysis capabilities. French construction companies are implementing BIM solutions that support green building certification, energy efficiency optimization, and historic preservation requirements. The emphasis on architectural excellence and design innovation is fostering demand for advanced BIM platforms that enable sophisticated visualization, analysis, and collaborative design processes. Government support for construction industry digitization and environmental compliance is creating opportunities for comprehensive BIM deployment across public and private sector projects. The focus on urban regeneration and infrastructure modernization is driving adoption of BIM technologies that support complex renovation projects and sustainable development practices.

Demand for building information modeling in the UK is projected to grow at a CAGR of 11.2%, supported by comprehensive government BIM mandates, substantial infrastructure investment programs, and continuous innovation in digital construction technologies and collaborative project delivery methods. British construction organizations are implementing advanced BIM platforms that support complex project coordination, risk management, and performance optimization across diverse project types and delivery methods. The emphasis on construction industry productivity improvement and quality enhancement is driving adoption of BIM solutions with integrated project management, cost control, and scheduling capabilities. Government initiatives promoting digital construction excellence and industry modernization are creating favorable conditions for technology adoption and encouraging innovation in BIM platform development. The focus on sustainable construction and carbon reduction is driving integration of environmental analysis and lifecycle assessment capabilities within comprehensive BIM solutions.

Demand for building information modeling in the USA is expanding at a CAGR of 10%, driven by established BIM adoption across major construction organizations, continuous technology innovation, and comprehensive integration with emerging technologies including artificial intelligence and cloud computing platforms. American construction companies are implementing sophisticated BIM solutions that support complex project delivery, facility management, and asset lifecycle optimization requirements. The emphasis on infrastructure modernization and smart building technologies is driving demand for BIM platforms with advanced analytics, predictive maintenance, and operational optimization capabilities. Large-scale infrastructure programs and public-private partnerships are creating opportunities for comprehensive BIM implementation that supports complex project coordination and long-term asset management. The focus on construction industry productivity and safety improvement is driving adoption of BIM solutions with integrated risk management, quality control, and performance monitoring capabilities.

Demand for building information modeling in Brazil is projected to grow steadily at a CAGR of 8.9%, supported by expanding infrastructure development, government regulations mandating BIM adoption, and increasing digitization across the construction industry. The federal government’s BIM BR strategy is accelerating adoption by requiring BIM use in public projects and promoting standards that encourage efficiency, cost reduction, and transparency in construction workflows. Brazilian construction companies are integrating BIM solutions to improve project coordination, minimize delays, and ensure compliance with sustainability goals. The emphasis on smart urban development and modernization of transportation, housing, and energy infrastructure is driving demand for BIM-enabled project management and visualization tools. Growing collaboration between local construction firms and international technology providers is expanding access to advanced platforms tailored for Brazil’s regulatory and environmental requirements, supporting wider adoption across both public and private sector projects.

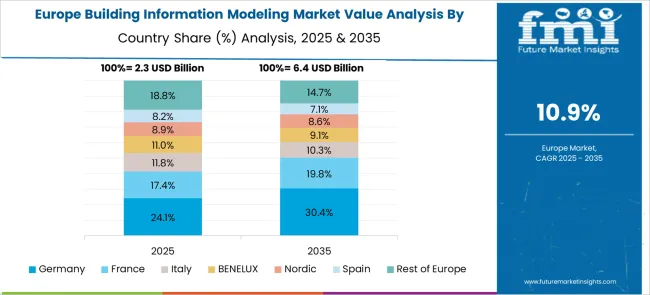

The European building information modeling (BIM) market reflects strong maturity across advanced economies. Germany leads with engineering excellence, government BIM mandates, and integration across infrastructure and industrial projects. France follows with a focus on architectural innovation and sustainable urban development, where leading firms use BIM to enhance collaboration and meet environmental standards. The United Kingdom demonstrates robust growth as an early BIM adopter, supported by regulations mandating BIM Level 2 and rising adoption of digital twin technologies. Italy and Spain show growing interest, particularly in energy-efficient building design and renovation projects. BENELUX emphasizes smart construction technologies, while Nordic countries pioneer BIM for sustainability. Eastern Europe presents emerging opportunities, driven by EU digital initiatives and efficiency-focused adoption.

The building information modeling market is characterized by intense competition among established software companies, specialized BIM solution providers, and emerging cloud-based platform developers. Companies are investing in artificial intelligence integration, cloud computing capabilities, mobile accessibility, and interoperability improvements to deliver comprehensive, user-friendly, and performance-optimized BIM solutions. Strategic partnerships, industry ecosystem development, and geographic expansion are central to strengthening market position and customer acquisition.

Autodesk Inc., USA-based, offers comprehensive BIM software portfolio including Revit, AutoCAD, and construction management solutions with extensive industry ecosystem and cloud platform integration. Bentley Systems provides advanced infrastructure modeling and asset management solutions with focus on large-scale projects and enterprise deployments. Trimble Inc. delivers integrated construction technology solutions combining BIM software with hardware and field management capabilities. Dassault Systèmes offers sophisticated 3D modeling and simulation platforms with emphasis on collaboration and lifecycle management.

Nemetschek Group provides comprehensive BIM software solutions through multiple brands serving architecture, engineering, and construction market segments. Hexagon AB delivers advanced measurement and visualization technologies with integrated BIM capabilities for construction and manufacturing applications. Topcon Positioning Systems Inc. offers construction technology solutions combining positioning systems with BIM integration. AVEVA Group PLC, Asite Solutions Ltd., Beck Technology, Bimeye Inc., and ACCA Software provide specialized BIM expertise across various application areas, deployment models, and industry segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.7 billion |

| Component Outlook | Software, Service (Professional Services, Managed Services) |

| Deployment Outlook | On-Premises, Cloud |

| Project Lifecycle Outlook | Pre-construction, Construction, Operation |

| Application Outlook | Designing, Planning and Modeling, Asset Management |

| Building Type Outlook | Commercial, Industrial, Residential, Government |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, France |

| Key Companies Profiled | Autodesk Inc., Bentley Systems, Trimble Inc., Dassault Systèmes, Nemetschek Group, Hexagon AB, Topcon Positioning Systems Inc., AVEVA Group PLC, Asite Solutions Ltd., Beck Technology, Bimeye Inc., ACCA Software |

| Additional Attributes | Dollar sales by component type, deployment model, and building type, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established software providers and emerging cloud platforms, customer preferences for on-premises versus cloud deployment models, integration with artificial intelligence and machine learning capabilities, innovations in collaborative design platforms and mobile accessibility, and adoption of digital twin technologies with embedded lifecycle management and predictive analytics for enhanced project delivery and asset optimization. |

The global building information modeling market is estimated to be valued at USD 9.7 billion in 2025.

The market size for the building information modeling market is projected to reach USD 29.6 billion by 2035.

The building information modeling market is expected to grow at a 11.8% CAGR between 2025 and 2035.

The key product types in building information modeling market are software, services, _professional services and _managed services.

In terms of deployment outlook, on-premises segment to command 57.0% share in the building information modeling market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Building Automation System Market Size and Share Forecast Outlook 2025 to 2035

Building Envelope Market Size and Share Forecast Outlook 2025 to 2035

Building Access Control Security Market Size and Share Forecast Outlook 2025 to 2035

Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Building Maintenance Unit (BMU) Market Size and Share Forecast Outlook 2025 to 2035

Building Energy Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Building Automation System Industry Analysis in Korea Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Building Thermal Insulation Market Growth - Trends & Forecast 2025 to 2035

Leading Providers & Market Share in Building Automation System

Building Integrated Photovoltaics Market - Solar & Architecture

Building Information Management (BIM) Market Analysis – Trends & Forecast 2024-2034

In-building Wireless Market Forecast and Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Solutions Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Market Size and Share Forecast Outlook 2025 to 2035

Green Building Materials Market Analysis by Type, Application, End-user and Region: Forecast for 2025 and 2035

Japan Building Automation System Market Analysis & Forecast by System, Application, and Region Through 2035

PCR Tire Building Machine Market Size and Share Forecast Outlook 2025 to 2035

Bio-Based Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Protective Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA