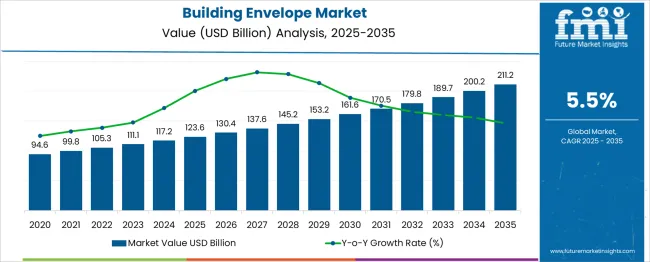

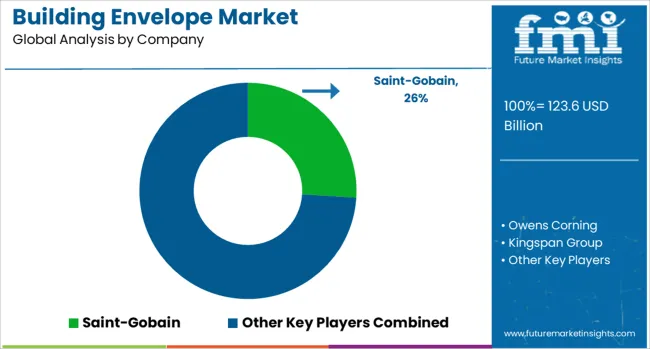

The global building envelope market is projected to grow from USD 123.6 billion in 2025 to approximately USD 211.2 billion by 2035, recording an absolute increase of USD 87.6 billion over the forecast period. This translates into a total growth of 70.9%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.5% between 2025 and 2035. The overall market size is expected to grow by nearly 1.71X during the same period, supported by increasing construction activities, rising demand for energy-efficient buildings, and growing focus on sustainable construction materials and green building initiatives.

Between 2025 and 2030, the building envelope market is projected to expand from USD 123.6 billion to USD 170.5 billion, resulting in a value increase of USD 46.9 billion, which represents 53.5% of the total forecast growth for the decade. This phase of growth will be shaped by rising urbanization rates, increasing demand for sustainable construction solutions, and growing penetration of smart building technologies in emerging markets. Construction companies are expanding their building envelope product portfolios to address the growing demand for energy-efficient and environmentally friendly building solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 123.6 billion |

| Forecast Value in (2035F) | USD 211.2 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

From 2030 to 2035, the market is forecast to grow from USD 170.5 billion to USD 211.2 billion, adding another USD 40.7 billion, which constitutes 46.5% of the overall ten-year expansion. This period is expected to be characterized by expansion of green building certifications, integration of advanced insulation technologies in construction, and development of smart building envelope solutions. The growing adoption of net-zero building initiatives and government-mandated energy efficiency standards will drive demand for premium building envelope systems with enhanced performance and sustainability profiles.

Between 2020 and 2025, the building envelope market experienced steady expansion, driven by increasing focus on energy-efficient construction and growing awareness of climate change impacts on building design. The market developed as construction companies recognized the need for effective building envelope solutions to achieve energy savings, indoor comfort, and regulatory compliance. Government incentives and building codes began emphasizing the importance of high-performance building envelopes in reducing energy consumption and carbon footprint.

Market expansion is being supported by the increasing global focus on energy efficiency and sustainability in the construction industry, with building envelopes playing a crucial role in reducing energy consumption and greenhouse gas emissions. Modern construction practices are increasingly focused on creating high-performance building envelopes that can optimize thermal performance, air tightness, and moisture management. The proven effectiveness of advanced building envelope systems in achieving significant energy savings and improving indoor environmental quality makes them essential components in both new construction and retrofit projects.

The growing emphasis on green building certifications such as LEED, BREEAM, and Energy Star is driving demand for building envelope products that meet strict performance criteria and sustainability standards. Consumer and regulatory preference for buildings that combine energy efficiency with occupant comfort and environmental responsibility is creating opportunities for innovative envelope solutions. The rising influence of climate policies and building energy codes is also contributing to increased adoption of high-performance building envelope systems across different building types and geographic regions.

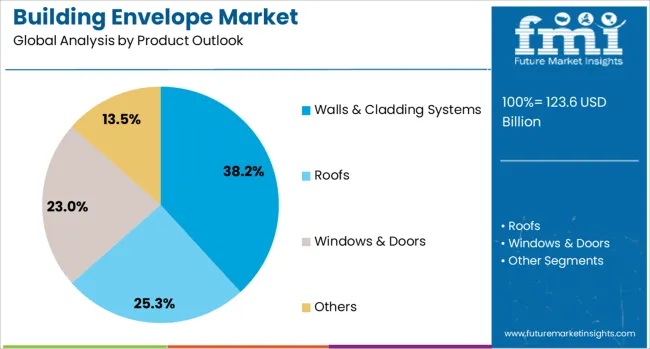

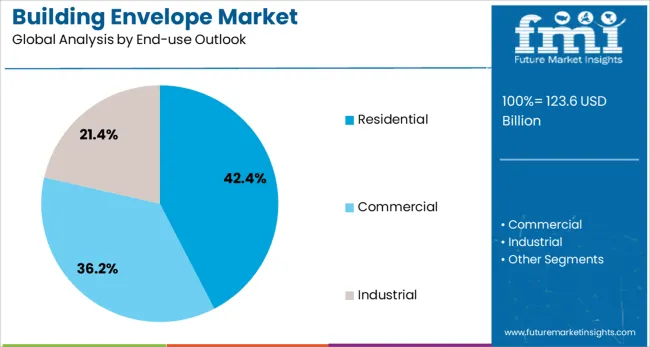

The market is segmented by product type, end-use, and region. By product type, the market is divided into walls & cladding systems, roofs, windows & doors, and others. Based on end-use, the market is categorized into residential, commercial, and industrial applications. Regionally, the market is divided into major countries including China, India, Germany, France, UK, USA, and Brazil.

The walls & cladding systems segment is projected to account for 38.2% of the building envelope market in 2025, reaffirming its position as the category's core component. This dominance stems from the critical role that wall systems play in determining overall building performance, including thermal efficiency, moisture management, and structural integrity. Advanced cladding systems offer superior insulation properties, weather resistance, and aesthetic versatility, making them essential for modern construction projects.

The segment benefits from continuous innovation in materials technology, including the development of high-performance insulation materials, vapor barriers, and exterior cladding options. Architects and builders increasingly recognize that wall systems significantly impact building energy consumption, making investment in advanced envelope technologies a priority. The growing trend toward prefabricated and modular construction methods also supports demand for integrated wall and cladding systems that can be manufactured off-site and installed quickly on construction sites.

Residential applications are projected to represent 42.4% of building envelope demand in 2025, reflecting the significant role of housing construction in driving market growth. The residential segment encompasses single-family homes, multi-family housing, and residential renovation projects, all of which require comprehensive building envelope solutions to meet energy efficiency standards and provide occupant comfort.

This segment is supported by global population growth, urbanization trends, and increasing homeowner awareness of energy costs and environmental impact. Government incentives for energy-efficient home construction and renovation are encouraging adoption of advanced building envelope technologies in residential applications. The growing popularity of smart homes and net-zero energy buildings is also driving demand for integrated envelope solutions that can support advanced HVAC systems and renewable energy integration.

The building envelope market is advancing rapidly due to increasing emphasis on energy efficiency, growing construction activities, and rising demand for sustainable building solutions. However, the market faces challenges including material cost volatility, complex installation requirements, and varying regional building codes and standards. Innovation in smart materials, modular systems, and building-integrated technologies continue to influence product development and market expansion patterns.

The growing adoption of green building certification programs is enabling construction companies to differentiate their projects and meet increasingly stringent environmental standards. These certifications require comprehensive building envelope performance that often exceeds minimum code requirements, driving demand for premium envelope solutions. Government policies supporting sustainable construction and carbon reduction targets are creating market opportunities for high-performance building envelope systems.

Modern building envelope manufacturers are incorporating smart sensors, automated shading systems, and responsive materials that can adapt to environmental conditions. These technologies improve building performance by optimizing energy consumption, indoor air quality, and occupant comfort in real-time. Advanced building envelope systems also enable integration with building management systems and smart grid technologies, supporting the development of intelligent buildings that can respond dynamically to changing conditions.

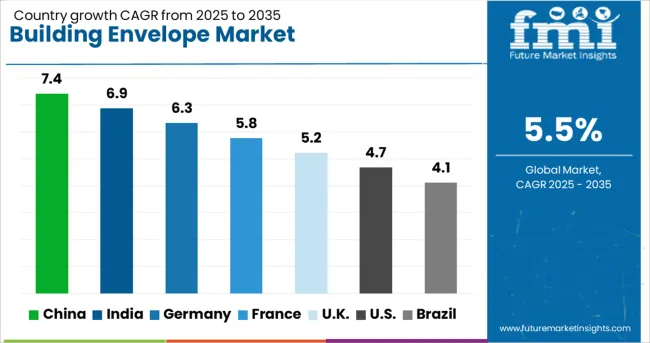

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The building envelope market is experiencing robust growth globally, with China leading at a 7.4% CAGR through 2035, driven by massive urbanization, government infrastructure investments, and increasing focus on energy-efficient construction. India follows closely at 6.9%, supported by rapid urban development, growing middle class housing demand, and implementation of green building policies. Germany shows strong growth at 6.3%, emphasizing energy efficiency standards and sustainable construction practices. France records 5.8%, focusing on renovation of existing building stock and new eco-friendly construction projects.

Revenue from building envelope systems in China is projected to exhibit strong growth with a CAGR of 7.4% through 2035, driven by continued urbanization, massive infrastructure projects, and government initiatives promoting energy-efficient construction. The country's commitment to carbon neutrality by 2060 is creating significant demand for high-performance building envelope solutions across residential, commercial, and industrial sectors.

Revenue from building envelope systems in India is expanding at a CAGR of 6.9%, supported by rapid urbanization, growing construction industry, and increasing awareness of energy-efficient building design. The country's expanding middle class and government housing initiatives are driving demand for modern construction technologies that can provide comfort and energy savings in challenging climate conditions.

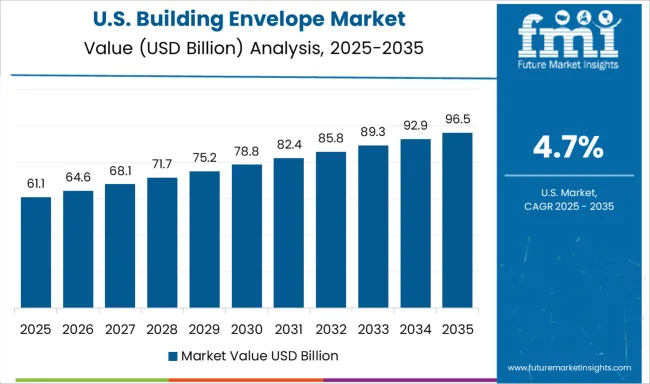

Demand for building envelope systems in the USA is projected to grow at a CAGR of 4.7%, supported by extensive building renovation activities, energy efficiency mandates, and growing focus on climate resilience. American construction markets are increasingly focused on upgrading existing building stock to meet modern performance standards while addressing aging infrastructure challenges.

Revenue from building envelope systems in Germany is projected to grow at a CAGR of 6.3% through 2035, driven by the country's stringent energy efficiency requirements, strong focus on sustainable construction, and leadership in building technology innovation. German building codes and standards often exceed international requirements, creating demand for premium building envelope solutions.

Revenue from building envelope systems in France is projected to grow at a CAGR of 5.8% through 2035, supported by the country's commitment to energy transition and ambitious building renovation programs. French regulations require significant improvements in building energy performance, creating substantial demand for advanced envelope solutions in both new construction and retrofit applications.

Revenue from building envelope systems in the UK is projected to grow at a CAGR of 5.2% through 2035, driven by the country's net-zero carbon commitment and comprehensive building decarbonization strategy. British construction markets are increasingly focused on deep energy retrofits and high-performance new construction to meet climate targets.

Revenue from building envelope systems in Brazil is expanding at a CAGR of 4.1%, supported by ongoing urbanization, infrastructure development projects, and increasing adoption of energy-efficient construction practices. The country's diverse climate zones and growing construction industry are creating demand for regionally appropriate building envelope solutions.

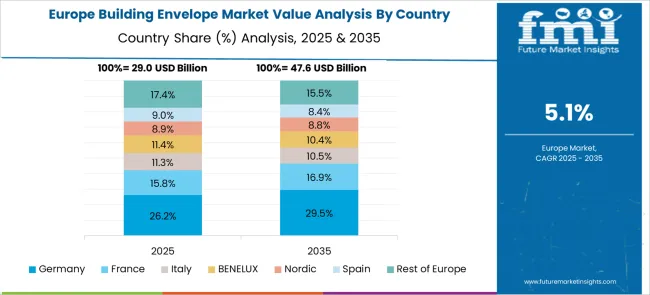

The European building envelope market demonstrates sophisticated development across major economies with Germany leading through its precision construction technology excellence and advanced building performance capabilities, supported by companies like BASF SE pioneering comprehensive envelope solutions with focus on walls & cladding systems, residential applications, and energy-efficient building technologies while emphasizing sustainability and regulatory compliance. The UK shows strength in building standards and construction innovation, with companies specializing in advanced envelope technologies that meet strict energy performance requirements and provide consistent thermal outcomes.

France contributes through companies delivering integrated building solutions and construction excellence for comprehensive residential and commercial applications. Italy and Spain demonstrate growth in specialized envelope systems for industrial and sustainable building projects. The market benefits from stringent EU building regulations, established construction infrastructure, and growing emphasis on energy efficiency positioning Europe as key center for advanced building envelope technologies.

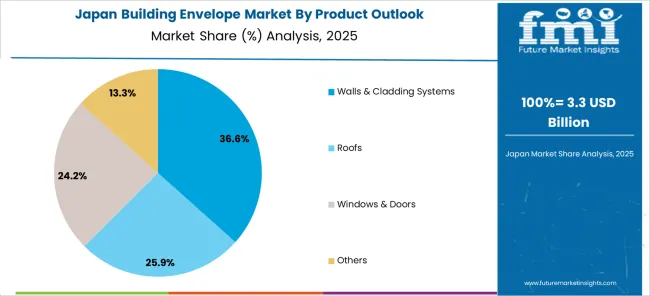

The Japanese building envelope market demonstrates steady growth driven by precision construction focus, advanced building technologies, and industry preference for high-quality envelope systems ensuring superior energy performance and seismic safety compliance throughout construction operations. International companies establish presence through cutting-edge building technologies aligning with Japan's sophisticated construction industry and stringent quality standards while incorporating advanced insulation capabilities and automated construction protocols.

The market emphasizes automated construction systems, precision building excellence, and advanced energy efficiency innovations reflecting Japanese construction precision and attention to detail in building processes. Growing investment in sustainable construction supports intelligent envelope systems with enhanced thermal performance, reduced energy consumption, and optimized building performance. Japanese developers prioritize system reliability, consistent energy outcomes, and regulatory compliance, creating opportunities for premium building envelope solutions delivering exceptional performance across residential, commercial, and industrial applications requiring highest quality standards.

The South Korean building envelope market shows exceptional growth potential driven by expanding construction industry, increasing adoption of advanced building technologies, and growing focus on energy efficiency requiring efficient and reliable envelope solutions. The market benefits from South Korea's technological advancement capabilities and increasing focus on construction innovation competitiveness driving investment in modern building technologies meeting international performance standards and regulatory requirements.

Korean construction companies increasingly adopt automated building systems, advanced envelope technologies, and integrated construction solutions improving energy efficiency and building performance while ensuring safety compliance. Growing influence of Korean construction innovations in global markets supports demand for sophisticated building envelope solutions ensuring construction excellence while maintaining cost-effectiveness. Integration of smart building principles and sustainable technologies creates opportunities for intelligent envelope systems with enhanced insulation properties, predictive performance monitoring, and real-time energy optimization across diverse construction applications.

The building envelope market is characterized by competition among established construction material manufacturers, specialty envelope system providers, and innovative technology companies. Companies are investing in advanced material science, sustainable manufacturing processes, digital design tools, and comprehensive building performance services to deliver effective, sustainable, and cost-competitive building envelope solutions. Product innovation, technical expertise, and regional market presence are central to strengthening competitive positions and market share.

Saint-Gobain leads the market with significant global presence, offering comprehensive building envelope solutions including insulation materials, roofing systems, and glazing products with focus on energy efficiency and sustainability. Owens Corning provides high-performance insulation and roofing systems with emphasis on thermal performance and moisture management. Kingspan Group delivers integrated building envelope solutions with focus on prefabricated systems and modular construction applications.

ROCKWOOL International specializes in stone wool insulation products with superior fire resistance and thermal performance for diverse building applications. BASF SE offers advanced chemical solutions and insulation systems that support energy-efficient construction. DuPont de Nemours provides specialty materials and building protection systems with focus on air and moisture barriers. GAF Materials Corporation, Sika AG, Etex Corp, and 3M Company provide specialized building envelope components and systems that support modern construction requirements and performance standards.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 123.6 billion |

| Product Type | Walls & cladding systems, Roofs, Windows & doors, Others |

| End-Use | Residential, Commercial, Industrial |

| Regions Covered | China, India, Germany, France, UK, US, Brazil, and other major markets |

| Key Companies Profiled | Saint-Gobain, Owens Corning, Kingspan Group, ROCKWOOL International, BASF SE, DuPont de Nemours, GAF Materials Corporation, Sika AG, Etex Corp, 3M Company |

| Additional Attributes | Market analysis by building type and climate zone, regional construction trends, competitive landscape, technology innovation trends, integration with smart building systems, sustainable material adoption, energy efficiency regulations impact, and green building certification requirements |

The global building envelope market is estimated to be valued at USD 123.6 billion in 2025.

The market size for the building envelope market is projected to reach USD 211.2 billion by 2035.

The building envelope market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in building envelope market are walls & cladding systems, roofs, windows & doors and others.

In terms of end-use outlook, residential segment to command 42.4% share in the building envelope market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Building Automation System Market Size and Share Forecast Outlook 2025 to 2035

Building Information Modeling Market Size and Share Forecast Outlook 2025 to 2035

Building Access Control Security Market Size and Share Forecast Outlook 2025 to 2035

Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Building Maintenance Unit (BMU) Market Size and Share Forecast Outlook 2025 to 2035

Building Energy Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Building Automation System Industry Analysis in Korea Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Building Thermal Insulation Market Growth - Trends & Forecast 2025 to 2035

Leading Providers & Market Share in Building Automation System

Building Integrated Photovoltaics Market - Solar & Architecture

Building Information Management (BIM) Market Analysis – Trends & Forecast 2024-2034

In-building Wireless Market Forecast and Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Solutions Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Market Size and Share Forecast Outlook 2025 to 2035

Green Building Materials Market Analysis by Type, Application, End-user and Region: Forecast for 2025 and 2035

Japan Building Automation System Market Analysis & Forecast by System, Application, and Region Through 2035

PCR Tire Building Machine Market Size and Share Forecast Outlook 2025 to 2035

Bio-Based Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Protective Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA