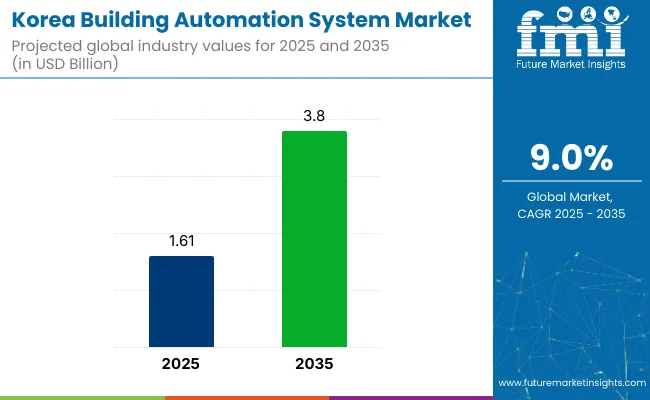

The Korea building automation system market is valued at USD 1.6 billion in 2025 and is expected to reach USD 3.8 billion by 2035, registering a CAGR of 9%. The market expansion is driven by rising adoption of integrated automation across HVAC, security, and lighting systems in commercial real estate.

| Metric | Value |

|---|---|

| Estimated Market Size (2025) | USD 1.6 Billion |

| Projected Market Size (2035) | USD 3.8 Billion |

| CAGR (2025 to 2035) | 9.0% |

The demand is rising as companies are investing in AI-based climate control and predictive analytics to enhance building performance and reduce operational costs, aligning with Korea’s smart city initiatives.

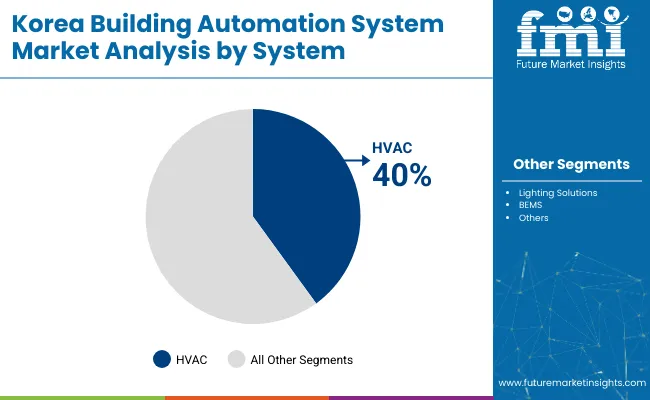

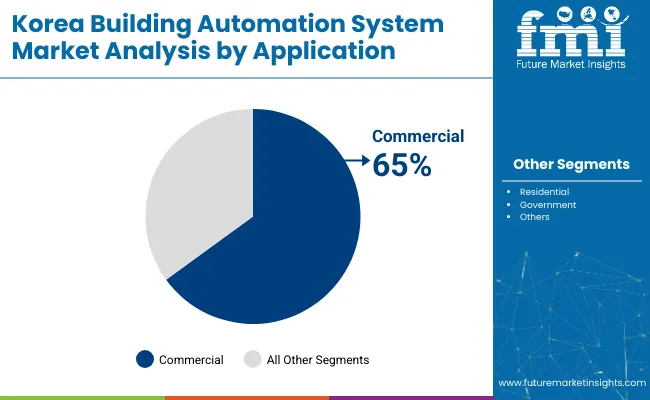

The market holds approximately 40% of share in 2025, driven by increasing demand for efficient temperature control in commercial spaces such as from offices, malls, and hotels. The commercial application segment is expected to dominate with nearly 65% of the overall share due to accelerating urbanization and rise of smart building initiatives.

Jeju is anticipated to record the fastest growth, with a projected CAGR of approximately 9.3%, supported by integration of renewable energy solutions and the expansion of smart tourism infrastructure expansion.

Government regulations impacting the market focus on stringent regulations and policies to promote energy efficiency and smart infrastructure, significantly impacting the building automation system (BAS) market. Key regulations include the Green Building Certification Criteria (G-SEED) and the Smart City Act, which mandate the integration of energy-saving technologies and intelligent control systems in new constructions and major renovations.

The Energy Use Rationalization Act also supports automation by encouraging building energy management systems (BEMS) to monitor and optimize energy consumption. These initiatives align with Korea’s national carbon neutrality targets and foster the adoption of smart, sustainable building automation solutions across commercial and public sectors.

Jeju is projected to be the fastest-growing market in expanding at a CAGR of 9.3% from 2025 to 2035. HVAC systems will lead with a 40% market share, while commercial applications will dominate with 65%. Jeju stands out as the fastest-growing region and aims to automate 80% of new commercial buildings with increasing adoption of IoT-based systems.

The Korea building automation market is segmented by system, application, and region. By system, the market is divided into security & surveillance, HVAC, lighting solutions, and BEMS. In terms of application, the market is categorized into commercial, residential, and government. Regionally, the market is classified into South Gyeongsang, North Jeolla, South Jeolla, Jeju, and Rest of Korea.

HVAC systems are projected to lead the system segment, accounting for approximately 40% of the market share by 2025. These are widely implemented across offices, malls, and hospitality facilities for efficient temperature and air quality management, improving occupant comfort while reducing energy costs.

The commercial segment is expected to lead the application segment, capturing approximately 65% of the market share in 2025. Commercial buildings such as offices, malls, and hotels are prioritizing automation for operational efficiency, safety, and regulatory compliance.

The Korea building automation system market is experiencing steady growth, driven by increasing demand for energy-efficient HVAC systems, AI-based security and surveillance solutions, and integrated smart lighting platforms.

Recent Trends in the Korea Building Automation System Market

Challenges in the Korea Building Automation System Market

South Gyeongsang’s momentum is driven by robust industrial growth, smart city initiatives, and government support for energy-efficient buildings. North Jeolla and South Jeolla maintain consistent demand, supported by regional eco-friendly building projects and increasing investments in sustainable infrastructure.

In contrast, Jeju (9.3% CAGR) is expanding at a rate aligned with its focus on eco-tourism and green building technologies, with growing interest in smart, energy-efficient buildings. The Rest of Korea shows steady growth driven by urbanization and local government regulations encouraging the adoption of building automation systems.

South Gyeongsang leads in manufacturing hubs where automation plays a crucial role in energy management and control. North and South Jeolla focus on integrating building automation within eco-conscious developments, while Jeju leverages its tourism infrastructure for sustainable, smart building solutions. The Rest of Korea benefits from nationwide initiatives aimed at enhancing urban efficiency and reducing energy consumption.

The report covers in-depth analysis of Korea’s regional building automation system market, with a focus on the five key regions driving growth.

The demand for building automation system in South Gyeongsang is projected to grow at a CAGR of approximately 9.1% from 2025 to 2035. the growth is driven by expanding manufacturing base, logistics centers, and industrial parks that require AI-based HVAC systems and advanced security automation for operational efficiency.

The North Jeolla building automation system market is forecast to expand at a CAGR of approximately 8.9% during the forecast period. The demand is driven by its robust agricultural sector adopting climate-controlled automation, along with public infrastructure investments supporting smart building technologies in healthcare, education, and government facilities.

The demand for building automation system in South Jeolla is projected to grow at a CAGR of approximately 9.2% between 2025 and 2035. The growth is driven by port facility expansions, smart city projects, and rising investments in hotels and public buildings for AI-based energy management, surveillance systems, and automated facility controls to enhance operational performance.

The revenue from building automation system in Jeju is expected to grow at a CAGR of approximately 9.3% from 2025 to 2035. The growth is driven by its Carbon-Free 2030 Initiative, promoting BAS integration with renewable energy sources in tourism, hospitality, and public infrastructure to enhance energy efficiency and sustainability.

The market is competitive, with leading domestic firms and global players pushing technological innovations and regulatory compliance. LG CNS and Samsung SDS focus on integrating IoT, AI, and energy management systems to enhance building efficiency, while Hyundai E&C prioritizes smart, sustainable solutions in large-scale construction projects. LS Electric and POSCO ICT lead in energy-efficient systems, providing advanced control and automation for building management.

Other key players such as SK C&C, KT Corporation, and Lotte E&C integrate next-gen technologies, including 5G and IoT, to optimize energy use and improve system interoperability. Companies like Doosan Robotics, Hanwha Solutions, and GS E&C further contribute by focusing on robotics, energy solutions, and smart building integration, ensuring both operational efficiency and sustainability. With a focus on smart, green buildings and energy optimization, these firms shape the future of Korea’s building automation landscape.

Recent Korea Building Automation System Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.6 billion |

| Projected Market Size (2035) | USD 3.8 billion |

| CAGR (2025 to 2035) | 9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameters | Revenue in USD billion / Volume in units |

| By System | Security & Surveillance, HVAC, Lighting Solutions, and BEMS |

| By Application | Commercial, Residential, and Government |

| Regions Covered | South Gyeongsang, North Jeolla, South Jeolla, Jeju, and Rest of Korea |

| Countries Covered | South Korea |

| Key Players | LG CNS, Samsung SDS, Hyundai E&C (Hyundai Engineering & Construction), LS Electric, HDC Hyundai Development Company, POSCO ICT, SK C&C, KT Corporation (Korea Telecom), Lotte E&C (Lotte Engineering & Construction), GS E&C (GS Engineering & Construction), Doosan Robotics, Hanwha Solutions, Kumho E&C (Kumho Engineering & Construction), Daewoo E&C (Daewoo Engineering & Construction), Daelim Industrial |

| Additional Attributes | Market share analysis by system and application, province-wise CAGR analysis, and brand positioning insights |

Security & Surveillance, HVAC, Lighting Solutions, BEMS (Building Energy Management)

Commercial, Residential, Government

South Gyeongsang, North Jeolla, South Jeolla, Jeju, Rest of Korea

The market is expected to reach USD 3.8 billion by 2035.

The market is projected to grow at a CAGR of 9.0% during this period.

HVAC systems are expected to lead with approximately 40% market share in 2025.

Commercial applications are expected to hold approximately 65% of the market share in 2025.

Jeju is anticipated to be the fastest-growing market with a CAGR of approximately 9.3% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Building Information Modeling Market Size and Share Forecast Outlook 2025 to 2035

Building Envelope Market Size and Share Forecast Outlook 2025 to 2035

Building Access Control Security Market Size and Share Forecast Outlook 2025 to 2035

Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Building Maintenance Unit (BMU) Market Size and Share Forecast Outlook 2025 to 2035

Building Energy Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Building Thermal Insulation Market Growth - Trends & Forecast 2025 to 2035

Building Integrated Photovoltaics Market - Solar & Architecture

Building Information Management (BIM) Market Analysis – Trends & Forecast 2024-2034

Building Automation System Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in Building Automation System

In-building Wireless Market Forecast and Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Solutions Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Market Size and Share Forecast Outlook 2025 to 2035

Green Building Materials Market Analysis by Type, Application, End-user and Region: Forecast for 2025 and 2035

Japan Building Automation System Market Analysis & Forecast by System, Application, and Region Through 2035

PCR Tire Building Machine Market Size and Share Forecast Outlook 2025 to 2035

Bio-Based Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Protective Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA