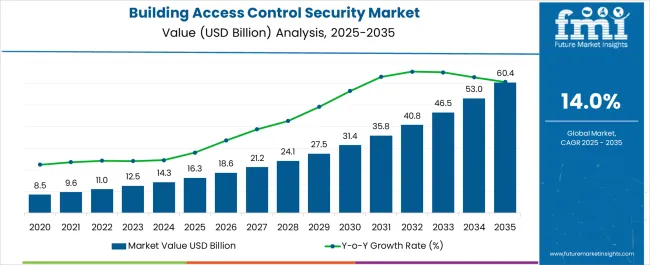

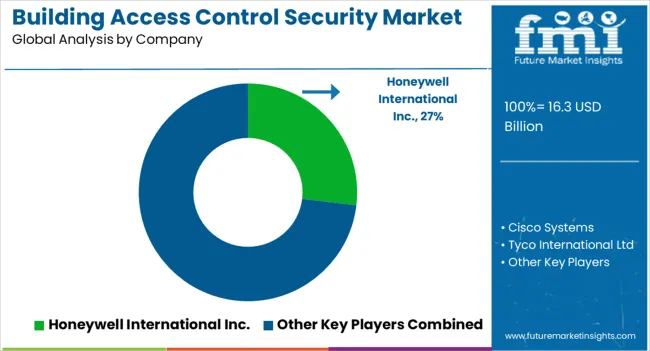

The Building Access Control Security Market is estimated to be valued at USD 16.3 billion in 2025 and is projected to reach USD 60.4 billion by 2035, registering a compound annual growth rate (CAGR) of 14.0% over the forecast period.

| Metric | Value |

|---|---|

| Building Access Control Security Market Estimated Value in (2025 E) | USD 16.3 billion |

| Building Access Control Security Market Forecast Value in (2035 F) | USD 60.4 billion |

| Forecast CAGR (2025 to 2035) | 14.0% |

The building access control security market is experiencing steady growth due to rising concerns around property security, data protection, and the prevention of unauthorized entry across both residential and commercial infrastructures. Increasing urbanization, rapid smart city developments, and heightened awareness of physical security threats have strengthened the adoption of advanced access control solutions.

Technological improvements in biometric authentication, cloud based platforms, and IoT integration are reshaping the functionality and scalability of security systems. Furthermore, regulatory frameworks requiring stricter security compliance in residential and corporate buildings are supporting broader implementation.

The market outlook remains positive as demand grows for intelligent, reliable, and user friendly solutions that enhance safety while aligning with modern building automation systems.

The hardware segment is projected to account for 48.70% of total revenue by 2025 within the component category, establishing it as the dominant segment. Growth has been reinforced by increasing demand for biometric scanners, smart card readers, and electronic locks that provide enhanced physical security.

The ability of hardware systems to integrate seamlessly with digital and cloud based platforms has improved their adaptability in modern security infrastructures. Additionally, investments in technologically advanced sensors and devices have strengthened system reliability and accuracy.

As end users continue to prioritize tangible, durable, and efficient security measures, hardware remains the preferred choice for large scale and individual building access solutions.

The residential segment is anticipated to represent 44.20% of total market revenue by 2025, positioning it as the leading end user segment. This dominance is supported by rising concerns over household security, increasing adoption of smart home technologies, and greater awareness of crime prevention measures.

Homeowners are increasingly investing in access control systems that include smart locks, mobile app based entry, and video door entry solutions. The integration of residential access control with broader smart home ecosystems has further accelerated adoption, providing both convenience and enhanced safety.

With rapid urbanization and growing middle class populations, particularly in emerging economies, the residential segment is expected to maintain its leadership within the building access control security market.

The demand for the elimination of issues associated with conventional access control systems, complemented by continuous innovations in technology, has led to the introduction of physical building access control security systems.

Building access control security systems are systems accessed without the requirement of a key. Technological innovations have led to the introduction of smart cards and proximity cards as well, besides magnetic stripe cards (under the card-based entry system market). In addition to offering an enhanced end-user experience, companies are strengthening the security of premises as well.

Building access control security systems, besides its primary application of granting access, can be used as an identity management, and time and attendance management system. It is, however, being witnessed that, multi-modal, i.e., physical access control systems with two or more modes of access (entry systems) are preferred over single-modal entry systems.

Out of all the types, biometric systems are the most preferred physical access control systems, owing to their applications across a majority of industry verticals.

Increasing Demand for Enhanced Building Access Control Security against Increasing Crimes and Home Burglaries

The demand for enhanced building access control security is being witnessed globally, across both commercial and residential end-users, in correspondence to increasing crimes such as thefts and burglaries.

In order to provide an efficient layer of security, end users have started adopting and installing building access control security systems, which as a result, is expected to support the growth of the building access control security market during the forecast period.

Due to the enhanced features associated with building access control security, increased demand is being witnessed from various industries, especially corporate offices and the hospitality sector. Besides these, high demand from the education and healthcare industries is also being witnessed for the same.

Lack of Infrastructural Development Hindering Growth of the Market

Many countries suffer from the lack of infrastructural development because of the lack of penetration of technology. As a result, this has restricted the penetration of various building access control security, such as RFID/proximity card/smart card-enabled entry systems and smartphone remote access entry systems.

This lack of penetration of a significant segment of the market impacts the overall growth of the market, and acts as a major restraint for the building access control security market.

Examples of some of the market participants in the global building access control security market identified across the value chain include

Following are some key strategies and developments in the global building access control security market:

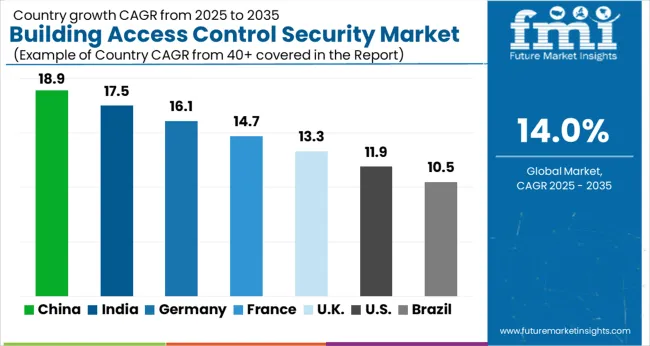

The north American building access control security market is expected to be the highest revenue contributor owing to factors such as penetration of internet users and increasing popularity of mobile services across different sectors such as BFSI, IT & Telecom, and government.

Whereas, East Asia is projected to exhibit the highest growth in the global building access control security market during the forecast period. The economic growth of developing countries, such as Japan and China, is complemented by the declining prices of software, hardware, and other components.

The building access control security market report is a compilation of first-hand information, qualitative and quantitative assessments by industry analysts, and inputs from industry experts and industry participants across the value chain.

The report provides an in-depth analysis of parent market trends, macroeconomic indicators, and governing factors, along with market attractiveness as per segment. The market report also maps the qualitative impact of various market factors on market segments and geographies.

The global building access control security market is estimated to be valued at USD 16.3 billion in 2025.

The market size for the building access control security market is projected to reach USD 60.4 billion by 2035.

The building access control security market is expected to grow at a 14.0% CAGR between 2025 and 2035.

The key product types in building access control security market are hardware, _cameras, _readers/scanners, _others, access control software/solutions, services, _professional services and _managed services.

In terms of end-user, residential segment to command 44.2% share in the building access control security market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Building Automation System Market Size and Share Forecast Outlook 2025 to 2035

Building Information Modeling Market Size and Share Forecast Outlook 2025 to 2035

Building Envelope Market Size and Share Forecast Outlook 2025 to 2035

Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Building Maintenance Unit (BMU) Market Size and Share Forecast Outlook 2025 to 2035

Building Energy Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Building Automation System Industry Analysis in Korea Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Building Thermal Insulation Market Growth - Trends & Forecast 2025 to 2035

Leading Providers & Market Share in Building Automation System

Building Integrated Photovoltaics Market - Solar & Architecture

Building Information Management (BIM) Market Analysis – Trends & Forecast 2024-2034

In-building Wireless Market Forecast and Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Solutions Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Market Size and Share Forecast Outlook 2025 to 2035

Green Building Materials Market Analysis by Type, Application, End-user and Region: Forecast for 2025 and 2035

Japan Building Automation System Market Analysis & Forecast by System, Application, and Region Through 2035

PCR Tire Building Machine Market Size and Share Forecast Outlook 2025 to 2035

Bio-Based Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Protective Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA