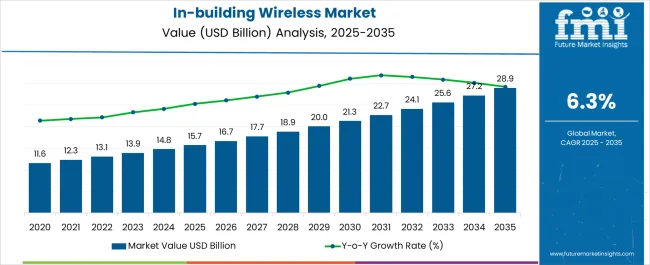

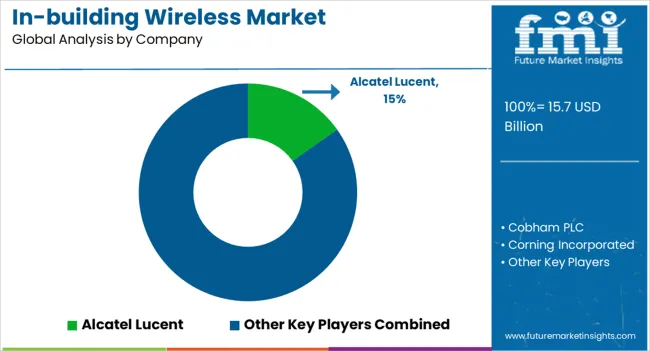

The In-building Wireless Market is estimated to be valued at USD 15.7 billion in 2025 and is projected to reach USD 28.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

The In-building Wireless market is experiencing strong growth, driven by the increasing demand for reliable indoor connectivity across commercial, industrial, and residential environments. Rising adoption of high-speed data applications, IoT devices, and mobile communications is creating a critical need for in-building wireless solutions that ensure seamless coverage and consistent network performance. Technological advancements in distributed antenna systems, small cells, and integrated network management platforms are enhancing network efficiency and scalability while reducing operational complexity.

The market is further supported by the expansion of smart buildings, enterprise digitization, and growing emphasis on workplace connectivity and customer experience. Investment in wireless infrastructure modernization, along with regulatory initiatives promoting high-quality indoor communications, is accelerating deployment.

As organizations and building owners prioritize uninterrupted connectivity for employees, tenants, and visitors, in-building wireless solutions are becoming essential components of digital infrastructure Continuous innovation in software-defined network management, real-time monitoring, and integration with existing IT and network systems is expected to sustain market growth over the coming decade.

| Metric | Value |

|---|---|

| In-building Wireless Market Estimated Value in (2025 E) | USD 15.7 billion |

| In-building Wireless Market Forecast Value in (2035 F) | USD 28.9 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

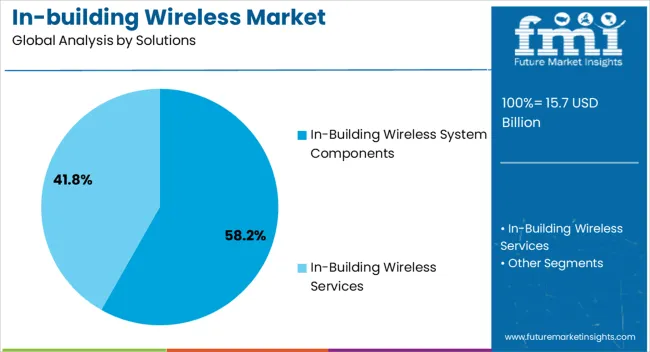

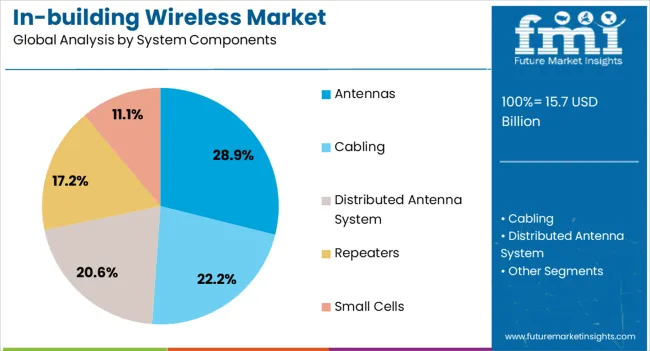

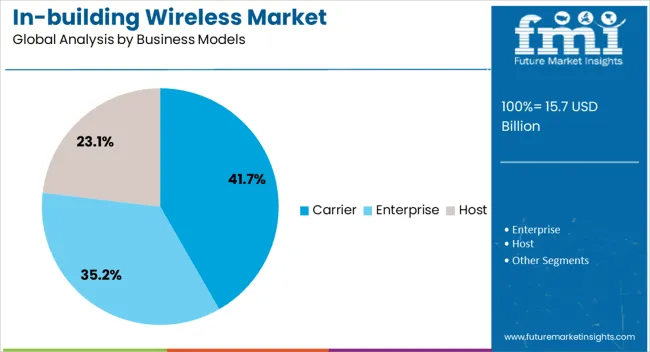

The market is segmented by Solutions, System Components, Business Models, Application, Business Type, and Building Size and region. By Solutions, the market is divided into In-Building Wireless System Components and In-Building Wireless Services. In terms of System Components, the market is classified into Antennas, Cabling, Distributed Antenna System, Repeaters, and Small Cells. Based on Business Models, the market is segmented into Carrier, Enterprise, and Host. By Application, the market is divided into Commercials, Residential, Government, Hospitals, Industrial Uses, Defense, and Retail. By Business Type, the market is segmented into Existing In-Building Wireless Businesses and New In-Building Wireless Businesses. By Building Size, the market is segmented into Large And Medium Buildings and Small Buildings. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The in-building wireless system components solutions segment is projected to hold 58.2% of the market revenue in 2025, establishing it as the leading component category. Growth in this segment is driven by the increasing requirement for comprehensive solutions that integrate multiple technologies, including distributed antennas, repeaters, and network controllers, to deliver seamless indoor coverage. These solutions provide enhanced scalability, enabling network operators and enterprises to adjust capacity and coverage according to user demand.

Integration capabilities with enterprise IT and monitoring platforms facilitate efficient network management and maintenance. The deployment of advanced software-driven platforms and automated monitoring tools has strengthened operational reliability and reduced downtime.

Organizations are leveraging these solutions to support high-speed data applications, IoT devices, and real-time communication needs, while ensuring compliance with connectivity standards As demand for uninterrupted indoor wireless performance grows in commercial, industrial, and public spaces, the in-building wireless system components solutions segment is expected to maintain its leading position, supported by technological innovation and strong adoption across multiple sectors.

The antennas system components segment is anticipated to account for 28.9% of the market revenue in 2025, making it the largest system components category. Growth is being driven by the essential role of antennas in ensuring optimal signal distribution and coverage across complex building layouts. Antennas are critical in enhancing signal quality, reducing dead zones, and supporting high-density user environments.

Advances in multi-band, MIMO, and smart antenna technologies are improving network capacity and performance, while reducing interference and energy consumption. Integration with distributed antenna systems and small cell networks further enhances overall system efficiency.

The ability to provide scalable coverage solutions for diverse building types, including office complexes, hospitals, airports, and educational institutions, has reinforced adoption As demand for reliable indoor wireless connectivity grows alongside mobile data usage and IoT proliferation, antennas are expected to remain a key driver of market growth within system components, supported by ongoing technological development and widespread deployment.

The carrier business models segment is projected to hold 41.7% of the market revenue in 2025, establishing it as the leading business model type. Growth is being driven by the increasing involvement of telecommunications providers in deploying and managing in-building wireless networks for commercial and enterprise clients. Carrier-led models offer comprehensive services including design, installation, operation, and maintenance, reducing complexity and upfront costs for building owners.

These models also enable predictable service quality, scalability, and integration with broader network infrastructures. The growing trend of shared network services and partnerships with building owners and system integrators is enhancing adoption.

Additionally, carrier business models facilitate compliance with regulatory standards and service-level agreements, ensuring reliable connectivity for tenants and end users As enterprises and property developers increasingly prioritize high-quality indoor wireless performance, the carrier segment is expected to remain the dominant business model, supported by strong operator expertise, end-to-end service offerings, and technological innovation in wireless network management.

People nowadays want clear network coverage and better public safety measures as smart phone penetration rate is skyrocketing. Over the past decade, mobile internet use has grown a lot as phones became smarter with many functions. As of 2025, the number of smartphone users could to reach around 5 billion.

Users are looking for these smart devices to save time and money because of reckless digital changes. The problem of limited indoor network coverage and capacity has pushed mobile network operators and virtual network operators to take action.

The rise of smart and intelligent buildings is opening new opportunities for market growth. In buildings like offices, hospitals, hotels, and malls, in-building wireless solutions are used to handle unstable cell networks due to heavy data traffic.

These solutions include DAS, in-building wireless gear, and small cells to deal with RF issues, power losses, and intermodulation challenges. It is essential to have Wi-Fi coverage in large buildings for a smooth user experience and better indoor service.

In-house wireless demand is hitting the roof because more companies are letting employees use their own devices for work, known as Bring Your Own Device (BYOD). This trend helps businesses save money on buying devices for employees.

It also gives workers the flexibility to use devices they are comfortable with, which can improve productivity and satisfaction. Along with smart buildings, factors like reliable connectivity for important applications in healthcare and better cellular coverage in rural areas are also boosting the expansion of in-building wireless systems.

From 2020 to 2025, the in-building wireless market showed very moderate growth, boasting a 5.50% CAGR. The pandemic led to the closure of many business buildings, delaying inside projects. In light of this trend, several industries used this time to fix problems and complete urgent repairs before reopening.

The introduction of the new 5G network has helped the in-building wireless market to grow further. For example, in October 2025, the Indian government started 5G services in the country. Companies like Reliance, Vi, Airtel, and BSNL are working to provide 5G across India.

| Attributes | Quantitative Outlook |

|---|---|

| In-building Wireless Market Value (2025) | USD 13.99 billion |

| Historical CAGR (2020 to 2025) | 5.50% |

The next generation of wireless technology is all set for take-off. The advent of 6G technology is set to transfigure the in-house wireless market. With its higher frequencies, 6G is on its way to unlock immense capacity, faster speeds, and lower latency. This is definitely going to make connections better for different uses.

By using distributed radio networks and terahertz spectrum, 6G is purposefully going to improve how networks share data and cut down on delays, making them work better and last longer. It stands to reason that this is going to lead to easier and more complete wireless connections, changing the way through which in-house wireless works.

Organizations in different industries are working to use IoT more to automate tasks and boost efficiency. This trend could potentially create many chances for the in-building wireless market to grow. In-building wireless networks let users connect various sensors, machines, people, vehicles, and devices for different applications. These networks handle issues like reliability, quality, security, and compliance.

Major companies like Nokia, Samsung, and Cisco are leading efforts to combine in-building wireless networks with IoT. This trend is likely to contribute to the positive outlook of the in-building wireless industry and presents several opportunities for market players.

The Asia Pacific in-building wireless industry is likely to make immense improvement. Governments in countries like China, South Korea, Japan, and India are making big efforts to digitize cities. Because of this, the region is becoming a very appealing market for companies that make telecom equipment and run telecom services.

On the other hand, Europe and North America are expected to grow moderately in this market on the back of rapid saturation of the internet. Simultaneously, business are creating a high demand for offer high-speed connectivity. Companies offering services like design, deployment, and testing are also helping the market growth as well.

| Countries | Forecasted CAGR (2025 to 2035) |

|---|---|

| Australia and New Zealand | 12.30% |

| China | 11.60% |

| Japan | 2.10% |

| United States | 4.40% |

| Germany | 1.80% |

Sales of in-building wireless in Australia and New Zealand are on track to record a CAGR of 12.30% through 2035.

Adoption of in-building wireless in China is all set to inflate at a CAGR of 11.60% through 2035.

Application of in-building wireless in Japan is on its way to surge at a CAGR of 2.10% through 2035.

Demand for in-building wireless in the United States is set to make a mark with a CAGR of 4.40% through 2035.

Deployment of in-building wireless in Germany is en route to achieving a CAGR of 1.80% through 2035.

As far as the component of in-building wireless is concerned, the hardware segment is generating significant profit in 2025, which is apparent in its 58.20% In-building Wireless market share. Similarly, the commercial segment is performing better in terms of application, possessing a 46.60% revenue share of the In-building Wireless industry in 2025.

| Segment | Market Share in the In-building Wireless (2025) |

|---|---|

| Hardware | 58.20% |

| Commercial | 46.60% |

The hardware segment is becoming the primary revenue generator within the market. Dynamics backing this hardware’s appeal include:

The chief position in the market is held by the commercial segment, a trend substantiated by factors such as:

Start-ups are looking at several ways to stand out in the highly competitive in-building wireless market. Some important start-up companies in the market are Cambium Networks, Mimosa, Siklu, Tarana, and H3C.

H3C, a start-up from China, makes fast WIFI 6 routers. It is working on making WIFI better for using wireless technology with IoT devices. Cambium Networks, another important player, focuses on providing wireless management for businesses of all sizes, from small to large enterprises.

In-building wireless market players employ diverse strategies to gain a competitive edge. They are working hard on new services and spending a lot on research to beat the competition. Also, teaming up with other companies and buying or merging with them is going to keep changing how the indoor wireless market looks.

Recent Developments

The global in-building wireless market is estimated to be valued at USD 15.7 billion in 2025.

The market size for the in-building wireless market is projected to reach USD 28.9 billion by 2035.

The in-building wireless market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in in-building wireless market are in-building wireless system components, _hardware, _software and in-building wireless services.

In terms of system components, antennas segment to command 28.9% share in the in-building wireless market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

North America In-building Wireless Market Growth - Demand & Forecast 2025 to 2035

Public Safety In-Building Wireless DAS System Market

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Wireless Video - 2.4/5GHz Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Wireless Audio Devices Market Size and Share Forecast Outlook 2025 to 2035

Wireless Communication Technologies In Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Wireless Mesh Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Tags Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Transmission Market Size and Share Forecast Outlook 2025 to 2035

Wireless Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Wireless Testing Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Bank Market Size and Share Forecast Outlook 2025 to 2035

Wireless Battery Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Printer Market Size and Share Forecast Outlook 2025 to 2035

Wireless Headphones Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensors Market Size and Share Forecast Outlook 2025 to 2035

Wireless Display Market Size and Share Forecast Outlook 2025 to 2035

Wireless Paging Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA