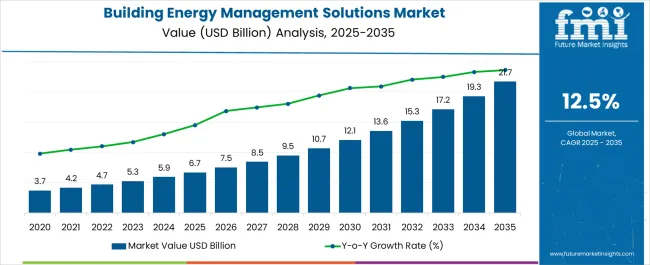

The Building Energy Management Solutions Market is estimated to be valued at USD 6.7 billion in 2025 and is projected to reach USD 21.7 billion by 2035, registering a compound annual growth rate (CAGR) of 12.5% over the forecast period.

| Metric | Value |

|---|---|

| Building Energy Management Solutions Market Estimated Value in (2025 E) | USD 6.7 billion |

| Building Energy Management Solutions Market Forecast Value in (2035 F) | USD 21.7 billion |

| Forecast CAGR (2025 to 2035) | 12.5% |

The building energy management solutions (BEMS) market is evolving rapidly as energy efficiency and sustainability become top priorities across the built environment. Driven by rising operational costs, decarbonization mandates, and pressure to comply with green building standards, organizations are turning to digital energy management platforms to monitor, control, and optimize consumption.

Integration of smart sensors, IoT devices, and AI-driven analytics has significantly enhanced energy visibility and decision-making for facilities managers and commercial property owners. Government-backed incentives, rising electricity tariffs, and ESG reporting pressures are further driving the adoption of intelligent building solutions.

The market is expected to expand significantly as retrofitting of aging infrastructure, remote energy monitoring, and demand-side optimization gain traction. Future growth is likely to be supported by cross-sector collaboration between energy providers, proptech firms, and automation vendors.

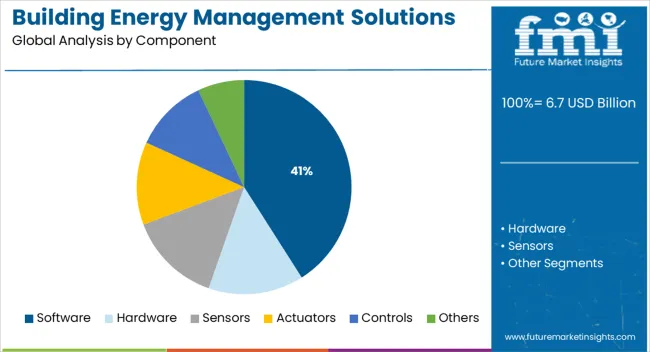

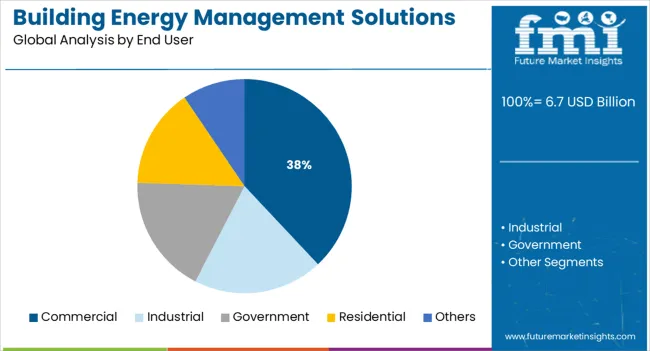

The market is segmented by Component and End User and region. By Component, the market is divided into Software, Hardware, Sensors, Actuators, Controls, and Others. In terms of End User, the market is classified into Commercial, Industrial, Government, Residential, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software segment is anticipated to lead the building energy management solutions market with a projected 41.0% share of overall revenue in 2025. This leadership is attributed to the software’s role in providing real-time energy monitoring, predictive analytics, and automated control functionalities.

Cloud-based platforms have enabled remote access and integration with building automation systems, allowing for continuous energy optimization across multi-site portfolios. The flexibility of software modules to scale across building sizes and types has enhanced their adoption, especially in cost-sensitive commercial environments.

Additionally, regulatory compliance reporting, fault detection, and energy benchmarking capabilities have positioned software as a core driver of ROI for stakeholders seeking performance transparency and sustainability alignment. The shift toward SaaS models has also made implementation more affordable and accessible for mid-sized enterprises.

The commercial sector is expected to contribute 38.0% of total revenue in the building energy management solutions market in 2025, making it the leading end-user category. This dominance is driven by heightened energy usage across offices, malls, hotels, and educational institutions, where operational efficiency is tied closely to energy performance.

Rising pressure to meet energy benchmarking ordinances and reduce carbon footprints has accelerated investment in BEMS across commercial buildings. The ability to integrate with HVAC, lighting, and security systems has made energy platforms essential for centralized control and optimization.

Moreover, the growing emphasis on green certifications such as LEED and BREEAM has increased the value of BEMS in enhancing building valuation and tenant attraction. With occupancy-based control, peak load management, and compliance reporting becoming business-critical, commercial end users are expected to remain the highest adopters of energy management solutions.

Currently, the key players are focusing on developing solutions that would help in achieving a net-zero Carbon footprint by 2035. This would certainly mean changing the way we consume and buy energy through the usage of on-site energy production. This process is called Total Energy Management.

The focus is also on leveraging data to uncover the best practices. This would give better control by looking at the greater picture and creating a customized energy program.

The key players in the building energy management solutions market are entering into strategic collaborations with key players from other sectors for decarbonizing power generation. In October 2025, General Electric Gas Power and NTPC signed an agreement to demonstrate Hydrogen co-firing in gas turbines to further decarbonize power generation.

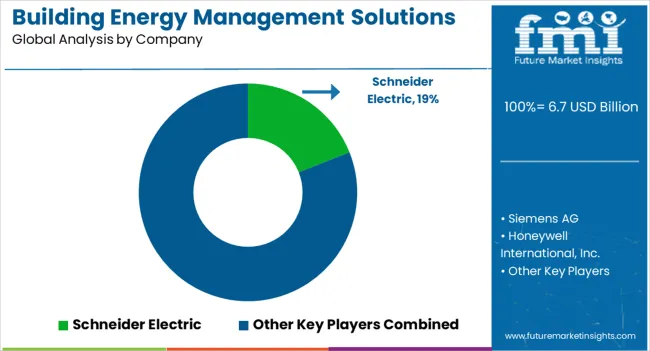

One of the most significant moves by the key players is the fact that they have started conducting programs to fund start-ups. For example, in June 2025, Schneider Electric launched ‘Innovate to Inspire,’ which was a supply chain hackathon specifically designed for start-ups.

Building energy management system is an integrated automated solution to enable cost-effective energy efficiency in buildings. These solutions include monitoring and controlling the operating devices and equipment of the building, such as ventilation & air conditioning systems, heating, lighting, monitoring, detecting, and other connected power systems.

Rising global initiatives for energy efficiency and technological advancement in energy-efficient building management solutions are the key factors influencing the growth of the global building management solutions market.

Building energy management solutions also includes energy demand management, which deals with energy optimization by integrating government regulations, financial incentives, and behavioral changes. It enables real-time monitoring and control of the entire system connected to the building. The energy performance of the building is achieved by continuously optimizing the building automation and control systems.

The wireless segment is predicted to expand at a greater rate throughout the projection period and at a notable CAGR of 18.3%. An increase in construction-related activities, such as those related to building and infrastructure construction, is driving this segment.

Rising energy efficiency standards and broader adaptation to the Internet of Things (IoT) technology coupled with analytical solutions have made it possible for building management solutions to gain popularity in the present market. Advancement of such technologies is anticipated to boost the target immensely in the future.

Changing organizational structures, rising energy costs, growing awareness of energy governance, and the developing trend toward smart building are further expected to accelerate the global demand for building energy management solutions. Stringent government regulation on energy efficiency and global initiatives to reduce greenhouse emissions is the key factor driving the global demand for building energy management solutions.

Increasing customer understanding of the business benefits of energy management solutions, rising carbon taxes, and favorable government policies to implement energy management solutions are expected to fuel the growth of global building energy management solutions.

The high implementation cost, unstable economic conditions,s and long-term return on investment are some of the factors restraining the growth of the global building energy management solutions market.

As per the building energy management solutions market survey report in 2024, the market was led by North America, contributing to almost 36.7% of the total sales.

The manufacturing industry in the area has expanded as a result of several government initiatives resulting in higher demand for building energy management solutions. Building energy management systems are anticipated to become more prevalent in companies over the next several years due to the world’s rapid expansion in the manufacturing sector.

As per the new research report on the adoption of building energy management solutions market, Europe countries hold a share of about 26.2%, making the geographical region second in the top order.

Europe is expected to develop moderately due to supportive government initiatives, a growing focus on environmental concerns, and high levels of technological adoption. The Asia Pacific is the fastest-growing market due to its growing economy, technological advancement, expanding infrastructure, smart city initiatives, and industrialization.

How is the Start-up Ecosystem in the Building Energy Management Solutions Market?

The global market for building energy management systems is somewhat dispersed, with a significant portion of sales coming from a substantial percentage of small- and medium-sized producers. Collaborating with other players and service providers in the building energy management market is the key strategy followed by major market vendors to gain a competitive edge.

Contrarily, several new players have come into existence over the past few years, sensing the growing opportunity in this sector in tandem with green initiatives. The Asia Pacific has turned out to be the primary hub for start-ups, given the renewed interest of governments in several countries of the region. For instance, the government-sponsored initiatives Make in India and Made in China 2025 have contributed to the expansion of the manufacturing industry.

As an effective business strategy, new market players have successfully integrated advanced technologies with existing formats. For instance, Athena Security is a company established in 2020 that offers buildings an AI-driven security management system. The solution comes in the shape of an ML layer that uses computer vision and a graphics card to detect potentially harmful things and notifies the stakeholders through an app when a vulnerability is identified.

| Attributes | Details |

|---|---|

| Growth Rate | CAGR of 12.5% from 2025 to 2035. |

| The base year for Estimation | 2025 |

| Historical Data Available for | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis. |

| Segments Covered | Component, End Use, Regions |

| Regions Covered | North America; Latin America; Asia Pacific; Japan; Western Europe; Eastern Europe; Middle East & Africa |

| Key Countries Profiled | The United States of America, Canada, Brazil, Argentina, Germany, The United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, GCC Countries, South Africa |

| Key Companies Profiled | Siemens AG; Schneider Electric; Honeywell International Inc.; Cisco Eaton.; General Electric Company; Johnson Controls.; CA Technologies; Ecova Inc.; Cylon Controls; Others |

| Customization | Available upon Request |

The global building energy management solutions market is estimated to be valued at USD 6.7 billion in 2025.

The market size for the building energy management solutions market is projected to reach USD 21.7 billion by 2035.

The building energy management solutions market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in building energy management solutions market are software, hardware, sensors, actuators, controls and others.

In terms of end user, commercial segment to command 38.0% share in the building energy management solutions market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Building Automation System Market Size and Share Forecast Outlook 2025 to 2035

Building Information Modeling Market Size and Share Forecast Outlook 2025 to 2035

Building Envelope Market Size and Share Forecast Outlook 2025 to 2035

Building Access Control Security Market Size and Share Forecast Outlook 2025 to 2035

Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Building Maintenance Unit (BMU) Market Size and Share Forecast Outlook 2025 to 2035

Building Automation System Industry Analysis in Korea Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Building Thermal Insulation Market Growth - Trends & Forecast 2025 to 2035

Leading Providers & Market Share in Building Automation System

Building Integrated Photovoltaics Market - Solar & Architecture

Building Information Management (BIM) Market Analysis – Trends & Forecast 2024-2034

In-building Wireless Market Forecast and Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Market Size and Share Forecast Outlook 2025 to 2035

Green Building Materials Market Analysis by Type, Application, End-user and Region: Forecast for 2025 and 2035

Japan Building Automation System Market Analysis & Forecast by System, Application, and Region Through 2035

Smart Building Solutions Market Size and Share Forecast Outlook 2025 to 2035

PCR Tire Building Machine Market Size and Share Forecast Outlook 2025 to 2035

Bio-Based Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Protective Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA