Building thermal insulation market growth will stay steady throughout the period between 2025 and 2035 because of increasing energy efficiency need and tough building standards coupled with rising heating and cooling expenses. Developments that use insulation in buildings save energy while helping to build sustainable projects and reach higher levels of comfort for residents.

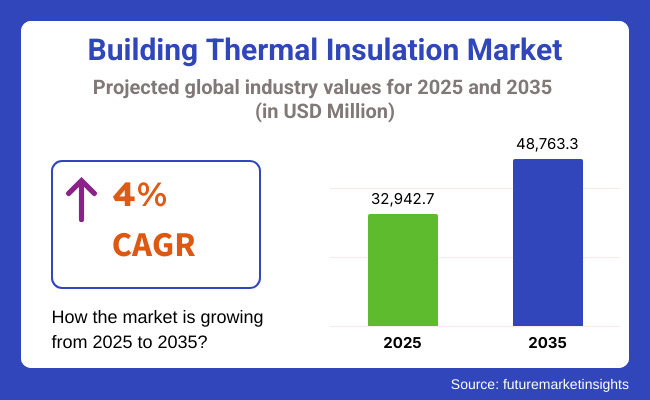

Thermal insulation for buildings will grow from USD 32,942.7 million in 2025 to USD 48,763.3 million in 2035 with a compound annual growth rate (CAGR) of 4% between these years.

The market expansion stems from environmental construction programs alongside population growth and improved room comfort requires in residential and commercial properties. The market utilizes four main materials that comprise mineral wool alongside polyurethane foam alongside polystyrene and cellulose since each has benefits for thermal resistance alongside flexible installation capability.

Faster adoption of thermal insulation solutions faces obstacles because of installation expenses and worries regarding fire safety and details in regulations. Distribution companies produce fire-resistant composite materials together with insulation systems that manufacturers create as new market requirements emerge.

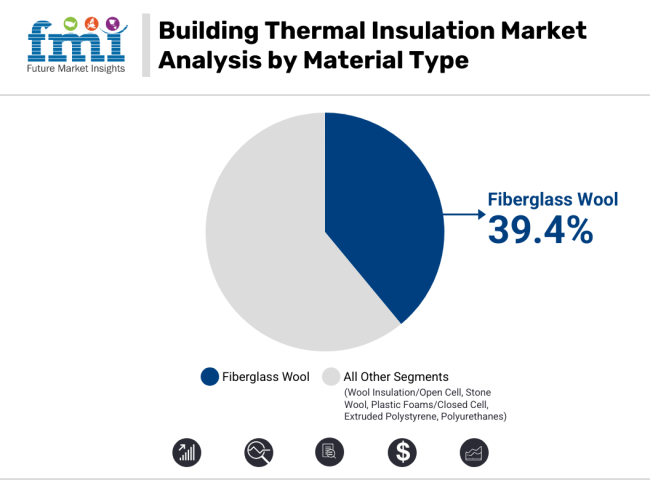

The building thermal insulation market exhibits two main segments which divide the industry according to materials and building construction types while showing increasing application in both new build-ups and renovation activities. The major building insulation elements comprise fiberglass, mineral wool, polyurethane and expanded polystyrene.

The affordability of fiberglass insulation combined with easy installation patterns align with market preference but polyurethane and mineral wool deliver advanced thermal performance required for specific demanding applications.

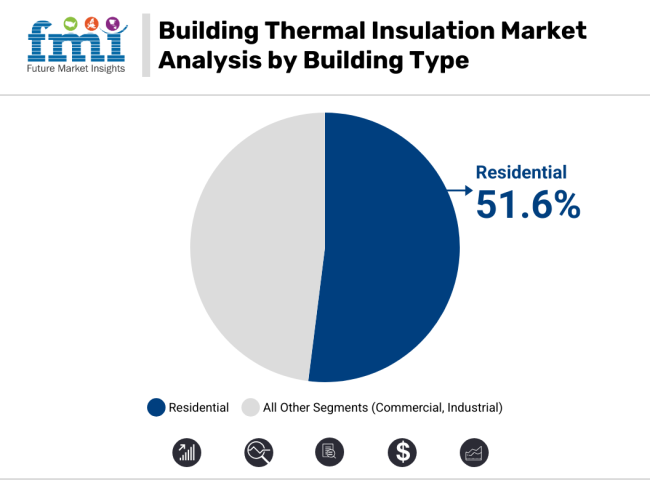

The market majority belongs to residential construction because owners seek utility cost savings through rising energy standards. Commercial facilities keep a tight pursuit of high-efficiency envelope construction in their hospitals and schools alongside buildings dedicated to office operations. Advancing regulations in energy standards drive the industry to adopt integrated vapor barrier insulation systems that provide acoustic advantages.

Governments and developers are increasingly focused on energy efficiency, lower emissions, and sustainable building practices, and as a result, the building thermal insulation market continues to grow. Insulation, as an integral component, helps with temperature regulation, energy reduction in HVAC systems, and improving overall comfort for the occupants.

Based on material type, fiberglass wool dominated the market due to low cost, good thermal resistance, and easy installation. Residential buildings make up the largest segment on the demand side, supported by increasing urbanization, energy parameters, and trends towards renovation or building new homes. These two segments collectively anchor a transition towards greener and more economically cost-competitive housing infrastructure in the world.

While net-zero and energy efficient construction goals are taking hold, insulation materials such as fiberglass assist builders in complying with codes while still keeping the costs low. The appetite from residential (especially single-family and multi-unit dwellings) remains powerful long into the future when it comes to innovating insulation design, application and integration with new construction and retrofit work.

Fiberglass wool leads the material segment by offering thermal resistance, affordability, and fire safety

Fiberglass wool holds the major share among different materials in the building thermal insulation market due to economical availability and flexibility of its usage in walls, roofs, ceilings, and attics. Fiberglass is made by spinning together molten glass into fine fibers that trap air and reduce heat transfer through convection and conduction.

Its non-combustibility, moisture resistance, and soundproofing make it the insulation of choice for all new buildings and retrofits. Builders like fiberglass because it comes in batt, roll, and loose-fill formats, allowing for simple adaptation to any architectural design and various climates.

Fiberglass wool is absolutely crucial to the work of contractors and the comfort of homeowners alike, not only for its insulation properties but also due to its superior fire safety rating and compliance with building codes. Improvements in binder technology and recycled glass content have also enhanced product sustainability and improved indoor air quality.

As green building certifications such as LEED and BREEAM gain more prominence, fiberglass wool is still a preferred material for projects looking to find the optimal balance between performance, safety, and environmental responsibility.

Residential buildings dominate the building type segment with rising demand for energy efficiency and affordable climate control

Due to the growing awareness among consumers regarding energy cost savings and increasing housing demand worldwide, the building type segment where thermal insulation is most commonly used is residential buildings. More homeowners and developers are putting insulation in walls, floors, attics and basements to reduce heating and cooling costs, particularly in areas with harsh temperatures.

Incentives from the government including tax credits and subsidies for energy-efficient retrofits further support the adoption of insulation in new and existing residential units. Fiberglass wool and (and some foams) remain popular for residential applications due to their ease of installation and compatibility with timber-framed structures.

The growth of urbanisation and the rise of the middle-class in Asia-Pacific, North America and Europe is driving demand for affordable thermally-efficient homes. Moreover, stricter building energy codes and the demand for comfortable, green living spaces keep this market growing year on year. As most households aspire to achieve long-term utility savings and enhance their indoor air quality, thermal insulation demand worldwide will continue to be elevated by residential construction.

The North America building thermal insulation market is thriving as a result of energy conservation policies, retrofitting initiatives and the focus on building performance. Material innovation and code-compliant insulation systems are how the United States and Canada win.

The Energy efficiency market in Europe is driven by ambitious climate action targets, building renovation programs, and enforcement of EU directives. Germany, France, and the UK invest in thermal upgrades and promote recyclable insulating materials.

The building thermal insulation market is also segmented into various regions such as North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa. Asia Pacific holds the highest market growth due to urban housing requirements, green building programs by the government, and growing energy consumption in the region. Urban expansion and affordable housing approach in China, India, Japan, developed it fast.

Challenge: Installation Complexity and Regulatory Variability

Challenge for building thermal insulation market is managing installation variability, complying with different regional building codes, and supporting to meet evolving fire safety regulations. The thermal insulation effectiveness of assigned material R-value is largely based on proper installation within walls, floors, and roofing systems, which can vary due to contractor practices, structural fabrication and climate zone concerns.

Finally, the market is under additional pressure from energy efficiency requirements, flame retardancy challenges, and environmental building certifications (LEED, BREEAM, and other national and regional standards, which differ by country and by region). These complexities mean insulation manufacturers struggle to provide uniform, compliant, high-performing, and cost-effective solutions at a scale that meets growing demand for multi-family residential, high-rise commercial, and retrofitting projects.

Opportunity: Energy Efficiency, Green Building, and Material Innovation

The building thermal insulation market is expected to grow driven by the need for net-zero energy buildings across the globe, reducing carbon footprints, and saving costs on heating/cooling. Setting insulated building envelopes so both governments and developers aim to abide by building energy codes, improve comfort in the interior environment, and reduce dependency on mechanical systems.

High-performance materials and the likes of aerogels, vacuum insulated panels (VIPs), phase-change materials (PCMs), plus bio-based insulators like hemp and sheep wool, are lightweight and sustainable, often thermally more efficient than traditional fiberglass or EPS insulation.

Retrofitting of existing buildings is becoming a growing trend, especially as urban renewal programs and incentive-based energy efficiency programs create new demand for spray foam, blown-in and rigid board insulation solutions. Additionally, smart construction technologies, like thermal imaging, prefabricated insulated panels, and IoT-based energy monitoring, validate insulation market growth.

Between 2020 to 2024 the building thermal insulation market grew due to rising energy costs, the pandemic construction boom, and interest in home energy upgrades and resilient building design. To achieve performance levels required by code, developers turned to mineral wool, polyurethane foam and expanded polystyrene. However, during this time, labour shortages, material volatility, and uneven adherence to best practices compromised optimal installation and performance.

The market transition towards sustainable, high-efficiency insulation materials backed by automated installation systems, modular construction and digital compliance tools will accelerate from 2025 till 2035. In multi-use developments, hybrid insulation formats merging thermal, acoustic and fireresistant properties will become the norm.

Airtight, vapor-controlled, and moisture-resistant insulation systems adopted according to climate resilient construction and passive house principles with building energy transparency becoming standard, insulation performance will more often be monitored and digitalized for performance as a service opportunities.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Focused on national energy codes and fire safety compliance. |

| Technological Advancements | Use of fiberglass, EPS, XPS, and traditional foams. |

| Sustainability Trends | Shift toward recyclable materials and formaldehyde-free insulation. |

| Market Competition | Led by large construction material firms and regional manufacturers. |

| Industry Adoption | Used in residential, commercial, and industrial new builds. |

| Consumer Preferences | Demand for affordable, effective, and safe insulation materials. |

| Market Growth Drivers | Growth driven by energy savings, comfort improvement, and code compliance. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Expansion into net-zero mandates, embodied carbon limits, and performance-based building certifications. |

| Technological Advancements | Growth in aerogels, vacuum insulated panels, bio-based insulation, and hybrid multi-performance systems. |

| Sustainability Trends | Broader adoption of low-emission, biodegradable, and carbon-negative insulation products. |

| Market Competition | Entry of green material startups, modular building system suppliers, and digital energy service providers. |

| Industry Adoption | Broader use in retrofitting, prefab construction, smart buildings, and climate-resilient infrastructure. |

| Consumer Preferences | Preference for sustainable, healthy, and digitally verifiable energy-saving solutions. |

| Market Growth Drivers | Expansion fueled by net-zero targets, material innovation, and green construction incentives. |

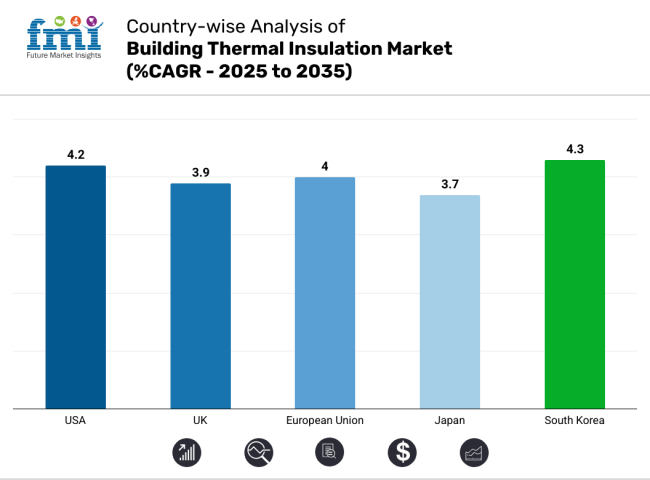

The United States thermal insulation market in the building segment is growing steadily due to increasing awareness regarding energy conservation, a surge in retrofitting demand in residential buildings, and government incentives for sustainable construction. Spray foam and rigid polyurethane boards are common, as are other materials, such as glass wool, across new builds and energy-efficient retrofits.

Beyond aspects like the DOE’s own Building Technologies Office and energy codes such as the IECC, programs are driving expanded use of thermal insulation across walls, attics and HVAC equipment. Urban housing, schools, and upgrades to commercial real estate are where growth is particularly strong.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

The UK building thermal insulation market is experiencing moderate growth in support of net-zero carbon building targets, an aging housing stock, and subsidies under schemes such as the Green Homes Grant. Loft, cavity wall and external insulation is also very much in demand especially semidetached and multifamily properties.

As energy costs climb and EPC (Energy Performance Certificate) standards become stricter, both homeowners and developers are looking to green insulation materials including sheep’s wool, recycled cellulose, and bio-based foams.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

The building thermal insulation market is expected to register higher growth in the European Union, owing to EU Green Deal, stringent building energy performance directives (EPBD) and renovation wave initiatives. Countries such as Germany, France, and Sweden lead the world in applying high-tech insulation methods to residential and non-residential buildings.

The demand for mineral wool, EPS, and PIR boards is underpinned driven by regulations for almost zero-energy buildings (NZEBs). To improve the long-term sustainability of buildings, the EU is also promoting low-emission and circular insulation materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.0% |

The building thermal insulation market in Japan is growing firmly, supported by the aged building stock, growing demand for indoor comfortable environment, and government promotion of low-carbon dwelling. Thermal insulation is an essential feature of multi-storey residential complexes and public infrastructure, especially in areas with high seasonal temperature fluctuations.

Where Japanese manufacturers, specializing in thin, high-efficiency insulation solutions like aerogels and vacuum insulated panels (VIPs) that are well suited to Japan’s compact urban architecture. Government Programs to Support ZEH (Net Zero Energy Homes) Still Driving Adoption

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.7% |

The market for building thermal insulation in South Korea is expanding due to the development of smart cities, energy performance certification requirements, and high-rise residential construction. It is in concrete apartment blocks, public schools, and commercial towers where reducing thermal bridging is a priority that demand for thermal insulation is strong.

Korean companies are implementing graphite-based EPS, non-flammable XPS, and sustainable foam insulation in order to comply with the Green Remodelling initiative led by the State. Ongoing market growth is being bolstered by strict building codes for new builds and retrofits.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

The building thermal insulation market is a segment of the construction materials industry that is focused on sustainability overcoming energy efficiency, which has allowed it to expand rapidly. Residential, commercial and industrial buildings use thermal insulation materials (f.e. mineral wool, expanded and extruded polystyrene (EPS/XPS), polyurethane (PU) and natural fibers) to reduce heat transmission and improve heating, ventilation and air conditioning performance.

Top players emphasize fire resistance, moisture control, recyclability, and high R-value performance. The market encompasses global manufacturers of insulation material, system integrators, and green building solution providers supporting retrofits and new builds in developed and emerging geographies.

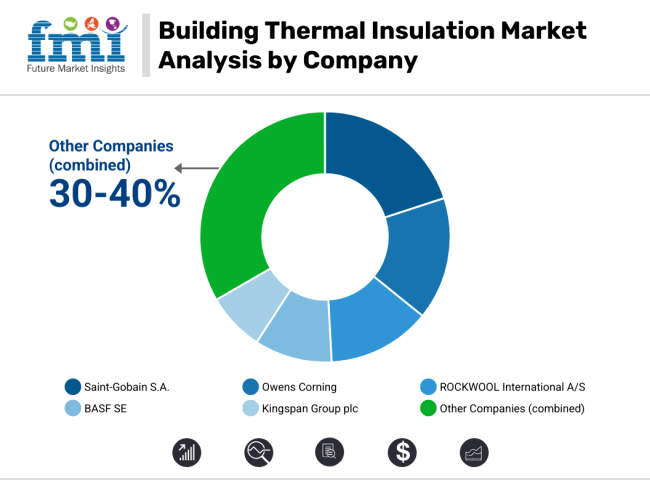

Market Share Analysis by Company

| Company Name | Key Offerings/Activities |

|---|---|

| Saint-Gobain S.A. | Introduced ISOVER Multi-Comfort glass wool insulation panels with recycled content in 2024, targeting net-zero and passive house projects. |

| Owens Corning | Launched Thermafiber® UltraBatt mineral wool insulation for fire-rated wall systems in 2025, designed for commercial buildings and high-rises. |

| ROCKWOOL International A/S | Expanded its stone wool insulation solutions with higher acoustic and thermal ratings in 2024, serving urban housing and retrofit programs. |

| BASF SE | Released Elastopor® rigid PU foam insulation with low-GWP blowing agents in 2025, tailored for prefabricated panels and industrial refrigeration. |

| Kingspan Group plc | Rolled out Kooltherm® K100 phenolic insulation boards in 2024, offering ultra-low thermal conductivity for narrow wall cavities. |

Key Company Insights

Saint-Gobain S.A.

Saint-Gobain leads the global insulation market with glass wool, stone wool, and foam products, integrating circular economy practices and digital building solutions.

Owens Corning

Owens Corning delivers high-performance mineral wool and fiberglass insulation, supporting LEED-certified construction and energy-efficiency upgrades.

ROCKWOOL International A/S

ROCKWOOL specializes in non-combustible stone wool insulation, addressing fire safety, noise control, and thermal comfort in dense urban settings.

BASF SE

BASF provides chemical-based insulation solutions, offering customized PU and PIR systems with environmentally optimized materials for industrial applications.

Kingspan Group plc

Kingspan is a pioneer in high-R-value phenolic insulation boards, widely used in space-limited constructions and high-performance façade systems.

Other Key Players (30-40% Combined)

Several other companies contribute to the building thermal insulation market, focusing on bio-based materials, spray foam systems, and regional code compliance:

The overall market size for the building thermal insulation market was USD 32,942.7 million in 2025.

The building thermal insulation market is expected to reach USD 48,763.3 million in 2035.

The increasing emphasis on energy efficiency in construction, rising demand for sustainable insulation solutions, and growing use of fiberglass wool in residential buildings fuel the building thermal insulation market during the forecast period.

The top 5 countries driving the development of the building thermal insulation market are the USA, UK, European Union, Japan, and South Korea.

Fiberglass wool and residential buildings lead market growth to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2016 to 2032

Table 2: Global Market Volume (Square Meter) Forecast by Region, 2016 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Material, 2016 to 2032

Table 4: Global Market Volume (Square Meter) Forecast by Material, 2016 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Building Type, 2016 to 2032

Table 6: Global Market Volume (Square Meter) Forecast by Building Type, 2016 to 2032

Table 7: Global Market Value (US$ Million) Forecast by Application, 2016 to 2032

Table 8: Global Market Volume (Square Meter) Forecast by Application, 2016 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Country, 2016 to 2032

Table 10: North America Market Volume (Square Meter) Forecast by Country, 2016 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Material, 2016 to 2032

Table 12: North America Market Volume (Square Meter) Forecast by Material, 2016 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Building Type, 2016 to 2032

Table 14: North America Market Volume (Square Meter) Forecast by Building Type, 2016 to 2032

Table 15: North America Market Value (US$ Million) Forecast by Application, 2016 to 2032

Table 16: North America Market Volume (Square Meter) Forecast by Application, 2016 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2016 to 2032

Table 18: Latin America Market Volume (Square Meter) Forecast by Country, 2016 to 2032

Table 19: Latin America Market Value (US$ Million) Forecast by Material, 2016 to 2032

Table 20: Latin America Market Volume (Square Meter) Forecast by Material, 2016 to 2032

Table 21: Latin America Market Value (US$ Million) Forecast by Building Type, 2016 to 2032

Table 22: Latin America Market Volume (Square Meter) Forecast by Building Type, 2016 to 2032

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2016 to 2032

Table 24: Latin America Market Volume (Square Meter) Forecast by Application, 2016 to 2032

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2016 to 2032

Table 26: Europe Market Volume (Square Meter) Forecast by Country, 2016 to 2032

Table 27: Europe Market Value (US$ Million) Forecast by Material, 2016 to 2032

Table 28: Europe Market Volume (Square Meter) Forecast by Material, 2016 to 2032

Table 29: Europe Market Value (US$ Million) Forecast by Building Type, 2016 to 2032

Table 30: Europe Market Volume (Square Meter) Forecast by Building Type, 2016 to 2032

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2016 to 2032

Table 32: Europe Market Volume (Square Meter) Forecast by Application, 2016 to 2032

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2016 to 2032

Table 34: Asia Pacific Market Volume (Square Meter) Forecast by Country, 2016 to 2032

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Material, 2016 to 2032

Table 36: Asia Pacific Market Volume (Square Meter) Forecast by Material, 2016 to 2032

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Building Type, 2016 to 2032

Table 38: Asia Pacific Market Volume (Square Meter) Forecast by Building Type, 2016 to 2032

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Application, 2016 to 2032

Table 40: Asia Pacific Market Volume (Square Meter) Forecast by Application, 2016 to 2032

Table 41: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2016 to 2032

Table 42: Middle East and Africa Market Volume (Square Meter) Forecast by Country, 2016 to 2032

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2016 to 2032

Table 44: Middle East and Africa Market Volume (Square Meter) Forecast by Material, 2016 to 2032

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Building Type, 2016 to 2032

Table 46: Middle East and Africa Market Volume (Square Meter) Forecast by Building Type, 2016 to 2032

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2016 to 2032

Table 48: Middle East and Africa Market Volume (Square Meter) Forecast by Application, 2016 to 2032

Figure 1: Global Market Value (US$ Million) by Material, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Building Type, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Application, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2016 to 2032

Figure 6: Global Market Volume (Square Meter) Analysis by Region, 2016 to 2032

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 9: Global Market Value (US$ Million) Analysis by Material, 2016 to 2032

Figure 10: Global Market Volume (Square Meter) Analysis by Material, 2016 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 13: Global Market Value (US$ Million) Analysis by Building Type, 2016 to 2032

Figure 14: Global Market Volume (Square Meter) Analysis by Building Type, 2016 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Building Type, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Building Type, 2022 to 2032

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2016 to 2032

Figure 18: Global Market Volume (Square Meter) Analysis by Application, 2016 to 2032

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 21: Global Market Attractiveness by Material, 2022 to 2032

Figure 22: Global Market Attractiveness by Building Type, 2022 to 2032

Figure 23: Global Market Attractiveness by Application, 2022 to 2032

Figure 24: Global Market Attractiveness by Region, 2022 to 2032

Figure 25: North America Market Value (US$ Million) by Material, 2022 to 2032

Figure 26: North America Market Value (US$ Million) by Building Type, 2022 to 2032

Figure 27: North America Market Value (US$ Million) by Application, 2022 to 2032

Figure 28: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2016 to 2032

Figure 30: North America Market Volume (Square Meter) Analysis by Country, 2016 to 2032

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 33: North America Market Value (US$ Million) Analysis by Material, 2016 to 2032

Figure 34: North America Market Volume (Square Meter) Analysis by Material, 2016 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 37: North America Market Value (US$ Million) Analysis by Building Type, 2016 to 2032

Figure 38: North America Market Volume (Square Meter) Analysis by Building Type, 2016 to 2032

Figure 39: North America Market Value Share (%) and BPS Analysis by Building Type, 2022 to 2032

Figure 40: North America Market Y-o-Y Growth (%) Projections by Building Type, 2022 to 2032

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2016 to 2032

Figure 42: North America Market Volume (Square Meter) Analysis by Application, 2016 to 2032

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 45: North America Market Attractiveness by Material, 2022 to 2032

Figure 46: North America Market Attractiveness by Building Type, 2022 to 2032

Figure 47: North America Market Attractiveness by Application, 2022 to 2032

Figure 48: North America Market Attractiveness by Country, 2022 to 2032

Figure 49: Latin America Market Value (US$ Million) by Material, 2022 to 2032

Figure 50: Latin America Market Value (US$ Million) by Building Type, 2022 to 2032

Figure 51: Latin America Market Value (US$ Million) by Application, 2022 to 2032

Figure 52: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2016 to 2032

Figure 54: Latin America Market Volume (Square Meter) Analysis by Country, 2016 to 2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 57: Latin America Market Value (US$ Million) Analysis by Material, 2016 to 2032

Figure 58: Latin America Market Volume (Square Meter) Analysis by Material, 2016 to 2032

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) Analysis by Building Type, 2016 to 2032

Figure 62: Latin America Market Volume (Square Meter) Analysis by Building Type, 2016 to 2032

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Building Type, 2022 to 2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Building Type, 2022 to 2032

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2016 to 2032

Figure 66: Latin America Market Volume (Square Meter) Analysis by Application, 2016 to 2032

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 69: Latin America Market Attractiveness by Material, 2022 to 2032

Figure 70: Latin America Market Attractiveness by Building Type, 2022 to 2032

Figure 71: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 72: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 73: Europe Market Value (US$ Million) by Material, 2022 to 2032

Figure 74: Europe Market Value (US$ Million) by Building Type, 2022 to 2032

Figure 75: Europe Market Value (US$ Million) by Application, 2022 to 2032

Figure 76: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2016 to 2032

Figure 78: Europe Market Volume (Square Meter) Analysis by Country, 2016 to 2032

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 81: Europe Market Value (US$ Million) Analysis by Material, 2016 to 2032

Figure 82: Europe Market Volume (Square Meter) Analysis by Material, 2016 to 2032

Figure 83: Europe Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 85: Europe Market Value (US$ Million) Analysis by Building Type, 2016 to 2032

Figure 86: Europe Market Volume (Square Meter) Analysis by Building Type, 2016 to 2032

Figure 87: Europe Market Value Share (%) and BPS Analysis by Building Type, 2022 to 2032

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Building Type, 2022 to 2032

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2016 to 2032

Figure 90: Europe Market Volume (Square Meter) Analysis by Application, 2016 to 2032

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 93: Europe Market Attractiveness by Material, 2022 to 2032

Figure 94: Europe Market Attractiveness by Building Type, 2022 to 2032

Figure 95: Europe Market Attractiveness by Application, 2022 to 2032

Figure 96: Europe Market Attractiveness by Country, 2022 to 2032

Figure 97: Asia Pacific Market Value (US$ Million) by Material, 2022 to 2032

Figure 98: Asia Pacific Market Value (US$ Million) by Building Type, 2022 to 2032

Figure 99: Asia Pacific Market Value (US$ Million) by Application, 2022 to 2032

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2016 to 2032

Figure 102: Asia Pacific Market Volume (Square Meter) Analysis by Country, 2016 to 2032

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Material, 2016 to 2032

Figure 106: Asia Pacific Market Volume (Square Meter) Analysis by Material, 2016 to 2032

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Building Type, 2016 to 2032

Figure 110: Asia Pacific Market Volume (Square Meter) Analysis by Building Type, 2016 to 2032

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Building Type, 2022 to 2032

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Building Type, 2022 to 2032

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Application, 2016 to 2032

Figure 114: Asia Pacific Market Volume (Square Meter) Analysis by Application, 2016 to 2032

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 117: Asia Pacific Market Attractiveness by Material, 2022 to 2032

Figure 118: Asia Pacific Market Attractiveness by Building Type, 2022 to 2032

Figure 119: Asia Pacific Market Attractiveness by Application, 2022 to 2032

Figure 120: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 121: Middle East and Africa Market Value (US$ Million) by Material, 2022 to 2032

Figure 122: Middle East and Africa Market Value (US$ Million) by Building Type, 2022 to 2032

Figure 123: Middle East and Africa Market Value (US$ Million) by Application, 2022 to 2032

Figure 124: Middle East and Africa Market Value (US$ Million) by Country, 2022 to 2032

Figure 125: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2016 to 2032

Figure 126: Middle East and Africa Market Volume (Square Meter) Analysis by Country, 2016 to 2032

Figure 127: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 128: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 129: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2016 to 2032

Figure 130: Middle East and Africa Market Volume (Square Meter) Analysis by Material, 2016 to 2032

Figure 131: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 132: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 133: Middle East and Africa Market Value (US$ Million) Analysis by Building Type, 2016 to 2032

Figure 134: Middle East and Africa Market Volume (Square Meter) Analysis by Building Type, 2016 to 2032

Figure 135: Middle East and Africa Market Value Share (%) and BPS Analysis by Building Type, 2022 to 2032

Figure 136: Middle East and Africa Market Y-o-Y Growth (%) Projections by Building Type, 2022 to 2032

Figure 137: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2016 to 2032

Figure 138: Middle East and Africa Market Volume (Square Meter) Analysis by Application, 2016 to 2032

Figure 139: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 140: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 141: Middle East and Africa Market Attractiveness by Material, 2022 to 2032

Figure 142: Middle East and Africa Market Attractiveness by Building Type, 2022 to 2032

Figure 143: Middle East and Africa Market Attractiveness by Application, 2022 to 2032

Figure 144: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermal Insulation Materials for Optical Fibers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Coating Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Packaging Market Size, Share & Forecast 2025 to 2035

Demand for Thermal Insulation Materials in EU Size and Share Forecast Outlook 2025 to 2035

Recyclable Thermal Insulation Packs Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Recyclable Thermal Insulation Packs Industry

Thermal Interface Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Market Forecast and Outlook 2025 to 2035

Insulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Thermal Impulse Sealers Market Size and Share Forecast Outlook 2025 to 2035

Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Building Automation System Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Printer Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Insulation Paper Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Service Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Materials for EV Batteries Market Size and Share Forecast Outlook 2025 to 2035

Insulation Market Size and Share Forecast Outlook 2025 to 2035

Building Information Modeling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA