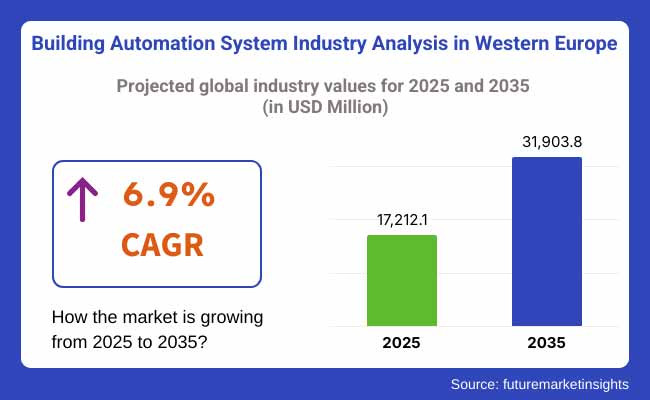

The Building Automation System Industry Analysis in Western Europe is valued at USD 17212.1 million in 2025. As per FMI's analysis, the Building Automation System Industry will grow at a CAGR of 6.9% and reach USD 31,903.8 million by 2035.

A significant trend is working with renewable energy sources, such as better integration with solar and wind energy systems, with BAS solutions that help to leverage renewable energy through buildings. Additionally, the refurbishment of existing older buildings with smart automation components will be a significant driver for the industry's growth.

In 2024, the Building Automation System (BAS) industry in Western Europe became dynamic, driven by digitalization, regulatory pressure, and increasing energy efficiency needs. Governments throughout the region have imposed tougher energy efficiency requirements (notably in Germany, France, and the UK), forcing businesses to adopt new formats.

As a result, AI-powered automation and IoT-enabled BAS solutions gained significant traction, as organizations sought to maximize energy usage and operational efficiency. Commercial real estate experienced a surge in smart building deployments, while industrial facilities turned to Building Automation Systems (BAS) for more efficient operations and to help meet emissions controls. There was also increasing demand for cybersecurity-augmented BAS solutions as connectivity broadened potential liabilities.

In Western Europe, the growth trajectory of the Building Automation System (BAS) industry share is one of steady growth, driven by increasingly stricter energy efficiency regulations, the increased adoption of smart building technology, and the overall demand for IoT-enabled automation.

The organizations having AI-driven cloud-based BAS solutions installed in the prime commercial real estate, industrial, and energy-intensive sectors will find themselves benefiting much from their investment, while the organizations lagging in upgrading their legacy systems may end up incurring higher costs and facing regulatory hurdles.

The revenue generation potential of the industry has been improved by an ongoing increase in the pace of sustainability as well as - now more than ever- digital transformation, as it is projected to continue growing over the years, reaching USD 31.9 billion in 2035.

During the period from 2025 to 2035, the industry for Building Automation System in the Western Europe region will witness systematic advancement in all major system categories. In terms of the system, the HVAC segment is expected to account for a share of 28.2% in 2025. Things will fall into place with respect to security and surveillance, where AI-powered analytics, facial recognition, and cloud monitoring will feature in almost all new installations by companies, driven by a deepening concern over cyber and physical security threats.

With the advent of widely automated HVAC systems and intelligent sensors coupled with machine learning for improved efficiency in energy and indoor air quality management, intelligent HVAC controls would increase due to the push towards net-zero buildings. These would also be well-suited for easy interfacing with renewable energy sources.

The direction for lighting solutions will be human-centric and adaptive, with an IoT and automation base to achieve energy efficiency and occupant comfort. BEMS will go further and become the central feature of BAS, integrating information from HVAC, lighting, and security to optimize energy and enable predictive maintenance in real-time.

Based on application, the commercial segment is expected to account for a share of 65.3% in 2025. The dynamic nature of commercial spaces, with varying occupancy and usage patterns, requires flexible and adaptable solutions. Building automation systems provide the flexibility to adjust settings based on real-time data, allowing commercial buildings to respond to changing needs. That is where most adoptions regarding BAS will be focused, commercial buildings and their office spaces, retail environments, and hospitality sectors, which will have robotic automation or smart automation introduced to be on course with the other operations, ranking in reduced operational costs and being green.

Of those factors that most large companies, which include retail, are installing or are on course to install systems with AI-based BASs, there are energy efficiency, space optimization, and tenant experiences improvement. Smart home automation will undoubtedly attain mass acceptance and penetration in the residential segment. Households will follow suit regarding adopting BAS for energy management, security, and convenience.

Affordability and easy, effective integration with consumer devices will significantly drive growth in this sector. Building codes, smart city projects, and incentives for green buildings will certainly transform the BAS landscape with the initiatives of the government as these features are among the top reasons pushing for the adoption of BAS.

Thus, public buildings, schools, hospitals, and municipal offices will be retrofitted on a large scale to comply with emerging energy efficiency regulations. All applications will witness a steady increase in demand for cloud-based, AI-enabled, cyber-secure BAS solutions.

Prioritize AI-Driven and Cloud-Enabled BAS Solutions

Executives must invest in AI-powered automation and cloud-based business analytics systems (BAS) platforms to enhance energy efficiency, predictive maintenance, and real-time monitoring. Organizations should allocate R&D budgets toward machine learning algorithms, IoT integration, and cybersecurity fortifications to future-proof their BAS infrastructure.

Align with Regulatory and Sustainability Trends

With Western Europe tightening energy efficiency regulations and incentivizing smart buildings, companies must proactively adapt. Executives should work closely with policymakers, ensuring their BAS offerings comply with evolving standards while leveraging government incentives to maximize adoption in both new and retrofit projects.

Strengthen Ecosystem Partnerships for Industry Expansion

Stakeholders should focus on strategic alliances with OEMs, proptech firms, and energy service providers to enhance product interoperability and industry reach. Mergers, acquisitions, and co-development agreements with IoT and cybersecurity specialists will ensure a competitive edge in an evolving BAS landscape.

| Risk | Probability & Impact |

|---|---|

| Regulatory Uncertainty - Shifts in energy policies or carbon taxation frameworks could disrupt investment planning. | Medium Probability, High Impact |

| Cybersecurity Threats - Increased connectivity in BAS systems raises the risk of cyberattacks on critical infrastructure. | High Probability, High Impact |

| Supply Chain Disruptions - Semiconductor shortages and geopolitical tensions may impact the availability of hardware for automation systems. | Medium Probability, Medium Impact |

| Priority | Immediate Action |

|---|---|

| AI and IoT Integration | Run pilot projects to evaluate AI-driven BAS solutions in commercial buildings. |

| Regulatory Compliance Acceleration | Establish a task force to monitor EU green building policies and adjust BAS offerings accordingly. |

| Strategic Partnerships | Initiate discussions with cloud service providers and cybersecurity firms to enhance BAS capabilities. |

To stay ahead, companies must have to know about the future of the Western European BAS industry hinges on agility in technology adoption, regulatory alignment, and strategic partnerships. To stay ahead, stakeholders must scale AI and cloud-based automation solutions, ensuring they meet evolving energy mandates and cybersecurity standards.

Immediate steps should include investment in advanced analytics, pilot projects for AI-powered BAS, and partnerships with digital infrastructure providers. As regulatory landscapes tighten and smart buildings become the norm, companies that act decisively now will define the industry’s future, securing industry leadership and long-term profitability.

FMI Survey Results: Western Europe Building Automation System Market Dynamics based on Stakeholder Perspectives

(Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across manufacturers, distributors, ranchers, in Germany, the UK, France, BENELUX, Scandinavia, and Italy.)

A recent stakeholder survey conducted by Future Market Insights (FMI), encompassing over 220 decision-makers across OEMs, cold chain operators, facility managers, and large-scale HVAC contractors in Western Europe, has revealed layered insights into the Building Automation System Industry. The findings reflect emerging regulatory pressures, shifting customer priorities, and divergent readiness levels across nations like Germany, the UK, France, BENELUX, Scandinavia, and Italy.

The United Kingdom emerged as one of the most advanced industries for Building Automation Systems (BAS), with four out of ten surveyed stakeholders citing the country’s aggressive net-zero targets and ESG commitments as key drivers of adoption.

More than 30% of respondents from commercial real estate and corporate facilities confirmed that AI-driven and cloud-based BAS solutions are now a priority in office buildings, hotels, and retail spaces. However, nearly one-third of small and medium-sized businesses (SMBs) expressed concerns over high initial investment costs, stating that government incentives remain insufficient to make large-scale retrofits financially viable. Furthermore, over 25% of facility managers highlighted data security concerns as a major barrier, especially as BAS networks become increasingly interconnected with IT infrastructure.

In Germany, industrial players are leading the adoption of BAS, with over 40% of manufacturing and logistics respondents stating that energy-efficient automation is now a core investment priority. Industry 4.0 initiatives are accelerating demand, particularly in large-scale industrial complexes where predictive maintenance, IoT connectivity, and energy monitoring systems are being integrated.

However, three out of ten stakeholders in the public sector flagged bureaucratic hurdles and slow regulatory approvals as obstacles to wider adoption in municipal and government buildings. Cybersecurity remains a top concern, with nearly half of German respondents emphasizing the need for stricter data protection laws to prevent breaches in BAS networks. Additionally, 35% of surveyed companies cited integration challenges with legacy systems as a significant hurdle, delaying the transition to fully automated facilities.

France and the BENELUX region (Belgium, Netherlands, and Luxembourg) displayed strong momentum toward sustainability-driven BAS adoption, with more than one-third of respondents stating that compliance with EU energy efficiency mandates has made BAS implementation an urgent necessity. In France, 30% of stakeholders noted that government-backed smart city projects are fueling demand for intelligent automation in both commercial and public infrastructure.

Meanwhile, the Netherlands is leading the region in renewable energy integration, with over 40% of BAS users incorporating solar and wind energy management into their systems. However, in Belgium, 28% of facility managers expressed frustration over the high costs and complexity of retrofitting historical buildings, making BAS penetration slower in older urban areas.

The Scandinavian industry (Sweden, Norway, and Denmark) stood out as the most mature in terms of smart building adoption, with nearly 45% of surveyed companies confirming that BAS is already a standard in newly constructed buildings. In Norway and Sweden, over 50% of stakeholders cited strong government incentives and regulatory support as key enablers of smart automation.

However, three out of ten respondents in the region highlighted industry fragmentation and the lack of standardization as critical issues, making interoperability between different Building Automation Systems (BAS) platforms a challenge. In Denmark, where one-third of BAS deployments are in public sector buildings, supply chain delays and rising material costs were identified as barriers to faster expansion.

Across all surveyed industries, there was a clear consensus: regulatory frameworks, sustainability targets, and AI-driven automation will be the defining forces behind BAS adoption between 2025 and 2035. However, cost concerns, cybersecurity risks, and interoperability challenges remain key barriers.

Nearly 70% of stakeholders agreed that collaborations between BAS providers, cloud service companies, and energy regulators will be crucial to overcoming these hurdles. Despite these challenges, the momentum toward smart building automation is strong, with over 60% of stakeholders predicting that BAS adoption will become a mainstream requirement across commercial, industrial, and government buildings within the next decade.

| Company | Market Share (%) & Competitive Position |

|---|---|

| Siemens AG | 18.5% - Industry leader with strong dominance in industrial and commercial BAS solutions. Expanding AI-driven automation and cloud-based BAS offerings to reinforce leadership. |

| Schneider Electric | 16.2% - Strong presence in France, the UK, and Germany. Leading EcoStruxure Building suite drives sustainability-focused automation. |

| Johnson Controls | 14.8% - Major player in HVAC automation with widely used Metasys and OpenBlue platforms. Leveraging IoT and AI-based energy optimization for growth. |

| Honeywell International | 12.3% - Focused on cybersecurity-driven BAS solutions. Forge for Buildings platform enhances energy efficiency and security. |

| ABB Group | 10.6% - Specializing in lighting automation and building energy management systems (BEMS). Investing in AI-driven smart energy management. |

| Legrand | 7.9% - Leading smart lighting and electrical automation provider. Strong demand in France, Italy, and the Netherlands. |

| Distech Controls (Acuity Brands) | 5.4% - Fast-growing provider of open-protocol BAS solutions. Attracting clients with flexible, interoperable systems. |

| Bosch Building Technologies | 4.3% - Expanding in security and surveillance integration with BAS. AI-powered security automation is a growing segment. |

| Others (Regional & Niche Players) | 10.0% - Includes local BAS providers, IoT-based automation firms, and specialized security companies. Focused on niche industries and regulatory compliance. |

Key Developments in 2024

The United Kingdom’s Building Automation System (BAS) industry is projected to grow at a CAGR of 7.2% from 2025 to 2035, driven by strict regulatory mandates, sustainability initiatives, and rapid technological advancements. The UK government’s Energy Performance of Buildings Directive (EPBD) is a key driver, compelling commercial and residential buildings to integrate advanced automation systems for energy efficiency. London, Manchester, and Birmingham are leading the adoption of smart HVAC, lighting, and energy management solutions, with over 60% of new commercial developments incorporating automation by 2025.

Residential adoption is increasing, as the government’s low-carbon housing initiatives push for intelligent HVAC and lighting solutions. Retrofitting older buildings remains a major industry opportunity, especially as businesses seek compliance with stricter energy-efficiency standards. Security and surveillance automation is expanding, particularly in critical infrastructure and government buildings, due to heightened cybersecurity risks.

While high upfront costs and cybersecurity threats pose challenges, advancements in AI-driven automation, IoT-enabled predictive maintenance, and cloud-based BAS solutions are expected to sustain long-term growth. Over one-third of UK facility managers express concerns about data security in BAS, emphasizing the need for robust cybersecurity frameworks alongside automation adoption.

Germany’s Building Automation System (BAS) industry is set to expand at a CAGR of 7.5% from 2025 to 2035, fuelled by the country’s leadership in Industry 4.0, smart manufacturing, and sustainable energy transformation. With stringent energy regulations, including the KfW Energy Efficiency Program, the demand for automated HVAC, security, and energy management systems is surging across both commercial and residential sectors.

The country’s manufacturing and logistics industries are among the largest adopters of BAS, with over 40% of industrial facilities integrating smart automation for energy monitoring, predictive maintenance, and real-time facility management. Berlin, Munich, and Hamburg are witnessing a rapid transition to smart commercial buildings, while industrial hubs like Stuttgart and Frankfurt are driving demand for advanced automation in factory operations and warehouse management.

The residential sector is also experiencing growth, supported by initiatives promoting energy-efficient smart homes. The introduction of building energy performance certification is compelling property developers to integrate BAS solutions to comply with regulatory requirements. However, supply chain constraints-particularly in semiconductors and BAS hardware-pose a challenge, with nearly 30% of stakeholders citing hardware shortages as a concern. Nevertheless, increased investments in AI, IoT-based automation, and sustainable energy solutions are expected to mitigate these risks and sustain industry growth.

France’s Building Automation System (BAS) industry is projected to grow at a CAGR of 6.8% from 2025 to 2035, supported by the country’s aggressive push for smart energy solutions, carbon neutrality, and digital transformation in buildings. Paris, Lyon, and Marseille are at the forefront of smart building deployments, with commercial skyscrapers and mixed-use developments integrating BAS to meet sustainability goals.

The residential segment is seeing increased adoption of smart home technologies, particularly in high-rise apartment buildings. Energy price volatility in France has further heightened interest in automated energy-saving solutions, with one-third of real estate developers prioritizing BAS integration in new projects.

However, industry fragmentation and high initial investment costs are key barriers to widespread adoption. Cloud-based BAS platforms, AI-driven predictive maintenance, and wireless IoT-based automation are anticipated to play a crucial role in overcoming these challenges and expanding industry penetration.

The Building Automation System (BAS) industry in the BENELUX region is expected to grow at a CAGR of 6.5% from 2025 to 2035, as sustainability regulations and smart city initiatives gain traction. The Netherlands leads the region in BAS adoption, driven by government mandates for energy-efficient infrastructure and large-scale urban development projects. Belgium and Luxembourg are also witnessing increasing BAS integration, particularly in commercial real estate and government infrastructure projects.

The Amsterdam and Rotterdam metropolitan areas are embracing smart building solutions, with nearly 40% of newly developed commercial buildings incorporating automated HVAC, lighting, and security systems. The region’s data centre industry is another major driver of BAS adoption, as energy optimization and security automation become essential for sustainability compliance.

Challenges in the BENELUX industry include retrofitting older buildings and overcoming cybersecurity risks, with over 30% of facility managers citing concerns about data protection in automated systems. However, increasing government incentives, along with the deployment of cloud-based, AI-driven BAS solutions, are expected to accelerate growth in the region.

Sweden’s Building Automation System (BAS) industry is forecast to grow at a CAGR of 6.9% from 2025 to 2035, propelled by the country’s commitment to sustainability, smart city development, and digitalization in infrastructure. Sweden’s climate policies and energy-efficiency mandates are pushing the adoption of advanced HVAC, energy management, and smart lighting systems in both public and private buildings. Stockholm, Gothenburg, and Malmö are leading the smart building transformation, with a focus on integrating AI-driven automation for real-time energy monitoring and optimization.

The residential sector is also experiencing rapid BAS adoption, especially in high-density urban developments. With Sweden’s high energy costs, building owners are increasingly investing in intelligent automation to minimize power consumption. However, industry challenges include high installation costs and interoperability issues across different BAS platforms. To address these concerns, manufacturers are prioritizing standardized, open-source automation technologies that ensure seamless integration with existing infrastructure.

Norway’s Building Automation System (BAS) industry is anticipated to expand at a CAGR of 6.7% from 2025 to 2035, driven by the country’s leadership in renewable energy adoption, green buildings, and digital transformation in infrastructure. Government policies such as TEK17 energy efficiency standards are compelling commercial and residential buildings to integrate BAS for optimized power consumption.

Smart HVAC, building energy management systems (BEMS), and IoT-based security solutions are in high demand, particularly in the office and retail sectors. Despite its promising growth, the industry faces hurdles such as high labour costs and cybersecurity risks in cloud-connected automation systems. However, Norway’s strong government incentives for energy-efficient infrastructure and advancements in wireless IoT-based BAS are expected to drive steady adoption across industries.

Denmark’s Building Automation System (BAS) industry is projected to grow at a CAGR of 6.6% from 2025 to 2035, supported by government-led green building policies, net-zero energy mandates, and rapid digital transformation. Denmark’s focus on sustainable urban infrastructure is increasing demand for automated energy management, smart lighting, and intelligent security solutions in commercial and residential buildings. Copenhagen, Aarhus, and Odense are at the forefront of smart building development, with a strong emphasis on energy-efficient commercial spaces and smart residential communities.

Challenges such as high implementation costs and fragmented BAS standards persist, but open-source automation platforms and AI-driven optimization tools are helping bridge the gap. The market is also benefiting from public-private partnerships that drive innovation in intelligent, self-learning BAS systems for improved operational efficiency.

Security & Surveillance, HVAC, Lighting Solutions, Building Energy Management

Commercial, Residential, Government

The United Kingdom, Germany, France, Netherlands, Italy

The growth is driven by increasing energy efficiency regulations, rising demand for smart buildings, advancements in IoT and AI technologies, and the push for sustainability. Government incentives and the need for cost-effective building management solutions are also accelerating adoption.

Commercial real estate, healthcare, hospitality, manufacturing, and government infrastructure benefit significantly. These industries rely on automation to optimize energy consumption, enhance security, improve operational efficiency, and meet sustainability goals.

Innovations such as AI-driven predictive maintenance, cloud-based control systems, and IoT-enabled sensors are making automation more efficient and scalable. Wireless solutions and smart analytics are also enhancing real-time monitoring and control.

High upfront costs, interoperability issues between different automation platforms, cybersecurity concerns, and the complexity of retrofitting older buildings are key challenges. However, advancements in open-source protocols and cost reductions in smart technologies are addressing these barriers.

Strict energy efficiency mandates, carbon reduction policies, and government incentives for smart infrastructure are driving widespread adoption. Regulations like the EPBD in Europe and various national energy codes require buildings to integrate advanced automation for compliance.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Units) Forecast by Country, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by System, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Units) Forecast by System, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Units) Forecast by Application, 2019 to 2034

Table 7: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 8: UK Industry Analysis and Outlook Volume (Units) Forecast By Region, 2019 to 2034

Table 9: UK Industry Analysis and Outlook Value (US$ Million) Forecast by System, 2019 to 2034

Table 10: UK Industry Analysis and Outlook Volume (Units) Forecast by System, 2019 to 2034

Table 11: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2019 to 2034

Table 12: UK Industry Analysis and Outlook Volume (Units) Forecast by Application, 2019 to 2034

Table 13: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 14: Germany Industry Analysis and Outlook Volume (Units) Forecast By Region, 2019 to 2034

Table 15: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by System, 2019 to 2034

Table 16: Germany Industry Analysis and Outlook Volume (Units) Forecast by System, 2019 to 2034

Table 17: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2019 to 2034

Table 18: Germany Industry Analysis and Outlook Volume (Units) Forecast by Application, 2019 to 2034

Table 19: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 20: Italy Industry Analysis and Outlook Volume (Units) Forecast By Region, 2019 to 2034

Table 21: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by System, 2019 to 2034

Table 22: Italy Industry Analysis and Outlook Volume (Units) Forecast by System, 2019 to 2034

Table 23: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2019 to 2034

Table 24: Italy Industry Analysis and Outlook Volume (Units) Forecast by Application, 2019 to 2034

Table 25: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 26: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by System, 2019 to 2034

Table 27: Rest of Industry Analysis and Outlook Volume (Units) Forecast by System, 2019 to 2034

Table 28: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2019 to 2034

Table 29: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Application, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by System, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Country, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 5: Industry Analysis and Outlook Volume (Units) Analysis by Country, 2019 to 2034

Figure 6: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 7: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 8: Industry Analysis and Outlook Value (US$ Million) Analysis by System, 2019 to 2034

Figure 9: Industry Analysis and Outlook Volume (Units) Analysis by System, 2019 to 2034

Figure 10: Industry Analysis and Outlook Value Share (%) and BPS Analysis by System, 2024 to 2034

Figure 11: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by System, 2024 to 2034

Figure 12: Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 13: Industry Analysis and Outlook Volume (Units) Analysis by Application, 2019 to 2034

Figure 14: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 15: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 16: Industry Analysis and Outlook Attractiveness by System, 2024 to 2034

Figure 17: Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Figure 18: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 19: UK Industry Analysis and Outlook Value (US$ Million) by System, 2024 to 2034

Figure 20: UK Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 21: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 22: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 23: UK Industry Analysis and Outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 24: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 25: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 26: UK Industry Analysis and Outlook Value (US$ Million) Analysis by System, 2019 to 2034

Figure 27: UK Industry Analysis and Outlook Volume (Units) Analysis by System, 2019 to 2034

Figure 28: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by System, 2024 to 2034

Figure 29: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by System, 2024 to 2034

Figure 30: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 31: UK Industry Analysis and Outlook Volume (Units) Analysis by Application, 2019 to 2034

Figure 32: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 33: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 34: UK Industry Analysis and Outlook Attractiveness by System, 2024 to 2034

Figure 35: UK Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Figure 36: UK Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 37: Germany Industry Analysis and Outlook Value (US$ Million) by System, 2024 to 2034

Figure 38: Germany Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 39: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 40: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 41: Germany Industry Analysis and Outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 42: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 43: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 44: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by System, 2019 to 2034

Figure 45: Germany Industry Analysis and Outlook Volume (Units) Analysis by System, 2019 to 2034

Figure 46: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by System, 2024 to 2034

Figure 47: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by System, 2024 to 2034

Figure 48: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 49: Germany Industry Analysis and Outlook Volume (Units) Analysis by Application, 2019 to 2034

Figure 50: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 51: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 52: Germany Industry Analysis and Outlook Attractiveness by System, 2024 to 2034

Figure 53: Germany Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Figure 54: Germany Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 55: Italy Industry Analysis and Outlook Value (US$ Million) by System, 2024 to 2034

Figure 56: Italy Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 57: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 58: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 59: Italy Industry Analysis and Outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 60: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 61: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 62: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by System, 2019 to 2034

Figure 63: Italy Industry Analysis and Outlook Volume (Units) Analysis by System, 2019 to 2034

Figure 64: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by System, 2024 to 2034

Figure 65: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by System, 2024 to 2034

Figure 66: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 67: Italy Industry Analysis and Outlook Volume (Units) Analysis by Application, 2019 to 2034

Figure 68: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 69: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 70: Italy Industry Analysis and Outlook Attractiveness by System, 2024 to 2034

Figure 71: Italy Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Figure 72: Italy Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 73: France Industry Analysis and Outlook Value (US$ Million) by System, 2024 to 2034

Figure 74: France Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 75: France Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 76: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 77: France Industry Analysis and Outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 78: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 79: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 80: France Industry Analysis and Outlook Value (US$ Million) Analysis by System, 2019 to 2034

Figure 81: France Industry Analysis and Outlook Volume (Units) Analysis by System, 2019 to 2034

Figure 82: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by System, 2024 to 2034

Figure 83: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by System, 2024 to 2034

Figure 84: France Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 85: France Industry Analysis and Outlook Volume (Units) Analysis by Application, 2019 to 2034

Figure 86: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 87: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 88: France Industry Analysis and Outlook Attractiveness by System, 2024 to 2034

Figure 89: France Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Figure 90: France Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 91: Spain Industry Analysis and Outlook Value (US$ Million) by System, 2024 to 2034

Figure 92: Spain Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 93: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 94: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 95: Spain Industry Analysis and Outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 96: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 97: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 98: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by System, 2019 to 2034

Figure 99: Spain Industry Analysis and Outlook Volume (Units) Analysis by System, 2019 to 2034

Figure 100: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by System, 2024 to 2034

Figure 101: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by System, 2024 to 2034

Figure 102: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 103: Spain Industry Analysis and Outlook Volume (Units) Analysis by Application, 2019 to 2034

Figure 104: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 105: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 106: Spain Industry Analysis and Outlook Attractiveness by System, 2024 to 2034

Figure 107: Spain Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Figure 108: Spain Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 109: Rest of Industry Analysis and Outlook Value (US$ Million) by System, 2024 to 2034

Figure 110: Rest of Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 111: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by System, 2019 to 2034

Figure 112: Rest of Industry Analysis and Outlook Volume (Units) Analysis by System, 2019 to 2034

Figure 113: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by System, 2024 to 2034

Figure 114: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by System, 2024 to 2034

Figure 115: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 116: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Application, 2019 to 2034

Figure 117: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 118: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 119: Rest of Industry Analysis and Outlook Attractiveness by System, 2024 to 2034

Figure 120: Rest of Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Blotting Market is segmented by product, application and end user from 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

The thermal printing Market in Western Europe is segmented by printer type, printing technology, industry and country from 2025 to 2035.

Western Europe Smart Space Market Growth – Trends & Forecast 2025 to 2035

Western Europe On-Shelf Availability Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Submarine Cable Market - Growth & Forecast 2025 to 2035

Western Europe Women’s Footwear Market Analysis – Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA