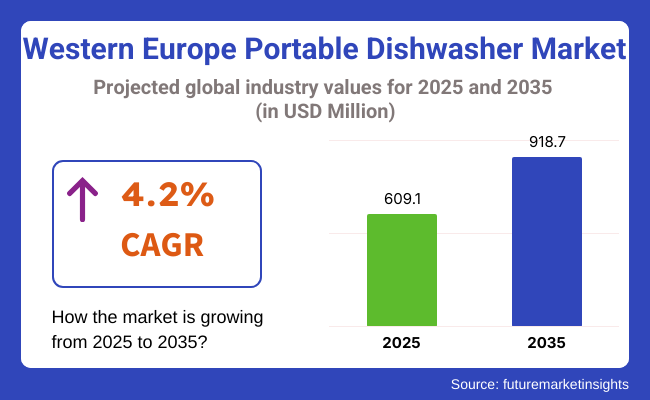

The Western Europe portable dishwasher market is poised to register a valuation of USD 609.1 million in 2025. The industry is slated to grow at 4.2% CAGR from 2025 to 2035, witnessing USD 918.7 million by 2035. The market is experiencing steady growth based on a number of interrelated lifestyle, demographic, and environmental trends.

Among the most significant drivers is the urbanization of the region and the increasing number of individuals who live in smaller houses or apartments, particularly in cities such as Paris, Berlin, and Amsterdam. These city residents frequently do not have room for full-size built-in dishwashers, and so compact, portable models are a functional and desirable choice.

With shrinking home sizes and increasing rental living, consumers are positively looking for flexible and space-efficient appliances that can quickly be shifted or stowed away.

Growth in dual-income households and active lifestyles is propelling demand for hassle-free kitchen solutions. People want to save time doing their laundry, and the portable dishwasher helps them by saving time washing dishes without having to renovate kitchens at a high expense.

Most new models also have energy- and water-saving features, which complement Western Europe's strong focus on environment-friendliness and sustainability. With eco-friendly designs and energy labels driving purchasing choices, portable dishwashers find favor with the green-conscious segment of consumers.

There is increased awareness and acceptability of non-traditional appliance forms. Younger generations, including millennials and Gen Z, are more receptive to unconventional appliances that are versatile and require minimal installation. E-commerce has also contributed by making a broad variety of models available, with extensive reviews and specifications assisting consumers in making informed decisions without the need for conventional retail experiences.

With ongoing advances in technology, contemporary portable dishwashers are becoming quieter, more energy-efficient, and design-sympathetic to contemporary European kitchen aesthetics, increasing their popularity in both rental and owner-occupied dwellings.

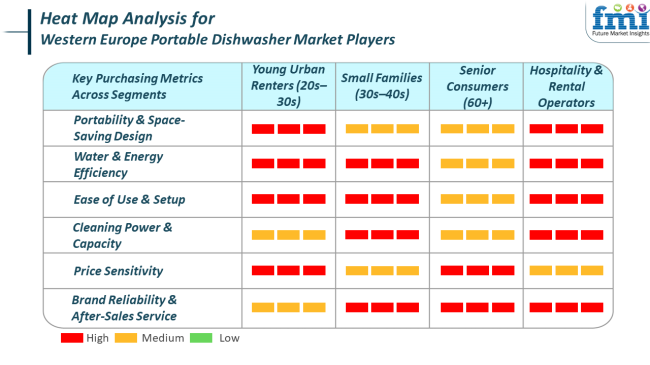

Western Europe's portable dishwasher market is developing at a consistent rate due to urbanization, declining household size, and rising rental homes throughout the cities. Buyers, such as young professionals and small households, are leaning toward compact, quick-to-fit devices that bring convenience without having to renovate their kitchens.

All these developments are propelled by active lifestyles, dual-income growth, and mounting importance on sustainability. Energy- and water-saving features, as well as smart technology integrations, are now major selling points. Moreover, the increased penetration of e-commerce sites has facilitated price comparison among models and informed purchases by consumers, driving market penetration even faster.

Variably across end-use segments, the residential segment is the largest, with customers favoring space-saving design, silent operation, greenness, and sleek looks. At the same time, the light commercial segment-boutique hotels, hostels, and small cafés-is also embracing portable dishwashers as flexible, space-saving back-of-house solutions.

In this segment, reliability, capacity, and quick wash cycles are the key considerations. Smart features, including app control and programmable timers, are becoming more important in both segments. With the consumer increasingly more informed and sustainable, buying preferences now significantly depend on energy rating, water efficiency, and adaptability of appliances, complementing a larger move toward flexible and sustainable living in the area.

During 2020 to 2024, the market for portable dishwashers in Western Europe saw a significant shift, which was primarily caused by lifestyle shifts and the effects of the COVID-19 pandemic. As more individuals stayed at home, there was an increased demand for home appliances that increased convenience and hygiene.

Portable dishwashers became popular as an efficient, non-invasive alternative for today's kitchens, particularly in leased or small residences where built-in units weren't an option. Environmental consciousness also caused consumers to prefer energy- and water-saving appliances, so manufacturers were challenged to innovate on eco-friendly features and smart technology.

The market also underwent a digital shift, with e-commerce becoming a leading vehicle for product discovery and acquisition, coupled with more educated and review-based purchasing behavior.

Forward-looking, the industry will change with increasing focus on smart integration, sustainable design, and customization of varied living areas. Portable dishwashers are expected to offer more sophisticated connectivity, such as voice assistant and home energy management system integration.

Sustainability will be a prime theme, driving development in recyclable materials, water reuse technologies, and ultra-low energy consumption. As housing in urban areas continues to dwindle, demand for ultra-compact and modular dishwasher units that can be easily customized to any layout will escalate.

In the restaurant segment, small food and hospitality enterprises will be looking for portable machines as cost-effective space-saving alternatives. The wider move towards minimalist, multi-functional living and eco-friendly consumerism is to influence design and marketing direction, placing portable dishwashers firmly on the agenda as a key appliance for future urban European life.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Consumers valued convenience and cleanliness as they spent more time at home, driving demand for convenient and easy-to-use dishwashing products. | Dishwashers will have improved connectivity, remote controls, and integration with smart home systems such as Alexa, Google Assistant, and energy management systems. |

| Customers became increasingly eco-conscious, preferring models with low energy and water usage, as well as eco-label certification. | Future models will probably employ recyclable materials, provide innovative water-saving technology, and comply with more stringent EU environmental and energy regulations. |

| Customers increasingly shopped online and made purchases, driven by reviews, comparison tools, and virtual demonstrations. | AI platforms will suggest models based on user behavior , home sizes, and environmental sustainability targets, making the purchasing experience more customized and streamlined. |

| Brands highlighted simplicity of installation, portability, and rentals- and small-space-friendly features. | Future models will be designed to be more adaptable to fit non-traditional kitchens and mobile living arrangements (e.g., tiny houses, RVs, modular apartments). |

Even with its steady expansion, Western Europe's portable dishwasher market is confronted with numerous risks that can influence its path. An instance is the market's high level of sensitivity to economic cycles. As portable dishwashers are regarded as discretionary products, any reduction in consumer spending-the result of inflation, increasing interest rates, or general economic uncertainty-can weaken market demand.

Also, steep energy costs in Western Europe could render even energy-saving appliances less desirable if consumers are more mindful of operating other household appliances. Financial pressure can also divert consumer attention to second-hand products or cheaper alternatives, impacting premium brands and innovation-driven models.

Another major threat is regulatory pressure and changing sustainability expectations. As environment awareness fuels innovation, more stringent EU regulations in the areas of energy labeling, recyclability, and product durability may raise manufacturing costs and entry barriers for the smaller players.

There is also the threat of technological obsolescence-now that smart home integration and AI-driven features become increasingly prevalent, older devices are likely to soon lag behind the expectations of the consumer, shortening product life and requiring higher replacement rates.

In Western Europe, the commercial use of portable dishwashers, while lower in volume than in the residential market, is gradually increasing, especially among small hospitality establishments. Boutique hotels, bed-and-breakfast establishments, food trucks, cafés, and coworking kitchen facilities are principal adopters.

These establishments usually have small spaces or temporary locations where it is not practical to install full-size, in-built dishwashing equipment. Portable dishwashers provide a versatile, plug-and-play option to maintain hygiene without needing expensive remodeling or plumbing updates.

They're particularly valuable when high-volume service times are hectic or in offsite catering installations where speedy, efficient washing of dishes is at a premium. Quiet operation, low energy consumption, and swift wash cycles appeal to environments that emphasize customer satisfaction.

The residential sector is the primary usage field for portable dishwashers in Western Europe. Urban living, compact dwellings, and the trend of renting lifestyles have established a robust demand for mobile, compact, and non-obtrusive kitchen appliances.

Portable dishwashers are suitable for households that lack in-built ones or do not wish to install permanent fixtures, and thus suit renters, students, and small families. Typical applications involve the daily washing of dishes for 1-3 users, providing an additional dishwashing solution for existing installations, or as a main appliance for studio flats and vacation homes.

With the growing concerns for sustainability among consumers, most home buyers are drawn to the water- and energy-saving aspects, as well as to newer features such as smartphone connectivity, eco modes, and space-saving constructions. Portable dishwashers are thus turning into a mass-market option for convenience-oriented, urban European families.

In Western Europe, online stores have become the principal distribution channel for portable dishwashers, especially in recent years. The transition to e-commerce has been driven by increasing demand for digital convenience, in-depth product comparison features, and doorstep delivery.

Customers increasingly turn to websites such as Amazon, AO, MediaMarkt, and manufacturer sites to be able to view more models, read user opinions, and compare major features such as energy consumption, size compatibility, and washing programs.

Websites tend to offer better prices, package deals, and generous returns, which tempt both first-time purchasers and technology-conscious households. As urban consumers drive demand for portable appliances, e-commerce is well-suited to meet their busy lifestyle and need for convenient shopping experiences. This platform has also gained traction after COVID-19, as online buying became increasingly normalized across all demographics.

The Western European market is competitive with a combination of regional players and global players driving innovation to address changing consumer requirements-particularly in small and environmentally friendly appliance design.

Although the old home appliance giants continue to be influencers, businesses such as Danby Appliances UK, Baridi, and ElectriQ have established solid niches by producing smart, energy-saving, and affordable portable dishwashers appropriate for European urban homes.

Start-ups like Loch Electronics and Think Gizmos provide cutting-edge design and miniaturized engineering to young consumers and small-space inhabitants, while existing niche producers like Clenaware Systems Ltd fulfill light commercial demands with stronger and more durable devices.

Distributors like GLOBAL Fliegenschmidt GmbH and firms like Neuhoff and Smad Appliances expand the scene even further with border-to-border access and affordability. Together, these companies drive market momentum by responding to Europe's sustainability objectives and need for high-performance, space-saving dishwashing technology.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Danby Appliances UK | 12-15% |

| ElectriQ | 10-12% |

| Baridi | 8-10% |

| Loch Electronics | 6-8% |

| Think Gizmos | 4-6% |

| Clenaware Systems Ltd | 4-6% |

| Smad Appliances | 3-5% |

| Neuhoff - Kitchen and Home Appliances | 2-4% |

| GLOBAL Fliegenschmidt GmbH | 2-4% |

| Company Name | Key Company Offerings and Activities |

|---|---|

| Danby Appliances UK | Produces wide selections of compact dishwashers suitable for small homes. Highly regarded for being reliable, easy to use, and boasting good retail reach across Europe. |

| ElectriQ | Renowned for its minimalist, space-saving, and cost-efficient models tailored to urban-style kitchens with innovative smart features and ecologically friendly technologies. |

| Baridi | Spearheads simple, compact dishwashers for use in inner city environments. Values quietness in operation, stylish appearance, and water-saving principles. |

| Loch Electronics | An innovation-driven, design-first firm that makes very compact, energy-saving dishwashers for tiny apartments, mobile homes, and environmentally minded consumers. |

| Think Gizmos | Makes very portable, simple-to-use dishwashers, catering to younger populations and small-apartment renters. Reputable for affordable models with rapid wash cycles. |

| Clenaware Systems Ltd | Is dedicated to producing tough, high-quality portable dishwashing systems suited to light commercial use such as cafes and hospitality environments. |

| Smad Appliances | Provides affordable and utilitarian models that target residential consumers seeking value. |

| Neuhoff - Kitchen and Home Appliances | Regional player offering reliable, mid-prize appliances focusing on durability and European design appeal. |

| GLOBAL Fliegenschmidt GmbH | Acts as a distributor and OEM supplier in Europe with a combination of locally manufactured and foreign dishwashing equipment. |

Strategic Outlook

The Western European portable dishwasher market is expected to grow sustainably, driven by the demand for space-saving, energy-efficient, and smart kitchen solutions. Market leaders like Danby, ElectriQ, and Baridi are consolidating their market position through diversification of products and retail alliances.

On the other hand, start-ups like Loch Electronics are shaking up the market with innovation that is specific to today's hectic lifestyles. Light commercial applications keep growing, supported by strong performers like Clenaware Systems. In the future, success will depend on how well brands embed sustainability, connectivity, and design flexibility into their offerings.

As digital shopping broadens and smart home penetration increases, manufacturers will need to be nimble and customer-centric to compete in this changing environment.Key Industry Players

In terms of application, the industry is bifurcated into commercial and residential.

With respect to capacity, the market is classified into 10-15 place settings and 5-19 place settings.

Based on distribution channel, the industry is classified into exclusive stores, multi-brand stores, online stores, others, and wholesalers/distributors.

On the basis of price range, the industry is divided into low, high, and medium.

By country, the industry is segregated into the UK, Germany, Italy, France, Spain, and the rest of Europe.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Units) Forecast by Country, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Units) Forecast by Application, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 10: Industry Analysis and Outlook Volume (Units) Forecast by Price Range, 2018 to 2033

Table 11: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 12: UK Industry Analysis and Outlook Volume (Units) Forecast By Region, 2018 to 2033

Table 13: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: UK Industry Analysis and Outlook Volume (Units) Forecast by Application, 2018 to 2033

Table 15: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 16: UK Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2018 to 2033

Table 17: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 18: UK Industry Analysis and Outlook Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 19: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 20: UK Industry Analysis and Outlook Volume (Units) Forecast by Price Range, 2018 to 2033

Table 21: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 22: Germany Industry Analysis and Outlook Volume (Units) Forecast By Region, 2018 to 2033

Table 23: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Germany Industry Analysis and Outlook Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 26: Germany Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2018 to 2033

Table 27: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 28: Germany Industry Analysis and Outlook Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 29: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 30: Germany Industry Analysis and Outlook Volume (Units) Forecast by Price Range, 2018 to 2033

Table 31: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 32: Italy Industry Analysis and Outlook Volume (Units) Forecast By Region, 2018 to 2033

Table 33: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 34: Italy Industry Analysis and Outlook Volume (Units) Forecast by Application, 2018 to 2033

Table 35: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 36: Italy Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2018 to 2033

Table 37: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 38: Italy Industry Analysis and Outlook Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 39: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 40: Italy Industry Analysis and Outlook Volume (Units) Forecast by Price Range, 2018 to 2033

Table 41: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 42: France Industry Analysis and Outlook Volume (Units) Forecast By Region, 2018 to 2033

Table 43: France Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 44: France Industry Analysis and Outlook Volume (Units) Forecast by Application, 2018 to 2033

Table 45: France Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 46: France Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2018 to 2033

Table 47: France Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: France Industry Analysis and Outlook Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 49: France Industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 50: France Industry Analysis and Outlook Volume (Units) Forecast by Price Range, 2018 to 2033

Table 51: Spain Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 52: Spain Industry Analysis and Outlook Volume (Units) Forecast By Region, 2018 to 2033

Table 53: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: Spain Industry Analysis and Outlook Volume (Units) Forecast by Application, 2018 to 2033

Table 55: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 56: Spain Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2018 to 2033

Table 57: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 58: Spain Industry Analysis and Outlook Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 59: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 60: Spain Industry Analysis and Outlook Volume (Units) Forecast by Price Range, 2018 to 2033

Table 61: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Application, 2018 to 2033

Table 63: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 64: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2018 to 2033

Table 65: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 66: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 67: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 68: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Price Range, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Capacity, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Price Range, 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 7: Industry Analysis and Outlook Volume (Units) Analysis by Country, 2018 to 2033

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 11: Industry Analysis and Outlook Volume (Units) Analysis by Application, 2018 to 2033

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 15: Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Industry Analysis and Outlook Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 23: Industry Analysis and Outlook Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 26: Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 27: Industry Analysis and Outlook Attractiveness by Capacity, 2023 to 2033

Figure 28: Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 29: Industry Analysis and Outlook Attractiveness by Price Range, 2023 to 2033

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 31: UK Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 32: UK Industry Analysis and Outlook Value (US$ Million) by Capacity, 2023 to 2033

Figure 33: UK Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 34: UK Industry Analysis and Outlook Value (US$ Million) by Price Range, 2023 to 2033

Figure 35: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 36: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 37: UK Industry Analysis and Outlook Volume (Units) Analysis By Region, 2018 to 2033

Figure 38: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 39: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 40: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 41: UK Industry Analysis and Outlook Volume (Units) Analysis by Application, 2018 to 2033

Figure 42: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 43: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 44: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 45: UK Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 46: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 47: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 48: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 49: UK Industry Analysis and Outlook Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 50: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 51: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 52: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 53: UK Industry Analysis and Outlook Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 54: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 55: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 56: UK Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 57: UK Industry Analysis and Outlook Attractiveness by Capacity, 2023 to 2033

Figure 58: UK Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 59: UK Industry Analysis and Outlook Attractiveness by Price Range, 2023 to 2033

Figure 60: UK Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 61: Germany Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 62: Germany Industry Analysis and Outlook Value (US$ Million) by Capacity, 2023 to 2033

Figure 63: Germany Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 64: Germany Industry Analysis and Outlook Value (US$ Million) by Price Range, 2023 to 2033

Figure 65: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 66: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 67: Germany Industry Analysis and Outlook Volume (Units) Analysis By Region, 2018 to 2033

Figure 68: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 69: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 70: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 71: Germany Industry Analysis and Outlook Volume (Units) Analysis by Application, 2018 to 2033

Figure 72: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 75: Germany Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 76: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 77: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 78: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 79: Germany Industry Analysis and Outlook Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 80: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 81: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 82: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 83: Germany Industry Analysis and Outlook Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 84: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 85: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 86: Germany Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 87: Germany Industry Analysis and Outlook Attractiveness by Capacity, 2023 to 2033

Figure 88: Germany Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 89: Germany Industry Analysis and Outlook Attractiveness by Price Range, 2023 to 2033

Figure 90: Germany Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 91: Italy Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 92: Italy Industry Analysis and Outlook Value (US$ Million) by Capacity, 2023 to 2033

Figure 93: Italy Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 94: Italy Industry Analysis and Outlook Value (US$ Million) by Price Range, 2023 to 2033

Figure 95: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 96: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 97: Italy Industry Analysis and Outlook Volume (Units) Analysis By Region, 2018 to 2033

Figure 98: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 99: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 100: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 101: Italy Industry Analysis and Outlook Volume (Units) Analysis by Application, 2018 to 2033

Figure 102: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 103: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 104: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 105: Italy Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 106: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 107: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 108: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 109: Italy Industry Analysis and Outlook Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 110: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 111: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 112: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 113: Italy Industry Analysis and Outlook Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 114: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 115: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 116: Italy Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 117: Italy Industry Analysis and Outlook Attractiveness by Capacity, 2023 to 2033

Figure 118: Italy Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 119: Italy Industry Analysis and Outlook Attractiveness by Price Range, 2023 to 2033

Figure 120: Italy Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 121: France Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 122: France Industry Analysis and Outlook Value (US$ Million) by Capacity, 2023 to 2033

Figure 123: France Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: France Industry Analysis and Outlook Value (US$ Million) by Price Range, 2023 to 2033

Figure 125: France Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 126: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 127: France Industry Analysis and Outlook Volume (Units) Analysis By Region, 2018 to 2033

Figure 128: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 129: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 130: France Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 131: France Industry Analysis and Outlook Volume (Units) Analysis by Application, 2018 to 2033

Figure 132: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 133: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 134: France Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 135: France Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 136: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 137: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 138: France Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 139: France Industry Analysis and Outlook Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 140: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 141: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 142: France Industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 143: France Industry Analysis and Outlook Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 144: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 145: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 146: France Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 147: France Industry Analysis and Outlook Attractiveness by Capacity, 2023 to 2033

Figure 148: France Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 149: France Industry Analysis and Outlook Attractiveness by Price Range, 2023 to 2033

Figure 150: France Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 151: Spain Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 152: Spain Industry Analysis and Outlook Value (US$ Million) by Capacity, 2023 to 2033

Figure 153: Spain Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 154: Spain Industry Analysis and Outlook Value (US$ Million) by Price Range, 2023 to 2033

Figure 155: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 156: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 157: Spain Industry Analysis and Outlook Volume (Units) Analysis By Region, 2018 to 2033

Figure 158: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 159: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 160: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 161: Spain Industry Analysis and Outlook Volume (Units) Analysis by Application, 2018 to 2033

Figure 162: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 163: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 164: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 165: Spain Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 166: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 167: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 168: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 169: Spain Industry Analysis and Outlook Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 170: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 171: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 172: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 173: Spain Industry Analysis and Outlook Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 174: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 175: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 176: Spain Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 177: Spain Industry Analysis and Outlook Attractiveness by Capacity, 2023 to 2033

Figure 178: Spain Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 179: Spain Industry Analysis and Outlook Attractiveness by Price Range, 2023 to 2033

Figure 180: Spain Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 181: Rest of Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 182: Rest of Industry Analysis and Outlook Value (US$ Million) by Capacity, 2023 to 2033

Figure 183: Rest of Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 184: Rest of Industry Analysis and Outlook Value (US$ Million) by Price Range, 2023 to 2033

Figure 185: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 186: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Application, 2018 to 2033

Figure 187: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 188: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 189: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 190: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 191: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 192: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 193: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 194: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 195: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 196: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 197: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 198: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 199: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 200: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 201: Rest of Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 202: Rest of Industry Analysis and Outlook Attractiveness by Capacity, 2023 to 2033

Figure 203: Rest of Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 204: Rest of Industry Analysis and Outlook Attractiveness by Price Range, 2023 to 2033

The industry is expected to reach USD 609.1 million in 2025.

The market is projected to witness USD 918.7 million by 2035.

The industry is slated to capture 4.2% CAGR during the study period.

They are widely used for commercial applications.

Leading companies include Clenaware Systems Ltd, Loch Electronics, Smad Appliances, Think Gizmos, Danby Appliances UK, Baridi, ElectriQ, Neuhoff - Kitchen and Home Appliances, and GLOBAL Fliegenschmidt GmbH.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA