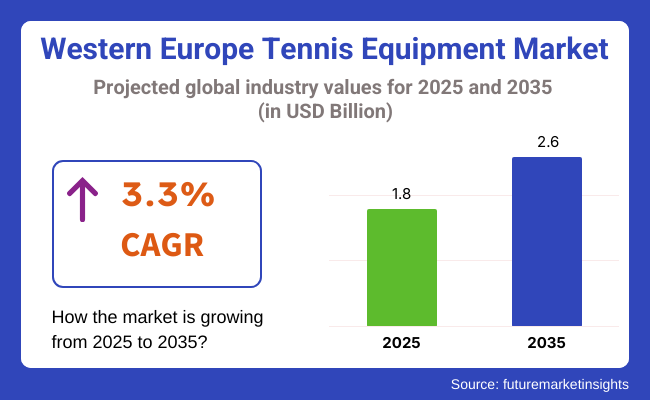

The Western Europe tennis equipment market is poised to register a valuation of USD 1.8 billion in 2025. The industry is slated to grow at 3.3% CAGR from 2025 to 2035, witnessing USD 2.6 billion by 2035. The market is growing steadily on the back of several factors including the growing interest in tennis, growing health and fitness awareness among consumers, and advances in sports equipment technology.

Tennis has been a favorite game in nations such as the United Kingdom, France, Germany, and Spain with an active training infrastructure as well as event infrastructure. This established interest is fostering a steady demand for tennis equipment, from racquets to shoes and accessories.

Among the main drivers of market growth is increasing emphasis on health and fitness. As individuals become increasingly aware of the significance of exercise, tennis is perceived to be a sport for all ages, catering to cardiovascular fitness and social interaction. Tennis academies, clubs, and leisure centers throughout Western Europe are observing a rise in membership, which translates directly into greater sales of tennis equipment.

Most importantly, numerous individuals are growing more attracted to individual sports such as tennis, which provide a combination of personal accomplishment and social interaction.

Technological innovation in tennis equipment also ranks highly as a growth driver. New racquets, for instance, are now lighter, stronger, and provide improved performance due to material developments like graphite, carbon fiber, and titanium.

These technologies render tennis more attractive to experienced players and newcomers alike, who are attracted to gear that improves their game. Furthermore, the creation of intelligent tennis equipment that monitors performance and offers data analysis is appealing to a technology-conscious generation of athletes

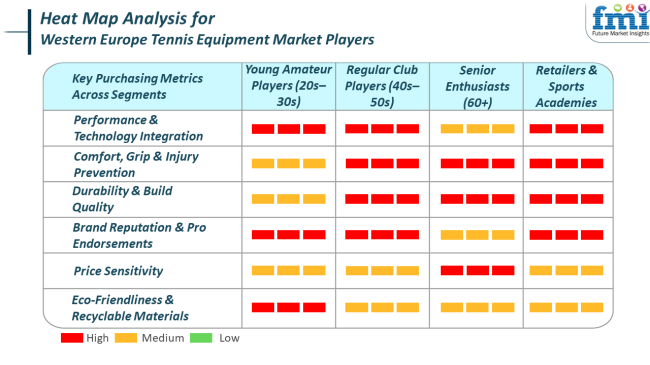

Across the Western European tennis equipment market, various end-use segments have differing buying criteria based on their particular requirements. Educational institutions will prioritize low-cost, robust, and simple-to-use equipment that is capable of withstanding intense usage.

Price sensitivity is paramount in this case, as schools tend to make bulk purchases. For the hospitality sector, which values the experiences of guests, premium, high-end equipment is sought after, prioritizing design, performance, and luxury. Likewise, families spend on multi-purpose, lightweight, and inexpensive tennis equipment for leisure use only, with ease of use and durability being important factors.

Offices and display rooms tend to purchase mid-range equipment for novice or intermediate players, with ease of maintenance and versatility being important considerations. Restaurants, on the other hand, concentrate on fashionable, high-end equipment that adds to the diners' leisure experience, with style and brand image being important determinants of choice.

Salons and spas, though not typical markets for tennis gear, are increasingly adding tennis as a recreational activity, usually choosing high-end products that focus on comfort and brand status. Simultaneously, other end-use segments such as sports clubs and recreational facilities seek cost-effective, durable tennis equipment appropriate for a broad spectrum of players.

Across all these segments, buying decisions are influenced by a combination of functionality, quality, cost, and the particular needs of each consumer group, with some emphasizing performance, while others emphasize appearance or long-term value.

Between 2020 and 2024, the tennis gear market has seen dramatic changes due to the changing consumer base, technological innovations, and the pandemic globally. The COVID-19 pandemic, which initially impacted manufacturing and supply chains, ultimately created a boom in interest in outdoor sports, such as tennis, as individuals looked for safer, socially distanced activities.

This change led to higher participation in tennis, which created demand for recreational as well as professional-level equipment. The sector witnessed growth in demand for beginner-level tennis equipment as fresh entrants learned the game. There was also increased focus on online interaction, with companies integrating e-commerce sites and online training aids to address stay-at-home customers. The growing interest in health and fitness also further accelerated interest in tennis as a sporting activity that improves general health.

In the years leading up to 2025 to 2035, a number of important trends are likely to define the future of the tennis equipment market. With heightened consumer awareness regarding sustainability, there will be a strong move toward more environmentally friendly products.

Companies will probably emphasize utilizing sustainable materials for tennis racquets, strings, and accessories, as well as more eco-friendly production processes. Technological advancements will also be instrumental, with intelligent tennis gear, including racquets that monitor performance and offer instant feedback, becoming increasingly mainstream. These technologies will appeal to professional players who want to maximize their game as well as recreational players who want tailored insights.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 (Short-Term Shifts) | 2025 to 2035 (Long-Term Trends) |

|---|---|

| The COVID-19 pandemic created an upsurge in interest in outdoor sports, including tennis. This was fueled by the demand for socially distanced recreation. New entrants joined the game as tennis proved to be a great individual exercise sport. | With growing environmental concerns, sustainability will be at the forefront. Tennis companies will concentrate on manufacturing environment-friendly equipment with the use of sustainable materials such as recycled plastics, natural fibers, and biodegradable parts. |

| Under restrictions on physical sales, tennis equipment firms heavily invested in e-commerce and digital advertising platforms. Online communities for tennis players and virtual coaching tools were common. | Tennis gear in the future will incorporate more intelligent technologies. Intelligently integrated racquets with performance-monitoring sensors and VR or AR tools for training are some of the products that will redefine consumer experience. |

| The expansion of amateur players resulted in a higher need for beginner, low-cost tennis gear. Manufacturers concentrated on making their products more accessible to newcomers to the sport. | As players gain experience, demand for high-end and customized tennis gear will increase. Players will demand top-of-the-line gear made specifically to their individual requirements and preferences. |

| The lockdowns drove consumers to spend on tennis gear for home use, with heightened demand for personal fitness. Consumers wanted equipment that was convenient to store and use in smaller spaces. | Retailers will shift toward experience-based shopping. Technologies such as virtual product trials, bespoke fittings, and immersive in-store experiences will become mainstream, supplemented by AR and VR technologies. |

The Western European tennis gear market, although set to grow steadily, is subject to a number of risks that may affect its performance in the short and long term. One of the key risks is the economic uncertainty, driven mainly by inflation, supply chain disruptions, and shifts in consumer spending patterns.

In times of economic downturn or recession, discretionary spending tends to fall, resulting in lower demand for non-essential items such as high-end tennis gear. The current inflation pressures can also cause the price of raw materials and production to escalate, which will result in increasing the price of products, likely discouraging price-conscious consumers.

Another key risk is the volatile exchange rates and trade policies, especially as a result of Brexit and its aftereffects on the United Kingdom and other EU markets. Volatility in currencies can influence pricing strategies and profit margins for manufacturers, particularly those that import components or finished goods from outside Europe. Also, the effect of trade restrictions or tariffs could disrupt the free movement of tennis equipment across borders, resulting in possible supply shortages or delays.

Racquets have undergone considerable development over the years, with companies constantly enhancing their design and material. High-performance racquets today that are made of carbon fiber, graphite, and other light materials offer greater control, power, and agility. Such advancements are attractive to both amateur and professional players who wish to improve their game. Furthermore, racquets also come in different models for varying playing styles, ranging from beginners to experts, which increases their market.

Also, Western European popularity for tennis, fuelled by activities such as Wimbledon and a dominant tennis culture within nations such as France, Spain, and the United Kingdom, maintains demand for racquets ever-present. Recreational centres, schools, and tennis clubs also need racquets in mass quantities, making them even more ubiquitous.

In contrast to other gear such as balls or bags, which are replaced periodically or are secondary in nature, racquets are a player's long-term investment, thus the most critical and commonly used product in the market.

Composites are the widely utilized material in the Korean market for tennis equipment, as a result of their high strength, light weight, and resistance to wear and tear. Composites, specifically carbon fiber and graphite, have also emerged as the preferred material as they can provide high performance but at lighter weights compared to other materials such as wood or metal. The need for high-strength and light materials is important because these help players have greater control and strength but not at the expense of maneuverability.

The use of composite materials in Korea is also consistent with Korea's technology and innovation drive because composite materials can be engineered for certain performance attributes. Carbon fiber and graphite racquets are renowned for their shock absorption, stiffness, and resilience, which minimize the stress on players' arms, a key characteristic for both amateur and professional players.

The materials are also extremely adaptable, enabling manufacturers to tailor racquet performance to suit various player preferences, including control, power, or spin.

The Western European market is competitive, with a combination of regional players and multinational corporations that fuel innovation and address diverse consumer tastes. Dominant global players like Amer Sports Corporation, Head N.V., and Yonex Co., Ltd. control the market with large portfolios comprising racquets, balls, footwear, and clothing.

These companies are able to capitalize on the market presence they have established and their robust networks of distribution throughout the region, making their products available to both professional and amateur players. Other global players like Babolat, Dunlop Sports Co., Ltd., and Tecnifibre follow them and strive to innovate further using new product technology, maintaining high performance standards in their equipment products.

Smaller firms like Oliver Sports & Squash GmbH and Solinco also help underpin the industry with specialized products meeting specific player requirements, emphasizing customization and expert-level gear for expert or professional players.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Amer Sports Corporation | 10-12% |

| Head N.V. | 12-15% |

| Dunlop Sports Co., Ltd. | 8-10% |

| Tecnifibre | 6-8% |

| Oliver Sports & Squash GmbH. | 2-4% |

| Babolat | 15-18% |

| Adidas AG | 4-6% |

| Solinco | 2-4% |

| Volkl Int. GmbH | 4-6% |

| Yonex Co., Ltd. | 18-22% |

| NISHOHI | 1-3% |

| Bridgestone | 2-4% |

| Mizuno Corporation | 3-5% |

| Tachikara | 1-2% |

| XIOM Co., Ltd | 1-2% |

| Seino Logix Co., Ltd | 1-2% |

| Molax Line Ltd. | 1-2% |

| Amer Sports Korea | 3-5% |

| F&F | 2-4% |

| Company Name | Key Company Offerings and Activities |

|---|---|

| Amer Sports Corporation | Recognized for its varied brands such as Wilson, Amer Sports provides racquets, balls, and clothing, targeting both amateur and professional players. |

| Head N.V. | Specializes in high-performance tennis racquets and accessories, developing new materials and technologies to enhance player performance. |

| Dunlop Sports Co., Ltd. | Provides a variety of racquets, tennis balls, and accessories, especially targeting performance and durability for professionals and enthusiasts alike. |

| Tecnifibre | Tecnifibre is famous for high-quality racquets, strings, and accessories. It specializes in selling advanced players premium equipment for precision. |

| Oliver Sports & Squash GmbH. | Deals with advanced squash and tennis equipment specialized in high-performance equipment for top athletes. |

| Babolat | Specializes in leading tennis racquets, strings, and accessories and fuses innovation with player-driven design to suit a range of players' needs. |

| Adidas AG | Adidas provides a variety of tennis shoes and clothing, emphasizing comfort, performance, and style for recreational and professional players alike. |

| Solinco | With a specialization in strings and accessories, Solinco provides products that cater to players looking for control and spin with emphasis on high-grade materials. |

| Volkl Int. GmbH | With a reputation for racquets and strings, Volkl integrates advanced technologies to develop products that cater to amateurs and professionals alike. |

| Yonex Co., Ltd. | Yonex is a leading brand, producing high-performance racquets and clothing with an emphasis on innovative materials and technology. |

| NISHOHI | Specializes in value tennis equipment for entry-level and intermediate players, with an emphasis on value for money. |

| Bridgestone | Reputed for tennis balls and accessories, Bridgestone focuses on quality and consistency in its products. |

| Mizuno Corporation | Manufactures tennis shoes, racquets, and clothes, focusing on comfort and ruggedness with considerable strength in Asia. |

| Tachikara | Makes tennis balls and accessories under its brand, which is reputable for tough but consistent products that cater to everyday players. |

| XIOM Co., Ltd. | Delivers high-grade racquets and strings, centering on designing for experienced players. |

| Seino Logix Co., Ltd | One of the minor players within the tennis gear market, Seino Logix is a specialty firm catering to niche markets. |

| Molax Line Ltd. | Deals in budget tennis accessories and equipment for beginners. |

| Amer Sports Korea | Offers a variety of tennis equipment in Korea, using its parent organization's international presence and brand name. |

| F&F | Deals in a variety of budget tennis equipment and clothing, emphasizing value for money. |

Strategic Outlook

The Western European market for tennis equipment is highly competitive with multinational firms such as Yonex, Babolat, and Head N.V. leading with their cutting-edge technologies and extensive market coverage. These firms keep refining themselves, serving both professional and amateur players with high-end equipment.

Specialist firms like Solinco and Tecnifibre offer specialist products, targeting experienced players looking for specialist equipment for improved control and accuracy. With growing consumer demand for performance-driven and sustainable products, brands are placing emphasis on innovation, customizations, and sustainability practices to sustain their competitive advantage.

As the market continues to expand, players in all segments will have to be responsive to shifting consumer tastes by emphasizing premium products and digital experiences that resonate with the shifting fitness and wellness trends of Western Europe.

In terms of product type, the industry is classified into racquets, balls, apparel, footwear, ball machines, tennis bags, and other accessories.

With respect to material, the industry is divided into composites, metallic, and other materials.

Based on buyer type, the industry is classified into individual and institutional.

In terms of sales channel, the industry is classified into independent sports outlets, sports retail chains, franchised sports outlets, direct-to-customer online channels, direct-to-customer institutional channels, modern trade channels, and third-party online channels.

By country, the industry is segregated into the UK, Germany, Italy, France, Spain, and the rest of Europe.

The industry is expected to reach USD 1.8 billion in 2025.

The market is projected to witness USD 2.6 billion by 2035.

The industry is slated to capture 3.3% CAGR during the study period.

Racquets are widely sold.

Leading companies include Amer Sports Corporation, Head N.V., Dunlop Sports Co., Ltd., Tecnifibre, Oliver Sports & Squash GmbH., Babolat, Adidas AG, Solinco, Volkl Int. GmbH, Yonex Co., Ltd., NISHOHI, Bridgestone, Mizuno Corporation, Tachikara, XIOM Co., Ltd, Seino Logix Co., Ltd, Molax Line Ltd., Amer Sports Korea, and F&F.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Units) Forecast by Country, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Units) Forecast by Material, 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Buyer Type, 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Units) Forecast by Buyer Type, 2018 to 2033

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: United Kingdom Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 12: United Kingdom Industry Analysis and Outlook Volume (Units) Forecast By Region, 2018 to 2033

Table 13: United Kingdom Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: United Kingdom Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: United Kingdom Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2018 to 2033

Table 16: United Kingdom Industry Analysis and Outlook Volume (Units) Forecast by Material, 2018 to 2033

Table 17: United Kingdom Industry Analysis and Outlook Value (US$ Million) Forecast by Buyer Type, 2018 to 2033

Table 18: United Kingdom Industry Analysis and Outlook Volume (Units) Forecast by Buyer Type, 2018 to 2033

Table 19: United Kingdom Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: United Kingdom Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 22: Germany Industry Analysis and Outlook Volume (Units) Forecast By Region, 2018 to 2033

Table 23: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Germany Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2018 to 2033

Table 26: Germany Industry Analysis and Outlook Volume (Units) Forecast by Material, 2018 to 2033

Table 27: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Buyer Type, 2018 to 2033

Table 28: Germany Industry Analysis and Outlook Volume (Units) Forecast by Buyer Type, 2018 to 2033

Table 29: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Germany Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 32: Italy Industry Analysis and Outlook Volume (Units) Forecast By Region, 2018 to 2033

Table 33: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Italy Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2018 to 2033

Table 36: Italy Industry Analysis and Outlook Volume (Units) Forecast by Material, 2018 to 2033

Table 37: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Buyer Type, 2018 to 2033

Table 38: Italy Industry Analysis and Outlook Volume (Units) Forecast by Buyer Type, 2018 to 2033

Table 39: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Italy Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 42: France Industry Analysis and Outlook Volume (Units) Forecast By Region, 2018 to 2033

Table 43: France Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: France Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: France Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2018 to 2033

Table 46: France Industry Analysis and Outlook Volume (Units) Forecast by Material, 2018 to 2033

Table 47: France Industry Analysis and Outlook Value (US$ Million) Forecast by Buyer Type, 2018 to 2033

Table 48: France Industry Analysis and Outlook Volume (Units) Forecast by Buyer Type, 2018 to 2033

Table 49: France Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: France Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: Spain Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 52: Spain Industry Analysis and Outlook Volume (Units) Forecast By Region, 2018 to 2033

Table 53: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: Spain Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2018 to 2033

Table 56: Spain Industry Analysis and Outlook Volume (Units) Forecast by Material, 2018 to 2033

Table 57: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Buyer Type, 2018 to 2033

Table 58: Spain Industry Analysis and Outlook Volume (Units) Forecast by Buyer Type, 2018 to 2033

Table 59: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: Spain Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 62: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 63: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2018 to 2033

Table 64: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Material, 2018 to 2033

Table 65: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Buyer Type, 2018 to 2033

Table 66: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Buyer Type, 2018 to 2033

Table 67: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 68: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Material, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Buyer Type, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 7: Industry Analysis and Outlook Volume (Units) Analysis by Country, 2018 to 2033

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 15: Industry Analysis and Outlook Volume (Units) Analysis by Material, 2018 to 2033

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by Buyer Type, 2018 to 2033

Figure 19: Industry Analysis and Outlook Volume (Units) Analysis by Buyer Type, 2018 to 2033

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Buyer Type, 2023 to 2033

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Buyer Type, 2023 to 2033

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 27: Industry Analysis and Outlook Attractiveness by Material, 2023 to 2033

Figure 28: Industry Analysis and Outlook Attractiveness by Buyer Type, 2023 to 2033

Figure 29: Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 31: United Kingdom Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: United Kingdom Industry Analysis and Outlook Value (US$ Million) by Material, 2023 to 2033

Figure 33: United Kingdom Industry Analysis and Outlook Value (US$ Million) by Buyer Type, 2023 to 2033

Figure 34: United Kingdom Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: United Kingdom Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 36: United Kingdom Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 37: United Kingdom Industry Analysis and Outlook Volume (Units) Analysis By Region, 2018 to 2033

Figure 38: United Kingdom Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 39: United Kingdom Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 40: United Kingdom Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: United Kingdom Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: United Kingdom Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: United Kingdom Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: United Kingdom Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 45: United Kingdom Industry Analysis and Outlook Volume (Units) Analysis by Material, 2018 to 2033

Figure 46: United Kingdom Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 47: United Kingdom Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 48: United Kingdom Industry Analysis and Outlook Value (US$ Million) Analysis by Buyer Type, 2018 to 2033

Figure 49: United Kingdom Industry Analysis and Outlook Volume (Units) Analysis by Buyer Type, 2018 to 2033

Figure 50: United Kingdom Industry Analysis and Outlook Value Share (%) and BPS Analysis by Buyer Type, 2023 to 2033

Figure 51: United Kingdom Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Buyer Type, 2023 to 2033

Figure 52: United Kingdom Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: United Kingdom Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: United Kingdom Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: United Kingdom Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: United Kingdom Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 57: United Kingdom Industry Analysis and Outlook Attractiveness by Material, 2023 to 2033

Figure 58: United Kingdom Industry Analysis and Outlook Attractiveness by Buyer Type, 2023 to 2033

Figure 59: United Kingdom Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 60: United Kingdom Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 61: Germany Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Germany Industry Analysis and Outlook Value (US$ Million) by Material, 2023 to 2033

Figure 63: Germany Industry Analysis and Outlook Value (US$ Million) by Buyer Type, 2023 to 2033

Figure 64: Germany Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 66: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 67: Germany Industry Analysis and Outlook Volume (Units) Analysis By Region, 2018 to 2033

Figure 68: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 69: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 70: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Germany Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 75: Germany Industry Analysis and Outlook Volume (Units) Analysis by Material, 2018 to 2033

Figure 76: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 77: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 78: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Buyer Type, 2018 to 2033

Figure 79: Germany Industry Analysis and Outlook Volume (Units) Analysis by Buyer Type, 2018 to 2033

Figure 80: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Buyer Type, 2023 to 2033

Figure 81: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Buyer Type, 2023 to 2033

Figure 82: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Germany Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Germany Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 87: Germany Industry Analysis and Outlook Attractiveness by Material, 2023 to 2033

Figure 88: Germany Industry Analysis and Outlook Attractiveness by Buyer Type, 2023 to 2033

Figure 89: Germany Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Germany Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 91: Italy Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Italy Industry Analysis and Outlook Value (US$ Million) by Material, 2023 to 2033

Figure 93: Italy Industry Analysis and Outlook Value (US$ Million) by Buyer Type, 2023 to 2033

Figure 94: Italy Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 96: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 97: Italy Industry Analysis and Outlook Volume (Units) Analysis By Region, 2018 to 2033

Figure 98: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 99: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 100: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Italy Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 105: Italy Industry Analysis and Outlook Volume (Units) Analysis by Material, 2018 to 2033

Figure 106: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 107: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 108: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Buyer Type, 2018 to 2033

Figure 109: Italy Industry Analysis and Outlook Volume (Units) Analysis by Buyer Type, 2018 to 2033

Figure 110: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Buyer Type, 2023 to 2033

Figure 111: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Buyer Type, 2023 to 2033

Figure 112: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Italy Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Italy Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 117: Italy Industry Analysis and Outlook Attractiveness by Material, 2023 to 2033

Figure 118: Italy Industry Analysis and Outlook Attractiveness by Buyer Type, 2023 to 2033

Figure 119: Italy Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Italy Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 121: France Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: France Industry Analysis and Outlook Value (US$ Million) by Material, 2023 to 2033

Figure 123: France Industry Analysis and Outlook Value (US$ Million) by Buyer Type, 2023 to 2033

Figure 124: France Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: France Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 126: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 127: France Industry Analysis and Outlook Volume (Units) Analysis By Region, 2018 to 2033

Figure 128: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 129: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 130: France Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: France Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: France Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 135: France Industry Analysis and Outlook Volume (Units) Analysis by Material, 2018 to 2033

Figure 136: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 137: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 138: France Industry Analysis and Outlook Value (US$ Million) Analysis by Buyer Type, 2018 to 2033

Figure 139: France Industry Analysis and Outlook Volume (Units) Analysis by Buyer Type, 2018 to 2033

Figure 140: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Buyer Type, 2023 to 2033

Figure 141: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Buyer Type, 2023 to 2033

Figure 142: France Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: France Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: France Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 147: France Industry Analysis and Outlook Attractiveness by Material, 2023 to 2033

Figure 148: France Industry Analysis and Outlook Attractiveness by Buyer Type, 2023 to 2033

Figure 149: France Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 150: France Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 151: Spain Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: Spain Industry Analysis and Outlook Value (US$ Million) by Material, 2023 to 2033

Figure 153: Spain Industry Analysis and Outlook Value (US$ Million) by Buyer Type, 2023 to 2033

Figure 154: Spain Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 156: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 157: Spain Industry Analysis and Outlook Volume (Units) Analysis By Region, 2018 to 2033

Figure 158: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 159: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 160: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: Spain Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 165: Spain Industry Analysis and Outlook Volume (Units) Analysis by Material, 2018 to 2033

Figure 166: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 167: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 168: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Buyer Type, 2018 to 2033

Figure 169: Spain Industry Analysis and Outlook Volume (Units) Analysis by Buyer Type, 2018 to 2033

Figure 170: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Buyer Type, 2023 to 2033

Figure 171: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Buyer Type, 2023 to 2033

Figure 172: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: Spain Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: Spain Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 177: Spain Industry Analysis and Outlook Attractiveness by Material, 2023 to 2033

Figure 178: Spain Industry Analysis and Outlook Attractiveness by Buyer Type, 2023 to 2033

Figure 179: Spain Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 180: Spain Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 181: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: Rest of Industry Analysis and Outlook Value (US$ Million) by Material, 2023 to 2033

Figure 183: Rest of Industry Analysis and Outlook Value (US$ Million) by Buyer Type, 2023 to 2033

Figure 184: Rest of Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 186: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 187: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 188: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 189: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 190: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Material, 2018 to 2033

Figure 191: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 192: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 193: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Buyer Type, 2018 to 2033

Figure 194: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Buyer Type, 2018 to 2033

Figure 195: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Buyer Type, 2023 to 2033

Figure 196: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Buyer Type, 2023 to 2033

Figure 197: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 198: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 199: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 200: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 201: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 202: Rest of Industry Analysis and Outlook Attractiveness by Material, 2023 to 2033

Figure 203: Rest of Industry Analysis and Outlook Attractiveness by Buyer Type, 2023 to 2033

Figure 204: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Blotting Market is segmented by product, application and end user from 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA