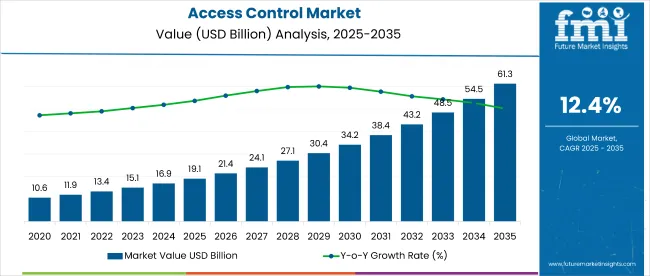

The global access control market is projected to grow from USD 19.05 Billion in 2025 to USD 61.31 Billion by 2035, expanding at a compound annual growth rate (CAGR) of 12.4% during the forecast period. This growth is fueled by increasing demand for security solutions across various sectors, including commercial buildings, residential complexes, government facilities, and industrial sites.

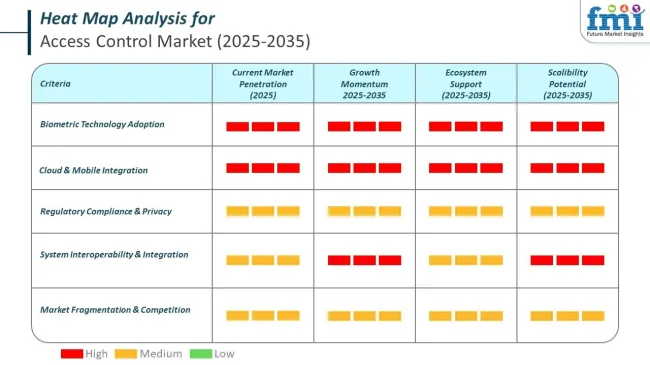

The rising need for enhanced security and the adoption of advanced technologies such as biometric systems, smart locks, and cloud-based access control are key drivers of this market.

Access control systems are becoming increasingly sophisticated, offering more robust security features that go beyond traditional lock-and-key solutions.

These systems allow organizations to manage who has access to specific areas in real time, track movements, and integrate with other security technologies such as surveillance cameras, alarms, and intrusion detection systems. With the growing focus on workplace safety, data protection, and reducing security breaches, the demand for advanced access control solutions is surging.

The transition from physical keys to digital solutions, including mobile credentials and biometric identification systems, is contributing to the market’s growth.

Biometric systems, such as fingerprint recognition, facial recognition, and iris scanning, are gaining popularity due to their high level of accuracy and convenience. These technologies are being integrated into access control systems to provide a higher level of security, ensuring only authorized individuals are granted access to sensitive areas.

Vimal Kapur, CEO of Honeywell Security, emphasized the pivotal role access control systems play in meeting the demands of today’s rapidly evolving security landscape. He noted,

“As security requirements evolve, access control systems are at the forefront of providing advanced protection. We are committed to driving innovation in this space to meet the growing need for secure, scalable, and efficient solutions.”

His statement highlights Honeywell’s focus on developing cutting-edge technologies that address the increasing complexity of modern threats. As businesses and institutions prioritize safeguarding physical and digital assets, access control solutions are becoming central to their security strategy.

With advancements in technology and growing concerns over safety and privacy, the access control market is expected to experience sustained growth through 2035, supported by both technological innovations and rising demand for enhanced security.

Key Industry Attributes

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 19.05 billion |

| Market Size (2035) | USD 61.31 billion |

| CAGR (2025-2035) | 12.4% |

Enterprise cloud adoption is the backbone of access control demand in 2025. In Europe, 45.2% of all businesses used cloud services in 2023, but this figure rises sharply to ~78% among large enterprises. This structural shift has forced organizations to invest in identity, policy enforcement, and access control solutions that operate at scale—turning identity into the new security perimeter.

Rise of Attribute-Based Access Control (ABAC) and Threat-Driven Spend

At the decision layer, NIST SP 800-162 explains why organizations are evolving beyond RBAC (role-based access control) toward ABAC (attribute-based access control). ABAC allows for context-aware permissions based on user role, device type, location, session timing, and data sensitivity.

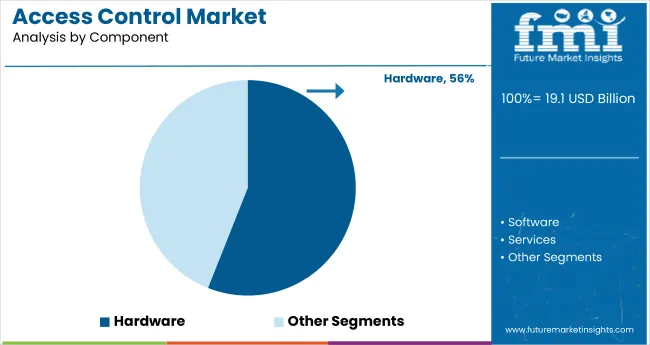

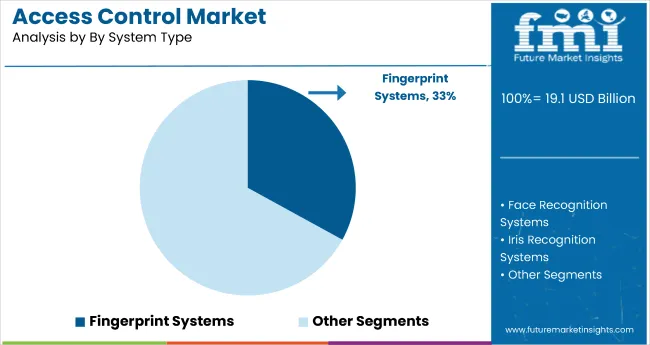

Hardware components will dominate the market, holding a 56% share, while iris recognition access control systems will capture 35% of the market share by 2035, driven by security concerns and advanced technology.

Hardware components are projected to capture a 56% share of the access control systems market by 2035. These components include physical devices such as card readers, biometric scanners, controllers, locks, and software that enable access to secure areas. The increasing demand for advanced physical security systems across various sectors, including commercial, government, and healthcare, is driving the growth of hardware-based solutions.

Major companies like Honeywell, Johnson Controls, and Assa Abloy lead this segment by providing highly reliable and customizable access control solutions. The demand for hardware components is expected to continue growing due to security concerns and the rise of smart buildings and IoT.

Iris recognition access control systems are expected to capture 35% of the market share by 2035. These systems use advanced biometric technology to scan the unique patterns in a person’s iris for secure and accurate identification. Iris recognition offers high levels of security as it is difficult to forge, ensuring restricted access to sensitive areas.

This technology is becoming increasingly popular in high-security environments, such as government facilities, airports, and healthcare institutions. Companies like ZKTeco, Suprema, and Iris ID are key players in this space, developing innovative and highly efficient iris recognition solutions for enhanced security in access control.

Traditionally, contactless biometrics were used for applications predominantly initiated by military access control, and civil, or criminal identification under a tightly regulated technical and legal framework. But nowadays, all industrial sectors including BFSI, healthcare, education, military and defense, and many others have started adopting contactless biometrics.

Most importantly, acceptance and awareness of this technology have increased among industrial users in the past few years. This increasing ubiquity of biometric authentication using a range of different identification methods makes mobile biometrics accessible in the industrial workplace. Moreover, facial recognition technology is also being used by companies to identify their employees as soon as they enter the organization.

| Region | CAGR (2023 to 2033) |

|---|---|

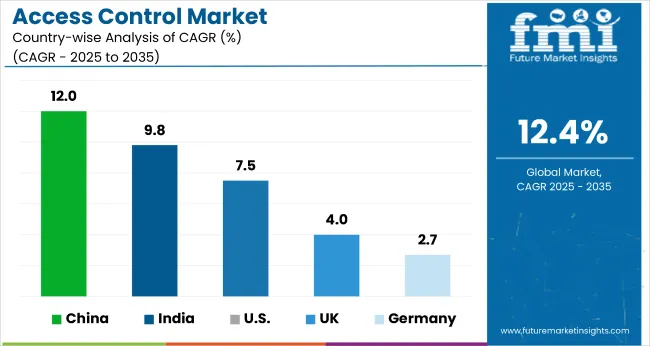

| The United States | 7.5% |

| China | 4.7% |

| India | 6.6% |

| Germany | 2.7% |

| The United Kingdom | 4.0% |

| The United States Market CAGR (2023 to 2033) | 7.5% |

|---|---|

| The United States Market Sales Volume (2023) | 4,328.4 |

As per FMI’s analysis, the United States access control market is thriving at an average CAGR of 7.5% between 2023 and 2033. The market is anticipated to hold a sales volume of 4,328.4 units in 2023. North America is predicted to remain one of the most attractive markets during the forecast period, according to Future Market Insights. The United States accounted for close to 79% of the North America market through 2031.

In February 2021, Honeywell entered into a strategic alliance with IDEMIA, to create and cultivate an intelligent building ecosystem that provides a seamless and enhanced experience for operators and occupants alike. The alliance integrated Honeywell’s security and building management systems with IDEMIA’s biometric-based access control systems to create frictionless, safe, and efficient buildings.

| China Market CAGR (2023 to 2033) | 12% |

|---|---|

| China Market Sales Volume (2023) | 1,605.8 |

Demand in China access control market is expected to rise at a CAGR of 12% over the forecast period. Increasing government investments in infrastructural development projects such as the construction and expansion of the Beijing International Airport, and the China-Pakistan Economic Corridor (CPEC), is anticipated to spur the demand for access control solutions. The regional market is expected to hold a sales volume of 1,605.8 units.

Increased terror threats and growing government spending to enhance security are some key factors driving the sales of access control solutions in China. In addition, the growing economy of China creates a significant requirement for security systems.

As per the report, China is recognized as a primary market, and it held a notable revenue share of 43.3% in 2021.

| India Market CAGR (2023 to 2033) | 9.8% |

|---|---|

| India Market Sales Volume (2023) (Units) | 890.4 |

In 2031, the demand for access control solutions in India is estimated to witness sales value of 890.4 units. India market thrives on a CAGR of 9.8% between 2023 and 2033. Several government and private entities have been investing in advanced security systems for workplace solutions and data protection. Factors such as the rapid deployment of access control systems across defense and commercial sectors are driving the demand in India.

The introduction of technologically enriched, contactless smart cards for diversified applications, is expected to propel the access control demand. Moreover, the urbanized areas of the country, including Chennai, Hyderabad, Mumbai, Delhi-NCR, and Bangalore have made remarkable progress in advancing security systems, pertaining to IT hubs, commercial spaces, and government buildings. Additionally, escalating criminal activities in the country, are driving IT companies to install access control systems for recording employee entry and exit timings to protect personnel and minimize data breaches.

Key vendors of access control solutions are focusing on evolving their existing product and service portfolio. Companies are launching industry-specific solutions to meet industry-specific needs.

Market Developments:

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 19.05 billion |

| Projected Market Size (2035) | USD 61.31 billion |

| CAGR (2025 to 2035) | 12.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Components Analyzed | Hardware (Fingerprint Scanners, Facial Recognition Devices, Iris Scanners, Smart Cards, Others), Software (Integrated Access Control Software, Standalone Software/Middleware, Facial Recognition Software, Iris Recognition Software, Others), Services (Professional Services, System Integration & Installation, Security Consulting, Support & Maintenance, Managed Services) |

| System Types Analyzed | Fingerprint Access Control Systems, Face Recognition Access Control Systems, Iris Recognition Access Control Systems, Card-Based Access Control Systems, Others |

| Industries Analyzed | IT & Telecom, BFSI, Military & Defense, Manufacturing, Healthcare, Transportation & Logistics, Government, Education, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific excluding Japan, The Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Russia, China, India, Malaysia, Singapore, Australia, GCC Countries, Israel, South Africa |

| Key Players Influencing the Market | Identiv, Honeywell International Inc., NEC Corporation, Johnson Controls, Bosch Security and Safety Systems, Assa Abloy, STANLEY Convergent Security Solutions, Inc., 3M, Secom Co., Ltd., Dormakaba Holding AG, HID Global, Matrix Comsec Pvt. Ltd., Paxton Access Ltd., BioEnable Technologies Pvt Ltd., ZKTeco India |

| Additional Attributes | Dollar sales growth by component (hardware/software/services), industry demand trends (IT/BFSI/defense/healthcare), regional market shares, competitive landscape, pricing strategies, technology innovations, adoption of advanced access control systems |

The global market could be developed at an impressive 12.4% CAGR until 2035.

The United States is the leading market and could achieve a sales volume of 4,328.4 units in 2023.

Government investments are expected to drive the China market at 12% CAGR through 2033.

The Iris recognition access control system segment is projected to grow at 16% CAGR through 2033.

IT boom in India is projected to drive its Access Control market at 9.8% CAGR up till 2033.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Access Control as a Service Market Size and Share Forecast Outlook 2025 to 2035

Access Control and Authentication Market Analysis & Forecast by Technology, Component, Application and Region through 2035

Access Control Readers Market

Network Access Control (NAC) Market Size and Share Forecast Outlook 2025 to 2035

Building Access Control Security Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Access Control Market Growth – Trends & Forecast through 2034

Industrial Access Control Market Size and Share Forecast Outlook 2025 to 2035

Pedestrian Access Control System Market Size and Share Forecast Outlook 2025 to 2035

North America Access Control Market - Security & IoT Integration 2025 to 2035

Card-Based Electronic Access Control Systems Market Growth - Forecast 2025 to 2035

North America Keyless Vehicle Access Control Market - Growth & Forecast through 2035

Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

Control Towers Market Size and Share Forecast Outlook 2025 to 2035

Controlled & Slow Release Fertilizers Market 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA