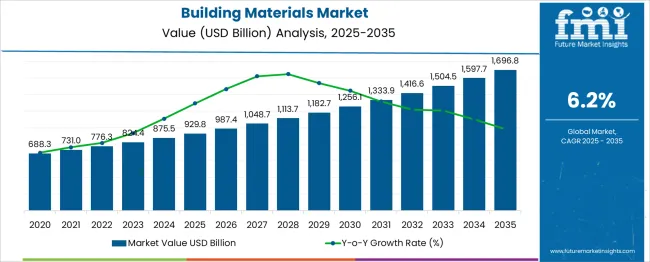

The Building Materials Market is estimated to be valued at USD 929.8 billion in 2025 and is projected to reach USD 1696.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. A Breakpoint Analysis reveals key phases where growth accelerates and slows down. Between 2025 and 2029, the market increases from USD 929.8 billion to USD 1,182.7 billion, reflecting an incremental increase of USD 252.9 billion.

During this period, the market shows a relatively strong CAGR of 7.6%, driven by rising infrastructure demand, urbanization trends, and increased construction activity globally. The first breakpoint occurs around 2029, when growth begins to decelerate slightly, with the market reaching USD 1,182.7 billion. This period indicates a shift toward more moderate growth rates, as the market matures and construction projects stabilize.

From 2029 to 2035, the market expands at a more stable rate, with an additional USD 514.1 billion in value added, reaching USD 1,696.8 billion by 2035. This phase reflects a CAGR of 5.3%, highlighting a period of consolidation where growth is driven more by refurbishment and maintenance projects than new large-scale constructions. The Breakpoint Analysis indicates that while growth remains steady, the market enters a phase of slower expansion after initial robust growth, driven by evolving demand dynamics in mature markets.

| Metric | Value |

|---|---|

| Building Materials Market Estimated Value in (2025 E) | USD 929.8 billion |

| Building Materials Market Forecast Value in (2035 F) | USD 1696.8 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The building materials market is undergoing sustained expansion, supported by rapid urbanization, infrastructure modernization, and rising demand for energy-efficient and durable construction inputs. Increased government spending on public infrastructure, housing schemes, and smart city development has bolstered demand across both residential and commercial sectors.

Emphasis on sustainability and circular construction practices has LED manufacturers to adopt low-carbon material technologies and recycling-integrated production methods. Additionally, the sector is benefiting from technological innovations in composite blending, 3D printing compatibility, and prefabrication methods, which are improving material performance and construction speed.

Future growth is likely to be influenced by regulatory standards on environmental compliance, building codes, and resilience planning. With emerging economies prioritizing green buildings and resilient urban planning, material selection is expected to align closely with both sustainability targets and structural reliability.

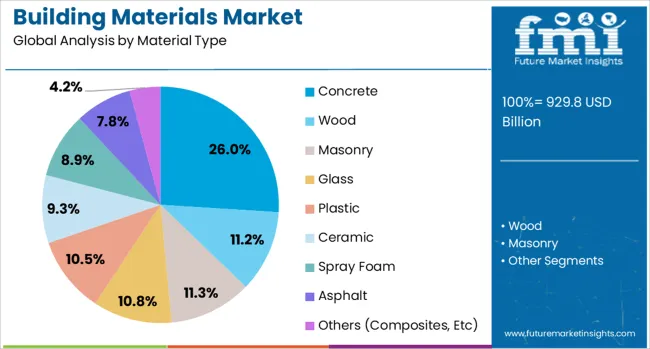

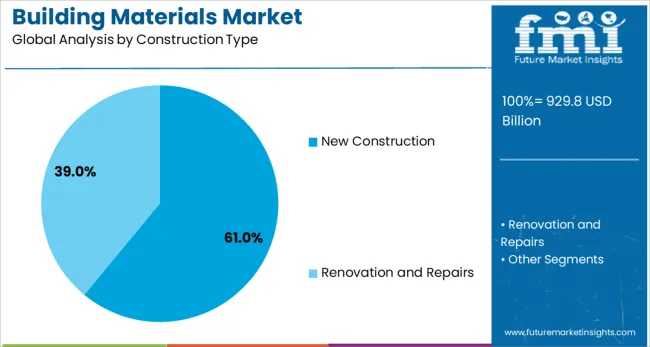

The building materials market is segmented by material type, construction type, application, end-use, distribution channel, and geographic regions. The building materials market is divided into Concrete, Wood, Masonry, Glass, Plastic, Ceramic, Spray Foam, asphalt, and others (Composites, etc.). In terms of construction type, the building materials market is classified into New Construction, Renovation, and Repairs.

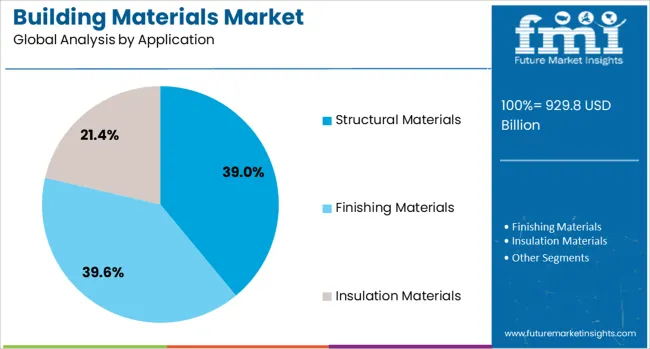

Based on the application, the building materials market is segmented into Structural Materials, Finishing Materials, and Insulation Materials. The end-use of the building materials market is segmented into Residential, Commercial, Industrial, and Infrastructure. The distribution channel of the building materials market is segmented into direct and indirect.

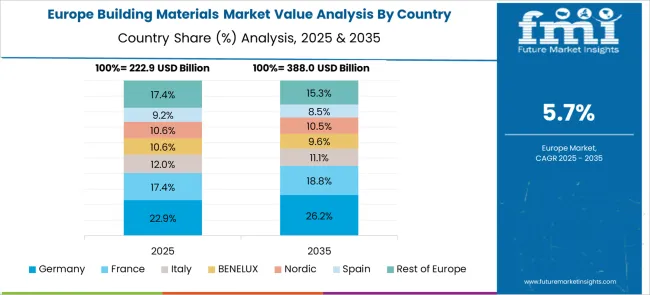

Regionally, the building materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Concrete is projected to account for 26.0% of the building materials market revenue in 2025, making it the most widely used material type. This leadership is driven by concrete’s strength-to-cost ratio, availability of raw materials, and compatibility with a wide range of construction applications.

The material’s compressive strength, fire resistance, and long lifecycle performance make it indispensable in both structural and foundational use cases. Adoption of pre-cast concrete systems and ready-mix solutions has enhanced construction efficiency while minimizing waste and labor requirements.

Advancements in green cement technology and recycled aggregate use are further supporting the material’s continued relevance amid growing sustainability mandates. As construction activity scales in high-growth urban corridors, concrete remains a preferred choice for cost-effective, large-scale development.

New construction is forecast to capture 61.0% of the total market revenue in 2025, positioning it as the leading construction type. The segment’s dominance is being shaped by surging demand for new residential units, commercial complexes, and industrial infrastructure across developing regions.

Favorable policy frameworks, urban population migration, and economic recovery cycles are contributing to an increase in greenfield development projects. Government-backed infrastructure initiatives-such as transportation corridors, energy plants, and affordable housing-are also fueling material demand in new builds.

The ability to adopt modern construction technologies and integrate smart materials from the ground up makes new construction projects more attractive for long-term investment. With sustainability and compliance frameworks increasingly influencing design standards, new builds offer opportunities for innovation in material integration and lifecycle optimization.

Structural materials are expected to command 39.0% of market revenue in 2025, ranking them as the leading application segment. This growth is underpinned by the foundational role these materials play in load-bearing, seismic resilience, and overall building integrity.

The segment benefits from consistent demand across residential towers, bridges, industrial buildings, and institutional structures where safety, strength, and longevity are non-negotiable. Advancements in high-performance concrete, steel reinforcement, and fiber composites have improved structural performance while reducing weight and material consumption.

Regulatory scrutiny on structural safety and adherence to modern building codes is reinforcing investment in this segment. As climate resilience and disaster mitigation become integral to infrastructure planning, the demand for durable structural materials is expected to remain strong.

Building materials are essential components used in construction projects, providing strength, durability, and structural integrity to buildings. These materials include a wide range of options such as cement, steel, timber, and composites, each chosen for specific properties to meet project needs. Growth in the sector is driven by increasing demand in residential, commercial, and infrastructure development. Manufacturers are focusing on developing advanced materials that offer better performance, energy efficiency, and sustainability. Ongoing innovation in material production technologies continues to support the evolving needs of the construction industry.

The building materials sector is grappling with significant challenges arising from price volatility and disruptions in the supply chain. Fluctuations in the cost of essential raw materials such as cement, steel, and timber are common due to global uncertainties, geopolitical tensions, and shifting demand-supply dynamics. These unpredictable price changes complicate budgeting and forecasting for construction projects. Additionally, logistical issues, including transportation delays and shortages, can cause extended project timelines and rising costs. Smaller contractors, with limited negotiating power, are especially vulnerable to these supply chain challenges. Furthermore, while advanced materials offer enhanced performance, they often come with a premium price tag, limiting their adoption in cost-sensitive regions.

The demand for building materials is being driven by the rapid expansion of both residential and commercial infrastructure. Urbanization and population growth are fueling the need for new homes, roads, bridges, and commercial spaces. In many developing regions, government-led infrastructure projects are driving the demand for durable building materials. Additionally, rising middle-class populations, especially in emerging economies, are increasing the demand for modern housing. Residential developments, including high-rise buildings and gated communities, continue to rise globally. The ongoing shift toward urban living, along with the increasing need for more efficient, technologically advanced infrastructure, is further boosting demand for building materials across various construction segments, making it a primary driver for market growth.

The building materials industry offers numerous opportunities driven by technological advancements and the global expansion of construction projects. Innovations in material technology, such as the development of self-healing concrete, high-performance insulation, and sustainable composite materials, present opportunities for improved efficiency, longevity, and cost-effectiveness in construction. The demand for smart materials integrated with sensors and IoT devices is also on the rise, enhancing building performance and energy efficiency. as infrastructure development booms in emerging markets, particularly in Asia, Latin America, and Africa, there is a significant opportunity for building material manufacturers to expand their reach and cater to growing urban and industrial construction needs.

The building materials industry is embracing modern construction methods, driven by technological advancements and the growing need for efficiency in construction. Techniques such as modular construction, prefabrication, and 3D printing are gaining popularity as they reduce labor costs and shorten project timelines. The integration of smart technologies, such as Internet of Things (IoT) devices and sensors in building materials, is helping monitor energy usage, temperature, and building health in real-time. There is a rising trend toward the use of durable, high-performance materials that provide better insulation, reduce energy consumption, and enhance the overall life cycle of buildings. These trends are driving the development of innovative and efficient building materials suited to modern construction needs.

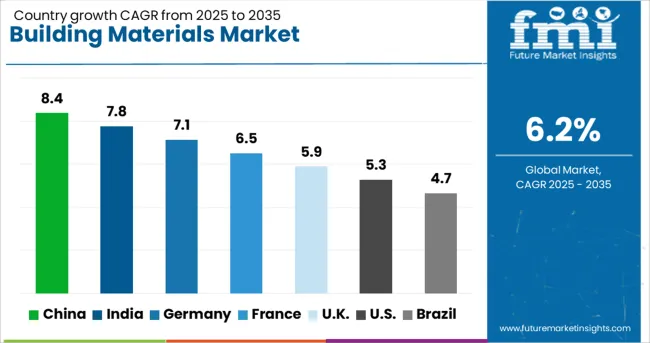

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

The building materials market is projected to grow globally at a CAGR of 6.2% from 2025 to 2035. Among the top markets, China leads at 8.4%, followed by India at 7.8%, while Germany posts 7.1%, the United Kingdom records 5.9%, and the United States stands at 5.3%. These growth rates reflect stronger demand in emerging economies like China and India, driven by rapid urbanization, infrastructure development, and housing needs. In contrast, mature markets in OECD countries such as the USA and UK exhibit steady growth, primarily fueled by renovation, infrastructure upgrades, and increasing demand for energy-efficient construction solutions. The analysis spans over 40 countries, with the leading markets detailed below.

China is expected to grow at a CAGR of 8.4% through 2035, with increasing demand for building materials driven by the country's massive urbanization and rapid industrial expansion. The demand for housing, commercial spaces, and infrastructure is continuously growing, especially in second and third-tier cities. As China continues its efforts to modernize and develop infrastructure projects, the need for construction materials like cement, steel, and glass is on the rise. Furthermore, the country’s growing real estate market, coupled with large-scale infrastructure projects like high-speed rail networks, bridges, and airports, continues to bolster demand for these materials.

India is projected to grow at a CAGR of 7.8% through 2035, driven by expanding urbanization, industrialization, and infrastructure development. The increasing demand for both residential and commercial buildings significantly contributes to the growing need for building materials. India's growing population and rising income levels support higher demand for new homes, retail spaces, and industrial facilities. Infrastructure projects, including roads, airports, and metro systems, are further driving the demand for materials. The country’s focus on improving its manufacturing capacity in various sectors, including construction, is fueling the adoption of advanced materials for new buildings and industrial structures.

Germany is expected to grow at a CAGR of 7.1% through 2035, with demand for building materials driven by the expansion of residential, commercial, and industrial projects. The country’s robust construction market is fueled by a rise in residential demand, particularly in urban areas. Commercial and industrial construction projects continue to increase, as Germany’s economy remains strong, and businesses expand. The focus on improving infrastructure, particularly transportation and energy networks, further supports the demand for construction materials. The rising need for high-quality materials for both traditional and modern buildings further accelerates growth in the sector.

The United Kingdom is projected to grow at a CAGR of 5.9% through 2035, with continued demand for building materials driven by a strong housing market and infrastructure projects. The UK faces increasing demand for new housing, particularly in metropolitan areas, as well as demand for office spaces and retail centers. Infrastructure projects such as roads, bridges, and public buildings also contribute to the growing need for building materials. The UK’s construction sector remains resilient, with steady demand for materials such as concrete, steel, and timber. Increased government focus on housing affordability and expanding infrastructure provides a solid foundation for future growth.

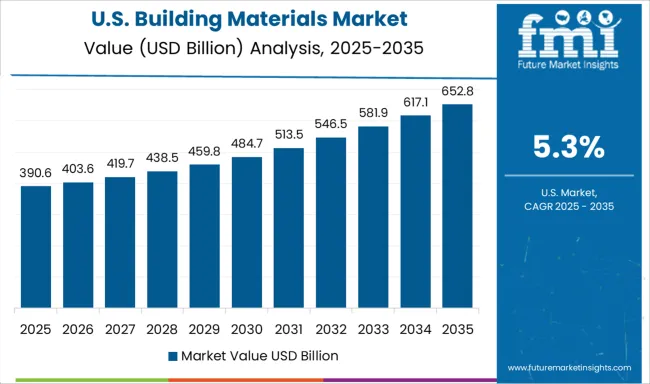

The United States is projected to grow at a CAGR of 5.3% through 2035, driven by both residential and commercial construction demand. The need for new housing continues to rise, driven by population growth and urban expansion. The commercial real estate market also supports the demand for building materials as businesses expand and commercial infrastructure projects are initiated. The USA construction market is marked by a demand for advanced and durable materials in both renovation and new-build projects. Furthermore, the growing focus on improving infrastructure such as roads, bridges, and public transport systems continues to push the demand for building materials.

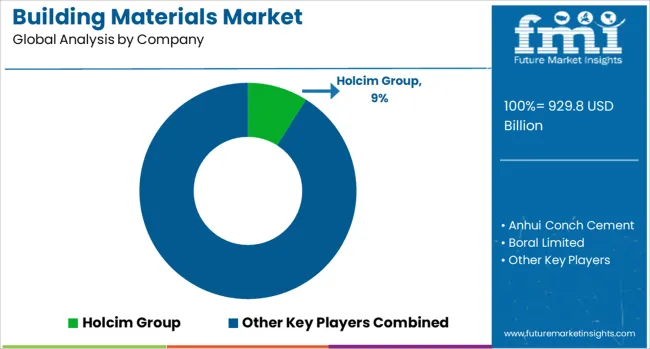

The building materials market is dominated by global leaders offering a wide range of products for residential, commercial, and industrial construction. Holcim Group and Cemex S.A.B. de C.V. lead the market with extensive cement, concrete, and aggregates solutions, focusing on sustainability and low-carbon alternatives to meet increasing environmental regulations.

Anhui Conch Cement and China National Building Material Group Corporation dominate the Asian market with a vast portfolio of cement and concrete products, benefiting from low production costs and strong regional demand. Boral Limited and Heidelberg Materials hold significant market shares in the global aggregates and concrete industries, with strong distribution channels across North America, Europe, and Asia-Pacific. Saint-Gobain and Owens Corning focus on energy-efficient insulation materials, providing advanced solutions for thermal and acoustic performance, aligning with the growing demand for sustainable and energy-efficient construction.

Etex Group and James Hardie Industries plc specialize in lightweight and fiber cement products, catering to residential and commercial building needs with a focus on durability and ease of installation. Kingspan Group and USG Corporation lead the insulated building materials sector, offering high-performance solutions for walls, ceilings, and flooring. Vulcan Materials Company stands out in aggregates and asphalt production, serving a wide range of infrastructure projects.

Competitive differentiation in this market is driven by product innovation and compliance with global construction standards. Barriers to entry include capital-intensive production facilities and stringent regulatory requirements. Strategic priorities involve developing low-emission, eco-friendly building materials, expanding production capacity in emerging markets, and focusing on innovation to improve the durability of products.

| Item | Value |

|---|---|

| Quantitative Units | USD 929.8 Billion |

| Material Type | Concrete, Wood, Masonry, Glass, Plastic, Ceramic, Spray Foam, Asphalt, and Others (Composites, Etc) |

| Construction Type | New Construction and Renovation and Repairs |

| Application | Structural Materials, Finishing Materials, and Insulation Materials |

| End-Use | Residential, Commercial, Industrial, and Infrastructure |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Holcim Group, Anhui Conch Cement, Boral Limited, Cement Roadstone Holding, Cemex S.A.B. de C.V., China National Building Material Group Corporation, Etex Group, Heidelberg Materials, James Hardie Industries plc, Kingspan Group, Martin Marietta Materials, Inc., Owens Corning, Saint-Gobain, USG Corporation, and Vulcan Materials Company |

| Additional Attributes | Dollar sales by product type (cement, concrete, aggregates, insulation, roofing materials) and end-use segments (residential, commercial, industrial, infrastructure). Demand dynamics are influenced by infrastructure development, urbanization, and the increasing emphasis on sustainability and energy efficiency in construction. Regional trends highlight North America and Europe leading in the adoption of green building materials and energy-efficient solutions, while Asia-Pacific shows rapid growth due to expanding urban infrastructure and construction activities. |

The global building materials market is estimated to be valued at USD 929.8 billion in 2025.

The market size for the building materials market is projected to reach USD 1,696.8 billion by 2035.

The building materials market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in building materials market are concrete, wood, masonry, glass, plastic, ceramic, spray foam, asphalt and others (composites, etc).

In terms of construction type, new construction segment to command 61.0% share in the building materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Green Building Materials Market Analysis by Type, Application, End-user and Region: Forecast for 2025 and 2035

Bio-Based Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Protective Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Bio-Based Binder for Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Building Automation System Market Size and Share Forecast Outlook 2025 to 2035

Building Information Modeling Market Size and Share Forecast Outlook 2025 to 2035

Building Envelope Market Size and Share Forecast Outlook 2025 to 2035

Building Access Control Security Market Size and Share Forecast Outlook 2025 to 2035

Building Maintenance Unit (BMU) Market Size and Share Forecast Outlook 2025 to 2035

Building Energy Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Building Automation System Industry Analysis in Korea Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Building Thermal Insulation Market Growth - Trends & Forecast 2025 to 2035

Leading Providers & Market Share in Building Automation System

Building Integrated Photovoltaics Market - Solar & Architecture

Building Information Management (BIM) Market Analysis – Trends & Forecast 2024-2034

In-building Wireless Market Forecast and Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Solutions Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Market Size and Share Forecast Outlook 2025 to 2035

Japan Building Automation System Market Analysis & Forecast by System, Application, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA