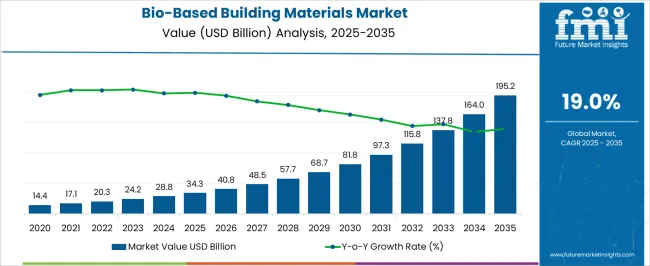

The bio-based building materials market is estimated to be valued at USD 34.3 billion in 2025 and is projected to reach USD 195.2 billion by 2035, registering a compound annual growth rate (CAGR) of 19.0% over the forecast period. A breakpoint analysis highlights key shifts in the market’s growth trajectory, identifying critical inflection points. Between 2025 and 2030, the market grows from USD 34.3 billion to USD 81.8 billion, contributing USD 47.5 billion in growth, with a CAGR of 19.3%. This period marks the first significant breakpoint, driven by the rising adoption of sustainable construction practices, increasing consumer demand for eco-friendly materials, and growing regulatory support for reducing carbon footprints.

The focus on reducing the environmental impact of traditional building materials plays a crucial role in accelerating demand. From 2030 to 2035, the market continues to expand from USD 81.8 billion to USD 195.2 billion, adding USD 113.4 billion in growth, with a slightly higher CAGR of 20.4%. This phase represents a second, more pronounced breakpoint, as bio-based building materials become mainstream in the construction industry. The adoption of innovative materials like hempcrete, bamboo, and recycled wood accelerates, fueled by government incentives and greater investment in sustainable infrastructure. The breakpoint analysis reveals that the market will experience a rapid early-phase acceleration, followed by sustained strong growth as the demand for sustainable building solutions continues to rise.

| Metric | Value |

|---|---|

| Bio-Based Building Materials Market Estimated Value in (2025 E) | USD 34.3 billion |

| Bio-Based Building Materials Market Forecast Value in (2035 F) | USD 195.2 billion |

| Forecast CAGR (2025 to 2035) | 19.0% |

The bio-based building materials market is gaining strong momentum globally, driven by increasing environmental regulations, rising demand for sustainable construction, and growing awareness about the carbon footprint of traditional building materials. This market is being shaped by a global shift toward decarbonization in the built environment, supported by green building certifications and government mandates promoting the use of renewable materials.

Industry stakeholders have been investing in research and development to enhance the performance and durability of bio-based alternatives, making them more competitive with conventional options. Annual reports and sustainability disclosures from leading construction firms have highlighted a growing preference for circular materials and low-emission components across both commercial and residential developments.

The future outlook remains promising as consumer preferences evolve in favor of eco-conscious products and construction companies continue adopting renewable and recyclable inputs to meet climate targets. These drivers are positioning the market for sustained growth, with wide-scale adoption expected across various segments of the construction industry.

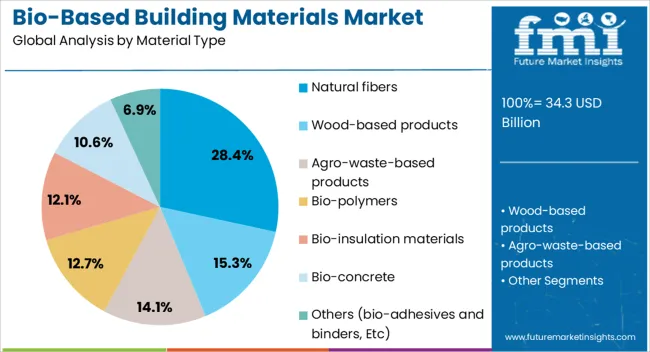

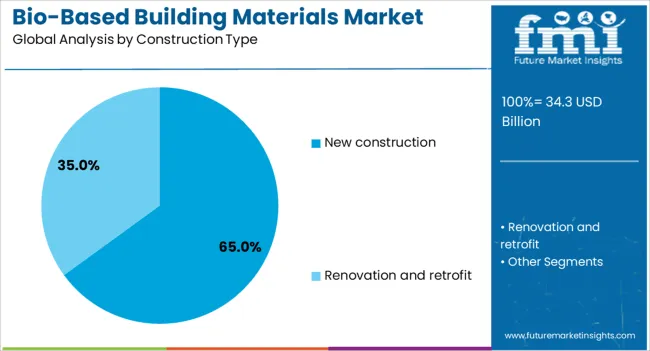

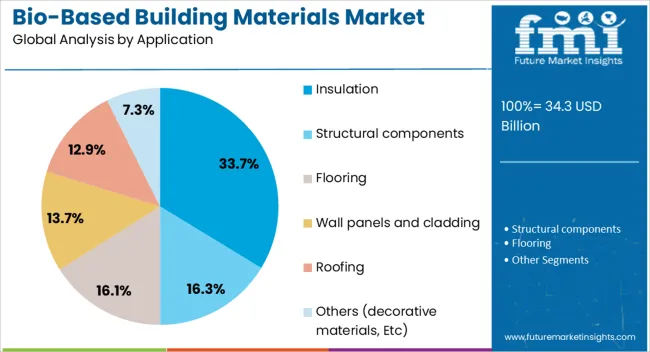

The bio-based building materials market is segmented by material type, construction type, application, end use, distribution channel, and geographic regions. By material type, the bio-based building materials market is divided into Natural fibers, Wood-based products, Agro-waste-based products, Bio-polymers, Bio-insulation materials, Bio-concrete, and Others (bio-adhesives and binders, etc.). In terms of construction type, the bio-based building materials market is classified into New construction, renovation and retrofit. Based on application, the bio-based building materials market is segmented into Insulation, Structural components, Flooring, Wall panels and cladding, Roofing, and Others (decorative materials, etc.).

By end use, the bio-based building materials market is segmented into Residential, Commercial, Industrial, and Infrastructure. By distribution channel, the bio-based building materials market is segmented into Direct and Indirect. Regionally, the bio-based building materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The natural fibers segment is anticipated to account for 28.4% of the Bio-Based Building Materials market revenue share in 2025, making it the leading material type. This position is being attributed to the increasing preference for renewable, biodegradable alternatives in the construction industry. Natural fibers such as hemp, flax, and jute have gained traction due to their favorable insulation properties, low embodied energy, and lightweight nature, as highlighted in sustainability reports and construction innovation journals.

These materials have been widely adopted for interior panels, insulation, and composite applications due to their mechanical strength and compatibility with green certification standards. Additionally, the ability of natural fibers to contribute to moisture regulation and indoor air quality has further elevated their acceptance in energy-efficient building design.

Enhanced supply chain availability and rising support from policy frameworks promoting agricultural waste utilization have also contributed to the growth of this segment. The combination of performance efficiency and environmental benefits has secured natural fibers a leading share in the market.

The new construction segment is projected to hold 65.0% of the bio-based building materials market revenue share in 2025, emerging as the leading construction type. This leadership has been supported by the integration of sustainability principles in the early stages of building design and execution. Green building initiatives and regulatory frameworks are being implemented across multiple countries, encouraging developers to prioritize bio-based materials in new projects.

Industry publications and government infrastructure plans have emphasized that incorporating renewable inputs during initial construction phases enables better lifecycle efficiency and compliance with climate goals. The higher design flexibility in new construction has allowed for tailored applications of bio-based products such as wall panels, insulation, and structural components.

Furthermore, long-term energy savings and the potential for green certifications have incentivized stakeholders to invest in such materials upfront. These drivers have enabled new construction to dominate the demand landscape, reflecting its central role in the market's transition to sustainable development.

The insulation segment is forecasted to contribute 33.7% of the bio-based building materials market revenue share in 2025, positioning it as the top application area. This dominance has been driven by rising energy efficiency regulations and increased focus on thermal performance in both residential and commercial buildings. Bio-based insulation materials, such as cellulose, wool, and hempcrete, have been increasingly utilized due to their superior thermal and acoustic properties, along with low toxicity and reduced environmental impact.

Technical whitepapers and construction sector updates have highlighted that such materials offer cost-effective alternatives to synthetic insulations while aligning with green building standards. Demand has also been strengthened by the need to meet net-zero targets and reduce heating and cooling loads in buildings. Moreover, the recyclability and low VOC emissions associated with bio-based insulation have further enhanced its appeal among architects and developers.

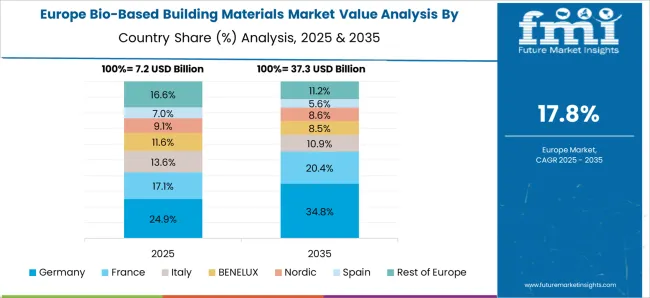

The bio-based building materials market is expanding due to rising eco-conscious construction, energy-efficiency standards, and urban development projects. Asia Pacific leads with 40% market share, with China contributing 26%, India 8%, and Japan 6%, making it 1.25x Europe’s 32% share. Europe is led by Germany 12%, France 10%, and UK 8%.

North America accounts for 25%, primarily the USA Residential applications account for 45% of adoption, commercial 35%, and public infrastructure 20%, showing a residential-to-commercial ratio of 1.29x. Products include wood-based panels (35%), bamboo (20%), natural fiber insulation (25%), and bio-concrete (15%), highlighting wood panels as 2.33x more adopted than bio-concrete.

Urbanization, government incentives, and energy-efficient building codes are primary drivers. Residential projects represent 45% of adoption, approximately 1.3x the commercial share of 35%. Wood-based panels and bamboo account for 55% of adoption, 3.67x higher than bio-concrete at 15%. Natural fiber insulation (25%) reduces energy consumption by 10-15%.

Asia Pacific drives 40% adoption, 1.25x Europe (32%), while North America contributes 25%. Prefabricated bamboo panels cut on-site construction time by 20-25%, roughly 4-5 weeks faster per project. Modular solutions and low-carbon materials increase adoption in residential, commercial, and public infrastructure projects globally.

Trends include modular prefabrication, bio-composites, and recycled agricultural by-products. Bamboo and timber panels reduce on-site time by 20-25%, 0.25x total project duration saved. Bio-concrete with hemp or rice husk increases compressive strength by 5-10%, roughly 1.05-1.10x improvement over conventional concrete. \

Circular economy initiatives, including straw and coconut fiber, account for 10-12% adoption (0.4x natural fiber insulation share). Smart insulation materials with thermal and moisture regulation are growing in North America (25%). Hybrid recycled-polymer materials represent 15-18% of premium applications, approximately 0.75x bio-concrete adoption, supporting scalability in residential (45%) and commercial (35%) sectors.

Residential construction represents 45%, commercial 35%, and public infrastructure 20% of adoption. Asia Pacific contributes 40%, 1.25x Europe (32%), while North America is 25%, 1.25x lower than Europe. Wood-based panels and bamboo account for 35%, 2.33x more than bio-concrete (15%), while natural fiber insulation is 25%, 1.67x higher than bio-concrete.

Modular prefabrication reduces timelines by 20-25%, or 4-5 weeks per project. Public infrastructure projects, such as hospitals, schools, and transit hubs, create potential to increase bio-concrete adoption by 1.5x. High adoption in residential and commercial units presents opportunities for standardized, eco-certified solutions.

Challenges include high costs, durability issues, and regulatory compliance. Bio-based materials are 10-25% costlier than conventional steel or concrete (1.1-1.25x baseline cost). Natural fiber composites require moisture treatment, adding 5-10% (1.05-1.10x production cost).

Certification for structural, fire, and energy efficiency in Europe and North America adds USD 20,000-50,000 per project (1.2-1.5x conventional testing costs). Asia Pacific mitigates costs through local sourcing, but durability in humid or coastal regions reduces adoption by 0.8x. Price sensitivity and uncertainty in long-term performance continue to constrain adoption in residential (45%) and commercial (35%) projects globally.

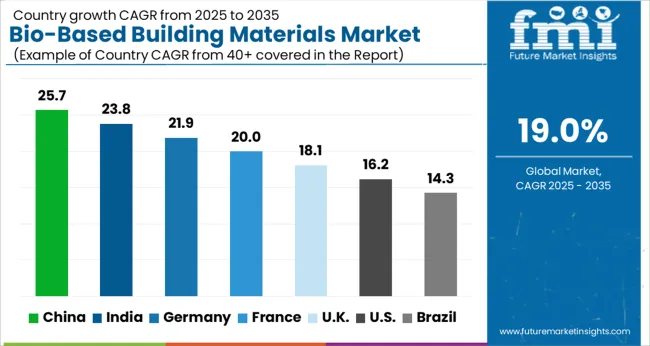

The bio-based building materials market is projected to grow at a global CAGR of 19.0% from 2025 to 2035. China leads the market with a growth rate of 25.7%, followed by India at 23.8%. Germany records a growth rate of 21.9%, while the UK shows 18.1% and the USA follows at 16.2%. The market is primarily driven by the increasing demand for eco-friendly building solutions, as well as growing awareness about the environmental impact of traditional construction materials. China and India are leading the growth, backed by rapid industrialization and a strong push for green construction practices. Developed economies like Germany, the UK, and the USA are witnessing steady growth as regulations for sustainable building materials continue to strengthen. The analysis spans over 40+ countries, with the leading markets shown below.

The bio-based building materials market in China is expanding at a CAGR of 25.7%, driven by rapid industrialization and large-scale infrastructure development. With urbanization increasing, there is a heightened demand for materials that improve energy efficiency and reduce heat loss. Bio-based materials such as bamboo, recycled wood, and plant-based insulation are gaining traction as part of this growth. The government is fostering green building initiatives and emphasizing carbon reduction in construction, which further supports the adoption of eco-friendly building materials. China’s focus on developing smart cities and modernizing infrastructure is accelerating the use of bio-based materials.

Demand for bio-based building materials in China is expected to grow at a CAGR of 23.8%, fueled by rapid infrastructure development and a shift toward using eco-conscious building materials. As the demand for housing and commercial projects grows, materials like compressed earth blocks and plant-based insulation are becoming increasingly popular. The Indian government is also supporting the adoption of energy-saving building practices, which further boosts the market. With an increasing focus on building quality, India is shifting towards more environmentally friendly and energy-efficient materials, further supporting market expansion.

In France, the bio-based building materials market is advancing with a CAGR of 21.9%, propelled by increasing demand for energy-efficient construction materials. France is focusing on reducing the environmental impact of construction by integrating natural and renewable materials such as wood and plant-based insulation into new building projects. With stringent building regulations and an emphasis on reducing carbon footprints, bio-based materials are gaining significant traction in both commercial and residential sectors. France’s commitment to improving building energy performance through high-quality, eco-friendly materials further fuels the growth of this market.

The bio-based building materials market in the UK is expected to grow at a CAGR of 18.1%, driven by increasing consumer demand for energy-efficient solutions in the construction industry. With building regulations focused on improving energy efficiency and reducing environmental impacts, bio-based materials are becoming the preferred choice for many builders. The UK’s commitment to modernizing infrastructure and increasing the use of alternative, eco-friendly building materials plays a significant role in the growth of this market. Builders are increasingly turning to products like natural fibers and plant-based composites to meet rising energy efficiency standards.

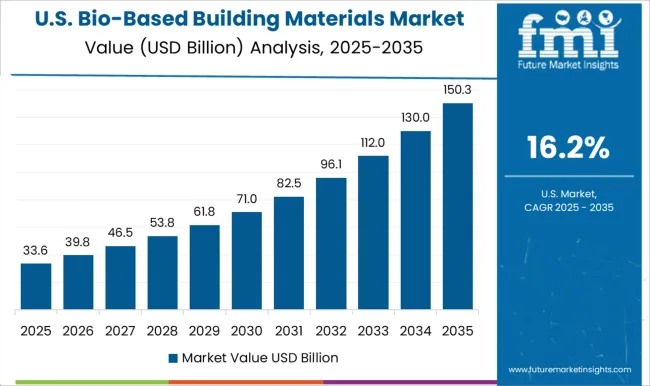

The bio-based building materials market in the USA is projected to grow at a CAGR of 16.2%, fueled by the increasing emphasis on energy-efficient construction and reducing environmental footprints. The construction industry in the USA is evolving with a strong focus on performance and efficiency, leading to greater adoption of bio-based materials. Government regulations supporting energy efficiency in buildings and growing consumer demand for high-performance, eco-friendly products are driving the market forward. The innovations in bio-based materials and increased availability of such products through various retail channels are contributing to the ongoing growth of the USA market.

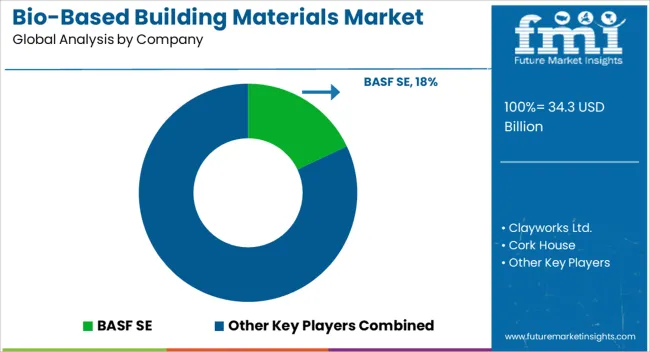

The bio-based building materials market is driven by leading companies that offer sustainable and environmentally friendly alternatives to traditional building materials. BASF SE is a key player, offering bio-based materials that contribute to energy efficiency and sustainable construction, with a focus on reducing the carbon footprint of buildings. Clayworks Ltd. provides natural clay plasters and wall finishes, known for their sustainability and aesthetic appeal, catering to environmentally conscious consumers seeking natural solutions for interior finishes. Cork House and Durisol focus on the use of renewable natural resources like cork and wood for building materials that offer insulation, soundproofing, and sustainability. EcoCocon specializes in eco-friendly, straw-based building panels, providing highly energy-efficient and sustainable construction solutions that are particularly popular in residential construction. ECOR Global offers bio-based structural materials made from recycled fibers and natural polymers, providing a sustainable alternative to traditional wood-based products in construction.

Forbo Flooring Systems provides sustainable flooring solutions made from bio-based and renewable materials such as linoleum, which is produced using natural ingredients like linseed oil, pine resin, and jute. Green Building Supply offers a wide range of eco-friendly materials, including bio-based insulation products and finishes, catering to the growing demand for sustainable building solutions in residential and commercial sectors. Hempitecture Inc. focuses on creating bio-based materials made from hemp, including insulation and construction panels, that provide high thermal performance while promoting environmental sustainability. Interface, Inc. is a significant player in the sustainable flooring market, providing modular flooring systems made from recycled and bio-based materials, reducing environmental impact across the entire supply chain. Kirei offers sustainable interior finishes made from bio-based materials such as bamboo and reclaimed wood, helping to reduce environmental degradation. MycoWorks and NatureWorks LLC focus on innovative bio-based materials, using fungi and plant-based polymers to create sustainable building products with unique properties such as durability and low environmental impact. Novamont S.p.A. specializes in producing biodegradable plastics and bio-based composites, expanding the use of renewable resources in building applications. Plantd provides plant-based wood alternatives for construction, helping to replace traditional timber with more sustainable, renewable options.

| Item | Value |

|---|---|

| Quantitative Units | USD 34.3 Billion |

| Material Type | Natural fibers, Wood-based products, Agro-waste-based products, Bio-polymers, Bio-insulation materials, Bio-concrete, and Others (bio-adhesives and binders, Etc) |

| Construction Type | New construction and Renovation and retrofit |

| Application | Insulation, Structural components, Flooring, Wall panels and cladding, Roofing, and Others (decorative materials, Etc) |

| End Use | Residential, Commercial, Industrial, and Infrastructure |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Clayworks Ltd., Cork House, Durisol, EcoCocon, ECOR Global, Forbo Flooring Systems, Green Building Supply, Hempitecture Inc., Interface, Inc., Kirei, MycoWorks, NatureWorks LLC, Novamont S.p.A., Plantd |

| Additional Attributes | Dollar sales by product type (bio-based insulation, flooring, coatings, structural panels, cladding) and end-use segments (residential, commercial, industrial, infrastructure). Demand dynamics are influenced by growing regulations and consumer preferences for sustainable building practices, the push for energy-efficient construction, and the increasing adoption of green certifications such as LEED and BREEAM. Regional trends show strong growth in North America and Europe, driven by stringent environmental regulations and the increasing popularity of green building solutions. |

The global bio-based building materials market is estimated to be valued at USD 34.3 billion in 2025.

The market size for the bio-based building materials market is projected to reach USD 195.2 billion by 2035.

The bio-based building materials market is expected to grow at a 19.0% CAGR between 2025 and 2035.

The key product types in bio-based building materials market are natural fibers, wood-based products, agro-waste-based products, bio-polymers, bio-insulation materials, bio-concrete and others (bio-adhesives and binders, etc).

In terms of construction type, new construction segment to command 65.0% share in the bio-based building materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Building Automation System Market Size and Share Forecast Outlook 2025 to 2035

Building Information Modeling Market Size and Share Forecast Outlook 2025 to 2035

Building Envelope Market Size and Share Forecast Outlook 2025 to 2035

Building Access Control Security Market Size and Share Forecast Outlook 2025 to 2035

Building Maintenance Unit (BMU) Market Size and Share Forecast Outlook 2025 to 2035

Building Energy Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Building Automation System Industry Analysis in Korea Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Building Thermal Insulation Market Growth - Trends & Forecast 2025 to 2035

Leading Providers & Market Share in Building Automation System

Building Integrated Photovoltaics Market - Solar & Architecture

Building Information Management (BIM) Market Analysis – Trends & Forecast 2024-2034

Building Materials Market Size and Share Forecast Outlook 2025 to 2035

In-building Wireless Market Forecast and Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Solutions Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Market Size and Share Forecast Outlook 2025 to 2035

Japan Building Automation System Market Analysis & Forecast by System, Application, and Region Through 2035

Green Building Materials Market Analysis by Type, Application, End-user and Region: Forecast for 2025 and 2035

PCR Tire Building Machine Market Size and Share Forecast Outlook 2025 to 2035

Protective Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA