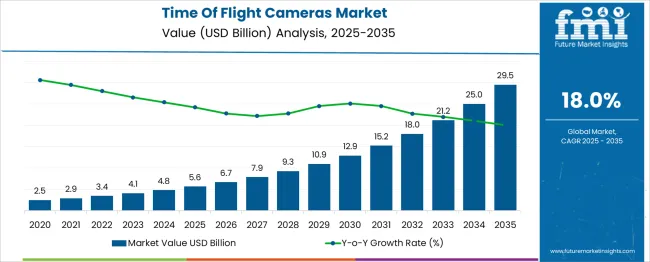

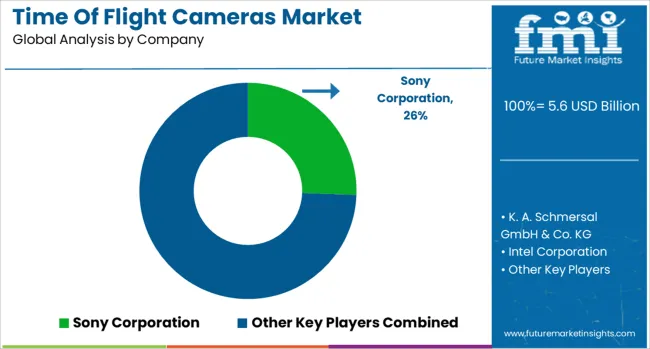

The Time Of Flight Cameras Market is estimated to be valued at USD 5.6 billion in 2025 and is projected to reach USD 29.5 billion by 2035, registering a compound annual growth rate (CAGR) of 18.0% over the forecast period.

| Metric | Value |

|---|---|

| Time Of Flight Cameras Market Estimated Value in (2025 E) | USD 5.6 billion |

| Time Of Flight Cameras Market Forecast Value in (2035 F) | USD 29.5 billion |

| Forecast CAGR (2025 to 2035) | 18.0% |

Technological advancements have made these cameras essential for augmented reality, facial recognition, and gesture control technologies. The rising integration of 3D imaging in smartphones, gaming devices, and automotive systems has further expanded market opportunities. Developments in sensor technology have improved camera accuracy, speed, and reliability, which are critical for delivering high-quality user experiences.

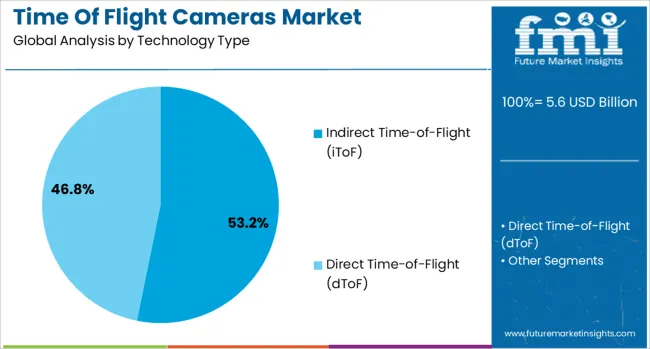

The expanding consumer electronics sector continues to drive the adoption of sophisticated imaging systems. Future growth is expected to be influenced by innovation in low-power sensors and miniaturized camera modules that enable integration into compact devices. The market is forecasted to grow, with segment leadership anticipated in Indirect Time-of-Flight (iToF) technology, sensor components, and the consumer electronics end-use industry.

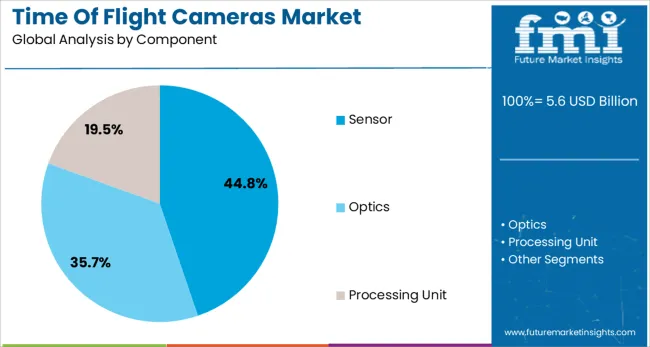

The time of flight cameras market is segmented by technology type, component, end-use industry, and application and geographic regions. The time-of-flight cameras market is divided by technology type into Indirect Time-of-Flight (iToF) and Direct Time-of-Flight (dToF). In terms of components, the time-of-flight cameras market is classified into Sensor, Optics, and Processing Unit.

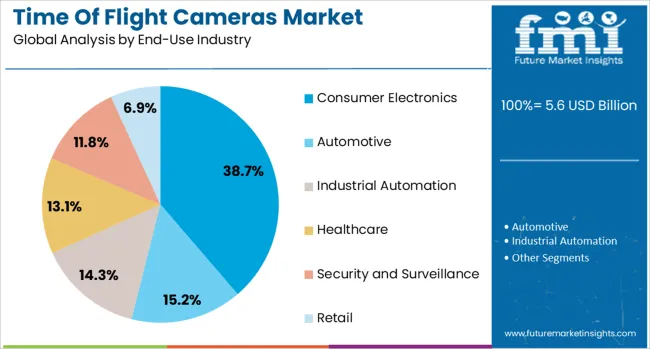

Based on the end-use industry, the time of flight cameras market is segmented into Consumer Electronics, Automotive, Industrial Automation, Healthcare, Security and Surveillance, and Retail. By application of the time of flight cameras, the market is segmented into 3D Imaging and Mapping, Gesture Recognition, Distance Measurement, Obstacle Detection, and Others.

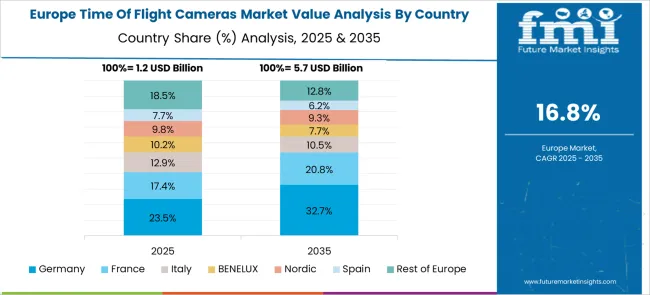

Regionally, the time of flight cameras industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Indirect Time-of-Flight (iToF) segment is projected to account for 53.2% of the market revenue in 2025, leading the technology type category. This segment has gained prominence due to its ability to deliver accurate depth measurements with reduced power consumption, making it suitable for mobile and portable devices.

iToF technology operates by calculating the phase shift of modulated light, which enables faster image processing and better performance in ambient lighting conditions. Its versatility across applications such as facial recognition and gesture detection has increased its adoption in consumer electronics.

The segment benefits from continuous improvements in modulation frequencies and signal processing algorithms that enhance depth resolution and reduce noise. As compactness and energy efficiency remain critical design factors, iToF technology is expected to sustain its market dominance.

The Sensor component segment is expected to contribute 44.8% of the time of flight cameras market revenue in 2025, maintaining its position as the key component segment. Sensors are fundamental to the operation of time of flight cameras, capturing reflected light signals and converting them into depth data.

Advances in sensor design have focused on improving sensitivity, dynamic range, and speed to meet the growing demand for accurate 3D imaging. The development of complementary metal-oxide-semiconductor (CMOS) sensors has enabled better integration with compact camera modules and lower manufacturing costs.

The importance of sensor performance in applications such as augmented reality and autonomous navigation has driven consistent investment and innovation. As sensor technology continues to evolve, this segment is anticipated to retain its leading share in the market.

The Consumer Electronics segment is projected to hold 38.7% of the time of flight cameras market revenue in 2025, securing its role as the primary end-use industry. The rapid adoption of 3D sensing technologies in smartphones, gaming consoles, and wearable devices has significantly boosted market demand.

Consumer preferences for enhanced device interactivity and security features like facial recognition have accelerated the integration of time of flight cameras. Furthermore, the miniaturization of camera modules has facilitated their inclusion in a broad range of portable consumer products.

Retail trends show increasing consumer willingness to invest in devices with advanced imaging capabilities, further driving growth. The consumer electronics industry’s continued focus on innovation and user experience is expected to sustain the segment’s leading market share.

Demand is rising for real-time depth sensing in robotics, manufacturing and interactive consumer devices. Growth opportunity lies in localized module production, vertical industry solutions and embedded system integration.

Time of flight cameras provide instantaneous three-dimensional mapping of environments using light return timing. Industrial robot arms in automotive and electronics assembly rely on depth data to avoid collisions and guide precise movements. Consumer devices such as smartphones and gaming consoles use these sensors for gesture control, spatial scanning and augmented reality perception. In warehouses, security checkpoints and smart factory floors the ability to capture distance information enhances object detection and automated decision-making. Unlike stereo-based systems, time of flight sensors offer consistent performance in low-light or reflective environments. This accuracy drives adoption in robotics, drones and interactive devices where safe, efficient operation depends on reliable spatial sensing.

Major commercial potential lies in offering depth sensor modules tailored for specific applications such as machine vision, gesture interfaces or safety monitoring. Embedded kits integrating depth cameras with onboard processing units, SDKs and calibration tools help system integrators build applications quickly. Partnerships with software developers and robotics integrators allow vertical-tailored solutions, for example, real-time object binning in warehouses or contactless control in hospitality. Local assembly or module production reduces import cost, enables faster delivery and supports region-specific standards. Subscription-based platforms offering continuous firmware updates, cloud analytics and performance monitoring extend product life cycles. Integrating depth camera output into broader spatial intelligence services such as 3D mapping or inventory tracking enables new revenue paths tied to application outcomes.

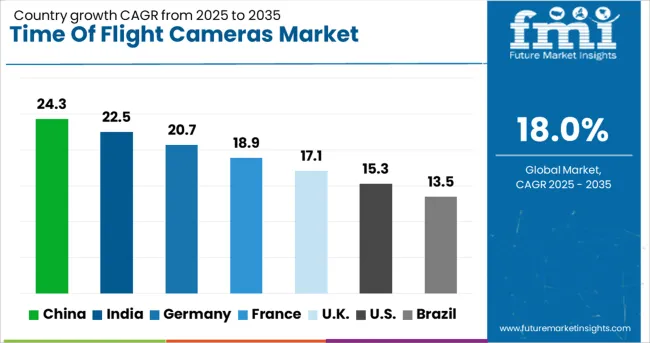

| Country | CAGR |

|---|---|

| China | 24.3% |

| India | 22.5% |

| Germany | 20.7% |

| France | 18.9% |

| UK | 17.1% |

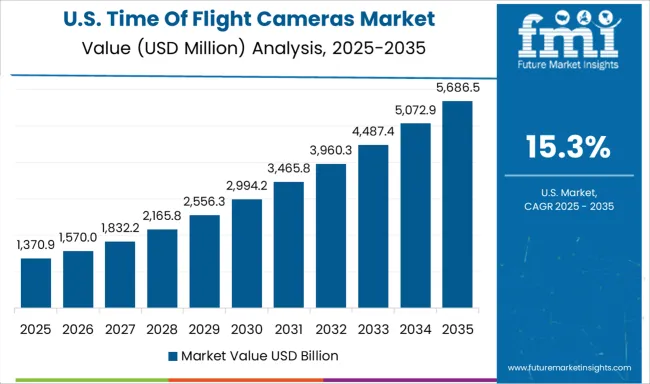

| USA | 15.3% |

| Brazil | 13.5% |

The Time of Flight (ToF) Cameras Market is projected to grow at a CAGR of 18% from 2025 to 2035, driven by rising adoption in autonomous vehicles, AR/VR, robotics, and smart devices. Among BRICS economies, China leads with a rapid 24.3% CAGR, followed closely by India at 22.5%, both benefiting from local manufacturing incentives and booming electronics demand. In the OECD bloc, Germany shows a strong CAGR of 20.7% as it integrates ToF systems in advanced automotive and industrial automation applications.

The United Kingdom (17.1%) and the United States (15.3%) are commercializing innovations in defense and consumer tech segments. With ASEAN and BRICS nations heavily investing in sensor tech, global competition is accelerating. Strategic investments in AI-enabled imaging and depth sensing are shaping the future of ToF technologies. This report includes insights on 40+ countries; the top five markets are shown here for reference.Sales Outlook for Time of Flight Cameras Market in China

China is expanding rapidly in the Time of Flight cameras market, showing a strong 24.3% CAGR, fueled by increasing demand in industrial automation and consumer electronics. Domestic smartphone brands are integrating ToF sensors into mid-range and premium devices to enhance depth-sensing capabilities. Robotics and logistics sectors are also actively adopting ToF modules for warehouse automation and object detection. Several camera module suppliers have launched low-cost, compact ToF solutions optimized for AI edge devices and AR headsets. Regional pilot programs are using ToF in smart retail for real-time inventory assessment. This multifaceted adoption across manufacturing, consumer tech, and automation systems is creating steady momentum for high-volume ToF sensor production by local players.

India is registering a 22.5% CAGR in the ToF camera market, backed by fast-growing electronics manufacturing and demand for touchless technology. Local OEMs are incorporating ToF sensors into smart door access systems, smartphones, and health-monitoring kiosks. Automotive manufacturers are exploring interior ToF cameras for driver behavior tracking and gesture controls. Indian system integrators are collaborating with global component makers to customize ToF modules for smart city deployments, particularly in traffic surveillance and public safety analytics. In consumer electronics, ToF technology is being paired with affordable AI chips to enable facial recognition in low-end devices. India’s steady growth in automation, coupled with cost-sensitive customization, is pushing forward ToF adoption across verticals.

In Germany, the market is advancing with a 20.7% CAGR, driven by the need for precision depth-sensing in industrial automation and autonomous systems. Manufacturers are incorporating ToF cameras into quality inspection processes for real-time defect detection. Automotive suppliers are embedding ToF modules in driver monitoring systems and parking assistance features. Local startups are also developing 3D vision systems using ToF for indoor robotics and warehouse management. Collaborative research projects are underway to enhance ToF signal processing for high-speed production environments. Adoption is particularly high in machine vision and safety systems, where depth accuracy directly affects operational performance. Germany’s industrial demand is pushing suppliers to develop high-resolution, robust ToF hardware for long-term deployment.

The United Kingdom is progressing with a 17.1% CAGR, as developers integrate ToF cameras into immersive retail tech, security tools, and healthcare devices. Several hospitals are testing ToF for patient movement monitoring, especially in elderly care settings. In retail, interactive displays using ToF enable gesture-based product browsing without physical contact. Defense technology firms are also evaluating ToF sensors for situational awareness and low-light navigation systems. University-led R&D programs are investigating compact ToF modules for wearable AR and smart glasses applications. As privacy-compliant 3D sensing becomes more relevant, the demand for embedded ToF cameras in secure and health-sensitive environments is growing steadily across both public and commercial applications.

The United States is recording a 15.3% CAGR in the ToF camera market, with adoption spanning smart appliances, autonomous vehicles, and advanced robotics. Major tech companies are enhancing consumer devices with ToF for spatial mapping in AR/VR platforms. ToF cameras are also being used in drone navigation and obstacle detection systems across logistics and surveillance. Appliance manufacturers are integrating ToF sensors into smart ovens, washers, and HVAC systems to improve human-device interaction. Some aerospace companies are incorporating ToF in cabin safety systems to monitor passenger movements. As device interactivity becomes more important in connected environments, USA firms are increasing their investment in ToF-enabled hardware.

The time-of-flight cameras market is led by a mix of established tech giants and emerging sensor specialists, structured into Tier 1, Tier 2, and Tier 3 suppliers. Sony Corporation commands the Tier 1 space with its advanced ToF sensor technologies used in mobile devices, robotics, and automotive applications, benefiting from strong OEM partnerships and precision imaging expertise.

Intel Corporation and STMicroelectronics N.V. also sit in this tier, offering robust 3D sensing solutions tailored for depth mapping, facial recognition, and industrial automation. Tier 2 players such as Basler and K. A. Schmersal GmbH & Co. KG focus on integrating ToF cameras into machine vision, safety, and smart factory systems. Tier 3 firms like DOMI Sensor provide customizable, compact ToF modules catering to niche use cases in AR/VR, healthcare devices, and research environments.

As mentioned in Infineon Technologies' press release on January 30, 2024, in collaboration with pmdtechnologies and OMS, they introduced a hybrid Time of Flight (hToF) camera enabling compact robot vacuums with enhanced 3D mapping and obstacle avoidance, replacing bulky scanners.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.6 Billion |

| Technology Type | Indirect Time-of-Flight (iToF) and Direct Time-of-Flight (dToF) |

| Component | Sensor, Optics, and Processing Unit |

| End-Use Industry | Consumer Electronics, Automotive, Industrial Automation, Healthcare, Security and Surveillance, and Retail |

| Application | 3D Imaging and Mapping, Gesture Recognition, Distance Measurement, Obstacle Detection, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sony Corporation, K. A. Schmersal GmbH & Co. KG, Intel Corporation, Basler, STMicroelectronics N.V., and DOMI sensor |

| Additional Attributes | Dollar sales by sensor type, camera architecture, and application segment; regional demand driven by smartphone AR, automotive ADAS, robotics, and industrial automation; innovation in SPAD-based ToF, hybrid 2D/3D imaging, and miniaturized modules; cost dynamics shaped by component complexity, VCSEL sourcing, and system integration; environmental considerations in energy use and sensor disposal; and emerging use cases in gesture interfaces, crowd monitoring, and autonomous drones. |

The global time of flight cameras market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the time of flight cameras market is projected to reach USD 29.5 billion by 2035.

The time of flight cameras market is expected to grow at a 18.0% CAGR between 2025 and 2035.

The key product types in time of flight cameras market are indirect time-of-flight (itof) and direct time-of-flight (dtof).

In terms of component, sensor segment to command 44.8% share in the time of flight cameras market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Time-Lapse Embryo Incubators Market Size and Share Forecast Outlook 2025 to 2035

Time Temperature Indicator Labels Market Size and Share Forecast Outlook 2025 to 2035

Time Temperature Indicator Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Time Switch Market Analysis Size and Share Forecast Outlook 2025 to 2035

Time Sensitive Networking TSN Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Time Temperature Indicator Labels Market Share & Provider Insights

Time of Flight (ToF) Sensor Market Insights - Growth & Forecast 2025 to 2035

Antimetabolite Drugs Market Size and Share Forecast Outlook 2025 to 2035

Altimeter Market

Multimedia Projectors Market Analysis – Growth & Industry Trends 2023-2033

Sentiment Analytics Software Market

Maritime Satellite Communication Market Size and Share Forecast Outlook 2025 to 2035

Maritime Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Maritime Patrol Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Maritime Patrol Naval Vessels Market Growth - Trends & Forecast 2025 to 2035

Real-time Lithium Sensor Market Size and Share Forecast Outlook 2025 to 2035

Real Time Location System (RTLS) Market Size and Share Forecast Outlook 2025 to 2035

Real-time Bioprocess Raman Analyzer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Real Time Parking System Market Growth - Trends & Forecast 2025 to 2035

Real-Time Store Monitoring Platform Market Outlook - Demand, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA