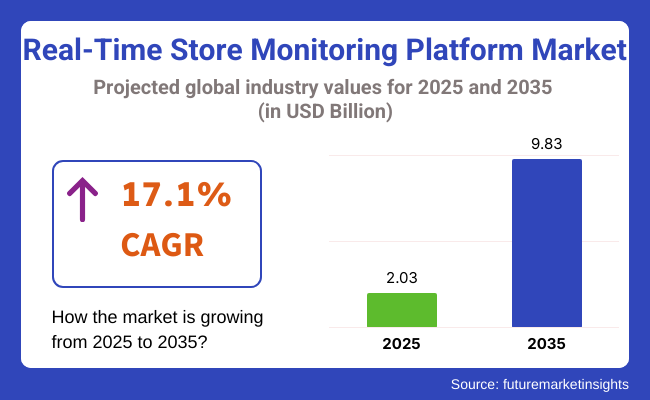

The real-time store monitoring platform market is fast-growing, with projections indicating it will reach USD 2.03 billion in 2025 and grow to USD 9.83 billion by 2035, representing a robust CAGR of 17.1%. The increasing demand for advanced solutions that allow retailers to monitor store operations in real-time is driving this growth.

As retailers seek to improve operational efficiency, enhance customer experiences, and optimize inventory management, real-time store monitoring platforms are becoming integral to modern retail operations. These platforms provide valuable insights into store performance, customer behavior, and inventory levels, which help retailers make informed decisions and streamline operations.

Looking ahead, the market for real-time store monitoring platforms is likely to continue its strong growth trajectory, driven by innovations in technology and the growing need for retailers to enhance operational efficiency. The adoption of artificial intelligence (AI), machine learning, and advanced analytics in these platforms is expected to offer new opportunities for growth.

Retailers will be able to gain deeper insights into customer behavior and store performance, which will drive further demand for these platforms. As industries increasingly rely on data-driven decision-making, the platforms' ability to provide actionable real-time data will be key to managing trends, improving customer engagement, and addressing emerging issues swiftly.

Government regulations in the real-time store monitoring platform market are focused on ensuring data privacy, cybersecurity, and consumer protection. As these platforms collect and analyze significant amounts of consumer data, regulatory bodies have implemented laws to secure and protect that information. Regulations such as the General Data Protection Regulation (GDPR) in the European Union and similar standards in other regions require businesses to ensure transparency, obtain consent, and protect consumer data. As platforms continue to integrate into retail operations, adherence to these evolving regulations will be crucial to maintaining consumer trust and ensuring the continued growth of the market.

The campaign management is estimated to grow at the highest CAGR of 22.1% in the real-time store monitoring platform industry during 2025. This growth is driven by the increasing need for personalized marketing, AI-led automation, and real-time promotional insights. Retail heavyweights such as Walmart and Target utilize AI-powered monitoring platforms to track shopper behavior, fine-tune marketing campaigns, and boost conversion rates.

The adoption of digital signage, predictive analytics, and location-based marketing among small and mid-sized retailers also drives this expansion. As 80% of consumers report being more likely to make a purchase from a company that provides personalized experiences, tools to manage campaigns in real-time are quickly becoming essential for every retail brand.

Store merchandising analysis is still by far the largest AI application, with a 31.2% industry share in 2025; real-time data analytics used for inventory tracking, planogram compliance, and demand forecasting are gaining popularity among retailers. Supply chain efficiency is increased with AI-based monitoring systems, which gives better product placement and helps reduce out-of-stock situations by 30%. Retailers such as Carrefour and Kroger use real-time analytics to enhance stock visibility and automate inventory updates.

Store merchandising analysis is when machines do the heavy lifting of meeting customer expectations at optimal efficiency as inventory is seamlessly integrated into Omni channel commerce and intelligent supply chains, a focus area in 2024 investment guarantees.

In 2025, large retailers will still lead the real-time monitoring platform industry with a 74.5% industry share. Walmart, Carrefour, and Target are some of the industry giants that use AI-powered beacon and sensor technology to analyze customer traffic patterns, promote a feeling of community and loyalty, and improve store layouts and store compliance.

To thrive in a post-pandemic retail environment, large retailers have turned to automated foot traffic analysis, digital shelf monitoring, and theft-prevention tools to both optimize their operations and improve customer experience. With AI-enabled Omni channel strategies being widely adopted, we are also starting to see systems of integration between physical stores and the digital world, which offer opportunities such as increased inventory accuracy and sales forecasting.

By 2025, small and mid-sized shops are set to gain a 25.5% industry share as they increasingly adopt AI-driven monitoring solutions. Similar to small and mid-sized stores that are leveraging the enterprise cloud for store intelligence, regional supermarkets and specialty and boutique retailers are adopting cloud-based store intelligence solutions to gain near-real-time insights into customer behavior, marketing performance and inventory availability.

Reduced operating costs, improved stock levels, a product sales boost, tailored offers, and customer attention through smarter pricing and promotions with flexible and readily available AI-powered technologies help smaller retailers deliver greater sales and customer contact.

| Company | Contract Value (USD Million) |

|---|---|

| RetailNext Inc. | Approximately USD 90 - USD 100 |

| Cisco Systems | Approximately USD 80 - USD 90 |

| Sensormatic Solutions (Johnson Controls) | Approximately USD 70 - USD 80 |

| Trax Retail | Approximately USD 60 - USD 70 |

The real-time store monitoring platform territory also contains the most critical risks that could deter its growth and efficiency. This platform's major threat could be of data security and privacy concerns, for such platforms generally require the collection of customer behavior, transaction data, and surveillance footage. Therefore, their breach or unauthorized access can result in a legal matter and a reputational loss.

Another issue of fusion is the problem of businesses that are often unable to connect the monitoring platforms with the existing POS systems, CRM tools, and the analytics dashboards. Poor performance in these areas generally leads to errors in the recorded data, the slowing down of operations, and the wastage of resources.

What is more, the spending on initial real-time monitoring software implementations is one big factor holding back small and medium-sized retailers. Budget allocations are impacted by the necessity of hardware installation, software licenses, and IT infrastructure upgrades, so the companies are constrained and delayed in ROI realization.

The lack of reliability in Artificial Intelligence and automation is also a drawback. The observations need to be made regarding the trustworthiness of operational issues that cannot be solved manually. Such issues may arise due to false positives, system error messages, or poor AI insights.

Furthermore, the situations related to regulatory compliance can also be uncomfortable, especially for retailers who have to comply with the laws regarding consumer data protection and surveillance regulations. Consequently, the failure to comply with these rules will bring penalties, lawsuits, and restrictions which will result in changes in platform deployment and usage. Long-term success in the business will be yielded by addressing such risks through implementing secure data practices, adopting cost-effective deployment models, and running comprehensive AI validation.

| Countries | CAGR |

|---|---|

| USA | 9.8% |

| UK | 8.5% |

| France | 8.7% |

| Germany | 8.9% |

| Italy | 8.3% |

| South Korea | 9.2% |

| Japan | 9.3% |

| China | 10.5% |

| Australia | 8.9% |

| New Zealand | 8.2% |

The USA industry is expected to expand at a CAGR of 9.8% between 2025 and 2035. Increasing demand for AI-based analytics and automation for the retail sector is fueling growth. Retailers are leveraging advanced monitoring platforms to improve efficiency in inventories, enhance customer experience, and achieve higher operational efficiency.

The intersection of AI-based predictive analytics and IoT is revolutionizing real-time monitoring of sales patterns and consumer behavior. Furthermore, increased smart store technology is assisting retailers in reducing losses, improving decision-making, and improving security controls.

Cloud-based store management solutions are also driving the industry. Retailers are deploying real-time monitoring platforms in different verticals, including e-commerce fulfillment centers, clothing stores, and supermarkets. The USA retail industry invested massively in intelligent store technology in 2024, demonstrating the increasing importance of real-time data analysis to retail business. As firms continue to invest in automated systems, the need for AI-based monitoring platforms will increase, offering greater efficiency, improved customer interaction, and streamlined supply chain management.

The UK industry is anticipated to grow at a rate of 8.5% during 2025 to 2035. Retailers across the country are adopting AI-driven monitoring solutions to enhance operating efficiency, automate stock control, and track customers in real time. Omnichannel retail is accelerating real-time monitoring solutions at a greater rate, and offline stores are becoming seamlessly integrated with e-commerce operations. Store owners are maximizing customer engagement and loss prevention with AI-driven analytics and IoT-compatible sensors.

Retail mall, department store, and supermarket deployments of smart store solutions are fueling further growth of real-time monitoring technology. Cloud analytics-driven change across the retail industry and increasing UK investments in cloud analytics are fueling the industry.

Predictive analytics and automated decision-making with the help of real-time store monitoring further improve supply chain effectiveness and overall store performance through the support of retailers. Although the need for personalized AI-based monitoring platforms will continue to increase with the growing requirement for individualized shopping.

The French industry is anticipated to expand at a CAGR of 8.7% from 2025 to 2035.

The country is experiencing an increase in AI-powered retail analytics implementation because of the need for data-driven decision-making in physical stores. French retailers are implementing real-time monitoring solutions to improve store fixtures, customer engagement, and security. Increased use of IoT and intelligent sensors within retail spaces is enabling firms to monitor customers' movement patterns and optimize stockpiles based on them. French retailers are heavily investing in cloud-based monitoring technology as well to improve forecasting of demands and reduce operating inefficiencies.

Increased application of automated checkout terminals and smart retail solutions in department stores and hypermarkets is driving industry growth to new heights. Since the retail sector is embracing AI-driven predictive analytics solutions and fraud management solutions, more will be using store monitoring platforms in real-time, thus facilitating greater efficiency, improved customer satisfaction, and improved loss management practices.

Germany industry is forecast to grow at a CAGR of 8.9% from 2025 to 2035. Strong retail ecosystem in Germany and emphasis on data-driven store optimization are driving demand for AI-powered monitoring solutions. German retailers are leveraging smart store technologies to enhance inventory tracking, fraud protection, and store efficiency. Rising interest in GDPR-conformant monitoring solutions also influences the use of privacy-centric analytics platforms within the retail setting.

German retailers are increasingly using AI-powered predictive analytics to improve inventory replenishment, demand forecasting, and supply chain management.

Cloud-based store monitoring platforms are converging to empower businesses to make informed decisions with real-time analytics. Creation of automated retail and rising use of IoT in supermarkets and shopping malls is additionally fueling industry growth. With retailers continuing to invest into AI-driven automation and upper-level analytics, real-time store monitoring solutions will pick up pace, with improved efficiency and improved customer experience being the promises.

The Italian industry is anticipated to record a growth of 8.3% CAGR between 2025 to 2035. Local retailers are adopting AI-based monitoring technologies to drive more effective inventory management, customer experiences, and store operating efficiency. Advanced retail automation in upscale stores and supermarkets is fueling adoption of real-time monitoring solutions. Retailers are adopting IoT-enabled analytics for measuring footfall traffic, fraud prevention, and tailored shopping experiences.

Cloud-enabled store monitoring solutions are in high demand, enabling retailers to maximize efficiency and eliminate wastage. Growing adoption of automated checkout lanes and AI-powered surveillance systems is also propelling the industry forward. As retail digital transformation accelerates, Italy's real-time monitoring platform adoption will gain momentum, enabling improved decision-making, fraud security, and supply chain management.

The Japanese industry will grow at a rate of 9.3% CAGR between 2025 to 2035. The country's strong focus on retail automation and digitalization is driving adoption. AI-based monitoring platforms are being implemented by Japanese retailers for optimal store designs, enhanced security, and self-service inventory management. Growth in cashier-less retail and self-scan checkout is also driving demand.

Japanese stores are investing in cloud-based monitoring systems to boost operational efficiency and customer engagement. Real-time analysis for demand forecasting and fraud protection is gaining traction, thereby contributing to overall industry growth. Japan leads the charge in innovation of smart retailing, with AI-based monitoring platform usage maintaining its strong demand.

The Chinese industry will develop at 10.5% CAGR in the forecast period of 2025 to 2035. The aggressively expanding retail industry in the country and the desire to integrate IoT and AI are pushing the industry. Chinese retailers are employing real-time analytics to monitor customer behavior, rationalize store format, and improve supply chains. Intelligent stores and unmanned retail stores increasingly are driving the requirement for AI-driven monitoring tools.

China's investment in digitalization and cloud-based analytics is also consolidating industry growth. Retailers are increasingly employing predictive analytics and automated decision-making to improve efficiency and customer experience. As smart retail technology continues to evolve, the Chinese industry for real-time monitoring platforms will continue to grow.

Australia's industry will remain growing at an 8.9% CAGR throughout 2025 to 2035. The Australian retail sector is realigning with AI-powered monitoring systems for improving operational effectiveness as well as enhancing customer interaction. Increased application of smart retail technologies and IoT-integrated inventory control is driving the demand.

Australian retailers are investing in predictive surveillance and cloud computing-based analytics for better store operations. Expansion of automatic checkout technology and digital business ideas is also expanding industry growth even more. As the retailers are concerned with enhancing decision-making processes as well as removing inefficiencies, real-time monitoring platform usage will expand even further.

New Zealand's industry will grow at a CAGR of 8.2% in the forecast period of 2025 to 2035. New Zealand is leading the digital retail revolution, and it's driving adoption. Retailers are implementing AI-powered monitoring platforms to optimize inventory, track consumers, and enhance security.

The adoption of cloud-based store management systems and predictive analytics is on the rise, enabling retailers to optimize their operations. With improved store technologies, the demand for real-time monitoring platforms in New Zealand will be on the rise, enabling overall performance and customer satisfaction enhancement of the stores.

Cisco Systems (20-25%)

Cisco leads the industry for real-time store monitoring platforms with AI-powered analytics, IoT-enabled solutions, and cloud-based data management that provide optimized retail operations.

Microsoft Corporation (15-20%)

Microsoft works on customer behavior tracking, predictive analytics, and data integration in real-time to improve store performance using AI.

IBM Corporation (10-15%)

IBM provides next-gen analytical solutions to enable retailers to optimize store efficiency, manage inventories, and improve customer engagement.

SAP SE (8-12%)

SAP focuses on intelligent retail automation and demand forecasting and operates ERP solutions for operational efficiency.

Oracle Corporation (5-10%)

Oracle implements real-time business intelligence by providing AI solutions for improved inventory control and enhanced customer engagement.

Other Key Players (35-40% Combined)

These companies contribute to ongoing advancements in real-time store monitoring by integrating AI-driven automation, cloud-based analytics, and IoT-enabled insights. The increasing adoption of real-time tracking, predictive analytics, and smart retail automation continues to shape the competitive landscape of the industry.

The industry is segmented into real-time store monitoring platforms, cloud-based and on-premises solutions, and services, including professional services, retail consulting & advisory, support & maintenance, implementation services, and managed services, with cloud-based solutions leading due to scalability and cost efficiency.

Key applications include in-store customer behavior analysis, campaign management, store merchandising analysis, store inventory management, shelf management, and product differentiation & management, with in-store customer behavior analysis being widely adopted to enhance personalized shopping experiences.

The industry serves small & mid-sized retailers and large retailers, with large retailers holding the majority share due to their investment in advanced retail analytics and automation technologies.

The industry spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East and Africa (MEA), with North America leading due to high adoption of AI-driven retail analytics solutions.

The industry is projected to witness a CAGR of 17.1% between 2025 and 2035.

The industry stood at USD 2.03 billion in 2025.

The industry is anticipated to reach USD 9.83 billion by 2035 end.

North America is set to record the highest CAGR during the assessment period, driven by increasing adoption of AI-powered analytics, the rise of smart retail solutions, and the growing need for real-time inventory and customer behavior tracking to optimize store operations.

SAP SE, Capgemini SE, Cloudera, Inc., Happiest Minds, RetailNext, Inc., Bosch Sicherheitssysteme GmbH, ShopperTrak, QLogik Technologies, Inc., SimpliField, Sisense Inc., Xperion Kft., Link Analytix, IntelliVision, Arm Limited, Manthan Software Services Pvt. Ltd., and Capillary Technologies are the key players in the industry.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Solution, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Market Attractiveness by Solution, 2023 to 2033

Figure 18: Global Market Attractiveness by Application, 2023 to 2033

Figure 19: Global Market Attractiveness by End User, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Solution, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 37: North America Market Attractiveness by Solution, 2023 to 2033

Figure 38: North America Market Attractiveness by Application, 2023 to 2033

Figure 39: North America Market Attractiveness by End User, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Solution, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Solution, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Solution, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 77: Europe Market Attractiveness by Solution, 2023 to 2033

Figure 78: Europe Market Attractiveness by Application, 2023 to 2033

Figure 79: Europe Market Attractiveness by End User, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Solution, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Solution, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Solution, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Solution, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Solution, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Solution, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Solution, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 157: MEA Market Attractiveness by Solution, 2023 to 2033

Figure 158: MEA Market Attractiveness by Application, 2023 to 2033

Figure 159: MEA Market Attractiveness by End User, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

In-Store Theater Packaging Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in In-Store Theater Packaging Market

Smart Retail – AI-Powered Store Management Solutions

In-Store Analytics Market

In store signage Market

App Store Optimization Software Market Size and Share Forecast Outlook 2025 to 2035

Out Store Signage Market

Dark Store Market Size and Share Forecast Outlook 2025 to 2035

Pharmacy and Drug Store Franchises Market is segmented by Type and Age Group from 2025 to 2035

Mobile Application Store Market Trends – Growth & Forecast through 2034

Intelligent Virtual Store Design Solution Market Size and Share Forecast Outlook 2025 to 2035

Platform Lifts Market Size and Share Forecast Outlook 2025 to 2035

Platform Architecture Market Size and Share Forecast Outlook 2025 to 2035

Platform Boots Market Trends - Growth & Industry Outlook to 2025 to 2035

Platform Shoes Market Trends - Demand & Forecast 2025 to 2035

Platform Trolley Market Growth – Trends & Forecast 2025 to 2035

AI Platform Cloud Service Market Size and Share Forecast Outlook 2025 to 2035

AI Platform Market Trends – Growth & Forecast through 2034

AIOps Platform Market Forecast and Outlook 2025 to 2035

Sales Platforms Software Market - Growth & Forecast 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA