In-store theater packaging is undergoing steady growth because so many retailers demand impactful, eye-catching retail displays that drive greater customer engagement. Retailers and brands are innovating with innovative, customizable, and sustainable packaging solutions to optimize shelf visibility and improve consumer experience. Digital printing, lightweight materials, and green solutions are influencing the competitive dynamics of this space.

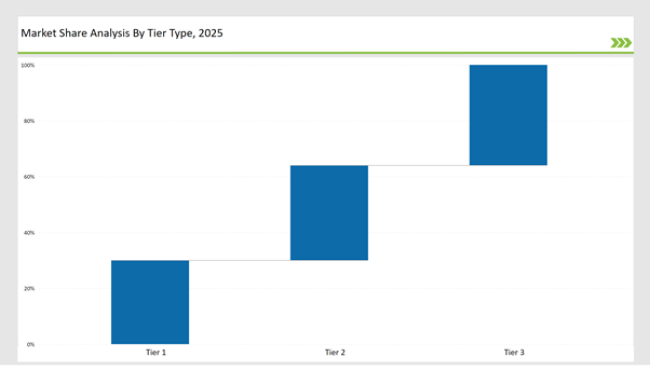

Tier 1 market leaders are Smurfit Kappa Group, DS Smith, and WestRock, who have 30% of the market share using advanced printing technologies, extensive distribution networks, and continuous product innovations.

Tier 2- The firms here include International Paper, Menasha Packaging, and Pratt Industries, which control 34% of the market. These firms do business directly with mid-sized retailers by offering customized, cost-effective, and high-performance packaging solutions with an emphasis on sustainability.

The remaining 36% of the market consists of Tier 3 players, which includes regional and niche manufacturers specializing in temporary and permanent POP displays. These players address specialized consumer demands with tailored designs and localized distribution networks, focusing on cost-effective and adaptable solutions.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Smurfit Kappa, DS Smith, WestRock) | 14% |

| Rest of Top 5 (International Paper, Menasha Packaging) | 10% |

| Next 5 of Top 10 (Pratt Industries, Georgia-Pacific, Packaging Corporation of America, Graphic Packaging International, VPK Group) | 6% |

In-store theater packaging markets for diverse industries such as retail branding, product promotions, and consumer engagement. There are also rising demand levels from the emerging markets especially in food and beverages and electronic markets

In package innovation now focuses on maximizing efficiency in terms of production productivity while minimizing its adverse effects to the environment; improving brand narrative

The competition is led by new developments in digital printing, automation, and sustainable materials. Manufacturers will invest in R&D for ease of design flexibility, cost-effectiveness, and production efficiency. Process innovations have reduced material waste and improved branding effectiveness.

Year-on-Year Leaders

Technology suppliers should focus on integrating automation, sustainability, and customization into in-store theater packaging solutions. Collaboration with material suppliers can help develop cost-effective and innovative designs.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Smurfit Kappa, DS Smith, WestRock |

| Tier 2 | International Paper, Menasha Packaging, Pratt Industries |

| Tier 3 | Georgia-Pacific, Graphic Packaging International, VPK Group |

Leading manufacturers are focusing on sustainability, production efficiency, and innovative branding solutions to meet evolving industry demands.

| Manufacturer | Latest Developments |

|---|---|

| Smurfit Kappa | In March 2024, introduced 100% recyclable in-store packaging solutions. |

| DS Smith | In August 2023, developed lightweight, fiber-based POP displays. |

| WestRock | In May 2024, launched high-resolution digital printing for customized displays. |

| International Paper | In November 2023, expanded global distribution with new packaging innovations. |

| Menasha Packaging | In February 2024, introduced an AI-enabled packaging design tool. |

| Pratt Industries | In July 2024, unveiled an eco-friendly, reusable display system. |

| Georgia-Pacific | In October 2023, developed modular retail packaging for product adaptability. |

| VPK Group | In December 2024, invested in advanced printing technology to improve branding. |

The competitive landscape of the in-store theater packaging market is highly dynamic, and leading players focus on sustainability, digital printing, and innovative design solutions to ensure that they hold a strong position in the market.

Growth will be driven by digital printing, material innovations, and sustainability efforts. Companies will integrate smart monitoring systems, invest in energy-efficient packaging solutions, and enhance recycling processes. The demand for high-impact, lightweight, and reusable in-store displays is expected to rise, further expanding the market. Additionally, advancements in AI-driven predictive design tools will enhance production efficiency and reduce costs.

Leading players include Smurfit Kappa, DS Smith, and WestRock.

The top 3 players collectively control 14% of the global market.

The market shows medium concentration, with top players holding 30%.

Key drivers include sustainability, automation, material innovation, and regulatory compliance.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

In-Store Theater Packaging Market Size and Share Forecast Outlook 2025 to 2035

3D Mobile Theater Market Demand & Trends 2024 to 2034

Sales Analysis of Tourism Industry in the Middle East Size and Share Forecast Outlook 2025 to 2035

Semen Analysis Systems Market Size and Share Forecast Outlook 2025 to 2035

Stone Analysis Software Market – Trends & Forecast 2025 to 2035

Water Analysis Instrumentation Market Analysis – Size, Share, and Forecast 2025 to 2035

Spend Analysis Software Market

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Failure Analysis Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Failure Analysis Equipment Market Insights – Forecast 2025 to 2035

Adoption Analysis of 5G in Aviation Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Outbound Tourism in Germany Size and Share Forecast Outlook 2025 to 2035

Adoption Analysis of SCADA in Oil and Gas Industry Forecast and Outlook 2025 to 2035

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA