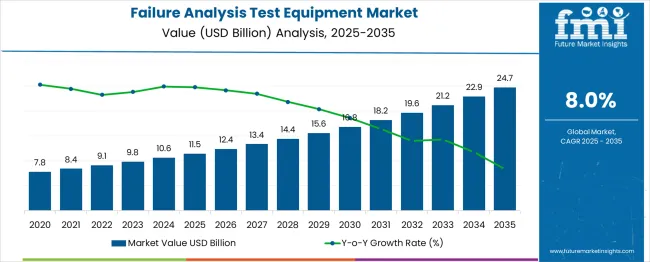

The global failure analysis test equipment market is anticipated to grow from USD 11.5 billion in 2025 to approximately USD 24.7 billion by 2035, recording an absolute increase of USD 13.2 billion over the forecast period. This translates into a total growth of 114.8%, with the market forecast to expand at a CAGR of 8.0% between 2025 and 2035. The overall market size is expected to grow by nearly 2.1X during the same period, supported by increasing demand for quality control and failure analysis across various industries, rising complexity of electronic components, and growing need for advanced testing technologies in manufacturing processes.

Between 2025 and 2030, the failure analysis test equipment market is projected to expand from USD 11.5 billion to USD 17.8 billion, resulting in a value increase of USD 6.3 billion, which represents 47.7% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for advanced semiconductor testing, increasing complexity of electronic devices, and growing adoption of nanotechnology applications across various industries. Manufacturing companies are expanding their failure analysis capabilities to ensure product quality and reduce defect rates in critical applications.

| Metric | Value |

| Estimated Value in (2025E) | USD 11.5 billion |

| Forecast Value in (2035F) | USD 24.7 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

From 2030 to 2035, the market is forecast to grow from USD 17.8 billion to USD 24.7 billion, adding another USD 6.9 billion, which constitutes 52.3% of the overall ten-year expansion. This period is expected to be characterized by advancement in high-resolution imaging technologies, integration of artificial intelligence in failure analysis processes, and development of automated testing solutions. The growing adoption of Industry 4.0 technologies and smart manufacturing practices will drive demand for sophisticated failure analysis equipment with enhanced precision and analytical capabilities.

Between 2020 and 2025, the failure analysis test equipment market experienced steady expansion, driven by increasing quality control requirements across manufacturing sectors and growing complexity of electronic components. The market developed as manufacturers recognized the need for advanced analytical instruments to identify failure mechanisms and improve product reliability. Rising investments in research and development activities and growing focuses on preventive maintenance strategies contributed to market growth during this period.

Market expansion is being supported by the increasing complexity of modern electronic devices and the corresponding demand for sophisticated testing and analysis capabilities. Manufacturing companies are increasingly focused on quality assurance and defect prevention strategies that require advanced failure analysis equipment to identify root causes of component failures. The growing miniaturization of electronic components and the need for nanoscale analysis are driving demand for high-resolution imaging and analytical instruments.

The rising adoption of electric vehicles, renewable energy systems, and advanced semiconductor technologies is creating new challenges in failure analysis, requiring specialized equipment capable of handling diverse materials and complex structures. The growing focuses on product reliability and safety standards across industries such as aerospace, automotive, and medical devices is driving investments in comprehensive failure analysis capabilities. The increasing integration of artificial intelligence and machine learning technologies in analytical instruments is enhancing the speed and accuracy of failure diagnosis processes.

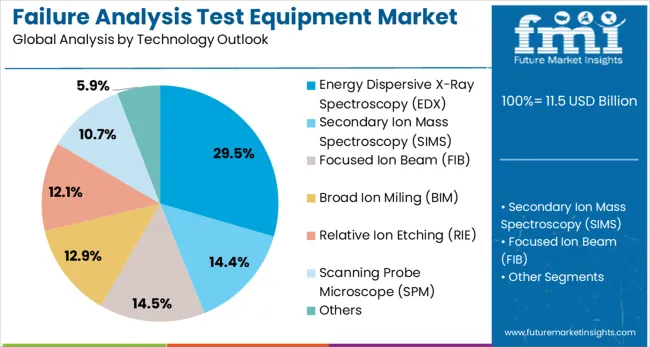

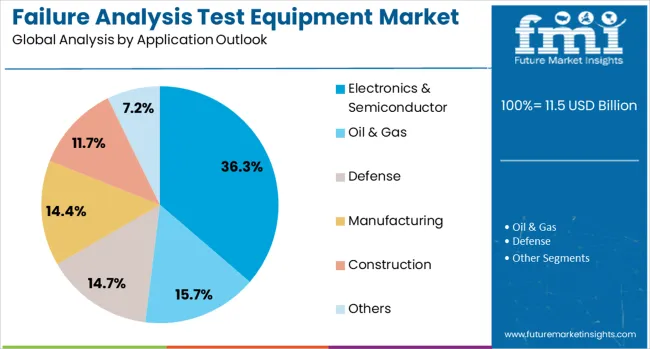

The market is segmented by product outlook, technology outlook, application outlook, and region. By product outlook, the market is divided into scanning electron microscope (SEM), transmission electron microscope (TEM), focused ion beam system (FIB), dual beam system, and others. Based on technology outlook, the market is categorized into energy dispersive X-ray spectroscopy (EDX), secondary ion mass spectroscopy (SIMS), focused ion beam (FIB), broad ion miling (BIM), and relative ion etching (RIE). In terms of application outlook, the market is segmented into electronics & semiconductor, oil & gas, defense, manufacturing, and construction. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The scanning electron microscope (SEM) segment is projected to account for 40.1% of the failure analysis test equipment market in 2025, reaffirming its position as the most widely adopted analytical instrument in failure analysis applications. SEM technology provides high-resolution imaging capabilities essential for examining surface morphology, material composition, and structural defects at microscopic levels. The versatility of SEM systems in handling various sample types and their ability to provide detailed topographical information make them indispensable tools in quality control and failure investigation processes.

This segment forms the foundation of most failure analysis laboratories, as it offers the perfect balance between resolution, ease of use, and analytical capabilities. The continuous advancement in SEM technology, including field emission sources, environmental chambers, and automated imaging systems, continues to enhance their analytical capabilities. With increasing demand for nanoscale analysis and materials characterization, SEM systems remain the primary choice for comprehensive failure analysis across diverse industrial applications, ensuring market dominance.

Energy dispersive X-ray spectroscopy (EDX) is projected to represent 29.5% of failure analysis test equipment technology demand in 2025, underscoring its critical role as a complementary analytical technique for elemental analysis and composition identification. EDX systems provide rapid and accurate elemental mapping capabilities that are essential for understanding material properties and identifying contamination sources in failure analysis investigations. The integration of EDX with electron microscopy systems creates powerful analytical platforms capable of simultaneous imaging and compositional analysis.

The segment is supported by the increasing need for precise elemental identification in advanced materials and complex electronic components. EDX technology enables analysts to determine the chemical composition of failure sites, identify foreign materials, and track elemental diffusion patterns that may contribute to component degradation. As material science continues to advance and new alloys and composite materials are developed, EDX remains an essential tool for comprehensive failure analysis, reinforcing its significant market presence.

The electronics & semiconductor application segment is forecasted to contribute 36.3% of the failure analysis test equipment market in 2025, reflecting the critical importance of quality control and reliability assurance in the semiconductor industry. The increasing complexity of integrated circuits, advanced packaging technologies, and miniaturization trends require sophisticated analytical capabilities to identify failure mechanisms at nanoscale dimensions. Semiconductor manufacturers rely heavily on failure analysis equipment to maintain yield rates, improve product reliability, and accelerate time-to-market for new technologies.

This segment benefits from the rapid growth of the global semiconductor market, driven by applications in artificial intelligence, 5G communications, automotive electronics, and Internet of Things devices. The continuous shrinking of feature sizes and increasing integration density in semiconductor devices create new challenges that require advanced analytical solutions. As the semiconductor industry continues to push technological boundaries, the demand for cutting-edge failure analysis equipment will remain strong, making this segment a primary growth driver for the overall market.

The failure analysis test equipment market is advancing steadily due to increasing quality control requirements across manufacturing industries and growing complexity of electronic components. The market faces challenges including high equipment costs, technical complexity requiring specialized expertise, and lengthy analysis procedures. Innovation in automation technologies and artificial intelligence integration continue to influence product development and market expansion patterns.

The growing adoption of artificial intelligence and machine learning algorithms is enabling automated defect detection, pattern recognition, and predictive analysis capabilities in failure analysis equipment. AI-powered systems can process large volumes of imaging data, identify anomalies, and provide rapid diagnostic recommendations, significantly reducing analysis time and improving accuracy. Machine learning algorithms are being trained to recognize specific failure patterns and correlate them with operational conditions, enabling predictive maintenance strategies.

Modern failure analysis equipment manufacturers are developing integrated platforms that combine multiple analytical techniques in single instruments, providing comprehensive characterization capabilities while reducing sample handling requirements. These multi-modal systems enable simultaneous imaging, elemental analysis, and structural characterization, improving efficiency and data correlation. Advanced software platforms are being developed to integrate data from different analytical techniques and provide unified analysis workflows for complex failure investigations.

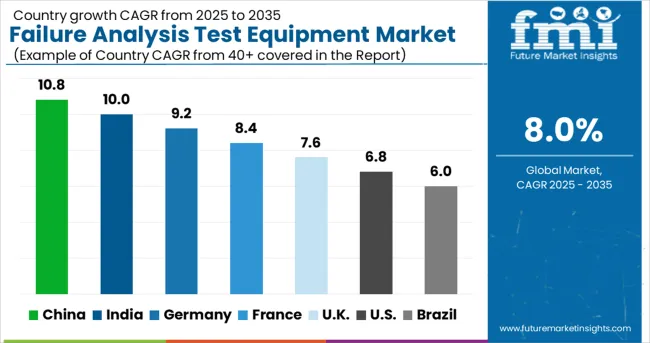

| Country | CAGR (2025-2035) |

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

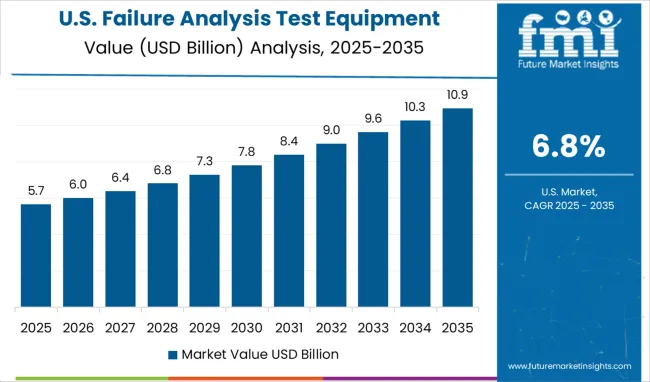

| USA | 6.8% |

| Brazil | 6.0% |

The market is experiencing robust growth globally, with China leading at a 10.8% CAGR through 2035, driven by rapid industrialization, expanding semiconductor manufacturing, and increasing focuses on quality control across manufacturing sectors. India follows at 10.0%, supported by growing electronics manufacturing, rising investments in research and development, and increasing adoption of advanced analytical technologies. Germany shows strong growth at 9.2%, focusing on precision manufacturing and advanced materials research. France records 8.4%, focusing on aerospace and automotive applications requiring sophisticated failure analysis capabilities. The UK shows 7.6% growth, prioritizing research and development activities and advanced materials characterization. The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Revenue from failure analysis test equipment in China is projected to exhibit strong growth with a CAGR of 10.8% through 2035, driven by rapid expansion of semiconductor manufacturing, electronics production, and advanced materials research activities. The country's commitment to becoming a global technology leader and reducing dependence on imported technologies is creating significant demand for sophisticated analytical instruments. Major domestic and international equipment manufacturers are establishing comprehensive service networks to support the growing population of research institutions and manufacturing facilities requiring advanced failure analysis capabilities.

Revenue from failure analysis test equipment in India is expanding at a CAGR of 10.0%, supported by growing electronics manufacturing, increasing investments in research and development, and rising focuses on quality control across various industries. The country's expanding semiconductor ecosystem and growing focus on advanced materials research are driving demand for sophisticated analytical instruments. International equipment manufacturers and domestic distributors are establishing distribution channels to serve the growing demand for failure analysis solutions.

Demand for failure analysis test equipment in the USA is projected to grow at a CAGR of 6.8%, supported by continued leadership in semiconductor technology, aerospace applications, and advanced materials research. American companies and research institutions are increasingly focused on cutting-edge analytical capabilities, product innovation, and maintaining technological competitiveness. The market is characterized by strong demand for high-end instruments that combine advanced imaging with comprehensive analytical capabilities.

Revenue from failure analysis test equipment in Germany is projected to grow at a CAGR of 9.2% through 2035, driven by the country's strong manufacturing heritage, focuses on precision engineering, and commitment to quality excellence. German companies consistently demand high-quality, reliable analytical instruments that deliver accurate results while maintaining operational efficiency and long-term reliability.

Revenue from failure analysis test equipment in the UK is projected to grow at a CAGR of 7.6% through 2035, supported by strong research and development activities, advanced materials research, and growing focuses on innovation across various industrial sectors. British institutions and companies value cutting-edge analytical capabilities, operational efficiency, and comprehensive technical support services.

Revenue from failure analysis test equipment in France is projected to grow at a CAGR of 8.4% through 2035, supported by the country's strong aerospace industry, automotive sector, and focuses on advanced materials research. French companies and institutions prioritize high-performance analytical equipment, safety standards, and comprehensive failure investigation capabilities.

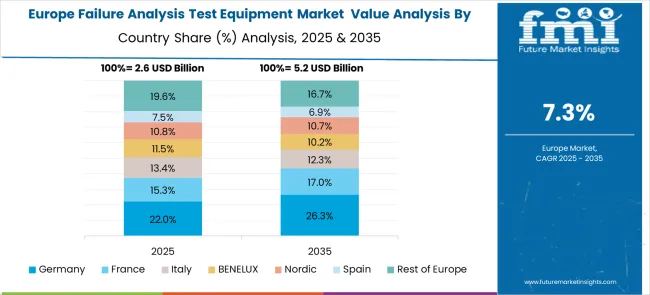

The market in Europe demonstrates strong development across major economies with Germany showing robust presence through its advanced manufacturing sector and focuses on precision engineering, supported by companies investing heavily in quality control and failure prevention technologies to maintain their reputation for high-quality products and innovative solutions. France represents a significant market driven by its aerospace and automotive industries, with organizations requiring sophisticated failure analysis capabilities to ensure safety and reliability standards in critical applications and advanced materials research.

The UK exhibits considerable growth through its focus on research and development activities and advanced materials characterization, with institutions and companies requiring state-of-the-art analytical equipment for failure investigation and product development applications. Italy and Spain show expanding adoption of failure analysis technologies, particularly in manufacturing and materials science applications where quality control and product reliability are essential for competitive positioning. BENELUX countries contribute through their advanced technology sectors and high-precision manufacturing industries, while Eastern Europe and Nordic regions display growing potential driven by increasing industrialization and focuses on quality assurance across various manufacturing sectors.

The market is characterized by competition among established analytical instrument manufacturers, specialized technology companies, and emerging solution providers. Companies are investing in advanced imaging technologies, automated analytical systems, artificial intelligence integration, and comprehensive service support to deliver accurate, efficient, and reliable failure analysis solutions. Product innovation, technical expertise, and global service networks are central to strengthening market position and customer relationships.

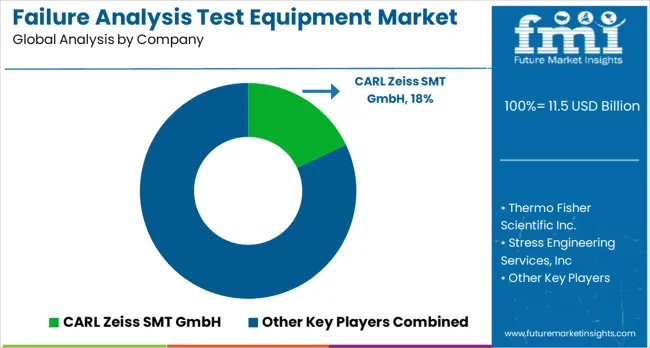

CARL Zeiss SMT GmbH, Germany-based, leads the market with 18.0% global value share, offering comprehensive electron microscopy and analytical solutions with focus on high-resolution imaging and advanced materials characterization. Thermo Fisher Scientific Inc., USA, provides integrated analytical platforms with focuses on multi-modal analysis and laboratory automation. Stress Engineering Services Inc., USA, delivers specialized failure analysis services with focus on materials testing and engineering consulting. Hitachi High-Technologies Corporation, Japan, offers advanced electron microscopy systems with focuses on semiconductor applications and high-throughput analysis.

Leica Microsystems, operating globally, provides comprehensive microscopy and imaging solutions across multiple application areas and price points. HORIBA Ltd., Japan, focusing on analytical and measurement technologies with focus on materials characterization and process monitoring. Oxford Instruments, UK, offers specialized analytical solutions with focuses on research applications and advanced materials analysis. Bruker provides comprehensive analytical instrumentation with focus on materials research and industrial applications.

| Items | Values |

| Quantitative Units (2025) | USD 11.5 billion |

| Product Outlook | Scanning Electron Microscope (SEM), Transmission Electron Microscope (TEM), Focused Ion Beam System (FIB), Dual Beam System, Others |

| Technology Outlook | Energy Dispersive X-Ray Spectroscopy (EDX), Secondary Ion Mass Spectroscopy (SIMS), Focused Ion Beam (FIB), Broad Ion Miling (BIM), Relative Ion Etching (RIE), Others |

| Application Outlook | Electronics & Semiconductor, Oil & Gas, Defense, Manufacturing, Construction |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | CARL Zeiss SMT GmbH, Thermo Fisher Scientific Inc., Stress Engineering Services Inc., Hitachi High-Technologies Corporation, Leica Microsystems, HORIBA Ltd., Oxford Instruments, Bruker, Tescan, and Orsay Holding |

| Additional Attributes | Dollar sales by equipment type and technology integration, regional demand trends, competitive landscape, buyer preferences for automated versus manual systems, integration with artificial intelligence and machine learning capabilities, innovations in high-resolution imaging, multi-modal analysis platforms, and advanced materials characterization solutions |

The global failure analysis test equipment market is estimated to be valued at USD 11.5 billion in 2025.

The market size for the failure analysis test equipment market is projected to reach USD 24.7 billion by 2035.

The failure analysis test equipment market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in failure analysis test equipment market are scanning electron microscope (sem), transmission electron microscope (tem), focused ion beam system (fib), dual beam system and others.

In terms of technology outlook, energy dispersive x-ray spectroscopy (edx) segment to command 29.5% share in the failure analysis test equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Failure Analysis Equipment Market Insights – Forecast 2025 to 2035

Heart Failure Testing Market

Sales Analysis of Tourism Industry in the Middle East Size and Share Forecast Outlook 2025 to 2035

Semen Analysis Systems Market Size and Share Forecast Outlook 2025 to 2035

Stone Analysis Software Market – Trends & Forecast 2025 to 2035

Water Analysis Instrumentation Market Analysis – Size, Share, and Forecast 2025 to 2035

Spend Analysis Software Market

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Adoption Analysis of 5G in Aviation Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Outbound Tourism in Germany Size and Share Forecast Outlook 2025 to 2035

Adoption Analysis of SCADA in Oil and Gas Industry Forecast and Outlook 2025 to 2035

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Korea Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA