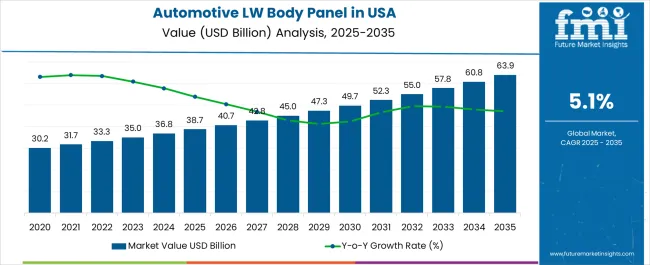

The Industry Analysis of Automotive Lightweight Body Panel in the United States is estimated to be valued at USD 38.7 billion in 2025 and is projected to reach USD 63.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

| Metric | Value |

|---|---|

| Industry Analysis of Automotive Lightweight Body Panel in the United States Estimated Value in (2025 E) | USD 38.7 billion |

| Industry Analysis of Automotive Lightweight Body Panel in the United States Forecast Value in (2035 F) | USD 63.9 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The automotive lightweight body panel market in the United States is experiencing accelerated growth. Increasing demand for fuel-efficient and environmentally sustainable vehicles, coupled with stringent regulatory standards on vehicle emissions and safety, is driving adoption of lightweight body panels. Current market dynamics are characterized by the integration of advanced materials and production technologies, rising consumer preference for high-performance vehicles, and growing investment in research and development to optimize weight reduction without compromising structural integrity.

The future outlook is shaped by expansion in electric and hybrid vehicle production, innovation in composite and polymer-based panels, and increased emphasis on cost-effective manufacturing processes. Growth rationale is founded on the need to enhance vehicle efficiency, comply with regulatory mandates, and reduce operational costs.

Manufacturers are leveraging technological advancements in material engineering and assembly processes to improve performance and durability Over the forecast period, consistent adoption across passenger and commercial vehicle segments is expected to drive sustained revenue growth and strengthen market penetration.

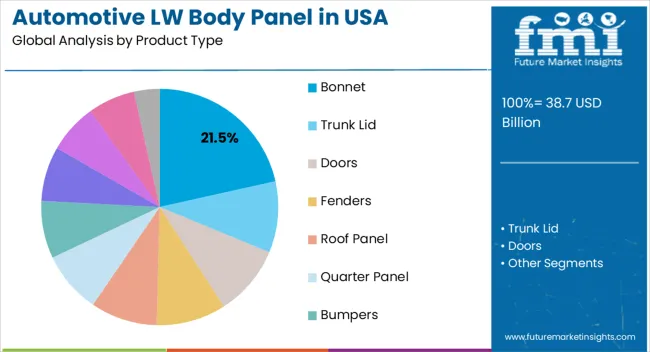

The bonnet segment, representing 21.50% of the product type category, has been leading due to its critical role in vehicle aerodynamics, safety, and aesthetic design. Adoption has been supported by advancements in lightweight manufacturing techniques and integration of polymer and composite materials, which improve performance while reducing overall vehicle weight.

Consistency in quality and structural integrity has reinforced preference among OEMs, while manufacturing efficiencies and cost-effective production methods have facilitated wider deployment. Technological refinements in panel molding, surface finishing, and durability testing have enhanced product reliability.

Strategic collaborations between material suppliers and automotive manufacturers have ensured optimized design and production, while evolving consumer expectations for performance, styling, and fuel efficiency have maintained the segment’s market share and supported sustained growth.

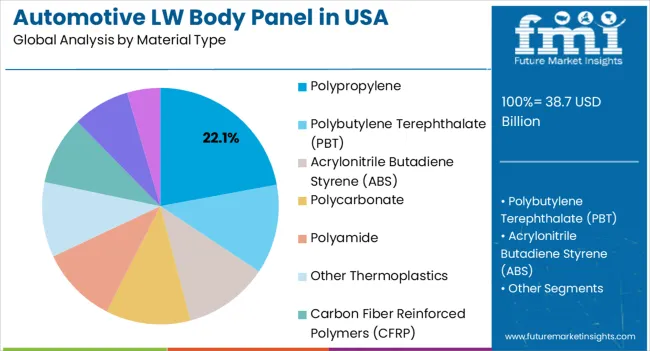

The polypropylene segment, holding 22.10% of the material type category, has maintained dominance due to its lightweight properties, corrosion resistance, and ease of molding into complex shapes. Adoption has been supported by the material’s versatility in automotive applications, cost-effectiveness, and compatibility with high-volume manufacturing processes.

Demand has been reinforced by integration into bonnets, bumpers, and other body panels where weight reduction and durability are prioritized. Material performance improvements, regulatory compliance, and supply chain reliability have strengthened market acceptance.

Ongoing innovation in polymer formulations and reinforced composites is expected to sustain the segment’s competitive position, ensuring continued contribution to overall market growth and enabling manufacturers to meet evolving vehicle efficiency standards.

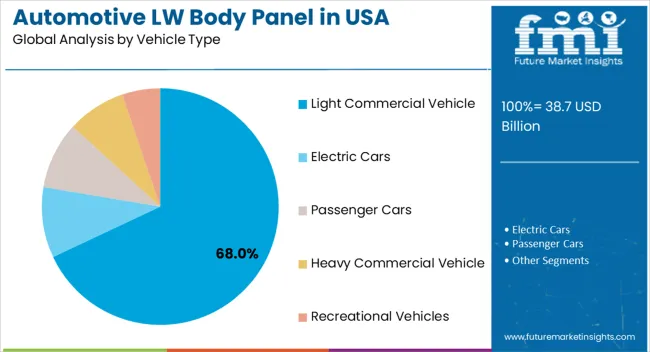

The light commercial vehicle segment, accounting for 68.00% of the vehicle type category, has been leading due to high adoption of lightweight panels for improved fuel efficiency and payload optimization. Adoption has been driven by increasing demand for delivery vehicles, fleet modernization programs, and regulatory pressure to reduce emissions.

Lightweight panels in this segment improve operational efficiency, reduce maintenance costs, and enhance vehicle longevity. OEMs have increasingly implemented advanced materials and manufacturing techniques to meet the durability and safety requirements of commercial applications.

Market leadership has been reinforced by consistent fleet demand, infrastructure expansion, and integration of energy-efficient vehicles Future growth is expected to be supported by continued focus on electrification, emission reduction mandates, and the need for cost-effective, lightweight solutions across commercial fleets.

Automotive manufacturers continue prioritizing lightweighting to enhance fuel efficiency and meet stringent emissions regulations. It has driven the demand for innovative polymer materials such as carbon fiber composites and advanced plastics. The rise of electric vehicles presents both opportunities and challenges, as weight reduction remains crucial, but EVs must also account for the weight of batteries.

Sustainability and recyclability are gaining prominence in material choices and advancements in manufacturing technologies. These technologies, including injection molding and 3D printing, are poised to impact production.

Advancement of intelligent and functional polymer-based lightweight body panels encompass integrated sensors, lighting components, and advanced functionalities to enhance vehicle performance and aesthetics. For instance, certain automakers are exploring the integration of LED lighting within these panels to improve visibility and communication. Others are incorporating real-time structural integrity sensors, providing valuable data for maintenance and safety.

These technological innovations hold great promise and bolster the overall value proposition of polymer-based body panels. As vehicles increasingly embrace connectivity and autonomy, the demand for intelligent and functional panels is anticipated to rise. It will likely foster product innovation and new prospects for manufacturers.

There is a growing emphasis on the circular economy, which promotes materials' reuse and recycling. Lightweight body panels, known for their recyclability, contribute to manufacturers' shift towards such materials.

Manufacturers are exploring closed-loop recycling systems, where end-of-life polymer components can be recycled and reintegrated into new vehicle parts, reducing waste and conserving resources. As sustainability becomes a key selling point for automakers, the demand for polymer-based lightweight body panels is expected to continue its upward trajectory.

Increased Demand for Fuel Efficiency:

With a growing emphasis on fuel efficiency and reduced emissions, automakers are incorporating lightweight body panels to decrease the overall vehicle weight.

Materials Innovation:

The landscape is seeing advancements in composition of materials such as carbon fiber, aluminum, and composite materials. These are lighter than traditional steel, while maintaining strength and safety standards.

Electric Vehicle (EV) Adoption:

The rise of electric vehicles has led to a greater need for lightweight materials, as lighter body panels can extend the driving range of electric cars.

3D Printing and Advanced Manufacturing:

Technologies like 3D printing and advanced manufacturing techniques are being explored to create lightweight body panels more efficiently.

Recycling and Sustainability:

There is a growing focus on the recyclability and sustainability of lightweight materials to reduce their environmental impact.

Environmental Concerns:

Lightweight materials like carbon fiber have significant environmental concerns related to their production and disposal.

Energy Intensive Production:

Producing lightweight materials can be energy-intensive, potentially offsetting the environmental benefits of reduced vehicle weight.

Recycling and Disposal:

Proper recycling and disposal methods for lightweight materials are not as established as those for traditional materials including steel.

The table below explains the demand for the United States automotive lightweight body panels in the top three regions. The forecast provides the revenue generated by these regions during the forecast period. South United States is anticipated to remain in the forefront by registering USD 63.9 million by 2035.

Midwest United States will likely reach USD 17524 million by 2035. West United States is set to generate a revenue potential of USD 5700 million by 2035.

| Countries | Projected Valuation (2035) |

|---|---|

| South United States | USD 63.9 million |

| Midwest United States | USD 17524 million |

| West United States | USD 5700 million |

The South United States automotive lightweight body panel ecosystem is anticipated to total USD 63.9 million by 2035. It is expected to witness a size of USD 38.7 million in 2025. The automotive industry in the southern United States is driven by growing demand for lightweight materials to improve fuel efficiency and reduce emissions. This has led to a rise in the adoption of lightweight body panels.

Aluminum remains the dominant lightweight material used in body panels. Manufacturers in the region have invested in aluminum production capabilities to meet the demand for lighter and more fuel-efficient vehicles.

While still relatively expensive, carbon fiber-reinforced composites are gaining traction, especially in high-performance and luxury car segments. Few manufacturers are exploring using carbon fiber for lightweight body panels to enhance performance. Southern United States has a well-established network of automotive suppliers, including those specializing in lightweight body panels. This network supports local and global automakers in sourcing lightweight components.

The growth of the electric vehicles (EV) space is also influencing sales of lightweight body panel. Electric vehicles benefit from lightweight materials to maximize range and efficiency. The supply chain disruptions experienced in recent years have prompted manufacturers to assess and diversify their supply chains to ensure a steady flow of lightweight materials.

The Midwest United States automotive lightweight body panel revenue is expected to reach USD 11786 million in 2025. The demand for lightweight body panels is increasing due to the automotive industry's focus on fuel efficiency and emissions reduction. Aluminum and carbon fiber-reinforced composites are the prominent materials in the Midwest for lightweight body panels, owing to their favorable weight-to-strength ratio.

Key automotive original equipment manufacturers (OEMs) in the Midwest are investing in research and production of lightweight body panels to meet regulatory standards and improve vehicle performance. With the rise of electric vehicles, lightweight body panels have become crucial to offset the weight of batteries, further boosting the demand for lightweight materials.

Key suppliers and manufacturers of lightweight body panels are strategically locating their facilities in the Midwest to cater to the local automotive industry and streamline supply chains. Ongoing advancements in manufacturing processes and technologies are enhancing the production efficiency and cost-effectiveness of lightweight body panels.

The West United States automotive lightweight body panel ecosystem is anticipated to reach USD 3441 million in 2025. Growing demand for lightweight body panels, such as aluminum, carbon fiber, and composites will likely fuel growth in Western United States. This is due to their ability to improve fuel efficiency and reduce vehicle emissions. Stringent emissions regulations in states such as California have pushed automakers to adopt lightweight materials to meet fuel efficiency standards, driving the adoption of lightweight body panels.

The presence of aerospace manufacturing in the region has led to the development of advanced lightweight materials and manufacturing techniques that are now being applied in the automotive sector. California is home to several key automotive manufacturers, research institutions, and startups focused on lightweight materials and electric vehicle production, contributing to sales growth.

Carbon fiber-reinforced composites have gained significant traction, especially in high-performance and luxury vehicle segments, owing to their exceptional strength-to-weight ratio. Aluminum remains a popular choice for lightweight body panels in mass-produced vehicles. Companies such as Tesla have utilized aluminum extensively in their electric vehicle designs.

The table below highlights the demand in the United States automotive lightweight body panel business. Demand for bumpers remains high during the forecast period, followed by the bonnet and door.

The bumper segment is set to hold about 21.4% shares in the United States automotive lightweight body panel space. It is expected to register a growth of USD 10,126.5 million by 2035.

| Category | Product Type |

|---|---|

| Sub-Category | Bumpers |

| Projected Valuation (2035) | USD 10,126.5 million |

Regarding product type, the bumper segment is projected to hold around 21.4% shares in the United States automotive lightweight body panel ecosysyem. Revenue is anticipated to reach a total of USD 7,228.3 million in 2025. Bumpers made from lightweight materials, such as aluminum or composite materials, can significantly reduce the weight of a vehicle. This is crucial for meeting stricter fuel efficiency and emissions regulations.

Bumpers also play a critical role in vehicle safety. Advancements in materials and design can improve impact absorption, protecting both the vehicle's occupants and pedestrians. Various consumers seek customized and stylish bumpers for their cars. The bumper segment can dominate by offering multiple design options and materials to meet these demands.

With growing environmental awareness, lightweight materials such as aluminum are being preferred due to their recyclability. Bumpers made from these materials align with sustainability goals. Incorporating technology into bumpers, such as sensors for parking assistance or adaptive cruise control, can further enhance their appeal and functionality.

The table below highlights the United States automotive lightweight body panel sales by categories. Under material type, the polypropylene segment will likely dominate in the assessment period. The segment is anticipated to own around 29.6% of shares in 2025. It is anticipated to register a sum of USD 13,930.4 million by 2035.

| Category | Product Type |

|---|---|

| Sub-Category | Polypropylene |

| Projected Valuation (2035) | USD 13,930.4 million |

By material type, the polypropylene segment recorded a considerable amount of USD 10.098.5 million in 2025. It is anticipated to generate a revenue potential of USD 13,930.4 million by 2035.

Polypropylene is cost-effective to produce and process, making it an economically attractive option for manufacturers. Polypropylene can be molded into various shapes and sizes, allowing greater design flexibility in creating aesthetically pleasing and aerodynamic body panels. This design flexibility is driving its adoption in the luxury car segment.

It offers good impact resistance, enhancing the safety of vehicles and reducing the likelihood of damage in minor collisions, making it highly sought-after by consumers. Unlike some metals, polypropylene is not prone to corrosion, which can extend the lifespan of body panels and reduce maintenance costs. Polypropylene can help dampen vibrations and reduce noise inside the vehicle, leading to a quieter and more comfortable driving experience. Polypropylene is recyclable, aligning with sustainability goals and reducing the environmental footprint of vehicle manufacturing.

Using lightweight materials such as polypropylene can help automakers meet stringent fuel efficiency and emissions regulations. Reducing the weight of body panels can improve the vehicle's overall handling and agility.

| Attribute | Details |

|---|---|

| Estimated Size (2025) | USD 38.7 billion |

| Projected Valuation (2035) | USD 63.9 billion |

| Value-based CAGR (2025 to 2035) | 5.1% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Industry Analysis | USD million for Value and Units for Volume |

| Key Regions Covered | Northeast United States, Midwest United States, West United States, South United States |

| Key Segments Covered | By Product Type, By Material Type, By Operation Type, By Vehicle Type, By Sales Channel, and By Regions |

| Key Companies Profiled | Solvay S.A.; Magna International, Inc.; Gestamp; Teijin Limited; Owens Corning; Lanxess AG; Covestro AG; Toray Industries, Inc.; Hexcel Corporation; Plastic Omnium Auto Exteriors, LLC; PlastiComp; ABC Group, Inc.; FLEX-N-GATE CORPORATION |

| Report Coverage | Industry Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Sales Dynamics and Challenges, and Strategic Growth Initiatives |

The global industry analysis of automotive lightweight body panel in the United States is estimated to be valued at USD 38.7 billion in 2025.

The market size for the industry analysis of automotive lightweight body panel in the United States is projected to reach USD 63.9 billion by 2035.

The industry analysis of automotive lightweight body panel in the United States is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in industry analysis of automotive lightweight body panel in the United States are bonnet, trunk lid, doors, _exterior, _interior, fenders, roof panel, quarter panel, bumpers, rocker panel, tail gate, cowl panel and dashboard / instrument panel.

In terms of material type, polypropylene segment to command 22.1% share in the industry analysis of automotive lightweight body panel in the United States in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

DOAS Industry Analysis in the United States Forecast and Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Solenoid Valve Market Growth – Trends & Forecast 2024-2034

US & Europe EndoAVF Device Market Analysis – Size, Share & Forecast 2024-2034

U.S. Laminated Tube Market Trends & Demand Forecast 2024-2034

Periodontal Gel Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Dialysis Equipment Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Growth – Trends & Forecast 2024-2034

U.S. Phlebotomy Equipment Market Analysis – Trends, Growth & Forecast 2024-2034

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

End-of-line Packaging Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

United States Distributed Antenna System (DAS) Market Growth – Trends & Forecast 2024-2034

United States Automotive Turbocharger Market Analysis – Size, Share & Forecast 2025–2035

United States Cold Laser Therapy Market Outlook – Trends, Demand & Forecast 2025-2035

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Korea Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

United States Countertop Market Trends - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA