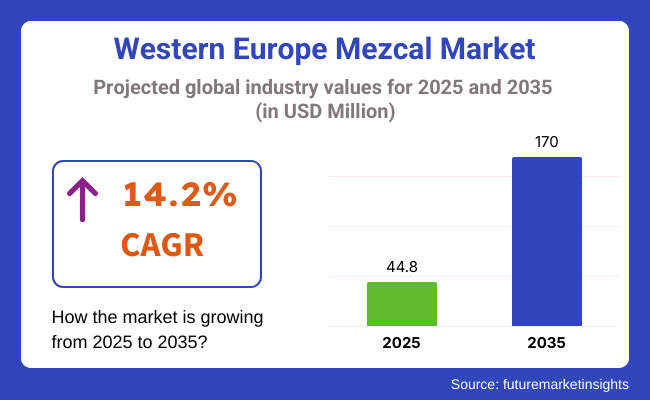

The western Europe mezcal market is valued at USD 44.8 million in 2025 and is expected to grow at a CAGR of 14.2% during 2025 to 2035. The industryis expected to reach USD 170 million by 2035. A major driver of this growth is the renewed interest in artisanal spirits in a handful of strong European markets, supported by a discerning consumer base in search of unconventional drinking experiences steeped in culture.

The premium beverage industry in western Europe is an ever-evolving ecosystem wherein consumers step beyond the classical love for wines and whiskies, now embracing atypical and lesser-known spirits like mezcal. This transition is most alive in countries like Germany, the UK, France, and the Netherlands, where cocktail culture intersects craft with sustainability and storytelling.

Its lingering appeal is the deep cultural roots of mezcal and its artisanal production methods, which speak to a European consumer increasingly mindful of authenticity, traceability, and environmental matters. Bartenders and beverage curators in metropolitan hubs like London, Berlin, and Paris have made an effort to present mezcal to the ever-refined palates of their consumers through curated tastings and high-concept cocktails.

Momentum is being generated in the industry by a growing network of specialized importers, artisanal retailers, and online marketplaces catering to niche and rare spirits consumers. Those labels of limited-edition mezcal detailing entire origin stories hit home with collectors as well as experience-seeking users, therefore underpinning industry value.

For the next ten years, the mezcal industry in Western Europe will profit from the deepening relationship with the hospitality industry while exploring creative collaborations with fashion and music influencers that will also help towards greater distribution through both digital and physical retail.

For the brands to follow through on such a path, a workable equilibrium must be then thought out between exclusivity and accessibility in tandem with navigating the uncertain terrain of new regulations and labeling provisions across the various EU markets set to disrupt this landscape.

In western Europe, the mezcal industry is predicted to be primarily driven by Joven, with a 78.4% share by product type in 2025, followed by Reposado with 13.1%. Mezcal Joven, characterized by its unaged yet clear, smoky profile, is today the favorite choice among European consumers because of its authenticity and versatility in cocktails. Authenticity and brutish boldness appeal to adventurous drinkers and mixologists alike, adding to the modern culture of bar usage and high-end cocktail menus.

Accessibility and normally lower costs than that of aged variants make it a great entry point for first-time consumers and locations wanting to feature mezcal without investing heavily. Such organizations within the Joven mezcal space in Europe include Montelobos, Ilegal Mezcal, and Del Maguey, which can be found in mezcal-forward bars all around cities like Berlin, London, and Amsterdam.

Mezcal Reposado, which is aged in oak barrels for a period of anywhere between two to twelve months, commands the remaining small industry share of 13.1% but is growing steadily. A line of attack for hippies and lovers of aged spirits, Reposado delivers a smoother, more complex profile with subtle vanilla and caramel notes, as well as the scent of wood. Because of their slow maturation and very complex flavors, they make up a small portion of their industry and end up being typically regarded as premium beverage products.

Accordingly, these beverages are usually found and enjoyed neatly or in high-end cocktails. Producers such as Los Danzantes, Mezcal Vago, and Bozal are extending their distribution of Reposado expressions across Europe yet tapping even further into a very niche industry comprising connoisseurs and upscale dining establishments.

The main product in the western Europe mezcal industry by 2025 will be 100% agave, with an industry share of 57.6%. Mixed tequila will have 42.4%, which is below 100% agave. Preference among western European consumers is most likely toward 100% agave mezcal because authenticity, artistry, and fine spirits are considered to have increasing values.

This segment resonates very much with discerning drinkers in search of pure ingredients and traditional methods of producing drinks. Del Maguey, Alipús, Real Minero, and Neta are all brands of production that have successfully cultivated their consumer base through educational campaigns, limited editions, and collaborations in high-end bar and restaurant establishments. The intense appeal for ethically sourced and sustainable products has drawn such consumers from London, Paris, and Berlin, where there is a growing industry for heritage spirits.

Contrastingly, mixed tequila, which combines agave spirit with different sugars, attracts price sensitivity for consumers who are not aware of it. This less pricey price point compared to 100% agave mezcal offers varied palettes and appeal toward nightclubs and casual bars rather than strict cocktail venues, where pure products matter less. The leading examples in the field are Zignum, El Recuerdo de Oaxaca, and Creyente, which, as part of preserving the signature smokiness of the mezcal, are offering a customer-friendly price on products.

The trend for mezcal in Western Europe compliments a larger cultural movement toward authenticity, craft, and global travel. Beverages are more than ever about the story for many consumers-products that carry with them the weight of regional tradition, ancestral techniques, and sustainable values. Mezcal has, therefore, become manifest in culture as well as mindful consumption.

This upsurge in demand also predominates in high-end restaurants and bars, where mezcal now comes as a luxury spirit, along with gourmet food and boutique wines. A great deal of new mixology spice was added to this to create something different by incorporating fresh European ideas. Hence, it looks a little more appealing to them, giving them new avenues to interact with it.

It will be a true grower not just on-trade but also at premium retail and DTC sites. Some knowledgeable consumers will even pay a premium for open agave, historic distillation methods, eco-conscious packing, and things such as these just because that aligns with how their other purchases are changing in Europe's most advanced spirits markets.

From 2020 to 2024, the industry showed an increase in demand, stimulated by a shift toward premium, original spirits as more consumers favored it. Mezcal gained popularity as a good tequila substitute among young and experimenting consumers.

Growth in Mezcal Joven consumption, ascribed to the distinctive taste characteristic of this form of Mezcal, was prominent throughout this timeline. Distribution increased among specialty liquor stores, online channels, and bars, particularly those with Latin American or Mexican food menus. Demand was further driven by the general cocktail culture and overall growth in artisanal, craft spirits.

In the period from 2025 to 2035, the industry should experience even stronger growth, especially as it turns to aged styles such as Mezcal Reposado. With changing consumer preferences, there will be increasing demand to try more aged and sophisticated expressions of Mezcal.

Distribution networks will come to include wider retail channels, and Mezcal will increasingly become accepted by the mainstream, further incorporated into cocktails, spirits lists, and high-end programs throughout the region. More focus on sustainability and ethically sourced agave will likely become a primary marketing feature for high-end Mezcal brands.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Focus on Mezcal Joven (unaged) with intense flavors profiles | Growing shift towards Mezcal Reposado (aged) and premium segments |

| Expansion in specialty liquor stores, online platforms, and restaurants/bars | Expansion in mass-market supermarkets and broader retail outlets |

| Consumer demand for premium, craft spirits and growing cocktail culture | Growing consumer interest in aged expressions and environmentally friendly options |

| Dominance of Mezcal Joven in the industry | Mezcal Reposado and other aged varieties to capture growing share of the industry |

| Regulation support ensuring authenticity of imported Mezcal | Continued regulation focus on ensuring product purity and ethical extraction |

The industry holds considerable growth potential; however, it is challenged by factors such as consumer education and fragmentation. Consumer awareness is still focused primarily on urban centers and very trend-sensitive areas, while knowledge among great swathes of the overall populace is severely lacking. Such incongruous exposure could dampen short-term growth in secondary markets.

Another hurdle is the burden of regulation, which varies from country to country within the EU. Labeling requirements, import duties on alcohol, and sustainability disclosures differ from country to country, and this requires brands to invest in region-specific compliance strategies that increase operational complexity and costs.

Finally, scalability stands as the main issue. The intense artisanal nature of mezcal production limits volume so that in times of high demand, the product is constrained in availability. Alternatively, as brands scale up to meet European interests, they may risk reducing quality and authenticity-two key attributes of the spirit's value proposition. The balance between scale and integrity will provide the true basis for long-term success in the Western European industry.

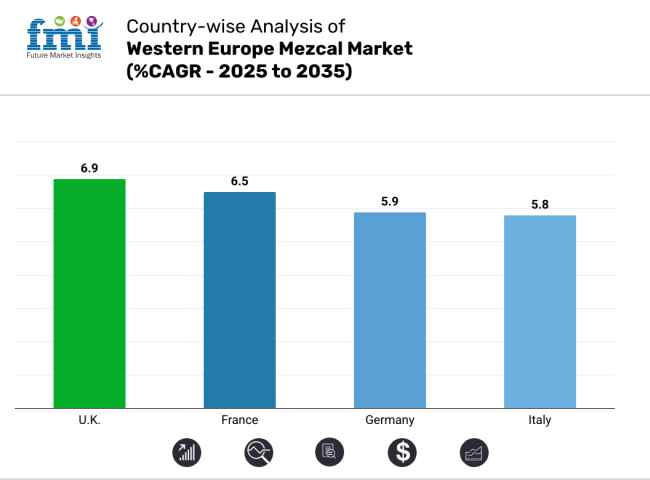

| Countries | CAGR (2025 to 2035) |

|---|---|

| UK | 6.9% |

| France | 6.5% |

| Germany | 5.9% |

| Italy | 5.8% |

The UKindustry is expected to have a 6.9% CAGR growth during the study period of 2025 to 2035. Mezcal is becoming more popular with UK drinkers who are looking for premium, craft-driven alcoholic beverages with an honest story behind them.

The full-bodied and smoky flavor profile of the spirit has also seen it carve a niche in high-end cocktail menus of major cities, especially London, where the mixology culture is highly sophisticated. Mezcal is more and more seen as an upscale alternative to gin and whiskey, and bartenders adore it for its depth and versatility. Specialty liquor retailers and online sources have expanded their selections of Mezcal, such as single-estate and pina agave styles appealing to connoisseurs seeking uniqueness and integrity.

Consumer enthusiasm is being maintained through cocktail education parties, trade education programs, and brand alignment with renowned mixologists who evangelize for the spirit. The UK's lively spirits industry and cultural openness to global trends have created an environment in which Mezcal can be expected to establish a lasting presence, particularly in the premium and super-premium segments.

The French industry will grow at 6.5% CAGR over the period of study from 2025 to 2035. Mezcal is increasingly appealing to French consumers because it is artisanal, has a strong regional character, and is produced using traditional methods. French drink culture's focus on terroir and place mirrors naturally Mezcal's handcrafted and place-based characteristics, which underpin its status as a niche premium spirit.

In big cities such as Paris and Lyon, upscale bars and restaurants have begun to feature Mezcal in expertly designed tasting menus and cocktail evenings. The didactic character of Mezcal-its agave types, classical roasting technique, and terroir variety-is especially relished by French wine experts and spirits connoisseurs.

Luxury boutiques and high-end liquor stores are spearheading the offering of diligently selected ranges of Mezcal, enhancing availability and awareness. With increasing consumer knowledge, Mezcal is set to achieve a secure place in France's connoisseur-driven spirit's industry.

The German industry will expand at 5.9% CAGR during the research period from 2025 to 2035. Mezcal is emerging as a distinctive and fascinating choice for those consumers who highly value authenticity, sustainability, and strong flavor experiences. The German craft spirits trend has opened the door to the adoption of lesser known but quality alternatives like Mezcal.

Cities such as Berlin, Munich, and Hamburg are leading the trend, with bars and restaurants incorporating Mezcal into new and creative cocktails. Mezcal's success is due to its handcrafted production process, regional diversity, and strong character-all attributes that resonate with German consumers who value meaningful, transparent production. Specialty shops and internet retailers are expanding product offerings to include craft Mezcals, often bundled with educational materials to increase consumer awareness.

Industry trade shows, bartender tastings, and specialty promotions are also expected to fuel the spirit's recognition further. As awareness builds, Mezcal has the potential to become an established premium category in Germany's evolving spirit's industry.

The Italian industry is forecast to grow at 5.8% CAGR during the study period of 2025 to 2035. Mezcal is gradually picking up pace in Italy's rich and complex beverage culture, famous for its sophisticated appreciation of tradition, craftsmanship, and regionality.

Italian consumers are beginning to unearth Mezcal as a credible player in the premium spirits segment, especially in the framework of modern mixology and upscale cocktail experiences. Metropolitan cities such as Milan, Rome, and Florence are witnessing a shift, with high-end bars and contemporary lounges infusing Mezcal into Aperitivo-inspired drinks.

The earthy and smoky flavor profile of the spirit is being paired with Mediterranean flavors to create flavor-driven cocktails appealing to Italian taste buds. Mezcal's craft origin tale, rooted in tradition and environmentalism, aligns with value long held dear in Italian beverage and food culture.

This synergy is developing more interest among industry professionals and consumers alike. As distribution channels become more mature and as education becomes prevalent, Mezcal will become more deeply rooted in Italy's premium spirits industry over the next decade.

The western Europe mezcal industry is rapidly growing due to increasing consumer shifts toward craft spirits, authenticity, and innovative taste experiences. Bacardi Limited is leading with a strong European distribution network and premiumization strategy; Bacardi is driving the introduction of mezcal through well-established on-trade channels in key metropolitan cities such as London, Paris and Berlin. Casa Armando S.A. de C.V. is energizing its artisanal heritage positioning, which is so well appreciated by European consumers who seem to want authenticity and terroir more and more.

El Silencio Holdings INC is now working to build a strong brand that is very much related to its original roots yet embodies a modern face that appeals to trend-driven markets like the UK and Germany. Diageo Plc. is strategically introducing mezcal within its opening luxury spirits portfolio, promoting consumer education campaigns, and visibility through upscale retail and hospitality partnerships.

Don Julio, being in tequila for a while now, is leveraging its prestige to penetrate the mezcal space. Smaller distillers, like Craft Distiller and Fidencio, are taking on limited editions and organic certifications, thus carving niche space among connoisseurs and eco-conscious consumers. With the competition now heating, brand storytelling, local partnerships as well and premium experiences will be the defining next stage of Mezcal's growth in Western Europe.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Bacardi Limited | 20-24% |

| Casa Armando S.A. de C.V. | 16-20% |

| El Silencio Holdings INC | 14-18% |

| Diageo Plc. | 12-16% |

| Don Julio | 10-14% |

| Other Players | 18-22% |

Key Company Insights

Bacardi Limited commands a strong 20-24% share of the western Europe mezcal industry, anchored by its strategic premiumization initiatives and a widespread presence across key nightlife and retail venues. The brand has entrenched its legacy as a leading choice for consumers seeking craft spirits through effective educational campaigns and experiential marketing. Casa Armando S.A. de C.V. takes up about 16-20% of the industry, constantly sold on the idea of its pure artisanal production practices to attract authenticity-hungry audiences.

El Silencio Holdings INC, for its part, has an approximate industry share of about 14-18%, taking advantage of massive branding concepts and modern aesthetics to pique the interest of the audience they are trying to reach, most especially the modernized audience found in urban metropolitan areas. Diageo Plc. maintains a healthy 12-16% share using its vast distribution avenues and alignment with its luxury brands to establish mezcal in the broader luxury spirits portfolio. Don Julio, which comes with anindustry share of 10-14%, then clinches the transformation of dedicated tequila consumers into avid mezcal drinkers through denotative brand extensions and upscale product positioning.

By product type, the industry is segmented into Joven, Reposado, and Anejo.

By concentration, the industry is categorized into 100% tequila and mixed tequila.

By country, the industry is divided into the UK, Germany, Italy, France, Spain, and the rest of western Europe.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Liters) Forecast by Country, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Concentration, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Liters) Forecast by Concentration, 2018 to 2033

Table 7: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 8: UK Industry Analysis and Outlook Volume (Liters) Forecast By Region, 2018 to 2033

Table 9: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: UK Industry Analysis and Outlook Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 11: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Concentration, 2018 to 2033

Table 12: UK Industry Analysis and Outlook Volume (Liters) Forecast by Concentration, 2018 to 2033

Table 13: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 14: Germany Industry Analysis and Outlook Volume (Liters) Forecast By Region, 2018 to 2033

Table 15: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Germany Industry Analysis and Outlook Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 17: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Concentration, 2018 to 2033

Table 18: Germany Industry Analysis and Outlook Volume (Liters) Forecast by Concentration, 2018 to 2033

Table 19: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 20: Italy Industry Analysis and Outlook Volume (Liters) Forecast By Region, 2018 to 2033

Table 21: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Italy Industry Analysis and Outlook Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 23: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Concentration, 2018 to 2033

Table 24: Italy Industry Analysis and Outlook Volume (Liters) Forecast by Concentration, 2018 to 2033

Table 25: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 26: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 27: Rest of Industry Analysis and Outlook Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 28: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Concentration, 2018 to 2033

Table 29: Rest of Industry Analysis and Outlook Volume (Liters) Forecast by Concentration, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Concentration, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 5: Industry Analysis and Outlook Volume (Liters) Analysis by Country, 2018 to 2033

Figure 6: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 7: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 8: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Industry Analysis and Outlook Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 10: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Industry Analysis and Outlook Value (US$ Million) Analysis by Concentration, 2018 to 2033

Figure 13: Industry Analysis and Outlook Volume (Liters) Analysis by Concentration, 2018 to 2033

Figure 14: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Concentration, 2023 to 2033

Figure 15: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Concentration, 2023 to 2033

Figure 16: Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 17: Industry Analysis and Outlook Attractiveness by Concentration, 2023 to 2033

Figure 18: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 19: UK Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: UK Industry Analysis and Outlook Value (US$ Million) by Concentration, 2023 to 2033

Figure 21: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 22: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 23: UK Industry Analysis and Outlook Volume (Liters) Analysis By Region, 2018 to 2033

Figure 24: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 25: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 26: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: UK Industry Analysis and Outlook Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 28: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Concentration, 2018 to 2033

Figure 31: UK Industry Analysis and Outlook Volume (Liters) Analysis by Concentration, 2018 to 2033

Figure 32: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Concentration, 2023 to 2033

Figure 33: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Concentration, 2023 to 2033

Figure 34: UK Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 35: UK Industry Analysis and Outlook Attractiveness by Concentration, 2023 to 2033

Figure 36: UK Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 37: Germany Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Germany Industry Analysis and Outlook Value (US$ Million) by Concentration, 2023 to 2033

Figure 39: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 40: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 41: Germany Industry Analysis and Outlook Volume (Liters) Analysis By Region, 2018 to 2033

Figure 42: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 43: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 44: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Germany Industry Analysis and Outlook Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 46: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Concentration, 2018 to 2033

Figure 49: Germany Industry Analysis and Outlook Volume (Liters) Analysis by Concentration, 2018 to 2033

Figure 50: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Concentration, 2023 to 2033

Figure 51: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Concentration, 2023 to 2033

Figure 52: Germany Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 53: Germany Industry Analysis and Outlook Attractiveness by Concentration, 2023 to 2033

Figure 54: Germany Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 55: Italy Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Italy Industry Analysis and Outlook Value (US$ Million) by Concentration, 2023 to 2033

Figure 57: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 58: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 59: Italy Industry Analysis and Outlook Volume (Liters) Analysis By Region, 2018 to 2033

Figure 60: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 61: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 62: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Italy Industry Analysis and Outlook Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 64: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Concentration, 2018 to 2033

Figure 67: Italy Industry Analysis and Outlook Volume (Liters) Analysis by Concentration, 2018 to 2033

Figure 68: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Concentration, 2023 to 2033

Figure 69: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Concentration, 2023 to 2033

Figure 70: Italy Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 71: Italy Industry Analysis and Outlook Attractiveness by Concentration, 2023 to 2033

Figure 72: Italy Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 73: France Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: France Industry Analysis and Outlook Value (US$ Million) by Concentration, 2023 to 2033

Figure 75: France Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 76: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 77: France Industry Analysis and Outlook Volume (Liters) Analysis By Region, 2018 to 2033

Figure 78: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 79: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 80: France Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: France Industry Analysis and Outlook Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 82: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: France Industry Analysis and Outlook Value (US$ Million) Analysis by Concentration, 2018 to 2033

Figure 85: France Industry Analysis and Outlook Volume (Liters) Analysis by Concentration, 2018 to 2033

Figure 86: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Concentration, 2023 to 2033

Figure 87: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Concentration, 2023 to 2033

Figure 88: France Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 89: France Industry Analysis and Outlook Attractiveness by Concentration, 2023 to 2033

Figure 90: France Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 91: Spain Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Spain Industry Analysis and Outlook Value (US$ Million) by Concentration, 2023 to 2033

Figure 93: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 94: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 95: Spain Industry Analysis and Outlook Volume (Liters) Analysis By Region, 2018 to 2033

Figure 96: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 97: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 98: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: Spain Industry Analysis and Outlook Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 100: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Concentration, 2018 to 2033

Figure 103: Spain Industry Analysis and Outlook Volume (Liters) Analysis by Concentration, 2018 to 2033

Figure 104: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Concentration, 2023 to 2033

Figure 105: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Concentration, 2023 to 2033

Figure 106: Spain Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 107: Spain Industry Analysis and Outlook Attractiveness by Concentration, 2023 to 2033

Figure 108: Spain Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 109: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: Rest of Industry Analysis and Outlook Value (US$ Million) by Concentration, 2023 to 2033

Figure 111: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 112: Rest of Industry Analysis and Outlook Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 113: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 114: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 115: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Concentration, 2018 to 2033

Figure 116: Rest of Industry Analysis and Outlook Volume (Liters) Analysis by Concentration, 2018 to 2033

Figure 117: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Concentration, 2023 to 2033

Figure 118: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Concentration, 2023 to 2033

Figure 119: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 120: Rest of Industry Analysis and Outlook Attractiveness by Concentration, 2023 to 2033

The industry is expected to reach USD 44.8 million in 2025.

The industry is projected to grow to USD 170 million by 2035.

The industry is expected to grow at a CAGR of approximately 14.2% during the forecast period.

The United Kingdom accounts for approximately 6.9% of the industry.

Key players include Bacardi Limited, Familia Camarena Tequila, Craft Distiller, Destileria Tlacolula, Diageo Plc., Don Julio, Casa Armando S.A. de C.V., El Silencio Holdings INC, Fidencio, Desolas, and Drink Monday Inc.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA