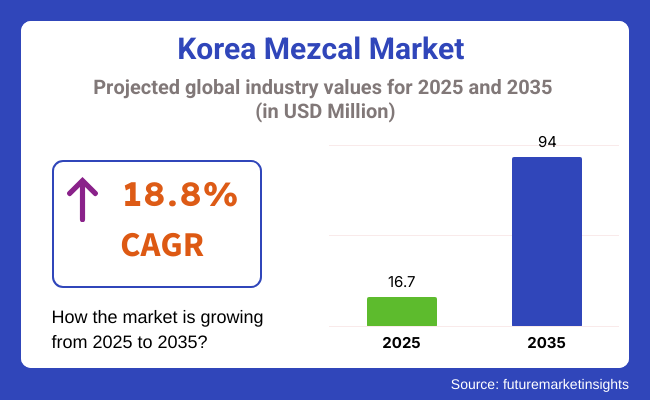

As of 2025, the Korea mezcal market was valued at USD 16.7 million and is projected to witness an 18.8% CAGR for the period from 2025 to 2035. The overall mezcal industry worth in South Korea is anticipated to rise to USD 94 million by 2035.

This remarkable growth is primarily driven by the convergence of Korea's premiumization trend along with a deepening appreciation of artisanal and heritage-based spirits among the younger consumer base.

With Korea's drinking culture further becoming a melting pot, it creates an increasing demand for globally recognized and craft-oriented alcoholic beverages. Mezcal has successfully managed to secure its space at the juncture of authenticity and luxury, thereby capturing the interest of the discerning Korean consumers who look not only for origin but for an astonishing amount of originality.

Changing preferences, especially among urban millennials and Gen Z, thus favor highly cultural spirits that come with a strong cultural narrative and a unique sensory experience.

The recent proliferation of high-end bars, rooftop lounges, and speakeasies in Seoul and Busan has offered great potential for the expansion of mezcal. The creative mixologist community from these venues is vital in consumer education through inventive mezcal cocktails, moving this spirit from the realm of curiosity and ever-evolving trends to something of their repertoire. Together with exclusive imports and limited releases, mezcal is increasingly becoming an emblem of status and fine taste.

Digital retail and direct-to-consumer publications have permitted mezcal brands to engage with South Korean consumers. Enhanced product storytelling, sustainable sourcing, and traceability now all form the foundation for differentiation among brands. As the e-commerce industry grows, curated online boutiques and influencer partnerships are furthering mezcal's visibility and accessibility.

The South Korean mezcal industry may evolve over the next decade in collaboration with K-lifestyle-led branding in music and pop culture. On-the-go success will depend on a seamless supply chain execution, outreach consumer education, and cultural localization in order to make sure that mezcal has the prospect of being a mainstay of Korea's fast-growing premium spirits segment.

In 2025, the industry in Korea will be primarily dominated by Mezcal Joven, with 83.3% of the industry share, with Mezcal Reposado holding 10%. Mezcal Joven will continue to lead the industry with a significant 83.3% share, largely due to its versatility and smoother, fresher taste profile. This unaged or lightly aged version of mezcal is increasingly popular for cocktails and is favored by both casual and more adventurous drinkers.

As Korean consumers develop a growing interest in diverse spirits, Mezcal Joven serves as a gateway to the mezcal category, providing a more accessible introduction to the smokier, more complex flavors of mezcal compared to its aged counterparts. International brands such as Monte Alban, El Silencio, and Del Maguey are prominent in this segment, offering products that cater to the rising trend of mezcal consumption in cocktail bars and among younger, trend-conscious drinkers.

Meanwhile, Mezcal Reposado will account for 10% of the industry share. Aged for a few months in oak barrels, Reposado has a richer, more complex flavor profile, which is appealing to consumers who prefer a more refined and balanced spirit. However, it will remain a smaller segment in Korea compared to Mezcal Joven, as the demand for aged spirits is still in the early stages of development.

Brands like Mezcal Vago and Ilegal Mezcal cater to this segment. Although its industry share is limited, it is expected to grow as more Korean consumers become educated about the differences in aging processes and flavors.

In 2025, the mezcal industry in Korea will see a distinct split between 100% tequila and mixed tequila, with 100% tequila constituting 54.1% of the industry share and mixed tequila at 45.9%. 100% tequila will continue to top the industry with a 54.1% industry share as it has a better quality and gapes sake performance on a purer taste profile.

As consumers become more discerning and enlightened in premium spirits, the demand for smooth taste and authenticity features in a 100% agave tequila will escalate. Such categories strikingly figure most likely to be from novice drinkers or consumers searching for super-high-quality cocktails.

International brands in this segment include Patrón, Don Julio, and Clase Azul, which focus on craftsmanship and traditional distillation methods that allude to the premium nature of 100% agave tequila. As Korean consumers are showing greater interest in spirits made with pure agave, from a perspective of bars as well as retail, it seems that 100% Tequila is poised to drive further growth here.

On the contrary, mixed tequila would make up 45.9% of the overall industry share. This is a tequila whose main component is either agave or other sugars fused, and it initially plays well in a wider consumer section because it is cheaper, making it applicable to the broader base of beginning consumers.

Mixed Tequila is very widely used because of its reduced monetary cost and very wide usefulness in drinks, making it among the major mixed drink standards such as margaritas and tequila sunrises. In terms of volume, Jose Cuervo and Sauza have made a significant contribution to this segment, as they provide lower-tier products for most consumers interested in price versus taste in mixed drinks. Even so, as tequila culture widens in Korea, Mixed Tequila will very much continue to be popular as the go-to Tequila both for social drinking and for casual occasions.

The rise of mezcal in South Korea follows the trend of a developing thirst for experience in drinking and authenticity-influenced purchasing. Young adults who are usually seen as early adopters of international lifestyle trends lean towards the artisanal character and indigenous Mexican history of mezcal. It turns out that most of this cultural storytelling shapes the brand selection at premium hospitality and retail spaces.

Experiential consumption has also been attached to mezcal tasting menus, pairing events, and Web content celebrating authenticity in production. These narratives strengthen brand-consumer relationships, in many cases leading to an even deeper perception of mezcal as a luxurious and meaningful beverage selection.

The interest that mezcal further triggers is because it could be shared with younger audiences that have started becoming more sustainability-conscious and wellness-disposed in South Korea. Ethical sourcing, transparency with respect to the agave grown, and environmentally friendly packaging are fast becoming keys to buying behavior, which indicates how mezcal could develop as a premium attribute within the increasingly changing face of alcohol consumption in Korea.

Between 2020 and 2024, the South Korean mezcal industry experienced a growth trend, fueled by a growing demand for premium and exotic spirits. The growth in cocktail culture and increasing popularity of artisanal and authentic alcoholic drinks, especially among young consumers, contributed to this trend.

Mezcal was becoming known as a superior substitute for other spirits like whiskey and tequila. The penetration of Mezcal into South Korean bars and Mexican and Latin American restaurants helped fuel awareness. Mezcal Joven, the unaged version, dominated the industry because of its unique flavor profile, while online distribution channels helped make it more widely available.

Forecast to 2025 to 2035, mezcal demand is expected to increase, driven by the movement towards aged styles, such as Mezcal Reposado, which will be poised to become increasingly popular. Consumers will venture more and experiment with different flavors and premium types.

Distribution will broaden through a variety of retail channels, such as supermarkets, thereby broadening mezcal's industry. The industry is expected to grow up as Mezcal is gaining greater mainstream popularity in the evolving alcoholic drinks industry in South Korea.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Mezcal Joven preference, with premium focus on unaged, high-proof variants | Transition to aged types, especially Mezcal Reposado, with premium emphasis |

| Growth in specialty liquor shops, internet sites, and bars/restaurants | Growth in supermarkets and mainstream retail stores |

| Growing demand for premium, handcrafted spirits among younger consumers | Growing cocktail culture and greater mainstream alcohol culture acceptance of Mezcal |

| Mezcal Joven spearheaded with rising demand for unique, handcrafted products | Mezcal Reposado and other age-style offerings increase popularity |

| Positive regulatory environment for importation and sale of Mezcal | Continued regulatory support to offer authenticity and quality in the industry |

The principal risk for the mezcal industry in South Korea is not much coercion to the whole population. Mezcal has been introduced in a good way by building up in premium venues, whereas it still does not sound too mainstream to the majority of consumers. Without any adequately structured education and branded storytelling programs, it might well be confined to niche markets.

An additional risk is the fragility of the supply chain, particularly artisanal production and individual regional-bound sources of mezcal. Any fault in the harvest of agave or the delivery logistics for export can create effects that impact product availability and may undermine distributor confidence in a fast-paced industry like South Korea.

Then again, the price range of imported mezcal compared to local spirits like soju or even premium whisky can lessen its chances of mass industry acceptance. Suppose brands are unable to convey the true added value behind authenticity, craftsmanship, and heritage. In that case, price-sensitive consumers will just stick to something they have gotten used to: readily available and affordable alternatives.

Mezcal is becoming a unique premium spirit in South Korea, appealing to younger generations of consumers who are looking for depth, authenticity, and cultural richness in their beverage of choice. Unlike more traditional imported spirits, the novelty of Mezcal comes from its handmade production process, utilization of wild and domesticated agave varieties, and earthy, smoky flavor profile that is unlike any other contemporary spirit trending in the South Korean industry. This handmade character strongly differs from mass-produced spirits, resonating with South Korea's emerging love for craftsmanship and original products.

Consumers are increasingly looking at Mezcal as a collector's spirit-each bottle connected to a particular village, agave type, and production method-giving rise to a feeling of scarcity and uniqueness that speaks strongly in anindustry that places a premium on sophisticated, niche experiences. In 2024, the South Korean premium spirits category is becoming increasingly curated, led by consumers who are looking for something more than taste alone-story, identity, and connection.

Mezcal has an authentic narrative based on indigenous Mexican heritage, eco-friendly farming, and small-batch production. These values resonate with leading social trends in South Korea, including increasing environmental consciousness, admiration for independent craftsmanship, and a move toward conscious consumption.

Seoul bartenders and drink curators are capitalizing on Mezcal's smoky depth and terroir-driven profiles to craft tasting menus and cocktail programs that cannot be duplicated with other spirits. It is also unique in its versatility-used in assertive cocktails or served neat as a sipper-making it both exotic and versatile to Korean tastes. In addition, Mezcal's rarity contributes to its allure. Limited exports, seasonal production schedules, and the use of wild-harvested agave in some styles make each bottling special.

In a consumer industry like South Korea, where exclusivity is valued, and people tend to seek out harder-to-find worldwide luxury products, this aspect of scarcity is an advantage. The limited processing and non-industrial origins of Mezcal also meet the clean-label and natural ingredients trends, gaining such strength among Korean consumers.

As more importers create niche portfolios and upscale restaurants incorporate Mezcal into well-crafted food pairings, the spirit is creating a unique niche in South Korea's developing luxury beverage landscape.

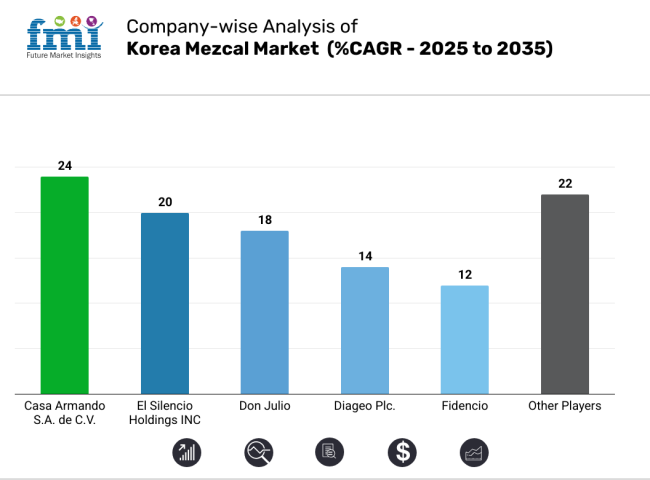

The Korean mezcal industry is at a formative stage but is experiencing steady growth, driven by rising consumer interest in premium craft spirits and authentic global flavors. Casa Armando S.A. de C.V. leads this emerging segment by emphasizing artisanal production methods and Mexican cultural heritage, which resonate strongly with Korea’s premiumization trend in alcoholic beverages.

El Silencio Holdings INC is gaining traction among younger Korean consumers by blending traditional mezcal roots with modern, edgy branding strategies suited to Seoul’s nightlife scene. Don Julio, although better known for its tequila, has successfully extended its brand trust into the mezcal category, offering premium expressions that appeal to affluent consumers.

Diageo Plc. leverages its established distribution networks and high-end positioning to introduce mezcal as part of its broader premium spirits portfolio. Meanwhile, boutique producers like Fidencio, Desolas, and Craft Distiller cultivate niche consumer bases through limited-batch offerings and sustainability narratives.

As Korean consumers seek out novel, artisanal experiences, companies that invest in experiential marketing, local brand education, and collaborations with upscale venues are expected to dominate the evolving mezcal landscape.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Casa Armando S.A. de C.V. | 20-24% |

| El Silencio Holdings INC | 16-20% |

| Don Julio | 14-18% |

| Diageo Plc. | 10-14% |

| Fidencio | 8-12% |

| Other Players | 18-22% |

Key Company Insights

Casa Armando S.A. de C.V. has managed to get about 20-24% of Korea's nascent mezcal industry, largely due to the storytelling built around its traditional, artisan Oaxacan production methods. Its emphasis on artisan integrity and cultural richness attracts Korean consumers who seek premium experiences with a global showcase.

El Silencio Holdings INC positions itself at the intersection of tradition and modernity to garner 16-20% of the industry, highly effective within Korea's urban bar culture. Don Julio is estimated to maintain a share of about 14-18%, capitalizing on the solid reputation of premium tequila to resonate with affluent consumers who are expanding their spirits repertoire.

Diageo Plc commands around 10-14% through an organized premium spirits portfolio, efficiently slotting its mezcal offerings through established distribution channels in hotels as well as fine dining restaurants. Fidencio, with 8-12%, has a small but vocally influential presence appealing to environmentally minded Korean consumers with sustainability and organic certification-based stories.

By product type, the industry is segmented into Joven, Reposado, and Anejo.

By concentration, the industry is categorized into 100% tequila and mixed tequila.

The industry is geographically divided into South Gyeongsang, North Jeolla, South Jeolla, Jeju, and the Rest of Korea.

The industry is estimated to reach USD 16.7 million by 2025.

The industry is forecasted to grow to USD 94 million by 2035.

The industry is projected to expand at a CAGR of 18.8% over the forecast period.

Mezcal Joven leads the product segment due to its popularity among younger consumers seeking premium and authentic spirits.

Major companies include Casa Armando S.A. de C.V., El Silencio Holdings INC, Fidencio, Desolas, Drink Monday Inc., Familia Camarena Tequila, Craft Distiller, Destileria Tlacolula, Diageo Plc., and Don Julio.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Liters) Forecast by Region, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Concentration, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Liters) Forecast by Concentration, 2018 to 2033

Table 7: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 8: South Gyeongsang Industry Analysis and Outlook Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 9: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Concentration, 2018 to 2033

Table 10: South Gyeongsang Industry Analysis and Outlook Volume (Liters) Forecast by Concentration, 2018 to 2033

Table 11: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North Jeolla Industry Analysis and Outlook Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 13: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Concentration, 2018 to 2033

Table 14: North Jeolla Industry Analysis and Outlook Volume (Liters) Forecast by Concentration, 2018 to 2033

Table 15: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: South Jeolla Industry Analysis and Outlook Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 17: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Concentration, 2018 to 2033

Table 18: South Jeolla Industry Analysis and Outlook Volume (Liters) Forecast by Concentration, 2018 to 2033

Table 19: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Jeju Industry Analysis and Outlook Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 21: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Concentration, 2018 to 2033

Table 22: Jeju Industry Analysis and Outlook Volume (Liters) Forecast by Concentration, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Concentration, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Region, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Industry Analysis and Outlook Volume (Liters) Analysis by Region, 2018 to 2033

Figure 6: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Industry Analysis and Outlook Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 10: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Industry Analysis and Outlook Value (US$ Million) Analysis by Concentration, 2018 to 2033

Figure 13: Industry Analysis and Outlook Volume (Liters) Analysis by Concentration, 2018 to 2033

Figure 14: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Concentration, 2023 to 2033

Figure 15: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Concentration, 2023 to 2033

Figure 16: Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 17: Industry Analysis and Outlook Attractiveness by Concentration, 2023 to 2033

Figure 18: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 19: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Concentration, 2023 to 2033

Figure 21: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 22: South Gyeongsang Industry Analysis and Outlook Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 23: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 24: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 25: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Concentration, 2018 to 2033

Figure 26: South Gyeongsang Industry Analysis and Outlook Volume (Liters) Analysis by Concentration, 2018 to 2033

Figure 27: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Concentration, 2023 to 2033

Figure 28: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Concentration, 2023 to 2033

Figure 29: South Gyeongsang Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 30: South Gyeongsang Industry Analysis and Outlook Attractiveness by Concentration, 2023 to 2033

Figure 31: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Concentration, 2023 to 2033

Figure 33: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North Jeolla Industry Analysis and Outlook Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 35: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Concentration, 2018 to 2033

Figure 38: North Jeolla Industry Analysis and Outlook Volume (Liters) Analysis by Concentration, 2018 to 2033

Figure 39: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Concentration, 2023 to 2033

Figure 40: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Concentration, 2023 to 2033

Figure 41: North Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 42: North Jeolla Industry Analysis and Outlook Attractiveness by Concentration, 2023 to 2033

Figure 43: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 44: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Concentration, 2023 to 2033

Figure 45: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 46: South Jeolla Industry Analysis and Outlook Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 47: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 48: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 49: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Concentration, 2018 to 2033

Figure 50: South Jeolla Industry Analysis and Outlook Volume (Liters) Analysis by Concentration, 2018 to 2033

Figure 51: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Concentration, 2023 to 2033

Figure 52: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Concentration, 2023 to 2033

Figure 53: South Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 54: South Jeolla Industry Analysis and Outlook Attractiveness by Concentration, 2023 to 2033

Figure 55: Jeju Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Jeju Industry Analysis and Outlook Value (US$ Million) by Concentration, 2023 to 2033

Figure 57: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Jeju Industry Analysis and Outlook Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 59: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Concentration, 2018 to 2033

Figure 62: Jeju Industry Analysis and Outlook Volume (Liters) Analysis by Concentration, 2018 to 2033

Figure 63: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Concentration, 2023 to 2033

Figure 64: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Concentration, 2023 to 2033

Figure 65: Jeju Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 66: Jeju Industry Analysis and Outlook Attractiveness by Concentration, 2023 to 2033

Figure 67: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 68: Rest of Industry Analysis and Outlook Value (US$ Million) by Concentration, 2023 to 2033

Figure 69: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 70: Rest of Industry Analysis and Outlook Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 71: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 72: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 73: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Concentration, 2018 to 2033

Figure 74: Rest of Industry Analysis and Outlook Volume (Liters) Analysis by Concentration, 2018 to 2033

Figure 75: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Concentration, 2023 to 2033

Figure 76: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Concentration, 2023 to 2033

Figure 77: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 78: Rest of Industry Analysis and Outlook Attractiveness by Concentration, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mezcal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Insights of Leading Mezcal Manufacturers

Mezcal Industry Analysis in Japan - Consumer Demand & Industry Trends in 2025

Mezcal Industry Analysis in Western Europe Report – Growth, Demand & Forecast 2025 to 2035

UK Mezcal Market Growth – Innovations, Trends & Forecast 2025-2035

USA Mezcal Market Analysis – Size, Share & Trends 2025-2035

ASEAN Mezcal Market Report – Trends, Demand & Industry Forecast 2025-2035

Europe Mezcal Market Insights – Size, Share & Growth 2025-2035

Australia Mezcal Market Trends – Growth, Demand & Forecast 2025-2035

Demand for Mezcal in EU Size and Share Forecast Outlook 2025 to 2035

Latin America Mezcal Market Outlook – Trends, Growth & Forecast 2025-2035

Industry 4.0 Market

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA