The global spirits market in 2025, a value of USD 61,784.2 million, with steady growth will increase to USD 87,152.7 million in the year 2035, that is CAGR (compound annual growth rate) of 3.5% This includes a rise in global disposable incomes, changes in consumption patterns towards premium and craft spirits, and the growing popularity of cocktail culture in urban centres. Innovative flavour profiles, heritage branding and experiential packaging all further fuel market growth among younger consumer groups looking for something new and of quality.

As premiumization accelerates, producers are using limited-edition specials, artisan techniques and sustainability stories to stand out in a crowded market. The importance of packaging enhancing shelf appeal, storytelling and brand value is particularly relevant in the duty-free, gifting and specialty retail categories. The increasing adoption of e-commerce and direct-to-consumer (DTC) models is driving demand for tamper-evident, rigid, and visually interesting packaging solutions specific to shipping and unboxing experiences.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 61,784.2 million |

| Market Value (2035F) | USD 87,152.7 million |

| CAGR (2025 to 2035) | 3.5% |

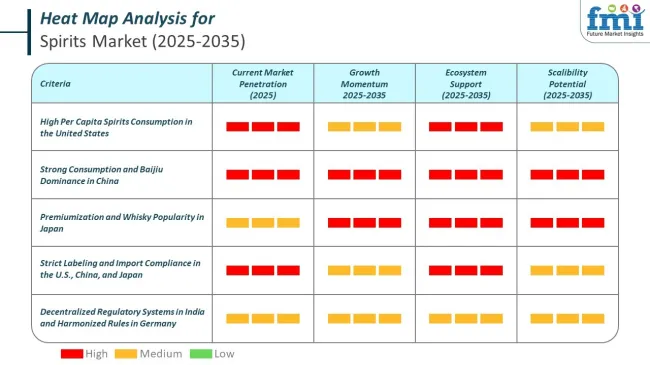

The spirits market in the world’s largest economies shows wide variance in per capita intake, with strong consumption leadership by the United States and China. Premiumization and evolving consumer behavior are driving both volume and value gains across these regions.

The spirits market in leading economies is shaped by stringent rules governing labeling, importation, and distribution. The United States, China, and Japan each enforce comprehensive frameworks to regulate how spirits enter and operate within their domestic channels.

India and Germany structure their regulatory systems to balance national standards with decentralized control. The emphasis is on safety, traceability, and compliance with import and excise systems that vary by jurisdiction.

North America is still one of the largest and most mature spirits markets, with robust consumption across whiskey, vodka and tequila categories. The United States is at the forefront of this region, exploring small-batch, craft and premium-label spirits, often with heritage-driven branding, limited releases.

Innovation is being driven by the rapid growth of ready-to-drink (RTD) spirit-based drinks and a move towards healthier formulations, including low-sugar and organic products. Another trend taking place in the region is the increased adoption of digital channels, with brands ensuring their packaging is optimized for e-commerce performance and shelf impact.

Europe’s spirits market is dominated by legacy producers and a broad range of products, from Scotch whisky and French cognac to Eastern European vodkas. Sustainability and traceability are emerging purchase drivers, which encourages investment in sustainable glass bottles, recyclable labels and plastic-free closures.

The UK, Germany, and France markets are experiencing strong gin and flavoured spirits demand, frequently in uniquely styled bottles to improve collectability and shelf presence. Regulatory changes pertain to alcohol labelling and environmental impact that also affect packaging and marketing strategies.

Growth is expected to be fastest in Asia-Pacific, where rising middle-class incomes, adopted western-style lifestyles and increases in urban populations have unlocked demand. Demand centres for premium and imported spirits are also significant in China, Japan, India, and South Korea.

Whiskey, brandy and liqueurs are becoming more common in metro regions; local rice-based spirits remain culturally significant. Driven by modern retail formats and online platforms, this accessibility is being accelerated, demanding secondary packaging that aligns brands with transport durability. The premiumization trend is most pronounced in China and South Korea, where consumers are attracted to attractive bottle designs, gift boxes and premium labelling.

New regulations regarding marketing, labelling and allowable levels of content of alcohol present hurdles for spirits manufacturers. Health-conscious consumers are moderating their alcohol intake, causing brands to develop more low-abv and no-alcohol versionsinnovating, but without compromising brand identity. Sets of strict import and export rules, excise duties and, sustainability legislation around packaging waste add all the more complexity to international expansion and product development timelines.

The increasing worldwide demand for high-end and artisanal spirits creates a profitable opportunity for both established and new players. Connoisseur consumption is on the rise, and consumers are willing to pay for authenticity, exclusivity, and a better experience which is what made aged, small-batch, and region-specific spirits fly off the shelves.

Innovative packaging formats, including etched bottles and custom embossing, tamper-proof seals and collectible formats, strengthen consumer engagement and build loyalty with brands. Digital storytelling through QR codes and AR-enabled labels also presents new opportunities for experiential marketing.

In 2020 to 2024, the spirits market saw innovation soar across all categories, both in product offerings and branding as producers catered to changing consumer demand for authenticity, low-alcohol alternatives, and eco-friendly packaging. Supply chain challenges caused a regional sourcing push and adoption of alternative materials in closures and labels. The RTD category soared, forcing revamps of most traditional types of packaging to accommodate smaller formats and impulse purchases.

Industry trends for 2025 to 2035 investing in the future with digitization, circular packaging solutions and flavour innovation. Disruptive trends prevalent in the narrative will include: provenance tracking on block chains; AI-driven revenue generation to enhance consumer engagement; and, low-impact packaging materials.

Such trends towards products and services that are personalized, virtual decisions, subscription-based delivery models, will also play an influential role in how products are designed, packaged, and delivered to customers. To remain competitive altered brands will increasingly map against lifestyle themes such as wellness and sustainability.

| Market Shift | 2020 to 2024 |

|---|---|

| Product Innovation | RTDs, low-alcohol spirits |

| Consumer Preferences | Value-driven purchases |

| Packaging Focus | Glass bottles, paper labels |

| Distribution Channels | Retail and on-trade |

| Regulatory Focus | Labelling and health warnings |

| Market Shift | 2025 to 2035 |

|---|---|

| Product Innovation | Aged, craft, and personalized spirits |

| Consumer Preferences | Premium, sustainable, and experiential choices |

| Packaging Focus | Smart labels, collectible formats, eco-glass |

| Distribution Channels | Direct-to-consumer, e-commerce-first models |

| Regulatory Focus | Sustainability mandates, global compliance |

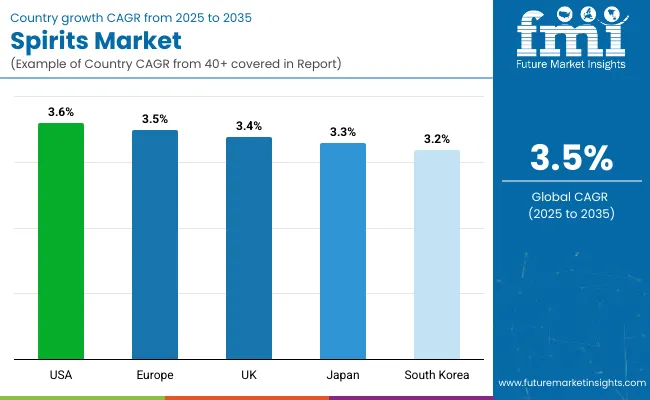

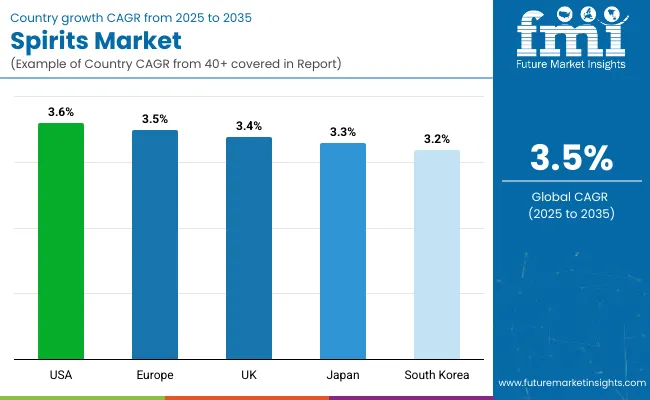

From 2025 to 2035, the USA spirits market is expected to grow at a CAGR of 3.6%. That growth is driven by changing consumer tastes, specifically millennials and Gen Z people who gravitate toward craft, premium and small-batch spirits. Demand for unique taste profiles and experiential drinking is fuelling the rapid growth of whiskey, tequila, and flavoured vodka segments.

Market accessibility is further elevated by way of regulatory easing on distilleries and extending distribution by way of e-commerce. And new high growth areas such as ready-to-drink (RTD) spirit and sustainable packaging innovations are changing the way the consumer encounters the category in bars and restaurants and home consumption channels.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.6% |

The UK spirits market is expected to grow at a CAGR of 3.4% over the forecast period. Both craft gin and super-premium rum remain clear leaders for growth by category, buoyed up by a strong artisanal production base and healthy cocktail culture. Consumers are also exploring low-ABV and no-sugar alternatives in spirits, both indicating a trend toward wellness and mindful consumption.

Local distillers are finding their footing with direct-to-consumer sales and subscription models. In alignment with such conscious consumer trends, investment in sustainable distillation processes and recyclable glass bottling is also happening in the spirits market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.4% |

The Europe Spirits Market is expected to rise at a CARG of over 3.5% until 2035, in particular booming in France, Germany and Italy. The market is buoyed by consumer sophistication, high spend on premium spirits and heritage-driven consumption. Cognac, brandy and liqueurs still dominate, but there is a trend toward organic and botanical-infused spirits that younger demographics are responding to.

Tourism and on-trade sales remain key market drivers. EU GI support is also reinforcing brand authenticity and export competitiveness. Digital marketing coupled with social media promotions have made these platforms even more visible and have created a brand loyal audience.

| Region | CAGR (2025 to 2035) |

|---|---|

| Europe | 3.5% |

Japan's spirits market is forecast to rise at 3.3% CAGR from 2025 through 2035. Japan remains a hallmark location for producing world-class whisky, and Japanese whisky has become a household name globally. Increasing consumer interest in cocktail culture, particularly among younger urban professionals, is driving imports of vodka, rum, and gin. There are retailers and bars also experimenting with fusion beverages that make use of local ingredients paired with Western spirit bases.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.3% |

The spirits market in South Korea is projected to grow at a CAGR of 3.2% during the forecast period. Soju remains king, but younger drinkers are experimenting with global spirits, including whiskey, rum and tequila. Awareness of Western drinking culture, increasing disposable incomes, and a proliferation of cocktail lounges are all driving diversification in the market.

This has led to a premiumization push from Korean distillers themselves, who are releasing craft and, sometimes, fruit-infused variations to appeal to female and health conscious demographics. The ways spirits are bought and consumed are being further altered by online retailing and influencer-driven marketing.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.2% |

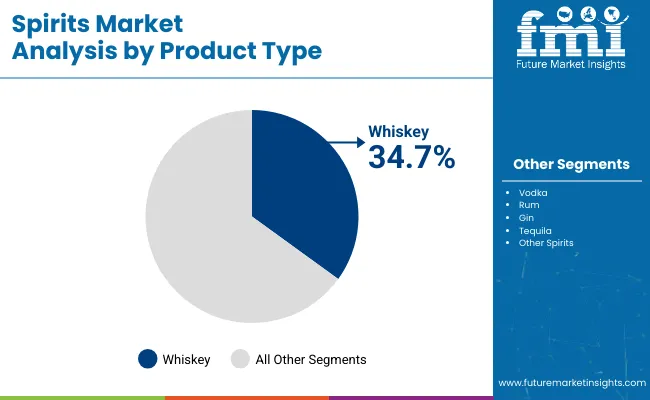

| By Product Type | Market Share (2025) |

|---|---|

| Whiskey | 34.7% |

As consumers increasingly gravitate toward rich flavor profiles, aging depth and cultural authenticity, whiskey has come to dominate the spirits market around the world. Using barley, corn, rye or wheat, distillers produce whiskey via precise fermentation and aging, with different types emerging, from Scotch to Bourbon and Irish whiskey. This range has helped whiskey establish a loyal and varied global consumer base.

From North America to Europe to Japan, distilleries are developing their premium whiskeys, reaching both the traditional drinker and, increasingly, a younger drinker looking for a craft experience. The international proliferation of whiskey festivals, tasting tours and collector communities has bestowed a strong cultural association with quality and sophistication. Small-batch releases, barrel-aged variants and marketing strategies that tell a story to create brand loyalty and authenticity continue to attract brands to the category.

Surging disposable incomes and the Westernization of lifestyles in emerging markets in Asia-Pacific and Latin America have also expanded whiskey demand. Governments too have relaxed trade and import barriers, letting international whiskey brands grab shelf space in urban retail outlets and duty-free stores. Whiskey maintains its cultural cachet, consistent with premiumization trends, and it is the only product segment with unedited consumer attraction.

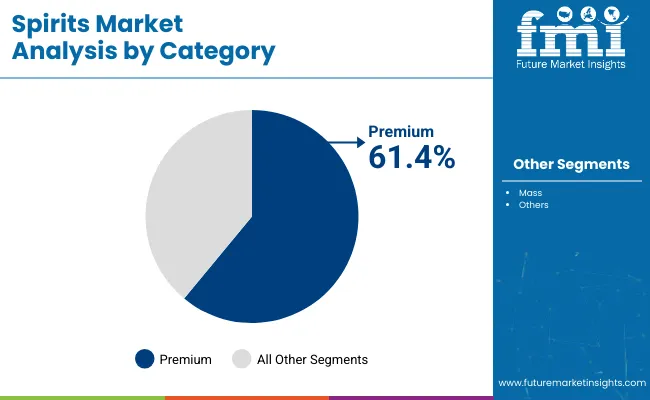

| By Category | Market Share (2025) |

|---|---|

| Premium | 61.4% |

The global spirits segment is dominated by premium brands, as consumers' growing thirst for authenticity, craftsmanship, and sophisticated taste experiences drives demand. That has been a trend particularly among millennial and Gen Z drinkers, who express their interests in quality versus quantity and a tendency toward heritage brands, craft distilleries and limited-edition products. Brands are jumping on board this move, launching small-batch series, single-origin ingredients and storytelling around their branding.

Premium spirits are particularly strong in whiskey, gin and tequila segments, where aging processes and artisanal production methods develop unique flavour complexities. These products are often more expensive, framing them as desirable and esteem-boosting. At the same time, manufacturers package their premium spirits in fancy bottles and spend on experiential marketing campaigns like distillery tours and exclusive tastings to raise the consumer experience.

The acceleration of global access to premium spirits has also been boosted by the proliferation of e-commerce and direct-to-consumer models. Increases in affluence and urbanization have driven premium sales growth in these markets in Europe, North America, and East Asia. As consumers continue to trade up for elevated drinking occasions, premium spirits remain the engine of market value growth.

The global spirits market is a robustly growing industry owing to the rising consumer demand for premium and craft spirits, the evolving taste preferences of consumers and the growing distribution channels. The market is also being driven forward with the advent of innovations in flavour profiles, sustainable production practices, and strategic marketing initiatives. Gaping white spaces for strategic expansion are further cementing key players on product diversification, mergers & acquisitions and digital engagement to strengthen the foothold.

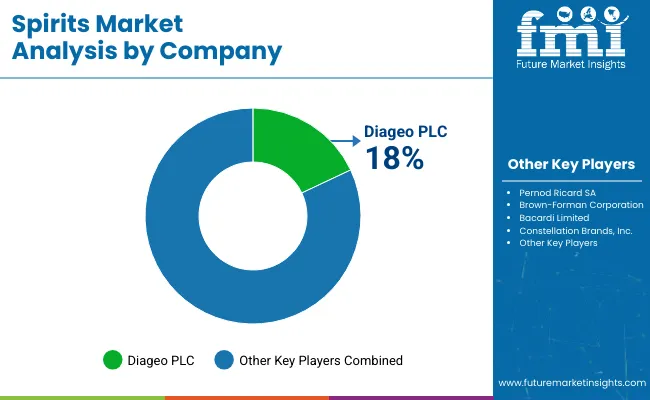

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Diageo plc | 18 - 20% |

| Pernod Ricard SA | 14 - 16% |

| Brown-Forman Corporation | 12 - 14% |

| Bacardi Limited | 10 - 12% |

| Constellation Brands, Inc. | 8 - 10% |

| Other Companies (combined) | 28 - 38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Diageo plc | In 2024, expanded its portfolio with the acquisition of several craft distilleries, enhancing its presence in the premium spirits segment. |

| Pernod Ricard SA | In 2025, launched a new line of sustainable and organic spirits, aligning with consumer demand for environmentally friendly products. |

| Brown-Forman Corporation | In 2024, introduced innovative ready-to-drink (RTD) cocktails under its flagship brands, catering to the growing RTD market. |

| Bacardi Limited | In 2025, invested in digital marketing campaigns targeting younger demographics, boosting brand engagement and sales. |

| Constellation Brands, Inc. | In 2024, expanded its distribution network in emerging markets, increasing its global footprint and market share. |

Diageo leads the market with a diverse portfolio of premium spirits, including iconic brands like Johnnie Walker and Smirnoff. The company's strategic acquisitions and focus on innovation have solidified its dominant position.

Pernod Ricard emphasizes sustainability and premiumization, with brands like Absolut and Chivas Regal catering to environmentally conscious consumers seeking high-quality products.

Brown-Forman, known for Jack Daniel's and Woodford Reserve, continues to innovate with RTD offerings and flavor extensions, appealing to a broad consumer base.

Bacardi focuses on digital transformation and experiential marketing, enhancing consumer engagement and expanding its reach among younger audiences.

Constellation Brands leverages its strong distribution channels and strategic investments to grow its spirits portfolio, including brands like Svedka and Casa Noble.

Several other companies contribute significantly to the spirits market through specialized offerings:

The overall market size for the Spirits Market was USD 61,784.2 million in 2025.

The Spirits Market is expected to reach USD 87,152.7 million by 2035.

The demand is driven by the rising consumption of premium and craft spirits, increasing popularity of cocktails, and evolving consumer preferences towards flavored and botanical products.

The top 5 countries driving market growth are the USA, UK, Europe, Japan, and South Korea.

The Whiskey segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Litre) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 6: Global Market Volume (Litre) Forecast by Category, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Litre) Forecast by Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 16: North America Market Volume (Litre) Forecast by Category, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: North America Market Volume (Litre) Forecast by Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 26: Latin America Market Volume (Litre) Forecast by Category, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Latin America Market Volume (Litre) Forecast by Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Europe Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 36: Europe Market Volume (Litre) Forecast by Category, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Europe Market Volume (Litre) Forecast by Application, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Europe Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 46: Asia Pacific Market Volume (Litre) Forecast by Category, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Asia Pacific Market Volume (Litre) Forecast by Application, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: MEA Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 56: MEA Market Volume (Litre) Forecast by Category, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: MEA Market Volume (Litre) Forecast by Application, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 60: MEA Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Category, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Litre) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 15: Global Market Volume (Litre) Analysis by Category, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 19: Global Market Volume (Litre) Analysis by Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Category, 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Category, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 45: North America Market Volume (Litre) Analysis by Category, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: North America Market Volume (Litre) Analysis by Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Category, 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Category, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 75: Latin America Market Volume (Litre) Analysis by Category, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 79: Latin America Market Volume (Litre) Analysis by Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Category, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Category, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Europe Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 105: Europe Market Volume (Litre) Analysis by Category, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: Europe Market Volume (Litre) Analysis by Application, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Europe Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Category, 2023 to 2033

Figure 118: Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Category, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Litre) Analysis by Category, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Litre) Analysis by Application, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Category, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Category, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: MEA Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 165: MEA Market Volume (Litre) Analysis by Category, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 169: MEA Market Volume (Litre) Analysis by Application, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: MEA Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Category, 2023 to 2033

Figure 178: MEA Market Attractiveness by Application, 2023 to 2033

Figure 179: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spirits Miniatures Market Analysis by Capacity, Material, End Use, and Region through 2035

Premium Spirits Glass Bottle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA