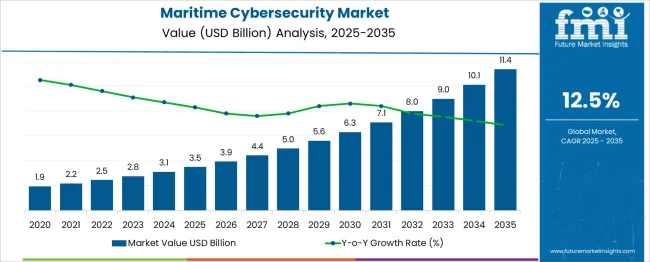

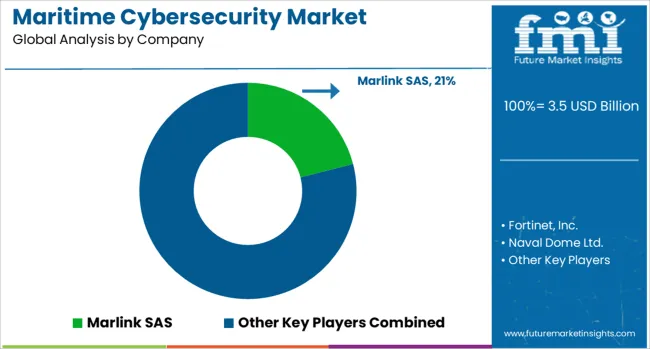

The global maritime cybersecurity market is expected to grow from USD 3.5 billion in 2025 to approximately USD 11.4 billion by 2035, recording an absolute increase of USD 7.9 billion over the forecast period. This translates into a total growth of 225.7%, with the market forecast to expand at a compound annual growth rate (CAGR) of 12.5% between 2025 and 2035. The market size is expected to grow by nearly 3.3X during the same period, supported by the rising adoption of digital technologies in maritime operations and increasing demand for comprehensive cybersecurity solutions following growing cyber threats targeting shipping infrastructure and port operations.

Between 2025 and 2030, the maritime cybersecurity market is projected to expand from USD 3.5 billion to USD 6.3 billion, resulting in a value increase of USD 2.8 billion, which represents 35.4% of the total forecast growth for the decade. This phase of growth will be shaped by rising digitalization of maritime operations, increasing cyber threats targeting shipping infrastructure, and growing regulatory requirements for cybersecurity compliance in port operations. Maritime organizations are investing in comprehensive cybersecurity platforms to protect operational technology systems and critical navigation infrastructure.

From 2030 to 2035, the market is forecast to grow from USD 6.3 billion to USD 11.4 billion, adding another USD 5.1 billion, which constitutes 64.6% of the ten-year expansion. This period is expected to be characterized by expansion of artificial intelligence-powered threat detection systems, integration of advanced security analytics for maritime operations, and development of specialized cybersecurity solutions for autonomous vessels and smart port operations. The growing complexity of maritime digital infrastructure and increasing focus on supply chain security will drive demand for more sophisticated cybersecurity technologies and comprehensive managed security services.

Between 2020 and 2025, the maritime cybersecurity market experienced significant expansion, driven by increasing digitalization of shipping operations and heightened awareness of cyber threats following high-profile attacks on maritime infrastructure. The market developed as shipping companies and port operators recognized the critical importance of cybersecurity protection for operational continuity and cargo security. International maritime organizations began emphasizing comprehensive cybersecurity frameworks and regulatory compliance requirements to maintain global shipping safety and security standards.

| Parameter | Value |

| Market Value (2025) | USD 3.5 billion |

| Market Forecast Value (2035) | USD 11.4 billion |

| Market Forecast CAGR | 12.5% |

Market expansion is being supported by the increasing digitalization of maritime operations and the corresponding vulnerability to cyber attacks targeting shipping infrastructure, port operations, and cargo management systems. Modern vessels and port facilities rely on interconnected digital systems for navigation, communication, cargo handling, and operational management, creating multiple attack vectors that require comprehensive cybersecurity protection. Regulatory bodies and international maritime organizations are establishing stringent cybersecurity requirements that mandate documented security procedures and continuous monitoring capabilities across shipping operations.

The growing sophistication of cyber threats targeting maritime infrastructure is driving demand for specialized cybersecurity solutions that can protect operational technology systems, navigation equipment, and cargo management platforms. Maritime organizations are implementing comprehensive security frameworks that integrate network security, endpoint protection, and operational technology security to address diverse threat landscapes. The increasing adoption of Internet of Things devices and autonomous systems in maritime operations is creating new security challenges that require advanced threat detection and response capabilities.

The market is segmented by component outlook, security type outlook, deployment outlook, organization size outlook, end-user outlook, and region. By component outlook, the market includes solutions and services. Based on security type outlook, the market is categorized into network security, endpoint security, application security, cloud security, and operational technology (OT) security. In terms of deployment outlook, the market is segmented into on-premise and cloud. By organization size outlook, the market is classified into large enterprises and small and medium-sized enterprises (SMEs). By end-user outlook, the market is divided into commercial shipping, naval and defense, port operators, offshore operations, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

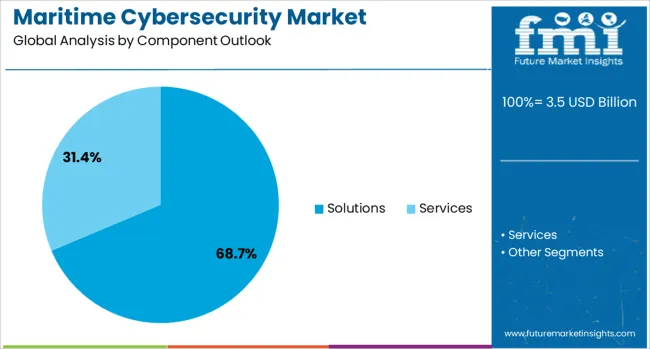

Solutions are projected to account for 68.7% of the maritime cybersecurity market in 2025. This leading share is supported by the widespread adoption of integrated cybersecurity platforms that provide comprehensive threat detection, prevention, and response capabilities specifically designed for maritime environments. Maritime cybersecurity solutions offer specialized functionality for protecting operational technology systems, navigation equipment, and cargo management platforms from diverse cyber threats. The segment benefits from continuous technological innovation and the development of maritime-specific security applications that address unique operational requirements and regulatory compliance standards.

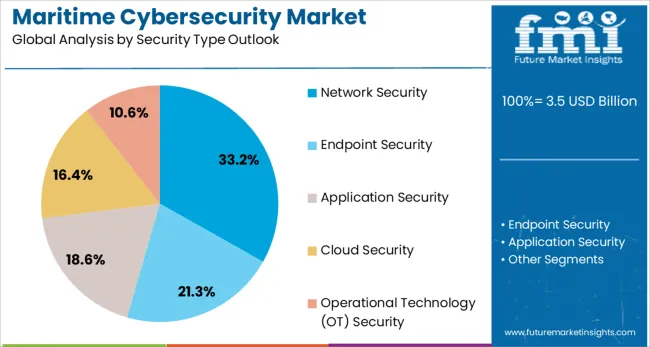

Network security is expected to represent 33.2% of the maritime cybersecurity market in 2025. This significant share reflects the critical importance of protecting maritime network infrastructure that connects vessels, port facilities, and cargo management systems across global shipping operations. Network security solutions provide essential protection for communication systems, data transmission, and interconnected operational technologies that support modern maritime operations. The segment benefits from the increasing complexity of maritime network architectures and the growing need for secure communication channels between vessels and shore-based operations.

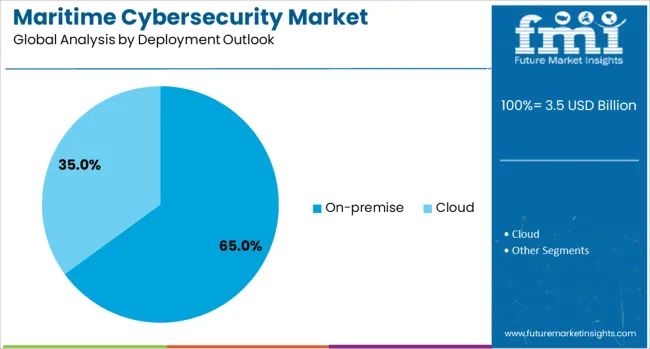

On-premise deployment is projected to contribute 65% of the market in 2025, representing the preferred deployment model for maritime cybersecurity solutions due to the unique operational requirements of vessels and port facilities. On-premise cybersecurity systems provide direct control over security infrastructure and enable rapid response to threats without relying on external network connectivity. The segment is supported by the need for autonomous security operations during extended sea voyages and the requirement for immediate threat response capabilities in critical maritime environments.

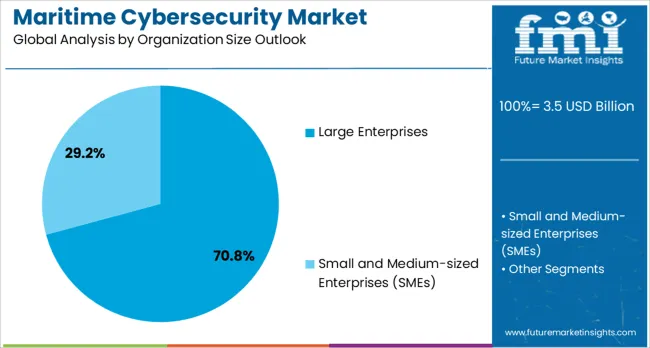

Large enterprises are estimated to hold 70.8% of the market share in 2025. This dominance reflects the extensive cybersecurity requirements of major shipping companies, port operators, and maritime service providers that manage complex operational infrastructures and face sophisticated cyber threats. Large maritime organizations typically operate multiple vessels, port facilities, and cargo management systems that require comprehensive, integrated cybersecurity solutions capable of addressing diverse operational and regulatory challenges. The segment provides a stable demand for advanced cybersecurity platforms through ongoing regulatory compliance requirements and the need for enterprise-wide security governance frameworks.

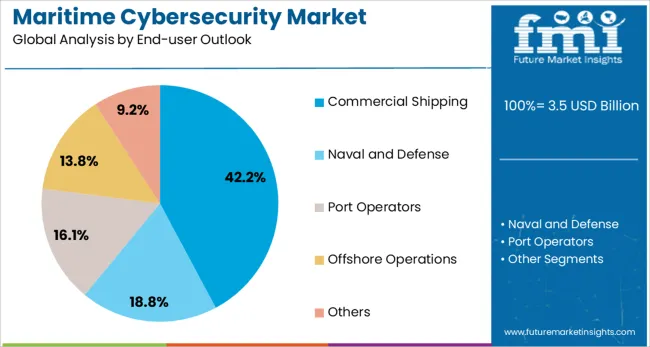

Commercial shipping is estimated to hold 42.1% of the market share in 2025. This significant share reflects the extensive cybersecurity requirements of container shipping, bulk carriers, tankers, and other commercial vessel operations that form the backbone of global maritime trade. Commercial shipping companies face diverse cyber threats targeting navigation systems, cargo management platforms, and operational technology infrastructure that require specialized protection measures. The segment benefits from increasing regulatory requirements for cybersecurity compliance and the growing awareness of cyber risks among shipping operators and cargo owners.

The maritime cybersecurity market is advancing rapidly due to increasing digitalization of maritime operations and growing awareness of cyber threats targeting shipping infrastructure. The market faces challenges, including implementation complexity in legacy maritime systems, need for specialized expertise in maritime cybersecurity applications, and varying regulatory requirements across different maritime jurisdictions. Technology integration and standardization efforts continue to influence solution development and market adoption patterns.

The growing deployment of artificial intelligence and machine learning capabilities is enabling automated threat detection, predictive risk assessment, and enhanced security monitoring across maritime operational environments. AI-powered maritime cybersecurity solutions provide real-time analysis of network traffic, operational data, and system behavior to identify potential threats before they impact critical maritime operations. These technologies are particularly valuable for detecting sophisticated attacks targeting operational technology systems and identifying unusual patterns that indicate potential cybersecurity incidents.

Modern maritime cybersecurity platforms are incorporating industry-specific functionality and regulatory compliance features that address unique security challenges in vessel operations, port management, and cargo handling systems. Maritime-specific solutions provide specialized protection for navigation systems, ballast control systems, engine management platforms, and cargo monitoring technologies that require tailored security approaches. Industry standards development and regulatory frameworks are establishing comprehensive cybersecurity requirements that drive demand for specialized maritime security solutions and professional certification programs.

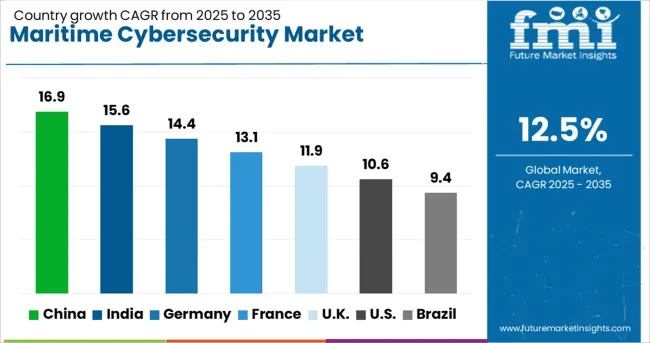

| Country | CAGR (2025-2035) |

| China | 16.9% |

| India | 15.6% |

| Germany | 14.4% |

| France | 13.1% |

| United Kingdom | 11.9% |

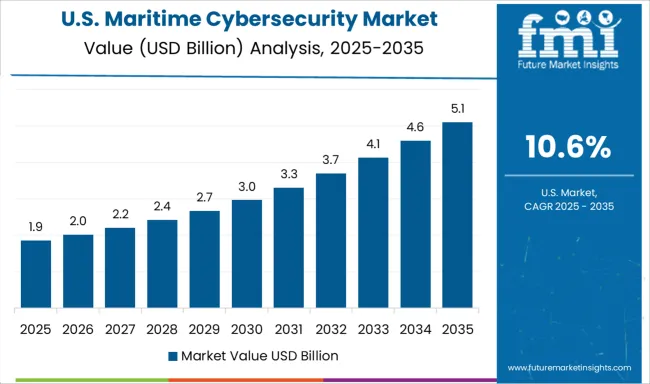

| United States | 10.6% |

| Brazil | 9.4% |

The global maritime cybersecurity market demonstrates varied growth across key countries, with China leading at a CAGR of 16.9% through 2035, driven by rapid port infrastructure expansion, smart port initiatives, and government mandates for operational technology security. India follows closely at 15.6%, supported by port modernization projects, digital technology adoption, and strategic programs like Sagarmala that enhance coastal and inland maritime security. Germany records a CAGR of 14.4%, emphasizing advanced maritime technology integration, Industry 4.0 initiatives, and operational security across major ports. France grows at 13.1%, focusing on naval defense, heritage maritime infrastructure, and commercial operations. The UK sees 11.9% growth, supported by maritime services, port security, and regulatory compliance initiatives. The USA expands at 10.6%, driven by critical infrastructure protection and naval cybersecurity programs. Brazil maintains steady growth at 9.4%, underpinned by port modernization, digital technology adoption, and offshore operations security.

Revenue from maritime cybersecurity in China is projected to exhibit strong growth with a CAGR of 16.9% through 2035, driven by rapid expansion of port infrastructure and increasing adoption of digital technologies in maritime operations across major shipping centers. The country's growing shipping industry and focus on smart port development are creating significant demand for comprehensive maritime cybersecurity solutions. Major port operators and shipping companies are implementing integrated cybersecurity platforms that address operational technology security, cargo management protection, and regulatory compliance requirements across coastal and inland maritime facilities.

China's Belt and Road Initiative and maritime infrastructure modernization programs are supporting the development of advanced cybersecurity capabilities and security governance frameworks that meet international maritime standards. Government initiatives emphasizing maritime security and operational resilience are driving demand for documented cybersecurity procedures and continuous threat monitoring capabilities. The expanding container shipping industry and port automation projects are creating additional opportunities for maritime cybersecurity applications and specialized security consulting services.

Revenue from maritime cybersecurity in India is expanding at a CAGR of 15.6%, supported by port modernization projects and increasing adoption of digital technologies across major shipping hubs, including Mumbai, Chennai, and Kolkata. The country's expanding maritime trade and growing focus on port security are driving demand for comprehensive cybersecurity solutions that protect operational systems and cargo management platforms. Maritime organizations are implementing integrated cybersecurity frameworks that address diverse threat categories and regulatory compliance requirements in evolving maritime environments.

India's Sagarmala port development program and maritime infrastructure investments are facilitating adoption of advanced cybersecurity technologies and professional training initiatives that meet international maritime security standards. The growing focus on coastal shipping and inland waterway development is creating demand for specialized maritime cybersecurity systems and real-time threat monitoring capabilities. Professional certification programs and industry standards development are enhancing technical expertise among maritime cybersecurity professionals and enabling comprehensive security assessment services.

Demand for maritime cybersecurity in Germany is projected to grow at a CAGR of 14.4%, supported by the country's leadership in maritime technology innovation and comprehensive security standards for shipping and port operations. German maritime organizations prioritize operational technology security and regulatory compliance across major ports, including Hamburg, Bremen, and other shipping centers. The market is characterized by a focus on precision threat detection, advanced security analytics integration, and compliance with comprehensive maritime security regulations and international standards.

Germany's shipping industry leadership and maritime technology innovation require extensive cybersecurity capabilities to maintain operational efficiency and security compliance standards across diverse maritime applications. Organizations are implementing advanced maritime cybersecurity platforms that support Industry 4.0 maritime initiatives and provide comprehensive protection for vessel systems, port infrastructure, and cargo management technologies. Professional certification programs ensure specialized expertise among maritime cybersecurity professionals, enabling comprehensive security assessment services and regulatory compliance support.

Demand for maritime cybersecurity in France is expanding at a CAGR of 13.1%, driven by the country's well-established maritime industry and naval defense cybersecurity requirements across commercial and military maritime operations. French maritime organizations maintain comprehensive cybersecurity protocols across major ports and naval facilities that require extensive threat monitoring and operational security management. The market benefits from regulatory requirements that mandate documented cybersecurity procedures and ongoing compliance monitoring across diverse maritime sectors.

France's naval defense industry and advanced maritime technology sector create a stable demand for specialized maritime cybersecurity solutions that meet international security standards and operational requirements. Maritime organizations are implementing advanced cybersecurity technologies and comprehensive threat assessment systems that support regulatory compliance and national security objectives. Professional development programs and industry standards ensure technical expertise among maritime cybersecurity professionals in specialized applications and regulatory compliance procedures.

Demand for maritime cybersecurity in the UK is projected to grow at a CAGR of 11.9%, supported by the country's leadership in maritime services and comprehensive port security management across major shipping centers, including London, Southampton, and Liverpool. British maritime organizations implement extensive cybersecurity protocols that ensure regulatory compliance and maintain operational resilience across shipping operations, port management, and maritime logistics services. The market is characterized by a focus on comprehensive security governance frameworks and integrated threat monitoring systems that support business continuity and international shipping security.

The UK's maritime services sector prioritizes advanced cybersecurity capabilities through comprehensive regulatory compliance programs and operational security assessment initiatives. Organizations are implementing integrated maritime cybersecurity platforms and automated threat detection systems that enhance operational resilience and security reporting capabilities. Professional training and certification programs develop specialized expertise among maritime cybersecurity professionals, enabling comprehensive security assessment services and regulatory compliance support.

Demand for maritime cybersecurity in the USA is expanding at a CAGR of 10.6%, driven by comprehensive critical infrastructure protection requirements and focus on naval cybersecurity across commercial shipping and defense operations. American maritime organizations implement extensive cybersecurity protocols that ensure regulatory compliance and maintain operational resilience across ports, shipping companies, and naval facilities. The market benefits from established regulatory frameworks and security requirements that mandate documented cybersecurity procedures and continuous threat monitoring programs.

The USA maritime environment emphasizes comprehensive cybersecurity capabilities through integrated security governance frameworks and automated threat detection systems. Organizations are implementing advanced maritime cybersecurity platforms that support critical infrastructure protection, operational security monitoring, and naval defense requirements across diverse maritime operations. Professional certification programs and industry standards ensure technical expertise among maritime cybersecurity professionals in specialized applications and regulatory compliance procedures.

Revenue from maritime cybersecurity in Brazil is growing at a CAGR of 9.4%, driven by maritime infrastructure development and increasing adoption of digital technologies across major ports, including Santos, Rio de Janeiro, and other coastal shipping centers. The country's expanding maritime trade and growing focus on port security are creating demand for comprehensive cybersecurity solutions that protect operational systems and cargo management platforms. Maritime organizations are implementing integrated cybersecurity frameworks that address operational risks, regulatory requirements, and threat management in evolving maritime environments.

Brazil's port modernization initiatives and maritime infrastructure investments are facilitating adoption of advanced cybersecurity technologies and professional training programs that meet international maritime security standards. The growing focus on coastal shipping development and offshore operations security is creating opportunities for specialized maritime cybersecurity solutions and automated threat monitoring capabilities. Professional development programs and regulatory enhancement efforts are improving maritime cybersecurity expertise and enabling comprehensive security assessment services.

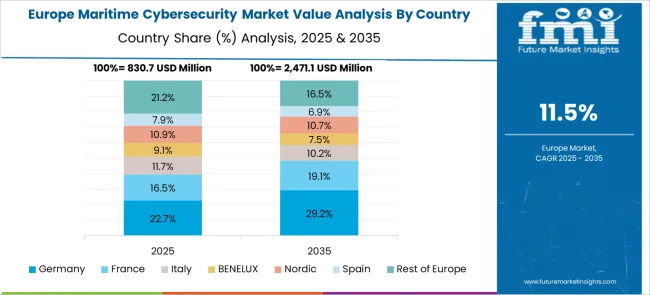

The European maritime cybersecurity market is growing steadily, driven by IMO guidelines, EU directives, and robust port security standards. Germany leads with advanced protocols at Hamburg and Bremen, emphasizing regulatory compliance and operational monitoring. France focuses on major ports like Le Havre and Marseille, supporting naval and commercial cybersecurity needs. The UK prioritizes port security in London, Southampton, and Liverpool, while Italy and Spain enhance Genoa, Naples, Venice, Barcelona, and Valencia ports with modernized cybersecurity programs. Nordic nations and BENELUX countries maintain high operational security standards. Eastern Europe shows emerging potential through infrastructure upgrades and standardized cybersecurity protocols across ports and maritime operations.

The maritime cybersecurity market is defined by competition among established cybersecurity companies, specialized maritime security solution providers, and emerging technology innovators. Companies are investing in operational technology security capabilities, maritime-specific threat intelligence, cloud-based security platforms, and professional consulting services to deliver comprehensive, scalable, and cost-effective maritime cybersecurity solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Marlink SAS, France-based, offers comprehensive maritime cybersecurity solutions with a focus on satellite communications security, vessel connectivity protection, and integrated maritime security platforms. Fortinet Inc., operating globally, provides network security solutions specifically adapted for maritime environments with a focus on operational technology protection. Naval Dome Ltd. delivers specialized cybersecurity solutions for naval and commercial vessels with a focus on operational technology security and threat detection. Cydome Security Ltd. offers maritime-specific cybersecurity platforms with a focus on vessel security management and port operations protection.

CyberOwl Ltd. provides maritime cybersecurity solutions with a focus on threat intelligence and security monitoring capabilities. ABS Group of Companies Inc. offers maritime cybersecurity consulting and compliance services with comprehensive regulatory expertise. Waterfall Security Solutions Ltd. delivers operational technology security solutions specifically designed for maritime industrial control systems. Kongsberg Gruppen ASA, Northrop Grumman Corporation, Thales Group, BAE Systems plc, Honeywell International Inc., Cisco Systems Inc., Raytheon Technologies Corporation, and Wärtsilä Corporation provide specialized maritime cybersecurity expertise, comprehensive platform solutions, and industry-specific capabilities across global and regional maritime markets.

| Item | Value |

| Quantitative Units | USD 11.4 billion |

| Component Outlook | Solutions, Services |

| Security Type Outlook | Network Security, Endpoint Security, Application Security, Cloud Security, Operational Technology (OT) Security |

| Deployment Outlook | On-premise, Cloud |

| Organization Size Outlook | Large Enterprises, Small and Medium-sized Enterprises (SMEs) |

| End-user Outlook | Commercial Shipping, Naval and Defense, Port Operators, Offshore Operations, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, France, Brazil |

| Key Companies Profiled | Marlink SAS, Fortinet Inc., Naval Dome Ltd., Cydome Security Ltd., CyberOwl Ltd., ABS Group of Companies Inc., Waterfall Security Solutions Ltd., Kongsberg Gruppen ASA, Northrop Grumman Corporation, Thales Group, BAE Systems plc, Honeywell International Inc., Cisco Systems Inc., Raytheon Technologies Corporation, Wärtsilä Corporation |

| Additional Attributes | Dollar sales by component outlook, security type outlook, deployment outlook, organization size outlook, and end-user outlook, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established cybersecurity companies and specialized maritime security solution providers, organizational preferences for on-premise versus cloud deployment models, integration with operational technology security and maritime communication systems, innovations in maritime-specific threat detection and automated response capabilities, and adoption of integrated maritime cybersecurity platforms with enhanced threat intelligence and regulatory compliance features. |

Commercial Shipping

The global maritime cybersecurity market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the maritime cybersecurity market is projected to reach USD 11.4 billion by 2035.

The maritime cybersecurity market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in maritime cybersecurity market are solutions, _risk and compliance management, _identity and access management, _firewall and intrusion detection systems, _encryption, _incident response, services, _professional services and _managed services.

In terms of security type outlook, network security segment to command 33.2% share in the maritime cybersecurity market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Maritime Satellite Communication Market Size and Share Forecast Outlook 2025 to 2035

Maritime Patrol Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Maritime Patrol Naval Vessels Market Growth - Trends & Forecast 2025 to 2035

Cybersecurity Insurance Market Size and Share Forecast Outlook 2025 to 2035

Drone Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence In Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-Everything (V2X) Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA