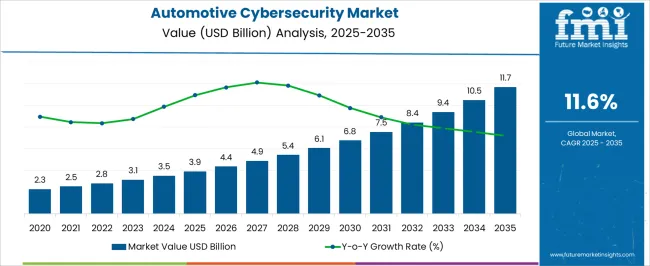

The Automotive Cybersecurity Market is estimated to be valued at USD 3.9 billion in 2025 and is projected to reach USD 11.7 billion by 2035, registering a compound annual growth rate (CAGR) of 11.6% over the forecast period.

The automotive cybersecurity market is projected to demonstrate strong and consistent year-on-year (YoY) growth from USD 2.3 billion in 2020 to approximately USD 11.7 billion by 2035, reflecting the growing emphasis on securing connected and autonomous vehicles. Between 2020 and 2025, the market expands steadily from USD 2.3 billion to USD 3.9 billion, supported by increasing integration of telematics, infotainment, and vehicle-to-everything (V2X) communication technologies.

This period marks foundational growth where automakers and suppliers focus on developing and implementing robust cybersecurity protocols, including encryption and intrusion detection systems, to protect vehicles from emerging cyber threats.

From 2026 to 2030, the market gains momentum, increasing from USD 4.4 billion to USD 6.8 billion. This phase benefits from advancements in artificial intelligence and machine learning, which enhance threat detection and response capabilities, alongside growing regulatory frameworks that mandate higher cybersecurity standards.

The proliferation of over-the-air (OTA) software updates further drives demand for continuous monitoring and risk mitigation solutions. From 2031 to 2035, growth accelerates significantly, with market value rising from USD 7.5 billion to USD 11.7 billion.

The surge is driven by wider adoption of fully autonomous and electric vehicles requiring sophisticated security architectures to ensure safety and data privacy. Overall, the automotive cybersecurity market's steady and accelerating YoY growth from 2020 through 2035 underscores its vital role in enabling secure, connected mobility in a rapidly evolving automotive landscape.

| Metric | Value |

|---|---|

| Automotive Cybersecurity Market Estimated Value in (2025 E) | USD 3.9 billion |

| Automotive Cybersecurity Market Forecast Value in (2035 F) | USD 11.7 billion |

| Forecast CAGR (2025 to 2035) | 11.6% |

The automotive cybersecurity market is witnessing accelerated momentum as digital connectivity becomes intrinsic to modern vehicles. The integration of autonomous driving systems, infotainment interfaces, and over-the-air updates has significantly increased exposure to cyber threats.

Regulatory mandates in key automotive markets are compelling OEMs to implement standardized cybersecurity frameworks, while investments in software-defined vehicles are pushing the boundaries of in-vehicle data protection. Manufacturers are placing greater emphasis on lifecycle cybersecurity, with secure boot protocols, threat detection systems, and data encryption embedded across electronics architecture.

The market is also supported by collaborative efforts among automakers, Tier 1 suppliers, and cybersecurity firms to ensure compliance with international standards such as ISO/SAE 21434. As vehicles continue evolving into connected mobility hubs, the cybersecurity landscape is expected to expand in scope, investment, and complexity, supporting long-term market growth.

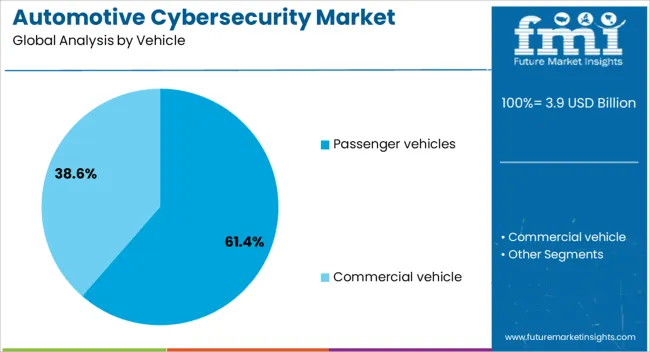

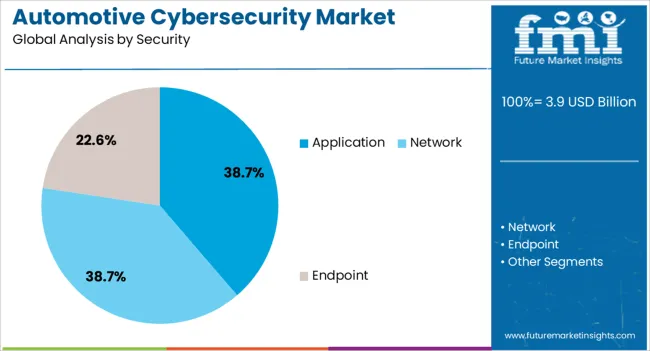

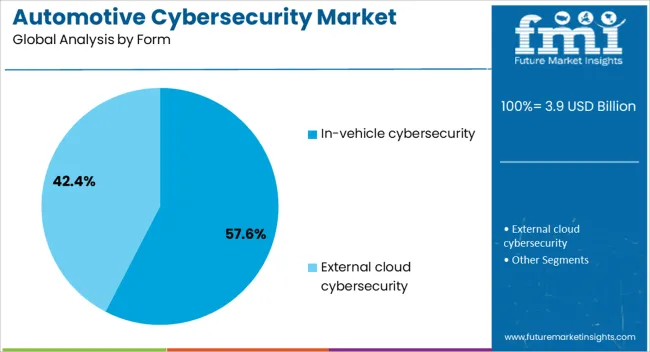

The automotive cybersecurity market is segmented by vehicle, security, form, application, and geographic regions. The automotive cybersecurity market is divided into Passenger vehicles and Commercial vehicles. In terms of security, the automotive cybersecurity market is classified into Application, Network, and Endpoint. The automotive cybersecurity market is segmented into In-vehicle cybersecurity and External cloud cybersecurity.

The automotive cybersecurity market is segmented into ADAS & safety, Body control & comfort, Infotainment, Telematics, Powertrain systems, and Communication systems. Regionally, the automotive cybersecurity industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Passenger vehicles are projected to hold 61.40% of the total market revenue in 2025, making them the leading vehicle category in the automotive cybersecurity market. The high rate of software integration in passenger cars, including telematics systems, ADAS, digital cockpits, and internet-based infotainment platforms is driving this dominance.

These features, while enhancing convenience and personalization, have introduced multiple access points for potential cyberattacks. As consumer demand grows for connected services, OEMs are under increasing pressure to embed robust security protocols throughout the software stack.

Passenger cars are also subject to stringent data privacy regulations, prompting earlier and deeper investments in multi-layered cybersecurity infrastructure. With vehicles expected to remain operationally dependent on continuous software interactions, the passenger segment remains the primary target for innovation and implementation in cybersecurity solutions.

Application security is anticipated to contribute 38.70% of the automotive cybersecurity market share in 2025, establishing it as a major segment by security focus. This growth is being shaped by the rising complexity of embedded automotive software and the widespread use of third-party applications in vehicles.

The need to secure application layers ranging from navigation and entertainment apps to connected diagnostics and e-commerce platforms has become critical. Vulnerabilities in these layers can serve as entry points for attackers targeting vehicle control systems or user data.

As a result, application-layer firewalls, secure coding practices, and runtime threat detection are being integrated throughout development pipelines. With the software-defined vehicle model gaining traction, application security is playing an increasingly central role in maintaining both safety and user trust across automotive ecosystems.

In-vehicle cybersecurity is expected to account for 57.60% of total revenue in the market by 2025, positioning it as the leading form of cybersecurity implementation. This dominance is being reinforced by the proliferation of electronic control units (ECUs), vehicle-to-everything (V2X) communications, and autonomous functionalities that require real-time threat mitigation within the vehicle’s internal network.

Automakers are prioritizing intrusion detection systems (IDS), secure gateways, and encrypted CAN communications to protect in-vehicle operations. Unlike external cybersecurity models, in-vehicle systems are designed to defend against runtime and protocol-level attacks that directly affect braking, steering, and engine performance.

As cars evolve into mobile computing platforms, the need for resilient in-vehicle cybersecurity is being embedded at the design stage, ensuring secure communication, fail-safe responses, and continuous monitoring throughout the vehicle lifecycle.

The automotive cybersecurity market is driven by rising vehicle connectivity, increasing cyber threats, and regulatory pressures. The adoption of advanced security systems is essential to safeguard against evolving threats and ensure compliance with global standards.

The rise in vehicle connectivity is a primary driver for growth in the automotive cybersecurity market. With the growing integration of telematics, infotainment systems, and over-the-air updates, the attack surface for potential cyber threats has expanded. These systems require robust security solutions to prevent unauthorized access, data breaches, and malicious attacks on critical vehicle functions. As the automotive industry shifts towards autonomous driving and connected vehicles, the demand for cybersecurity solutions is intensifying to safeguard the vehicle's electronic systems and personal data.

The increasing frequency of cyberattacks targeting the automotive sector has highlighted the need for advanced cybersecurity. With more vehicles adopting connected features, the risks of hacking into onboard systems and remotely controlling vehicle functions have surged. High-profile incidents, such as hacking into infotainment systems or exploiting vulnerabilities in ECU communication, are pushing manufacturers and suppliers to implement stronger security measures. As vehicles become more complex, cybersecurity has become a key factor in ensuring the safety and trust of consumers.

The automotive industry is facing increasing regulatory scrutiny over cybersecurity practices, particularly with the introduction of global cybersecurity regulations. Governments are mandating stricter standards to ensure the protection of vehicle data, systems, and infrastructure. Regulations such as the UNECE R155, which requires manufacturers to implement cybersecurity measures and provide risk management for vehicle software, are pushing automakers to prioritize secure vehicle designs. Compliance with these regulations is creating a major push for robust, standardized security frameworks within the automotive sector.

As cyber threats evolve, automotive manufacturers are adopting more sophisticated security systems to mitigate risks. These systems include intrusion detection, secure software updates, and encryption of vehicle communication channels. The demand for end-to-end security solutions is growing, with emphasis on real-time threat detection, secure authentication, and data protection. Manufacturers are investing in advanced security measures to build trust and ensure vehicle safety in the face of increasing cyber threats, particularly in the context of autonomous vehicles and IoT integration.

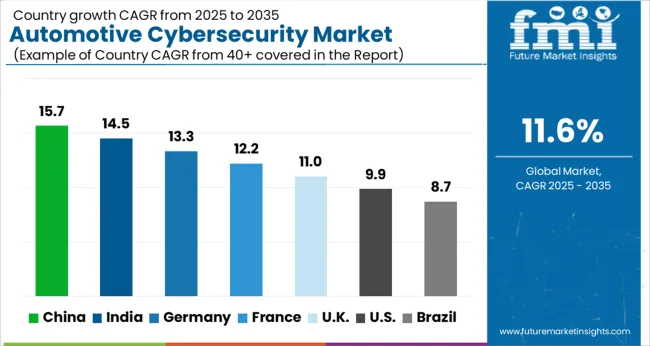

The automotive cybersecurity market is projected to grow globally at a CAGR of 11.6% from 2025 to 2035, fueled by the increasing adoption of connected vehicles, autonomous driving technology, and the growing need for secure in-car systems. China leads with a CAGR of 15.7%, driven by rapid advancements in electric vehicles (EVs), autonomous technology, and the expansion of the country’s automotive sector. India follows with a CAGR of 14.5%, supported by growing vehicle connectivity, a rise in the adoption of advanced driver-assistance systems (ADAS), and increasing regulatory pressure for cybersecurity solutions. France grows at 12.2%, benefiting from stringent European regulations on vehicle safety and the increasing penetration of cybersecurity technologies in both OEM and aftermarket solutions. The United Kingdom achieves a CAGR of 11.0%, driven by the integration of cybersecurity in connected vehicle systems and autonomous technologies, while the United States records a CAGR of 9.9%, supported by steady demand for cybersecurity solutions in the automotive sector, especially for EVs and connected cars. This growth trajectory reflects the growing need for robust cybersecurity solutions in the automotive industry, as the sector increasingly moves toward automation and vehicle connectivity, with rising concerns over data privacy and cyber threats.

The UK’s automotive cybersecurity market grew at a CAGR of 9.2% from 2020 to 2024 and is expected to rise to 11.0% during 2025-2035. The initial growth during 2020-2024 was driven by increasing vehicle connectivity, the rollout of ADAS (Advanced Driver Assistance Systems), and a rise in consumer demand for secure in-vehicle technology. The market’s growth will accelerate in the upcoming decade due to tightening regulations around vehicle cybersecurity, increasing threats from cyberattacks on connected vehicles, and greater adoption of autonomous driving technologies. Growing investments from automotive manufacturers and technology providers to develop robust cybersecurity solutions will drive further demand for cybersecurity technologies across the UK automotive sector.

China is expected to lead the automotive cybersecurity market with a CAGR of 15.7% from 2025 to 2035, surpassing the global CAGR of 11.6%. The market grew at a CAGR of 13.5% during 2020-2024, driven by the country’s focus on smart cities, electric vehicle adoption, and the development of autonomous driving technologies. The acceleration in the coming decade is linked to the rapid expansion of China’s automotive sector, where cybersecurity has become a top priority due to the growing complexity of vehicle systems and their connectivity. As vehicle manufacturers increasingly embrace smart technologies and autonomous driving solutions, the demand for robust cybersecurity solutions will rise significantly.

India’s automotive cybersecurity market is projected to grow at a CAGR of 14.5% during 2025-2035, well above the global average of 11.6%. The market grew at 12.3% during 2020-2024, driven by the growing adoption of connected vehicle technologies, ADAS, and rising concerns about cybersecurity risks in the automotive sector. As the automotive industry in India continues to expand, with more vehicles becoming connected, the need for advanced cybersecurity solutions will rise significantly. Government policies aimed at enhancing vehicle safety, data privacy, and cyber-resilience will further boost the market in the coming decade.

France’s automotive cybersecurity market is expected to grow at a CAGR of 12.2% from 2025 to 2035. The market grew at 10.5% from 2020 to 2024, driven by the integration of advanced safety features in vehicles and the implementation of stringent EU regulations on cybersecurity. The acceleration in growth in the upcoming decade is linked to the rapid advancement of autonomous driving and vehicle-to-vehicle (V2V) communication systems. With the European Union’s regulatory frameworks becoming more stringent, France’s automotive sector will face increasing pressure to implement secure systems for connected and autonomous vehicles, boosting the demand for advanced cybersecurity solutions.

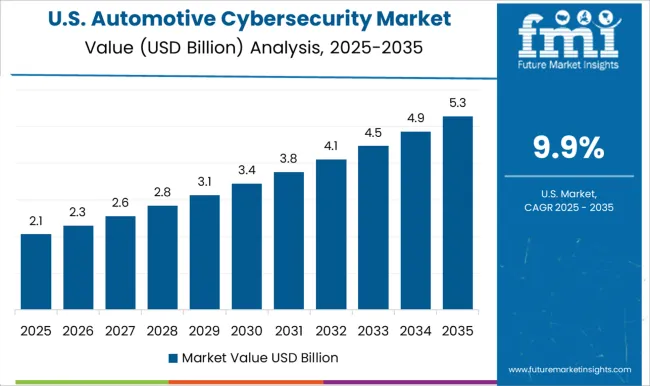

The USA automotive cybersecurity market is projected to grow at a CAGR of 9.9% during 2025-2035. The market grew at a CAGR of 8.3% from 2020 to 2024, supported by the widespread adoption of connected vehicle technologies and increasing concerns about the security of vehicle systems. In the next decade, growth will be driven by the rise of electric vehicles, autonomous driving technologies, and a stronger regulatory push to ensure the cybersecurity of vehicles. With the automotive industry heavily investing in vehicle-to-everything (V2X) communication and autonomous driving, the need for advanced cybersecurity solutions to protect vehicle data and communication will intensify.

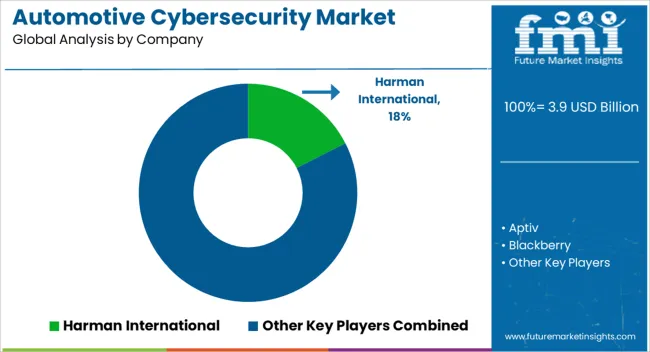

The automotive cybersecurity market is dominated by leading global technology providers and specialized cybersecurity firms, including Harman International, Aptiv, Blackberry, Continental, Denso, Intertek, Karamba Security, Lear, NXP, and Upstream Security. These companies compete on the basis of advanced security solutions, real-time threat detection, and the integration of cybersecurity within connected and autonomous vehicle systems.

Harman International maintains a strong presence with its end-to-end security solutions designed for in-vehicle systems and over-the-air software updates. Aptiv is recognized for its advanced cybersecurity technologies tailored for autonomous vehicles, integrating AI-driven security measures to safeguard data. Blackberry focuses on secure communication systems and software, providing cybersecurity for connected vehicle networks, while Continental offers comprehensive solutions for safeguarding vehicle-to-vehicle (V2V) and V2X communications. Denso leads in automotive ECU security and data protection, prioritizing resilience against cyber threats in electrified and autonomous vehicles.

Intertek, with its testing and certification expertise, ensures compliance with global cybersecurity standards for automotive applications. Karamba Security specializes in embedded security solutions for ECUs, focusing on protecting in-vehicle networks from cyber-attacks. Lear provides solutions for securing critical automotive data and communications within vehicle systems.

NXP is a key player in secure hardware for automotive applications, enabling encryption and secure key management in automotive systems. Upstream Security focuses on cloud-based solutions for securing connected vehicle data, emphasizing predictive threat detection and remote monitoring.

Competitive strategies in this market involve significant investments in research and development for securing connected and autonomous vehicles, partnerships with automakers for EV and autonomous vehicle cybersecurity, and expansion of security solutions for vehicle fleets. As the automotive ecosystem becomes increasingly interconnected, future competitiveness will rely on innovations in embedded security, secure communication protocols, and real-time threat detection technologies.

Major players like Bosch, Continental, Harman (Samsung), Aptiv, and Denso are heavily investing in the development of multi-layered in-vehicle cybersecurity systems, including intrusion detection, secure gateways, and over-the-air (OTA) update capabilities. Many are expanding partnerships with tech firms and cybersecurity startups to accelerate innovation, integrate AI-driven threat detection, and ensure compliance with global standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.9 Billion |

| Vehicle | Passenger vehicles and Commercial vehicle |

| Security | Application, Network, and Endpoint |

| Form | In-vehicle cybersecurity and External cloud cybersecurity |

| Application | ADAS & safety, Body control & comfort, Infotainment, Telematics, Powertrain systems, and Communication systems |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Harman International, Aptiv, Blackberry, Continental, Denso, Intertek, Karamba Security, Lear, NXP, and Upstream Security |

| Additional Attributes | Dollar sales projections, market share by region, application, and security technology, growth drivers in connected and autonomous vehicles, regulatory impacts, competitive landscape, and emerging cybersecurity trends. |

The global automotive cybersecurity market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the automotive cybersecurity market is projected to reach USD 11.7 billion by 2035.

The automotive cybersecurity market is expected to grow at a 11.6% CAGR between 2025 and 2035.

The key product types in automotive cybersecurity market are passenger vehicles, _hatchback, _sedan, _suv, commercial vehicle, _light commercial vehicle and _heavy commercial vehicle.

In terms of security, application segment to command 38.7% share in the automotive cybersecurity market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Cybersecurity Insurance Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA