The Cybersecurity Insurance market is experiencing significant growth driven by the escalating frequency and sophistication of cyberattacks across industries. The rise in ransomware incidents, data breaches, and identity theft has compelled organizations to adopt insurance coverage as a critical element of their cybersecurity strategy. The market’s outlook remains strong as digital transformation accelerates, increasing exposure to potential threats and regulatory compliance requirements.

Insurers are focusing on advanced risk assessment models that utilize artificial intelligence and analytics to evaluate cyber risks more accurately, ensuring better policy customization and premium optimization. The ongoing adoption of cloud-based services and remote working environments has further expanded the threat surface, prompting demand for robust cyber insurance solutions.

Additionally, heightened awareness among small and large enterprises regarding the financial and reputational impact of cyber incidents is boosting market penetration As global regulations tighten on data privacy and cybersecurity, the Cybersecurity Insurance market is poised for long-term expansion supported by innovation in risk modeling and growing collaboration between insurers and technology providers.

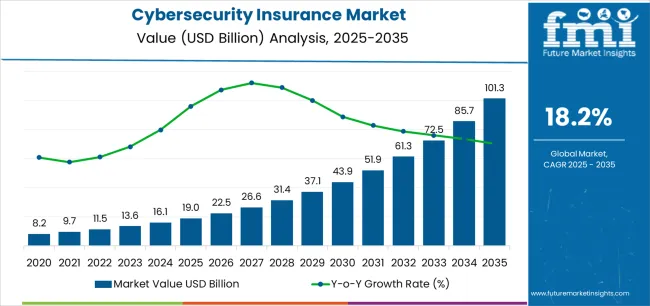

| Metric | Value |

|---|---|

| Cybersecurity Insurance Market Estimated Value in (2025 E) | USD 19.0 billion |

| Cybersecurity Insurance Market Forecast Value in (2035 F) | USD 101.3 billion |

| Forecast CAGR (2025 to 2035) | 18.2% |

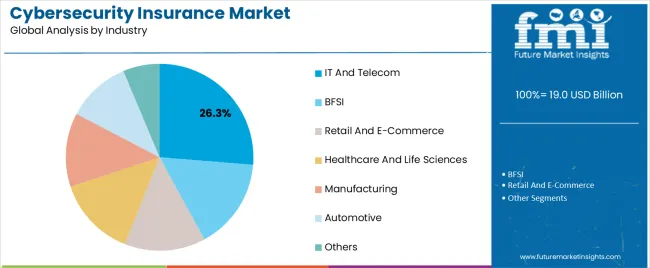

The market is segmented by Component, Enterprise Size, and Industry and region. By Component, the market is divided into Solution and Services. In terms of Enterprise Size, the market is classified into Large Enterprises and Small & Medium Enterprises. Based on Industry, the market is segmented into IT And Telecom, BFSI, Retail And E-Commerce, Healthcare And Life Sciences, Manufacturing, Automotive, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solution segment is projected to hold 60.30% of the Cybersecurity Insurance market revenue share in 2025, making it the leading component segment. This dominance is attributed to the growing reliance on comprehensive insurance solutions that provide coverage for a wide range of cyber threats including data breaches, business interruption, and network damage.

Organizations are increasingly seeking policy structures that integrate risk assessment, incident response, and loss mitigation services to strengthen their resilience. The expansion of digital ecosystems and the integration of connected technologies have further amplified the demand for flexible insurance solutions capable of addressing diverse cybersecurity challenges.

The segment’s growth is also supported by insurers’ focus on developing tailored policies that align with specific industry risks As cyber incidents become more frequent and costly, enterprises are prioritizing solution-based offerings that combine financial protection with proactive risk management, reinforcing the leadership of this segment in the overall market.

The large enterprises segment is expected to account for 65.00% of the Cybersecurity Insurance market revenue share in 2025, solidifying its position as the dominant enterprise size segment. This growth is driven by the extensive digital infrastructure and higher exposure to cyber threats faced by large organizations operating across multiple geographies. The complexity of IT systems and the volume of sensitive data handled by these enterprises necessitate comprehensive coverage to mitigate potential losses.

Large enterprises are increasingly integrating cybersecurity insurance into their risk management frameworks to ensure compliance with evolving data protection regulations. The ability to negotiate customized policies and higher coverage limits further contributes to this segment’s dominance.

Moreover, the rising cost of cyberattacks, reputational risks, and potential legal liabilities are compelling large corporations to secure advanced insurance products As digital transformation continues to deepen across industries, large enterprises will remain the primary contributors to Cybersecurity Insurance market growth.

The IT and telecom industry segment is anticipated to capture 26.30% of the Cybersecurity Insurance market revenue share in 2025, emerging as the leading industry vertical. This dominance is driven by the critical role the IT and telecom sector plays in managing and transmitting vast volumes of digital information, making it a prime target for cyberattacks. The increasing dependence on interconnected networks and cloud-based platforms has elevated vulnerability levels, pushing companies to invest heavily in cybersecurity insurance.

Insurers are offering specialized policies designed to address data privacy breaches, system failures, and service disruptions prevalent in this industry. The implementation of 5G networks and expansion of digital communication infrastructures have further heightened the need for coverage against evolving threats.

Additionally, the pressure to comply with stringent data security standards has encouraged IT and telecom companies to adopt cyber insurance as a risk mitigation tool The growing complexity of threats and the sector’s strategic importance in global connectivity continue to reinforce its leading position in the market.

The below table presents the anticipated CAGR for the global cybersecurity insurance market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the cybersecurity insurance industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 symbolizes first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half (H1) of the year from 2025 to 2035, the business is expected to grow at a CAGR of 17.8%, followed by an increased growth rate of 18.8% in the second half (H2) of the same year.

| Particular | Value CAGR |

|---|---|

| H1, 2025 | 17.8% |

| H2, 2025 | 18.8% |

| H1, 2025 | 17.5% |

| H2, 2025 | 18.9% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 17.5% in the first half and remain higher at 18.9% in the second half. In the first half (H1) the market witnessed a decrease of 30 BPS while in the second half (H2), the market witnessed an increase of 10 BPS.

Rising Cooperation between Cyber Insurers and Service Providers is an Emerging Trend in Cybersecurity Insurance Market

Cyber insurer’s players seek customers that have accurate threat detection and rapid incident response. However, majority of companies across the globe with low resources are victims of cybersecurity skills shortages and may not fulfill the requirements of cyber insurance companies.

These problem can be addressed with the by partnering with the managed security service provider (MSSP). They offers complete outsourced security solutions that assist these companies in fulfilling the security demands. It also helps businesses in filling the gaps in internal security team, helping them to defend.

Majority of market players are establishing strategic partnerships with the cybersecurity technology providers to improve their service offerings. Such an initiatives is bodes well for the cybersecurity insurance market. For instance, in June 2025, investment banking company, AXIS Capital Holdings Limited partnered with cybersecurity technology company, Elpha Secure to expand its offerings in cyber insurances.

This is intended for USA customers to reduce their exposure to cyber threats, and improve their risk profiles. Moreover, AXIS Capital Holdings Limited also unveiled a service, AXIS Cyber Incident Commander, designed to support cyber insurance policy holders during cyber incidents. This provides quick assistance on crisis management, and legal actions which are available 24/7. This helps to reduce the impact of cyber incidents, and initiate faster recovery.

Integration of Artificial Intelligence (AI) is fueling the Cybersecurity Insurance Market Growth

Incorporation of AI and machine learning models in the cyber insurances is reshaping the landscape of the market. With the integration of AI and ML, cyber insurers can focus on other crucial tasks over the low-priority areas. This allows cyber insurers to enhance their underwriting operations and improve risk assessment.

AI and computer vision solutions possess an ability to extract and process data from natural language processing. This ensure the security terms validation and accelerates the underwriting process. It also allows cyber security professionals to review security procedures impact at higher scale as compared to manual review.

Insurers majorly uses questionnaires to collect data related to incident loss history, security measures, and data handling. They assess this data to understand the vulnerability and health of the security systems. This process can be made very effective by integrating these values in supervised learning models powered by AI.

This solutions assist insurance companies by providing comprehensive understanding of the clients IT environments and determine the risk levels of their portfolio. Such a use of AI is anticipated to drive the cybersecurity insurance market growth notable in the projected timeframe.

Supportive Regulations for Cybersecurity is Creating Opportunities for Market Growth

Growing focus of multiple industries towards cybersecurity is expected to create favorable environment for cybersecurity insurance market. Governments of various countries are drafting rules & regulations to improve the security. Any of the regulations have mandated businesses to implement digital security solutions which is favoring the growth of cyber insurance market.

Regulators have also increased efforts to alleviate cyber risks and protect businesses. This is initiated by passing regulations to monitor insurers and their cyber insurance offerings. For instance, Cybersecurity Information Sharing Act of 2020 outlines the framework for sharing cybersecurity information between federal and non-federal entities. The act intends to simplify the sharing of cyber threat indicators and protective measures to improve cybersecurity across various sectors.

Regulations are intended to improve cyber risk environment and reduce threats. This also necessitates businesses to have data privacy standards and cybersecurity solutions before seeking insurance. The regulations will ensure better cyber security measures and improved digital service delivers. This will favor the growth of the cybersecurity insurance market growth.

Lack of Awareness and Standardization may affect Cybersecurity Insurance Market Growth in the Projected Timeframe

Though cybersecurity insurance market is growing notably, lack of standardization and awareness may restrict the market growth. Mostly small and medium enterprises are less aware of the cyber insurance services. This lack of awareness leads to a limited understanding of the benefits and necessity of cybersecurity insurance, causing lower adoption rates.

Moreover, underwriting procedure is made more difficult by the lack of proven procedures for assessing cyber risks. Differences in the methods and standards used by insurers can result in inconsistencies in the way risk is measured. Due to this, it is challenging for businesses to understand their coverage alternatives and compare policies. This lack of standardization affects the offerings clarity making client to avoid insurance cover.

It also adds to the larger difficulty of making sure that different industries' varying degrees of cyber risk are properly covered. Potential clients may get confused as a result of this inconsistency, which would further impede market adoption. Comparing and choosing the right insurance products is another difficult task for businesses due to the variation in policy terms, coverage limits, and exclusions.

Comprehensive cybersecurity insurance is clearly necessary, given the rapid evolution of cyber risks in recent years. However, the market might find it difficult to realize its full growth potential during the projected period until there is a clearer understanding of these risks and the implementation of established methods.

The global cybersecurity insurance market registered a CAGR of 17.3% during the historic period between 2020 and 2025. The growth of cybersecurity insurance industry was progressive as it reached a value of USD 13,621.5 million in 2025 from USD 6,978.4 million in 2020.

The market for cybersecurity insurance saw notable growth from 2020 to 2025. In 2020, the growth was driven by increasing cyberattacks fueled by the notable digitization across the globe. Moreover, there was increase in adoption of cloud-based solutions, automation tools, and emergence of progressive analytics. The companies were recognizing the importance of the cybersecurity which were creating opportunities for the industry expansion.

In early 2025, COVID-19 pandemic fueled the digitization in multiple industries driving the cyber insurance market growth remarkably. The businesses were shifting their operations over the cloud, which was necessitating the strong cybersecurity measure to protect their sensitive data.

Moreover, need for virtual sales interactions and remote work increased demand for cybersecurity Insurance. These platforms need sensor data analytics, collaborative capabilities, and reliable remote access which resulted into high market growth in year.

Post pandemic, market continued to witness notable expansion driven by improved user experiences and innovations in AI. The growth is also driven by the increasing regulatory pressures and the implementation of stricter data protection laws.

This forced end-user businesses to implement strong cybersecurity measures including insurance to avoid any legal problems and penalties. Moreover, various cyber insurance companies partnered with technology providers to implement advance features such as automation, regulatory compliance, and incident response plants. This initiatives were focused to attract potential businesses clientele and increase their revenue streams.

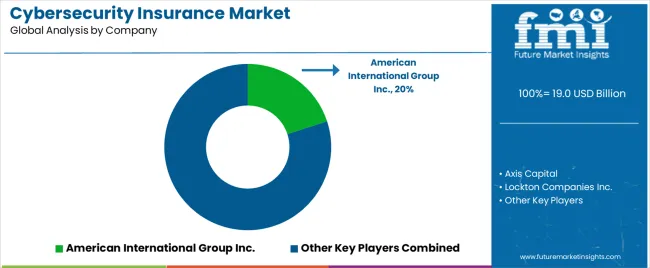

In the global cybersecurity insurance market, Tier 1 companies hold a notable market share of 45% to 50%, making them the market leaders. These companies have established strong client bases across the globe. Tier 1 players focuses on partnering with cybersecurity solutions providers to improve the reliability of their solution services.

This players are also engaged in mergers and acquisitions to expand the portfolio of their cyber insurance components, and retain their high market position. Key companies in the tier 1 are American International Group Inc., Axis Capital, Lockton Companies Inc., Zurich Insurance Co. Ltd., Aon PLC, and Munich RE.

Tier 2 companies may not have extensive global reach as tier 1 players but holds respectable market share. These players are focused on providing tailored solutions to the clients’ needs. This cybersecurity insurance providers have strong knowledge of the regional markets.

With this knowledge, these companies develop their solutions accordingly to attract potential business clients and improve their brand representation. They also focuses on superior customer services to increase customer retention rate and brand identity. Prominent companies in tier 2 contain Hiscox, CNA Financial Corporation, Allianz, Berkshire Hathaway, and Liberty Mutual.

Tier 3 businesses are small sized firms and emerging startups that may lacks the global customer network as compared to tier 1 and tier 2 players. These market players are well-known for their cost-effective and innovative insurance solutions and services. This players majorly partners with third party policy providers to expand their product market availability and brand presence.

The section below covers the industry analysis for the cybersecurity insurance market for different countries. Market demand analysis on key countries in several regions of the globe, including the USA, Germany, China, India, Brazil, and UK is provided.

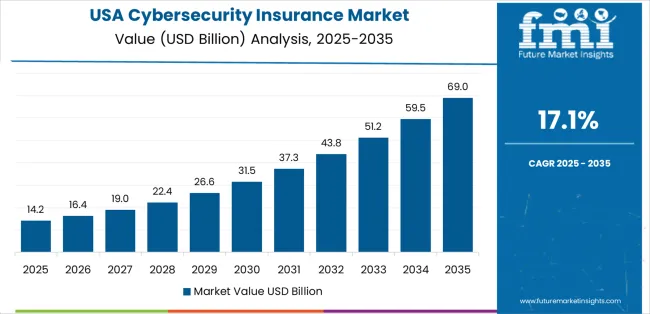

The United States is anticipated to remain at the forefront in North America, with a value share of 72.36% through 2035. In East Asia, South Korea is projected to witness a CAGR of 11.2% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 16.2% |

| Germany | 15.7% |

| China | 18.6% |

| India | 19.1% |

| UK | 16.8% |

North America, spearheaded by the USA which currently holds around 77.81% share of the North America cybersecurity insurance industry. USA cybersecurity insurance market is anticipated to grow at a CAGR of 16.2% throughout the forecast period.

The federal and state governments in country have introduced strict rules for the incorporation of cybersecurity. For instance, the New York Department of Financial Services (NYDFS) Cybersecurity Regulation mandates that financial institutions should implement vigorous cybersecurity methods.

This encourages the inclusion of cybersecurity solutions including insurance in their security management frameworks. Similarly, California Privacy Rights Act (CPRA), increase the responsibility of companies for data breaches, stimulating many businesses to seek cybersecurity insurance to ease financial risks.

China’s cybersecurity insurance market is poised to exhibit a CAGR of 18.6% between 2025 and 2035. Currently, it holds the significant market share in the East Asia market, and the dominance is expected to continue through the forecast period.

With the growing digitization in industrial sector is creating need for robust cybersecurity measure in China.

The government in the country are outlining strategies to strengthen the industrial cybersecurity and protect the sensitive data. For instance, in February 2025, ministry of industry and information technology (MIIT) in China unveiled the plan to improve the country’s industrial sector to reduce their dependency on foreign cybersecurity solutions and address key risk scenarios.

This includes ransomware attacks on connected machineries, uncontrolled remote operations, and illegal operations by workforce. This will create positive outlook for cybersecurity insurance market in the forecast period in China.

India’s cybersecurity insurance market is expected to witness a CAGR of 19.1% in the forecast period and hold considerable market share in South Asia & Pacific region through 2035. In India, organizations from BFSI sector are increasingly embracing digital transformation. These includes online banking, digital payments, and fintech services. Increasing digital transformation in banks is creating space for frequent cyberattacks.

Additionally, the increasing interconnectivity within the financial ecosystem where banks, insurance companies, and fintech firms share data further amplifies the risk of cyber threats. These makes cybersecurity insurance an important component of risk management. This trend is driving demand for tailored insurance products that cater specifically to the unique risks faced by the BFSI sector in India.

The section contains information about the leading segments in the industry. By component, servcies segment is estimated to grow at a CAGR of 19.5% throughout 2035. Additionally, the by industry, retail & ecommerce segment is projected to expand at 18.6% till 2035.

| Component | Solution |

|---|---|

| Value Share (2025) | 60.3% |

Solution segment is expected to acquire share of 60.3% in the market in terms of component in 2025. Rising usage of cybersecurity insurance solutions such as analytics platform, and disaster recovery is propelling the segment growth.

Analytics platform are used notably to identify gaps between security measures, measuring policy coverage, and ensuring the insurance process is executed within legal requirements. Businesses seek comprehensive suite of insurance solutions to address their costs associated with data recovery and setting third-party lawsuits.

| Industry | IT & Telecom |

|---|---|

| Value Share (2025) | 26.3% |

The IT & telecom segment is expected to capture share of 26.3% in 2025. IT and telecom companies are shifting their focus towards cybersecurity insurance to protect the financial loss incurred due to data theft. These companies often buys cyber insurance policies to protect their monetary losses due to cyberattacks on IT infrastructure and information governance.

An organization might reduce its legal costs by purchasing cyber insurance coverage in case it violates any privacy policies or laws. Additionally, it will assist them in hiring computer forensics or security specialists that can help them recover compromised data or prevent the attack.

Key players operating in the cybersecurity insurance market are investing in advanced technologies and also entering into partnerships. Key cybersecurity insurance providers have also been acquiring smaller players to grow their presence to further penetrate the market across multiple regions.

Recent Industry Developments in Cybersecurity Insurance Market:

In terms of component, the industry is divided into solution and services.

In terms of enterprise size, the industry is divided into small & medium enterprises and large enterprises.

The industry is classified by industry as retail and e-commerce, IT and telecom, BFSI, healthcare and life sciences, manufacturing, automotive, and others.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa (MEA) have been covered in the report.

The global cybersecurity insurance market is estimated to be valued at USD 19.0 billion in 2025.

The market size for the cybersecurity insurance market is projected to reach USD 101.3 billion by 2035.

The cybersecurity insurance market is expected to grow at a 18.2% CAGR between 2025 and 2035.

The key product types in cybersecurity insurance market are solution and services.

In terms of enterprise size, large enterprises segment to command 65.0% share in the cybersecurity insurance market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insurance Telematics Market

Reinsurance Market Size and Share Forecast Outlook 2025 to 2035

Pet Insurance Market - Trends, Growth & Forecast 2025 to 2035

Drone Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Horse Insurance Market Size and Share Forecast Outlook 2025 to 2035

Maritime Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Commercial Insurance Market Insights – Growth & Forecast 2024-2034

Telematics-based Auto Insurance Market - Trends & Forecast 2025 to 2035

Artificial Intelligence In Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-Everything (V2X) Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Guaranteed Auto Protection Gap Insurance Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA