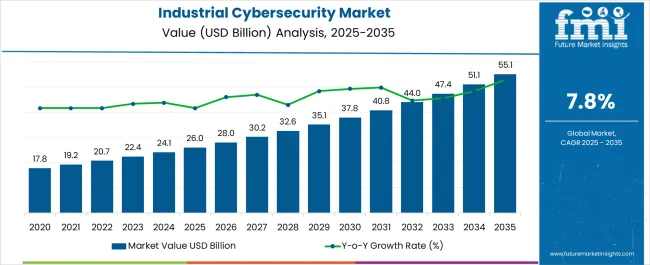

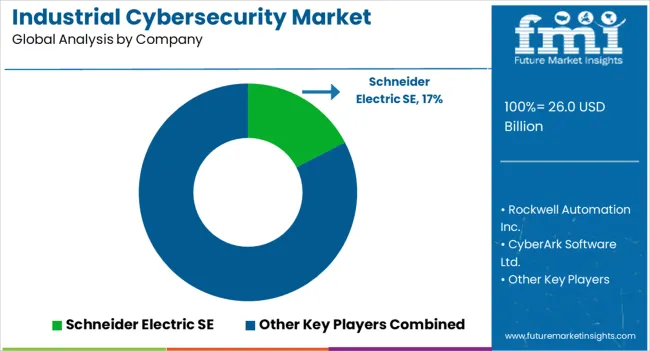

The Industrial Cybersecurity Market is estimated to be valued at USD 26.0 billion in 2025 and is projected to reach USD 55.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

| Metric | Value |

|---|---|

| Industrial Cybersecurity Market Estimated Value in (2025 E) | USD 26.0 billion |

| Industrial Cybersecurity Market Forecast Value in (2035 F) | USD 55.1 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The industrial cybersecurity market is experiencing rapid growth as industries increasingly prioritize safeguarding operational technology infrastructures from rising cyber threats. The growing frequency of targeted attacks on industrial control systems, combined with the rising integration of connected devices and IoT platforms, is creating heightened exposure to risks.

Regulatory frameworks across critical sectors are mandating stricter compliance, driving adoption of advanced cybersecurity solutions. Continuous investments in hardware, software, and services are being made to secure networks, prevent operational disruptions, and ensure the integrity of industrial processes.

Advancements in AI driven monitoring tools, real time threat detection, and adaptive defense systems are further supporting market expansion. The long term outlook remains positive as industries emphasize resilience, risk mitigation, and the strengthening of digital trust within industrial ecosystems.

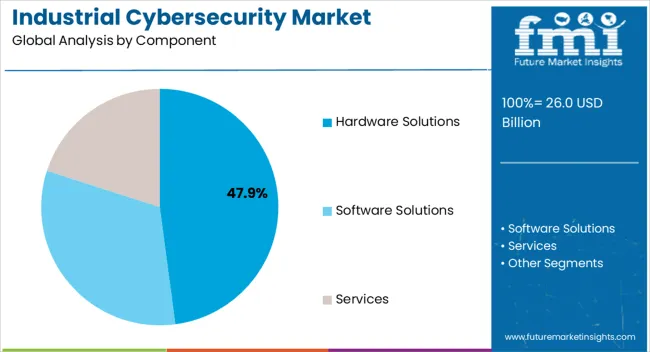

The hardware solutions segment is projected to account for 47.90% of the total market revenue by 2025 within the component category, making it the leading segment. This growth is supported by the increasing need for robust physical security infrastructure that ensures uninterrupted industrial operations.

Hardware based systems such as firewalls, intrusion prevention devices, and secure gateways provide essential protection against unauthorized access and cyberattacks targeting industrial assets. Their ability to deliver dedicated performance, low latency protection, and higher reliability compared to software only solutions has reinforced adoption.

The continued focus on operational continuity and system resilience has further strengthened the leadership of hardware solutions in this market.

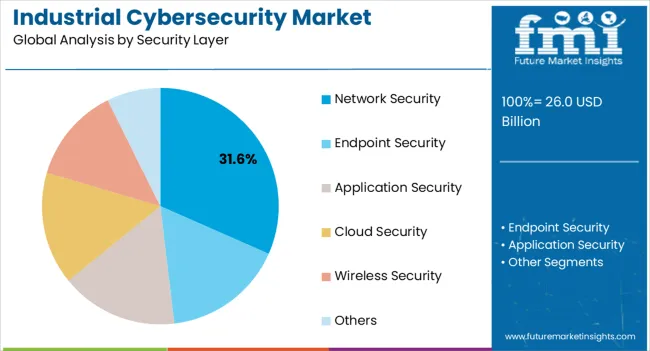

The network security segment is expected to hold 31.60% of the market revenue by 2025, positioning it as the most significant security layer. This dominance is driven by the increasing vulnerability of interconnected industrial networks to malware, ransomware, and advanced persistent threats.

Network security solutions provide end to end visibility, segmentation, and encryption, all of which are essential to protect sensitive industrial data and communications. The rise in remote operations, cloud integration, and IoT connectivity has amplified the importance of robust network defenses.

As organizations focus on preventing disruptions to critical infrastructure, network security has become central to industrial cybersecurity strategies.

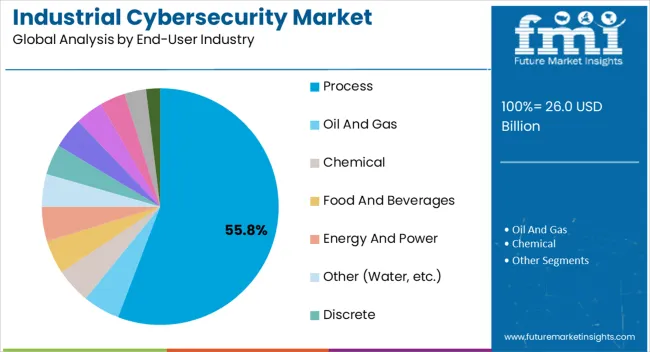

The process industry segment is forecasted to contribute 55.80% of the overall revenue by 2025 within the end user industry category, making it the dominant segment. This leadership is attributed to the high reliance of process industries on complex control systems that are particularly vulnerable to cyberattacks.

Industries such as oil and gas, chemicals, and power generation require uninterrupted operations, making cybersecurity a strategic priority. The need to secure industrial control systems, supervisory control and data acquisition platforms, and distributed control systems has driven significant investment in cybersecurity measures.

Growing regulatory scrutiny and the rising cost of downtime have further accelerated adoption. This focus on protecting critical processes has reinforced the position of the process industry as the largest contributor to the industrial cybersecurity market.

The demand for industrial cybersecurity solutions and services is rising as it helps firms in a variety of industries safeguard their data and other secret information from cyber-attacks. These industrial cybersecurity services assist businesses in monitoring and controlling a wide range of process outputs and inputs on the job site.

To carry out their core operations, numerous firms around the world have chosen cloud-based and connection equipment. This shift has put a significant strain on cyber security operations, as well as raising the risk of cyber-attacks.

Manufacturing and industrial facilities are increasingly adopting cloud-based ICS-as-a-service and industrial robots based on artificial intelligence platforms. This is driving the demand for industrial cybersecurity solutions. Industrial robots have cybersecurity solutions installed to protect them from cyber-attacks and keep them running properly.

According to the International Federation of Robotics, roughly 125.6 thousand industry robots were deployed in the automotive sector in 2020. Where, 105.2 thousand were in the electrical industry, and 43.6 thousand were in the metal and mining industries worldwide in 2020.

As a result, firms in the global market for industrial cybersecurity solutions are obtaining significant sales opportunities. The rising use of the internet in all parts of the world has resulted in a significant increase in cybercrime incidents in a variety of industries. Including discrete and process management.

As a result, businesses in a variety of industries, including oil and gas, automotive, energy and power, and aerospace and defense, are increasingly adopting industrial cyber security solutions. In the industrial cybersecurity services market, this scenario is likely to provide significant demand prospects.

In the years ahead, rising acceptance of cloud security solutions and IoT in industrial cybersecurity systems are anticipated to drive market expansion. As vast volumes of data and information are generated across sectors daily. One of the developing market trends is integrating industrial cybersecurity solutions with modern cloud services.

Advanced cloud services are necessary to monitor and analyze this data. The market's key players are concentrating on creating and integrating cloud-based cybersecurity solutions for OT and ICS applications across various sectors.

Over the last several years, government entities in several nations throughout the world have increased financial support for activities that aid in the reduction of cyber security breaches. The global market for industrial cybersecurity solutions is growing as a result of the mentioned factors.

| Countries | Revenue Share % (2025) |

|---|---|

| United States | 18.5% |

| Germany | 9.3% |

| Japan | 5.7% |

| Australia | 2.9% |

| North America | 27.4% |

| Europe | 23.1% |

| Countries | CAGR % (2025 to 2035) |

|---|---|

| China | 9.3% |

| India | 9.5% |

| United Kingdom | 7.8% |

North America held a significant market share of 27.4% in 2025. Leading players have contributed to the region's success. Furthermore, increased investment by key companies to extend their global footprint is likely to drive demand for industrial cybersecurity solutions in North America.

CyberArk Software Ltd. introduced CyberArk, Cloud Entitlements Manager, an artificial intelligence-based service, in November 2024. The solution was created to improve cloud infrastructure security layers across businesses. The country is safeguarded from foreign trade vulnerabilities thanks to the implementation of modern cybersecurity solutions across industrial applications.

During the anticipated period, the demand for industrial cybersecurity solutions in the Asia Pacific is expected to increase at a swift rate. Key firms in China, India, Taiwan, Japan, Australia, South Korea, and other ASEAN nations are concentrating their efforts on cloud-based security applications. In the manufacturing industry, these countries have several small and medium companies (SMEs) and startups.

During the forecasted period, the demand for industrial cybersecurity solutions in Europe is expected to increase at a significant rate. The rise in investment for the expansion of secure IT infrastructure across the automotive industry is largely responsible for the region's success.

| Category | By Component |

|---|---|

| Leading Segment | Hardware |

| Market Share (2025) | 46.1% |

| Category | By End-use Industry |

|---|---|

| Leading Segment | Discrete |

| Market Share (2025) | 54.6% |

Due to the rising demand for industrial cybersecurity solutions like firewalls, SCADA encryption, and others, the software segment is expected to lead.

The software is anticipated to hold a substantial market share. DDoS, firewall, SCADA encryption, virtualization security, antivirus/malware, backup & recovery, and other software solutions are all seeing increased demand.

Key businesses are concentrating their efforts on creating and delivering advanced industrial security software solutions for a variety of industries. Including automotive, oil & gas, energy, and others.

Check Point Software Technologies Ltd., for example, introduced Check Point R81, a unified cybersecurity platform for industrial applications, in November. The technology aids IT workers in efficiently managing complicated network configurations by delivering pre-programmed threat protection notifications.

During the projected period, cloud application security is expected to increase substantially. This is primarily due to the heavy manufacturing industry's increased usage of cloud technologies.

During the forecast period, the network security, end-point security, and internet security segments are predicted to increase at a steady rate. Increased demand for dependable and safe security solutions across industries such as energy, food, beverages, automotive, and others is driving the segment's expansion.

During the projected period, the discrete industry is expected to dominate the market. The demand for IoT-enabled devices, 5G networks, and industry 4.0 solutions are driving the increase.

The discrete sector is further divided into automotive, electronics, heavy manufacturing, packaging, and other categories (aerospace and defense, and others).

Coronavirus had a negative influence on cybersecurity spending in the industrial sector around the world. The top players are concentrating on finishing pending investments and business initiatives to reclaim the market position.

Furthermore, in the near future, spending on infrastructure as a service (IaaS) and cloud computing tools is expected to rise. These investments may help to foster a variety of growth prospects and demand for industrial cybersecurity in industrial applications.

Market Developments

The global industrial cybersecurity market is estimated to be valued at USD 26.0 billion in 2025.

The market size for the industrial cybersecurity market is projected to reach USD 55.1 billion by 2035.

The industrial cybersecurity market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in industrial cybersecurity market are hardware solutions, software solutions and services.

In terms of security layer, network security segment to command 31.6% share in the industrial cybersecurity market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Cybersecurity Insurance Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA