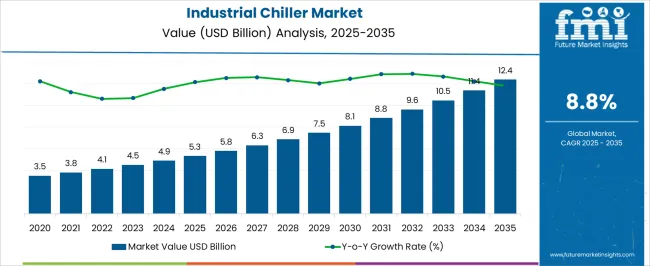

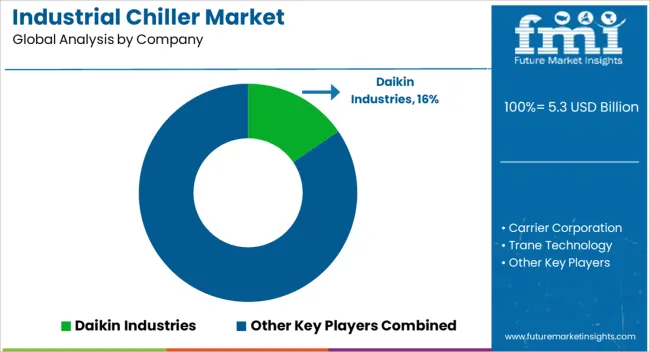

The Industrial Chiller Market is estimated to be valued at USD 5.3 billion in 2025 and is projected to reach USD 12.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.8% over the forecast period.

| Metric | Value |

|---|---|

| Industrial Chiller Market Estimated Value in (2025 E) | USD 5.3 billion |

| Industrial Chiller Market Forecast Value in (2035 F) | USD 12.4 billion |

| Forecast CAGR (2025 to 2035) | 8.8% |

The Industrial Chiller Market is experiencing consistent growth, driven by rising industrial automation, energy efficiency mandates, and the demand for precise process cooling solutions. Current trends, as observed in corporate announcements and industry journals, highlight a shift toward smart chillers that offer real-time monitoring, modular configurations, and reduced environmental impact. Governmental policies promoting eco-friendly refrigerants and the phasing out of high-GWP refrigerants have also influenced investment in next-generation chilling systems.

Food processing, pharmaceuticals, plastic manufacturing, and data centers are leading adopters due to their critical need for temperature-controlled operations. Product launches and corporate strategies have increasingly focused on hybrid systems and digitally enabled controls, which are expected to enhance operational efficiency and reduce energy consumption.

The future outlook is being shaped by regulatory frameworks, infrastructure upgrades, and the rising demand from emerging economies investing in industrial manufacturing These factors are collectively laying the foundation for sustained expansion in the global industrial chiller ecosystem.

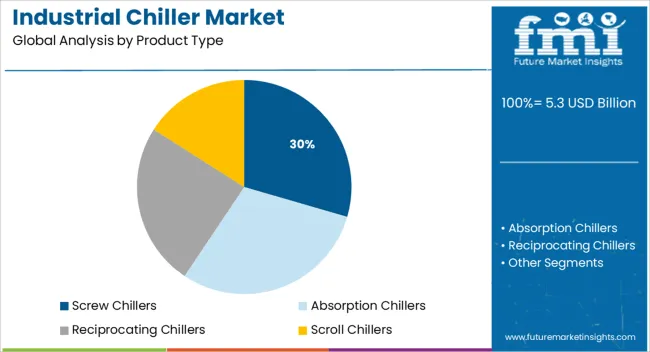

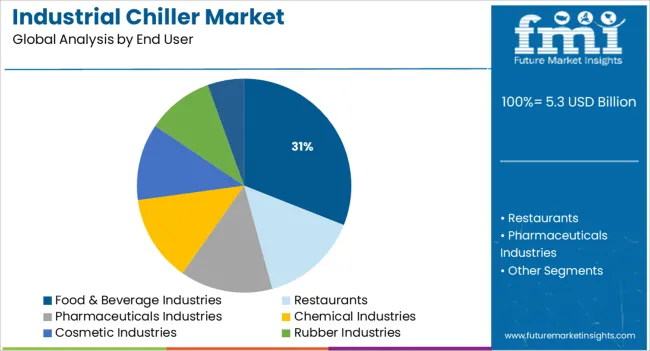

The market is segmented by Product Type and End User and region. By Product Type, the market is divided into Screw Chillers, Absorption Chillers, Reciprocating Chillers, and Scroll Chillers. In terms of End User, the market is classified into Food & Beverage Industries, Restaurants, Pharmaceuticals Industries, Chemical Industries, Cosmetic Industries, Rubber Industries, and Plastics Industries. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The screw chillers segment is projected to hold 29.5% of the Industrial Chiller Market revenue share in 2025, making it the leading product type. This dominance is being attributed to the segment’s ability to deliver high efficiency, continuous operation, and reliable performance in demanding industrial environments. Screw chillers are being adopted widely due to their capacity to handle large-scale cooling loads with minimal maintenance and operational noise.

Corporate announcements have noted their growing preference in sectors requiring round-the-clock operation, including food processing and chemical manufacturing. The segment’s growth is also being supported by technological advancements such as variable speed drives and integration with energy management systems, which help industries meet sustainability targets.

The ability of screw chillers to operate effectively across variable load conditions has further reinforced their use in energy-intensive applications These advantages have positioned screw chillers as a preferred solution for industries aiming to reduce lifecycle costs while maintaining high cooling efficiency.

The food and beverage industries segment is expected to account for 31.0% of the Industrial Chiller Market revenue share in 2025, retaining its position as the top end-use segment. This leadership is being driven by the sector’s constant demand for precise temperature control during production, storage, and packaging processes. Industry-specific news and corporate presentations have identified consistent growth in cold chain logistics, beverage processing lines, and dairy operations as primary factors influencing chiller adoption.

Food safety regulations and hygiene standards have necessitated uninterrupted cooling, further prompting the use of high-performance industrial chillers. Technological upgrades including remote monitoring, real-time diagnostics, and compatibility with natural refrigerants are being implemented to enhance reliability and environmental compliance.

Investments in plant automation and increased capacity expansions by food and beverage manufacturers are also contributing to segment growth These operational demands, coupled with strict regulatory frameworks, are continuing to make this segment a cornerstone of demand within the industrial chiller landscape.

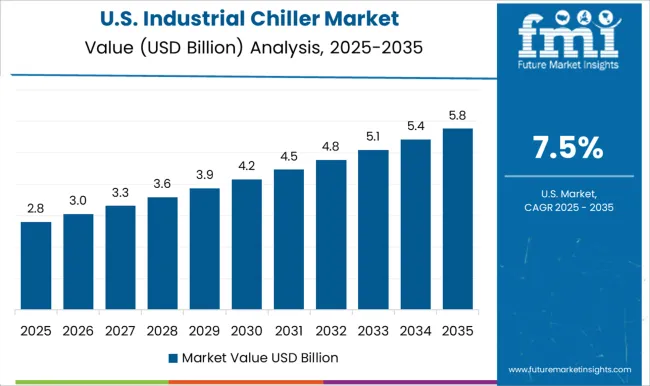

Increasing government spending on construction building activities due to rising demand for residential and commercial spaces would require chillers for temperature control. This factor pushed the global industrial chiller market during the historical period from 2020 to 2025 and it exhibited growth at a CAGR of 6.9%.

Growing temperatures owing to rapidly increasing global warming are anticipated to push the demand for industrial chillers in the next ten years. Also, the surging adoption of industrial chillers backed by their ability to eliminate heat from buildings and maintain internal temperature is expected to aid growth.

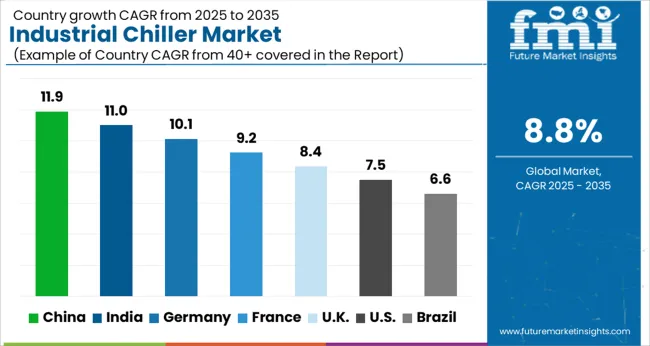

Pharmaceutical Companies to Look for Industrial Refrigeration Systems in the USA

The pharmaceutical, biotechnology, plastics & rubber, and chemical industries are growing at a fast pace in the USA All types of drugs, right from basic over-the-counter medications to sophisticated antibiotics, must be manufactured by using a cold water application.

Systems that are to be manufactured from stainless steel can be made to achieve temperatures as low as -75°F. They come with either air-cooled or water-cooled condensers. Companies can create a sturdy system to meet any size requirements based on their consumers’ unique needs. The novel system will be more adaptable and effective because of numerous additional features like dual compressors, hot gas bypass, and high-efficiency evaporator, which help to cut down on wasteful electricity use. These factors are expected to boost the USA industrial chiller market in the evaluation period.

The rising Supply of Medicines from India to Other Countries Will Push Sales of Industrial Water Chillers

In the Indian pharmaceutical sector, a pharmaceutical chiller is used to maintain a steady temperature and manage the same efficiently. When making biological pharmaceuticals, a water chiller is frequently employed. The quality of drug manufacturing can be raised by using a laser water chiller to assure the stability of drug ingredients during production.

Auxiliary water chillers for experimental medicines, refining Chinese and Western medicines, cooling tank reactors, and cooling plant medicines are a few of the uses for these devices. In India, the pharmaceutical market was predicted to be worth USD 4.9 Billion in 2024. With a 20% share of all pharmaceutical exports worldwide, India is the largest producer of generic medications by volume. This factor is estimated to bode well for the Indian industrial chiller market during the forecast period.

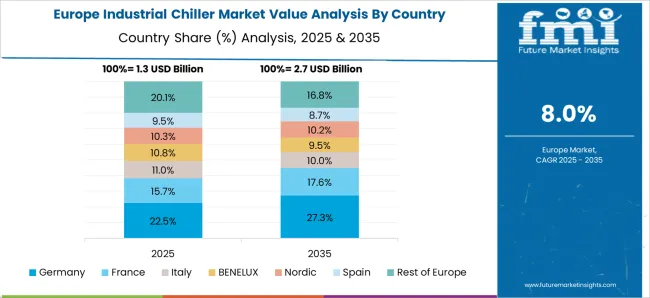

Presence of the German Chiller Manufacturer to Drive Demand for Industrial Cooling Equipment

The German Chiller Manufacturer (GCM) creates and develops natural refrigerant-based chillers that are very energy efficient. GCM concentrates on producing novel systems by using natural refrigerants, primarily R717, as a result of European Union (EU) Regulation No. 517/2014 and the EU's phase-out of F-gases (ammonia). GCM stands for custom, high-quality solutions, and adaptable design alternatives to meet the individual needs of its clientele.

The German Chiller Manufacturer (GCM) created the GS-1-KO-1-N-102-SP chiller, for instance, which unites three independently running machines into a single unit and runs on ammonia (R717). Therefore, the operator benefits from full redundancy because the other two machines continue to cool even if one of the three fails. A master control system links the three units that make up the GS-1-KO-1-N-102-SP, however, each machine has its own emergency control center.

Food and Beverage Industry to Extensively Utilize Industrial Water Chiller Machines

Based on end users, the food and beverage segment is projected to remain at the forefront in the global industrial chiller market during the assessment period. Increasing demand for glycol chillers in breweries and wineries to maintain the temperature of beverages is expected to drive the segment in the next ten years. Besides, industrial chillers can efficiently circulate chilled propylene glycol through innovative cooling coils to keep the cold temperature of the food storage units and beverages.

The global industrial chiller market is highly competitive in nature on the back of the presence of various global and local manufacturers. The majority of these companies are engaging in expansion through joint ventures, as well as mergers & acquisitions. A few other key players are focusing on broadening their distribution channels by offering their in-house products through multiple channels such as e-commerce websites, company-owned websites, retailers, and distributions.

For instance:

Coolest Guys in the Room: An Inside look at Industrial Chillers Offered by Daikin Industries, Carrier Corporation, and Johnson Controls

With more companies realizing that industrial chillers are key to their efficient manufacturing process, there has been a growing demand for these powerful units. The benefits of using an industrial chiller are numerous, from saving money on energy costs to increasing productivity. The efficiency of industrial chillers allows manufacturers to save money in three main ways: by reducing operating costs, eliminating downtime due to equipment failure, and improving production output.

Daikin is one of the leading manufacturers in Japan with a diverse product line, including refrigeration systems and air conditioning products. The company’s offerings include commercial, residential, and automotive vehicle air conditioning units, as well as heat pumps. The company introduced a new line of air-cooled scroll chillers. These R32 refrigerant-based variations have a 10% greater SEEP ratio than R410A-based ones.

In October 5.322, Daikin Applied announced improvements to its award-winning Pathfinder air-cooled screw chiller. Already the most energy-efficient air-cooled screw chiller on the market, these upgrades will give even greater energy savings in the same footprint, as well as greater flexibility with the option to add factory-installed pump packages.

In January 5.321, Daikin North America LLC acquired ABCO HVACR Supply + Solutions, which is a leading full-line distributor of HVAC and refrigeration systems. This approach lays the groundwork for Daikin's comprehensive array of equipment, parts, and accessories.

Carrier Global Corporation, on the other hand, is a global American corporation located in Palm Beach Gardens, Florida that manufactures heating, ventilation, and air conditioning (HVAC), refrigeration, and fire and security systems. Additionally, it provides packaged terminal air conditioners (PTACs), which are used primarily in hotels and motels; window AC units; furnaces; water heaters; ductless mini splits; thermostats; humidifiers; and controls and accessories.

In June 5.31, Carrier Corporation acquired China-based HVAC manufacturer Guangdong Giwee Group and its subsidiaries, including Guangdong Chigo Heating & Ventilation Co Ltd. The acquisition will provide Carrier Corporation with more access to the rapidly growing variable refrigerant flow (VRF) and light commercial sectors, which are expected to exceed USD 5.3 Billion by 5.325.

Johnson Controls International is a global business based in Cork, Ireland that manufactures fire, HVAC, and security technology for buildings. The company offers a wide variety of products for both residential and commercial use. Whether the customer is interested in an air conditioning system for their home or an industrial-grade chiller capable of cooling thousands of square feet, the company delivers solutions for all types of uses.

In February 5.319, Johnson Controls International plc expanded its YORK YLAA series with two additional air-cooled scroll models, namely, 041 and 048. Two different circuits would provide partial redundancy for these chillers, thereby increasing their chilling capacity from 40 tons to 230 tons.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 5.3 billion |

| Projected Market Valuation (2035) | USD 12.4 billion |

| Value-based CAGR (2025 to 2035) | 8.8% |

| Forecast Period | 2020 to 2025 |

| Historical Data Available for | 2025 to 2035 |

| Market Analysis | Value (USD Million) |

| Key Regions Covered |

North America; Europe; Asia Pacific; South America; Middle East and Africa (MEA) |

| Key Countries Covered |

USA, Canada, Germany, UK, France, Italy, Russia, Turkey, Spain, China, Japan, Korea, India, Indonesia, Thailand, Philippines, Malaysia, Vietnam, South Korea, Australia, Brazil, Argentina, Colombia, South Africa, UAE, Egypt, Nigeria, South Africa |

| Key Segments Covered |

Product Type, End User, Region |

| Key Companies Profiled |

Daikin Industries; Carrier Corporation; Trane Technology; Johnson Controls- Hitachi Air Conditioning; Mitsubishi Electric Corporation; Smardt Chiller Group Inc.; KKT Chillers; MTA S.P.A; Friulair S.R.L; HYDAC International; Reynold India Pvt. Ltd; Ingersoll-Rand Company; Paul Mueller Company; Mueller Streamline Co.; PolyScience; Sentry Equipment Corp |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global industrial chiller market is estimated to be valued at USD 5.3 billion in 2025.

The market size for the industrial chiller market is projected to reach USD 12.4 billion by 2035.

The industrial chiller market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in industrial chiller market are screw chillers, absorption chillers, reciprocating chillers and scroll chillers.

In terms of end user, food & beverage industries segment to command 31.0% share in the industrial chiller market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA