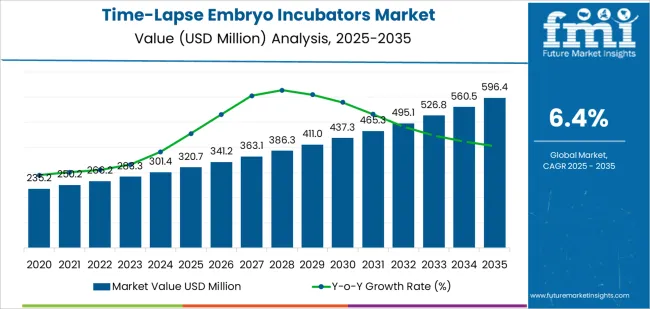

The time-lapse embryo incubators sector is projected to rise from USD 320.7 million in 2025 to USD 596.5 million by 2035, advancing at a CAGR of 6.4% and adding USD 275.7 million in new revenue over the decade. This 1.9X expansion reflects accelerating adoption of continuous embryo monitoring technologies across fertility clinics, hospital-based IVF laboratories, and academic research institutions. Increasing reliance on AI-assisted morphokinetic assessment, rising single embryo transfer protocols, and expanding IVF infrastructure investments across Asia Pacific, Europe, and North America are driving this growth.

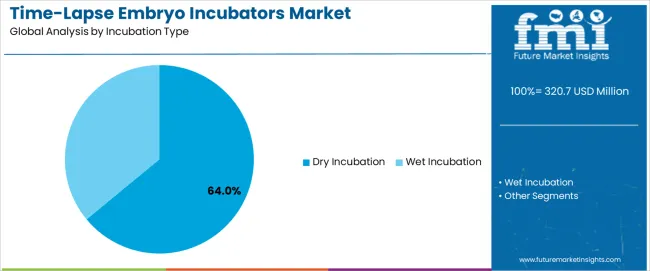

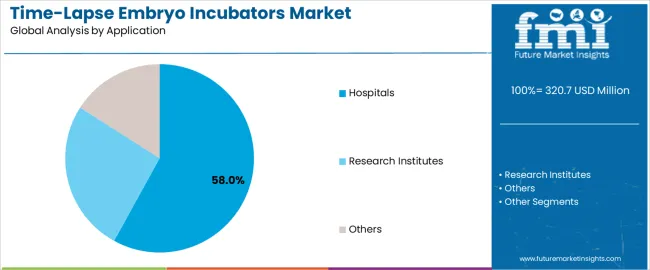

The dry incubation segment, accounting for 64% market share, dominates due to superior temperature recovery, independent chamber control, and minimal contamination risk. These systems offer operational flexibility and low maintenance requirements, making them preferred in multi-patient fertility laboratories. The wet incubation segment, representing 36%, maintains relevance in conventional embryology setups requiring water-jacketed thermal stabilization. By application, hospital-based fertility programs lead with 58% share, reinforced by institutional investments, university partnerships, and clinical validation requirements, while research institutes, holding 28%, increasingly utilize time-lapse systems for preimplantation embryo studies and algorithm development.

The integration of these specialized incubation systems with automated image capture algorithms and artificial intelligence-based embryo assessment software enables embryologists to monitor embryo development continuously without disturbing optimal culture conditions, supporting improved embryo viability predictions.

Clinical adoption accelerates as fertility specialists and embryologists seek to optimize embryo selection accuracy and maximize pregnancy rates per embryo transfer cycle in assisted reproduction programs. The proliferation of single embryo transfer protocols creates sustained demand for time-lapse incubation systems capable of identifying highest-quality embryos through kinetic development parameters and morphokinetic algorithms that conventional static observation methods cannot detect.

Time-lapse embryo incubators with stable environmental control, integrated microscopy systems, and multi-chamber designs offer clinical advantages in IVF laboratories, fertility research institutions, and university reproductive medicine centers where embryo culture optimization directly impacts treatment success rates and patient satisfaction outcomes.

Research institutions are adopting these advanced systems for preimplantation embryo development studies, culture media optimization investigations, and reproductive biology research applications where continuous documentation of embryo development provides essential data for scientific advancement. However, high equipment costs compared to conventional incubators and specialized training requirements for optimal system utilization may pose challenges to market expansion in resource-constrained fertility clinics and developing markets with limited assisted reproductive technology infrastructure investment capacity.

Between 2025 and 2030, the time-lapse embryo incubators market is projected to expand from USD 320.7 million to USD 437.4 million, resulting in a value increase of USD 116.7 million, which represents 42.3% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for advanced embryo assessment technologies and IVF laboratory modernization initiatives, product innovation in artificial intelligence-based embryo selection algorithms and environmental control precision, as well as expanding integration with electronic witnessing systems and laboratory information management platforms. Companies are establishing competitive positions through investment in optical imaging technology enhancements, multi-chamber incubator designs, and strategic market expansion across fertility clinic networks, academic research institutions, and hospital-based reproductive medicine centers.

From 2030 to 2035, the market is forecast to grow from USD 437.4 million to USD 596.5 million, adding another USD 159.1 million, which constitutes 57.7% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized incubation configurations, including compact benchtop systems for low-volume clinics and large-capacity models tailored for high-throughput IVF laboratories, strategic collaborations between time-lapse system manufacturers and artificial intelligence software developers, and an enhanced focus on predictive algorithm validation and clinical outcome optimization. The growing emphasis on personalized reproductive medicine and evidence-based embryo selection will drive demand for advanced, high-performance time-lapse embryo incubator solutions across diverse assisted reproductive technology applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 320.7 million |

| Market Forecast Value (2035) | USD 596.5 million |

| Forecast CAGR (2025-2035) | 6.4% |

The time-lapse embryo incubators market grows by enabling fertility specialists to achieve superior embryo selection accuracy and improved clinical pregnancy rates while minimizing embryo handling stress in assisted reproductive technology procedures. IVF laboratories and fertility clinics face mounting pressure to improve treatment success rates and reduce multiple pregnancy risks, with time-lapse incubation systems typically providing 8-12% higher pregnancy rates over conventional incubation methods through enhanced embryo assessment capabilities, making these advanced systems essential for competitive fertility treatment programs. The reproductive medicine field's need for objective embryo selection criteria creates demand for time-lapse monitoring solutions that can identify optimal developmental kinetics, detect abnormal cleavage patterns, and predict embryo implantation potential through quantifiable morphokinetic parameters unavailable through conventional observation.

Single embryo transfer initiatives promoting multiple pregnancy risk reduction drive adoption in fertility clinics, research institutions, and university reproductive medicine programs, where embryo selection accuracy has a direct impact on pregnancy success rates and patient safety outcomes. The global shift toward personalized reproductive medicine and evidence-based embryology accelerates time-lapse embryo incubator demand as fertility programs seek technology solutions that deliver consistent embryo assessment independent of embryologist experience levels and subjective morphological grading variations. However, capital investment barriers affecting small-scale fertility clinics and limited reimbursement coverage for advanced monitoring technologies may limit adoption rates among budget-constrained reproductive medicine practices and markets with restricted healthcare funding for elective fertility procedures.

The market is segmented by incubation type, application, and region. By incubation type, the market is divided into dry incubation and wet incubation. Based on application, the market is categorized into hospitals, research institutes, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The dry incubation segment represents the dominant force in the time-lapse embryo incubators market, capturing approximately 64.0% of total market share in 2025. This advanced category encompasses forced-air circulation systems with independent chamber controls, integrated humidity management, and precise temperature regulation optimized for stable embryo culture environments, delivering efficient environmental control and superior chamber-to-chamber isolation in multi-patient IVF laboratory operations. The dry incubation segment's market leadership stems from its operational flexibility, proven environmental stability characteristics, and compatibility with diverse culture media formulations across different embryology laboratory protocols.

The wet incubation segment maintains a substantial 36.0% market share, serving laboratories requiring water-jacketed thermal regulation through heated water systems and traditional humidity control methods suitable for established embryology workflows where thermal mass stability provides environmental advantages during frequent incubator access cycles.

Key advantages driving the dry incubation segment include:

Hospitals applications dominate the time-lapse embryo incubators market with approximately 58.0% market share in 2025, reflecting the extensive adoption of advanced embryo monitoring systems across hospital-based fertility centers, academic medical center reproductive medicine departments, and integrated healthcare system IVF programs. The hospitals segment's market leadership is reinforced by widespread implementation in university hospital IVF laboratories (24.0%), private hospital fertility centers (20.0%), and tertiary care reproductive medicine units (14.0%), which provide essential clinical outcome advantages and research capabilities in comprehensive fertility treatment environments.

The research institutes segment represents 28.0% market share through specialized applications including developmental biology studies (12.0%), preimplantation genetic research (10.0%), and reproductive technology innovation programs (6.0%). Other applications constitute 14.0% market share, encompassing standalone fertility clinics, veterinary reproductive medicine facilities, and pharmaceutical research applications.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to clinical outcomes and reproductive medicine advancement. First, IVF treatment volume growth creates increasing requirements for advanced embryo assessment technologies, with global assisted reproductive technology cycles exceeding 2.5 million annually in major markets worldwide, requiring reliable time-lapse monitoring systems for embryo selection optimization where pregnancy rates per transfer improve by 8-12% through morphokinetic assessment compared to conventional observation methods. Second, single embryo transfer protocol adoption and multiple pregnancy risk reduction drive implementation of precise selection technologies, with time-lapse incubators enabling embryologists to identify highest-quality embryos for transfer while maintaining pregnancy rates and reducing twin pregnancy risks from 25% to below 5% through improved embryo viability prediction capabilities. Third, artificial intelligence integration and automated embryo assessment accelerate deployment of quantitative selection algorithms, with time-lapse systems providing essential kinetic data for machine learning models that analyze thousands of embryo development parameters and predict implantation potential with accuracy levels exceeding 70% compared to 50-60% for conventional morphological assessment.

Market restraints include high capital costs affecting small-scale fertility clinics and independent reproductive medicine practices, particularly where conventional incubation methods remain adequate for basic IVF services and where equipment budgets constrain adoption of advanced monitoring technologies priced between USD 50,000 to USD 150,000 per unit. Clinical evidence variability regarding pregnancy rate improvements poses adoption challenges for evidence-focused fertility specialists, as meta-analyses demonstrate inconsistent outcome benefits across different clinic populations and embryo selection protocols, with some studies showing significant improvements while others report marginal advantages compared to conventional embryo assessment methods. Reimbursement limitations for advanced monitoring services create additional barriers in healthcare systems with restricted fertility treatment coverage, as patients may decline time-lapse monitoring when associated costs exceed USD 500-1,000 per cycle without corresponding insurance reimbursement for enhanced embryo assessment services.

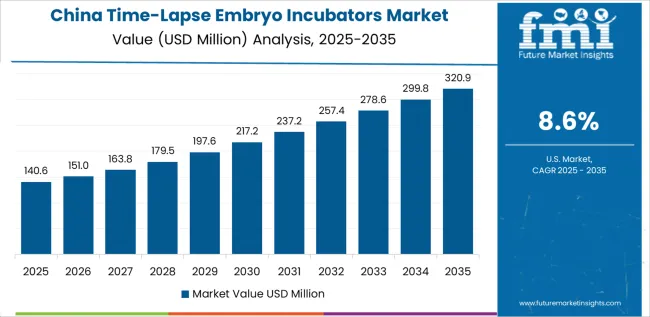

Key trends indicate accelerated adoption in Asian fertility treatment markets, particularly China and India, where assisted reproductive technology accessibility and fertility clinic infrastructure are expanding rapidly through private healthcare investment and growing middle-class demand for advanced reproductive medicine services. Technology advancement trends toward artificial intelligence-based embryo scoring integrated with time-lapse imaging data, compact benchtop systems suitable for low-volume clinics operating 100-200 cycles annually, and wireless connectivity enabling remote embryo monitoring by embryologists are driving next-generation product development. However, the market thesis could face disruption if non-invasive preimplantation genetic testing technologies achieve breakthrough capabilities for embryo selection, potentially offering competitive assessment methods that evaluate embryonic genome integrity without requiring continuous morphokinetic monitoring throughout culture periods.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.3% |

| Brazil | 6.7% |

| USA | 6.0% |

| UK | 5.4% |

| Japan | 4.8% |

The time-lapse embryo incubators market is gaining momentum worldwide, with China taking the lead thanks to aggressive fertility clinic expansion and assisted reproductive technology service development programs. Close behind, India benefits from growing IVF treatment accessibility and private healthcare investment in reproductive medicine infrastructure, positioning itself as a strategic growth hub in the Asia-Pacific region. Brazil shows strong advancement, where expanding fertility clinic networks and reproductive medicine service modernization strengthen its role in South American assisted reproductive technology markets.

The USA demonstrates robust growth through IVF laboratory technology upgrades and single embryo transfer protocol adoption, signaling continued investment in advanced embryology equipment. Meanwhile, Japan stands out for its precision medicine focus and reproductive technology innovation emphasis, while UK and Germany continue to record consistent progress driven by clinical research leadership and fertility treatment quality standards. Together, China and India anchor the global expansion story, while established markets build stability and clinical evidence into the market's growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the Time-Lapse Embryo Incubators Market with a CAGR of 8.6% through 2035. The country's leadership position stems from comprehensive fertility clinic expansion, intensive assisted reproductive technology development programs, and substantial private healthcare investment driving adoption of advanced embryology technologies. Growth is concentrated in major urban regions, including Beijing, Shanghai, Guangdong, and Jiangsu, where private fertility centers, hospital-based reproductive medicine departments, and university medical centers are implementing time-lapse incubation systems for clinical outcome improvement and competitive service differentiation.

Distribution channels through medical equipment distributors, fertility equipment specialists, and direct manufacturer relationships expand deployment across fertility clinic networks, academic medical centers, and research institutions. The country's healthcare modernization initiatives provide support for advanced medical technology adoption, including quality standards for assisted reproductive technology laboratories and equipment specifications for embryology facilities.

Key market factors:

In the National Capital Region, Maharashtra, Karnataka, and Tamil Nadu metropolitan areas, the adoption of time-lapse embryo incubator systems is accelerating across private fertility centers, hospital reproductive medicine departments, and academic medical institutions, driven by increasing fertility treatment accessibility and rising demand for advanced assisted reproductive technology services. The market demonstrates strong growth momentum with a CAGR of 8.0% through 2035, linked to comprehensive fertility clinic expansion and increasing investment in embryology laboratory modernization capabilities.

Indian fertility specialists and embryologists are implementing time-lapse monitoring technology and advanced assessment platforms to improve pregnancy success rates while meeting patient expectations for cutting-edge reproductive medicine services in domestic fertility treatment markets. The country's growing medical tourism sector creates sustained demand for internationally-competitive technology, while increasing emphasis on single embryo transfer drives adoption of precise embryo selection systems that optimize clinical outcomes.

Germany's advanced reproductive medicine sector demonstrates sophisticated implementation of time-lapse embryo incubator systems, with documented case studies showing 10-12% pregnancy rate improvements in university hospital IVF programs through optimized embryo selection strategies. The country's fertility treatment infrastructure in major medical centers, including Bavaria, Baden-Württemberg, North Rhine-Westphalia, and Lower Saxony, showcases integration of advanced monitoring technologies with existing embryology laboratory protocols, leveraging expertise in reproductive medicine research and evidence-based clinical practice.

German fertility specialists emphasize clinical outcome validation and scientific rigor, creating demand for reliable time-lapse incubation solutions that support pregnancy rate optimization commitments and stringent quality management requirements. The market maintains strong growth through focus on reproductive medicine research leadership and clinical innovation, with a CAGR of 7.3% through 2035.

Key development areas:

The Brazilian market leads in Latin American time-lapse embryo incubator adoption based on expanding fertility clinic infrastructure and growing reproductive medicine service accessibility in major urban centers. The country shows solid potential with a CAGR of 6.7% through 2035, driven by private healthcare investment and increasing demand for advanced assisted reproductive technology services across metropolitan regions.

Brazilian fertility specialists are adopting time-lapse monitoring technology for clinical outcome enhancement, particularly in private clinic networks serving middle and upper-income patients and in academic medical centers where research programs investigate embryo development optimization. Technology deployment channels through medical equipment distributors, fertility equipment specialists, and international manufacturer representatives expand coverage across fertility clinic networks.

Leading market segments:

The USA market leads in advanced time-lapse embryo incubator applications based on mature fertility treatment infrastructure and comprehensive reproductive medicine research capabilities supporting technology innovation. The country shows solid potential with a CAGR of 6.0% through 2035, driven by IVF laboratory modernization and increasing adoption of single embryo transfer protocols across academic medical centers, private fertility networks, and hospital-based reproductive medicine programs.

American fertility specialists are implementing time-lapse monitoring systems for evidence-based embryo selection, particularly in university medical centers conducting clinical trials and in high-volume fertility clinics where technology differentiation supports competitive positioning. Technology deployment channels through specialized fertility equipment distributors, manufacturer direct sales, and group purchasing organizations expand coverage across diverse fertility practice settings.

Leading market segments:

The UK market demonstrates consistent implementation focused on NHS fertility services and private reproductive medicine clinics, with documented integration of time-lapse embryo incubator systems achieving 9-11% pregnancy rate improvements in regulated fertility treatment programs.

The country maintains steady growth momentum with a CAGR of 5.4% through 2035, driven by HFEA regulatory framework and clinical outcome transparency requirements. Major fertility treatment regions, including London, Manchester, and Birmingham areas, showcase deployment of advanced embryo monitoring technologies that integrate with existing fertility clinic operations and support regulatory compliance requirements for treatment outcome reporting.

Key market characteristics:

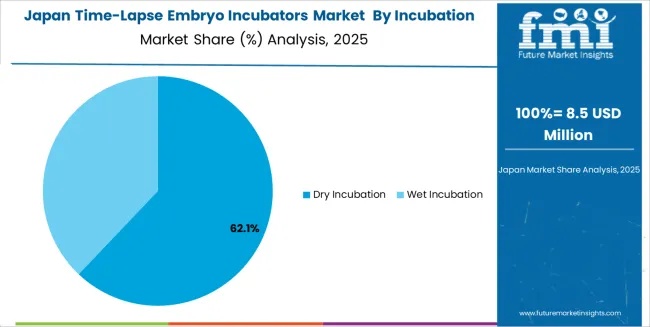

Japan's time-lapse embryo incubators market demonstrates sophisticated implementation focused on university hospital reproductive medicine programs and precision embryology research applications, with documented integration of advanced monitoring systems achieving 8-10% clinical pregnancy rate improvements through optimized morphokinetic assessment protocols.

The country maintains steady growth momentum with a CAGR of 4.8% through 2035, driven by research excellence culture and emphasis on reproductive medicine innovation principles aligned with precision healthcare objectives. Major academic medical centers in Tokyo, Osaka, Kyoto, and Nagoya showcase advanced deployment of time-lapse monitoring technologies that integrate seamlessly with embryology laboratory quality management systems and comprehensive clinical research programs.

Key market characteristics:

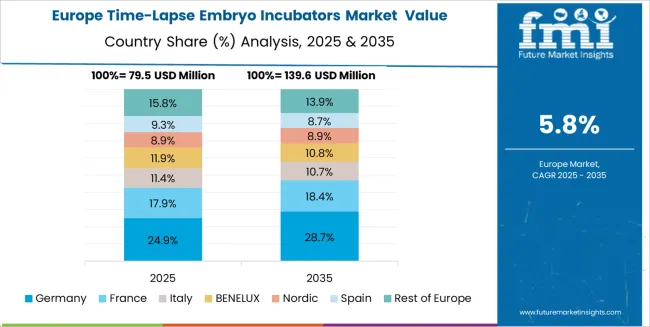

The time-lapse embryo incubators market in Europe is projected to grow from USD 109.8 million in 2025 to USD 179.8 million by 2035, registering a CAGR of 5.1% over the forecast period. Germany is expected to maintain its leadership position with a 31.4% market share in 2025, declining slightly to 30.9% by 2035, supported by its extensive university hospital reproductive medicine infrastructure and major fertility treatment centers, including Bavaria, Baden-Württemberg, and North Rhine-Westphalia medical regions.

France follows with a 18.7% share in 2025, projected to reach 19.0% by 2035, driven by comprehensive public fertility treatment programs and academic medical center reproductive medicine departments in major urban regions. The United Kingdom holds a 16.9% share in 2025, expected to reach 17.1% by 2035 through HFEA-regulated fertility services and private clinic network expansion.

Italy commands a 12.2% share in both 2025 and 2035, backed by private fertility clinic operations and university hospital programs. Spain accounts for 8.3% in 2025, rising to 8.5% by 2035 on fertility tourism services and reproductive medicine center modernization. The Rest of Europe region is anticipated to hold 12.5% in 2025, expanding to 13.3% by 2035, attributed to increasing time-lapse embryo incubator adoption in Nordic countries and emerging Central & Eastern European fertility clinic networks implementing advanced embryology technologies.

The Japanese time-lapse embryo incubators market demonstrates a mature and research-focused landscape, characterized by sophisticated integration of dry incubation systems with existing university hospital embryology laboratory infrastructure across academic reproductive medicine programs, research institutions, and advanced fertility treatment centers. Japan's emphasis on scientific validation and clinical evidence development drives demand for high-performance monitoring systems that support research objectives and clinical outcome optimization in competitive reproductive medicine environments.

The market benefits from strong partnerships between international time-lapse technology providers and domestic medical equipment distributors including major healthcare companies, creating comprehensive service ecosystems that prioritize technical support and clinical application training programs. Academic medical centers in Tokyo, Osaka, Kyoto, and other major university hospitals showcase advanced embryology implementations where time-lapse incubator systems enable morphokinetic research and clinical protocol optimization through comprehensive embryo development documentation.

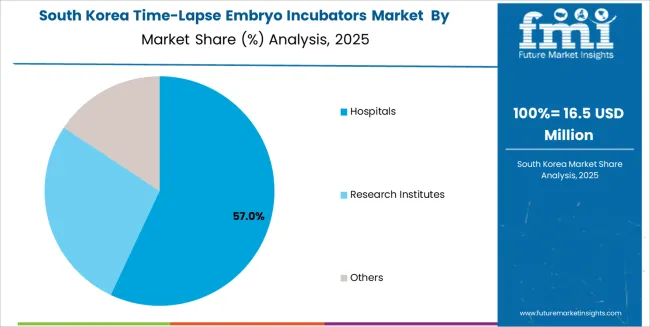

The South Korean time-lapse embryo incubators market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive technical support and clinical training capabilities for fertility clinics and hospital reproductive medicine departments. The market demonstrates increasing emphasis on clinical outcome improvement and technology-driven service differentiation, as Korean fertility specialists increasingly demand advanced embryo monitoring solutions that integrate with domestic IVF laboratory infrastructure and quality management systems deployed across major fertility treatment centers.

Regional medical equipment distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including clinical application training and morphokinetic assessment education programs for embryology staff. The competitive landscape shows increasing collaboration between multinational time-lapse technology companies and Korean fertility medicine specialists, creating hybrid service models that combine international product development expertise with local clinical practice knowledge and regulatory compliance capabilities.

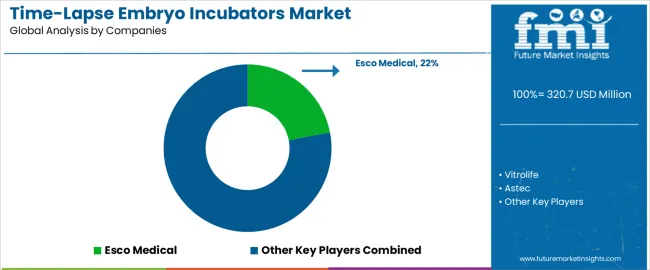

The time-lapse embryo incubators market features approximately 10-15 meaningful players with moderate concentration, where the top three companies control roughly 52-58% of global market share through established clinical validation evidence and comprehensive distribution networks. Competition centers on imaging quality specifications, algorithm validation evidence, and clinical outcome data rather than price competition alone. Esco Medical leads with approximately 22.0% market share through its comprehensive embryology equipment portfolio and global fertility clinic presence.

Market leaders include Esco Medical, Vitrolife, and Astec, which maintain competitive advantages through proven clinical outcome validation, extensive morphokinetic algorithm development, and deep expertise in embryology laboratory workflow integration across multiple fertility clinic segments, creating trust and performance advantages with fertility specialists, embryologists, and reproductive medicine program directors. These companies leverage research and development capabilities in artificial intelligence-based embryo assessment and ongoing clinical collaboration relationships to defend market positions while expanding into emerging fertility markets and research institution applications.

Challengers encompass Genea BIOMEDX and Weigao Group, which compete through innovative product offerings and strong regional presence in key fertility treatment markets. Product specialists, including Hua Yue Enterprise Holdings and Wuhan Huchuang Union Technology, focus on specific geographic markets or price segments, offering differentiated capabilities in cost-effective solutions, regional service responsiveness, and localized technical support programs.

Regional players and emerging reproductive technology companies create competitive pressure through localized manufacturing advantages and competitive pricing strategies, particularly in high-growth markets including China and India, where domestic manufacturers provide cost-effective alternatives to international brands while meeting basic clinical requirements. Market dynamics favor companies that combine proven clinical outcome evidence with comprehensive embryologist training offerings and ongoing algorithm optimization programs that address the complete embryo assessment cycle from image acquisition through predictive analysis and clinical decision support.

Time-lapse embryo incubators represent advanced assisted reproductive technology equipment that enables fertility specialists to achieve 8-12% higher pregnancy rates compared to conventional incubation methods, delivering superior embryo selection accuracy and clinical outcome optimization with reduced embryo handling stress and continuous developmental monitoring in demanding IVF laboratory applications.

With the market projected to grow from USD 320.7 million in 2025 to USD 596.5 million by 2035 at a 6.4% CAGR, these precision monitoring systems offer compelling advantages - pregnancy rate improvement, embryo selection optimization, and evidence-based assessment - making them essential for hospitals applications (58.0% market share), research institutes (28.0% share), and fertility programs seeking alternatives to conventional embryo assessment methods that compromise selection accuracy through subjective morphological grading and limited observation timepoints.

Scaling market adoption and clinical validation requires coordinated action across reproductive medicine policy, assisted reproductive technology standards, embryology equipment manufacturers, fertility clinic networks, and reproductive healthcare investment capital.

| Item | Value |

|---|---|

| Quantitative Units | USD 320.7 million |

| Incubation Type | Dry Incubation, Wet Incubation |

| Application | Hospitals, Research Institutes, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, U.S., U.K., Japan, and 40+ countries |

| Key Companies Profiled | Esco Medical, Vitrolife, Astec, Genea BIOMEDX, Weigao Group, Hua Yue Enterprise Holdings, Wuhan Huchuang Union Technology |

| Additional Attributes | Dollar sales by incubation type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with reproductive technology manufacturers and fertility clinic distribution networks, embryology laboratory requirements and specifications, integration with artificial intelligence-based embryo assessment platforms and laboratory information management systems, innovations in imaging technology and morphokinetic algorithm development, and advancement of specialized time-lapse monitoring solutions with enhanced clinical outcome prediction and embryo selection optimization capabilities. |

The global time-lapse embryo incubators market is estimated to be valued at USD 320.7 million in 2025.

The market size for the time-lapse embryo incubators market is projected to reach USD 596.4 million by 2035.

The time-lapse embryo incubators market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in time-lapse embryo incubators market are dry incubation and wet incubation.

In terms of application, hospitals segment to command 58.0% share in the time-lapse embryo incubators market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Embryo Incubator Market Growth - Trends & Forecast 2025 to 2035

Carcinoembryonic Antigen (CEA) Market

Infant Incubators & Warmers Market Size and Share Forecast Outlook 2025 to 2035

Infant Incubators Market Analysis - Trends & Forecast 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Incubators Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA