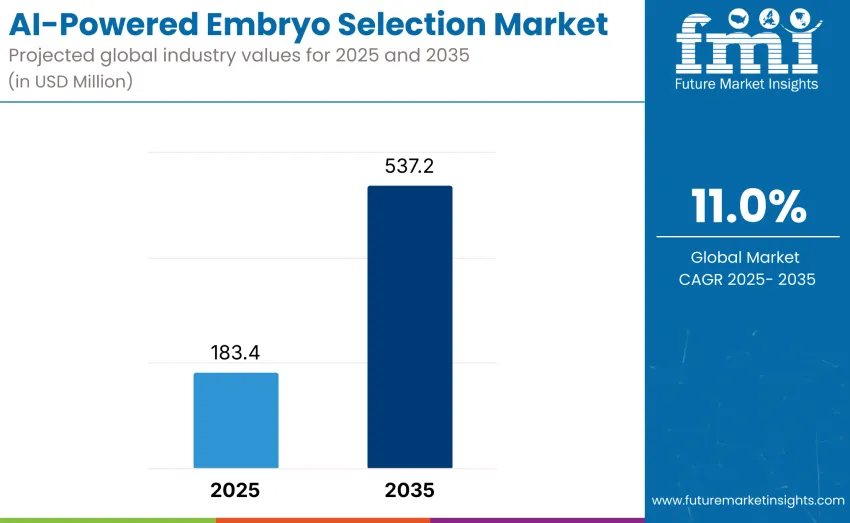

The global AI-powered embryo selection market is projected to reach USD 537.2 million by 2035, recording an absolute increase of USD 442.6 million over the forecast period. Market is valued at USD 183.4 million in 2025 and is set to rise at a CAGR of 11% during the forecast period 2025-2035. Overall market size is expected to grow by more than two times during the same period, supported by growing demand for assisted reproductive technologies, increasing global IVF procedure volumes, and adoption of artificial intelligence in clinical embryology workflows. High implementation costs, ethical considerations in embryo grading, and regulatory validation requirements may restrain faster adoption.

Market expansion reflects fundamental shifts in reproductive medicine and embryology practices, where enhanced embryo selection systems enable embryologists and clinicians to improve implantation success rates and reduce subjectivity in embryo evaluation. Traditional morphology-based selection methods are increasingly complemented or replaced by software-driven tools that analyze time-lapse imaging data to identify embryos with the highest developmental potential. Clinical studies and early adoption in fertility centers indicate that assisted selection can improve implantation rates compared to conventional manual grading, driving interest from IVF laboratories seeking to enhance accuracy, reduce variability, and shorten time to pregnancy.

AI-Powered Embryo Selection Market Key Takeaways

| Metric | Value |

|---|---|

| Market Value (2025) | USD 183.4 million |

| Market Forecast Value (2035) | USD 537.2 million |

| Forecast CAGR (2025 to 2035) | 11% |

Technological advancements in time-lapse imaging, deep learning algorithms, and non-invasive embryo evaluation techniques reshape the embryo selection landscape. Contemporary systems employ computer vision models trained on thousands of embryo images and developmental sequences, providing automated scoring and predictive insights on embryo viability. Integration with existing laboratory management software and IVF hardware supports seamless workflow compatibility, while cloud-based analytics platforms enable centralized embryo assessment across multiple clinics.

Between 2025 and 2030, the AI-powered embryo selection market is projected to expand from USD 183.4 million to USD 327.0 million, resulting in a value increase of USD 143.6 million, which represents 40.5% of total forecast growth for the decade. This phase will be driven by rising global demand for assisted reproductive technologies, increasing IVF procedure volumes, and growing adoption of decision-support systems in fertility clinics.

From 2030 to 2035, growth continues from USD 327.0 million to USD 537.2 million, adding another USD 210.2 million, which constitutes 59.5% of overall ten-year expansion. This period will be characterized by large-scale clinical adoption of assisted embryo selection platforms, regulatory approvals in key markets, and integration of predictive analytics with broader fertility care ecosystems.

The AI-powered embryo selection market is expanding as fertility clinics and embryologists adopt artificial intelligence to enhance the accuracy, efficiency, and success rates of in-vitro fertilization (IVF). AI systems analyze time-lapse imaging and developmental patterns, enabling clinicians to identify embryos with the highest implantation potential, improving success rates by 15-25% over traditional methods. This growth is driven by rising infertility rates, delayed parenthood, and lifestyle-related fertility challenges, putting pressure on clinics to optimize patient outcomes within limited treatment cycles.

AI tools support decision-making, reducing the risk of failed transfers and improving laboratory precision. As fertility treatment becomes more accessible and competitive, clinics invest in advanced technologies to improve workflow efficiency and data management. Government initiatives and collaborations between technology developers and healthcare providers further support the integration of AI in reproductive health. The increasing use of telemedicine and remote embryology monitoring also boosts demand for cloud-connected AI systems for centralized analysis and cross-clinic collaboration.

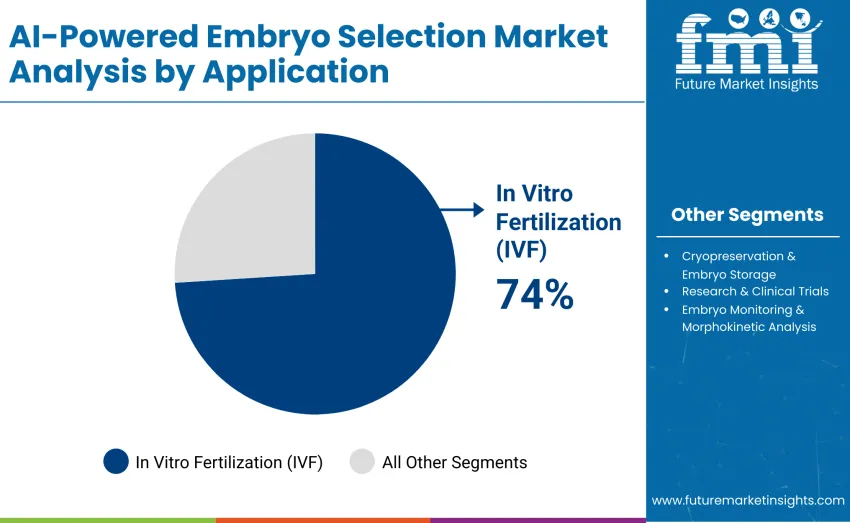

The market is segmented by product, application, and region. By product, categories include Imaging & Scoring Platforms, Embryo Selection Software, IVF Lab Automation Systems with enhanced capabilities, Predictive Analytics & Data Tools, and Support Modules/Integration Solutions. Based on application, segments cover In Vitro Fertilization, Cryopreservation & Embryo Storage, Research & Clinical Trials, and Embryo Monitoring & Morphokinetic Analysis. Regionally, coverage spans Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

Imaging & Scoring Platforms dominate the market with a 40.5% share in 2025, driven by deep learning algorithms, high-resolution time-lapse imaging, and automated scoring systems that improve embryo morphology assessment and IVF success. These platforms enhance implantation rates and consistency across labs. The Embryo Selection Software segment follows with a 25.0% share, offering real-time embryo grading and implantation probability using image interpretation and patient data. Their affordability and ease of integration make them popular in mid-sized and developing fertility clinics adopting assisted decision tools for improved patient outcomes.

The In Vitro Fertilization (IVF) segment dominates the AI-powered embryo selection market with a 74.0% share in 2025, driven by the integration of enhanced imaging and scoring platforms to improve embryo grading, implantation prediction, and cycle success. IVF clinics rely on software-based assessments to reduce subjectivity, standardize decisions, and optimize pregnancy outcomes. Dominance is supported by regulatory approvals, cost-efficiency, and data analytics for personalized fertility treatments. The Cryopreservation & Embryo Storage segment holds 10.0%, driven by assisted monitoring systems for tracking frozen embryo viability and optimizing storage conditions. Research applications further refine algorithms and clinical performance.

The AI-powered embryo selection market is driven by three key factors linked to advancements in reproductive medicine and rising adoption of assisted reproductive technologies. First, the growing prevalence of infertility and delayed parenthood has increased demand for IVF procedures globally, with clinics seeking AI-powered systems to enhance implantation success and reduce treatment cycles. Second, the need for precision and consistency in embryo evaluation drives adoption, as AI minimizes subjectivity in grading and provides evidence-based predictions of embryo viability. Third, healthcare’s digital transformation and AI integration into clinical workflows encourage fertility centers to invest in data-driven, automated solutions for quality-assured embryology operations.

What Are the Key Drivers of Growth in the AI-Powered Embryo Selection Market?

The AI-powered embryo selection market is driven by three factors. First, increasing infertility rates and delayed parenthood boost global IVF demand, with AI improving implantation success and reducing treatment cycles. Second, the need for accurate and consistent embryo evaluation drives AI adoption, minimizing subjectivity and providing data-backed viability predictions. Third, healthcare’s digital transformation and AI integration into clinical workflows prompt fertility centers to invest in data-driven solutions, advancing embryology labs toward automated, predictive, and quality-assured operations, optimizing overall IVF outcomes.

What Emerging Trends Are Shaping the AI-Powered Embryo Selection Market?

Emerging trends in the AI-powered embryo selection market include the integration of time-lapse imaging with cloud-based AI analytics for centralized embryo assessment and remote collaboration. Non-invasive evaluation methods combining AI with morphokinetic data, metabolic profiling, and biomarkers are gaining popularity. Partnerships between AI developers, reproductive medicine institutes, and IVF equipment manufacturers are advancing digital fertility ecosystems. Asia-Pacific markets are rapidly adopting AI-assisted IVF, supported by government initiatives.

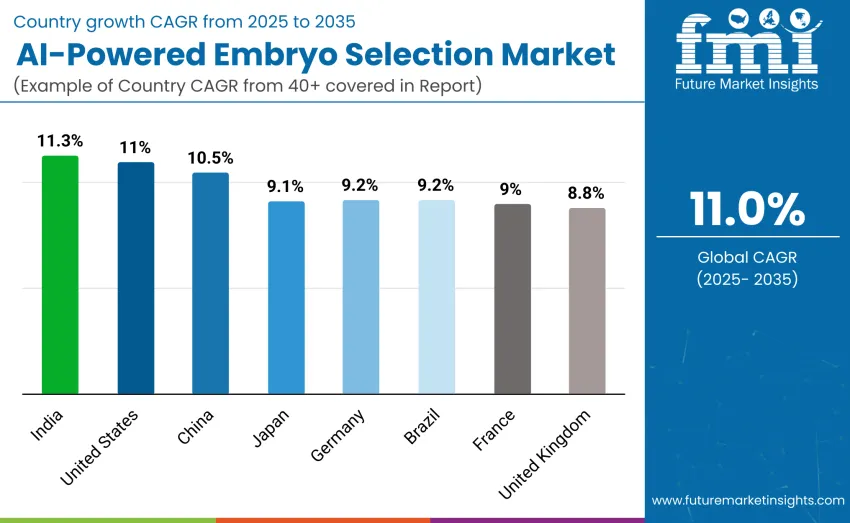

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 11.3% |

| United States | 11.0% |

| China | 10.5% |

| Japan | 9.1% |

| Germany | 9.2% |

| France | 9.0% |

| Brazil | 9.2% |

| United Kingdom | 8.8% |

The AI-powered embryo selection market is growing globally, with India leading due to rapid IVF infrastructure expansion, increased adoption of enhanced embryo assessment, and government-backed fertility initiatives. The country’s expanding private hospital network and focus on integrating digital technologies position it as a key growth hub in Asia-Pacific. The United States follows with strong advancement, supported by established fertility networks, early adoption of integrated imaging platforms, and continuous innovation. China shows impressive progress through expanded access to fertility treatments, digitalization, and investment in reproductive technologies. Germany maintains steady growth in Europe, driven by advanced healthcare infrastructure and clinical precision.

China shows strong growth potential with a 10.5% CAGR through 2035, driven by rapid fertility infrastructure modernization, large-scale IVF expansion, and government-backed healthcare digitalization. Performing over one million assisted reproductive cycles annually, China has one of the largest IVF patient bases globally, fostering the integration of advanced technologies into clinical workflows. Growth is concentrated in hubs like Beijing, Shanghai, Guangzhou, and Chengdu, where reproductive centers and private fertility networks adopt enhanced imaging and embryo assessment tools to boost IVF success rates. National initiatives under "Healthy China 2030" and regional programs encourage intelligent reproductive solutions, supported by domestic developers and cloud platforms.

India shows strong growth with an 11.3% CAGR through 2035, driven by an expanding IVF service base with over 350,000 treatment cycles annually and increased awareness of advanced embryo viability assessment and improved pregnancy success rates. Government-backed reproductive health initiatives and private training programs equip clinicians with data analytics skills, accelerating the shift to automated embryo grading. Leading fertility hubs like Delhi NCR, Mumbai, Bangalore, Chennai, and Hyderabad are adopting these technologies across IVF centers. Skill development programs under the National Digital Health Mission and ICMR frameworks, along with technology partnerships, enable access to advanced imaging software and cloud-based embryo analytics.

Germany’s fertility medicine sector shows advanced implementation, with IVF success rates improving by 20-35% through enhanced embryo imaging and predictive analytics platforms. The country’s healthcare infrastructure in cities like Berlin, Munich, Hamburg, and Frankfurt supports early adoption of precision reproductive technologies within regulated frameworks emphasizing data integrity, ethical compliance, and patient safety. German fertility professionals focus on evidence-based practices and clinical validation, driving demand for high-quality solutions that meet European medical device standards. Leading IVF centers and research institutions implement integrated embryo evaluation workflows, achieving measurable improvements within 12-18 months, while university partnerships support nationwide professional skill development.

Brazil leads Latin American adoption with a projected 9.2% CAGR through 2035, driven by the rapid expansion of private fertility clinic networks and growing awareness of advanced reproductive medicine. Increased infertility treatment demand across São Paulo, Rio de Janeiro, Brasília, and Porto Alegre fuels the adoption of enhanced embryo grading systems to improve IVF success rates, optimize lab efficiency, and reduce treatment costs. Private clinics and reproductive networks streamline operations through improved embryo evaluation workflows. Partnerships with international developers enable localized integration, clinician training, and compliance with national health data regulations, while collaborations with fertility associations and research institutes support adoption.

The United States AI-powered embryo selection market shows advanced adoption, supported by a well-established fertility ecosystem including leading IVF networks, academic centers, and reproductive endocrinology practices. With a projected CAGR of 11% through 2035, growth is fueled by the integration of AI into assisted reproductive technology workflows, large patient volumes, and ongoing clinical research. Major networks like Ovation Fertility, Shady Grove Fertility, and CCRM adopt enhanced embryo selection tools to improve implantation outcomes and reduce cycle costs. Partnerships with developers ensure integration with lab imaging systems and electronic medical records, while standardized digital imaging protocols across top-tier IVF clinics enable reliable algorithm training and validation.

In leading medical hubs like London, Manchester, Birmingham, and Edinburgh, fertility clinics and IVF providers adopt AI-powered embryo selection systems to improve treatment precision, reduce cycle failures, and enhance patient satisfaction. Growth maintains a steady 8.8% CAGR through 2035, supported by the UK’s advanced fertility services ecosystem, high patient demand for personalized care, and increasing use of AI in diagnostics. Fertility specialists integrate enhanced embryo assessment software into laboratory workflows to ensure objective selection and improve implantation success. NHS-affiliated and private healthcare networks implement assisted embryo evaluation systems, while research partnerships validate algorithm accuracy and clinical performance.

Japan's AI-powered embryo selection market shows advanced adoption across fertility clinics and reproductive medicine centers, focusing on clinical precision, data reliability, and ethical transparency. With a 9.1% CAGR through 2035, growth is supported by advanced healthcare infrastructure, an aging population, and a strong focus on technological innovation in assisted reproductive technologies. Fertility specialists integrate enhanced embryo selection systems in major centers in Tokyo, Osaka, Nagoya, and Fukuoka, improving grading accuracy, reducing multiple embryo transfers, and increasing patient confidence. Collaborations with academic institutes refine algorithm accuracy and optimize imaging data standardization, strengthening IVF outcomes and enhancing clinical workflows.

France's AI-powered embryo selection market shows steady growth, supported by strong healthcare infrastructure and the increasing adoption of digital fertility workflows. Collaborations between academic research institutes and digital health startups drive consistent adoption of assisted reproductive technologies. Reproductive practitioners implement enhanced embryo selection software within fertility management protocols, with collaboration between physicians and specialists. Growth is fueled by rising awareness of software-based selection benefits, physician preference for precision treatments, and better integration of digital scanning and computational workflows. Academic institutions and professional associations support education programs focused on digital reproductive techniques, boosting practitioner confidence and adoption in metropolitan regions and specialized centers.

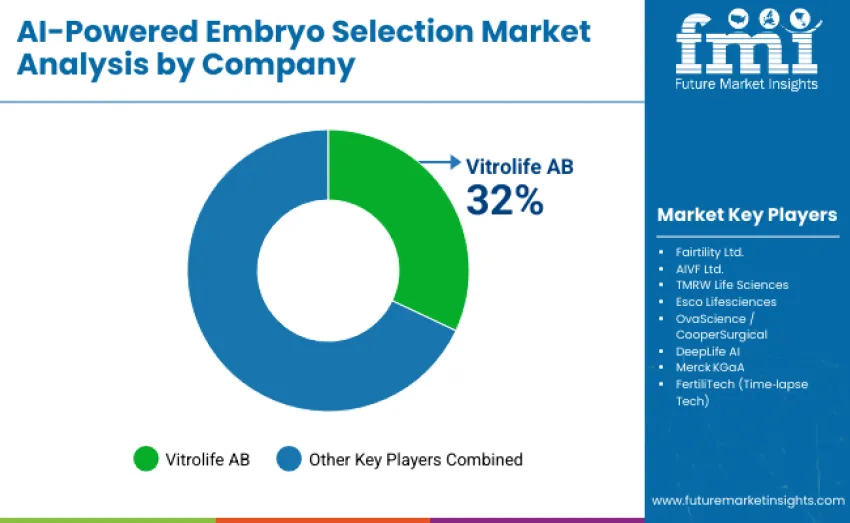

The AI-powered embryo selection market is moderately concentrated, with 10 major participants. The top three, Vitrolife AB, Fairtility Ltd., and CooperSurgical (via OvaScience), collectively hold 50–55% of global share, with Vitrolife AB alone accounting for 32%. Competition centers on algorithm accuracy, clinical validation strength, and integration with IVF imaging ecosystems rather than pricing. Clinics prioritize reliability, data transparency, and regulatory compliance to improve outcomes and workflow efficiency.

Vitrolife AB leads the market through its iDAScore platform, tightly integrated with time-lapse imaging and lab management systems for automated embryo scoring. Fairtility’s CHLOE platform differentiates itself through explainable AI, real-time monitoring, and transparent algorithm design, gaining traction across Europe and Asia-Pacific. CooperSurgical leverages its OvaScience portfolio to offer integrated AI-driven fertility solutions.

Challengers such as AIVF Ltd., Esco Lifesciences, and TMRW Life Sciences compete with modular, scalable platforms. AIVF’s EMA emphasizes cloud-based interoperability, Esco embeds AI within incubators and lab automation systems, and TMRW advances digital cryostorage for secure embryo lifecycle management.

Supporting participants, including Merck KGaA, FertiliTech, and DeepLife AI, add market diversity. Merck integrates AI within fertility consumables, FertiliTech provides foundational time-lapse imaging essential for AI training, and DeepLife AI develops customizable algorithms optimized for regional datasets, broadening access for mid-sized clinics.

Key Players in the AI-Powered Embryo Selection Market

| Item | Value |

|---|---|

| Quantitative Units | USD 183.4 million |

| Product Type | Imaging & Scoring Platforms, Embryo Selection Software, IVF Lab Automation Systems, Predictive Analytics & Data Tools, Support Modules/Integration Solutions |

| Application | In Vitro Fertilization, Cryopreservation & Embryo Storage, Research & Clinical Trials, Embryo Monitoring & Morphokinetic Analysis |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Vitrolife AB, Fairtility Ltd., AIVF Ltd., TMRW Life Sciences, Esco Lifesciences, OvaScience / CooperSurgical , DeepLife AI, Merck KGaA , and FertiliTech (Time-lapse Tech) |

| Additional Attributes | Dollar sales are driven by product types and application categories, with regional adoption growing in Asia Pacific, Europe, and North America. The competitive landscape includes AI embryo selection providers and fertility clinics, focusing on algorithm innovations, IVF lab integration, and advancements in viability prediction, morphokinetics , and workflow efficiency |

The global AI-powered embryo selection market is estimated to be valued at USD 183.4 million in 2025.

The market size for the AI-powered embryo selection market is projected to reach USD 537.2 million by 2035.

The AI-powered embryo selection market is expected to grow at an 11% CAGR between 2025 and 2035.

The key product types in the AI-powered embryo selection market are Imaging & Scoring Platforms, Embryo Selection Software, IVF Lab Automation Systems with AI, Predictive Analytics & Data Tools, and Support Modules/Integration Solutions.

The In Vitro Fertilization (IVF) segment is expected to dominate the market with a 74.0% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Embryo Incubator Market Growth - Trends & Forecast 2025 to 2035

Carcinoembryonic Antigen (CEA) Market

Time-Lapse Embryo Incubators Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA