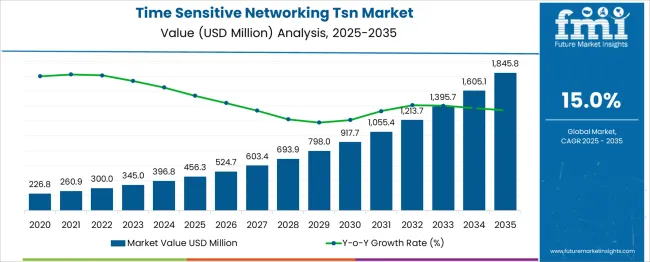

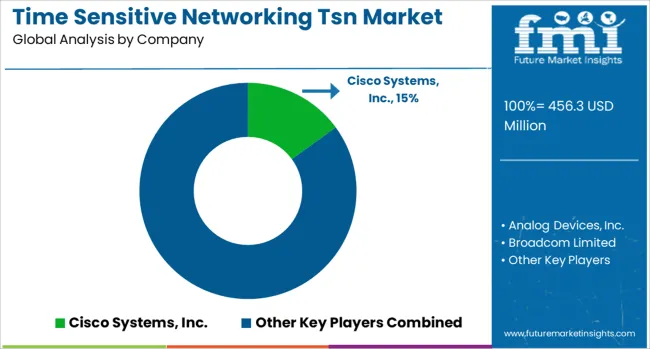

The Time Sensitive Networking (TSN) Market is estimated to be valued at USD 456.3 million in 2025 and is projected to reach USD 1845.8 million by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period. The time sensitive networking (TSN) market is set to deliver a compound absolute growth of USD 1,389.5 million, which represents a more than 4x expansion over the forecast horizon at a CAGR of 15.0%. Analyzing the cumulative growth pattern reveals a highly back-loaded structure, with the initial five years (2025–2030) adding USD 341.7 million, or just 25% of total incremental value, as adoption remains in the standardization and early integration phase within industrial automation, automotive Ethernet, and mission-critical networking.

The subsequent five-year span (2030–2035) accounts for an overwhelming USD 1,047.8 million, representing 75% of the total absolute gain, driven by accelerated deployment in autonomous mobility, real-time robotics, and converged IT/OT infrastructure. Annual increments compound sharply from USD 52 million in early years to nearly USD 250 million by 2034–2035, reflecting exponential demand elasticity tied to latency-sensitive applications in 5G backhaul, avionics, and smart manufacturing. This growth geometry indicates a transformative adoption cycle where vendors emphasizing deterministic Ethernet hardware, software-defined TSN controllers, and end-to-end interoperability will dominate as industries prioritize low-latency, synchronized data flows, positioning TSN as a foundational enabler of Industry 4.0 and edge computing ecosystems.

| Metric | Value |

|---|---|

| Time Sensitive Networking (TSN) Market Estimated Value in (2025 E) | USD 456.3 million |

| Time Sensitive Networking (TSN) Market Forecast Value in (2035 F) | USD 1845.8 million |

| Forecast CAGR (2025 to 2035) | 15.0% |

The time sensitive networking (TSN) market holds a crucial position in enabling deterministic communication across multiple sectors. In the industrial automation space, TSN accounts for about a 15–18% share, supporting real-time control, robotics, and process automation where guaranteed latency and synchronization are critical. Within automotive in-vehicle networking, TSN captures nearly 8–10%, driven by its application in advanced driver-assistance systems (ADAS), infotainment platforms, and coordinated powertrain control in electric and connected vehicles.

The telecommunications and networking infrastructure segment reflects early adoption, with TSN contributing 5–6% as it underpins ultra-reliable low-latency communication for 5G transport and edge connectivity. In data centers and high-performance IT environments, TSN provides precise synchronization and traffic prioritization, accounting for about 3–4% of total networking technology spend. Additionally, in the smart grid and energy communication sector, TSN plays a vital role in substation automation, load balancing, and integration of distributed energy resources, commanding a 7–9% share. The market’s expansion is supported by the growing demand for time-critical networking in Industry 4.0, connected mobility, edge computing, and smart energy systems. Its trajectory suggests rapid adoption across mission-critical domains where reliability, low latency, and interoperability define performance, positioning TSN as a foundational enabler for next-generation digital infrastructure.

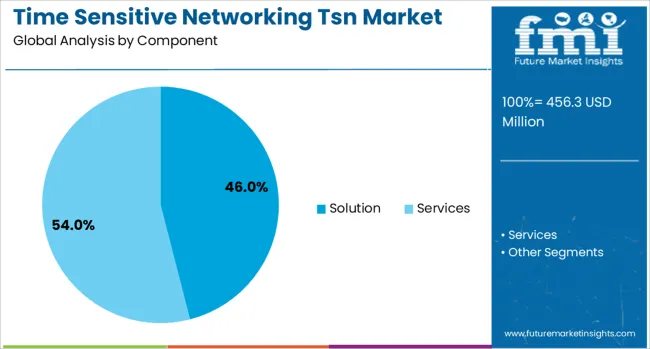

The solution segment is projected to command 46.0% of the total TSN market revenue in 2025, making it the leading component category. This dominance is being driven by growing integration of TSN protocols within switches, network interface cards, and controllers, offering real-time capabilities across Ethernet-based systems.

Solutions are being deployed widely to ensure ultra-low latency, jitter control, and time synchronization across mission-critical applications. Industry players have prioritized the development of modular and scalable TSN solution stacks to ensure compatibility with existing infrastructure.

Enhanced security, precision timing, and plug-and-play interoperability are among the factors boosting the deployment of integrated solutions. As industries seek future-ready communication frameworks, the demand for comprehensive TSN solutions is expected to sustain leadership across this segment.

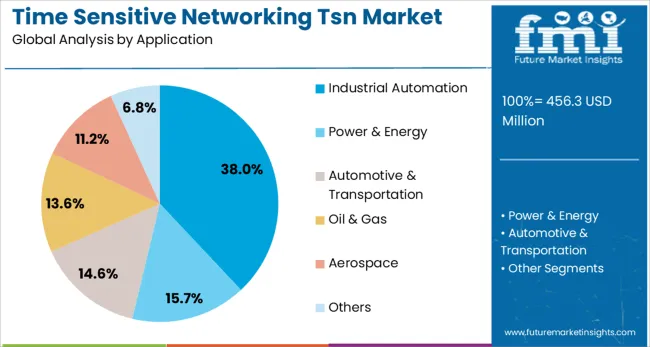

Industrial automation is expected to account for 38.0% of the TSN market’s revenue share in 2025, leading among application categories. The increasing need for reliable, synchronized communications in automated production lines and robotic systems is fueling this.

TSN’s capability to merge standard Ethernet with real-time data transmission has positioned it as a key enabler for smart factories. Manufacturers are increasingly leveraging TSN to ensure deterministic networking in processes involving motion control, sensor fusion, and edge computing.

Compatibility with OPC UA, PROFINET, and other industrial protocols has accelerated adoption in brownfield and greenfield deployments alike. With the proliferation of AI-driven automation, the reliance on time-sensitive, lossless data exchange will continue to drive preference for TSN in industrial environments.

Time Sensitive Networking TSN technology ensures deterministic communication and low-latency data transfer across Ethernet networks, supporting real-time control in industrial automation, automotive systems, and telecommunication infrastructure. Adoption has been reinforced by the need for time-critical applications in Industry 4.0, autonomous vehicles, and advanced robotics. Manufacturers and network providers are focusing on developing TSN-compliant switches, controllers, and integrated systems for interoperability across diverse environments. Market growth has been supported by increasing investment in digital transformation, convergence of operational and information technologies, and the demand for high-reliability networks in mission-critical sectors.

The requirement for deterministic communication in industrial automation and automotive systems has driven growth in TSN adoption. Traditional Ethernet solutions lack precise time synchronization and latency guarantees, making TSN essential for mission-critical applications. Expansion of connected vehicles and advanced driver assistance systems has accelerated TSN integration for in-vehicle communication. Manufacturing plants adopting Industry 4.0 frameworks rely on TSN to converge operational technology and IT systems for seamless data exchange. Telecommunications providers have also incorporated TSN capabilities to ensure low latency performance in 5G and edge computing networks, further reinforcing market adoption globally.

Market expansion has been hindered by the complexity of integrating TSN into existing legacy networks, which often lack compatibility with deterministic protocols. Variability in TSN standards adoption across vendors has created interoperability challenges, delaying deployment in multivendor environments. High initial investment required for TSN-enabled hardware and network upgrades limits adoption in cost-sensitive industries. Limited awareness of TSN benefits and a lack of skilled professionals with expertise in configuring real-time Ethernet systems have further slowed implementation. The requirement for rigorous validation and certification processes before deployment adds additional time and cost, impacting market growth in certain sectors.

Significant opportunities exist in the automotive sector, particularly in autonomous vehicle platforms that require low latency and synchronized communication between sensors, ECUs, and control units. The growth of Industrial IoT and smart factories offers potential for TSN in real-time process control and machine-to-machine communication. Integration with 5G networks creates possibilities for TSN in remote industrial operations and connected healthcare systems. The development of standardized test frameworks and certification programs provides vendors with avenues to enhance market confidence. Strategic partnerships between TSN solution providers and semiconductor manufacturers are supporting the creation of chipsets optimized for real-time Ethernet communication in emerging applications.

Recent trends highlight increasing adoption of TSN standards under IEEE 802.1 for interoperability across industrial and automotive ecosystems. Virtualization of control systems using TSN-enabled hypervisors is gaining traction for flexible deployment in cloud-managed industrial environments. Integration of TSN with edge computing platforms supports ultra-reliable communication for latency-sensitive applications. Growing use of software-defined networking SDN for centralized TSN traffic management is transforming network configuration models. Vendors are focusing on modular TSN solutions that combine time synchronization, bandwidth reservation, and frame preemption capabilities. Continuous collaboration among technology consortia and standardization bodies is shaping the evolution of TSN for next-generation deterministic Ethernet networks.

| Country | CAGR |

|---|---|

| China | 20.3% |

| India | 18.8% |

| Germany | 17.3% |

| France | 15.8% |

| UK | 14.3% |

| USA | 12.8% |

| Brazil | 11.3% |

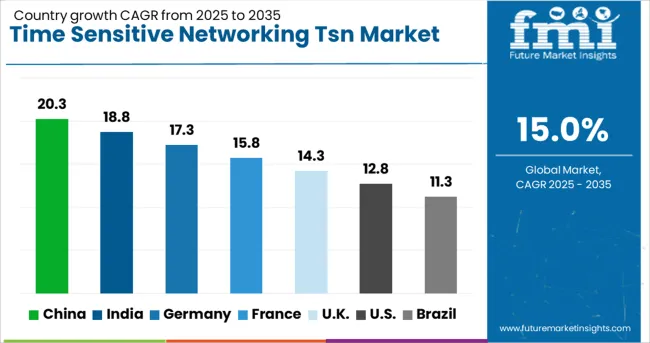

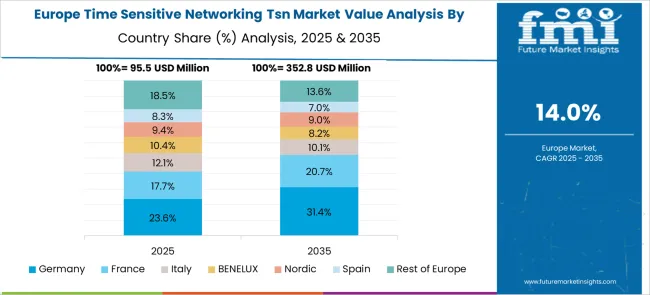

The time sensitive networking (TSN) market is projected to grow at a CAGR of 15.0% from 2025 to 2035. Among the top five profiled markets, China leads at 20.3%, followed by India at 18.8%, while France posts 15.8%, the United Kingdom records 14.3%, and the United States stands at 12.8%. These growth rates represent a premium of +35% for China and +25% for India versus the global baseline, whereas France remains slightly ahead at +5%, while the UK and the US trail at –5% and –15%, respectively. Divergence is driven by strong industrial automation programs and smart manufacturing initiatives in BRICS markets, while OECD regions emphasize precision networking in automotive, aerospace, and telecommunications. The analysis spans over 40 countries, with the leading markets detailed below.

China is projected to grow at a CAGR of 20.3% through 2035, driven by its strong industrial automation ecosystem and rapid adoption of Industry 4.0 initiatives. TSN is being widely deployed across smart factories, automotive assembly lines, and robotics networks to achieve deterministic data transfer with low latency. Major Chinese manufacturers are investing in TSN-enabled Ethernet switches and integrated control systems to meet performance standards for critical applications. Partnerships with global technology providers are accelerating TSN adoption in high-demand sectors like electric vehicle production and advanced electronics manufacturing. The rising implementation of TSN for real-time control in energy and power distribution systems further enhances market prospects.

India is expected to register a CAGR of 18.8% through 2035, supported by expanding industrial digitization and large-scale automation projects in sectors like automotive, energy, and telecommunications. Government-led smart manufacturing initiatives and increased penetration of connected infrastructure are fueling TSN adoption for precise, real-time communication. Indian enterprises are deploying TSN-enabled solutions in robotics, motion control, and process automation systems to enhance operational reliability and synchronization. Domestic technology firms are collaborating with global vendors to develop cost-effective TSN solutions suitable for local manufacturing environments. Future adoption is likely to accelerate in autonomous transport systems and next-generation telecom networks, reinforcing India’s position in the global TSN landscape.

France is projected to post a CAGR of 15.8% through 2035, driven by the modernization of automotive production facilities and adoption of Industry 4.0 standards. French manufacturers are focusing on TSN integration for advanced robotics, real-time motion control, and predictive maintenance applications in high-value industries. Adoption in aerospace and defense sectors is accelerating as TSN provides deterministic communication essential for avionics and complex systems. Domestic suppliers emphasize interoperability and compatibility with legacy Ethernet systems to ease migration for large-scale industrial players. Research institutions in France are actively investing in TSN-based network simulation and testing platforms, supporting advancements in secure and reliable industrial communications.

The United Kingdom is expected to achieve a CAGR of 14.3% through 2035, supported by strong adoption in advanced manufacturing and smart infrastructure projects. TSN technology is being integrated into industrial automation systems for sectors like energy, transport, and automotive to enhance real-time data exchange. British firms are investing in secure, deterministic communication networks for electric vehicle assembly lines and smart grid applications. Growth is reinforced by increasing deployment of TSN-enabled Ethernet solutions in high-speed rail systems and precision engineering environments. Local technology providers are focusing on software-defined networking solutions integrated with TSN to optimize latency and reliability across industrial processes.

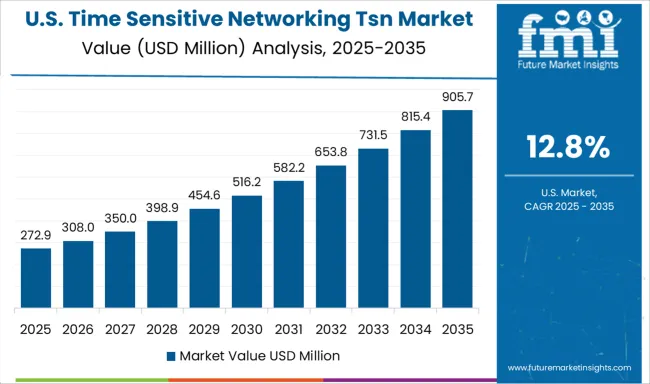

The United States is projected to grow at a CAGR of 12.8% through 2035, driven by the adoption of TSN in automotive, aerospace, and industrial automation sectors. The increasing complexity of connected manufacturing environments has prompted USA enterprises to invest in deterministic Ethernet networks with advanced traffic scheduling capabilities. TSN solutions are being integrated into systems requiring ultra-low latency for robotics, motion control, and real-time monitoring. USA technology firms are prioritizing TSN deployments in autonomous vehicle platforms and industrial IoT applications. Federal initiatives aimed at strengthening critical infrastructure resilience and network security further encourage TSN integration across key industries.

The TSN market is driven by networking technology leaders, semiconductor manufacturers, and industrial automation specialists focused on enabling real-time, deterministic Ethernet for critical applications. Cisco Systems, Inc. dominates with advanced TSN-enabled Ethernet switches and software solutions for industrial automation, automotive, and smart grid applications. Analog Devices, Inc. provides TSN-compatible PHY transceivers and integrated systems targeting precision synchronization in harsh environments. Broadcom Limited and Marvell Technology Group Ltd. supply high-performance TSN switch chips and controllers for scalable industrial and automotive networks. Belden, Inc., through its Hirschmann brand, is a key player in industrial-grade TSN networking hardware, offering ruggedized switches and connectivity solutions.

Microsemi Corporation (now part of Microchip Technology) specializes in timing and synchronization technologies that are critical for deterministic communication in TSN-enabled networks. Nokia Corporation, Inc. integrates TSN within its IP and optical networking portfolios for 5G and mission-critical industrial connectivity. Renesas Electronics Corporation focuses on TSN-ready microcontrollers and Ethernet solutions for automotive ECUs and industrial edge devices. TTTech Computertechnik AG plays a major role in software stacks and integration services, particularly for the automotive and aerospace markets, facilitating safety-critical applications. Competitive differentiation revolves around interoperability with IEEE 802.1 TSN standards, ultra-low latency, scalability, and integration with cybersecurity frameworks. Barriers to entry include complex compliance requirements and high R&D costs. Strategic initiatives focus on convergence of TSN with OPC UA, edge computing, and 5G for seamless connectivity in Industry 4.0 and autonomous mobility ecosystems.

On July 3, 2024, Analog Devices joined the CC-Link Partner Association (CLPA) Board and committed to implementing CC-Link IE TSN on its Scalable Ethernet Switch platform. This strategic move is aimed at accelerating the global adoption of TSN technology in industrial automation applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 456.3 Million |

| Component | Solution and Services |

| Application | Industrial Automation, Power & Energy, Automotive & Transportation, Oil & Gas, Aerospace, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cisco Systems, Inc., Analog Devices, Inc., Broadcom Limited, Belden, Inc., Microsemi Corporation, Marvell Technology Group Ltd., Nokia Corporation, Inc., Renesas Electronics Corporation, and TTTech Computertechnik AG |

| Additional Attributes | Dollar sales by component type (switches, controllers, software solutions) and application (industrial automation, automotive, aerospace, power & energy). Demand dynamics are driven by the need for synchronized communication in factory automation, connected vehicles, and critical energy systems. Regional trends show Europe and North America leading adoption due to early industrial digitalization, while Asia-Pacific experiences strong growth supported by smart manufacturing initiatives. Innovation trends include TSN-over-5G solutions, TSN-enabled SoCs for ADAS and autonomous vehicles, and enhanced cybersecurity layers to protect real-time industrial networks. |

The global time sensitive networking tsn market is estimated to be valued at USD 456.3 million in 2025.

The market size for the time sensitive networking tsn market is projected to reach USD 1,845.8 million by 2035.

The time sensitive networking tsn market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in time sensitive networking tsn market are solution, _switches, _controllers & processors, _other hardware components, services, _professional services and _managed services.

In terms of application, industrial automation segment to command 38.0% share in the time sensitive networking tsn market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Time-Lapse Embryo Incubators Market Size and Share Forecast Outlook 2025 to 2035

Time Temperature Indicator Labels Market Size and Share Forecast Outlook 2025 to 2035

Time Temperature Indicator Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Time Switch Market Analysis Size and Share Forecast Outlook 2025 to 2035

Time Of Flight Cameras Market Size and Share Forecast Outlook 2025 to 2035

Time of Flight (ToF) Sensor Market Insights - Growth & Forecast 2025 to 2035

Evaluating Time Temperature Indicator Labels Market Share & Provider Insights

Antimetabolite Drugs Market Size and Share Forecast Outlook 2025 to 2035

Altimeter Market

Multimedia Projectors Market Analysis – Growth & Industry Trends 2023-2033

Sentiment Analytics Software Market

Maritime Satellite Communication Market Size and Share Forecast Outlook 2025 to 2035

Maritime Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Maritime Patrol Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Maritime Patrol Naval Vessels Market Growth - Trends & Forecast 2025 to 2035

Real-time Lithium Sensor Market Size and Share Forecast Outlook 2025 to 2035

Real Time Location System (RTLS) Market Size and Share Forecast Outlook 2025 to 2035

Real-time Bioprocess Raman Analyzer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Real Time Parking System Market Growth - Trends & Forecast 2025 to 2035

Real-Time Store Monitoring Platform Market Outlook - Demand, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA