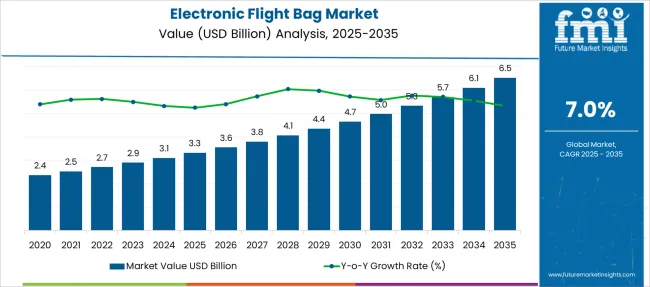

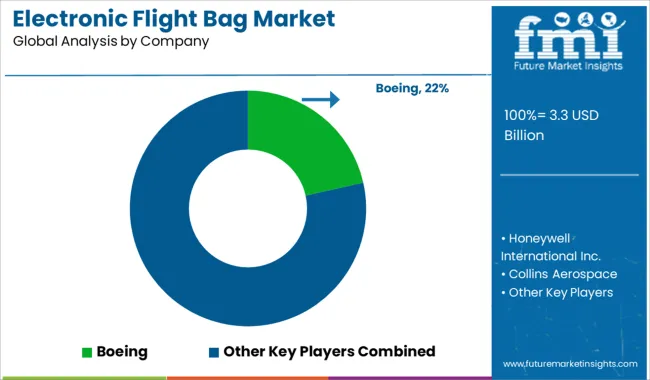

The Electronic Flight Bag Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 6.5 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

| Metric | Value |

|---|---|

| Electronic Flight Bag Market Estimated Value in (2025 E) | USD 3.3 billion |

| Electronic Flight Bag Market Forecast Value in (2035 F) | USD 6.5 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The electronic flight bag (EFB) market is progressing steadily as aviation operators continue to prioritize digital transformation to enhance flight operations, safety, and efficiency.

The rising demand for fuel efficiency, the elimination of paper-based systems, and improved situational awareness have accelerated adoption across commercial and military aviation. Airlines are increasingly integrating EFBs with broader avionics systems to streamline pre-flight planning and in-flight decision-making.

With continuous advancements in connectivity, user interface design, and application integration, the market is expected to witness sustained growth. The future outlook remains strong as air traffic volumes increase globally and operators seek to modernize fleets with advanced digital cockpit tools that align with evolving regulatory standards and performance expectations.

The electronic flight bag market is segmented by type, component, platform, and application and geographic regions. By type of the electronic flight bag market is divided into Portable and Installed. In terms of component of the electronic flight bag market is classified into Hardware and Software. Based on platform of the electronic flight bag market is segmented into Commercial Aviation, Business and General Aviation, and Military Aviation. By application of the electronic flight bag market is segmented into Flight Planning, Weather Updates, Performance Calculations, E-manuals, and Others. Regionally, the electronic flight bag industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

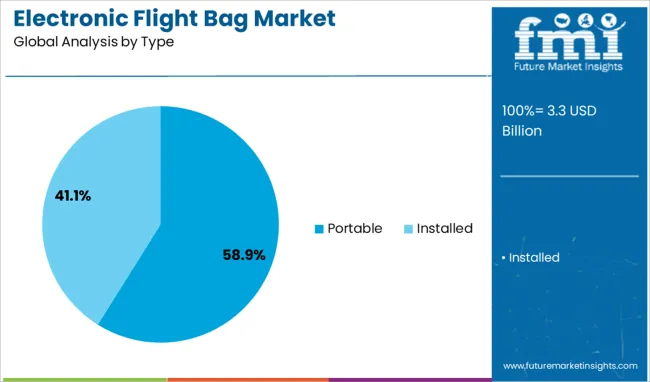

The portable segment accounts for a leading 58.9% share in the type category, driven by its flexibility, lower implementation cost, and ease of integration across various aircraft types. Portable EFBs, typically deployed on tablets or mobile devices, are favored by operators for their plug-and-play nature and minimal certification requirements compared to installed systems.

This segment has gained momentum among low-cost carriers and smaller fleets due to faster deployment timelines and the ability to upgrade or replace hardware with minimal operational disruption. Advancements in device durability, touchscreen performance, and offline functionality have made portable solutions increasingly reliable under diverse flight conditions.

As aviation stakeholders aim for quicker digitalization without incurring the high cost of retrofitting existing cockpits, portable EFBs continue to be the preferred choice. The segment is expected to maintain its leadership through ongoing enhancements in app ecosystems, battery life, and data synchronization capabilities.

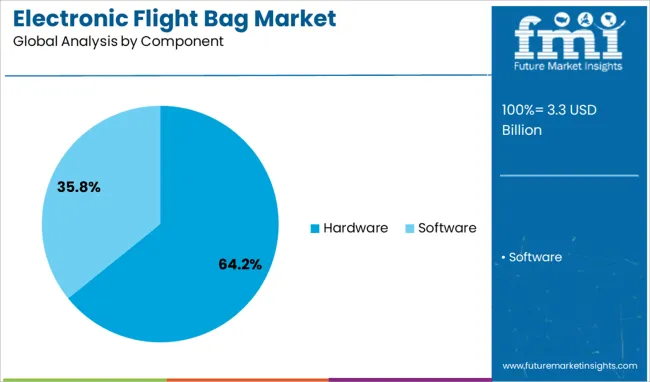

The hardware segment leads the component category with a 64.2% market share, underscoring its foundational role in enabling EFB functionality and performance. This dominance is attributed to increasing demand for ruggedized tablets, mounting systems, protective cases, and cockpit integration kits tailored for aviation environments. Hardware components must meet stringent safety and operational standards, which drives innovation in terms of durability, electromagnetic compatibility, and usability during flight.

Airlines and operators prioritize high-performance hardware that supports continuous access to mission-critical data, even in offline or high-turbulence scenarios. The trend towards lightweight and modular hardware configurations has also contributed to wider adoption across different aircraft models.

As more carriers move toward fleet-wide standardization of digital flight tools, hardware investments are set to increase, particularly in support of long-haul and international operations where reliability and redundancy are crucial. The segment is projected to retain its dominant share due to continuous upgrades in processing power, screen clarity, and interoperability with cockpit systems.

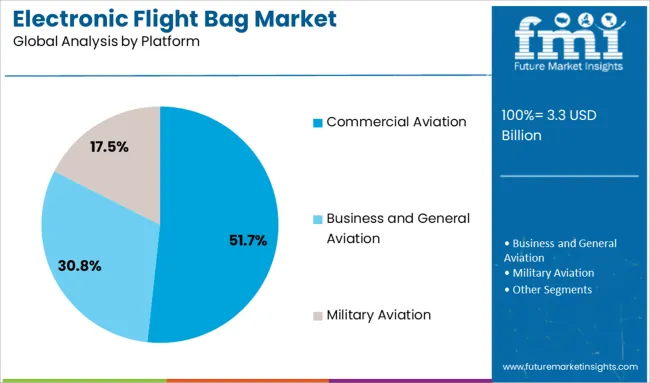

The commercial aviation segment holds a prominent 51.7% share in the platform category, reflecting the sector’s aggressive pursuit of digital cockpit solutions that enhance operational efficiency and regulatory compliance. Commercial airlines are leveraging EFBs to streamline documentation, reduce fuel burn through optimized flight planning, and improve in-flight communication with dispatch and ground services.

The segment has seen accelerated adoption due to rising fleet sizes, heightened competition, and evolving safety mandates requiring real-time data accessibility for pilots. Integration of EFBs with airline operational control systems further improves turnaround times and route adaptability, contributing to cost savings and enhanced customer service.

As air traffic recovers and new aircraft deliveries resume, EFB deployment is being included as a standard feature in next-generation cockpits. The commercial aviation segment is expected to maintain its lead as carriers continue investing in scalable digital tools that offer measurable ROI through efficiency, compliance, and improved flight performance metrics.

The electronic flight bag market is driven by increasing adoption for efficiency, connectivity, and compliance, replacing paper-based systems. Key growth factors include cost optimization, regulatory mandates, and integration with real-time operational data for enhanced safety and performance.

The Electronic Flight Bag market is witnessing robust adoption as airlines and business aviation operators seek efficiency in flight operations. EFB solutions replace paper-based documentation, reducing cockpit workload and optimizing route planning. Integration with flight performance tools and weather updates enhances decision-making, reducing delays and fuel consumption. Airlines are implementing EFB systems to comply with strict aviation authority mandates for digital recordkeeping and operational transparency. Growing use of real-time connectivity for performance data sharing strengthens the role of EFB systems. These factors collectively accelerate demand among both large fleet operators and smaller carriers seeking operational cost reductions and safety improvements.

A significant market dynamic is the shift toward connected EFB platforms that link aircraft systems, ground operations, and maintenance teams. Airlines are increasingly adopting solutions that enable predictive performance analysis and data synchronization across fleets. Enhanced connectivity through broadband and satellite communication allows EFB systems to provide live weather information and updated navigational charts during flight. This interconnectivity ensures better flight planning and improved compliance with global aviation standards. The trend toward centralized platforms is creating opportunities for software developers to deliver EFB systems integrated with broader airline management tools, supporting end-to-end operational visibility.

Regulatory requirements by aviation authorities such as FAA and EASA have played a critical role in accelerating EFB adoption. Airlines are required to maintain digital compliance for flight plans, performance data, and operational manuals. These mandates reduce the dependency on manual documentation and enhance transparency in safety protocols. The increasing emphasis on eliminating human error through structured digital processes has further driven EFB system deployment. Standardization efforts have also simplified integration, enabling interoperability between EFB platforms and other avionics systems. These regulatory dynamics make compliance-driven adoption a key driver in both mature and emerging aviation markets globally.

Airlines are under continuous pressure to reduce operational costs, and EFB systems play a pivotal role in achieving these objectives. By digitizing manuals, charts, and operational data, carriers significantly lower fuel consumption by reducing aircraft weight. EFB platforms enhance route optimization, leading to time and fuel savings during long-haul flights. Maintenance scheduling and real-time fault reporting through EFB solutions contribute to higher aircraft availability and reduced downtime. These cost advantages are particularly important in highly competitive markets where margins are under pressure. As airlines focus on profitability, EFB adoption is expected to expand rapidly across regional and global operators.

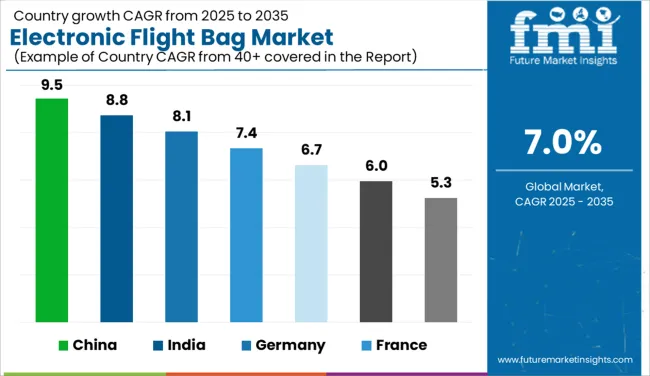

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The electronic flight bag market, projected to grow globally at 7.0% CAGR from 2025 to 2035, is witnessing significant regional variation. China leads with a 9.5% CAGR, driven by rapid fleet expansion and government-led digitalization initiatives in aviation. Increasing adoption of EFBs in new aircraft deliveries and the upgrade of legacy fleets to meet digital compliance standards have accelerated growth in this region. India follows with an 8.8% CAGR, supported by rising low-cost carrier penetration and regulatory requirements for digital documentation.

The growth trend is also strong in Germany (8.1%), fueled by adoption in premium and regional airline fleets, aided by strong avionics infrastructure. France records 7.4% CAGR, with emphasis on operational cost reduction through paperless cockpits. The UK and US show moderate growth at 6.7% and 6.0% CAGR, respectively, due to early saturation and slower fleet renewal cycles. However, ongoing integration of EFBs with predictive analytics and connectivity platforms is expected to maintain steady demand in these mature markets. The report provides an in-depth analysis of 40+ countries, with the top five countries highlighted for reference

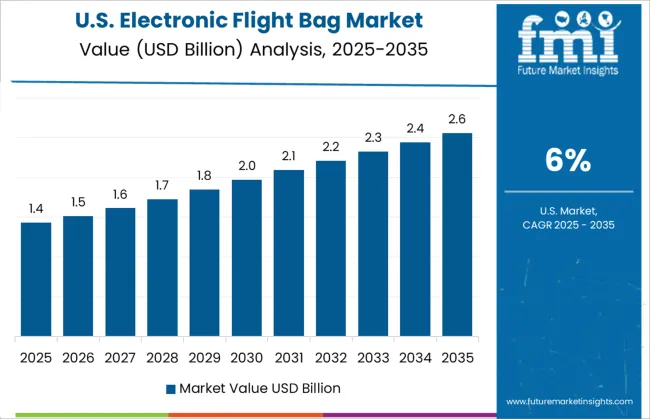

The CAGR for the electronic flight bag market in the USA increased from approximately 4.9% during 2020–2024 to 6.0% for 2025–2035, supported by continuous upgrades to cockpit technology and FAA-driven mandates for digital compliance. USA carriers adopted EFB solutions to streamline pre-flight and inflight operations, reducing manual documentation and enabling route optimization. Increasing integration with real-time data for weather updates and performance tracking improved operational efficiency. Regional airlines also embraced EFB deployment to reduce costs and enhance scheduling accuracy. With broadband connectivity expanding, predictive maintenance and data synchronization have accelerated.

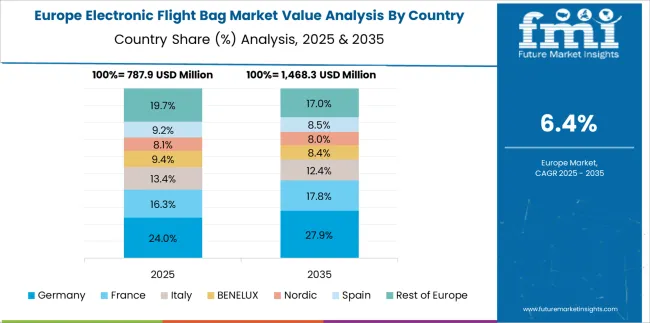

The CAGR in Germany shifted from nearly 6.4% during 2020–2024 to 8.1% during 2025–2035, driven by EASA compliance requirements and demand for digital cockpit solutions across premium airline fleets. EFB systems became central to enhancing pilot workflow, improving route efficiency, and reducing cockpit paperwork. German carriers increasingly deployed Class 2 and Class 3 EFB platforms integrated with avionics for real-time updates. These deployments supported predictive planning and improved fleet safety standards. Partnerships between technology providers and airlines accelerated platform customization to meet European operational norms, increasing the scope of EFB applications beyond navigation to performance monitoring.

The UK’s CAGR advanced from about 5.1% during 2020–2024 to 6.7% during 2025–2035, indicating renewed investment in cockpit digitalization among major carriers. Airlines adopted EFB solutions to meet CAA compliance mandates while improving fuel efficiency and route optimization. Low-cost carriers leveraged cost-effective EFB platforms for operational transparency and weight reduction, replacing traditional paper-based systems. Enhanced connectivity and broadband-based updates enabled integration with maintenance logs and flight planning systems. UK operators also implemented EFB-linked analytics for better decision-making during volatile weather conditions. Continuous regulatory support and competitive market conditions further accelerated adoption across commercial and business aviation sectors.

China’s CAGR surged from nearly 7.1% during 2020–2024 to 9.5% for 2025–2035, fueled by rapid fleet expansion and aggressive digital cockpit modernization programs. Government-backed digitalization policies enabled early adoption of connected EFB platforms, which streamlined route planning and performance tracking for domestic and international operations. Chinese carriers emphasized integrating EFB solutions into broader airline operations management systems, supporting real-time weather, fuel optimization, and compliance tracking. Regional aircraft operators adopted mobile-based Class 1 solutions for operational flexibility, while major carriers opted for advanced integrated Class 3 systems. Investments in cloud-based EFB analytics positioned China as a leading market for adoption.

India’s CAGR improved from around 6.0% during 2020–2024 to 8.8% during 2025–2035, driven by rapid expansion of low-cost carriers and DGCA mandates promoting paperless cockpit operations. Airlines invested in affordable, tablet-based EFB systems to reduce operational costs and comply with digital documentation standards. Growth in regional aviation, combined with demand for better route planning and fuel efficiency, supported adoption. Integration of EFB systems with mobile connectivity enabled faster updates for charts, weather, and flight planning tools. Strategic partnerships with software providers facilitated cost-effective solutions for budget airlines, while full-service carriers adopted advanced predictive analytics through connected EFB platforms.

The electronic flight bag (EFB) market is shaped by strategic initiatives from leading aviation and avionics companies focused on digital cockpit transformation and operational efficiency. Boeing plays a pivotal role with its Jeppesen EFB solutions, delivering real-time navigational data and route optimization capabilities for airlines worldwide. Honeywell International Inc. emphasizes advanced EFB software integrated with connectivity solutions for performance monitoring and in-flight updates. Collins Aerospace, a major avionics provider, delivers robust EFB platforms that integrate seamlessly with flight management systems, supporting predictive analytics and safety compliance. Thales Group drives innovation with EFB applications designed for enhanced situational awareness and connected flight operations. Astronautics Corporation of America focuses on portable and installed EFB solutions offering secure data transfer and user-friendly interfaces for regional and business aviation. Lufthansa Systems enhances operational efficiency through its Lido/Flight EFB applications, widely adopted by global carriers for optimized flight planning and documentation. Teledyne Technologies contributes by integrating EFB functionalities with advanced data analytics for performance tracking and predictive maintenance. These companies are prioritizing software-driven ecosystems, connected solutions, and compliance-driven technologies, ensuring that airlines transition toward fully digitized flight operations. Continuous innovation, partnerships with carriers, and global connectivity integration define their competitive edge in the rapidly expanding EFB market.

In November 2024, Lufthansa Systems launched a new update to its Lido mPilot navigation solution, enabling EFB displays on Airbus A350 cockpit screens by mirroring an iPad-based EFB.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 Billion |

| Type | Portable and Installed |

| Component | Hardware and Software |

| Platform | Commercial Aviation, Business and General Aviation, and Military Aviation |

| Application | Flight Planning, Weather Updates, Performance Calculations, E-manuals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Boeing, Honeywell International Inc., Collins Aerospace, Thales Group, Astronautics Corporation of America, Lufthansa Systems, and Teledyne Technologies |

| Additional Attributes | Dollar sales, share, regional growth trends, fleet adoption rates, class-wise segmentation (Class 1, 2, 3), competitive landscape, pricing benchmarks, regulatory compliance updates, connectivity integration, forecasted CAGR, and emerging airline procurement strategies. |

The global electronic flight bag market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the electronic flight bag market is projected to reach USD 6.5 billion by 2035.

The electronic flight bag market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in electronic flight bag market are portable and installed.

In terms of component, hardware segment to command 64.2% share in the electronic flight bag market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electronic Circulation Pump Market Size and Share Forecast Outlook 2025 to 2035

Electronic Lab Notebook (ELN) Market Size and Share Forecast Outlook 2025 to 2035

Electronic Control Unit in Automotive Systems Market Size and Share Forecast Outlook 2025 to 2035

Electronic Film Market Size and Share Forecast Outlook 2025 to 2035

Electronic Weighing Scale Market Size and Share Forecast Outlook 2025 to 2035

Electronic Packaging Adhesives Market Forecast and Outlook 2025 to 2035

Electronic Sealants Market Size and Share Forecast Outlook 2025 to 2035

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Electronic Expansion Valves Market Size and Share Forecast Outlook 2025 to 2035

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electronic Tactile Tester Market Size and Share Forecast Outlook 2025 to 2035

Electronic Trial Master File (eTMF) System Market Size and Share Forecast Outlook 2025 to 2035

Electronic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Electronic Grade Trisilylamine Market Size and Share Forecast Outlook 2025 to 2035

Electronically Scanned Arrays System Market Size and Share Forecast Outlook 2025 to 2035

Electronics Retailing Market Size and Share Forecast Outlook 2025 to 2035

Electronic Dictionary Market Size and Share Forecast Outlook 2025 to 2035

Electronic Shelf Label Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electronics Films Market Size and Share Forecast Outlook 2025 to 2035

Electronic Payment System For Transportation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA