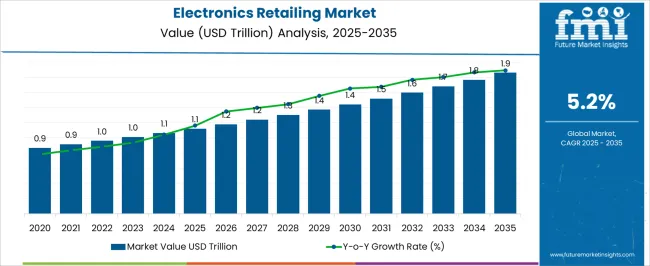

The Electronics Retailing Market is estimated to be valued at USD 1.1 trillion in 2025 and is projected to reach USD 1.9 trillion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Electronics Retailing Market Estimated Value in (2025 E) | USD 1.1 trillion |

| Electronics Retailing Market Forecast Value in (2035 F) | USD 1.9 trillion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The Electronics Retailing market is experiencing steady growth, driven by increasing consumer demand for electronic products, including smartphones, home appliances, computers, and entertainment devices. Growth is being supported by rising disposable incomes, urbanization, and greater penetration of organized retail chains across emerging and developed markets. The shift toward omnichannel retailing, combining physical stores with e-commerce platforms, is enhancing customer reach and improving convenience, which is further fueling market expansion.

Investments in supply chain optimization, digital marketing, and customer experience innovations are enabling retailers to maintain competitiveness. The market is also being influenced by rapid technological advancements in electronics, which increase product variety and encourage frequent upgrades by consumers.

Regulatory measures, warranty standards, and quality certifications are supporting consumer confidence in organized retail As digital transformation continues and consumer preferences evolve, electronics retailing is expected to witness sustained growth, with merchants leveraging data-driven strategies and efficient operations to drive sales and enhance profitability.

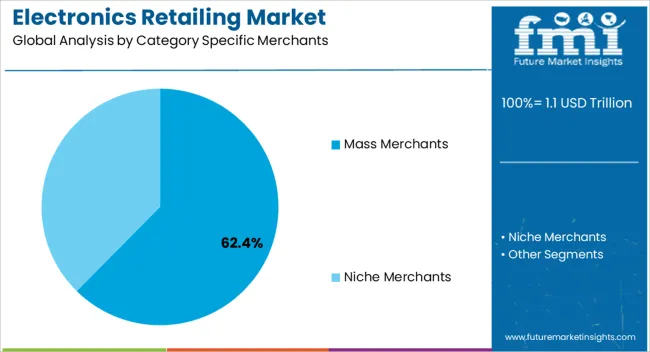

The electronics retailing market is segmented by category specific merchants, and geographic regions. By category specific merchants, electronics retailing market is divided into Mass Merchants and Niche Merchants. Regionally, the electronics retailing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mass merchants segment is projected to hold 62.4% of the market revenue in 2025, establishing it as the leading category within electronics retailing. Its growth is being driven by the ability to offer a wide range of electronic products at competitive prices, appealing to price-sensitive and value-conscious consumers. Large-scale distribution networks and economies of scale enable mass merchants to maintain cost efficiency while providing convenience and extensive product selection under one roof.

Integration of digital platforms, loyalty programs, and in-store promotions enhances customer engagement and drives repeat purchases. The flexibility to adapt to seasonal demand fluctuations and promotional campaigns further strengthens their market position.

Mass merchants are also investing in advanced inventory management, point-of-sale technologies, and omnichannel strategies, allowing seamless shopping experiences As consumer preference shifts toward convenient, reliable, and competitively priced electronics purchasing, the mass merchants segment is expected to maintain its leading position, driven by scale, operational efficiency, and evolving customer expectations.

The use of advanced technical products such as laptop, mobile phones have given a new platform for shopping. By using internet, a person can buy any product through virtual stores like websites, mobile apps/portals which are becoming totally new perspective of shopping & proving beneficial for both the seller as well as the buyers.

The term electronic retailing also be called as E-tailing where ‘E’ stands for the electronics medium since the retailing starts through the internet (electronic media). With the use of these shopping websites/portals customer can visit the virtual store and choose their preferred product in the shopping cart by seeing its pictures, features, and price.

After that payment can be made by different methods mentioned by shopping site and then product would be delivered to customer’s doorstep by an associated courier company of shopping site.

The success of electronic retailing depends on various factors/components such as online portal attractiveness, appropriate revenue model and last but not least penetration over internet.

Electronic retailing is a rapidly growing segment of e-commerce with the attractive services provided by the vendors and is expected to grow in future as well.

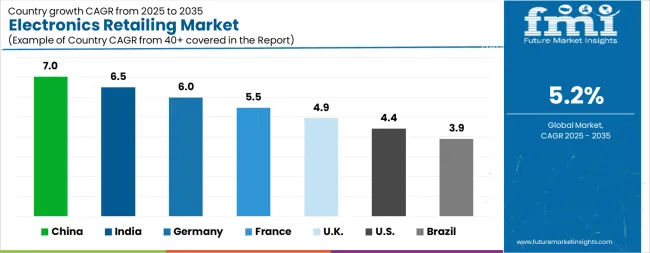

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The Electronics Retailing Market is expected to register a CAGR of 5.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.0%, followed by India at 6.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.9%, yet still underscores a broadly positive trajectory for the global Electronics Retailing Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.0%. The USA Electronics Retailing Market is estimated to be valued at USD 385.5 trillion in 2025 and is anticipated to reach a valuation of USD 594.1 trillion by 2035. Sales are projected to rise at a CAGR of 4.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 51.9 trillion and USD 37.9 trillion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Trillion |

| Category Specific Merchants | Mass Merchants and Niche Merchants |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

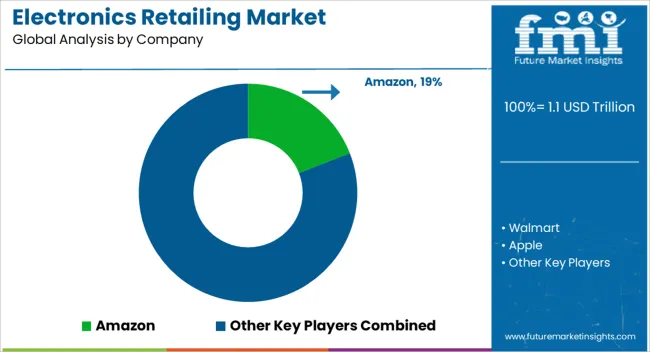

| Key Companies Profiled | Amazon, Walmart, Apple, BestBuy, Dell, Samsung, LG Electronics, Staples, Panasonic, and Haier Group |

The global electronics retailing market is estimated to be valued at USD 1.1 trillion in 2025.

The market size for the electronics retailing market is projected to reach USD 1.9 trillion by 2035.

The electronics retailing market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in electronics retailing market are mass merchants and niche merchants.

In terms of , segment to command 0.0% share in the electronics retailing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electronics Films Market Size and Share Forecast Outlook 2025 to 2035

Electronics Cleaning Solvents Market - Growth & Demand 2025 to 2035

Electronics Accessories Market Report – Trends & Forecast 2015-2025

2D Electronics Market

HIFI Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Green Electronics Manufacturing Market – Sustainability & Trends 2025 to 2035

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Printed Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Defense Electronics Obsolescence Market Size and Share Forecast Outlook 2025 to 2035

Printed Electronics Devices Market Size and Share Forecast Outlook 2025 to 2035

Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wearable Electronics Market Size and Share Forecast Outlook 2025 to 2035

Consumer Electronics High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Graphene Electronics Market Size and Share Forecast Outlook 2025 to 2035

Consumer Electronics Market - Trends, Growth & Forecast 2025 to 2035

Market Share Insights for Consumer Electronics Packaging Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA