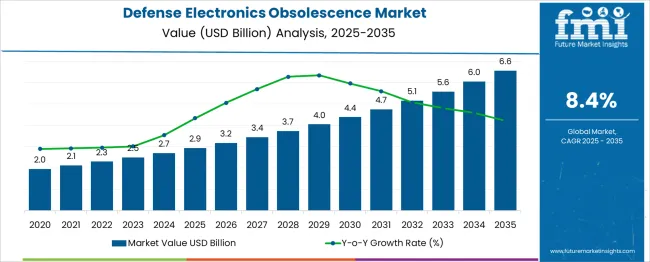

The Defense Electronics Obsolescence Market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 6.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period. This growth is supported by a steady CAGR of 8.4%, driven by the need for defense contractors to manage and mitigate the risks associated with aging electronic systems. During the first five-year phase (2025–2030), the market is expected to expand from USD 2.9 billion to USD 4.1 billion, adding USD 1.2 billion, which accounts for 32.4% of the total incremental growth, fueled by increased defense budgets and modernization efforts. The second phase (2030–2035) contributes USD 2.5 billion, representing 67.6% of incremental growth, reflecting accelerating efforts to extend the life cycle of critical defense systems and integrate newer technologies.

Annual increments will rise from USD 0.3 billion in early years to USD 0.5 billion by 2035, driven by the growing need for electronic component replacements, upgrades, and integration with cutting-edge technologies in defense applications. Companies focusing on supply chain management, component replacements, and developing solutions for legacy systems will capture the largest share of this USD 3.7 billion opportunity.

| Metric | Value |

|---|---|

| Defense Electronics Obsolescence Market Estimated Value in (2025 E) | USD 2.9 billion |

| Defense Electronics Obsolescence Market Forecast Value in (2035 F) | USD 6.6 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The defense electronics obsolescence market is witnessing heightened demand driven by the rapid pace of technological evolution, legacy system dependencies, and increasing global defense modernization programs. As militaries extend the lifecycle of platforms while integrating newer capabilities, the challenge of managing obsolete components has grown significantly. Defense contractors and OEMs are prioritizing obsolescence mitigation strategies, integrating advanced tools for forecasting, inventory risk management, and secure component sourcing.

Governments are emphasizing secure domestic supply chains and modular open systems approaches to mitigate vendor lock-in and support future upgrades. Additionally, the growing reliance on software-defined architectures and AI-driven condition-based maintenance is enhancing the need for digital tools that support proactive obsolescence tracking.

Budget allocations toward sustainment and platform availability have increased, further supporting investments in predictive monitoring and lifecycle management tools. As long-term fleet readiness becomes a critical objective, the market is expected to expand steadily, especially in advanced economies and allied defense networks.

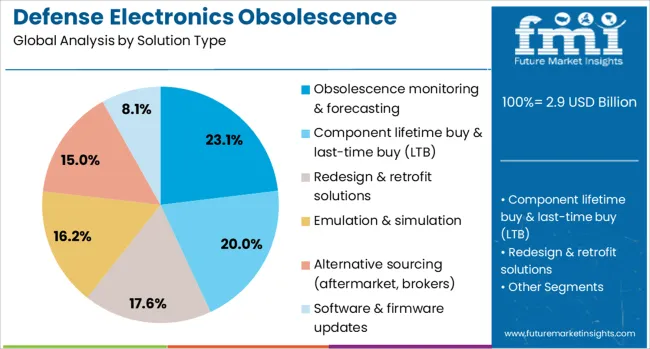

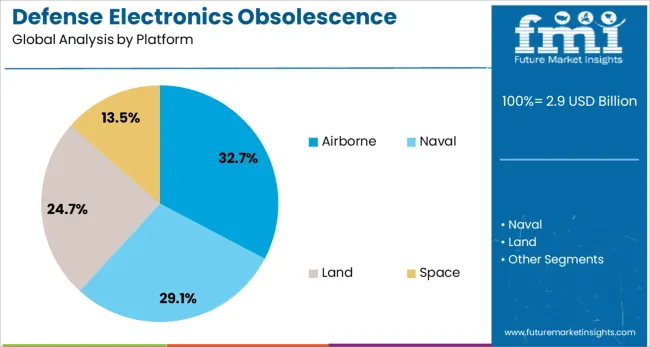

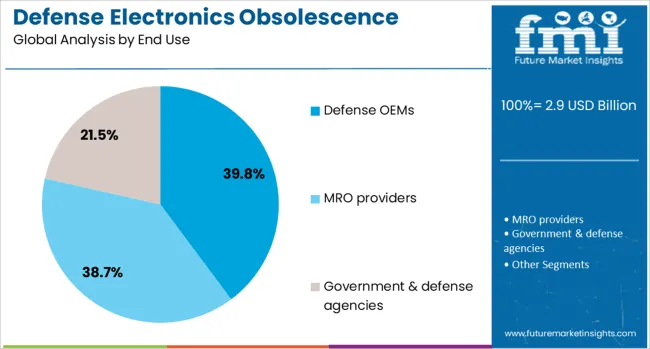

The defense electronics obsolescence market is segmented by solution type, platform, end use, and geographic regions. The defense electronics obsolescence market is divided into Obsolescence monitoring & forecasting, Component lifetime buy & last-time buy (LTB), Redesign & retrofit solutions, Emulation & simulation, Alternative sourcing (aftermarket, brokers), Software & firmware updates. In terms of the platform, the defense electronics obsolescence market is classified into Airborne, Naval, and Land. Based on end use, the defense electronics obsolescence market is segmented into Defense OEMs, MRO providers, and Government & defense agencies. Regionally, the defense electronics obsolescence industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The obsolescence monitoring and forecasting segment is projected to hold 23.1% of total revenue within the solution type category in 2025, positioning it as the leading segment. This prominence is driven by the increasing importance of real-time visibility into component lifecycles and the need for proactive planning to avoid mission-critical disruptions.

Tools that provide end-of-life notifications, supplier availability insights, and multi-tier risk assessments have become central to obsolescence strategies adopted by defense contractors and integrators. The growing adoption of digital twins and AI-powered analytics platforms has further enhanced forecasting accuracy, enabling better inventory control and sourcing agility.

Moreover, the pressure to maintain readiness of aging platforms while securing critical components has solidified this segment's position in the overall market, especially as global defense ecosystems push toward sustainment-centric procurement strategies.

The airborne platform segment is expected to account for 32.7% of total revenue in 2025, marking it as the leading platform category within the defense electronics obsolescence market. This dominance is attributed to the complexity, longevity, and mission-critical nature of avionics systems, where obsolescence can severely impact platform availability and safety.

Airborne platforms often have operational life spans extending over decades, requiring continuous upgrades, part replacements, and subsystem compatibility assessments. Increased deployment of surveillance aircraft, combat jets, and unmanned aerial vehicles has heightened the need for comprehensive lifecycle support and upgrade planning.

The integration of software-intensive systems and the demand for modular open architecture designs have further underscored the need for robust obsolescence management, making airborne systems a focal point for strategic investment and innovation.

Within the end use category, defense OEMs are projected to capture 39.8% of the market’s total revenue share in 2025, emerging as the dominant stakeholder. This leadership is underpinned by the OEMs’ critical role in long-term platform sustainment, systems integration, and end-to-end component management.

As prime contractors face mounting pressure to ensure platform readiness and reduce lifecycle costs, investment in predictive obsolescence tools and secure supply chain frameworks has intensified. OEMs are actively partnering with technology providers to incorporate AI-enabled monitoring systems, digital BOM repositories, and component health analytics into their production and support models.

Additionally, OEMs are increasingly held accountable under performance-based logistics and availability-based contracts, reinforcing the need to address obsolescence risks at the design and manufacturing stages. This segment’s strength is expected to persist as global defense programs prioritize through-life support, modernization cycles, and electronic component resilience.

The defense electronics obsolescence market is driven by the growing need for maintaining the longevity of legacy defense systems and avoiding costly upgrades. Growth drivers include rising defense budgets and modernization initiatives. Opportunities arise in the refurbishment and life extension of existing systems. Emerging trends include the development of modular and adaptable defense electronics. However, the market faces restraints such as high costs associated with retrofitting and the challenge of balancing modern requirements with older technology.

The primary growth driver in the defense electronics obsolescence market is the rising defense budgets globally, coupled with the need to modernize aging defense systems. In 2024, several governments began prioritizing upgrades to their military infrastructures, leading to a demand for solutions to combat electronic obsolescence. These efforts have led to an increasing need for cost-effective methods of extending the life of existing military hardware, thereby ensuring operational continuity without full system overhauls.

Opportunities in the defense electronics obsolescence market are found in the refurbishment and life extension of outdated systems. In 2025, defense contractors began focusing on providing maintenance and retrofitting solutions to extend the operational life of defense electronics. This approach reduces the need for costly replacements while improving system capabilities. As military forces aim to optimize budgets, refurbishment services for legacy systems are gaining traction, providing a viable solution for extending defense asset longevity.

Emerging trends in the defense electronics obsolescence market include the adoption of modular and adaptable electronics. In 2024, the shift toward modular defense systems began, allowing for easier upgrades and replacements of outdated components without overhauling entire systems. This trend is expected to enhance the flexibility and scalability of defense electronics while reducing the impact of obsolescence. As defense budgets remain constrained, these trends will shape the future of defense electronics by enabling long-term adaptability.

The major market restraints for the defense electronics obsolescence market include the high costs of retrofitting legacy systems and the challenges posed by compatibility issues. In 2024 and 2025, upgrading older electronics to meet current technological standards required significant investments in both time and money. Additionally, ensuring compatibility between new components and older systems remained a challenge, hindering the full potential of some defense modernization efforts. These barriers pose ongoing difficulties for widespread adoption of obsolescence management strategies.

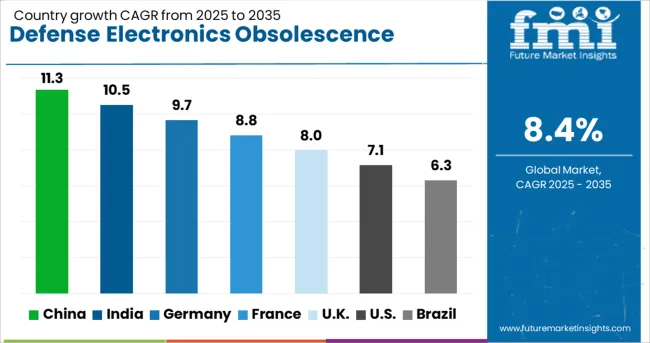

| Country | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK | 8.0% |

| USA | 7.1% |

| Brazil | 6.3% |

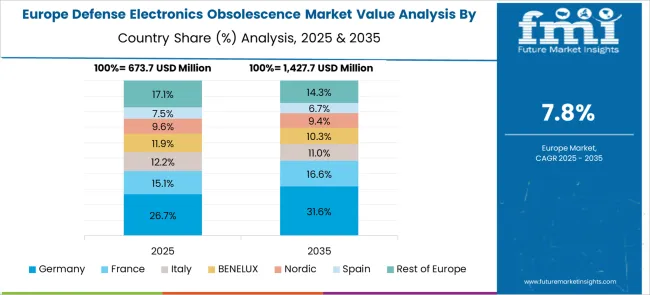

The global defense electronics obsolescence market is projected to grow at a CAGR of 8.4% from 2025 to 2035. China leads the market with a remarkable growth rate of 11.3%, followed by India at 10.5%, and France at 8.8%. The United Kingdom records a growth rate of 8.0%, while the United States shows the slowest growth among the profiled markets at 7.1%. These varying growth rates are largely influenced by the pace of defense modernization, technological advancements, and the need to address obsolescence in military systems. While countries like China and India are rapidly upgrading their defense electronics capabilities, more mature markets like the USA and the UK are facing slower growth due to the saturation of existing defense infrastructure.

The defense electronics obsolescence market in China is growing at a strong pace, with a projected CAGR of 11.3%. The country’s ongoing defense modernization program, which includes the upgrade of electronic systems in military aircraft, naval vessels, and ground vehicles, is driving this growth. With an increasing focus on advanced technologies like AI, radar systems, and electronic warfare, China is actively addressing the challenge of obsolescence in its defense electronics. Additionally, China’s expanding defense budget and emphasis on self-reliance in military technology further fuel the demand for solutions that mitigate the risks of outdated defense systems.

The defense electronics obsolescence market in India is projected to grow at a CAGR of 10.5%. The country’s defense sector is undergoing significant modernization, with the Indian government focusing on the upgrade of legacy military systems to more advanced electronics. As India continues to expand its defense capabilities, addressing obsolescence becomes crucial in ensuring the efficiency and reliability of military operations. The increasing emphasis on indigenization and the adoption of cutting-edge defense technologies are driving the demand for solutions that help extend the lifecycle of electronic systems, while also improving operational effectiveness.

The defense electronics obsolescence market in France is expected to grow at a CAGR of 8.8%. France’s defense sector is heavily invested in upgrading military equipment to meet modern challenges, particularly with electronic systems in aircraft, tanks, and naval vessels. The country’s commitment to improving defense capabilities within NATO frameworks and its ongoing participation in international peacekeeping missions necessitate the use of the latest defense electronics. Additionally, France’s focus on reducing the risks of obsolescence in defense electronics is supported by significant investments in research and development and the adoption of new technologies like cyber-defense systems.

The defense electronics obsolescence market in the United Kingdom is projected to grow at a CAGR of 8.0%. The UK’s defense sector is focusing on modernizing its military equipment, especially to address the obsolescence of legacy systems in land, air, and sea platforms. With rising concerns about maintaining operational efficiency and ensuring interoperability in NATO-led operations, the UK is investing in the upgrading of defense electronics. The country’s defense strategies, which include expanding capabilities in cybersecurity, radar systems, and autonomous vehicles, further drive the demand for modern electronic systems to replace outdated ones.

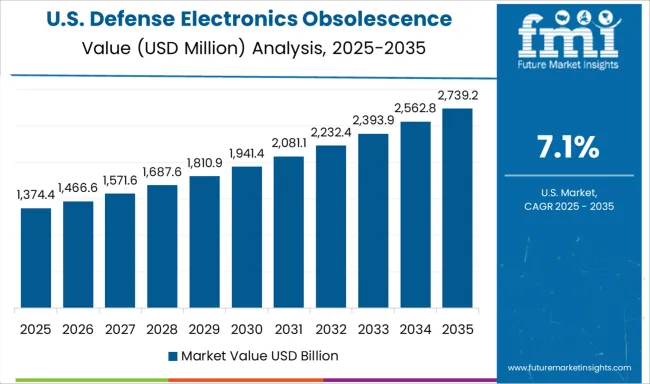

The defense electronics obsolescence market in the United States is expected to grow at a slower pace, with a CAGR of 7.1%. While the USA is a global leader in defense technology, the market for upgrading and replacing outdated electronics is growing as the country faces challenges in maintaining and modernizing its extensive military infrastructure. The USA Department of Defense’s initiatives to modernize aging military assets, including advanced fighter jets, naval vessels, and missile defense systems, are key drivers of this market. Despite the slower growth, ongoing technological advancements in AI, electronic warfare, and cybersecurity continue to contribute to the demand for defense electronics obsolescence solutions.

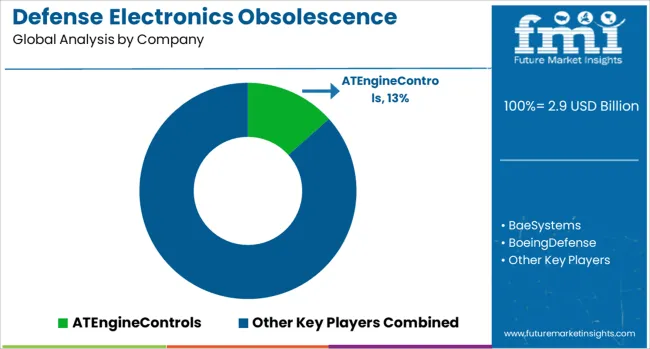

The defense electronics obsolescence market is dominated by ATEngineControls, which leads with a broad range of solutions designed to address the challenges of electronic component obsolescence in defense systems. ATEngineControls strengthens its dominance by offering innovative technology solutions, including life cycle management, parts replacement, and obsolescence forecasting to extend the service life of critical military electronics. Key players such as BAE Systems, Boeing Defense, L3Harris Technologies, and Lockheed Martin maintain significant market shares by providing end-to-end solutions for managing obsolescence in defense electronics, including software and hardware upgrades and system integration.

These companies focus on minimizing the risk of equipment failure while ensuring operational continuity in defense and aerospace applications. Emerging players like Leonardo, Mercury Systems, Thales Group, and Teledyne Technologies are expanding their market presence by offering tailored obsolescence management solutions for specific military platforms and defense technologies. Their strategies include developing more robust supply chains, improving component tracking, and integrating advanced analytics to predict and manage obsolescence risks more effectively. Market growth is driven by increasing defense modernization programs, the rising need for long-term support of legacy systems, and advancements in electronic components that address the evolving threats and technologies in the defense sector. Innovations in component sourcing, hardware redesign, and predictive maintenance are expected to shape competitive dynamics and drive growth in the global defense electronics obsolescence market.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Solution Type | Obsolescence monitoring & forecasting, Component lifetime buy & last-time buy (LTB), Redesign & retrofit solutions, Emulation & simulation, Alternative sourcing (aftermarket, brokers), and Software & firmware updates |

| Platform | Airborne, Naval, Land, and Space |

| End Use | Defense OEMs, MRO providers, and Government & defense agencies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ATEngineControls, BaeSystems, BoeingDefense, L3HarrisTechnologies, Leonardo, LockheedMartin, Lynx, MercurySystems, NorthropGrumman, Rheinmetall, RTX, SaabRDS, SMTCorp, TeledyneTechnologies, ThalesGroup, and TTElectronics |

| Additional Attributes | Dollar sales by electronic component type and application, demand dynamics across defense contractors, military systems, and aerospace sectors, regional trends in defense electronics obsolescence management, innovation in lifecycle management and repair technologies, impact of regulatory standards on defense procurement, and emerging use cases in advanced military systems and legacy equipment upgrades. |

The global defense electronics obsolescence market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the defense electronics obsolescence market is projected to reach USD 6.6 billion by 2035.

The defense electronics obsolescence market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in defense electronics obsolescence market are obsolescence monitoring & forecasting, component lifetime buy & last-time buy (ltb), redesign & retrofit solutions, emulation & simulation, alternative sourcing (aftermarket, brokers) and software & firmware updates.

In terms of platform, airborne segment to command 32.7% share in the defense electronics obsolescence market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA