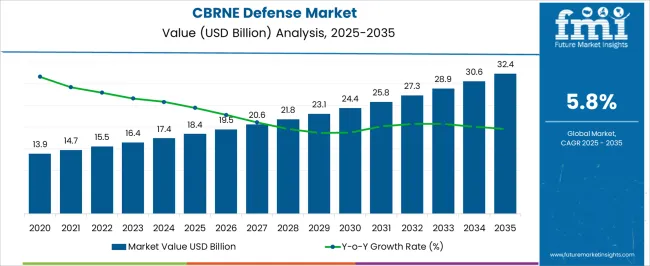

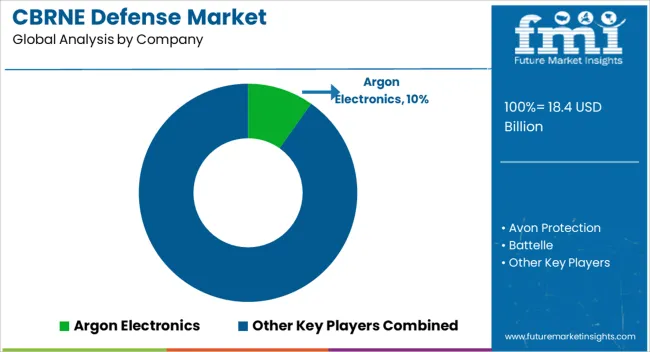

The CBRNE defense market, estimated at USD 18.4 billion in 2025 and forecasted to reach USD 32.4 billion by 2035 with a CAGR of 5.8%, is deeply shaped by regulatory frameworks that prioritize public safety, international security, and compliance with non-proliferation treaties. Regulatory oversight influences product development, procurement, and deployment strategies, particularly given the dual civilian and military applications of CBRNE defense systems.

International treaties such as the Chemical Weapons Convention, Biological Weapons Convention, and Nuclear Non-Proliferation Treaty form a strong foundation for mandatory compliance, ensuring the adoption of standardized defense protocols. Governments in North America and Europe enforce stringent procurement requirements for detection, decontamination, and protective systems, which encourage consistent investments in research and deployment. Export control regulations also play a pivotal role, especially in the movement of sensitive detection and protective technologies across borders. The regulatory impact extends into civil defense and emergency preparedness, where national mandates require readiness against radiological and nuclear incidents.

Furthermore, harmonization of standards across agencies such as NATO, the International Atomic Energy Agency, and national defense authorities ensures interoperability of equipment and systems. As funding allocations increasingly align with these mandates, the regulatory environment will remain a central driver in sustaining the market’s progression toward USD 32.4 billion by 2035.

| Metric | Value |

|---|---|

| CBRNE Defense Market Estimated Value in (2025 E) | USD 18.4 billion |

| CBRNE Defense Market Forecast Value in (2035 F) | USD 32.4 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The CBRNE defense market represents a critical segment within the global defense and homeland security industry, emphasizing protection against chemical, biological, radiological, nuclear, and explosive threats. Within the overall defense technology market, it accounts for about 4.7%, driven by military preparedness and civil security initiatives. In the homeland security and emergency response sector, it holds nearly 5.1%, reflecting adoption of detection systems, protective gear, and decontamination solutions. Across the specialized equipment and defense systems market, the segment captures 3.9%, supporting surveillance, reconnaissance, and rapid response applications.

Within the public safety and disaster management category, it represents 3.5%, highlighting integration with detection networks and communication systems. In the critical infrastructure protection sector, it secures 3.2%, underscoring its role in safeguarding airports, ports, and urban centers. Recent developments in this market have focused on advanced detection, interoperability, and rapid response systems. Innovations include portable biosensors, AI-driven chemical detectors, and next-generation protective suits with improved comfort and resistance. Key players are collaborating with governments, military agencies, and research institutions to enhance preparedness and resilience against unconventional threats. Integration of unmanned aerial vehicles for remote detection and robotic systems for decontamination is gaining traction.

The CBRNE (Chemical, Biological, Radiological, Nuclear, and Explosives) defense market is experiencing consistent expansion, driven by evolving global security threats, rising geopolitical tensions, and the increasing frequency of hazardous incidents. Defense agencies and government organizations are prioritizing investments in advanced detection, protection, and decontamination solutions to enhance preparedness and response capabilities.

Industry briefings and defense procurement updates have highlighted a shift toward integrated CBRNE defense systems that combine real-time monitoring with rapid deployment capabilities. Technological innovations, such as sensor miniaturization, advanced filtration materials, and AI-assisted threat analysis, are further strengthening operational efficiency in field environments.

International collaborations and joint training programs between allied nations are also fostering standardization of protocols and interoperability of equipment. The market outlook is supported by steady funding allocations, both for modernizing existing protective infrastructure and for developing next-generation defense technologies. In the coming years, chemical threat mitigation, protective wearables, and defense and government end-use will continue to dominate segmental demand, reflecting their strategic importance in national security frameworks.

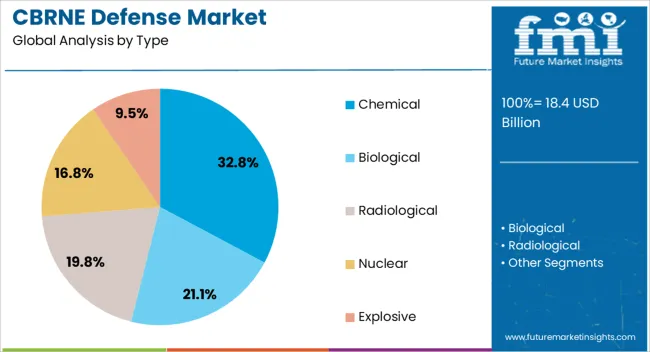

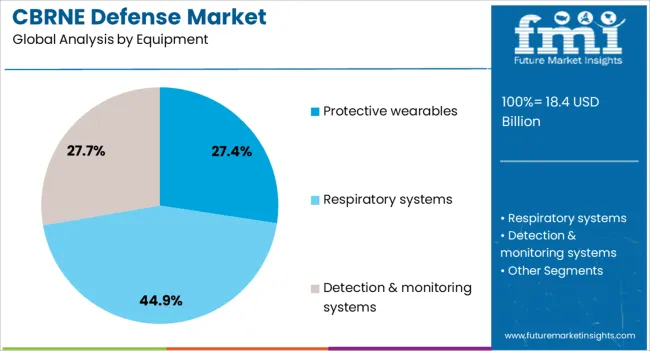

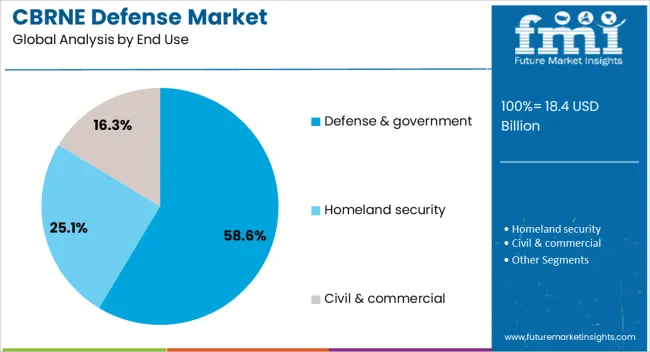

The CBRNE defense market is segmented by type, equipment, end use, and geographic regions. By type, the CBRNE defense market is divided into Chemical, Biological, Radiological, Nuclear, and Explosive. In terms of equipment, the CBRNE defense market is classified into Protective wearables, Respiratory systems, Detection & monitoring systems, Decontamination systems, and Simulators. Based on end use, the CBRNE defense market is segmented into Defense & government, Homeland security, and Civil & commercial. Regionally, the CBRNE defense industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The chemical segment is projected to account for 32.8% of the CBRNE defense market revenue in 2025, maintaining its position as the largest type category. This dominance is driven by the high incidence of chemical threats in both military conflicts and terrorist activities.

Reports from defense research organizations have emphasized that chemical agents pose immediate and large-scale health hazards, necessitating rapid detection, containment, and neutralization. Governments have prioritized chemical defense programs due to the persistence and toxicity of many chemical agents, leading to sustained investment in detection systems, personal protective equipment, and decontamination solutions.

Additionally, international compliance with agreements such as the Chemical Weapons Convention has prompted the adoption of advanced chemical defense measures. The segment’s growth is further supported by technological progress in portable chemical detection devices and enhanced filtration materials for protective gear, ensuring frontline readiness against chemical hazards.

The Protective Wearables segment is expected to hold 27.4% of the CBRNE defense market revenue in 2025, reflecting its critical role in safeguarding personnel during hazardous operations. This segment’s expansion is fueled by rising demand for lightweight, ergonomically designed protective suits, masks, gloves, and boots that offer extended operational comfort without compromising safety.

Defense procurement records and industry developments have highlighted the shift toward advanced materials with improved chemical, biological, and radiological resistance, coupled with high breathability and durability.

Integration of wearable sensors for physiological monitoring and environmental hazard detection has further enhanced functionality, enabling real-time threat assessment for personnel in the field. The strategic necessity of ensuring troop readiness in hostile environments has led to continuous government funding and long-term supply contracts for protective wearable manufacturers, solidifying the segment’s market position.

The Defense & Government segment is projected to capture 58.6% of the CBRNE defense market revenue in 2025, reinforcing its role as the primary end-use sector. This dominance stems from the sector’s responsibility for national security, emergency preparedness, and rapid response to CBRNE threats.

Defense ministries and homeland security agencies have significantly increased budget allocations for modernizing CBRNE capabilities, focusing on integrated detection networks, mobile response units, and specialized training.

Government-led initiatives have also facilitated research collaborations with private industry to accelerate innovation in threat mitigation. Furthermore, international security alliances and joint military exercises have promoted the adoption of standardized CBRNE defense systems across member states, ensuring operational interoperability. With the persistent risk of both state and non-state actors deploying hazardous materials, defense and government agencies remain the primary drivers of demand for CBRNE defense technologies and equipment.

The market has emerged as a crucial segment within global security and defense strategies, focusing on protection against chemical, biological, radiological, nuclear, and explosive threats. Governments, defense forces, and specialized agencies have prioritized investments in advanced detection, decontamination, and protective equipment to mitigate risks associated with both state and non-state actors. Modern CBRNE defense solutions integrate sensor technologies, unmanned platforms, protective suits, and emergency response systems, ensuring preparedness during both military operations and civilian emergencies. Rising geopolitical tensions, terrorism risks, and regulatory mandates for safety compliance have accelerated the need for stronger capabilities.

Government expenditure has played a decisive role in expanding the CBRNE defense market, with many nations increasing their budget allocations toward protective and detection systems. Investments are directed toward modernizing armed forces, strengthening civil defense, and improving disaster preparedness frameworks. Nations with heightened exposure to geopolitical risks or terrorist activities have accelerated procurement of specialized CBRNE defense systems. Long-term contracts with defense contractors have been established for the supply of protective gear, decontamination units, and detection devices. Training programs and joint exercises are also supported by defense spending, ensuring that personnel are equipped to handle potential threats. This consistent financial support has provided stability to the market and has encouraged innovation from suppliers seeking to meet evolving security requirements.

Significant advancements in detection and decontamination technologies have strengthened the operational capabilities of CBRNE defense systems. Modern sensor-based solutions, capable of identifying even trace levels of hazardous substances, have improved early-warning systems for military and civilian applications. Automated decontamination units and mobile platforms have been designed for faster deployment in contaminated zones. The use of artificial intelligence and data analytics has enhanced threat assessment, enabling quicker decision-making. Protective materials with improved resistance and reduced weight have been developed, increasing the efficiency and comfort of field personnel. These technological advancements have broadened application in emergency response and public safety beyond military use. As threats continue to evolve, innovation in CBRNE defense technologies remains central to maintaining preparedness and minimizing the impact of hazardous incidents.

Unmanned and autonomous systems have gained significant relevance in the market, driven by the need to minimize human exposure to hazardous environments. Unmanned aerial vehicles, ground robots, and autonomous detection platforms are being deployed to survey contaminated areas, collect samples, and deliver countermeasures. These systems offer operational flexibility, reduced risk, and faster response times in scenarios where human intervention would be unsafe. Integration with advanced sensors, communication networks, and real-time data processing has increased the effectiveness of unmanned operations. Defense organizations are investing heavily in these systems to strengthen reconnaissance and tactical response capabilities. The incorporation of robotics into defense frameworks has reshaped strategies, enabling military and civil defense agencies to manage CBRNE threats with greater precision and reduced human vulnerability.

Despite advancements, the market continues to face challenges related to logistics, training, and standardization. Transporting and maintaining specialized equipment requires significant investment and planning, which complicates deployment during emergencies. In many regions, the shortage of trained personnel restricts the effective use of advanced defense systems. Standardization across countries is also limited, leading to interoperability challenges in multinational operations. Civil defense agencies often struggle with budgetary constraints, affecting procurement and readiness. Furthermore, complex regulatory frameworks can slow down the adoption of innovative technologies. Addressing these challenges requires greater international collaboration, investment in workforce training, and the development of standardized protocols. Without improvements in these areas, the effectiveness of CBRNE defense operations could be undermined despite strong technological capabilities.

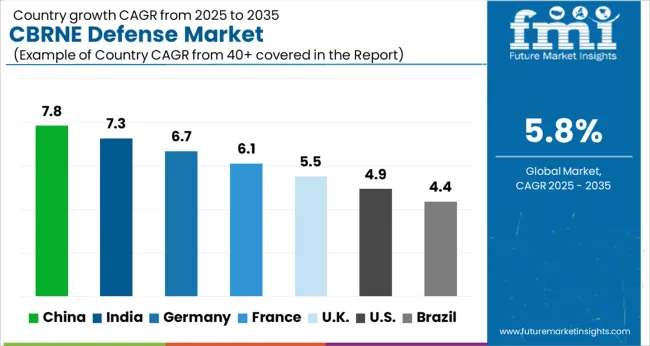

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

China leads the market with a projected growth rate of 7.8%, influenced by strong investments in military modernization and the adoption of advanced detection systems. India follows at 7.3%, where increasing security concerns and border safety measures have encouraged the adoption of specialized protective technologies. Germany, with 6.7%, demonstrates steady progress supported by its research-driven initiatives and commitment to equipping defense forces with sophisticated countermeasure systems. The United Kingdom records 5.5%, reflecting rising focus on preparedness strategies and enhanced response frameworks. The United States shows a 4.9% growth rate, driven by continued procurement of protective equipment and advancements in biodefense solutions. Together, these leading countries illustrate the evolving role of CBRNE defense technologies in strengthening national security and public safety. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expected to expand at a CAGR of 7.8%, driven by continuous investments in military modernization and public safety infrastructure. Heightened focus on preparedness against chemical, biological, radiological, nuclear, and explosive threats has reinforced demand for detection, protection, and decontamination systems. Advanced sensor technologies and domestic production capabilities are being prioritized to reduce reliance on imports. Collaboration between defense research organizations and state-owned enterprises is fueling innovation in protective gear and rapid detection equipment. Additionally, urban disaster management planning and border security requirements are further accelerating market adoption. The integration of artificial intelligence in surveillance and monitoring systems is also being explored to enhance early-warning capabilities.

India’s market is projected to grow at a CAGR of 7.3%, supported by rising defense expenditure and emphasis on counter-terrorism preparedness. Strategic importance of CBRNE defense has been reinforced by regional security challenges and the need to safeguard densely populated urban centers. Investments in indigenous defense manufacturing are strengthening the availability of advanced detection systems and protective equipment. Collaborative projects between Indian research agencies and global defense companies are creating opportunities for technology transfer and innovation. Growing emphasis on training programs for first responders and military personnel is also enhancing operational readiness. National policies focused on enhancing nuclear and biological threat preparedness are expected to keep demand strong.

Germany is forecasted to grow at a CAGR of 6.7%, influenced by strong emphasis on homeland security and NATO commitments. Investments in advanced detection systems and decontamination solutions are shaping the market outlook. German defense agencies are adopting portable and integrated technologies that improve efficiency in identifying CBRNE threats. Public safety initiatives and preparedness for cross-border emergencies have further encouraged adoption of reliable protective gear. Research institutes and defense technology companies are actively developing next-generation biosensors and automated monitoring systems. Germany’s strong focus on interoperability within European defense networks is expected to enhance demand for standardized and efficient CBRNE defense systems.

The market in the United Kingdom is set to expand at a CAGR of 5.5%, supported by rising investments in national security and counter-terrorism measures. Increased preparedness against potential biological and chemical threats has encouraged adoption of advanced protective and decontamination solutions. Government-led programs are focusing on enhancing rapid response capabilities for first responders and military units. Integration of mobile detection units and field-ready protective equipment is gaining momentum. British defense suppliers are also collaborating with global technology leaders to strengthen innovation and improve system interoperability. With a heightened focus on cross-border defense cooperation, the UK market is expected to experience steady demand in the coming years.

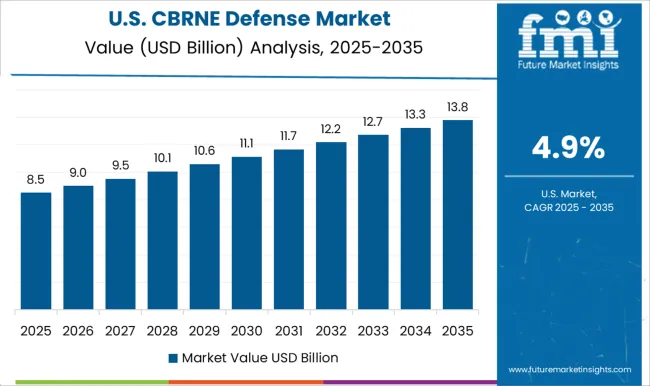

The market in the United States is projected to register a CAGR of 4.9%, fueled by increasing investments in homeland security, military defense, and emergency response systems. Rising concerns over chemical and biological threats have encouraged procurement of advanced detection and monitoring technologies. Federal agencies are actively supporting research in wearable protective gear, autonomous detection systems, and AI-based threat modeling. Emergency preparedness programs are being enhanced through simulation training and cross-agency collaborations. Significant funding for biodefense initiatives is also driving market adoption. Integration of advanced technologies with existing defense infrastructure is expected to further strengthen operational resilience against CBRNE threats in the United States.

The market is driven by growing emphasis on national security, preparedness, and protection against chemical, biological, radiological, nuclear, and explosive threats. Leading companies such as Thales, Rheinmetall, and Saab are at the forefront, developing integrated detection and protection systems for armed forces and homeland security. Teledyne FLIR and Bruker specialize in advanced detection technologies that enable rapid identification of hazardous substances, enhancing operational safety. Avon Protection and Smiths Group strengthen the market with protective gear and sensor systems that ensure frontline defense. Battelle and Chemring Group contribute significantly with research-led innovations and specialized countermeasure solutions.

Argon Electronics supports training and simulation programs, ensuring preparedness across defense and emergency response units. INDRA and KNDS expand their influence through defense electronics and military platforms integrated with CBRNE capabilities. Karcher Futuretech plays a key role in decontamination systems, while Leidos delivers solutions combining data analytics, AI, and sensor technologies for real-time threat monitoring. Collaboration among global defense firms and rising investments in technological advancements are reshaping the competitive landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.4 Billion |

| Type | Chemical, Biological, Radiological, Nuclear, and Explosive |

| Equipment | Protective wearables, Respiratory systems, Detection & monitoring systems, Decontamination systems, and Simulators |

| End Use | Defense & government, Homeland security, and Civil & commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Argon Electronics, Avon Protection, Battelle, Bruker, Chemring Group, INDRA, Karcher Futuretech, KNDS, Leidos, Rheinmetall, Saab, Smiths Group, Teledyne FLIR, and Thales |

| Additional Attributes | Dollar sales by equipment type and application, demand dynamics across military, homeland security, and emergency response sectors, regional trends in CBRNE preparedness and adoption, innovation in detection technologies, protective gear, and decontamination systems, environmental impact of material disposal and contamination risks, and emerging use cases in border security, disaster management, and critical infrastructure protection. |

The global CBRNE defense market is estimated to be valued at USD 18.4 billion in 2025.

The market size for the CBRNE defense market is projected to reach USD 32.4 billion by 2035.

The CBRNE defense market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in CBRNE defense market are chemical, biological, radiological, nuclear and explosive.

In terms of equipment, protective wearables segment to command 27.4% share in the CBRNE defense market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Defense Electronic Market Size and Share Forecast Outlook 2025 to 2035

Defense Communication System Market Size and Share Forecast Outlook 2025 to 2035

Defense Aircraft Materials Market Size and Share Forecast Outlook 2025 to 2035

Defense Electronics Obsolescence Market Size and Share Forecast Outlook 2025 to 2035

Defense Integrated Antenna Market Size and Share Forecast Outlook 2025 to 2035

Biodefense Market Analysis – Size, Share & Forecast 2025 to 2035

5G in Defense Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Rubber Track for Defense and Security Market Size and Share Forecast Outlook 2025 to 2035

Coated Fabrics for Defense Market 2025 to 2035

High-Performance Fibers for Defense Market Report – Demand, Trends & Industry Forecast 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA