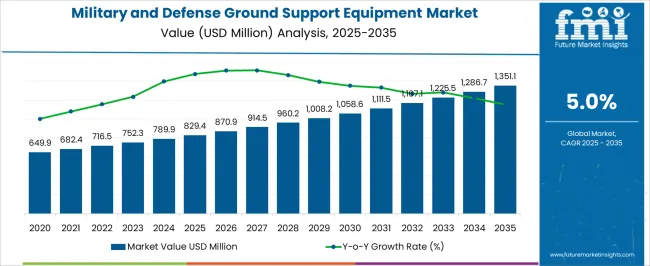

The military and defense ground support equipment market is estimated to be valued at USD 829.4 million in 2025 and is projected to reach USD 1351.1 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The military and defense ground support equipment market is valued at USD 829.4 million in 2025 and is expected to grow to USD 1,351.1 million by 2035, with a CAGR of 5.0%. Between 2021 and 2025, the market grows steadily from USD 649.9 million to USD 829.4 million, progressing through values of USD 682.4 million, 716.5 million, 752.3 million, and 789.9 million. During this early phase, growth is driven by steady demand for ground support equipment in the military sector, including airfield support vehicles, fuel systems, and maintenance tools, as well as increasing military budgets across key regions. The market sees gradual adoption and incremental demand expansion from defense contractors.

From 2026 to 2030, the market continues to expand from USD 829.4 million to USD 1,058.6 million, with intermediate values progressing through USD 870.9 million, 914.5 million, 960.2 million, and 1,008.2 million. This period sees the market entering a higher growth phase as defense operations modernize, driven by technological advancements and the need for more versatile and automated support equipment.

Between 2031 and 2035, the market accelerates further, reaching USD 1,351.1 million, with values passing through USD 1,167.1 million, 1,225.5 million, and 1,286.7 million. The late growth curve sees a stronger, more mature demand for cutting-edge equipment with enhanced capabilities, influenced by rising global defense expenditures and increasing geopolitical tensions.

| Metric | Value |

|---|---|

| Military and Defense Ground Support Equipment Market Estimated Value in (2025 E) | USD 829.4 million |

| Military and Defense Ground Support Equipment Market Forecast Value in (2035 F) | USD 1351.1 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

The defense equipment market plays a major role, accounting for around 30-35%, as ground support equipment such as loaders, tugs, and power units are essential for the operation and maintenance of defense systems, especially in airfields, military bases, and depots. The aerospace and defense market is another significant contributor, with around 25-30%, as ground support equipment is crucial for the efficient turnaround of aircraft and supporting military aviation operations. The military logistics market contributes about 20-25%, as ground support equipment plays a vital role in transporting and maintaining military supplies, vehicles, and personnel, ensuring efficient supply chain management on military bases and in the field.

The automotive and heavy machinery market also impacts the demand for ground support equipment, contributing around 10-12%, as the design and manufacturing of such equipment often overlap with heavy machinery used in other sectors like construction and industrial operations. Finally, the construction and infrastructure market accounts for approximately 8-10%, as ground support equipment is used in the construction of military bases, airstrips, and other defense infrastructure projects. These parent markets underscore the importance of ground support equipment in ensuring operational efficiency, supporting logistics, and maintaining military assets across various defense-related sectors.

The military and defense ground support equipment market is experiencing steady expansion, fueled by rising global defense budgets, increased military modernization initiatives, and the growing need for advanced logistical and operational support systems. As armed forces focus on improving combat readiness and operational efficiency, the demand for robust and mobile ground support equipment is intensifying. Ground power units, towing tractors, and air conditioning units are becoming essential components of support infrastructure for aircraft, armored vehicles, and other high-value military assets.

Modern militaries are prioritizing rapid deployment capabilities and equipment versatility, which is driving innovation in both fixed and mobile support platforms. The integration of digital diagnostics, remote monitoring, and predictive maintenance technologies is further enhancing equipment performance and lifecycle management.

Additionally, the shift toward modular and interoperable systems is allowing for smoother logistics and fleet compatibility across different mission scenarios As geopolitical tensions remain elevated and joint operations expand, the market is expected to grow consistently, supported by long-term procurement programs and a sustained focus on mission-critical support solutions.

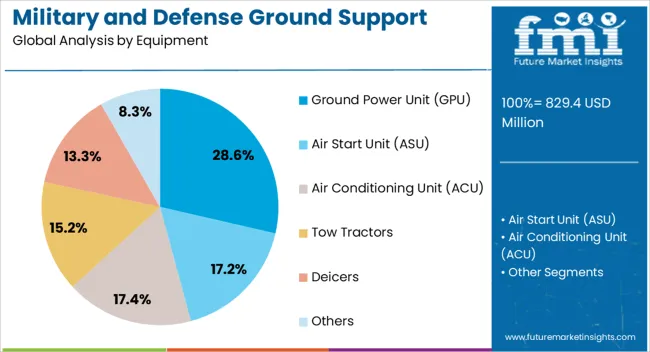

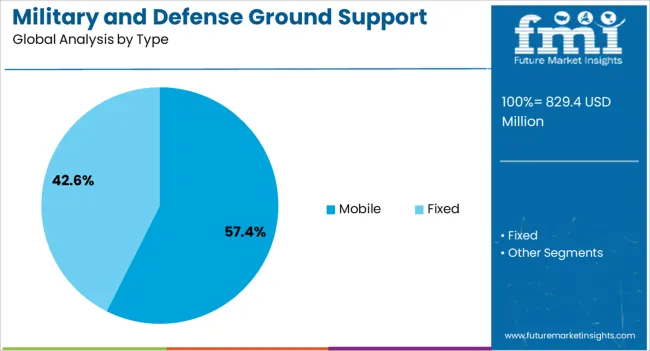

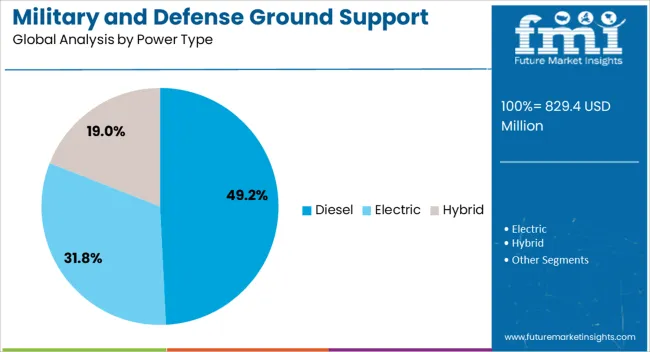

The military and defense ground support equipment market is segmented by equipment, type, power type, aircraft type, and geographic regions. By equipment, military and defense ground support equipment market is divided into ground power unit (GPU), air start unit (ASU), air conditioning unit (ACU), tow tractors, deicers, and others. In terms of type, military and defense ground support equipment market is classified into mobile and fixed. Based on power type, military and defense ground support equipment market is segmented into diesel, electric, and hybrid. By aircraft type, military and defense ground support equipment market is segmented into fighter jet, transport aircraft, and special mission aircraft. Regionally, the military and defense ground support equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ground power unit equipment segment is projected to hold 28.6% of the military and defense ground support equipment market revenue share in 2025, establishing it as the leading equipment category. This segment’s dominance is being driven by its critical role in delivering consistent electrical power to a wide range of military platforms, including aircraft, radar systems, and ground vehicles during maintenance and pre-operation procedures. GPUs ensure mission readiness by supporting systems without requiring the main engines to run, thereby conserving fuel and reducing wear.

The ability to provide reliable, high-capacity power in field conditions has made GPUs indispensable in forward-operating bases, airfields, and mobile command centers. The increasing complexity of electronic systems in modern defense equipment is amplifying the demand for GPUs that can handle variable loads and voltages with precision.

Additionally, their compatibility with both fixed and mobile operations contributes to widespread adoption As armed forces continue to enhance their operational infrastructure, ground power units are expected to remain a foundational component of support logistics, driving continued growth in this segment.

The mobile type segment is anticipated to account for 57.4% of the military and defense ground support equipment market revenue share in 2025, making it the dominant configuration. This leadership is being supported by the operational flexibility and tactical mobility that mobile ground support units offer across diverse terrains and deployment environments. Military forces are prioritizing equipment that can be rapidly transported, positioned, and operated in both peacetime and active-duty scenarios, from forward-operating bases to battlefield perimeters.

Mobile configurations allow support functions to be relocated quickly without the need for fixed infrastructure, enabling agile mission planning and reducing logistical overhead. The rising emphasis on expeditionary forces and rapid response capabilities is further boosting the preference for mobile platforms.

Enhanced towing capacity, modular attachments, and onboard diagnostic systems are increasing the reliability and functionality of mobile equipment As military operations become increasingly dynamic and geographically dispersed, the mobile segment is expected to maintain its dominance by aligning with evolving tactical doctrines and deployment strategies.

The diesel power type segment is projected to represent 49.2% of the military and defense ground support equipment market revenue share in 2025, establishing it as the leading power source. This segment’s strong position is being supported by the durability, reliability, and high energy density offered by diesel-powered systems in demanding operational conditions. Diesel engines are well-suited for heavy-duty and continuous-use applications, making them ideal for ground support tasks that require prolonged operation in remote or austere environments.

Their ability to operate with minimal maintenance and high torque output under load enhances their suitability for powering ground units such as GPUs, tugs, and mobile command equipment. The widespread availability of diesel fuel in defense logistics networks further supports the segment’s adoption.

While interest in alternative energy sources is rising, the current performance advantages and logistical compatibility of diesel systems are ensuring their continued dominance As militaries seek dependable and robust solutions for field-deployed support equipment, the diesel segment is expected to maintain its leadership in the power type category.

Ground support equipment (GSE) is crucial for various functions such as aircraft maintenance, cargo handling, vehicle servicing, and equipment repair. The market is driven by the growing focus on enhancing military readiness, operational efficiency, and rapid deployment capabilities. Key demand drivers include the modernization of defense infrastructure, increasing defense budgets, and the need for advanced, versatile equipment that can handle complex military operations.

Challenges include high development and maintenance costs, integration complexities, and stringent regulatory compliance regarding safety and performance standards. Opportunities are emerging in the development of automated and electric-powered GSE, as well as innovations that enhance mobility, adaptability, and multi-functional capabilities. Trends in the market indicate a shift toward more environmentally friendly and energy-efficient solutions, along with increasing demand for smart, connected ground support equipment that can be remotely monitored and controlled.

The military and defense ground support equipment market is being driven by the growing demand for efficient ground operations and enhanced military readiness. As defense forces worldwide focus on improving their capabilities and operational effectiveness, the need for advanced GSE that can quickly deploy, maintain, and repair military vehicles and aircraft has risen. Military readiness depends on a range of ground operations, including fueling, maintenance, cargo handling, and transport services, all of which require specialized support equipment.

As armed forces continue to modernize their fleets and adapt to changing operational requirements, the demand for GSE that offers higher performance, reliability, and faster turnaround times is expected to increase. The growing focus on rapid mobility and deployment of defense forces further supports the need for high-quality and versatile ground support equipment.

The military and defense ground support equipment market faces several challenges related to high development and production costs. Developing advanced GSE often requires significant investment in cutting-edge technology, which can be costly. Additionally, the complexity of integrating new technologies into existing military systems and ensuring compatibility across various platforms can increase costs and time to market. Regulatory compliance, especially regarding safety standards, emissions, and environmental impact, adds another layer of complexity for manufacturers.

The evolving nature of military operations also demands continuous innovation, requiring GSE to be adaptable and easily configurable to meet the dynamic needs of defense forces. Furthermore, supply chain disruptions and procurement challenges can delay production and availability, making it crucial for defense contractors to ensure a stable and reliable supply of critical components.

Opportunities in the military and defense ground support equipment market are emerging with the increasing development of electric-powered and automated solutions. As the military sector aims to reduce carbon footprints and enhance operational efficiency, electric-powered GSE is gaining traction for its environmental and cost-saving benefits. Electric vehicles and ground support equipment can significantly reduce maintenance costs, fuel consumption, and emissions compared to their traditional counterparts.

Automation is also playing a key role in revolutionizing ground support functions, with automated systems being used for tasks like aircraft towing, refueling, and cargo handling. These innovations not only reduce the need for manual labor but also enhance the speed and precision of operations, making them ideal for fast-paced military environments. As military forces look to enhance their sustainability and efficiency, the demand for these advanced, eco-friendly solutions is expected to increase.

The growing adoption of the Internet of Things (IoT) in military operations is leading to the development of connected GSE that can be remotely monitored and controlled, providing real-time data on equipment performance, location, and condition. These smart GSE solutions enable predictive maintenance, improve operational efficiency, and reduce downtime. Additionally, there is a growing demand for multi-functional GSE that can handle a wide range of tasks, from aircraft maintenance to cargo loading and offloading. These versatile solutions not only optimize space and reduce the need for multiple specialized pieces of equipment but also enhance flexibility and cost-effectiveness for military forces. As these trends continue, GSE manufacturers are focusing on developing systems that can adapt to a variety of military scenarios and provide greater value to defense contractors.

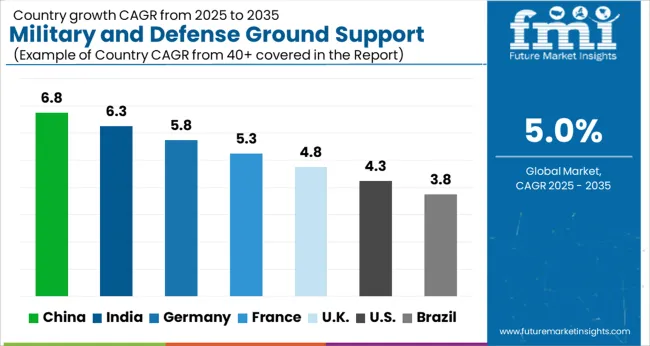

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global military and defense ground support equipment market is projected to grow at a CAGR of 5.0% from 2025 to 2035. China leads the market with a growth rate of 6.8%, followed by India at 6.3% and France at 5.3%. The UK and USA show moderate growth rates of 4.8% and 4.3%, respectively. The demand for advanced ground support equipment is driven by ongoing defense modernization efforts, increasing military operations, and the rising adoption of new technologies such as automation and robotics. The market is also benefiting from increasing international defense collaborations and military readiness initiatives. The analysis includes over 40+ countries, with the leading markets detailed below.

The military and defense ground support equipment market in China is projected to grow at a CAGR of 6.8% from 2025 to 2035. The country’s robust defense sector, coupled with the expansion of its military forces, is a key driver of this market. The increasing investment in advanced ground support systems for airbases, military installations, and operational theaters is further fueling the demand for defense support equipment. China’s emphasis on self-reliance in defense technology is driving the local production of ground support systems, from aircraft handling equipment to fueling and maintenance systems.

With an increasingly modernized military infrastructure and rapid advancements in technology, including automation and robotics, China is poised to lead the regional market. The government’s commitment to bolstering its defense capabilities and upgrading military facilities is accelerating the demand for high-tech ground support equipment.

The military and defense ground support equipment market in India is set to grow at a CAGR of 6.3% from 2025 to 2035. As India continues to strengthen its defense capabilities, the demand for advanced ground support equipment is on the rise. The country’s large-scale military operations and emphasis on improving airbase infrastructure are driving the need for more efficient and technologically advanced ground support systems. The government’s defense modernization initiatives and plans to increase the domestic production of military equipment have contributed to the growth in this sector.

Furthermore, India’s participation in joint military exercises and international peacekeeping missions necessitates the deployment of reliable ground support equipment. The growing focus on upgrading existing facilities and investing in cutting-edge technology, such as electric-powered equipment, is set to boost the market.

The military and defense ground support equipment market in France is projected to grow at a CAGR of 5.3% from 2025 to 2035. France’s strategic focus on enhancing its defense capabilities, both domestically and as part of NATO, is driving demand for advanced ground support equipment. The French military’s ongoing modernization plans include upgrading airbases, logistics facilities, and maintenance systems, leading to increased procurement of sophisticated ground support equipment.

Additionally, France’s defense industry is focusing on creating more efficient and versatile equipment to support both combat and humanitarian missions. With a focus on technological innovation, including automation and digitization of support processes, France is witnessing a demand for cutting-edge equipment such as aircraft tow tractors, maintenance vehicles, and fueling systems. The country’s involvement in joint operations with international allies and its commitment to strengthening its military readiness are contributing to the growth of the defense ground support sector.

The UK’s military and defense ground support equipment market is expected to grow at a CAGR of 4.8% from 2025 to 2035. The UK has made significant investments in its defense infrastructure, particularly in ground support systems for its airbases, maintenance depots, and military logistics. The country’s ongoing defense modernization initiatives and the integration of new technologies such as robotics and electric-powered ground support vehicles are expected to drive market growth.

The UK’s military operations, both domestically and abroad, are creating a higher demand for efficient and reliable equipment for aircraft servicing, refueling, and maintenance. The UK’s role as a key NATO member and its participation in global peacekeeping missions contribute to the need for advanced support systems. With a strong focus on reducing operational costs and improving efficiency, the UK military is shifting toward more cost-effective and sustainable ground support solutions.

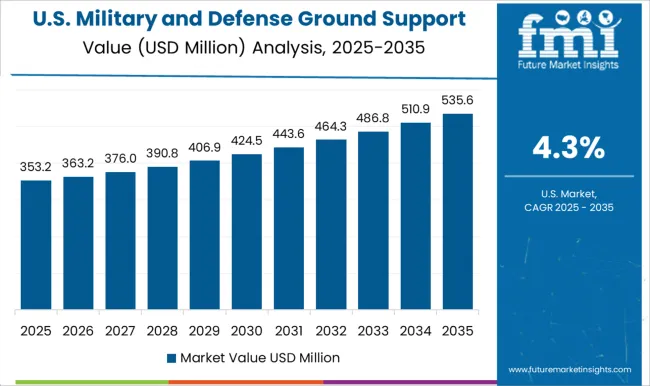

The USA military and defense ground support equipment market is projected to grow at a CAGR of 4.3% from 2025 to 2035. As a global leader in defense technology, the USA continues to invest heavily in its military infrastructure, leading to rising demand for state-of-the-art ground support equipment. The USA military’s focus on maintaining its technological superiority and ensuring rapid deployment capabilities in various combat scenarios drives the need for advanced ground support systems.

The increasing adoption of automation, digital systems, and robotics in military operations is also playing a key role in reshaping the ground support equipment landscape. The USA military’s involvement in various international defense collaborations and peacekeeping missions necessitates efficient and reliable equipment for aircraft handling, maintenance, and refueling. The demand for eco-friendly solutions and energy-efficient equipment is also rising as part of the military’s broader operational goals.

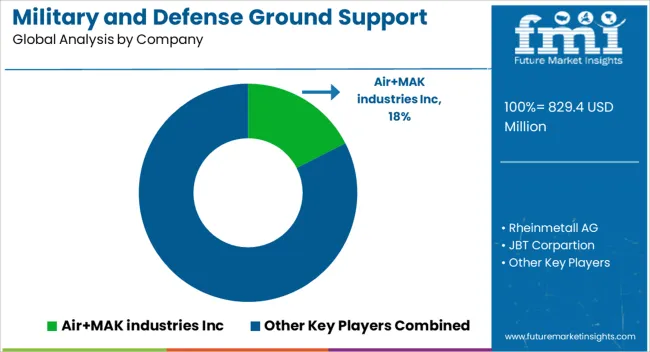

The military and defense ground support equipment (GSE) market is highly competitive, with several prominent players providing critical systems that support military aircraft operations, including maintenance, refueling, and towing equipment. Air+MAK Industries Inc. is a leading player in this market, offering a broad range of GSE products such as aircraft refueling systems, hydraulic equipment, and air conditioning units, designed for reliability and performance under extreme conditions. The company’s focus on developing tailored solutions for military needs positions it as a top provider in this niche sector.

Rheinmetall AG competes by offering state-of-the-art military ground support systems, particularly for armored vehicles and air defense applications. Their equipment is known for durability, modularity, and integration with advanced military technologies. JBT Corporation offers a wide range of GSE solutions, including aircraft handling and cargo loading equipment. Their focus on automation and robust, field-tested systems for military and defense applications gives them a competitive edge. Cavotec SA is a strong competitor with its comprehensive range of power supply, refueling, and towing equipment designed for military use. The company emphasizes energy-efficient solutions, providing both ground support for aircraft and vehicle charging systems for military logistics.

ATEC, Inc. specializes in providing aviation ground support equipment with an emphasis on specialized hydraulic and electrical systems for military aviation applications. Their products are known for precision, safety, and high-performance standards. Hydraulics International Inc. is recognized for offering high-pressure hydraulic ground support equipment for military aircraft, including maintenance systems for repair and refueling. ITW GSE ApS provides a range of equipment for aircraft power generation, air conditioning, and refueling, focusing on ease of use, high performance, and integration with modern military bases.

Tronair Inc. and GATE GSE also compete by providing innovative, portable ground support equipment for aircraft, designed to ensure efficient and safe operations in military environments. Unitron, LP. offers advanced systems focused on electronic and hydraulic GSE solutions, while maintaining a strong reputation for reliability and service. Product brochures from these companies highlight key features such as advanced safety mechanisms, integration with military technologies, and robust performance under extreme conditions. Competitive strategies revolve around offering highly durable, flexible, and efficient solutions to meet the evolving needs of military and defense sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 829.4 million |

| Equipment | Ground Power Unit (GPU), Air Start Unit (ASU), Air Conditioning Unit (ACU), Tow Tractors, Deicers, and Others |

| Type | Mobile and Fixed |

| Power Type | Diesel, Electric, and Hybrid |

| Aircraft Type | Fighter Jet, Transport Aircraft, and Special Mission Aircraft |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air+MAK industries Inc, Rheinmetall AG, JBT Corpartion, Cavotec SA, ATEC, Inc., Hydraulics International Inc., ITW GSE ApS, Tronair Inc., GATE GSE, and Unitron, LP. |

| Additional Attributes | Dollar sales by equipment type (towing equipment, refueling systems, maintenance platforms, ground power units), application (military, defense, airfields, aerospace), and technology (hydraulic, electric, pneumatic). Demand dynamics are driven by the increasing need for modernized military ground support infrastructure, with a focus on reducing operational costs, improving energy efficiency, and ensuring mission-critical equipment readiness. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, driven by defense modernization programs and the increasing adoption of advanced, eco-friendly GSE for military airfields. |

The global military and defense ground support equipment market is estimated to be valued at USD 829.4 million in 2025.

The market size for the military and defense ground support equipment market is projected to reach USD 1,351.1 million by 2035.

The military and defense ground support equipment market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in military and defense ground support equipment market are ground power unit (gpu), air start unit (asu), air conditioning unit (acu), tow tractors, deicers and others.

In terms of type, mobile segment to command 57.4% share in the military and defense ground support equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Military Textile Materials Testing Market Size and Share Forecast Outlook 2025 to 2035

Military Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Military Sensor Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicle Electrification Market Size and Share Forecast Outlook 2025 to 2035

Military Wearables Market Size and Share Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Military Logistics Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Military Hydration Products Market Growth - Trends & Forecast 2025 to 2035

Military Batteries Market Analysis & Forecast by Platform, Capacity, Type, End-Use and Region through 2025 to 2035

Military Communications Market Analysis by Component, Application, End User & Region from 2025 to 2035

Military Boots Market Analysis – Growth, Demand & Forecast 2025 to 2035

Military Parachute Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA